The global mattress market is experiencing robust expansion, driven by rising urbanization, increasing disposable incomes, and a growing emphasis on sleep health. According to Grand View Research, the global mattress market size was valued at USD 45.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. A key contributor to this growth is the rising demand for supportive and durable bed bases, particularly steel mattress frames, which offer superior strength, longevity, and compatibility with modern bed designs. As consumers increasingly shift from traditional wooden or box spring foundations to more resilient steel alternatives, manufacturers are scaling production and innovation to meet evolving needs. This growing demand has elevated the prominence of specialized steel mattress frame manufacturers, many of which are now leading the industry through advanced engineering, cost-efficiency, and mass distribution capabilities. The following list highlights the top nine manufacturers shaping this dynamic segment today.

Top 9 Steel Mattress Frame Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Flexsteel

Domain Est. 1996

Website: flexsteel.com

Key Highlights: Discover exceptional craftsmanship and style with Flexsteel, your premier manufacturer for high-quality furniture. Explore our extensive range of living ……

#2 hollywood bed frame

Domain Est. 1997

Website: hollywoodbed.com

Key Highlights: A full service manufacturer of quality bedding support products, including bed frames, bed bases, portable beds, center supports, bed rails, daybed hardware ……

#3 Heavy

Domain Est. 1997

Website: originalmattress.com

Key Highlights: Heavy-duty bed frames made with the world’s strongest wedge lock system. These bed frames feature steady plastic glides and rugged vinyl end caps for safety….

#4 Metal Platform Bed Frames

Domain Est. 2000

#5 Modern Bed Frames, Minimalist Metal, Steel

Domain Est. 2007

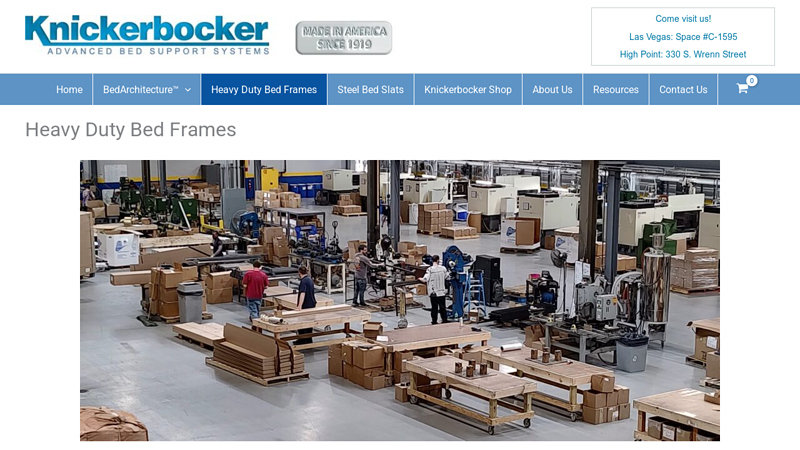

#6 Heavy Duty Bed Frames

Domain Est. 2008

Website: knickerbockerbedframe.com

Key Highlights: Knickerbocker manufactures all of our bed frames in the United States from railroad track steel. Other companies import their bed frames, raw materials or….

#7 Steel Bed Frames

Domain Est. 2013

Website: rizehome.com

Key Highlights: Free delivery · 30-day returnsShop Rize Home’s selection of strong and reliable steel bed frames, engineered for durability and support. Choose from various sizes to suit any bedr…

#8 Easy Metal Bed Frame Sale

Domain Est. 2014

Website: brentwoodhome.com

Key Highlights: In stock Rating 5.0 (27) Our sleek and elegant Easy Metal Bed Frame is durable, tool-free, and works with any foundation. It’s made from reclaimed railroad steel….

#9 Metal Bed Frame

Domain Est. 2016

Website: avocadogreenmattress.com

Key Highlights: Elevate your bed with our modern, heavy-duty metal bed frame. Made of durable reclaimed steel, the simple tool-free design assembles in minutes….

Expert Sourcing Insights for Steel Mattress Frame

H2: 2026 Market Trends for Steel Mattress Frames

The global steel mattress frame market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and sustainability imperatives. Several key trends are expected to shape the industry landscape over the next few years:

-

Growing Demand for Durable and Supportive Bedding Solutions

Consumers are increasingly prioritizing durability and ergonomics in sleep furniture. Steel mattress frames, known for their strength, longevity, and superior support compared to wooden or plastic alternatives, are gaining traction—especially in urban households and the hospitality sector. This trend is amplified by rising health awareness and the demand for products that enhance sleep quality. -

Rise of E-Commerce and Direct-to-Consumer (DTC) Models

The proliferation of online furniture retailers and DTC brands is reshaping distribution channels. By 2026, e-commerce is expected to dominate sales of steel mattress frames, offering consumers greater convenience, competitive pricing, and access to customizable designs. Brands are investing in compact, flat-pack steel frames optimized for shipping and easy assembly, further fueling online adoption. -

Innovation in Design and Functionality

Manufacturers are integrating smart features into steel frames, such as built-in USB charging ports, under-bed LED lighting, and adjustable height mechanisms. Additionally, modular and space-saving designs—like foldable or loft-style frames—are becoming popular in small urban dwellings and multifunctional living spaces, particularly in densely populated regions. -

Sustainability and Recyclability

As environmental concerns grow, steel’s recyclability is emerging as a major selling point. By 2026, companies are expected to emphasize eco-friendly production processes, use of recycled steel, and low-carbon manufacturing practices to appeal to environmentally conscious consumers. Certifications like Cradle to Cradle or Environmental Product Declarations (EPDs) may become standard in product marketing. -

Expansion in Emerging Markets

Rapid urbanization, rising disposable incomes, and growing middle-class populations in regions like Southeast Asia, Latin America, and Africa are creating new growth opportunities. Localized manufacturing and cost-effective steel frame solutions tailored to regional preferences are anticipated to drive market penetration in these areas. -

Impact of Raw Material and Supply Chain Dynamics

Fluctuations in steel prices and global supply chain volatility will continue to influence production costs and pricing strategies. By 2026, leading manufacturers are likely to adopt strategic sourcing, vertical integration, and localized supply chains to mitigate risks and ensure consistent product availability. -

Increased Competition and Brand Differentiation

As the market becomes more saturated, brands will focus on differentiation through design innovation, warranty offerings, and enhanced customer service. Partnerships with mattress brands for bundled offerings and smart home integrations will also become common strategies to gain competitive advantage.

In summary, the 2026 steel mattress frame market will be defined by a convergence of durability, design innovation, sustainability, and digital transformation. Companies that adapt to these trends—by embracing technology, eco-conscious practices, and responsive supply chains—are likely to lead the market in the coming years.

Common Pitfalls When Sourcing Steel Mattress Frames (Quality and Intellectual Property)

Sourcing steel mattress frames can be a complex process, especially when balancing cost, quality, and legal compliance. Businesses often encounter challenges related to material integrity, manufacturing standards, and intellectual property (IP) risks. Being aware of these common pitfalls helps mitigate risks and ensures a reliable supply chain.

Poor Material Quality and Durability

One of the most frequent issues in sourcing steel mattress frames is receiving products made from substandard materials. Low-grade steel may lead to premature rusting, warping, or structural failure, resulting in customer dissatisfaction and potential safety hazards. Buyers should verify steel grade specifications (e.g., Q235, Q195) and request material test reports (MTRs) to ensure durability and load-bearing capacity.

Inconsistent Manufacturing Standards

Manufacturers, especially in low-cost regions, may lack consistent quality control processes. This can result in variations in welding quality, dimensional accuracy, and coating thickness. Without proper oversight, these inconsistencies compromise the product’s performance and safety. Implementing third-party inspections and audits helps maintain consistency across production batches.

Inadequate Coating and Rust Protection

Many steel frames suffer from poor anti-corrosion treatment. A thin or uneven powder coating or lack of zinc plating increases the risk of rust, particularly in humid environments. Buyers should specify coating standards (e.g., ASTM B117 salt spray testing) and require proof of compliance to ensure long-term performance.

Non-Compliance with Safety and Regulatory Standards

Steel mattress frames must meet safety standards such as CPSA (Consumer Product Safety Improvement Act) in the U.S. or EN 1725 in Europe. Failure to comply can result in product recalls, fines, or import rejections. Sourcing partners must provide documentation proving conformity with relevant regulations, including flammability, stability, and lead content limits.

Intellectual Property (IP) Infringement Risks

Copying patented designs or using trademarked features without authorization is a significant risk when sourcing from regions with lax IP enforcement. Some suppliers may offer “look-alike” products that infringe on existing patents. Conducting due diligence—such as patent searches and design clearance reviews—before production is crucial to avoid legal disputes and financial liability.

Lack of Design and Engineering Validation

Many suppliers lack the technical expertise to validate structural integrity under load. Without proper engineering analysis or load testing, frames may fail under normal use. Buyers should require performance testing data and consider engaging independent engineers to evaluate prototype designs.

Hidden Costs from Rework or Rejection

Poor quality control often leads to high defect rates, requiring rework or product rejection. These issues increase lead times and logistics costs. To avoid this, establish clear quality acceptance criteria upfront and use inspection protocols (e.g., AQL levels) during production.

Overlooking Supplier Reliability and Transparency

Choosing suppliers based solely on price can backfire if the vendor lacks transparency in sourcing raw materials or subcontracting production. Verify supplier credentials, conduct factory audits, and request traceability documentation to ensure ethical and reliable manufacturing practices.

Conclusion

Successfully sourcing steel mattress frames requires more than competitive pricing. Attention to material quality, manufacturing consistency, regulatory compliance, and intellectual property integrity is essential. By proactively addressing these common pitfalls, businesses can protect their brand reputation, reduce risk, and deliver safe, durable products to market.

Logistics & Compliance Guide for Steel Mattress Frame

Product Overview and Classification

Steel mattress frames are structural support systems designed to hold mattresses in place. They are typically constructed from durable steel tubing or rods, often featuring a grid or slat design. These frames are categorized under furniture components and may fall under specific HS (Harmonized System) codes for international trade classification. Accurate classification is essential for customs clearance and tariff determination.

Harmonized System (HS) Code and Tariff Classification

The appropriate HS code for steel mattress frames varies by country but generally falls within Chapter 73 (Articles of Iron or Steel). A common classification is 7308.90 (Other structures and parts of structures, of iron or steel). However, some countries may classify these under furniture categories such as 9403.20 (Metal parts of furniture). Confirm the correct HS code with destination country customs authorities to ensure compliance and accurate duty assessment.

Packaging and Handling Requirements

Steel mattress frames must be packaged to prevent damage during transit. Recommended packaging includes:

– Corrugated cardboard edge protectors

– Stretch-wrapped units to secure frame components

– Palletization with corner boards and shrink wrap for stability

– Waterproof covering when shipped via sea freight

Ensure frames are stacked flat and secured to avoid bending or deformation. Label packages with “Fragile,” “Do Not Stack,” and orientation arrows as needed.

Labeling and Marking Compliance

All shipments must include:

– Product identification (SKU, model number)

– Country of origin (e.g., “Made in Vietnam”)

– Weight and dimensions

– Handling instructions (e.g., “This Side Up”)

– Retail compliance labels (e.g., UPC barcodes) if applicable

Ensure labeling adheres to destination country requirements, including language and font size regulations.

Import/Export Documentation

Standard documentation includes:

– Commercial Invoice (with detailed product description, value, and HS code)

– Packing List (itemizing contents per package)

– Bill of Lading (for sea freight) or Air Waybill (for air freight)

– Certificate of Origin (to claim preferential tariffs under trade agreements)

– Import Declaration (submitted by importer of record)

Maintain records for at least five years for audit and compliance purposes.

Regulatory and Safety Compliance

Steel mattress frames must comply with applicable safety and construction standards in the destination market. Key regulations include:

– U.S. (CPSC): No specific federal regulation, but general product safety under the Consumer Product Safety Act applies.

– EU: Must comply with General Product Safety Directive (2001/95/EC). CE marking is not mandatory unless combined with other regulated components.

– Canada: Complies with Health Canada’s product safety guidelines under the Canada Consumer Product Safety Act (CCPSA).

Ensure structural integrity testing is performed to confirm load-bearing capacity and durability.

Environmental and Material Restrictions

Verify compliance with environmental regulations such as:

– REACH (EU): Restriction of hazardous substances like lead, cadmium, and phthalates in coatings or finishes.

– RoHS (if applicable): Though primarily for electronics, ensure no restricted substances are used in auxiliary components.

– Proposition 65 (California): Warn consumers if products contain chemicals known to cause cancer or reproductive harm.

Use powder-coated or galvanized finishes that meet environmental standards.

Transportation and Freight Considerations

- Mode of Transport: Ocean freight is cost-effective for bulk shipments; air freight is suitable for urgent or low-volume orders.

- Container Loading: Optimize container space using standard frame dimensions; secure loads with dunnage and straps.

- Incoterms: Clearly define responsibilities using standard terms (e.g., FOB, CIF, DDP).

- Insurance: Obtain cargo insurance to cover damage, loss, or delay during transit.

Customs Clearance and Duties

Work with a licensed customs broker to ensure smooth clearance. Provide accurate:

– Product valuation (transaction value method preferred)

– Classification (HS code)

– Country of origin documentation

Duties vary by destination; for example, U.S. import duties on steel frames under 7308.90 are typically low (0–4%), but verify current rates via the HTSUS database.

Post-Import Requirements

After arrival:

– Conduct quality inspection for shipping damage

– Verify compliance with local labeling and safety standards

– Retain import documentation for audits

– Register with local authorities if required (e.g., business licensing, tax registration)

Sustainability and End-of-Life Considerations

Promote recyclability by:

– Using 100% recyclable steel materials

– Providing disassembly instructions

– Encouraging take-back or recycling programs

Align with circular economy principles to meet growing consumer and regulatory expectations.

Conclusion on Sourcing Steel Mattress Frames

Sourcing steel mattress frames requires a strategic approach that balances cost, quality, durability, and supply chain reliability. After evaluating various suppliers, manufacturing regions, material specifications, and market trends, it is evident that partnering with reputable manufacturers—particularly those in regions known for steel production excellence, such as China, India, or Eastern Europe—can offer competitive pricing and scalable production capacity. However, it is crucial to conduct thorough due diligence on potential suppliers to ensure compliance with international quality standards (e.g., ISO certifications), environmental regulations, and ethical labor practices.

Key considerations include the grade and gauge of steel used, which directly impact the frame’s strength and longevity, as well as the finish (e.g., powder coating or galvanization) to prevent rust and corrosion. Additionally, logistics, lead times, and import regulations must be factored into the overall sourcing strategy to avoid disruptions.

In conclusion, a successful sourcing strategy for steel mattress frames hinges on selecting reliable suppliers with proven manufacturing capabilities, maintaining rigorous quality control processes, and fostering long-term partnerships to ensure consistency and adaptability in a dynamic market. By prioritizing these elements, businesses can achieve a cost-effective, high-quality supply of steel mattress frames that meet both customer expectations and sustainability goals.