The global suspension insulators market is experiencing steady growth, driven by rising investments in power transmission infrastructure, increasing electricity demand, and the expansion of renewable energy integration. According to Grand View Research, the global insulators market size was valued at USD 6.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence projects continued momentum in the sector, citing aging grid systems and government-led grid modernization initiatives—particularly across Asia-Pacific and Latin America—as key growth catalysts. Amid this expanding landscape, suspension insulators remain critical components in high-voltage transmission systems due to their superior mechanical strength, electrical performance, and reliability. As demand intensifies, a select group of manufacturers are leading innovation, scalability, and global market penetration. Below, we spotlight the top seven suspension insulators manufacturers shaping the future of electrical infrastructure.

Top 7 Suspension Insulators Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wholesale Suspension Insulator Manufacturer, Factory

Domain Est. 2010

Website: ec-insulators.com

Key Highlights: Brand Name: ECI. Model Number: FXBW±15/120. Type: Suspension Insulator. Material:Composite Polymer, Silicon rubber. Application: High Voltage….

#2

Domain Est. 1997

Website: k-line.net

Key Highlights: K-Line Insulators Limited is a manufacturer of high quality insulators for the global market. Explore Our Website. Home · Products & Catalogues · Superior ……

#3 Sediver

Domain Est. 2003

Website: sediver.com

Key Highlights: Sediver is a world technical leader in the research, design, manufacturing of glass insulators for medium or high voltage lines, distribution or railways….

#4 High voltage porcelain insulators

Domain Est. 2005

Website: lappinsulators.com

Key Highlights: The LAPP Insulators Group is a leading manufacturer and supplier of high-voltage insulators with a global sales network and references in over 70 countries….

#5 Suspension Insulators

Domain Est. 1992

Website: te.com

Key Highlights: Our range of Suspension Insulators is made of silicone and has been designed for your overhead distribution lines to support the reduction of the total cost of ……

#6 Insulators

Domain Est. 1995

Website: hubbell.com

Key Highlights: Hubbell provides a comprehensive selection of insulators, including power pole insulators and polymer insulators, tailored for 69kV distribution systems….

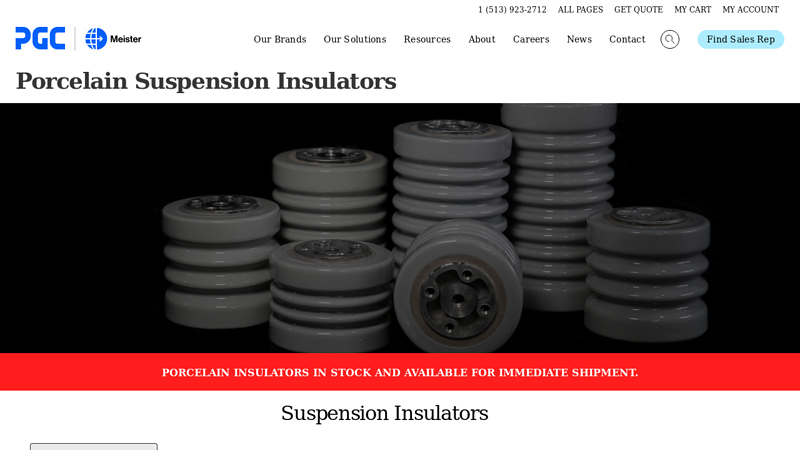

#7 Porcelain Suspension Insulators

Domain Est. 2003

Website: meisterintl.com

Key Highlights: Meister International are of the highest quality porcelain insulators. They are manufactured from wet process porcelain, giving them the ability to shed water ……

Expert Sourcing Insights for Suspension Insulators

2026 Market Trends for Suspension Insulators

Rising Demand from Power Infrastructure Expansion

The global suspension insulators market is projected to experience significant growth by 2026, driven primarily by the expansion and modernization of power transmission and distribution networks. Emerging economies in Asia-Pacific, such as India, China, and Southeast Asian nations, are investing heavily in grid infrastructure to meet rising electricity demand. Additionally, developed regions like North America and Europe are upgrading aging transmission systems, further boosting demand for high-performance suspension insulators. These infrastructure projects require reliable, long-lasting insulators, positioning ceramic and composite suspension insulators as key components.

Shift Toward Composite and Lightweight Materials

A major trend shaping the 2026 market is the increasing adoption of composite (polymer) suspension insulators over traditional porcelain and glass types. Composite insulators offer advantages such as lighter weight, superior hydrophobicity, better resistance to vandalism, and easier installation. Utilities and transmission companies are increasingly favoring composite solutions for their longer service life and reduced maintenance costs. Innovations in silicone rubber formulations and core materials are expected to enhance durability in harsh environments, accelerating this shift—especially in coastal and pollution-prone areas.

Growth in Renewable Energy Integration

The integration of renewable energy sources—particularly solar and wind farms located in remote or rugged terrains—is driving demand for robust overhead transmission lines, where suspension insulators are essential. As countries strive to meet carbon reduction targets, large-scale renewable projects require new transmission corridors, increasing the need for high-voltage insulators. By 2026, this trend is expected to be a key growth driver, particularly in regions with ambitious renewable energy goals such as the European Union, the United States, and parts of Latin America.

Technological Advancements and Smart Grid Integration

Advancements in smart grid technology are influencing the design and functionality of suspension insulators. By 2026, the market is likely to see a rise in “smart insulators” embedded with sensors to monitor parameters like temperature, leakage current, and mechanical stress. These intelligent systems support predictive maintenance and improve grid reliability. While still in early adoption, ongoing R&D and pilot projects indicate that sensor-integrated suspension insulators could become more prevalent, especially in high-reliability transmission networks.

Regional Market Dynamics

Asia-Pacific is expected to dominate the suspension insulators market in 2026 due to rapid urbanization, industrialization, and government-led electrification programs. China and India remain the largest consumers, supported by national grid initiatives like China’s Ultra-High Voltage (UHV) projects and India’s Green Energy Corridors. Meanwhile, North America and Europe will see steady growth driven by grid resilience programs and the replacement of legacy infrastructure. Latin America and Africa present emerging opportunities, with increasing foreign investment in power infrastructure.

Environmental and Regulatory Influences

Environmental regulations are increasingly influencing material choices and manufacturing processes in the insulator industry. Stricter standards on pollution performance and lifecycle sustainability are pushing manufacturers to develop eco-friendly composite materials and reduce carbon footprints. Additionally, standards from bodies such as IEC and IEEE are evolving to accommodate higher voltage classes and harsher climatic conditions, shaping product development strategies leading into 2026.

In conclusion, the suspension insulators market in 2026 will be characterized by material innovation, renewable energy integration, digitalization, and strong regional growth—especially in developing economies. Companies that adapt to these trends through R&D investment and strategic partnerships are likely to gain a competitive edge in the evolving power transmission landscape.

Common Pitfalls Sourcing Suspension Insulators (Quality, IP)

Sourcing suspension insulators—critical components in high-voltage transmission and distribution systems—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to system failures, safety hazards, legal disputes, and financial losses. Below are key pitfalls to avoid:

Poor Quality Control and Non-Compliant Materials

One of the most frequent issues is procuring insulators made from substandard materials or manufactured without adherence to international standards (e.g., IEC 60383, ANSI C29). Suppliers, especially from low-cost regions, may cut corners by using inferior porcelain, glass, or composite materials that degrade prematurely under environmental stress, leading to flashovers, mechanical failure, or reduced service life.

Inadequate Testing and Certification

Many suppliers provide falsified or incomplete test reports. Buyers may accept insulators without verifying type tests, routine tests, or third-party certifications (e.g., KEMA, CESI). This increases the risk of field failures, particularly under pollution, high humidity, or electrical stress conditions. Always demand verifiable test reports and consider independent lab testing.

Misrepresentation of Insulation Performance (Creepage Distance, IP Rating)

Suppliers may exaggerate creepage distance or mislabel the Ingress Protection (IP) rating—especially for composite insulators. For example, claiming an IP68 rating without proper testing can result in moisture ingress and internal tracking. Ensure that IP ratings are validated for the specific environmental conditions (e.g., coastal, industrial) where the insulators will be deployed.

Counterfeit or Clone Products

Some suppliers offer “compatible” or “equivalent” insulators that mimic designs from reputable brands. These clones may infringe on patents or trademarks and often lack the rigorous quality systems of the original manufacturers. The use of counterfeit insulators can expose buyers to IP litigation and void warranties.

Ignoring Supply Chain Transparency

Lack of visibility into the manufacturing origin and component sourcing increases risk. For instance, sourcing from unauthorized subcontractors can compromise quality and traceability. Always audit suppliers and require full disclosure of manufacturing locations and processes.

Overlooking Long-Term Durability and Aging Performance

Short-term cost savings can lead to long-term liabilities. Composite insulators, for example, may appear identical but vary significantly in resistance to UV degradation, hydrophobicity loss, and brittle fracture. Without proper aging and accelerated weathering data, buyers risk premature in-service failures.

Insufficient Due Diligence on IP Rights

Using insulator designs protected by patents (e.g., specific shed profiles, housing materials, or assembly methods) without licensing can result in legal action. Buyers must ensure that suppliers have the right to manufacture and sell the products, particularly when sourcing from emerging markets with weak IP enforcement.

Failure to Enforce Warranty and Liability Clauses

Poorly drafted contracts may omit clear warranty terms, performance guarantees, or liability for defects. In the event of failure, recovering costs or replacing defective insulators becomes difficult. Always include stringent quality clauses and define responsibilities for defects discovered in service.

Avoiding these pitfalls requires thorough supplier vetting, independent verification of quality and compliance, and legal review of IP-related risks. Investing in due diligence upfront ensures long-term reliability and legal safety in power infrastructure projects.

Logistics & Compliance Guide for Suspension Insulators

Suspension insulators are critical components in electrical power transmission and distribution systems, designed to support overhead conductors while providing reliable electrical insulation. Proper logistics planning and adherence to compliance standards are essential to ensure product integrity, worker safety, and regulatory conformity throughout the supply chain.

Product Characteristics and Handling Requirements

Suspension insulators are typically made from materials such as porcelain, glass, or composite (polymer). They are brittle and susceptible to mechanical shock, making careful handling and packaging crucial.

- Fragility: Insulators must be protected from impact, vibration, and excessive pressure during transport.

- Weight and Size: Units can be heavy and bulky; proper lifting equipment (e.g., forklifts, cranes) is required.

- Packaging: Insulators should be packed in sturdy wooden crates or pallets with cushioning material (e.g., foam, cardboard dividers) to prevent movement and breakage.

Storage Guidelines

Proper storage prevents damage and maintains insulator performance.

- Indoor Storage: Store in a dry, covered area to protect from moisture, temperature extremes, and direct sunlight (especially for composite insulators).

- Horizontal Positioning: Porcelain and glass insulators should be stored horizontally on flat, level surfaces to avoid stress cracks.

- Stacking Limits: Do not exceed manufacturer-recommended stacking heights to prevent crushing.

- Segregation: Keep insulators separated from corrosive or abrasive materials.

Transportation Considerations

Ensure safe and efficient movement from manufacturer to installation site.

- Mode of Transport: Suitable for road, rail, or sea freight. Air freight is less common due to weight and cost.

- Securement: Use straps, braces, or dunnage to prevent shifting during transit.

- Environmental Protection: Waterproof covers are recommended for open transport to guard against rain or humidity.

- Labeling: Clearly mark packages as “Fragile,” “This Side Up,” and “Do Not Stack,” with handling instructions.

Regulatory and Compliance Standards

Suspension insulators must comply with international and regional standards to ensure safety and performance.

- IEC Standards: IEC 60383 (Tests on Insulators), IEC 60168 (Acceptance Tests), and IEC 61109 (Composite Insulators).

- ANSI/IEEE Standards: ANSI C29 series for electrical and mechanical performance.

- RoHS and REACH: Compliance required if insulators contain restricted substances (particularly relevant for composite/polymer materials).

- Customs and Import Regulations: Verify country-specific import requirements, including certification (e.g., CE marking in the EU, BIS in India).

Documentation Requirements

Maintain accurate records for traceability and customs clearance.

- Commercial Invoice and Packing List: Include product specifications, quantities, weights, and HS code (e.g., 8546.20 for electrical insulators).

- Certificate of Conformity (CoC): Proof of compliance with applicable standards.

- Test Reports: Factory acceptance test (FAT) reports and type test certificates.

- Bill of Lading/Air Waybill: Legal document for transport.

- Material Safety Data Sheet (MSDS): Required if hazardous materials are involved (e.g., in composite resins).

Quality Assurance and Inspection

Implement checks at key logistics stages.

- Pre-Shipment Inspection: Verify packaging integrity, labeling, and documentation.

- In-Transit Monitoring: Use shock and tilt indicators for high-value shipments.

- Receiving Inspection: Check for damage upon arrival; document and report any discrepancies.

Environmental and Safety Considerations

- Worker Safety: Use appropriate PPE (gloves, safety footwear) when handling heavy or sharp-edged units.

- Disposal: Follow local regulations for disposal of damaged insulators, especially porcelain and glass (non-hazardous) vs. composite (may require special handling).

- Sustainability: Opt for recyclable packaging and consolidate shipments to reduce carbon footprint.

Best Practices Summary

- Train personnel in proper handling techniques.

- Partner with experienced freight forwarders familiar with heavy, fragile cargo.

- Maintain a chain of custody for high-voltage components.

- Conduct periodic audits of logistics and compliance processes.

By following this guide, stakeholders can ensure the safe, compliant, and efficient delivery of suspension insulators, minimizing risks and supporting reliable power infrastructure.

Conclusion for Sourcing Suspension Insulators

In conclusion, the successful sourcing of suspension insulators requires a comprehensive approach that balances technical specifications, quality standards, supplier reliability, and cost-effectiveness. Suspension insulators play a critical role in ensuring the safety, efficiency, and reliability of overhead power transmission systems, making it essential to select products that meet international standards such as IEC, ANSI, or BS.

Key considerations in the sourcing process include material quality—particularly the use of high-strength porcelain, toughened glass, or composite polymer materials—proven performance under electrical, mechanical, and environmental stresses, and appropriate creepage distance for the intended operating environment. Additionally, evaluating suppliers based on certification, manufacturing capabilities, track record, and after-sales support is crucial to ensuring long-term supply chain stability and product reliability.

By conducting thorough market research, performing site audits when necessary, and leveraging competitive bidding processes, organizations can secure high-quality suspension insulators that enhance grid performance while minimizing life-cycle costs. Ultimately, strategic sourcing not only supports operational efficiency but also contributes to the overall resilience and sustainability of power transmission infrastructure.