The global automotive subframe market is experiencing steady growth, driven by increasing demand for lightweight vehicle components and advancements in modular vehicle platforms. According to Mordor Intelligence, the automotive subframe market was valued at approximately USD 24.7 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by the rising adoption of aluminum and high-strength steel subframes to improve fuel efficiency and vehicle handling. As automakers focus on modular architectures to streamline production and enhance structural rigidity, subframes have become critical components in modern vehicle design. The following list highlights the top nine car manufacturers leading innovation and integration of advanced subframe systems, based on production volume, engineering influence, and market presence.

Top 9 Subframe Car Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chassis Systems

Domain Est. 1991

Website: magna.com

Key Highlights: Explore Magna’s chassis structures including frame assemblies, chassis subframes and structural assemblies….

#2 Genuine BMW Subframe Assemblies

Domain Est. 1996

Website: turnermotorsport.com

Key Highlights: Free delivery over $49This is a Genuine BMW replacement rear subframe axle carrier. Perfect for replacing a frame damaged from rust or other physical impacts….

#3 BMW E46 Rear Subframe Reinforcement

Domain Est. 1999

Website: bimmerworld.com

Key Highlights: Installing rear subframe and floor reinforcements in BMW E46 models – 323i, 325i, 328i, 330i, and M3….

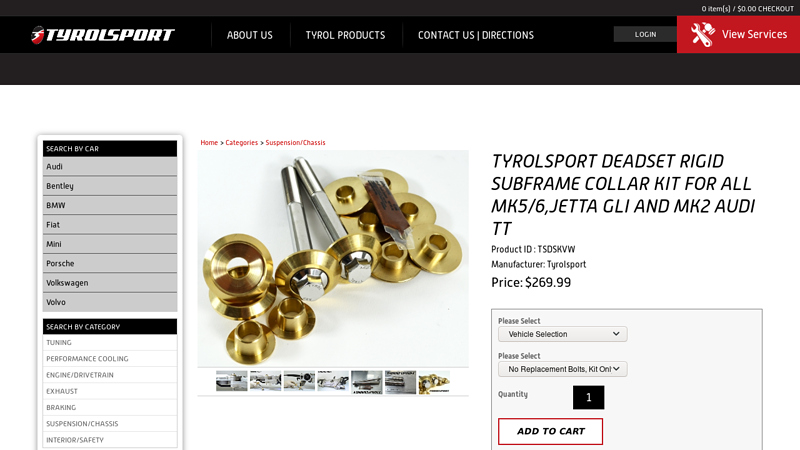

#4 TyrolSport DeadSet Rigid Subframe Collar Kit for all MK5/6,Jetta GLI …

Domain Est. 2002

Website: tyrolsport.com

Key Highlights: 10-day returnsThe TyrolSport DeadSet collar kit will repair the subframe clunk and stiffen the chassis on your Volkswagen Golf, GTI, Jetta, GLI,Passat, and more, ……

#5 Speedtech Performance

Domain Est. 2009

Website: speedtechperformance.com

Key Highlights: Suspension kits, coilovers, shocks, Chassis, Subframes and more. QA1 offers high-quality performance parts for circle track racing, drag racing, ……

#6 BMW Subframe Reinforcement Service

Domain Est. 2017

Website: mporiumbmw.com

Key Highlights: Mporium is equipped to handle BMW Subframe Reinforcement. Mporium BMW is North Texas’ premier BMW specialist shop….

#7 Universal subframe Sparco

Domain Est. 2017

Website: sparco-official.com

Key Highlights: In stock 14-day returnsDescription. Mechanism to adjust the height of the seat, for cars with removable slides from the original seat with distance between slides up to 430 mm….

#8 Subframe

Domain Est. 2019

Website: aludyne.com

Key Highlights: Our Subframe solutions are custom built to support a wide range of architectures, one piece subframes, nodes, and hollow structure….

#9 Front Subframe

Domain Est. 2019

Website: eurosubframes.com

Key Highlights: Eurosubframes specializes in the supply of essential automotive components, including rear axles, rear suspension arms, and front subframes….

Expert Sourcing Insights for Subframe Car

H2: Market Trends Shaping the Subframe Car Industry in 2026

As the automotive industry evolves toward electrification, lightweight construction, and advanced driver assistance systems (ADAS), subframe car components are undergoing significant transformation. The subframe—critical for supporting powertrain and suspension systems—is adapting to meet the demands of next-generation vehicles. By 2026, several key market trends will shape the design, materials, and production of automotive subframes.

1. Increased Adoption in Electric Vehicles (EVs)

With global EV sales projected to surpass 40% of all light-duty vehicle sales by 2026, subframe design is being reengineered to accommodate battery packs, electric motors, and regenerative braking systems. Unibody-integrated subframes are gaining traction, particularly in platforms designed for EVs, where rigidity and crash safety are paramount. OEMs such as Tesla, Rivian, and BYD are pioneering modular subframe designs that streamline assembly and improve weight distribution.

2. Lightweight Material Innovation

Aluminum and high-strength steel remain dominant, but by 2026, advanced composites and hybrid materials are expected to gain share. Aluminum subframes offer substantial weight savings—critical for improving EV range—while magnesium alloys and carbon fiber-reinforced polymers are being tested in premium and performance segments. Additionally, multi-material subframes (e.g., steel-reinforced aluminum) are being optimized through generative design and simulation software to balance strength, cost, and weight.

3. Integration with ADAS and Autonomous Systems

Subframes are becoming more than structural components; they now serve as mounting platforms for sensors, cameras, and radar units. By 2026, subframes will increasingly be engineered with precise alignment zones and vibration-dampening features to support the stability of ADAS hardware. This integration demands tighter tolerances and improved durability, driving investments in precision manufacturing techniques like hydroforming and robotic welding.

4. Regional Manufacturing and Supply Chain Shifts

Geopolitical dynamics and sustainability mandates are reshaping subframe production. North America and Europe are investing in localized, automated subframe manufacturing to reduce dependency on offshore suppliers and lower carbon footprints. Meanwhile, Southeast Asia and India are emerging as cost-effective production hubs due to growing EV adoption and government incentives. By 2026, nearshoring and vertical integration will be key strategies for Tier 1 suppliers like Magna, Benteler, and Hyundai Mobis.

5. Sustainability and Circular Economy Focus

Regulatory pressure and consumer demand for greener vehicles are pushing automakers to prioritize recyclability. Subframes made from recycled aluminum or designed for easier disassembly at end-of-life will be increasingly common. OEMs are exploring modular subframe designs that allow for repair or upgrade rather than replacement, supporting the circular economy model.

Conclusion

By 2026, the subframe car market will be defined by innovation in materials, integration with smart technologies, and alignment with electrification and sustainability goals. As vehicles become more complex and software-defined, the mechanical role of the subframe will expand into a multifunctional, systems-integrated component—positioning it as a critical enabler of next-generation mobility.

Common Pitfalls Sourcing Subframe Car (Quality, IP)

Sourcing subframe components for automotive manufacturing involves significant risks related to both quality control and intellectual property (IP) protection. Overlooking these areas can lead to safety concerns, production delays, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Supplier Qualification

Failing to rigorously vet suppliers based on certifications (e.g., IATF 16949), production capabilities, and track record can result in substandard subframes. Poorly qualified suppliers may lack proper quality management systems, leading to inconsistent tolerances, welding defects, or material failures.

Insufficient Material and Process Verification

Subframes require high-strength steel or aluminum alloys with precise heat treatment and forming processes. Without verifying material certifications and process controls (e.g., weld integrity, corrosion resistance), buyers risk receiving components prone to premature fatigue or failure under load.

Lack of In-Process and Final Inspection Protocols

Relying solely on final product inspection without oversight of in-process quality checks increases the risk of undetected defects. Without regular audits or on-site quality monitoring, deviations in dimensional accuracy or assembly can go unnoticed until late in the supply chain.

Inconsistent Tolerance and Fitment Standards

Subframes must align precisely with other vehicle systems. Sourcing from suppliers using incompatible GD&T (Geometric Dimensioning and Tolerancing) standards or without access to original OEM tooling data can lead to fitment issues during vehicle assembly.

Intellectual Property-Related Pitfalls

Unauthorized Use of OEM Designs

Many subframe designs are protected by patents or are considered trade secrets. Sourcing from suppliers who reverse-engineer or copy OEM designs without licensing exposes the buyer to IP infringement claims, potential product recalls, and legal liability.

Lack of Clear IP Ownership Agreements

Failure to establish written agreements defining IP ownership—especially for custom-designed subframes—can result in disputes. Suppliers may claim rights to design improvements, limiting the buyer’s ability to switch vendors or modify designs.

Inadequate Protection of Technical Data

Sharing CAD models, specifications, or manufacturing processes with suppliers without robust non-disclosure agreements (NDAs) and data security measures risks unauthorized duplication or leakage to competitors.

Gray Market or Counterfeit Components

Purchasing subframes through unauthorized distribution channels increases the likelihood of receiving counterfeit or non-compliant parts. These components may mimic genuine designs but lack proper testing, certification, or traceability, posing both quality and IP risks.

Mitigating these pitfalls requires due diligence in supplier selection, rigorous quality assurance protocols, and proactive legal safeguards to protect intellectual property throughout the sourcing lifecycle.

Logistics & Compliance Guide for Subframe Car

This guide outlines the key logistics considerations and compliance requirements for the transportation, handling, and regulatory adherence related to Subframe Cars within your operations.

Overview of Subframe Car Logistics

Subframe Cars—vehicles or components transported on a subframe or skid—are commonly used in automotive manufacturing, shipping, and aftermarket logistics. They require specialized handling due to weight, dimensions, and structural sensitivity. Proper planning ensures safe transit and compliance with transportation regulations.

Packaging and Securing Requirements

Ensure each Subframe Car is securely mounted to a robust subframe designed to support its weight and prevent shifting. Use industrial-grade fasteners, straps, or brackets to affix the vehicle or component. The subframe must be compatible with lifting equipment (e.g., forklifts, cranes) and shipping containers. Protective covers or coatings may be necessary to prevent corrosion or impact damage during transit.

Transportation Modes and Handling

Subframe Cars can be transported via flatbed trucks, railcars, or ocean freight (in containers or RO-RO vessels). Confirm that the chosen mode accommodates the combined dimensions and weight of the vehicle and subframe. Use trained personnel and certified equipment for loading and unloading. Avoid abrupt movements and ensure even weight distribution to prevent tipping or structural stress.

Regulatory Compliance

Adhere to local, national, and international transportation regulations. This includes compliance with:

– Department of Transportation (DOT) guidelines for vehicle transport in the U.S.

– International Maritime Organization (IMO) standards for sea freight.

– Customs regulations when crossing borders, including proper documentation (e.g., commercial invoice, bill of lading, certificate of origin).

– Environmental regulations regarding hazardous materials (e.g., residual fluids in vehicles).

Weight and Dimension Restrictions

Verify that the total weight and dimensions of the Subframe Car comply with road, rail, and port limitations. Oversized or overweight loads may require special permits and routing. Always declare accurate weight and dimensions to carriers and authorities to avoid fines or delays.

Documentation and Traceability

Maintain a complete logistics record for each Subframe Car, including:

– Shipment manifest

– Load securing checklist

– Compliance certifications

– Inspection reports pre- and post-transport

Use barcodes or RFID tags for real-time tracking and inventory control.

Safety and Risk Mitigation

Conduct regular inspections of subframes and securing mechanisms. Train staff on safety protocols for handling heavy automotive components. Implement risk assessments for high-value or fragile Subframe Cars, and consider insurance coverage for transport-related damage.

Environmental and Sustainability Considerations

Optimize load efficiency to reduce carbon emissions. Recycle or reuse subframes where possible. Comply with environmental standards for waste management (e.g., fluid disposal) during preparation for shipping.

Incident Reporting and Corrective Actions

Establish a clear procedure for reporting transport incidents (e.g., damage, delays, compliance breaches). Investigate root causes and implement corrective actions to prevent recurrence. Maintain records for audit and continuous improvement purposes.

Conclusion for Sourcing a Subframe for a Car:

Sourcing a subframe for a car requires careful consideration of several key factors including compatibility, condition, cost, and availability. Whether opting for new, used, or aftermarket components, it is essential to ensure the subframe matches the vehicle’s make, model, year, and engine configuration to maintain structural integrity and performance. Reputable suppliers, detailed research, and professional advice can greatly reduce the risk of purchasing an incompatible or defective part. Additionally, considering factors such as rust damage, accident history (for used parts), and warranty coverage will contribute to a more reliable and cost-effective solution. Ultimately, investing time in proper sourcing ensures vehicle safety, longevity, and optimal handling performance, making it a critical step in automotive repair and restoration.