The global sunflower oil market has experienced steady expansion, driven by rising consumer preference for healthier cooking oils and increasing demand from the food processing industry. According to Grand View Research, the global sunflower oil market size was valued at USD 14.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is further supported by Mordor Intelligence, which highlights expanding production capacities in key regions such as Eastern Europe, South America, and Asia-Pacific, where sunflower cultivation is gaining momentum due to favorable agro-climatic conditions and government support. As demand surges, a select group of manufacturers are scaling production, improving oil quality, and investing in sustainable sourcing—shaping the competitive landscape. Here, we spotlight the top 10 sunflower oil manufacturers leading the industry through innovation, volume, and market reach.

Top 10 Sunflower Oil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Agro-industrial company overview

Website: kernel.ua

Key Highlights: Kernel is the largest producer and exporter of grains in Ukraine, the leader of the world sunflower oil market, and a major supplier of agricultural products….

#2 Sunrich Products

Domain Est. 1996

Website: sunrich.com

Key Highlights: Sunrich Products, is a leading producer, supplier, and ingredient developer for the Sunflower industry. To ensure excellence and comply with regulations, we ……

#3 Kernel — №1 sunflower oil producer in the world kernel

Domain Est. 2016

Website: kernel-brand.com

Key Highlights: Most high-quality sunflower oil directly from the Ukrainian fields, which recognized all over the world. Modern technologies, highest quality and finest ……

#4 Bellvie SHD

Domain Est. 2019

Website: shd.com.lb

Key Highlights: SHD supplies regional markets with the highest quality of vegetable oil. We always ensure the highest standards of quality….

#5 Yuzhnyi Polyus Oil Mill, LLC

Domain Est. 2019

Website: en.so-pole.ru

Key Highlights: Yuzhnyi Polyus Oil Mill, LLC is a producer of organic sunflower oil in the Krasnodar region … The official website of the company is located at: en.so-pole.ru….

#6 Sunflower Oil

Domain Est. 1997

Website: sunflowernsa.com

Key Highlights: The versatility of this healthy oil is recognized by cooks internationally. Sunflower oil is valued for its light taste, frying performance and health benefits….

#7 Red River Commodities

Domain Est. 1998

Website: redriv.com

Key Highlights: Red River Commodities processes, roasts and packages sunflowers, and other crops into food processing ingredients and consumer products….

#8 Avesafya Oil

Domain Est. 2023

Website: avesafya-oil.com

Key Highlights: Avesafya Sunflower Oil was specially developed to bring the purest form of taste to your tables. You can use Avesafya Sunflower Oil safely in all hot and cold ……

#9 Safya Cooking Oil Suppliers

Domain Est. 2023

Website: safyayagi.com

Key Highlights: Aves, which has a large share in the supply and production of Turkish crude sunflower oil, produces 1 million tons of edible oil, pulp, and biodiesel per year….

#10 Sunflower Oil

Website: orkide.com.tr

Key Highlights: 500 ML Sunflower Oil. You may use the Orkide Sunflower Oil in all meals warm and cold, in fries, salads and pastries….

Expert Sourcing Insights for Sunflower Oil

2026 Market Trends for Sunflower Oil: A H2 Analysis

The global sunflower oil market is poised for significant shifts in 2026, driven by the interplay of supply chain dynamics, evolving consumer preferences, and macroeconomic factors. Here’s a breakdown of the key trends expected during the second half of 2026 (H2 2026), focusing on the critical period following the new harvest season in major producing regions:

1. Supply Recovery & Price Stabilization (Post-Harvest Impact)

- Ukraine & Black Sea Revival: The most defining trend in H2 2026 will be the anticipated recovery in Ukrainian sunflower production and exports. Assuming continued stabilization and improved logistics (ports, rail), Ukraine should return to being a dominant global supplier. This increased supply will be the primary driver for price stabilization or potential moderation compared to the volatility seen earlier in the year or in previous years.

- European Union (EU) Output: EU production (led by Romania, Bulgaria, France) is expected to remain relatively stable or slightly increase, supported by ongoing support for oilseed cultivation. This provides additional supply buffer.

- Price Trajectory: Prices will likely peak in early H2 (May-June) as pre-harvest stocks dwindle and uncertainty remains. The arrival of the new Ukrainian and EU crop (July onwards) should trigger a downward pressure on prices. By Q4 2026, prices are expected to settle at more sustainable levels, though still influenced by global vegetable oil benchmarks and energy costs.

2. Geopolitical & Logistical Factors Remain Critical

- Black Sea Shipping Security: The safe and efficient export of Ukrainian sunflower oil via the Black Sea remains paramount. Any disruptions due to conflict escalation, mine threats, or political agreements impacting the export corridor will cause immediate price spikes and supply chain anxiety.

- Global Trade Flows: The competition for Ukrainian and Russian supply will intensify. Traditional importers (India, EU, Middle East, North Africa) will be highly active. Alternative sourcing from the Americas (Argentina, USA) may see increased demand if Black Sea logistics face delays, but scale is smaller.

3. Demand Dynamics: Diverging Paths

- Food Sector Resilience: Demand from the food processing industry (margarine, snacks, frying oil) and household consumption in key markets (India, EU, MENA) is expected to remain relatively stable or grow modestly, driven by population growth and established culinary uses. Premium/high-oleic variants may see stronger growth.

- Biodiesel Uncertainty: Demand for sunflower oil as a biodiesel feedstock will be highly sensitive to:

- Government Mandates: EU’s ReFuelEU Aviation and broader renewable energy targets could provide support, but competition from waste oils, used cooking oil (UCO), and other feedstocks (rapeseed, palm) is fierce.

- Economic Viability: Sunflower oil’s cost-effectiveness compared to alternatives will determine its share in the biodiesel mix. High crude oil prices make biodiesel more attractive, but sunflower oil needs to compete on price.

- Industrial Applications: Use in cosmetics, lubricants, and animal feed is expected to grow steadily but won’t be a major volume driver.

4. Competitive Landscape with Other Vegetable Oils

- Palm Oil: Sunflower oil’s main competitor. Lower palm oil prices (potentially driven by strong Indonesian/Malaysian output) could pressure sunflower oil demand, especially in price-sensitive markets like India for frying and food service. Sustainability concerns around palm may offer sunflower a slight advantage in some segments.

- Soybean Oil: A major global player. US/SA crop yields and export competitiveness will influence the overall vegetable oil basket pricing, impacting sunflower oil’s relative attractiveness.

- Rapeseed/Canola Oil: Strong EU production and its established role in food and biodiesel will keep it a key competitor, particularly within Europe.

5. Sustainability & Traceability Gaining Traction

- Consumer & Regulatory Pressure: Demand for certified sustainable sunflower oil (e.g., via ISCC, RSPO equivalents) is expected to grow, driven by EU deforestation regulations (EUDR) and corporate ESG commitments. Traceability from farm to end-product will become increasingly crucial, especially for exports to the EU.

- “High-Oleic” Premium: High-oleic sunflower oil (HOSO), with superior stability and health profile (higher monounsaturated fats), will continue to command a significant price premium. Demand from the food industry seeking clean-label, non-GMO, high-stability oils will drive HOSO growth.

6. Input Cost & Climate Influences

- Input Costs: Fertilizer (especially potash and nitrogen) and energy (diesel, electricity for crushing) costs will continue to impact farmers’ planting decisions and crusher margins, feeding into final oil prices.

- Climate Risk: Weather patterns during the critical growing season (April-July) in Ukraine, Russia, and the EU will be a major wildcard. Drought, excessive rain, or heat stress could significantly impact yield forecasts and create supply concerns even in H2.

Summary Outlook for H2 2026:

H2 2026 is expected to be a period of transition and stabilization for the sunflower oil market. The successful harvest and export of the Ukrainian crop will be the single most important factor, leading to increased supply and downward pressure on prices after the typical pre-harvest peak. While geopolitical risks persist, the market should see improved predictability. Demand will be steady in food, with biodiesel remaining a wildcard. Competition with palm and soybean oil will be intense on price, while sustainability and high-oleic variants represent growth niches. Overall, the market is likely to move towards a more balanced state compared to recent volatile years, assuming stable conditions in the Black Sea region.

Common Pitfalls in Sourcing Sunflower Oil (Quality and Intellectual Property)

Sourcing sunflower oil effectively requires careful attention to both quality consistency and potential intellectual property (IP) issues. Overlooking these aspects can lead to supply chain disruptions, reputational damage, and legal liabilities. Below are the most common pitfalls to avoid:

Poor Quality Control and Inconsistent Specifications

One of the foremost challenges in sunflower oil sourcing is ensuring consistent quality across batches and suppliers. Key pitfalls include:

- Variable Oil Composition: Sunflower oil can vary significantly in fatty acid profile (e.g., high oleic vs. linoleic) depending on the seed variety and growing conditions. Sourcing without clearly defined specifications can result in off-spec oil unsuitable for intended applications (e.g., frying stability, shelf life).

- Adulteration and Contamination: Lower-cost suppliers may dilute sunflower oil with cheaper oils (e.g., palm or soybean) or use improper refining processes, leading to impurities, off-flavors, or elevated free fatty acid (FFA) levels.

- Inadequate Certifications: Failure to verify certifications such as non-GMO, organic, or food-grade (e.g., ISO, HACCP) can expose buyers to regulatory risks or consumer backlash.

- Inconsistent Processing Standards: Differences in refining, bleaching, and deodorizing (RBD) processes across suppliers affect color, odor, and oxidative stability. Poor process control can compromise end-product performance.

Lack of Traceability and Transparency

Without full supply chain visibility, buyers risk:

- Unverified Origin: Sunflower oil may be sourced from regions with poor agricultural practices or environmental concerns (e.g., deforestation, water overuse), impacting sustainability commitments.

- Blended Oils from Multiple Sources: Suppliers may blend oils from different origins or batches, obscuring traceability and increasing the risk of quality deviations.

- Insufficient Documentation: Missing or falsified certificates of analysis (CoA), origin declarations, or chain-of-custody records hinder compliance and audit readiness.

Overlooking Intellectual Property (IP) and Seed Rights

Intellectual property issues are increasingly relevant in agricultural commodities, particularly with proprietary seed varieties:

- Unauthorized Use of Protected Varieties: Many high-performance sunflower seeds (e.g., high oleic hybrids) are patented or protected under Plant Variety Rights (PVR). Sourcing oil derived from such seeds without proper licensing may infringe IP rights, especially if the oil is used in branded or specialty products.

- Downstream Liability: Even if the oil buyer is unaware, using oil from protected seed varieties in commercial products can expose them to legal claims from seed developers (e.g., BASF, Syngenta, or regional breeders).

- Lack of Supplier Declarations: Failing to require suppliers to certify that the sunflower seeds used are either non-protected varieties or properly licensed increases legal exposure.

Mitigation Strategies

To avoid these pitfalls:

- Define clear technical specifications (fatty acid profile, FFA, peroxide value, etc.) in procurement contracts.

- Conduct regular third-party testing and on-site audits of suppliers.

- Require full traceability documentation and sustainability certifications.

- Include IP compliance clauses in supplier agreements, mandating disclosure of seed origin and rights status.

- Engage legal counsel to assess IP risks, particularly when sourcing from regions with strong plant breeders’ rights.

By proactively addressing quality and IP concerns, organizations can secure reliable, compliant, and sustainable sunflower oil supplies.

Logistics & Compliance Guide for Sunflower Oil

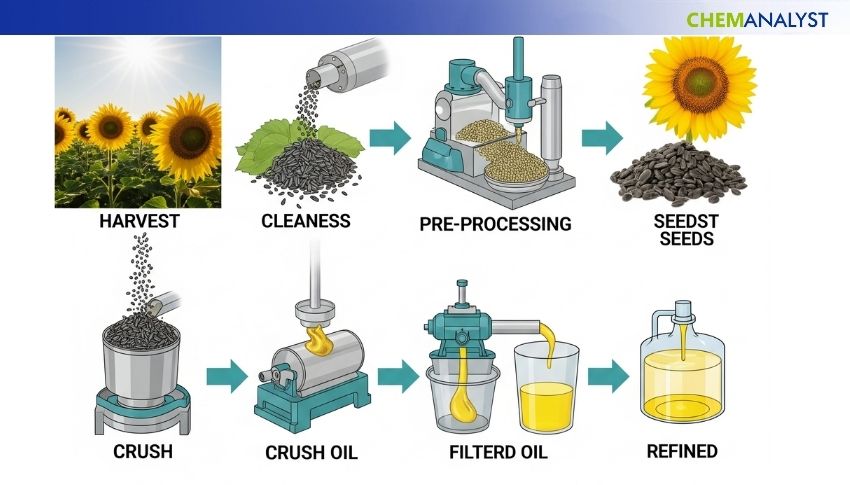

Overview and Key Characteristics

Sunflower oil, derived from sunflower seeds, is a widely traded vegetable oil used in food processing, cooking, and industrial applications. It is generally classified as a non-hazardous, edible liquid when refined. Its physical properties—such as viscosity, flash point, and freezing point—affect storage, transport, and handling requirements. Understanding these characteristics is essential for safe and compliant logistics.

Regulatory Compliance

Sunflower oil must comply with food safety and trade regulations in both origin and destination countries. Key compliance standards include:

– Codex Alimentarius: Sets international food safety standards for edible oils.

– FDA (U.S.): Requires adherence to Current Good Manufacturing Practices (CGMPs) under 21 CFR Part 117 for human food.

– EU Regulations: Complies with Regulation (EC) No 852/2004 on food hygiene and Regulation (EU) No 1169/2011 on food labeling.

– Country-Specific Import Requirements: Many countries require phytosanitary certificates, certificates of origin, and nutritional labeling. Importers must verify halal, kosher, or non-GMO status if applicable.

Packaging and Containment

Sunflower oil is typically transported in:

– Drums (200L): Steel or plastic; suitable for small volumes.

– Intermediate Bulk Containers (IBCs): 1,000L capacity; stackable and reusable.

– Flexitanks: Installed in 20ft dry containers; cost-effective for bulk shipments (up to 24,000L).

– Tank Containers: Stainless steel ISO tanks for large-volume, high-purity shipments.

Ensure packaging is food-grade, leak-proof, and protected from contamination. Use nitrogen blanketing if oxidation is a concern during long transit.

Storage Conditions

Store sunflower oil in a cool, dry, and dark environment to prevent rancidity and quality degradation:

– Ideal temperature: 10°C to 25°C (50°F to 77°F).

– Avoid direct sunlight and heat sources.

– Maintain relative humidity below 70% to prevent condensation.

– Keep away from strong-smelling substances due to oil’s absorbent nature.

Transportation Requirements

Sunflower oil can be shipped via sea, road, rail, or air, depending on volume and urgency:

– Marine Freight: Most common for bulk shipments; use reefer containers if temperature control is needed.

– Road/Rail: Suitable for regional distribution; ensure tankers or containers are dedicated to food-grade products.

– Air Freight: Rare due to cost; reserved for small, high-value or urgent shipments.

Adhere to the International Maritime Dangerous Goods (IMDG) Code if transporting in large quantities, though sunflower oil is generally not classified as dangerous.

Documentation and Labeling

Essential documents include:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Analysis (CoA)

– Certificate of Origin

– Phytosanitary certificate (if required)

– Food safety compliance certificate (e.g., FDA Prior Notice for U.S. imports)

Labels must include product name, batch number, net weight, manufacturing/expiry date, storage instructions, and allergen information (if applicable).

Quality Control and Testing

Implement quality checks at origin and destination:

– Test for free fatty acids (FFA), peroxide value (PV), and moisture content.

– Verify color, odor, and clarity.

– Ensure compliance with international or customer-specific specifications.

– Retain samples for traceability and dispute resolution.

Sustainability and Traceability

Increasing demand for sustainable sourcing requires:

– Proof of sustainable agricultural practices (e.g., ISCC or RSPO certification, if applicable).

– Traceability from farm to final product using batch tracking systems.

– Compliance with deforestation-free supply chain policies in target markets.

Risk Management and Contingency Planning

Anticipate and mitigate common risks:

– Contamination: Use dedicated food-grade transport and storage.

– Temperature Fluctuations: Monitor and control during transit.

– Theft or Pilferage: Secure loads and use tamper-evident seals.

– Delays: Maintain buffer stock and flexible logistics partners.

Develop procedures for spill response, product recall, and customs clearance issues.

Conclusion

Effective logistics and compliance for sunflower oil require attention to food safety standards, proper handling, accurate documentation, and adherence to international trade regulations. Proactive planning and quality assurance ensure product integrity, regulatory compliance, and customer satisfaction across the supply chain.

In conclusion, sourcing sunflower oil manufacturers requires a strategic approach that balances quality, cost, reliability, and compliance. It is essential to evaluate potential suppliers based on their production capacity, adherence to international quality standards (such as ISO, HACCP, or FDA), raw material sourcing practices, and ability to meet volume and delivery requirements. Conducting on-site audits, requesting product samples, and verifying certifications help ensure credibility and product consistency. Additionally, considering factors like geographical proximity, sustainability practices, and scalability can provide long-term advantages. Building strong, transparent relationships with manufacturers not only facilitates smoother operations but also supports resilience in the supply chain. Ultimately, a well-researched and due diligence-driven selection process will enable businesses to source high-quality sunflower oil efficiently and sustainably.