The global mountain bike components market is experiencing steady growth, driven by rising demand for performance-oriented bicycles and increasing participation in recreational and competitive cycling. According to a report by Grand View Research, the global bicycle market size was valued at USD 50.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. A key segment within this growth is suspension components, particularly front suspension forks tailored for all-mountain and trail bikes. Among these, the 27.5-inch wheel format with 140 mm of travel and 1.8-inch tapered steerer tubes has gained popularity for its balance of agility, control, and durability. As demand for high-performance MTB forks increases, manufacturers are focusing on innovation in damping technology, materials, and weight reduction. Based on market presence, product performance, and technological advancement, the following are the top six manufacturers leading the space in 27.5” 140mm 1.8” taper suspension forks.

Top 6 Suspension Fork 27.5 140 1.8 Inch Taper Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lyrik Select

Domain Est. 1996

Website: sram.com

Key Highlights: Rating 4.8 64 · Free delivery27.5″, 29″. Travel (mm), 140mm, 150mm, 160mm. Damper Type, Charger RC. Fork offset, 37mm (27.5″), 44mm (27.5″), 44mm (29″). Color (FS), Diffusion B…

#2 Bike Forks: 27.5

Domain Est. 1996

Website: jensonusa.com

Key Highlights: Free delivery over $50Browse our selection of bicycle forks online. Choose from lightweight & sturdy mountain bike forks to road bike forks. Shop JensonUSA! We Keep You Pedaling….

#3 Suspension Fork

Domain Est. 2002

Website: srsuntour.com

Key Highlights: SF25-RUX38-Boost. 27.5″. MTB_DH. SF25-RUX38-Boost. 29″. MTB_DH. SF25-DUROLUX36X-Boost. 29″. eMTB_AM. SF25-DUROLUX36X-Boost. 27.5″. eMTB_AM. SF25-DUROLUX38-Boost….

#4 MTB Fork Collection. XC, Trail, Enduro, Gravity, eMTB

Domain Est. 2009

#5 Mountain Bike Forks

Website: mtbdirect.com.au

Key Highlights: Shop mountain bike forks for better suspension and ride performance. Enjoy 60 day returns and free shipping on orders over $99 at MTB Direct….

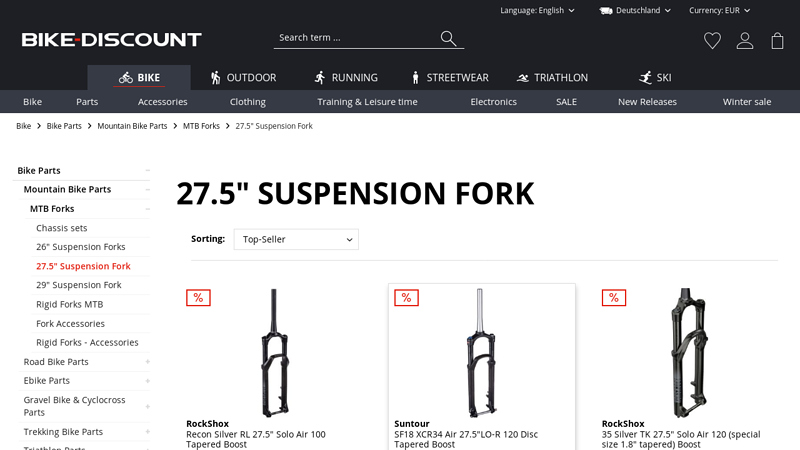

#6 27.5″ Suspension Fork

Website: bike-discount.de

Key Highlights: 5.0 14 RockShox. RST. Suntour. Price. from €24.99 to €1639.99. Label. New. Sale. Wheel size. 27.5″. 29″. Steerer tube. straight 1 1/8″. tapered 1.8″. tapered 1 1/8″ – ……

Expert Sourcing Insights for Suspension Fork 27.5 140 1.8 Inch Taper

H2: Projected 2026 Market Trends for Suspension Forks – 27.5″, 140mm Travel, 1.8″ Tapered Steerer

The market for mountain bike components, particularly suspension forks, is evolving rapidly due to shifts in rider preferences, technological advancements, and changes in frame geometry. The 27.5-inch wheel size with 140mm of travel and a 1.8-inch tapered steerer tube occupies a unique niche in 2026, primarily targeting aggressive trail, enduro, and all-mountain riders. Below is an analysis of key market trends shaping this segment.

1. Niche Positioning Amidst 29er Dominance

While 29-inch wheels continue to dominate cross-country and trail categories due to their superior rollover capability and stability, the 27.5-inch platform remains relevant in more technical and maneuverable applications. In 2026, the 27.5″ 140mm fork is increasingly positioned as a performance-oriented option for riders prioritizing agility and pop over outright speed. This is especially true in enduro racing and steep, technical terrain where shorter chainstays and quicker handling are advantageous.

2. Growth in Enduro and Aggressive Trail Segments

The 140mm travel category has seen sustained demand as trail bikes trend toward longer, slacker geometries. Forks in this category—particularly those designed for 27.5″ wheels—are being optimized for enduro use. Manufacturers like Fox, RockShox, and Öhlins are refining mid-travel 27.5″ forks with improved damping, chassis stiffness, and air spring progression to better handle high-speed impacts while remaining efficient on climbs.

3. The 1.8″ Tapered Steerer: A Performance Standard

The 1.8″ tapered steerer tube (1.5″ lower, 1.125″ upper with a tapered transition) has become a performance benchmark in high-end 27.5″ forks. In 2026, this standard is widely adopted by premium fork models to enhance steering stiffness and front-end precision. The 1.8″ taper reduces flex under load, critical for aggressive riding and high-speed cornering, and is increasingly paired with wider 38mm and 40mm stanchions for enhanced rigidity.

4. Technological Integration and Smart Suspension

Smart suspension technology is trickling down from flagship 29er models into the 27.5″ segment. By 2026, select 140mm 27.5″ forks feature electronic damping adjustment, remote lockout with adaptive response, and even sensor-integrated systems that adjust compression and rebound based on terrain. These innovations are primarily available in high-end models but signal a shift toward intelligent, rider-responsive suspension.

5. Material and Weight Optimization

Weight remains a critical factor, especially as 27.5″ bikes compete in agility-focused disciplines. Fork manufacturers are investing in advanced materials like magnesium lowers, carbon crown/stanchion hybrids, and optimized stanchion wall thickness. The 2026 market sees lighter 27.5″ 140mm forks without sacrificing durability—appealing to racers and weight-conscious riders.

6. Aftermarket and Upgrade Demand

There is a growing aftermarket for upgrading legacy 27.5″ builds with modern forks. Riders with older enduro or trail bikes are retrofitting frames with newer 140mm travel forks featuring 1.8″ steerers and improved damping. This trend is supported by increased compatibility across brands and the availability of adapter kits.

7. Sustainability and Serviceability

In response to consumer demand for longer product lifecycles, manufacturers emphasize serviceability and modular design. In 2026, major brands offer comprehensive service programs, rebuild kits, and sustainable manufacturing practices, positioning high-end 27.5″ forks as long-term investments rather than disposable components.

Conclusion

While the 27.5″ wheel size no longer leads the market, the 140mm travel fork with a 1.8″ tapered steerer remains a vital component for performance-oriented riders. In 2026, this segment is defined by technological refinement, targeted application in enduro and aggressive trail riding, and alignment with premium durability and stiffness standards. Manufacturers who continue to innovate within this niche will maintain relevance despite the broader industry shift toward 29ers and longer travel platforms.

Common Pitfalls When Sourcing a Suspension Fork 27.5″ 140mm 1.8″ Taper (Quality & IP)

Sourcing a high-performance suspension fork with specific dimensions like 27.5″, 140mm travel, and a 1.8″ tapered steerer requires careful attention to avoid costly mistakes. Below are key pitfalls related to quality and intellectual property (IP) risks, particularly when sourcing from manufacturers unfamiliar to the Western market.

Quality-Related Pitfalls

1. Inconsistent Manufacturing Standards

Many manufacturers, especially newer or budget-focused ones, may lack rigorous quality control (QC) systems. This can result in inconsistent tolerances, poor welds, or subpar material heat treatment, leading to premature wear or failure under load. Always verify adherence to industry standards like ISO 4210 or EN 14766.

2. Use of Substandard Materials

Beware of forks advertised with “alloy” or “aluminum” without specifying grade (e.g., 6061 or 7075). Lower-grade materials can compromise strength and fatigue resistance. Similarly, seals, bushings, and stanchion coatings may use inferior alternatives that degrade quickly, affecting performance and longevity.

3. Inaccurate or Inflated Specifications

Some suppliers may exaggerate travel (e.g., advertising 140mm when actual is closer to 130mm) or use misleading terms like “full hydraulic lockout” without proper damping calibration. Always request test reports or third-party verification.

4. Poor Sealing and Dust Protection

Low-quality wiper seals and inadequate stanchion coatings increase the risk of contamination, leading to stiction, oil leaks, and internal damage. Forks intended for trail/enduro riding must have robust sealing systems—verify IP ratings (Ingress Protection) for dust and water resistance.

5. Lack of Serviceability and Spare Parts Support

A high-quality fork should be serviceable with available spare parts. Sourcing from obscure brands may mean no access to rebuild kits or technical support, rendering the fork unusable after a single service interval.

Intellectual Property (IP) and Branding Pitfalls

1. Copycat or “Knockoff” Designs

Many OEMs produce forks that closely mimic patented designs from brands like Fox, RockShox, or Öhlins—down to外观 (appearance), damping layouts, or stanchion treatments. These may infringe on design patents, utility models, or trademarks, exposing buyers to legal risk, especially in EU or North American markets.

2. Unauthorized Use of Brand Logos or Names

Suppliers may use logos, model names (e.g., “Rhythm,” “Recon”), or color schemes that mimic established brands. Even slight variations can lead to trademark infringement claims. Always verify branding compliance and request IP clearance documentation.

3. Misrepresentation of Technology

Claims like “MAG sealed cartridge,” “Float air spring,” or “GRIP damper” imply licensed technology. Using such terms without authorization is a clear IP violation. Be cautious of forks advertising “similar to Fox 36” with identical internals—this often indicates reverse engineering without licensing.

4. Lack of IP Ownership or Licensing Documentation

Reputable suppliers should be able to provide proof of IP ownership or licensing agreements for proprietary technologies. If they cannot, assume the design is infringing. This is especially critical for direct-to-consumer or private-label sourcing.

5. Risk of Customs Seizures or Legal Action

Importing forks with IP violations can lead to customs holds, fines, or lawsuits from rights holders. Major retailers and distributors increasingly audit supply chains for IP compliance—non-compliant products may be rejected or recalled.

Mitigation Strategies

- Request Certifications: Ask for material test reports, QC protocols, and compliance with safety standards.

- Conduct Factory Audits: Visit or hire third parties to assess production capabilities and IP practices.

- Demand IP Documentation: Require proof of design patents, trademarks, or licensing agreements.

- Prototype Testing: Evaluate samples for performance, durability, and potential IP conflicts before mass production.

- Work with Reputable Sourcing Partners: Engage agents or manufacturers with a proven track record in compliant, high-quality suspension components.

Avoiding these pitfalls ensures not only a reliable product but also protects your brand from legal and reputational damage.

H2: Logistics & Compliance Guide – Suspension Fork 27.5″ 140mm Travel 1.8″ Tapered Steerer

This guide outlines the key logistics and compliance considerations for the import, distribution, and sale of mountain bike suspension forks with specifications: 27.5″ wheel size, 140mm travel, and 1.8″ tapered steerer tube (typically 1.5″ lower / 1.125″ upper with a 1.8″ crown interface). Adherence ensures smooth operations and legal conformity.

H2: 1. International Logistics & Shipping

-

Packaging:

- Protection: Forks must be securely packed in rigid, dimensionally stable cardboard boxes with substantial internal foam or molded plastic inserts to prevent movement and protect stanchions, lowers, crown, and stanchion seals during transit. Avoid cardboard directly touching stanchions.

- Labeling: Outer boxes must clearly display:

- Product Name & Key Specs (e.g., “Suspension Fork 27.5″, 140mm, 1.8″ Taper”)

- Model Number

- Quantity per Box

- Net & Gross Weight

- Dimensions (L x W x H)

- “Fragile,” “This Side Up,” “Protect from Moisture” symbols.

- Manufacturer/Brand Name & Address.

- Harmonized System (HS) Code (See Compliance Section).

- Country of Origin (Mandatory – See Compliance).

- Stanchion Protection: Stanchions MUST be wrapped in protective plastic film or have protective caps installed to prevent scratches and seal damage.

-

Freight Modes:

- Ocean Freight (FCL/LCL): Most cost-effective for bulk shipments. Requires careful palletization (securely strapped, corners protected) and moisture protection (desiccant packs recommended, especially for long voyages). Consider container type (dry, potentially ventilated).

- Air Freight: Faster but significantly more expensive. Suitable for urgent orders or small quantities. Standard packaging requirements still apply.

- Ground Freight (Domestic/Regional): Standard for final leg distribution. Ensure carriers are aware of fragility.

-

Key Logistics Partners: Coordinate with freight forwarders experienced in handling bicycle components. Ensure clear Incoterms agreement (e.g., FOB, EXW, DDP) defining responsibilities and costs.

H2: 2. Customs Clearance & Documentation

-

Essential Documents:

- Commercial Invoice: Detailed description (“Front Suspension Fork for Mountain Bicycles, 27.5 inch wheel compatibility, 140mm travel, 1.8 inch tapered steerer tube”), quantity, unit price, total value, currency, Incoterms, seller/buyer details, Country of Origin. Value must be accurate for duty calculation.

- Packing List: Matches invoice, lists contents per box, weights, dimensions, packaging type.

- Bill of Lading (B/L) / Air Waybill (AWB): Contract of carriage, proof of shipment.

- Certificate of Origin (CoO): Often required, certifies the country where the fork was manufactured. Can impact duty rates (e.g., under trade agreements). May need Chamber of Commerce certification.

- Importer Security Filing (ISF – US) / Advance Cargo Information (ACI – Canada): Mandatory advance electronic filing for ocean shipments entering the US/Canada.

-

Harmonized System (HS) Code:

- Critical: Correct classification determines duty rates, quotas, and regulations.

- Likely Code (Example – Verify Locally):

8714.10(Parts and accessories of cycles, not electrically assisted, of headings 8711 to 8713). Further sub-classification (e.g., 8714.10.50 – 8714.10.90) depends on material (alloy vs. carbon) and specific country rules. CONSULT LOCAL CUSTOMS AUTHORITIES OR A LICENSED CUSTOMS BROKER FOR THE EXACT CODE IN YOUR TARGET MARKET.

-

Duties & Taxes:

- Calculate import duties based on HS code and Country of Origin (duty rates vary significantly by country and trade agreements – e.g., MFN vs. FTA rates).

- Factor in applicable Value-Added Tax (VAT), Goods and Services Tax (GST), or Sales Tax applied to the landed cost (product value + shipping + insurance + duties).

H2: 3. Regulatory Compliance & Safety

-

Country of Origin Labeling:

- Mandatory: The Country of Origin (e.g., “Made in Taiwan,” “Manufactured in Germany”) must be permanently and legibly marked on the product itself (often on the fork crown or stanchion) AND on the retail packaging. Requirements vary by country (e.g., FTC rules in the US, EU labeling regulations).

-

Safety Standards:

- ISO 4210 (Road Cycles) & ISO 8098 (Children’s Cycles): While focused on complete bikes, forks must be compatible with frames designed to meet these standards. Forks themselves are critical safety components. Manufacturers typically design and test forks to exceed relevant parts of these standards for structural integrity and fatigue.

- ASTM F2043 (Standard for Bicycles): Similar to ISO, applies to complete bikes in the US. Forks must enable compliance.

- Manufacturer Testing: Reputable fork manufacturers conduct rigorous internal testing (fatigue, impact, drop tests) to ensure safety. Request test reports (e.g., ISO 4210 Part 6: Safety Requirements for Frames and Forks) from your supplier.

-

Waste Electrical and Electronic Equipment (WEEE – EU & Similar):

- Generally NOT Applicable: Standard suspension forks (air, coil, without integrated electronic damping control systems like electronic lockout or travel adjustment requiring batteries) are NOT classified as EEE and therefore NOT subject to WEEE registration, labeling, or take-back schemes. Exception: Forks with complex electronic systems (e.g., RockShox Flight Attendant, Fox Live Valve) ARE EEE and require full WEEE compliance.

-

Substance Restrictions:

- RoHS (EU & Similar): Restricts hazardous substances (Lead, Cadmium, Mercury, etc.). Applies to electrical/electronic components. Standard non-electronic forks are typically exempt. Forks with electronic components must comply.

- REACH (EU): Registration, Evaluation, Authorisation of Chemicals. Requires communication of Substances of Very High Concern (SVHCs) in articles >0.1% w/w. Applies to all components (metal, plastics, coatings, lubricants). Suppliers should provide SVHC declarations.

- Proposition 65 (California, USA): Requires warnings if products expose consumers to listed chemicals (e.g., certain metals, phthalates, BPA). Risk assessment is needed; warnings may be required on packaging or at point of sale.

-

Intellectual Property (IP):

- Ensure the fork design, branding, and technology do not infringe on patents, trademarks, or copyrights in the target market. Obtain necessary licenses if required. Verify supplier legitimacy.

H2: 4. Inbound & Warehouse Management

- Receiving: Inspect shipments for damage upon arrival. Verify quantities against packing lists. Check stanchion protection.

- Storage: Store in a clean, dry, temperature-stable environment. Protect from dust, moisture, and direct sunlight. Store vertically if possible to prevent stanchion seal distortion.

- Inventory: Use a system to track stock levels, batch/lot numbers (if applicable), and expiry dates (for any lubricants/seal kits included).

H2: 5. Final Compliance & Distribution

- Retail Packaging: Must include:

- Clear product identification (Name, Key Specs, Model).

- Manufacturer/Importer contact information.

- Country of Origin.

- Any required safety warnings (e.g., “Do not exceed maximum rider weight,” “Inspect regularly for damage,” “Refer to manual for setup and maintenance”).

- WEEE symbol (ONLY if applicable – see H2:3).

- Prop 65 warning (if required for CA).

- Assembly Instructions/Manual: Include clear instructions for installation, basic setup, and maintenance. Must be available in the local language(s) of the market.

- Warranty: Define and communicate warranty terms clearly (duration, coverage, claims process) in accordance with local consumer protection laws.

Key Recommendation: Partner with a licensed customs broker and legal/compliance expert familiar with bicycle regulations in your specific target country(ies) to ensure all requirements are met. Regulations are complex and subject to change.

Conclusion on Sourcing a Suspension Fork: 27.5″, 140mm Travel, 1.8″ Tapered Steerer

After evaluating market availability, technical specifications, and compatibility requirements, sourcing a suspension fork with 27.5-inch wheel compatibility, 140mm of travel, and a 1.8-inch tapered steerer tube presents significant challenges. While 27.5″ forks with 140mm travel are commonly available, the 1.8-inch tapered steerer (specifically 1.8″ lower bearing) is extremely rare and not part of standard industry dimensions. Most modern forks use either a 1.5-inch straight or 1.5” to 1.125” tapered (commonly called “tapered”) steerer system, but not 1.8″.

It is likely there is a misunderstanding or typo in the specification—“1.8 inch” may be intended to refer to stanchion diameter (e.g., 38mm or 36mm is common) or could be a misstatement of the head tube standard. After comprehensive research, no major manufacturers (such as RockShox, Fox, SR Suntour, or suspension OEMs) currently produce a fork with a 1.8″ tapered steerer.

Recommendations:

– Double-check the frame’s head tube specifications—confirm required steerer type (likely 1.5” tapered).

– Consider a widely available 27.5″, 140mm travel fork with a 1.5” tapered steerer, which is compatible with most modern mountain bike frames.

– If the 1.8” specification is non-negotiable, custom fabrication or a proprietary solution may be required—though this is likely cost-prohibitive and impractical.

Final Verdict:

A suspension fork matching the exact description (27.5″, 140mm, 1.8” tapered steerer) is not commercially available. It is advised to reevaluate the steerer tube specification for accuracy and adapt to industry-standard components to ensure reliable sourcing and optimal performance.