The global sustainable packaging market is undergoing rapid transformation, driven by escalating consumer demand for eco-conscious products and tightening environmental regulations. According to Grand View Research, the market was valued at USD 257.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. This surge is fueled by innovations in biodegradable materials, increased corporate sustainability commitments, and shifts in supply chain strategies to reduce environmental impact. As brands across food and beverage, healthcare, and e-commerce sectors seek greener alternatives, the role of leading sustainable packaging manufacturers has become more critical than ever. These companies are not only pioneering next-generation materials—from compostable films to recyclable mono-materials—but are also scaling production to meet rising global demand. In this evolving landscape, the top 10 sustainable packaging manufacturers are setting the benchmark for innovation, scalability, and environmental stewardship.

Top 10 Sustainable Packaging Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Global Packaging Manufacturer Driving Sustainable Packaging

Domain Est. 1997

Website: westrock.com

Key Highlights: Smurfit Westrock’s EverGrow® recyclable boxes offer sustainable alternatives to plastic, with paper-based innovative solutions….

#2 Pretium Packaging

Domain Est. 1997

Website: pretiumpkg.com

Key Highlights: Pretium Packaging supplies high-quality bottles, jars and closures made of PET, HDPE and PP. We have a focus on sustainable packaging solutions for diverse ……

#3 Packaging World

Domain Est. 1995

Website: packworld.com

Key Highlights: Follow Packaging World. Topics. Sustainable Packaging · Flexibles · Rigid · Coding, Printing & Labeling · Secondary Packaging · Trends · Contract Manufacturing ……

#4 Compostable, Recycled, & Reusable Food Service Products

Domain Est. 1997

Website: ecoproducts.com

Key Highlights: We only make products from renewable., post-consumer recycled, and reusable materials, and care deeply about what happens to them after use….

#5 Flexible Packaging Association

Domain Est. 1997

Website: flexpack.org

Key Highlights: The Flexible Packaging Association is the leading advocate and voice for the growing US flexible packaging industry….

#6 Graham Packaging Company

Domain Est. 1999

Website: grahampackaging.com

Key Highlights: Our global team of experts matches your products with innovative, sustainable plastic packaging solutions….

#7 Sustainable Packaging

Domain Est. 1999

Website: prempack.com

Key Highlights: We are proud to offer sustainable packaging options that not only respect the environment but also cater to your business needs….

#8 Better Packaging

Domain Est. 2001

Website: betterpackaging.com

Key Highlights: Leading supplier of eco friendly packaging, compostable packaging, recycled poly mailers, poly bags and more. We partner with ambitious brands to reduce ……

#9 Sustainable Packaging Coalition

Domain Est. 2003

Website: sustainablepackaging.org

Key Highlights: The Sustainable Packaging Coalition is a membership-based organization that believes in the power of industry to advance sustainable packaging….

#10 EcoEnclose

Domain Est. 2010

Website: ecoenclose.com

Key Highlights: EcoEnclose helps businesses ship sustainably. Order custom shipping boxes, mailers, and other sustainable packaging supplies for a greener supply chain….

Expert Sourcing Insights for Sustainable Packaging

H2: 2026 Market Trends in Sustainable Packaging

By 2026, the sustainable packaging market is poised for transformative growth and innovation, driven by intensified environmental regulations, evolving consumer demands, corporate sustainability commitments, and technological advancements. Here’s a detailed analysis of the key trends shaping this critical sector:

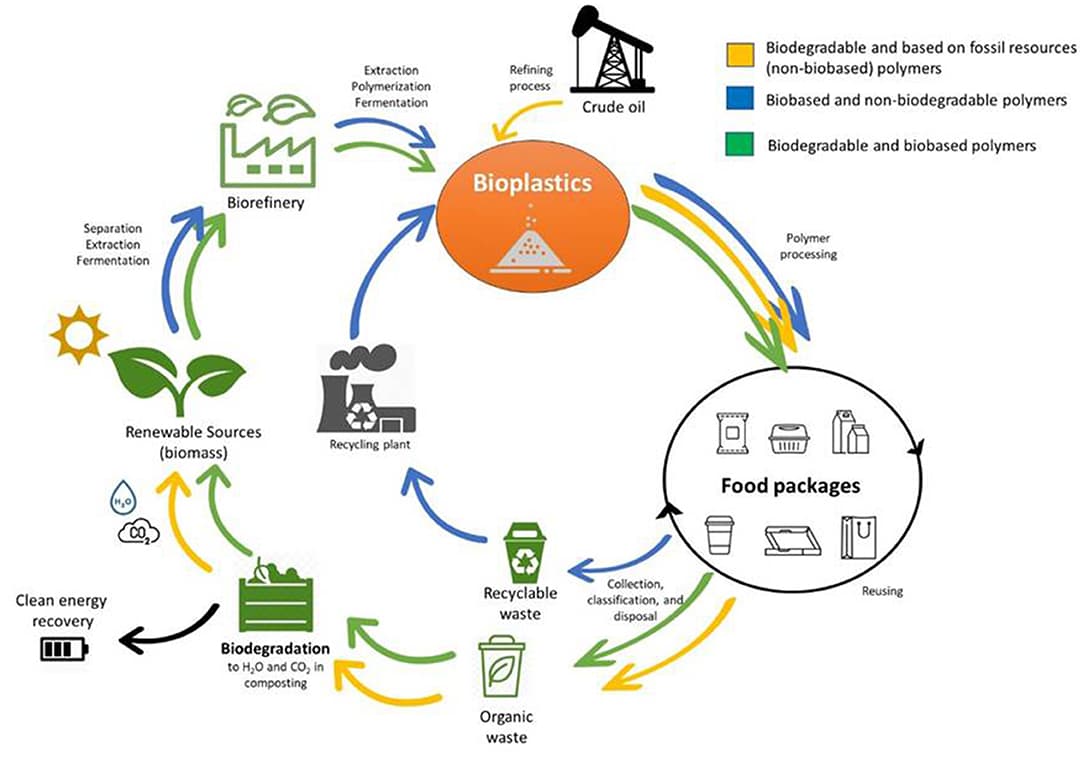

H3: Dominance of Material Innovation and Circularity

- Beyond Bioplastics to Advanced Alternatives: While bioplastics (PLA, PHA) will grow, focus will shift towards next-generation materials like mycelium (mushroom) packaging, seaweed-based films, and agricultural waste composites (e.g., bagasse, bamboo). These offer superior compostability and lower environmental footprints.

- Recycled Content Mandates Accelerate: Regulatory pressure (e.g., EU Packaging & Packaging Waste Regulation – PPWR) will mandate significantly higher post-consumer recycled (PCR) content in plastics (potentially 30-50%+ for specific applications). This will drive investment in advanced recycling technologies (chemical recycling, depolymerization) to improve PCR quality and availability.

- Design for Circularity: “Circular by design” principles will become standard. This includes mono-material packaging (easier recycling), reduced complexity (fewer layers, adhesives), elimination of problematic components (carbon black, dark pigments, mixed laminates), and standardized formats to improve sorting efficiency.

H3: Regulatory Pressure as a Primary Catalyst

- Extended Producer Responsibility (EPR) Expansion: EPR schemes, making producers financially and physically responsible for end-of-life packaging, will become widespread globally (beyond EU, Canada, parts of US). This will significantly increase costs for non-recyclable packaging, forcing redesign.

- Harmonized Standards and Labeling: Expect increased efforts towards standardized recyclability/compostability labeling (e.g., How2Recycle, On-Pack Recycling Label) to reduce consumer confusion and improve sorting accuracy. Regulations will likely mandate clearer labeling.

- Packaging Taxation and Bans: Governments will implement or expand plastic taxes (e.g., UK Plastic Packaging Tax) and bans on specific single-use items (e.g., EPS foam, certain sachets, non-recyclable multi-materials), pushing adoption of alternatives.

H3: Consumer Demand and Brand Accountability

- Transparency as a Competitive Edge: Consumers will demand greater supply chain transparency (origin of materials, carbon footprint data, recyclability proof). Brands will leverage blockchain and digital product passports (DPPs) to provide verifiable sustainability credentials.

- “Greenwashing” Scrutiny Intensifies: Regulatory bodies (e.g., FTC, EU authorities) and consumers will increasingly penalize misleading claims. Specific, quantifiable, and third-party verified sustainability claims will be essential. Vague terms like “eco-friendly” will lose credibility.

- Reuse and Refill Models Gain Traction: While still a smaller segment, refill stations (in-store, at-home) and durable returnable packaging systems (for e-commerce, food service) will see accelerated pilot programs and scaling, driven by consumer interest in eliminating single-use waste entirely.

H3: Technological Advancements Driving Efficiency

- AI and Machine Learning in Sorting: Advanced AI-powered robotics and optical sorting systems will improve the accuracy and speed of Material Recovery Facilities (MRFs), increasing the yield and quality of recyclables, making recycling more economically viable.

- Digital Watermarks (HolyGrail 2.0): Widespread piloting and initial commercial deployment of digital watermarking (e.g., Digimarc) will begin. This technology embeds invisible codes in packaging, enabling precise sorting of complex materials, unlocking higher recycling rates for challenging streams.

- Lightweighting and Material Optimization: Continued innovation in nano-coatings and barrier technologies will allow for thinner, lighter packaging films without compromising protection, reducing material use and transportation emissions.

H3: Supply Chain Resilience and Collaboration

- Local Sourcing Imperative: Geopolitical instability and carbon footprint concerns will drive efforts to shorten supply chains and source sustainable materials (recyclers, bio-based feedstocks) regionally where possible.

- Industry Collaboration: Solving systemic challenges (collection infrastructure, recycling technology gaps) will require unprecedented collaboration between brands, retailers, recyclers, material suppliers, and waste management companies (e.g., through consortia like CEFLEX, Ellen MacArthur Foundation initiatives).

H3: Challenges and Considerations for 2026

- Scalability & Cost: Scaling next-gen materials and advanced recycling remains expensive. Achieving cost parity with virgin plastics, especially with fluctuating oil prices, will be a persistent challenge.

- Infrastructure Gaps: Lack of widespread industrial composting for compostable packaging and insufficient collection/sorting infrastructure for recyclables, particularly in developing regions, will hinder progress.

- Performance & Functionality: Some sustainable alternatives may still face hurdles in matching the barrier properties, durability, or shelf-life performance of conventional packaging, especially for sensitive products.

- Carbon Accounting Complexity: Accurately measuring and comparing the full lifecycle carbon footprint (including land use change for bio-based materials) will be complex but crucial for credible claims.

Conclusion for 2026:

The sustainable packaging market in 2026 will be defined by regulatory enforcement, material science breakthroughs, technological integration, and heightened consumer scrutiny. Success will belong to companies that proactively embrace circular design principles, invest in verifiable transparency, collaborate across the value chain, and navigate the complex interplay of environmental, economic, and performance requirements. The transition will be rapid and disruptive, but essential for a viable future.

Common Pitfalls Sourcing Sustainable Packaging: Quality and Intellectual Property (IP) Challenges

When sourcing sustainable packaging, businesses often focus heavily on environmental benefits but may overlook critical quality and intellectual property (IP) risks. Failing to address these areas can lead to product failures, legal disputes, reputational damage, and increased costs. Below are key pitfalls to avoid:

Quality Inconsistencies in Sustainable Materials

One of the most prevalent challenges is the variability in quality when switching to alternative, eco-friendly materials. Bioplastics, recycled content, and compostable substrates may not offer the same durability, barrier properties, or shelf-life performance as conventional packaging. This can result in compromised product protection, spoilage, or consumer dissatisfaction. Suppliers may also lack standardized production processes, leading to batch-to-batch inconsistencies that affect print quality, structural integrity, or sealing performance.

Limited Scalability and Supply Chain Reliability

Many sustainable packaging solutions are produced by smaller or specialized manufacturers with limited production capacity. This can lead to supply shortages, extended lead times, or inability to meet demand during peak seasons. Relying on niche materials—such as algae-based films or agricultural waste composites—may also introduce logistical complexities, including geographic constraints or seasonal availability, affecting consistent quality and delivery timelines.

Misleading or Unverified Sustainability Claims

Suppliers may promote packaging as “eco-friendly” or “biodegradable” without credible certifications or scientific validation. These greenwashing practices not only mislead buyers but also expose companies to regulatory scrutiny and consumer backlash. Without third-party verification (e.g., TÜV, BPI, FSC), claims about compostability or recyclability may not hold up in real-world waste management systems, undermining both environmental goals and brand trust.

Intellectual Property Infringement Risks

Innovative sustainable packaging designs and materials are often protected by patents, trademarks, or trade secrets. Sourcing from third parties without proper due diligence can inadvertently lead to IP infringement—especially when designs closely resemble patented solutions. This is particularly risky when working with offshore manufacturers who may replicate proprietary technologies without authorization. Legal disputes can result in costly litigation, forced redesigns, or import bans.

Lack of Design Ownership and Customization Rights

When working with packaging suppliers on custom solutions, companies may assume they own the final design or formulation. However, contracts often retain IP rights with the supplier unless explicitly negotiated. This limits a company’s ability to modify, scale, or transfer the packaging solution to another vendor. Without clear IP agreements, businesses risk dependency on a single supplier or loss of competitive advantage.

Inadequate Testing and Regulatory Compliance

Sustainable packaging must meet the same safety, performance, and regulatory standards as traditional options—yet new materials may not have been thoroughly tested for food contact, child resistance, or transportation durability. Additionally, compostable packaging may not comply with regional regulations (e.g., EU EN 13432, ASTM D6400), leading to rejection in composting facilities or non-compliance penalties.

Overlooking End-of-Life Realities

A major quality pitfall is assuming that “compostable” or “recyclable” packaging will automatically be processed correctly. In many regions, infrastructure for industrial composting or recycling of novel materials is lacking. Packaging that degrades prematurely on the shelf or fails to break down in available facilities undermines both functionality and sustainability goals.

To mitigate these risks, companies should conduct thorough supplier audits, demand material data sheets and certifications, perform real-world performance testing, and establish clear IP ownership terms in contracts. Collaborating with legal and technical experts during the sourcing process is essential to ensure sustainable packaging delivers on both environmental promises and operational reliability.

Logistics & Compliance Guide for Sustainable Packaging

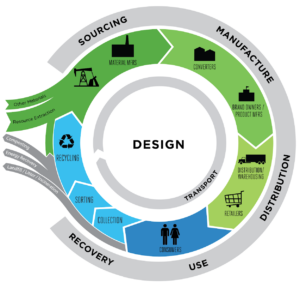

Understanding Sustainable Packaging in the Supply Chain

Sustainable packaging refers to materials and design practices that minimize environmental impact throughout a product’s life cycle—from sourcing and production to distribution, use, and end-of-life disposal. In logistics, this approach supports reduced carbon emissions, lower waste generation, and improved resource efficiency. Key elements include using recycled or renewable materials, minimizing packaging size and weight, and designing for recyclability or compostability.

Regulatory Compliance and Industry Standards

Businesses must comply with a growing number of regulations governing packaging sustainability. Key frameworks include:

- EU Packaging and Packaging Waste Directive (PPWD) – Mandates recyclability targets, recycled content requirements, and extended producer responsibility (EPR) schemes.

- EU Single-Use Plastics Directive (SUPD) – Bans certain plastic packaging and promotes reusable alternatives.

- U.S. State-Level Regulations – States like California and Maine have enacted EPR laws and restrictions on specific packaging materials.

- ISO 18601–18606 Series – International standards for optimizing packaging sustainability, covering material use, reusability, and recovery.

- FTC Green Guides – U.S. guidelines for environmental marketing claims to prevent greenwashing.

Ensure packaging claims (e.g., “recyclable,” “compostable”) are accurate, substantiated, and region-specific to avoid legal risks.

Material Selection and Sourcing

Choose materials that align with circular economy principles:

- Prioritize post-consumer recycled (PCR) content in plastics, paper, and metals.

- Use renewable resources such as FSC-certified paper, bamboo, or bioplastics (with verified compostability).

- Avoid problematic materials like PVC, black plastics (non-detectable in sorting), and mixed laminates.

Engage suppliers with environmental certifications (e.g., Cradle to Cradle, SCS Recycled Content) and conduct lifecycle assessments (LCA) to evaluate environmental impacts.

Design for Logistics Efficiency

Optimize packaging to reduce transportation footprint:

- Downsize and lightweight packaging to increase load efficiency and reduce fuel consumption.

- Standardize packaging dimensions to maximize pallet and container utilization.

- Design for durability to prevent damage during transit, reducing waste and returns.

Use simulation tools to test drop, compression, and vibration resistance with minimal material use.

Reverse Logistics and End-of-Life Management

Plan for post-consumer recovery:

- Design packaging for easy disassembly and material separation.

- Support take-back programs or participate in industry-led recycling initiatives.

- Label packaging clearly with recycling instructions (e.g., How2Recycle labels).

- Partner with waste management providers to ensure proper collection and processing.

Monitoring, Reporting, and Continuous Improvement

Track key performance indicators (KPIs) such as:

- Percentage of recycled/recyclable content

- Packaging weight per unit shipped

- Return rates due to packaging failure

- End-of-life recovery rates

Regularly audit compliance with local and international regulations. Use data to refine packaging strategies and report progress in sustainability disclosures (e.g., CDP, GRI).

Collaboration Across the Value Chain

Achieving sustainable packaging requires coordination among suppliers, logistics partners, retailers, and consumers. Engage stakeholders early to align on goals, share best practices, and invest in innovation such as reusable packaging systems or digital product passports.

By integrating sustainability into logistics planning and ensuring regulatory compliance, businesses can reduce environmental impact, lower costs, and meet evolving consumer and legislative expectations.

In conclusion, sourcing sustainable packaging suppliers is a strategic and essential step toward building an environmentally responsible supply chain. By prioritizing suppliers that utilize recycled, recyclable, biodegradable, or compostable materials and adhere to ethical manufacturing practices, businesses can significantly reduce their environmental footprint. A thorough evaluation process—considering certifications, transparency, innovation, and lifecycle impact—ensures that partnerships align with both sustainability goals and performance requirements. Ultimately, choosing the right sustainable packaging suppliers not only supports ecological preservation but also enhances brand reputation, meets evolving consumer expectations, and ensures compliance with increasing regulatory standards. As sustainability becomes a cornerstone of corporate responsibility, proactive sourcing decisions today will position businesses for long-term success in a greener economy.