The global automotive fuel pump market is experiencing steady growth, driven by rising vehicle production, increasing demand for fuel-efficient engines, and the expansion of aftermarket replacement services. According to Grand View Research, the global automotive fuel pump market was valued at USD 10.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is further fueled by the increasing complexity of fuel delivery systems in modern vehicles, including advanced direct injection technologies commonly found in performance-oriented models like those from Subaru. As reliability and precision become critical in fuel system components, OEMs and aftermarket suppliers alike are under pressure to deliver high-quality, durable fuel pumps. In this evolving landscape, a select group of manufacturers has emerged as leaders in supplying fuel pumps tailored specifically for Subaru vehicles—balancing performance, efficiency, and longevity. These top eight manufacturers combine engineering excellence with global supply capabilities, supporting both original equipment and replacement demand across diverse markets.

Top 8 Subaru Fuel Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Parts and Accessories

Domain Est. 1995

Website: subaru.com

Key Highlights: Demand genuine Subaru quality. Choose high-performance OEM parts and accessories installed by Subaru Certified Technicians to ensure safety and reliability….

#2 Shop OEM Subaru Part # 42021FG050. Electric Fuel Pump. Fuel tank

Domain Est. 1995

Website: parts.subaru.com

Key Highlights: Genuine Subaru Part # 42021FG050 – Electric Fuel Pump. Cooling, Engine, Maintenance, System, TANK. Fits STI….

#3 2018

Domain Est. 1997

Website: subaruparts.com

Key Highlights: In stock 30-day returnsFuel Pump And Sender Assembly – Subaru (42021FL040). Genuine Subaru Parts. Subaru Parts. Manufacturer: Subaru; Part Number: 42021FL040. Details. Brand: Parts…

#4 2018

Domain Est. 2001

Website: subarupartsforyou.com

Key Highlights: In stock $38.71 deliveryFuel Pump And Sender Assembly – 42021fl040. Genuine Subaru® Parts & Accessories. Manufacturer Warranty. From the Dealership to your Door….

#5 Subaru Walbro Fuel Pump

Domain Est. 2003

Website: walbrofuelpumps.com

Key Highlights: Free delivery 60-day returnsHigh quality Walbro fuel pumps available for Subaru vehicles and more! Search our catalog for all Subaru fuel pumps made by Walbro….

#6 2020

Domain Est. 2009

Website: parts.subaruonlineparts.com

Key Highlights: In stock $12.80 deliveryManufacturer: Subaru ; Part Number: 42022AN00A ; Description: Legacy, Outback. In tank. Fuel pump. Without turbo. ; Condition: New ; MSRP: $115.27 ……

#7 Fuel Pumps for Subaru, WRX, STI, Impreza, BRZ & More

Domain Est. 2013

Website: subispeed.com

Key Highlights: Free delivery over $199Our collection includes a range of gasoline pumps developed to give your Subaru a dependable and steady fuel supply….

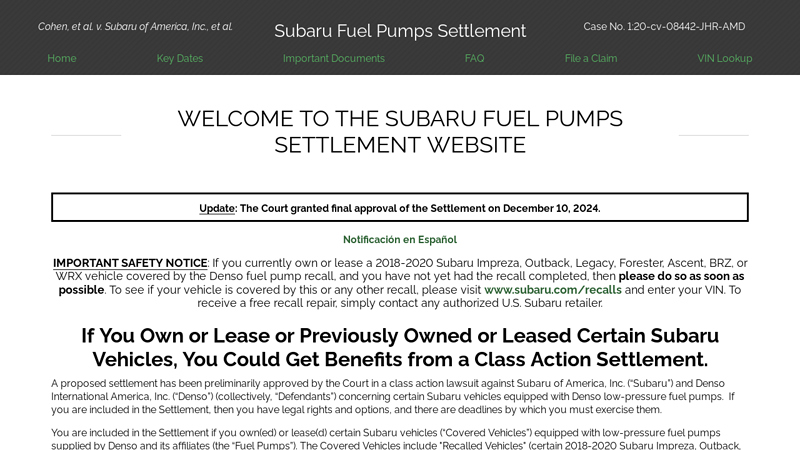

#8 Subaru Fuel Pump Settlement

Domain Est. 2024

Website: subarufuelpumpssettlement.com

Key Highlights: Current and former owners or lessees of certain Subaru vehicles with Denso-manufactured fuel pumps could get benefits from a class action settlement….

Expert Sourcing Insights for Subaru Fuel Pump

H2: Projected 2026 Market Trends for Subaru Fuel Pumps

The market for Subaru fuel pumps in 2026 is expected to undergo significant transformation driven by evolving automotive technologies, regulatory standards, consumer preferences, and Subaru’s strategic direction. Below is a comprehensive analysis of key trends likely to shape the Subaru fuel pump market in 2026:

-

Decline in Demand for Traditional Fuel Pumps Due to Electrification

By 2026, Subaru will have expanded its electrified vehicle lineup, including more hybrid and plug-in hybrid models like the Solterra and future e-Subaru platforms. As the company advances toward carbon neutrality, demand for conventional internal combustion engine (ICE) fuel pumps is expected to decline. This shift will reduce replacement and OEM demand for traditional mechanical and electric fuel pumps used in gasoline-powered models. -

Focus on High-Efficiency and High-Pressure Fuel Pumps

For remaining ICE and hybrid applications, Subaru is likely to rely on advanced fuel delivery systems. High-pressure direct injection (DI) systems, which require robust and precise fuel pumps, will dominate in performance and efficiency-oriented models like the WRX and Legacy. These systems demand fuel pumps capable of operating at higher pressures (up to 3,500 psi), driving innovation and premium pricing in the OEM and aftermarket segments. -

Growth in Aftermarket Demand from Aging Vehicle Fleet

Despite the shift to electrification, Subaru’s strong vehicle longevity and loyal customer base mean a large number of ICE-powered models will remain on the road through 2026. Vehicles like the Outback, Forester, and Impreza from the 2015–2022 model years will increasingly require maintenance and replacement parts. This aging fleet will sustain aftermarket demand for reliable, OEM-compatible fuel pumps, especially in regions where fuel quality may accelerate pump wear. -

Increased Emphasis on Fuel System Reliability and Diagnostics

Subaru’s commitment to reliability will push suppliers to integrate smarter fuel pumps with onboard diagnostics (OBD-II compatibility) and enhanced durability. In 2026, fuel pumps may feature condition monitoring capabilities, enabling predictive maintenance through vehicle telematics. This trend will benefit premium aftermarket brands and OEM service networks offering integrated solutions. -

Regional Market Variations

Demand for Subaru fuel pumps will vary significantly by region. In North America and Japan—Subaru’s core markets—aftermarket fuel pump sales will remain steady due to high ownership rates and rugged driving conditions. In contrast, European and Chinese markets may see faster declines in fuel pump demand due to stricter emissions regulations and aggressive EV adoption, limiting the lifespan of new ICE models. -

Supply Chain and Manufacturing Trends

Subaru’s supply chain partnerships with Japanese and global Tier-1 suppliers (e.g., Denso, Mitsuba) will influence fuel pump design and availability. Localization of production and increased automation may reduce costs, but semiconductor shortages or raw material volatility could impact production timelines. Additionally, Subaru’s emphasis on sustainability may lead to more recyclable and energy-efficient fuel pump components. -

Aftermarket Competition and Brand Loyalty

The 2026 aftermarket will see continued competition between OEM, remanufactured, and third-party fuel pump suppliers. However, Subaru owners’ high brand loyalty may favor OEM or certified aftermarket parts, supporting premium pricing. Online retail platforms and subscription-based maintenance services could streamline access to genuine Subaru fuel pumps.

Conclusion

While the long-term trajectory points toward reduced reliance on fuel pumps due to Subaru’s electrification strategy, the 2026 market will still present opportunities in high-performance ICE models and the robust used vehicle segment. Stakeholders should prepare for a transitional phase where innovation in fuel delivery systems coexists with declining volumes, requiring strategic adaptation in product development, distribution, and customer service.

Common Pitfalls When Sourcing a Subaru Fuel Pump (Quality & IP)

Sourcing a replacement fuel pump for your Subaru can be fraught with challenges, particularly concerning quality and intellectual property (IP). Avoiding these common pitfalls ensures reliability, performance, and vehicle safety.

1. Falling for Counterfeit or Knockoff Parts

One of the most significant risks is purchasing counterfeit fuel pumps that mimic genuine OEM or reputable aftermarket brands. These often bear fake logos or packaging resembling Denso, Bosch, or Subaru OEM parts.

- Quality Impact: Counterfeits use substandard materials (inferior plastics, weak motors, cheap wiring) leading to premature failure, inconsistent fuel pressure, engine stalling, or even complete fuel system failure.

- IP Concerns: These parts directly infringe on trademarks and patents. Distributors knowingly or unknowingly trafficking in them contribute to IP theft, undermining innovation and brand reputation.

- Red Flags: Prices significantly below market rate, poor packaging spelling/grammar, vague seller descriptions, sales on unverified third-party marketplaces.

2. Choosing Cheap, Low-Quality Aftermarket Pumps

Even if not counterfeit, many budget aftermarket pumps cut corners on engineering and materials to reduce costs.

- Quality Impact: These pumps may not meet Subaru’s strict fuel flow, pressure, and noise specifications. They often fail sooner, cause drivability issues (hesitation, surging), and may contaminate the fuel system with debris from internal wear.

- IP Concerns: While not always direct IP infringement, many low-tier manufacturers reverse-engineer OEM designs without licensing, potentially violating design patents or functional IP, especially in advanced components like integrated sensors or brushless motors.

- Red Flags: Unknown brands, lack of certifications, absence of detailed performance specs, negative reviews citing short lifespan.

3. Overlooking Proper OEM Specifications and Compatibility

Subaru models (especially turbocharged vs. NA, or different generations) require fuel pumps with specific flow rates, pressure outputs, and electrical characteristics.

- Quality Impact: A pump not meeting exact OEM specs can starve the engine under load (leading to detonation and engine damage) or over-pressurize the system (damaging injectors or lines). Incorrect physical dimensions may prevent installation.

- IP Concerns: Genuine OEM pumps incorporate proprietary engineering and calibration data protected as trade secrets. Using non-compliant parts bypasses this IP, potentially leading to system incompatibility and voiding warranties.

- Red Flags: Listings using vague fitment like “fits most Subarus,” failure to list exact Subaru part numbers or model/year/trim specifics.

4. Sourcing from Unreliable or Unauthorized Distributors

Purchasing from sellers without official distribution rights increases the risk of receiving non-genuine or tampered parts.

- Quality Impact: Unauthorized channels may sell expired stock, refilled/repackaged pumps, or parts stored improperly (exposure to heat/moisture degrading components).

- IP Concerns: Unauthorized distributors often operate outside the manufacturer’s control, facilitating the distribution of counterfeit goods and violating distribution agreements protected by IP and contract law.

- Red Flags: Sellers with no verifiable physical address, poor customer service, lack of brand authorization badges, selling far below authorized dealer prices.

5. Ignoring Warranty and Support Limitations

Cheap or counterfeit pumps rarely come with reliable warranties.

- Quality Impact: No recourse for failure means bearing the full cost of replacement and potentially related labor or damage. Genuine or reputable aftermarket brands offer warranties reflecting confidence in their product’s durability.

- IP Concerns: Legitimate IP holders stand behind their products with warranties and technical support. The absence of these services is a hallmark of infringing or low-quality goods.

- Red Flags: “No questions asked” returns instead of a manufacturer warranty, extremely short warranty periods (e.g., 30 days), difficulty contacting the seller post-purchase.

Conclusion: Prioritize sourcing fuel pumps from reputable suppliers, authorized dealers, or trusted aftermarket brands (like Denso, Bosch, or reputable OEM suppliers). Always verify part numbers, check seller legitimacy, and avoid deals that seem too good to be true. Investing in a genuine or high-quality compliant pump protects your Subaru’s performance, longevity, and avoids the risks associated with substandard or IP-infringing components.

Logistics & Compliance Guide for Subaru Fuel Pump

Product Overview

The Subaru fuel pump is a critical component of the vehicle’s fuel delivery system, responsible for transferring fuel from the tank to the engine at the correct pressure. This guide outlines logistics handling, transportation, storage, and regulatory compliance requirements specific to Subaru fuel pumps, whether new OEM, aftermarket, or replacement units.

Regulatory Compliance Requirements

Safety & Environmental Standards

Subaru fuel pumps must comply with various international, national, and regional regulations:

– EPA (Environmental Protection Agency) – USA: Fuel pumps must support evaporative emissions control systems compliant with Tier 3 vehicle standards.

– CARB (California Air Resources Board): Aftermarket or replacement fuel pumps for vehicles sold or registered in California must be CARB Executive Order (EO) certified.

– E-Mark Certification (Europe): All fuel system components, including fuel pumps, must meet UNECE Regulation No. 10 (EMC) and relevant parts of Regulation No. 125 (evaporative emissions).

– RoHS & REACH (EU): Ensure materials used in the fuel pump (e.g., plastics, coatings, solder) are compliant with hazardous substance restrictions.

– ADR (Australia): Must meet Australian Design Rules for fuel system integrity and emissions.

DOT & Hazardous Materials Considerations

- Hazard Class: Empty fuel pumps (devoid of residual fuel) are generally non-hazardous. However, units containing trace fuel or fuel vapor may be classified under Hazard Class 3 (Flammable Liquids).

- UN Number: If classified as hazardous, use UN1203, Gasoline or Petrol with proper packaging and documentation.

- Packaging: Use UN-rated packaging if shipping residual fuel-containing units. Include absorbent materials and vapor-proof seals.

- Labeling: Apply appropriate GHS/HazCom labels if residual flammability is present. Most new OEM pumps are dry and exempt.

Packaging & Labeling Guidelines

Packaging Standards

- Use factory-sealed, static-dissipative packaging for electric fuel pumps to protect against electrostatic discharge (ESD).

- Include cushioning (e.g., foam inserts) to prevent damage during transit.

- Ensure boxes are moisture-resistant, especially for marine or humid climates.

- For return shipments of used pumps: place in sealed plastic bag with absorbent pad if fuel residue is suspected.

Labeling Requirements

- Include part number, Subaru OEM number, vehicle compatibility (model/year/engine), and manufacturing date.

- Add compliance markings: CE, RoHS, CARB EO number (if applicable), and E-Mark (for EU).

- Barcodes or QR codes for traceability (recommended for inventory and warranty tracking).

- Do not label as hazardous unless residual fuel is present.

Storage & Handling Procedures

Storage Conditions

- Temperature: Store between 5°C and 35°C (41°F to 95°F). Avoid freezing or extreme heat.

- Humidity: Keep relative humidity below 70% to prevent corrosion on electrical connectors.

- Location: Store indoors on pallets, away from direct sunlight and incompatible materials (e.g., oils, solvents, oxidizers).

- Shelf Life: Most electric fuel pumps have a recommended shelf life of 5 years from manufacture. Monitor batch dates.

Handling Precautions

- Wear gloves when handling used fuel pumps to avoid skin contact with fuel residue.

- Ground all personnel and equipment when handling electric pumps to prevent ESD damage.

- Do not drop or impact fuel pumps—internal components (especially turbine or roller cells) are sensitive.

Transportation & Shipping Protocols

Domestic (USA)

- Non-hazardous shipments: Use standard LTL or parcel services (e.g., UPS, FedEx).

- Hazardous (residual fuel): Follow 49 CFR regulations—use certified carriers with HAZMAT training, proper shipping papers, and emergency response info.

International

- IATA (Air): Dry fuel pumps can ship as non-dangerous goods. Pumps with fuel residue require Class 3 declaration, limited quantity exceptions may apply.

- IMDG (Sea): Follow packing group II/III guidelines if flammable liquids are present. Declare under proper shipping name.

- Customs Documentation: Include HS Code 8413.30 (fuel pumps), commercial invoice, certificate of origin, and compliance certificates (CARB, CE, etc.).

Returns & End-of-Life Management

Return Logistics

- Use original packaging or equivalent protective materials.

- Complete return authorization (RMA) form with reason code (e.g., DOA, warranty, compatibility error).

- For defective units: label as “Used Automotive Part – Non-Hazardous Waste” if dry.

Recycling & Disposal

- Electric fuel pumps contain recyclable metals (steel, copper) and plastics.

- Follow local e-waste or automotive recycling regulations.

- In EU: Comply with ELV (End-of-Life Vehicles) Directive—ensure take-back availability through authorized treatment facilities.

Quality & Traceability

- Maintain lot traceability through barcode/serial number tracking.

- Document storage conditions and inventory turnover (FIFO recommended).

- Report compliance incidents (e.g., non-CARB pump installed in CA) immediately to Subaru Technical Support or distributor.

Summary

Proper logistics and compliance management of Subaru fuel pumps ensures safety, regulatory adherence, and product integrity. Always verify the condition (dry vs. residual fuel), confirm regional compliance (CARB, CE, etc.), and follow ESD and handling best practices—especially for electric in-tank pumps. Partner with certified carriers and stay updated on evolving environmental regulations affecting fuel system components.

In conclusion, sourcing a Subaru fuel pump requires careful consideration of compatibility, quality, and reliability to ensure optimal vehicle performance and longevity. It is essential to verify the correct part number based on your Subaru’s model, year, engine type, and fuel system requirements. Opting for OEM (Original Equipment Manufacturer) or reputable aftermarket brands helps guarantee durability and proper functionality. Purchasing from trusted suppliers or authorized dealers minimizes the risk of counterfeit or substandard parts. Additionally, considering warranty coverage and professional installation can provide added peace of mind. By taking these factors into account, you can source a high-quality Subaru fuel pump that maintains fuel efficiency, engine reliability, and overall driving safety.