The global sunglasses market is experiencing robust growth, driven by rising fashion consciousness, increased UV protection awareness, and expanding e-commerce channels. According to a report by Grand View Research, the global sunglasses market size was valued at USD 28.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. Similarly, Mordor Intelligence projects steady expansion, citing North America as a key regional contributor due to high consumer spending on luxury accessories and strong brand presence. In the U.S., domestic manufacturing continues to play a critical role in delivering high-quality, innovative eyewear that meets both fashion and functional demands. As demand for sustainable, premium, and technologically advanced sunglasses rises, American manufacturers are leveraging advanced materials, domestic production agility, and design excellence to capture market share. Here’s a data-driven look at the top 10 sunglasses manufacturers in the USA shaping this evolving industry landscape.

Top 10 Sunglass Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

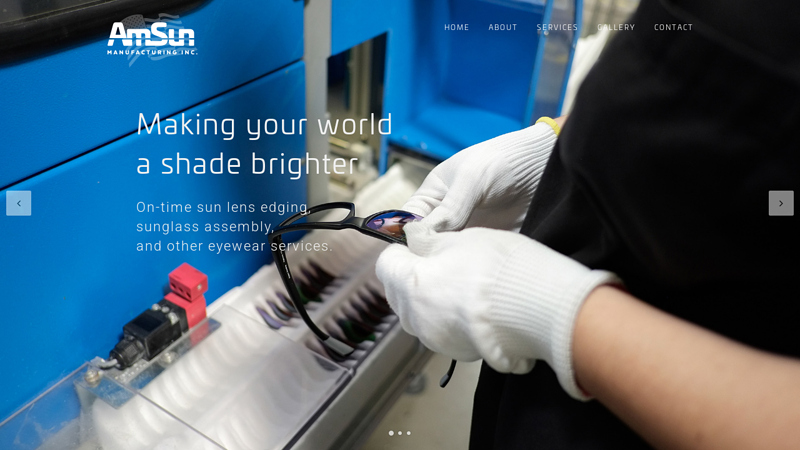

#1 AmSun

Domain Est. 2017

Website: americansunglassmanufacturing.com

Key Highlights: We are a collaborative team of expert sunglass and prescription eyewear producers with over 30 years of experience….

#2 Marchon Eyewear

Domain Est. 1995

Website: marchon.com

Key Highlights: As one of the world’s largest designers, manufacturers and distributors of quality eyewear and sun wear, Marchon Eyewear specializes in premium fashion….

#3 Private Label Designs Eyewear and Sunglasses

Domain Est. 2018

Website: ioves-usa.com

Key Highlights: Private label custom design sunglasses made in Italy by IOVES Italian eyewear manufacturer for new and popular brands established in the US American market….

#4 Official Vuarnet US Store

Domain Est. 1997

Website: us.vuarnet.com

Key Highlights: Free delivery · 30-day returnsExplore the official Vuarnet US store for premium sunglasses, lenses, and frames. Experience the legendary vision and protection of our French-made e…

#5 Zeal Optics

Domain Est. 1997

Website: zealoptics.com

Key Highlights: Free delivery Free 30-day returnsSunglasses and goggles for any outdoor adventure. Explore more with plant-based polarized sunglasses. Superior ski goggles for an unsurpassed visua…

#6 Smith Optics

Domain Est. 2000

Website: smithoptics.com

Key Highlights: Crafted in the USA for nearly 60 years—made for a lifetime of adventures. Go behind the scenes at our U.S. manufacturing facility, affectionately known as MFG….

#7 Wiley X Sunglasses and Safety Glasses

Domain Est. 2000

Website: wileyx.com

Key Highlights: Discover and shop high-end protective sunglasses, tactical goggles, apparel, and more available on the official Wiley X online store….

#8 Studio Optyx

Domain Est. 2009

Website: studiooptyx.com

Key Highlights: Studio Optyx is a wholesale eyewear design & manufacturing company specializing in quality frames that push limits of design….

#9 IVI Vision ®

Domain Est. 2011

Website: ivivision.com

Key Highlights: ivi is a Family Owned Company based in Orange County, California offering premium sunglasses, optical frames, and lenses….

#10 Explore Sunglasses for Men & Women

Domain Est. 2014

Website: epocheyewear.com

Key Highlights: Epoch Eyewear is a Veteran owned sunglasses brand offering designer quality eyewear at an affordable price. Quit overpaying for sunglasses, shop Epoch Eyewear….

Expert Sourcing Insights for Sunglass Usa

2026 Market Trends for Sunglasses in the USA

The U.S. sunglasses market is poised for dynamic changes by 2026, shaped by evolving consumer preferences, technological advancements, sustainability demands, and shifting fashion trends. As a mature yet highly competitive segment of the eyewear industry, the market is expected to experience steady growth driven by health awareness, fashion innovation, and digital transformation.

Growing Emphasis on Health and UV Protection

Consumer awareness about the long-term risks of UV exposure continues to rise, prompting greater demand for sunglasses with enhanced UV400 protection and blue light filtering. By 2026, health-conscious buyers—especially millennials and Gen Z—are expected to prioritize functional benefits over fashion alone. Brands are responding with lenses that offer not only UV protection but also polarization, anti-glare, and digital eye strain reduction, positioning sunglasses as essential wellness accessories.

Sustainability and Eco-Friendly Materials

Sustainability is becoming a key differentiator in the sunglasses market. By 2026, an increasing number of U.S. consumers will favor brands using recycled plastics, bio-based acetates, and biodegradable packaging. Leading players like Pela and Proof Eyewear are setting benchmarks in eco-conscious design, influencing larger brands to adopt circular business models. Transparency in sourcing and ethical production will be critical for brand loyalty and market share.

Rise of Direct-to-Consumer (DTC) and E-Commerce Platforms

The DTC model will continue to disrupt traditional retail in 2026. Online-first brands such as Quay, Ray-Ban Meta (in partnership with Meta), and Knockaround leverage social media, influencer marketing, and personalized shopping experiences to capture younger demographics. Augmented reality (AR) virtual try-ons and AI-powered style recommendations will enhance online engagement, reducing dependency on brick-and-mortar stores.

Integration of Smart Technology

Smart sunglasses are expected to gain traction, particularly with the rollout of Ray-Ban Meta and similar tech-integrated eyewear. Features such as built-in audio, voice assistants, camera capabilities, and fitness tracking will appeal to tech-savvy users. As wearable technology becomes more seamless, the convergence of fashion and functionality will redefine the product category, creating a premium niche within the market.

Fashion and Personalization Trends

Personalization will be a major trend in 2026, with consumers seeking unique styles that reflect individual identity. Customizable frame colors, lens tints, and engraving options will be offered by both luxury and affordable brands. Additionally, fashion collaborations—such as designer x streetwear crossovers—will drive limited-edition releases that generate buzz and boost sales.

Expansion of the Premium and Luxury Segment

The luxury sunglasses segment is projected to grow significantly, fueled by rising disposable incomes and aspirational branding. Brands like Gucci, Prada, and Tom Ford will maintain strong positions, while emerging luxury labels focus on exclusivity and craftsmanship. The resale market for high-end sunglasses is also expected to expand, supported by platforms like The RealReal and Grailed.

Demographic Shifts and Inclusivity

In 2026, brands will increasingly focus on inclusive design—offering sunglasses for diverse face shapes, skin tones, and gender expressions. Adaptive styles for children, seniors, and people with disabilities will gain attention, aligning with broader social values. Marketing campaigns will reflect greater diversity, reinforcing authenticity and brand trust.

Conclusion

By 2026, the U.S. sunglasses market will be characterized by innovation, sustainability, and personalization. Brands that successfully integrate health benefits, eco-conscious practices, digital engagement, and inclusive design will lead the industry. As the line between fashion, function, and technology blurs, the future of sunglasses in America will be defined not just by style, but by purpose and personal connection.

Common Pitfalls When Sourcing Sunglasses in the USA: Quality and Intellectual Property Issues

Logistics & Compliance Guide for Sunglasses in the USA

Navigating the logistics and compliance landscape is essential for successfully importing or distributing sunglasses in the United States. This guide outlines key considerations to ensure smooth operations and regulatory adherence.

Import Regulations and Customs Clearance

All sunglasses imported into the USA must comply with U.S. Customs and Border Protection (CBP) requirements. Importers are responsible for accurate classification under the Harmonized Tariff Schedule (HTS), typically under HTS code 9004.10.00 for sunglasses. Duties vary based on frame and lens materials, so proper classification is critical to avoid delays and penalties. Required documentation includes a commercial invoice, bill of lading, packing list, and, if applicable, a Customs Bond.

FDA Compliance for Eyewear

While most standard sunglasses are not subject to pre-market approval, the U.S. Food and Drug Administration (FDA) regulates sunglasses as medical devices under 21 CFR Part 801.410. Manufacturers and importers must ensure that sunglasses provide adequate UV protection—blocking at least 99% of UVA and 99% of UVB rays. Labeling must include UV protection claims, and products must meet impact resistance standards if marketed as protective eyewear. FDA registration is required for foreign manufacturers, and U.S. agents must be designated.

Labeling and Consumer Protection

Sunglasses sold in the USA must comply with Federal Trade Commission (FTC) labeling rules. Labels must include:

– UV protection information (e.g., “UV400” or “100% UV protection”)

– Country of origin

– Material composition (e.g., acetate, polycarbonate)

– Care instructions

Misleading claims about UV protection or lens performance can result in enforcement actions. The FTC also requires truthful advertising and clear disclosure of product limitations.

Consumer Product Safety Commission (CPSC) Requirements

While not all sunglasses fall under CPSC jurisdiction, those intended for children (under 12 years) may be subject to the Consumer Product Safety Improvement Act (CPSIA). This includes limits on lead content and phthalates in accessible parts. Importers should test for compliance and maintain Children’s Product Certificates (CPCs) when applicable. General safety standards for sharp edges and structural integrity also apply.

Intellectual Property and Brand Protection

Ensure that sunglass designs, logos, and branding do not infringe on existing trademarks or patents. Register trademarks with the U.S. Patent and Trademark Office (USPTO) to protect brand identity. Counterfeit goods are frequently flagged at U.S. ports—working with reputable suppliers and maintaining documentation helps avoid seizures.

Distribution and Supply Chain Logistics

Efficient logistics involve selecting reliable freight forwarders, warehousing partners, and last-mile carriers. Temperature and humidity-controlled storage may be necessary to prevent lens and frame damage. Consider Fulfillment by Amazon (FBA) or third-party logistics (3PL) providers for e-commerce operations. Inventory management systems should track batch numbers and expiration dates (if applicable) for traceability.

State-Level Compliance and Sales Tax

Sunglasses are generally subject to state sales tax. Register with state revenue departments where you have economic nexus (typically based on sales volume or transaction count). Some states also require additional labeling or environmental fees. Verify local regulations in high-volume markets such as California (which enforces Proposition 65 warnings for certain chemicals).

Sustainability and Packaging Regulations

Packaging must comply with state and federal environmental standards. Avoid excessive plastic use and consider recyclable materials. States like California require recycling symbols and may restrict certain plastics. Include proper disposal instructions if applicable.

Recordkeeping and Audits

Maintain records of import documentation, compliance testing, FDA registration, and transaction history for a minimum of five years. These records may be requested during CBP, FDA, or FTC audits. Implement a compliance management system to monitor regulatory updates and ensure ongoing adherence.

By following this guide, businesses can ensure that their sunglass operations in the USA remain compliant, efficient, and consumer-focused.

In conclusion, sourcing sunglass manufacturers in the USA offers numerous advantages, including high-quality craftsmanship, compliance with strict safety and environmental regulations, and shorter lead times due to domestic logistics. American manufacturers often provide greater transparency, ethical labor practices, and opportunities for customization and collaboration, making them ideal partners for brands focused on sustainability, innovation, and premium product standards. While costs may be higher compared to overseas alternatives, the investment supports local economies, reduces supply chain risks, and enhances brand credibility. For businesses prioritizing quality, speed to market, and brand integrity, partnering with a reputable U.S.-based sunglass manufacturer can be a strategic and sustainable choice. Conducting thorough due diligence, requesting samples, and evaluating manufacturing capabilities are essential steps to ensure a successful and long-term partnership.