The global steel rebar market is experiencing robust growth, driven by rising infrastructure development, urbanization, and government investments in construction across emerging economies. According to a 2023 report by Mordor Intelligence, the market was valued at USD 126.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2028, reaching an estimated value of USD 173.5 billion by 2028. This expansion is further supported by increasing demand for durable construction materials in residential, commercial, and industrial projects. As the backbone of reinforced concrete structures, steel rebar plays a critical role in ensuring structural integrity, making leading manufacturers pivotal to global construction supply chains. In this landscape, innovation, production capacity, and geographic reach distinguish the top players shaping the industry’s future. Here are the top 9 steel rebar manufacturers driving market growth and setting standards for quality and efficiency worldwide.

Top 9 Steel Rebar Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Insteel Industries Inc.

Domain Est. 1996

Website: insteel.com

Key Highlights: Insteel is the nation’s largest manufacturer of steel wire reinforcing products for concrete construction applications….

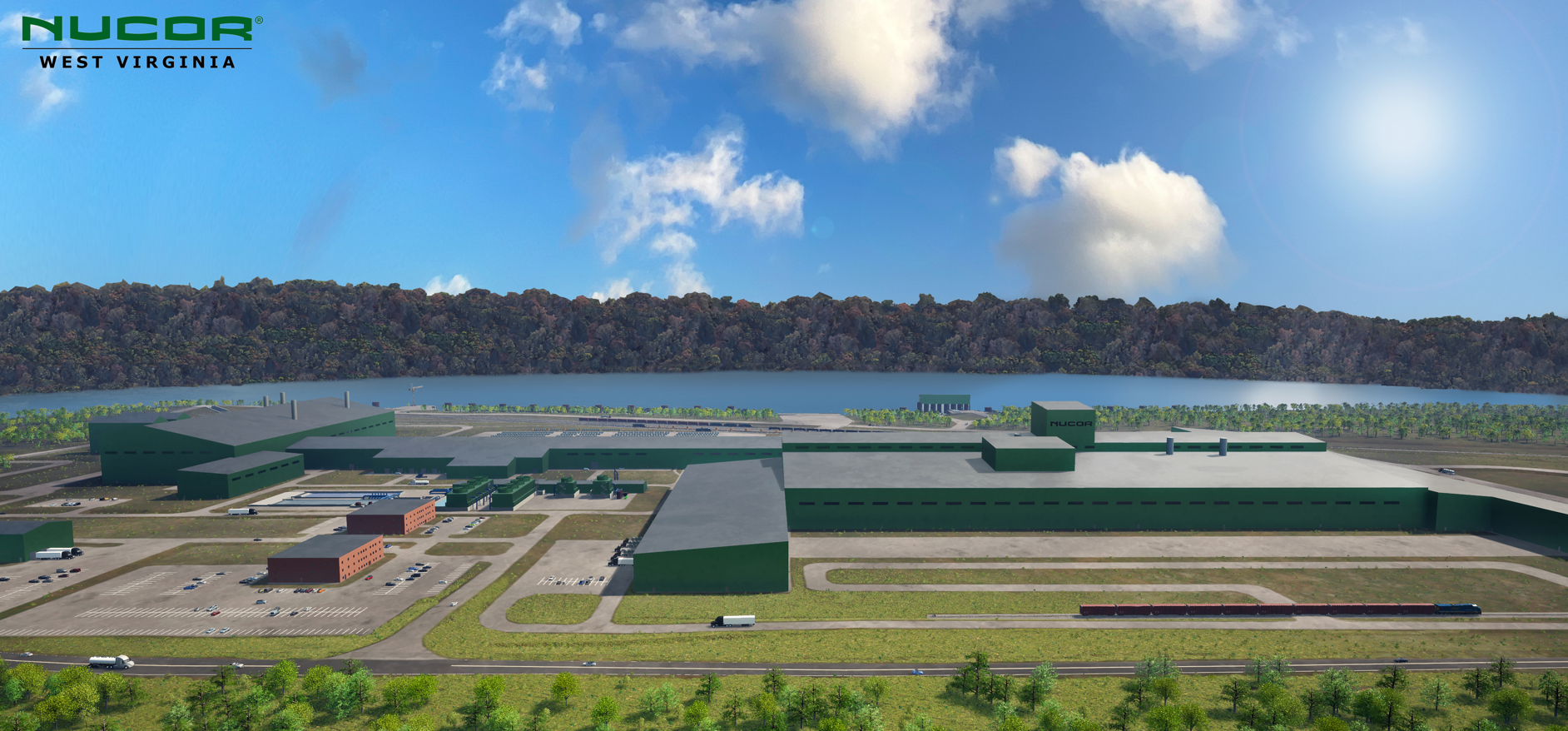

#2 Nucor

Domain Est. 1997

Website: nucor.com

Key Highlights: North America’s largest steel manufacturer and recycler. We are a team forged around a vision for leading our industry by providing unparalleled customer care….

#3 Concrete reinforcing bar (Rebar)

Domain Est. 2006

Website: northamerica.arcelormittal.com

Key Highlights: ArcelorMittal Long Products Canada is the main domestic manufacturer of rebar. With excellent servicing and business relationships, we have been able to form ……

#4

Website: resteel.com

Key Highlights: to fabricate and supply high quality rebar, wire mesh, continuous spirals, anchor bolts, couplers, and bar supports for all of your construction projects. Learn ……

#5 Red Sea Steel

Website: redseasteel.sa

Key Highlights: Red Sea Steel provides top-tier rebar steel from ASTM A615 Grade 60 and Grade 80, ensuring superior strength, durability, and compliance with international ……

#6 CMC

Domain Est. 1990

Website: cmc.com

Key Highlights: WE USE 100% RECYCLED STEEL. We save over 17 billion pounds of scrap metal from going to landfils, turning non-useful scrap into new, sustainable steel products….

#7 Roldan

Domain Est. 1998

Website: acerinox.com

Key Highlights: Roldán manufactures the widest range of long stainless steel products: bars, wire rod, angles, hexagonal bars and reinforcement bars….

#8 Harris Supply Solutions: Steel Rebar Distributor

Domain Est. 2005

Website: harrissupplysolutions.com

Key Highlights: Harris Supply Solutions is the largest steel rebar distributor in the U.S., offering high-quality concrete reinforcing bar for any application. Call today!…

#9 Helix Steel

Domain Est. 2009

Website: helixsteel.com

Key Highlights: Helix Steel’s Twisted Steel Micro Rebar reinforces concrete with proven strength, speed, and durability. Replace rebar, cut costs, and build smarter today….

Expert Sourcing Insights for Steel Rebar

H2: Analysis of 2026 Market Trends for Steel Rebar

The global steel rebar market is poised for notable transformation by 2026, driven by macroeconomic dynamics, infrastructure development, regional policy shifts, and evolving material preferences. As the backbone of construction in residential, commercial, and civil engineering projects, rebar demand is closely tied to urbanization, government investment in infrastructure, and industrial growth. This analysis outlines the key trends and factors influencing the steel rebar market in H2 2026.

1. Infrastructure-Led Demand Growth

Governments worldwide are prioritizing infrastructure development to stimulate economic recovery and resilience. In 2026, large-scale public projects—particularly in emerging economies such as India, Indonesia, Nigeria, and Brazil—are expected to drive substantial rebar demand. The U.S. Infrastructure Investment and Jobs Act and the European Union’s Green Deal Industrial Plan continue to allocate significant funding to transportation, water systems, and energy networks, many of which require reinforced concrete, directly benefiting rebar consumption.

2. Supply Chain Stabilization and Cost Dynamics

After volatility in raw material prices and logistics disruptions seen in previous years, H2 2026 reflects a more stabilized supply chain. Iron ore and scrap steel prices have moderated due to balanced global supply and reduced geopolitical tensions in key mining regions. This stability enables rebar producers to offer more predictable pricing, supporting long-term construction contracts. However, regional disparities persist—particularly in areas affected by trade restrictions or logistics bottlenecks.

3. Green and Sustainable Construction Practices

Environmental concerns are reshaping rebar production and use. By H2 2026, the adoption of low-carbon steelmaking technologies—such as electric arc furnaces (EAF) using scrap metal—is accelerating. Regulatory pressures and ESG (Environmental, Social, and Governance) investing are pushing producers to reduce carbon footprints. Additionally, corrosion-resistant rebar (e.g., epoxy-coated, stainless steel, or glass-fiber-reinforced polymer rebars) is gaining traction in coastal and high-moisture environments, driven by lifecycle cost savings and sustainability goals.

4. Technological Advancements and Digitalization

Digital tools such as BIM (Building Information Modeling), AI-driven inventory management, and smart manufacturing are enhancing efficiency across the rebar value chain. Prefabrication and modular construction techniques, which rely on precision-cut and bent rebar, are expanding—especially in developed markets. These trends reduce waste, improve project timelines, and increase demand for customized rebar solutions.

5. Regional Market Divergence

– Asia-Pacific: Remains the largest consumer and producer of steel rebar, with China still dominant. However, China’s market shows signs of saturation in urban housing, shifting focus toward high-grade and specialized rebar for mega-projects and repairs.

– India: Emerges as a high-growth market, backed by rapid urbanization and government initiatives like “Smart Cities” and “Bharatmala.”

– Middle East & Africa: Infrastructure modernization and population growth support steady rebar demand, although financing challenges persist.

– North America & Europe: Growth is moderate but stable, with emphasis on replacement infrastructure and sustainable materials.

6. Trade and Protectionist Policies

Trade tensions and anti-dumping measures continue to influence rebar flows. Countries like the U.S. and EU maintain safeguards on imported rebar to protect domestic industries. Meanwhile, producers in Southeast Asia and Turkey are diversifying export markets to offset restrictions, increasing competition in Africa and Latin America.

7. Price Outlook and Market Sentiment in H2 2026

Steel rebar prices in H2 2026 remain firm but range-bound, supported by steady demand and controlled input costs. Market sentiment is cautiously optimistic, with construction backlogs and project pipelines indicating sustained activity through 2027. However, concerns over inflationary pressures and potential interest rate hikes could moderate private-sector construction spending, particularly in high-cost regions.

Conclusion

By H2 2026, the steel rebar market reflects a maturing, globally interconnected industry adapting to sustainability imperatives, technological innovation, and shifting infrastructure priorities. While growth remains robust in developing economies, advanced markets are focusing on quality, durability, and environmental performance. Stakeholders—producers, contractors, and policymakers—must navigate regional disparities, regulatory changes, and evolving customer demands to capitalize on the opportunities ahead.

Common Pitfalls Sourcing Steel Rebar: Quality and Intellectual Property (IP) Concerns

Sourcing steel rebar involves navigating several critical challenges, particularly concerning product quality and intellectual property risks. Failing to address these pitfalls can lead to structural failures, project delays, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Substandard Material Composition

One of the most frequent issues is receiving rebar that does not meet specified chemical compositions (e.g., incorrect levels of carbon, manganese, or other alloying elements). This can compromise tensile strength, ductility, and weldability, potentially leading to structural weaknesses.

2. Inconsistent Mechanical Properties

Even if chemical composition appears adequate, poor manufacturing processes can result in inconsistent yield strength, elongation, or bend performance across batches. Relying solely on supplier-provided test reports without independent verification increases the risk of accepting non-compliant material.

3. Poor Surface Quality and Corrosion Resistance

Defects such as cracks, seams, scale, or excessive rust can impair bond strength with concrete and accelerate corrosion. Rebar exposed to moisture during storage or transport without proper protection may degrade before installation, reducing service life.

4. Non-Compliance with Standards

Suppliers, especially in unregulated markets, may claim compliance with international standards (e.g., ASTM A615, BS 4449, or ISO 6935) without proper certification or third-party testing. Mislabeling or falsified mill test certificates are common red flags.

5. Inadequate Traceability

Lack of batch traceability makes it difficult to investigate quality issues or conduct recalls if defective rebar is discovered post-installation. Without clear lot numbering and documentation, accountability is compromised.

Intellectual Property (IP) and Branding Pitfalls

1. Counterfeit or Gray Market Products

Some suppliers sell rebar bearing the trademarks or mill marks of reputable manufacturers without authorization. These counterfeit products often fail to meet the quality standards associated with the genuine brand, exposing buyers to liability.

2. Unauthorized Use of Patented Technologies

Certain rebar types, such as epoxy-coated, stainless-clad, or seismic-grade bars, may incorporate patented manufacturing techniques or protective coatings. Sourcing from unauthorized producers can infringe IP rights and result in legal action against both supplier and end-user.

3. Misrepresentation of Origin and Manufacturer

Suppliers may falsely claim that rebar originates from a specific country or mill known for high-quality production. This misrepresentation not only breaches IP norms but can also violate trade regulations and contracts requiring certified sources.

4. Lack of Licensing Agreements

For specialized rebar (e.g., thermomechanically treated or low-yield-point steel), using products without proper licensing exposes projects to IP litigation. Buyers should verify that suppliers have authorization to produce or distribute branded or patented rebar types.

Mitigating these risks requires rigorous due diligence, third-party inspections, chain-of-custody verification, and legal review of supply agreements—particularly when sourcing from international or unfamiliar vendors.

Logistics & Compliance Guide for Steel Rebar

Overview

Steel rebar (reinforcing bar) is a critical construction material used to strengthen concrete in infrastructure, buildings, and industrial projects. Efficient logistics and strict compliance with international and local standards are essential to ensure product quality, safety, and timely delivery. This guide outlines key considerations for transporting, handling, and complying with regulatory requirements for steel rebar.

Product Specifications and Classification

Steel rebar is commonly categorized by grade (e.g., Grade 60, Grade 40), size (diameter in millimeters or inches), surface type (deformed or plain), and material composition (carbon steel, stainless steel, or epoxy-coated). Accurate classification is vital for regulatory compliance and proper handling.

- ASTM Standards (U.S.): ASTM A615 (carbon steel), ASTM A955 (stainless steel), ASTM A775/A775M (epoxy-coated)

- ISO Standards: ISO 6935-2 (reinforcing steels)

- EU Standards: EN 10080 (steel for reinforcement of concrete)

- HS Code (Harmonized System): Typically 7214.20 (non-alloy steel bars and rods, hot-rolled) or 7214.30 (alloy steel) – country-specific variations may apply

Packaging and Handling

Proper packaging and handling prevent corrosion, deformation, and damage during transit.

- Bundling: Rebar is typically bundled with steel or plastic strapping. Bundle weight should comply with lifting equipment limits (usually 1–5 metric tons).

- End Protection: Plastic caps or protective sleeves prevent injury and damage to threaded ends (if applicable).

- Stacking: Store bundles on level, dry ground using timber dunnage to avoid contact with soil/moisture. Max stacking height depends on ground strength and bundle integrity.

- Corrosion Protection: For coated or stainless rebar, avoid contact with carbon steel to prevent galvanic corrosion. Use separate storage zones if needed.

Transportation and Logistics

Land Transport

- Truck Loading: Secure bundles with chains or straps to prevent shifting. Use cradles or racks for long bars to minimize bending.

- Axle Weight Compliance: Ensure load adheres to local road weight regulations (e.g., U.S. DOT, EU Directive 96/53/EC).

- Route Planning: Account for bridge weight limits, low clearances, and construction zones, especially for oversized loads.

Sea Freight

- Containerization: Standard containers (20’ or 40’) can carry cut-to-length rebar. Oversized or bulk shipments require breakbulk or flat-rack containers.

- Stowage: Load evenly to prevent container deformation. Use dunnage and lashings to minimize movement.

- Ventilation & Moisture Control: Include desiccants in containers to reduce condensation and rust formation during long voyages.

Rail Transport

- Suitable for long-distance, high-volume movements. Secure loads per rail safety standards (e.g., AAR in North America).

- Coordinate with terminals for timely loading/unloading to avoid demurrage charges.

Storage Requirements

- Location: Dry, well-drained area with coverage (e.g., warehouse or tarp) to minimize exposure to moisture.

- Duration: Limit outdoor storage; inspect periodically for rust. Light surface rust may be acceptable per project specs, but heavy scaling requires treatment.

- Inventory Management: Implement FIFO (First In, First Out) to prevent long-term storage issues.

Regulatory Compliance

Safety Standards

- OSHA (U.S.): Follow guidelines for material handling, lifting, and worker protection (e.g., PPE, safe stacking).

- Workplace Health and Safety (WHS) – Australia / HSE – UK: Adhere to manual handling and site safety regulations.

Environmental Regulations

- REACH (EU): Ensure declaration of substances used in coatings or alloying elements.

- RoHS Compliance: Applicable if rebar includes electronic components (rare).

- Spill and Runoff Control: Prevent oil or coating residue from contaminating soil/water during storage.

Import/Export Documentation

- Commercial Invoice & Packing List: Detail weight, dimensions, grade, and HS code.

- Certificate of Origin: Required for tariff determination and trade agreements.

- Mill Test Certificate (MTC): Provides chemical and mechanical properties per ASTM, ISO, or EN standards. Essential for customs clearance and quality assurance.

- Phytosanitary Certificate: Not typically required unless wooden dunnage is used (ISPM 15 compliance needed for wood packaging).

Quality Assurance and Inspection

- Pre-Shipment Inspection (PSI): Verify dimensions, surface quality, labeling, and compliance with purchase order.

- Third-Party Testing: Independent labs may test samples for tensile strength, yield point, and elongation.

- Traceability: Maintain batch/heat numbers for full traceability from mill to site.

Risk Mitigation

- Insurance: Cover cargo for damage, loss, or delay (All-Risk Marine Cargo Insurance recommended).

- Force Majeure Clauses: Include in contracts to address disruptions (e.g., port strikes, natural disasters).

- Supplier Audits: Evaluate mills and logistics partners for compliance and reliability.

Conclusion

Effective logistics and compliance management for steel rebar reduce project delays, ensure material integrity, and support regulatory adherence. By following international standards, optimizing handling procedures, and maintaining thorough documentation, stakeholders can ensure the safe and efficient delivery of rebar to construction sites worldwide. Regular training and audits further strengthen operational excellence in rebar supply chains.

Conclusion:

After a comprehensive evaluation of potential steel rebar manufacturers, it is evident that selecting the right supplier involves balancing quality, cost, compliance, production capacity, and reliability. The chosen manufacturer should demonstrate adherence to international standards (such as ASTM, BS, or ISO), possess robust quality control processes, and have a proven track record in delivering consistent, high-strength rebar suitable for structural applications.

Additionally, logistical capabilities, scalability, and transparent communication are critical factors that contribute to long-term partnership success. After careful comparison of multiple suppliers based on these criteria, [Insert Selected Manufacturer Name] emerges as the most suitable sourcing partner. They offer competitive pricing, certified product quality, timely delivery, and the operational capacity to support current and future project demands.

In conclusion, partnering with [Selected Manufacturer] mitigates supply chain risks, ensures material integrity, and supports project efficiency and safety—making them the optimal choice for steel rebar procurement. Continuous performance monitoring and periodic quality audits are recommended to maintain standards and strengthen the supplier relationship over time.