The global steel bushings market is experiencing robust growth, driven by rising demand across industrial machinery, automotive, and construction sectors. According to Mordor Intelligence, the global bushings market was valued at approximately USD 3.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by the increasing need for durable, low-maintenance components that enhance equipment efficiency and longevity. Steel bushings, in particular, are favored for their high load-bearing capacity, wear resistance, and performance in extreme conditions—making them indispensable in heavy-duty applications. As industries continue prioritizing reliability and cost-effectiveness, the demand for high-quality steel bushings is expected to rise, especially in emerging economies with expanding manufacturing and infrastructure sectors. In this evolving landscape, leading manufacturers are leveraging advanced materials, precision engineering, and scalable production capabilities to meet stringent performance standards. Based on market presence, product innovation, and global reach, here are the top 9 steel bush manufacturers shaping the industry’s future.

Top 9 Steel Bush Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mild Steel Bush

Domain Est. 2018

Website: unitedforgeind.com

Key Highlights: Find the perfect mild steel bush for your application at United Forge Industries. We offer a variety of sizes and lengths in MS bushes….

#2 Mild Steel Bush MSB

Domain Est. 2018

Website: gsautomates.com

Key Highlights: In stockExplore our premium Mild Steel Bush MSB-01 with high tensile strength, corrosion resistance, and customizable dimensions. Ideal for industrial and ……

#3 Metal Bushes Plain Bearing

Domain Est. 2019

Website: bronzelube.com

Key Highlights: As a leading manufacturer of metal split bearing bushes and steel bushings, we use premium, reliably sourced metals to produce a diverse range of sizes and ……

#4 Mild Steel Forged Bush Manufacturer from Gondal

Domain Est. 2022

Website: realtechnoforge.com

Key Highlights: Manufacturer of Forged Steel Bush – Mild Steel Forged Bush, Hot Forged Bushes, MS SS Forged Bush and SS Forged Bushing offered by Real Techno Forge, Gondal, ……

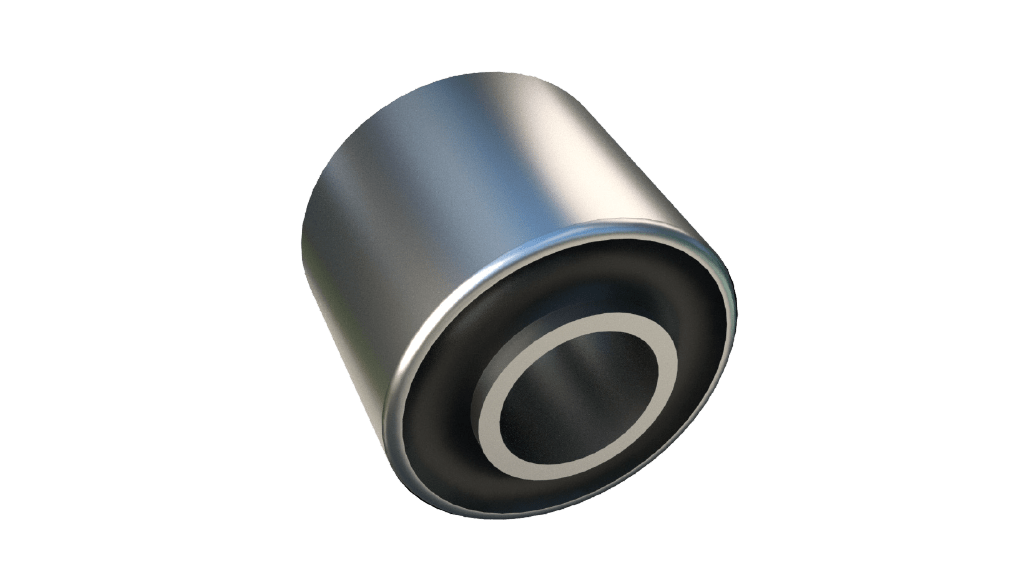

#5 Ultra Bush and VP Bushes

Domain Est. 1996

Website: trelleborg.com

Key Highlights: The bush consists of two concentric sleeves with rubber securely bonded between them. Designed to accommodate torsional movement and axial and radial loads….

#6 NSK Global

Domain Est. 1996

Website: nsk.com

Key Highlights: Global leader in Motion & Control. NSK keeps the world moving with bearings, ball screws, linear guides, auto parts, and precision machinery solutions….

#7 Materion

Domain Est. 1999

Website: materion.com

Key Highlights: A global supplier of specialty materials including high-performance alloys, beryllium products, metal matreix composites, clad metals, thin film deposition ……

#8 Bearing, Bush, Washers, Graphite Filled Bronze Bushes, Half Shell …

Domain Est. 2001 | Founded: 1997

Website: bearingbush.com

Key Highlights: Bearing & Bush Co. was established in 1997. BBC offers BUSHES & PARTS made out from, SINTERED BRONZE (SELF LUBRICATING), MDU/MDX (Dry Bushes & washers)…

#9 Brass Bushes

Domain Est. 2017

Website: viiplus.com

Key Highlights: Explore selection of bronze bushes & plain bearings suitable for various applications: from metal self-lubricating bushes to brass bushes ……

Expert Sourcing Insights for Steel Bush

H2: Market Trends Shaping the Steel Bush Industry in 2026

As we approach 2026, the global steel bush market is undergoing significant transformation driven by technological advancements, evolving industrial demands, sustainability imperatives, and shifting supply chain dynamics. Steel bushes—precision-engineered sleeve bearings used across automotive, industrial machinery, aerospace, and construction sectors—are adapting to new performance standards and market expectations. Below is an analysis of key trends expected to shape the steel bush market in 2026:

1. Rising Demand from Automotive and Electric Vehicle (EV) Manufacturing

The automotive sector remains the largest consumer of steel bushes, and this trend is intensifying with the global shift toward electric vehicles. In 2026, EV production is expected to account for over 30% of total vehicle output in major markets such as North America, Europe, and China. Steel bushes are critical components in drivetrains, suspension systems, and chassis assemblies. With EVs requiring higher durability and lower maintenance, demand for high-strength, corrosion-resistant steel bushes is growing. Manufacturers are investing in advanced materials like stainless steel and bimetallic composites to meet these needs.

2. Growth in Industrial Automation and Robotics

The proliferation of automation across manufacturing, logistics, and warehousing is fueling demand for precision motion control components. Steel bushes are essential in robotic joints, conveyor systems, and automated assembly lines due to their load-bearing capacity and wear resistance. By 2026, the global industrial robotics market is projected to expand at a CAGR of 10–12%, directly boosting steel bush consumption. Integration with smart sensors and predictive maintenance systems is also pushing innovation in self-lubricating and low-friction steel bush designs.

3. Emphasis on Sustainability and Green Manufacturing

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are reshaping material sourcing and production methods. In 2026, steel bush manufacturers are increasingly adopting recycled steel and energy-efficient production processes. Leading companies are pursuing ISO 14001 certification and investing in closed-loop manufacturing systems. Additionally, demand for maintenance-free, long-life bushes reduces lubricant use and waste, aligning with circular economy principles.

4. Supply Chain Resilience and Regionalization

Ongoing geopolitical tensions and lessons from recent disruptions (e.g., pandemic, trade conflicts) are prompting companies to regionalize supply chains. In 2026, North American and European manufacturers are onshoring or nearshoring steel bush production to reduce dependency on Asia. This shift supports local job creation and shortens lead times, though it may increase production costs initially. Meanwhile, countries like India and Vietnam are emerging as alternative manufacturing hubs due to lower labor costs and favorable trade policies.

5. Advancements in Material Science and Coating Technologies

Material innovation is a key driver in the steel bush market. By 2026, surface treatments such as PTFE coatings, DLC (Diamond-Like Carbon), and laser cladding are becoming standard to enhance wear resistance, reduce friction, and extend service life. Composite steel bushes with engineered polymers offer lighter weight and improved performance in harsh environments. R&D investments by major players like NTN, NSK, and SKF are accelerating the commercialization of next-generation bushing solutions.

6. Digitalization and Industry 4.0 Integration

Smart factories are leveraging IoT-enabled components to monitor equipment health in real time. In 2026, intelligent steel bushes embedded with micro-sensors are being piloted to detect vibration, temperature, and load anomalies—enabling predictive maintenance and reducing unplanned downtime. This trend is particularly strong in aerospace, energy, and heavy machinery sectors where failure costs are high.

7. Price Volatility and Raw Material Challenges

Steel prices remain sensitive to global iron ore and coking coal markets, as well as energy costs. In 2026, fluctuating raw material prices—exacerbated by climate policies and carbon taxation—are pressuring margins. To mitigate risks, manufacturers are entering long-term supply agreements and exploring alternative alloys with comparable performance at lower cost.

Conclusion

By 2026, the steel bush market is poised for steady growth, underpinned by innovation, industrial modernization, and sustainability. Companies that embrace advanced materials, digital integration, and resilient supply chains will gain a competitive edge. While challenges around cost and regulation persist, the demand for reliable, high-performance steel bushes across critical industries ensures a robust market outlook.

Common Pitfalls When Sourcing Steel Bushings (Quality and Intellectual Property)

Sourcing steel bushings can be deceptively complex, with hidden risks related to both product quality and intellectual property (IP). Overlooking these pitfalls can lead to production delays, safety issues, legal disputes, and reputational damage. Here are key challenges to watch for:

Quality-Related Pitfalls

Inconsistent Material Composition

Suppliers may use substandard or non-compliant steel grades to cut costs, resulting in bushings with poor hardness, wear resistance, or corrosion performance. Without proper material certifications (e.g., mill test reports), verifying compliance with required standards (e.g., ASTM, ISO, DIN) becomes difficult.

Poor Dimensional Accuracy and Tolerances

Low-cost manufacturers may lack precision machining capabilities, leading to bushings with out-of-tolerance inner/outer diameters or lengths. This can cause fitting issues, premature wear, or mechanical failure in assemblies.

Inadequate Surface Finish and Coating

A poor surface finish increases friction and accelerates wear. Similarly, missing or low-quality surface treatments (e.g., zinc plating, black oxide) compromise corrosion resistance. Insufficient coating thickness or adhesion can lead to early degradation.

Lack of Traceability and Documentation

Reputable suppliers provide full traceability, including heat lot numbers and inspection reports. Sourcing from vendors without proper documentation increases the risk of receiving non-conforming or counterfeit parts.

Insufficient Testing and Quality Control

Some suppliers skip critical quality checks such as hardness testing, dimensional inspection, or load testing. Without third-party or in-house validation, defects may go undetected until after deployment.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Proprietary Designs

Sourcing bushings based on a patented or trademarked design without a license exposes your company to IP infringement claims. This is especially common when sourcing reverse-engineered parts from regions with weak IP enforcement.

Counterfeit or Grey Market Components

Using suppliers who distribute imitation bushings that mimic branded products (e.g., ISO-standard designs with misleading logos) can lead to legal action and damage customer trust. These parts often lack quality control and performance guarantees.

Lack of Design Ownership Clarity

If you provide custom bushing specifications to a supplier, unclear agreements may allow them to reuse or resell your design to competitors. Always ensure contracts include IP assignment or confidentiality clauses.

Failure to Conduct IP Due Diligence

Not verifying whether the bushing design or manufacturing process infringes existing patents can result in costly litigation. A freedom-to-operate (FTO) analysis is recommended for custom or specialized components.

Geopolitical and Regulatory Risks

Sourcing from regions known for IP violations increases exposure to counterfeit goods and legal complications. Additionally, import regulations (e.g., U.S. Section 301 tariffs) may apply to components from certain countries, especially if IP concerns are flagged.

Best Practices to Mitigate Risks

- Require full material and inspection certifications from suppliers

- Audit supplier facilities or use third-party inspection services

- Use NDAs and clearly defined IP agreements with custom designs

- Conduct IP searches before adopting new bushing designs

- Source from reputable, certified suppliers with a proven track record

By proactively addressing these quality and IP pitfalls, companies can ensure reliable performance, regulatory compliance, and legal protection in their steel bushing supply chain.

Logistics & Compliance Guide for Steel Bush

Steel Bush, as a manufacturer and distributor of steel products, must adhere to stringent logistics and compliance protocols to ensure product integrity, regulatory adherence, and customer satisfaction. This guide outlines key procedures and standards for transportation, handling, documentation, and regulatory compliance.

Transportation and Handling

Ensure all steel bush components are transported using secure methods to prevent damage during transit. Use padded straps and protective wrapping to avoid surface scratches or deformation. Load products evenly on pallets or in containers to maintain balance and prevent shifting. For international shipments, comply with International Maritime Dangerous Goods (IMDG) Code where applicable, though most steel products are non-hazardous.

Packaging Standards

All steel bushings must be packaged according to internal quality standards and customer specifications. Use moisture-resistant wrapping and desiccants when necessary to prevent corrosion during storage or ocean freight. Clearly label packages with product identification, batch number, quantity, weight, and handling instructions (e.g., “Do Not Stack,” “This Side Up”).

Documentation Requirements

Maintain accurate and complete shipping documentation for all domestic and international orders. Required documents include:

– Commercial Invoice

– Packing List

– Bill of Lading (BOL) or Air Waybill (AWB)

– Certificate of Origin

– Material Test Report (MTR) or Mill Certificate

– REACH and RoHS Compliance Statements (for EU shipments)

Ensure all documents are verified for accuracy prior to shipment to avoid customs delays.

Regulatory Compliance

Steel Bush must comply with regional and international regulations:

– REACH (EU): Register all applicable substances and provide Safety Data Sheets (SDS) upon request.

– RoHS (EU): Confirm that products do not contain restricted hazardous substances.

– TSCA (USA): Certify compliance with the Toxic Substances Control Act, particularly for imported steel components.

– Customs-Trade Partnership Against Terrorism (C-TPAT): Follow security guidelines for shipments to the U.S.

– UKCA Marking: Where applicable for post-Brexit UK market access.

Export Controls

Verify that steel bush products are not subject to export restrictions under entities such as the U.S. Department of Commerce (BIS) or similar regulatory bodies. Classify products using the appropriate Harmonized System (HS) codes and confirm licensing requirements for sensitive end-uses or destinations.

Quality Assurance and Traceability

Implement a traceability system that links each batch of steel bushings to raw material sources, production records, and inspection reports. Conduct routine internal audits to ensure compliance with ISO 9001 and other relevant quality management standards.

Environmental and Safety Compliance

Adhere to OSHA and local safety regulations in handling and warehouse operations. Minimize environmental impact by recycling packaging materials and reducing waste. For shipments involving coatings or lubricants, ensure compliance with VOC regulations and proper disposal protocols.

Supplier and Partner Compliance

Require all logistics partners and subcontractors to comply with Steel Bush’s logistics and compliance standards. Conduct periodic assessments of third-party carriers and warehouses to ensure alignment with company policies and regulatory requirements.

Incident Response and Corrective Actions

Establish procedures for reporting and addressing logistics or compliance incidents, such as damaged goods, customs penalties, or regulatory violations. Implement corrective and preventive actions (CAPA) to mitigate recurrence and maintain continuous improvement.

Conclusion for Sourcing Steel Bushes

In conclusion, sourcing steel bushes requires a strategic approach that balances quality, cost, reliability, and supply chain efficiency. Selecting the right supplier involves evaluating material specifications, manufacturing capabilities, adherence to industry standards (such as ISO or ASTM), and the ability to meet delivery timelines consistently. Whether sourcing domestically or internationally, factors such as lead times, freight costs, and customization options must be carefully considered. Building long-term relationships with reputable suppliers, conducting regular quality audits, and leveraging procurement best practices will ensure a reliable supply of high-performance steel bushes essential for machinery and equipment across various industrial applications. Ultimately, effective sourcing not only supports operational continuity but also contributes to improved product durability and overall cost savings.