The global steel entry doors market is experiencing steady growth, driven by rising demand for durable, energy-efficient, and secure residential building materials. According to Grand View Research, the global exterior doors market was valued at USD 44.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030, with steel doors gaining traction due to their strength, fire resistance, and low maintenance. Similarly, Mordor Intelligence forecasts increasing adoption of steel doors in both new construction and renovation projects, particularly in North America and Europe, where building codes and homeowner preferences emphasize security and thermal performance. Within this growing segment, French entry doors made from steel combine architectural elegance with functional benefits, bridging aesthetic appeal and structural integrity. As demand rises, a select group of manufacturers has emerged as leaders in innovation, quality, and market reach—setting the standard for premium steel French entry doors.

Top 8 Steel French Entry Doors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Waudena

Domain Est. 2009

Website: waudena.com

Key Highlights: Waudena is North America’s leading manufacturer and distributor of steel and fiberglass exterior doors, entrance systems, windows and garage door frames….

#2 View all Doors

Domain Est. 1995

Website: thermatru.com

Key Highlights: 1–8 day deliverySearch through all Therma-Tru doors and narrow down by using filtering options to find the perfect entry door for your home….

#3 Masonite Residential

Domain Est. 1995

Website: masonite.com

Key Highlights: Explore the best selection of interior and exterior doors for your home. Masonite doors are crafted from the highest quality materials for every home style….

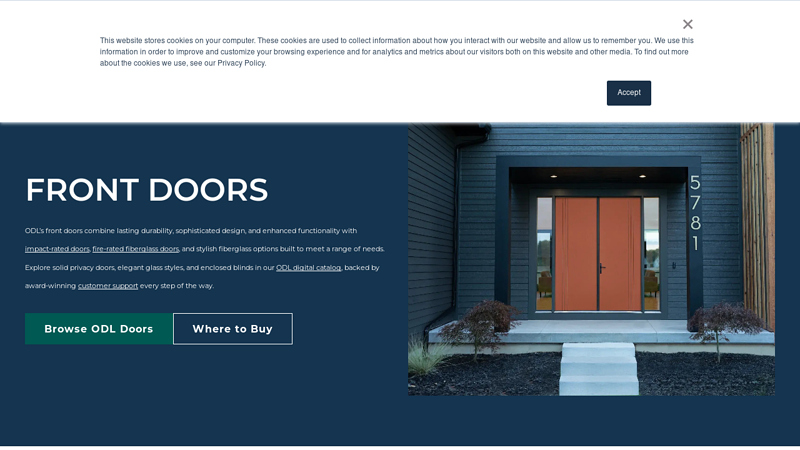

#4 Front Doors by ODL

Domain Est. 1996

Website: odl.com

Key Highlights: Explore front doors and entry doors by material, style, and performance features. Choose from fiberglass, steel, ADA-compliant, impact-rated, and fire-rated ……

#5 French Doors

Domain Est. 1996

Website: jeld-wen.com

Key Highlights: JELD-WEN French Doors offer timeless design with lasting performance. Choose from luxuriously hand-crafted wood, resilient fiberglass, or durable steel….

#6 CODEL Doors

Domain Est. 2008

Website: codeldoors.com

Key Highlights: Our Best Selling Door Collections · Steel Doors · Primed Shaker Doors · Patio Doors · Engineered Core Shaker Doors · Smooth Fiberglass · Oak Textured Fiberglass….

#7 The French Steel Company

Domain Est. 2015

Website: frenchsteel.com

Key Highlights: Elevate Your Space with Custom Steel Doors and Windows: The French Steel Company has sets new standards for custom steel doors and windows….

#8 Maison Janneau

Domain Est. 2022

Website: maison-janneau.com

Key Highlights: Our windows and doors are very durable and long-lasting. They are designed with French Oak or the thinnest steel to withstand the elements and can hold up well ……

Expert Sourcing Insights for Steel French Entry Doors

2026 Market Trends for Steel French Entry Doors

Steel French entry doors continue to evolve as a popular choice for homeowners seeking durability, security, and aesthetic appeal. As we approach 2026, several key trends are shaping the market, driven by consumer preferences, technological advancements, and broader economic and environmental considerations.

Growing Demand for Enhanced Security and Durability

In an era of increasing focus on home safety, steel French entry doors are gaining traction due to their superior resistance to forced entry compared to wood or fiberglass alternatives. By 2026, consumers are expected to prioritize doors with reinforced frames, multi-point locking systems, and impact-resistant glazing. Manufacturers are responding by integrating smart locking technology—such as biometric access and app-based control—directly into steel door systems, blending physical strength with digital security.

Sustainability and Energy Efficiency Advancements

Environmental consciousness is reshaping consumer choices. Steel, being highly recyclable, positions French entry doors favorably in green building initiatives. In 2026, expect wider adoption of thermally broken steel frames that minimize heat transfer, improving energy efficiency without sacrificing the sleek, slim profiles steel is known for. Low-emissivity (Low-E) glass, argon gas fills, and improved weatherstripping will become standard, helping homes meet stricter energy codes and reducing long-term utility costs.

Design Innovation and Customization

While traditionally associated with industrial or commercial aesthetics, modern steel French doors are embracing residential elegance. By 2026, the market will see a surge in customizable options, including powder-coated finishes in bold colors, matte textures, and historically inspired grille patterns. Homeowners are increasingly using these doors as architectural focal points, especially in open-concept homes connecting indoor and outdoor living spaces. The demand for oversized and multi-panel configurations will continue to rise, supported by advances in manufacturing that maintain structural integrity at larger scales.

Integration with Smart Home Ecosystems

Smart home integration is no longer a luxury but an expectation. Steel French entry doors in 2026 will increasingly feature embedded sensors for monitoring door position, temperature, and security breaches. These systems will seamlessly integrate with home automation platforms like Apple HomeKit, Google Home, and Amazon Alexa, allowing for remote monitoring and control. This convergence of robust construction and intelligent technology enhances convenience and peace of mind.

Regional Market Variations and Economic Influences

North America and Europe will remain strong markets due to high renovation activity and stringent building codes. However, emerging markets in Asia-Pacific may see accelerated adoption as urbanization and premium housing projects increase. Supply chain resilience and raw material costs—particularly steel pricing influenced by global trade dynamics—will impact affordability and availability. Manufacturers investing in localized production and sustainable sourcing are likely to gain a competitive edge.

Conclusion

By 2026, the steel French entry door market will be defined by a convergence of strength, sustainability, and smart technology. As homeowners seek long-term value, aesthetic versatility, and integrated home solutions, steel doors are poised to maintain and expand their share in the premium entry door segment. Success will depend on manufacturers’ ability to innovate in design, efficiency, and connectivity while addressing cost and environmental concerns.

Common Pitfalls When Sourcing Steel French Entry Doors (Quality and Intellectual Property)

Sourcing steel French entry doors from international suppliers, particularly in regions with varying regulatory standards, can present significant challenges related to quality control and intellectual property (IP) protection. Being aware of these pitfalls is essential to ensure product performance, brand integrity, and legal compliance.

Poor Material Quality and Construction

One of the most frequent issues is receiving doors made with substandard steel or inadequate manufacturing processes. Suppliers may use thinner gauge steel than specified, leading to reduced durability, warping, or compromised security. Additionally, poor welding, inconsistent powder coating, or low-grade insulation can affect thermal performance, weather resistance, and longevity.

Inadequate Weather and Security Testing

Many sourced steel French doors lack proper certification for weather resistance (e.g., water penetration, air leakage) or forced entry protection. Without third-party testing reports (such as those from AAMA or NFRC), buyers risk importing products that fail to meet local building codes or consumer expectations, resulting in costly returns or liability.

Misrepresentation of Product Features

Suppliers may exaggerate performance claims—such as fire resistance, soundproofing, or energy efficiency—without supporting documentation. Features like multi-point locking systems or reinforced frames may be missing or poorly executed, undermining the door’s functionality and safety.

Intellectual Property Infringement

A critical but often overlooked risk is the unauthorized replication of branded or patented door designs. Some suppliers produce “look-alike” versions of popular models protected by design patents or trademarks. Importing such products can lead to legal action, customs seizures, and reputational damage, especially in markets like the U.S. or EU with strict IP enforcement.

Lack of Traceability and Compliance Documentation

Suppliers may fail to provide essential documentation, including material certifications, test reports, or origin tracing. This lack of transparency complicates compliance with import regulations and makes it difficult to verify claims about quality or IP legitimacy.

Inconsistent Finishes and Aesthetic Defects

Cosmetic flaws—such as uneven paint finishes, surface scratches, or misaligned panels—are common when quality control is lax. For premium products like French entry doors, where appearance is crucial, these defects can lead to customer dissatisfaction and increased warranty claims.

Failure to Meet Local Building Codes

Steel doors sourced overseas may not conform to regional standards (e.g., U.S. ANSI/AAMA standards or EU CE marking requirements). Differences in dimensions, egress requirements, or fire ratings can render the product unsellable or unsafe in the target market.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough factory audits and request independent product testing.

– Verify IP rights and require legal assurances from suppliers.

– Use detailed specifications and quality control checklists during production.

– Work with legal counsel to ensure compliance with import and IP laws.

– Partner with reputable sourcing agents or inspection companies.

By proactively addressing these risks, businesses can secure high-quality, compliant steel French entry doors while protecting their brand and avoiding legal complications.

Logistics & Compliance Guide for Steel French Entry Doors

Product Overview and Classification

Steel French entry doors are heavy, durable exterior doors typically constructed with a steel frame and dual swinging panels. They are commonly used in residential and commercial applications for security, insulation, and aesthetic appeal. These doors often include glass inserts, weather-stripping, and locking mechanisms. From a logistics and compliance standpoint, they are classified as oversized freight due to dimensions and weight, requiring careful handling and specialized transportation.

Packaging and Handling Requirements

Proper packaging is essential to prevent damage during transit. Steel French entry doors must be wrapped in protective film or shrink wrap and secured to wooden skids or pallets using edge protectors and corner guards. Doors should be stored vertically during transport to avoid warping or denting. Handling requires forklifts or pallet jacks with soft grips to prevent scratching. Workers must wear gloves to avoid fingerprints and corrosion from skin oils.

Transportation and Freight Classification

Steel French entry doors are typically shipped via LTL (Less-Than-Truckload) or full truckload carriers. They fall under NMFC (National Motor Freight Classification) codes related to prefabricated doors, often class 125–150 depending on density and packaging. Due to their size and weight, shipments must comply with carrier-specific dimensional guidelines and weight limits. Over-dimensional surcharges may apply if doors exceed standard pallet dimensions (48” x 48” x 80”).

Domestic and International Shipping Regulations

For domestic U.S. shipments, carriers must adhere to FMCSA (Federal Motor Carrier Safety Administration) standards, including securement rules under 49 CFR Part 393. For international shipments, steel doors must comply with ISPM 15 for wooden pallets (requiring heat treatment and stamping). Export documentation such as a commercial invoice, packing list, and bill of lading is required. Importers must verify customs tariff codes—typically HTS 7308.30 for steel doors—and ensure compliance with destination country standards.

Safety and Workplace Compliance

All handling operations must follow OSHA (Occupational Safety and Health Administration) regulations. Employees should be trained in safe lifting techniques and equipment operation. Work areas must be free of obstructions, with clear signage indicating heavy load zones. Personal protective equipment (PPE), including steel-toed boots and gloves, is mandatory. Proper ventilation is required if doors are pre-treated with protective coatings.

Environmental and Material Compliance

Steel French entry doors must comply with environmental regulations regarding materials used. Volatile Organic Compound (VOC) emissions from paints and coatings must meet EPA standards and regional regulations like SCAQMD Rule 1113 in California. Recyclability of steel components should be documented. If doors contain composite glass, they must meet ANSI Z97.1 or CPSC 16 CFR 1201 for safety glazing.

Building and Energy Code Compliance

Doors must meet applicable building codes such as the International Building Code (IBC) and International Residential Code (IRC). Key compliance areas include:

– Energy Efficiency: Compliance with ENERGY STAR and NFRC (National Fenestration Rating Council) standards for U-factor and Solar Heat Gain Coefficient (SHGC).

– Security: Meeting ANSI A250.8 or ASTM E2932 for forced entry resistance.

– Egress: Adhering to IRC R311.4 for emergency egress, ensuring minimum clear opening dimensions.

Certification and Labeling Requirements

Each steel French entry door must bear permanent labeling indicating:

– Manufacturer name and model number

– Certification marks (e.g., NFRC, ENERGY STAR, AAMA)

– Fire rating (if applicable)

– Installation instructions and compliance statements

Labels must remain legible throughout distribution and installation.

Import/Export Documentation and Duties

Exporters must provide a properly classified HS code (e.g., 7308.30.0000 for the U.S.) and complete an Electronic Export Information (EEI) filing via the AES (Automated Export System) if the value exceeds $2,500. Importers are responsible for duties, which vary by country. Anti-dumping or countervailing duties may apply on steel products depending on the country of origin.

Returns, Damages, and Claims

A clear returns policy must be established with distributors and retailers. Damaged goods must be documented with photos and a freight claim filed within 24 hours of delivery. Carriers require proof of proper packaging to process claims. Reverse logistics should include inspection, repair assessment, and environmentally compliant disposal if necessary.

Storage and Inventory Management

Warehouses storing steel French entry doors should maintain dry, climate-controlled environments to prevent rust or coating degradation. Doors must be stored vertically on racks with adequate spacing to allow airflow. Inventory systems should track lot numbers, certifications, and shelf life of sealants and coatings to ensure compliance during fulfillment.

In conclusion, sourcing steel French entry doors requires careful consideration of quality, security, aesthetics, and long-term value. These doors offer superior durability, enhanced insulation, and excellent resistance to forced entry, making them a reliable choice for both residential and commercial applications. When selecting a supplier, it is essential to evaluate craftsmanship, material thickness, finish options, and compliance with industry standards such as ENERGY STAR or ASTM. Additionally, working with reputable manufacturers or distributors who provide comprehensive warranties and support ensures product reliability and customer satisfaction. By prioritizing these factors, buyers can secure high-performance steel French entry doors that combine elegance with functionality, ultimately enhancing the security, energy efficiency, and curb appeal of any property.