The global submersible aerator market is experiencing robust growth, driven by increasing demand for efficient wastewater treatment solutions across municipal and industrial sectors. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 1.8 billion in 2022 and is projected to grow at a CAGR of over 6.5% from 2023 to 2028. This expansion is fueled by stringent environmental regulations, rising urbanization, and the need for sustainable water management practices. Submersible aerators, known for their energy efficiency and low maintenance, are becoming a preferred choice in activated sludge processes and aerobic digestion systems. As innovation intensifies and digital monitoring integration rises, manufacturers are focusing on smart, high-performance models to meet evolving industry needs. With North America and Europe maintaining strong market shares while Asia-Pacific emerges as a high-growth region, the competitive landscape is rapidly evolving. The following list highlights the top 10 submersible aerator manufacturers leading this transformation through technological advancement, global reach, and scalable solutions.

Top 10 Submersible Aerator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Submersible aerator type ABS XTA XTAK

Domain Est. 1996

Website: sulzer.com

Key Highlights: The XTA and XTAK are self-aspirating submersible aerators for wastewater and water treatment in municipal and industrial plants….

#2 Flygt Jet aerators

Domain Est. 1999

Website: xylem.com

Key Highlights: Flygt jet aerators come with proven long-term reliability thanks to Flygt N-technology, renowned for its non-clogging design and high operational efficiency ……

#3 Submersible Aerators / Air Mixers

Domain Est. 2013

Website: tsurumi-global.com

Key Highlights: Tsurumi’s submersible aerators are used at wastewater treatment facilities to aerate and agitate industrial wastewater, livestock wastewater and other water ……

#4 Submersible Aerator

Domain Est. 2013

Website: crigroups.com

Key Highlights: Submersible aerators are used at wastewater treatment facilities to aerate industrial wastewater and other water that needs treating….

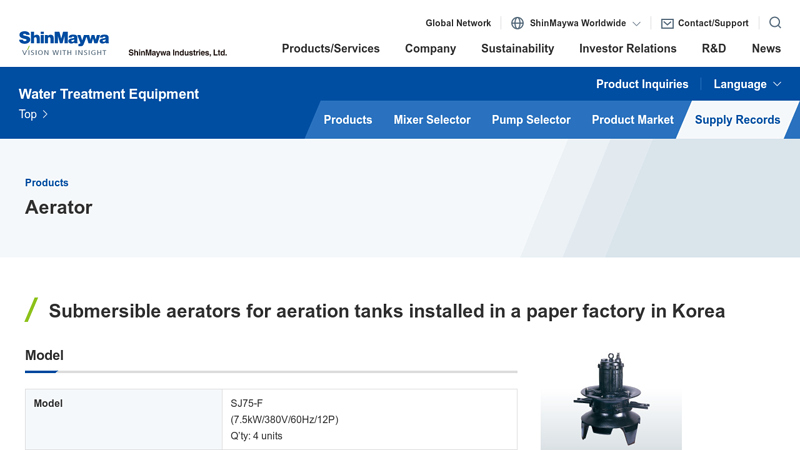

#5 Supply Records – Aerator

Website: shinmaywa.co.jp

Key Highlights: ShinMaywa submersible aerators realize efficient water treatment and help the customer to treat the industrial wastewater even in a small space….

#6 Sanko Pump Manufacturing, Co., Ltd. (Official)

Website: sankopump.co.jp

Key Highlights: Sand pumps for small-diameter mud propulsion methods, sand pumps for high depths, submersible aeration pumps, fountain pumps, submersible stirring pumps, ……

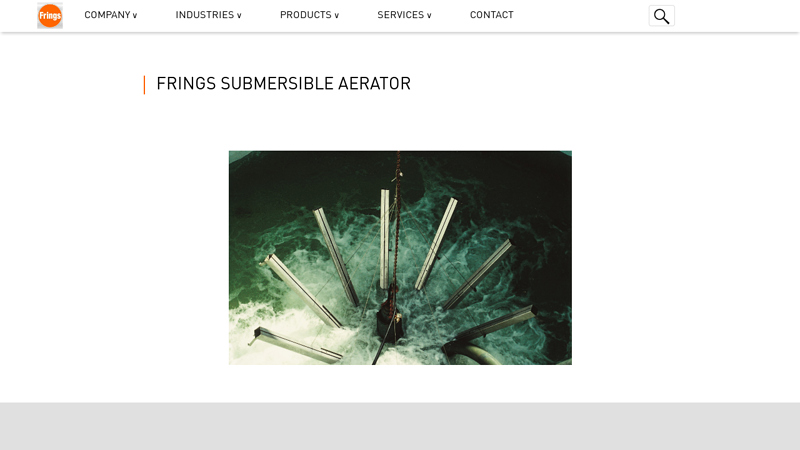

#7 frings submersible aerator

Domain Est. 1997

Website: frings.com

Key Highlights: FRINGS has been supplying aeration units for over 50 years. FRINGS rotor/stator high performance aerators enable a fine-bubble air or gas entry into liquids and ……

#8 Kasco Marine

Domain Est. 1998

Website: kascomarine.com

Key Highlights: Kasco Marine provides world leading aeration systems such as fountains, de-icers, circulators, aerators, diffusers, & biologics for aquatic applications….

#9 HURRICANE® Submersible Aerator/Mixer

Domain Est. 1998

Website: newterra.com

Key Highlights: The Hurricane’s self-contained system ensures an inexpensive installation process and requires no additional pumps, mounting platforms, or compressors….

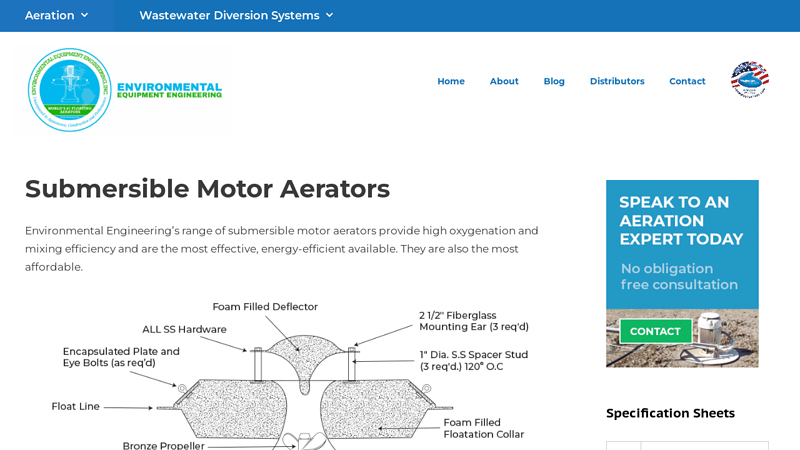

#10 Submersible Aerators – Optimal Performance and Reliability

Domain Est. 2005

Website: eeeusa.net

Key Highlights: The Submersible Pond Aerator You Can Rely On. Manufactured in the USA our range includes the Hy-Spray 3450 and 1800. Simplified design and creative engineering ……

Expert Sourcing Insights for Submersible Aerator

H2: Submersible Aerator Market Trends in 2026

The global submersible aerator market is projected to experience substantial growth and transformation by 2026, driven by increasing environmental regulations, urbanization, and the expansion of wastewater treatment infrastructure. This analysis outlines key market trends shaping the submersible aerator industry in 2026 across technological innovation, regional demand, sustainability, and competitive dynamics.

-

Growing Demand in Municipal and Industrial Wastewater Treatment

By 2026, rising urban populations and stricter discharge regulations are compelling municipalities and industries to upgrade wastewater treatment facilities. Submersible aerators—valued for their energy efficiency, ease of installation, and low maintenance—are being increasingly adopted in both new plants and retrofitted systems. The industrial sector, particularly food and beverage, pharmaceuticals, and chemical manufacturing, is a key growth driver due to stringent effluent standards. -

Advancements in Energy-Efficient and Smart Technologies

Technological innovation is a defining trend in the 2026 market. Manufacturers are integrating variable frequency drives (VFDs), real-time monitoring systems, and IoT-enabled sensors into submersible aerators. These smart features allow operators to optimize oxygen transfer rates, reduce energy consumption, and enable predictive maintenance. Energy efficiency remains a top priority, with new models achieving higher oxygen transfer efficiency (OTE) while consuming up to 20–30% less power than older systems. -

Shift Toward Sustainable and Eco-Friendly Solutions

Sustainability initiatives are influencing procurement decisions. By 2026, there is a noticeable shift toward submersible aerators made from corrosion-resistant, recyclable materials and designed for longer lifespans. Additionally, products with lower carbon footprints—through renewable energy integration or energy recovery systems—are gaining market preference, especially in Europe and North America. -

Regional Market Expansion

Asia-Pacific is expected to dominate the submersible aerator market by 2026, led by rapid industrialization in China, India, and Southeast Asian nations. Government investments in smart cities and water sustainability projects are accelerating demand. Meanwhile, North America and Europe continue to lead in adopting advanced aerator technologies, driven by modernization of aging infrastructure and compliance with EU Water Framework Directive and U.S. Clean Water Act standards. -

Consolidation and Competitive Differentiation

The competitive landscape is seeing consolidation, with major players acquiring niche technology firms to enhance product portfolios. Companies are differentiating through service offerings, including remote monitoring, lifecycle support, and performance guarantees. Key market participants such as Xylem, Sulzer, EBARA, and Aerostar are investing heavily in R&D to deliver modular, scalable solutions for diverse applications. -

Impact of Regulatory Policies and Incentives

Environmental regulations are a key catalyst. By 2026, countries worldwide are expected to enforce tighter limits on biochemical oxygen demand (BOD) and nitrogen levels in effluents. Incentives for green infrastructure and public-private partnerships (PPPs) are also promoting the adoption of advanced aeration systems in municipal projects.

In summary, the 2026 submersible aerator market is characterized by technological sophistication, sustainability imperatives, and robust regional growth. Stakeholders who prioritize innovation, energy efficiency, and regulatory compliance are likely to lead the market in this evolving landscape.

Common Pitfalls When Sourcing Submersible Aerators (Quality & Intellectual Property)

Sourcing submersible aerators involves technical complexity and market risks, particularly concerning product quality and intellectual property (IP) integrity. Overlooking these areas can lead to performance failures, safety hazards, legal disputes, and financial losses. Below are key pitfalls to avoid:

Inadequate Quality Verification

Many buyers focus solely on price and specifications without verifying actual product quality. Submersible aerators operate in harsh, continuous-duty environments (e.g., wastewater treatment), making durability and performance consistency critical. Common quality-related pitfalls include:

- Reliance on Spec Sheets Alone: Vendors often exaggerate performance data such as oxygen transfer efficiency (OTE), power consumption, or flow rates. Without third-party testing or real-world validation, these claims may be misleading.

- Poor Material Selection: Low-quality motors, seals, or impeller materials (e.g., inferior stainless steel or non-corrosion-resistant polymers) lead to premature failure, leaks, or reduced efficiency.

- Lack of Certifications: Absence of recognized certifications (e.g., IP68, CE, UL, ISO 9001) indicates potential non-compliance with international safety and performance standards.

- Inconsistent Manufacturing Processes: Suppliers with weak quality control may produce units with variable performance, even within the same batch.

Mitigation Strategy: Require independent test reports, conduct factory audits, and request sample testing under real operating conditions before large-scale procurement.

Intellectual Property (IP) Infringement Risks

Submersible aerators often incorporate patented technologies related to impeller design, motor efficiency, sealing mechanisms, or control systems. Sourcing from unverified suppliers increases the risk of purchasing counterfeit or IP-infringing products.

- Counterfeit or Copycat Products: Some suppliers replicate branded designs without licensing, offering lower prices but exposing buyers to legal liability and performance issues.

- Unclear IP Ownership: Contracts may not specify who owns modifications or custom designs, leading to disputes over usage rights or resale.

- Use of Unlicensed Technology: Suppliers may integrate patented components (e.g., energy-efficient motors or smart controls) without authorization, implicating the end user in infringement claims.

Mitigation Strategy: Perform due diligence on suppliers’ IP compliance, require warranties against infringement, and include IP ownership clauses in procurement contracts. Prefer suppliers who develop proprietary technology or have licensing agreements with original equipment manufacturers (OEMs).

By addressing these quality and IP pitfalls proactively, organizations can ensure reliable system performance, avoid legal exposure, and achieve long-term operational savings.

Logistics & Compliance Guide for Submersible Aerators

Product Overview and Classification

Submersible aerators are mechanical devices used in wastewater treatment and aquaculture to increase oxygen levels in water by mixing air with the liquid medium. These units typically consist of a motor, impeller, and diffuser, designed to operate fully submerged. Proper classification under international trade codes (e.g., HS Code) is essential for customs clearance. Submersible aerators generally fall under HS Code 8413.70 (Pumps for liquids, submersible types), though classification may vary by country and specific design. Confirm the correct HS code with local customs authorities or a licensed customs broker.

Packaging and Handling Requirements

To prevent damage during transit, submersible aerators must be securely packaged in robust, moisture-resistant materials. Use wooden crates or heavy-duty cardboard with internal foam or plastic supports to protect the motor housing and impeller. Clearly label packages with:

– “Fragile” and “This Side Up” indicators

– Product model number and serial number

– Weight and dimensions

– Handling instructions (e.g., “Do Not Stack”)

Ensure all electrical components are sealed against moisture, and remove any water from internal components before shipping. For units with integrated cables, coil and secure them to avoid strain.

Transportation Modes and Considerations

Submersible aerators can be shipped via air, ocean, or ground freight depending on urgency, destination, and unit size.

– Air Freight: Recommended for time-sensitive or remote deliveries. Comply with IATA regulations for machinery containing electrical components.

– Ocean Freight: Most cost-effective for large volumes. Secure cargo in containers using anti-vibration mounts and moisture-absorbing desiccants.

– Ground Transport: Ideal for regional deliveries. Ensure vehicles are equipped with suspension systems to minimize shock.

Always insure shipments and use freight forwarders experienced in industrial equipment logistics.

Import/Export Documentation

Accurate documentation is critical for customs compliance. Required documents typically include:

– Commercial Invoice (detailing value, quantity, and terms of sale)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Technical Specifications and User Manual (for regulatory review)

– Import/Export License (if required by destination country)

For exports from regulated regions (e.g., EU, USA), verify adherence to export control laws—most submersible aerators do not require an export license unless intended for restricted end-uses.

Regulatory and Environmental Compliance

Submersible aerators must comply with environmental and safety standards in both origin and destination countries. Key regulations include:

– CE Marking (for EU markets): Compliance with Machinery Directive 2006/42/EC and Low Voltage Directive 2014/35/EU.

– UL/CSA Certification (for North America): Ensures electrical safety per applicable standards (e.g., UL 508).

– RoHS and REACH Compliance: Restricts hazardous substances in electrical equipment (EU).

– IP Rating: Confirm minimum IP68 rating for full submersion capability.

Additionally, verify that the product does not violate local environmental discharge regulations, especially in sensitive ecological zones.

Customs Clearance and Duties

Engage a customs broker in the destination country to facilitate clearance. Provide full technical details to avoid misclassification. Duties and taxes vary by country—typical import tariffs for submersible pumps range from 0% to 8%. Some countries may impose additional environmental or energy efficiency levies. Pre-shipment inspections may be required (e.g., SONCAP for Nigeria, SASO for Saudi Arabia).

Installation and Post-Delivery Compliance

Upon delivery, verify the unit’s condition and documentation before installation. Only trained personnel should handle installation to meet safety and warranty requirements. Maintain records of:

– Delivery confirmation

– Installation logs

– Commissioning reports

– Compliance certifications

Notify end-users of any mandatory registration or reporting requirements under local environmental protection laws.

Maintenance and End-of-Life Disposal

Provide users with a maintenance schedule and guidelines for safe operation. At end-of-life, ensure disposal follows local e-waste and hazardous material regulations. Components such as motors and wiring may contain recyclable metals and must be processed by certified e-waste facilities. Avoid landfill disposal in jurisdictions with strict environmental legislation (e.g., EU WEEE Directive).

Contact and Support Information

For logistics or compliance inquiries, contact the manufacturer’s export compliance officer or designated logistics partner. Keep records of all communications and regulatory approvals for audit purposes.

Conclusion for Sourcing Submersible Aerators:

Sourcing submersible aerators requires a strategic evaluation of technical specifications, performance requirements, energy efficiency, durability, and after-sales support to ensure optimal performance in wastewater treatment or aquaculture applications. Selecting the right supplier involves assessing product quality, compliance with environmental and safety standards, and cost-effectiveness over the equipment’s lifecycle. By partnering with reputable manufacturers and suppliers who offer proven technology, reliable installation guidance, and responsive service, organizations can achieve efficient aeration, reduce operational costs, and support sustainable water management practices. A well-informed sourcing decision ultimately enhances system reliability, improves oxygen transfer efficiency, and contributes to long-term environmental and operational success.