The global components manufacturing industry is experiencing robust expansion, driven by rising demand across electronics, automotive, and industrial sectors. According to Mordor Intelligence, the global electronic components market was valued at USD 337.4 billion in 2023 and is projected to grow at a CAGR of 9.3% from 2024 to 2029. This surge is fueled by advancements in 5G technology, increased adoption of IoT devices, and the electrification of transportation. As supply chains become more complex and quality expectations rise, identifying superior manufacturers has become critical for OEMs aiming to maintain competitive advantage. Based on performance metrics, innovation output, and global market presence, the following three companies stand out as leaders in delivering high-reliability components at scale.

Top 3 Superior Components Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Superior Components

Domain Est. 2001

Website: superiorcomponents.com

Key Highlights: We are the world’s largest stocking distributor for OEMs building industrial, commercial, or residential furniture. Shop our inventory and order today!…

#2 Conveyor Components

Domain Est. 1996

Website: superior-ind.com

Key Highlights: Conveyor components including idlers, pulleys, belt cleaners, and accessories for reliable performance….

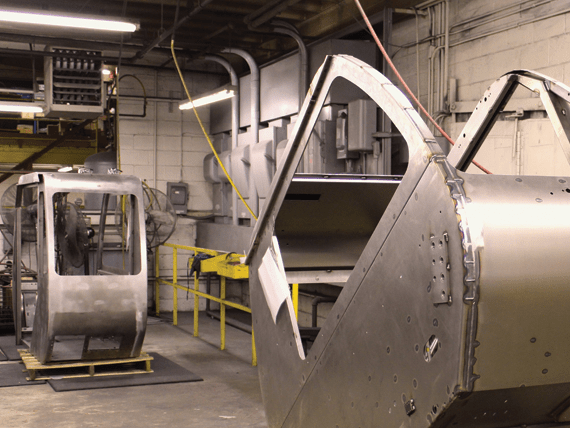

#3 Superior Components and Manufacturing

Domain Est. 1998

Website: supercomp.com

Key Highlights: Superior Components is continuing to serve the forging industry – providing standard hammer wear parts, die keys, dowels, bolsters, trim tools, and other parts….

Expert Sourcing Insights for Superior Components

H2: Market Trends Forecast for Superior Components in 2026

As we approach 2026, Superior Components—operating in the industrial and advanced manufacturing sectors—is positioned to experience transformative shifts driven by technological innovation, evolving customer demands, and macroeconomic dynamics. The following analysis outlines key market trends expected to shape the company’s landscape in the coming years.

1. Accelerated Adoption of Smart Manufacturing

The global push toward Industry 4.0 is expected to intensify, with smart factories leveraging IoT-enabled sensors, predictive maintenance, and real-time data analytics. Superior Components will likely see increased demand for intelligent, connected components that integrate seamlessly into automated systems. By 2026, customers across automotive, aerospace, and industrial automation will prioritize components that support digital twin technology and remote monitoring, pushing Superior Components to enhance product digitization and data compatibility.

2. Growth in Electric Vehicles (EVs) and Renewable Energy

With global EV sales projected to exceed 40 million units annually by 2026, Superior Components stands to benefit from rising demand for high-performance motors, power electronics, and precision-engineered parts. Additionally, expanding investments in wind, solar, and energy storage infrastructure will drive need for reliable, durable components in harsh environments. Superior Components can capitalize on this trend by expanding its product lines tailored for EV drivetrains and renewable energy systems, especially with a focus on lightweight, corrosion-resistant materials.

3. Supply Chain Resilience and Regionalization

Post-pandemic lessons and geopolitical tensions have prompted a shift toward nearshoring and supply chain localization. By 2026, OEMs will increasingly favor suppliers with regional manufacturing hubs and agile logistics networks. Superior Components must consider expanding production capacity in North America and Europe to meet Just-in-Time (JIT) delivery expectations while reducing dependency on single-source suppliers. Strategic partnerships with local logistics providers and adoption of blockchain for supply chain transparency will be critical differentiators.

4. Sustainability and Regulatory Pressure

Environmental regulations, including the EU’s Green Deal and U.S. Inflation Reduction Act, will mandate lower emissions and greater energy efficiency across industrial supply chains. Superior Components will face growing demand for eco-designed products—components that are recyclable, energy-efficient, and produced with low-carbon processes. By 2026, sustainability reporting and compliance with ESG standards will be non-negotiable for market access, pushing the company to invest in green manufacturing technologies and circular economy practices.

5. Talent and Automation in Production

Labor shortages in skilled manufacturing roles are expected to persist into 2026. Superior Components will need to balance automation adoption with workforce development. Investment in AI-driven quality control, robotic assembly lines, and upskilling programs will be essential to maintain competitiveness. Companies that integrate human-machine collaboration effectively will achieve higher throughput and product consistency, improving margins and customer satisfaction.

6. Customization and On-Demand Manufacturing

Customers are shifting from standardized parts to engineered-to-order solutions. Advances in additive manufacturing (3D printing) and modular design will enable Superior Components to offer rapid prototyping and low-volume, high-complexity production. By 2026, the ability to deliver customized components with short lead times will be a key competitive advantage, especially in aerospace and medical device markets.

Conclusion

In 2026, Superior Components will operate in a highly dynamic and competitive environment shaped by digital transformation, sustainability imperatives, and evolving customer expectations. To maintain leadership, the company must proactively invest in smart technologies, strengthen regional supply chains, and align its product development with global decarbonization goals. A strategic focus on innovation, agility, and sustainability will position Superior Components as a preferred partner in next-generation industrial ecosystems.

Common Pitfalls in Sourcing Superior Components (Quality, IP)

Sourcing superior components is critical to ensuring product performance, reliability, and compliance. However, companies often encounter significant challenges related to quality assurance and intellectual property (IP) protection. Failing to address these pitfalls can result in product failures, legal liabilities, and reputational damage.

Quality-Related Pitfalls

1. Inadequate Supplier Qualification

Relying on unverified or poorly vetted suppliers increases the risk of receiving substandard components. Many organizations skip comprehensive audits or fail to validate a supplier’s manufacturing capabilities, certifications (e.g., ISO 9001, IATF 16949), or quality control processes, leading to inconsistent product quality.

2. Counterfeit or Recycled Components

The electronics and manufacturing sectors are particularly vulnerable to counterfeit parts. These may include recycled, remarked, or falsified components that mimic genuine products but fail prematurely. Sourcing from unauthorized distributors or gray market channels significantly increases this risk.

3. Inconsistent Quality Across Batches

Even with qualified suppliers, performance may vary between production runs due to changes in raw materials, processes, or oversight. Without robust incoming inspection protocols or statistical process control (SPC) requirements, these inconsistencies can go undetected until field failures occur.

4. Lack of Traceability

Superior components require full traceability—batch numbers, date codes, material certifications, and chain of custody. Poor traceability complicates root cause analysis during failures and undermines compliance with industry standards (e.g., aerospace, medical, automotive).

5. Overlooking Environmental and Regulatory Compliance

Components may meet functional specs but fail to comply with RoHS, REACH, or conflict minerals regulations. Ignoring these requirements can result in supply chain disruptions, product recalls, or market access denials.

Intellectual Property-Related Pitfalls

1. Unauthorized Use of Proprietary Designs

Sourcing from suppliers who reverse-engineer or copy patented components exposes buyers to IP infringement claims. Even if the buyer is unaware, legal liability can still arise under doctrines of contributory infringement.

2. Weak or Unclear IP Clauses in Contracts

Many procurement agreements lack explicit terms defining ownership of custom-designed components, tooling, or modifications. This ambiguity can lead to disputes over rights to use, modify, or transfer designs, especially when switching suppliers.

3. Supplier Ownership of Jointly Developed IP

In collaborative development scenarios, suppliers may claim ownership of improvements or derivative works. Without clear IP assignment clauses, companies risk losing control over critical innovations integral to their products.

4. Exposure to Trade Secret Leakage

Sharing sensitive specifications or schematics with suppliers without proper NDAs or data protection controls can result in trade secret exposure. Unsecured communication channels or insufficient cybersecurity at supplier facilities increase this vulnerability.

5. Grey Market Redistribution of Custom Components

Custom-designed parts may be diverted by unscrupulous suppliers to third parties or sold on the open market. This not only undermines competitive advantage but may also dilute brand integrity if components are used in inferior products.

Mitigation Strategies

To avoid these pitfalls, organizations should implement rigorous supplier qualification programs, conduct regular audits, enforce strong contractual IP protections, and use serialization and authentication technologies to ensure component authenticity. Engaging legal and technical experts early in the sourcing process can significantly reduce both quality and IP risks.

Logistics & Compliance Guide for Superior Components

This guide outlines the essential logistics and compliance procedures for Superior Components to ensure efficient operations, regulatory adherence, and customer satisfaction.

Supply Chain Management

Superior Components maintains a strategic network of suppliers and distribution partners to ensure timely material procurement and product delivery. All supply chain activities must comply with contractual agreements, quality standards, and ethical sourcing principles. Regular performance evaluations of suppliers are conducted to monitor reliability, lead times, and compliance with environmental and labor regulations.

Inventory Control

Accurate inventory management is critical to meeting production schedules and customer demands. The company utilizes an integrated inventory management system to track raw materials, work-in-progress (WIP), and finished goods in real time. Cycle counts and periodic audits are performed to maintain inventory accuracy and identify discrepancies promptly.

Shipping & Receiving Procedures

All incoming and outgoing shipments must be documented and inspected. Receiving personnel verify purchase order numbers, quantities, and product condition upon delivery. Shipping documentation, including packing slips, bills of lading, and commercial invoices, must be complete and accurate. Carriers are selected based on reliability, cost, and capability to meet delivery timelines.

Export Compliance

Superior Components adheres to all U.S. export control regulations, including the Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), where applicable. All exports undergo a classification review to determine licensing requirements. Employees involved in international shipping must complete export compliance training and maintain records for a minimum of five years.

Import Compliance

Imported goods must comply with U.S. Customs and Border Protection (CBP) regulations. All shipments require accurate Harmonized Tariff Schedule (HTS) classification, proper valuation, and country-of-origin marking. Documentation, including entry filings and certificates of origin, must be retained in accordance with customs requirements.

Regulatory Certifications

Products must meet all relevant industry standards and certifications, including but not limited to ISO 9001 (Quality Management), RoHS (Restriction of Hazardous Substances), and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals). Certification status is reviewed annually and updated as necessary.

Hazardous Materials Handling

If handling hazardous materials, all staff must be trained in accordance with OSHA’s Hazard Communication Standard (HCS). Proper labeling, storage, and disposal procedures must be followed. Safety Data Sheets (SDS) are maintained and readily accessible for all hazardous substances.

Record Retention & Documentation

All logistics and compliance-related documents—including shipping records, customs filings, compliance training logs, and audit reports—must be securely stored for a minimum of seven years. Digital records are backed up regularly to ensure data integrity and availability.

Continuous Improvement

Superior Components is committed to ongoing improvement in logistics efficiency and compliance practices. Regular internal audits and management reviews are conducted to identify areas for enhancement and ensure alignment with evolving regulatory requirements and industry best practices.

In conclusion, sourcing superior components is a strategic imperative that directly impacts product quality, reliability, and long-term success. By prioritizing factors such as supplier reputation, material quality, certifications, and consistent performance, organizations can ensure they integrate only the best components into their products. This not only enhances operational efficiency and customer satisfaction but also strengthens competitive advantage in the market. A disciplined, transparent, and proactive approach to component sourcing ultimately drives innovation, reduces risk, and supports sustainable growth.