The global steam heating systems market is experiencing steady growth, driven by increasing demand for energy-efficient heating solutions across industrial, commercial, and residential sectors. According to a report by Mordor Intelligence, the global heating, ventilation, and air conditioning (HVAC) market — encompassing steam heating systems — was valued at USD 177.2 billion in 2022 and is projected to grow at a CAGR of over 7.5% from 2023 to 2028. Steam heating systems, in particular, remain a critical component in sectors requiring high-temperature, reliable thermal energy, such as manufacturing, healthcare, and district heating. Grand View Research further highlights that the global industrial boiler market, a key enabler of steam heating, is expected to expand at a CAGR of 4.8% from 2023 to 2030, underpinned by modernization of aging infrastructure and stricter emissions regulations. As energy efficiency and system reliability become strategic priorities, leading manufacturers are investing in advanced materials, IoT integration, and low-emission technologies. In this evolving landscape, the following ten companies stand out as top steam heating systems manufacturers, combining innovation, global reach, and proven performance.

Top 10 Steam Heating Systems Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Steam Boilers

Domain Est. 1996

Website: miuraboiler.com

Key Highlights: As a leading manufacturer of industrial steam boilers, Miura America specializes in high-efficiency, low NOx modular systems….

#2 Thermon

Domain Est. 1994

Website: thermon.com

Key Highlights: Whether you’re looking for complete flow assurance, industrial heating, temperature maintenance, freeze protection or environmental monitoring, Thermon has you ……

#3 U.S. Boiler Company

Domain Est. 2010

Website: usboiler.net

Key Highlights: US Boiler Company is a leading manufacturer of home heating equipment, water boilers, steam boilers, hot water heaters, radiators and boiler control systems….

#4 A Steam Specialist Company

Domain Est. 1995

Website: tlv.com

Key Highlights: TLV delivers innovative products, services and solutions for steam and air systems, from steam traps, condensate recovery pumps, pressure reducing valves, ……

#5 Fulton: High

Domain Est. 1996

Website: fulton.com

Key Highlights: Trusted globally, Fulton engineers high-efficiency steam and hydronic boilers, thermal fluid heaters, and custom heat transfer systems….

#6 Superior Boiler

Domain Est. 1997

Website: superiorboiler.com

Key Highlights: Superior Boiler solves your most complex boiler challenges so you can get down to business – sterilizing essential hospital equipment, heating large facilities….

#7 Cleaver

Domain Est. 1998

Website: cleaverbrooks.com

Key Highlights: Cleaver-Brooks is your total solution provider for boilers and boiler room systems, including rentals, maintenance programs, parts, and training….

#8 Steam Systems

Domain Est. 1999

Website: energy.gov

Key Highlights: Many manufacturing facilities can recapture energy by installing more efficient steam equipment and processes and applying energy management practices….

#9 SussmanBoilers

Domain Est. 2000

Website: sussmanboilers.com

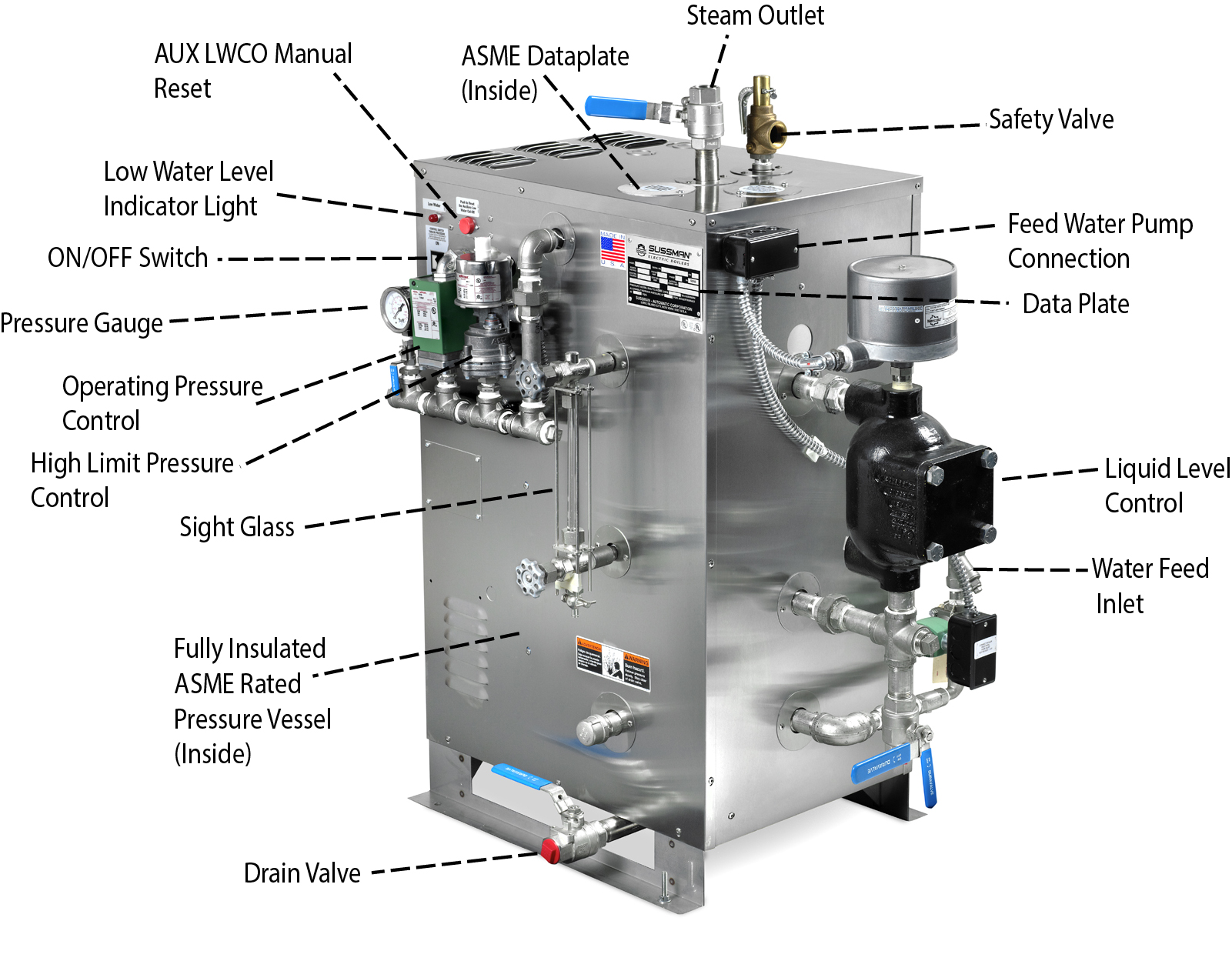

Key Highlights: Search Products EWx – Electric Hot Water Boiler EW- Electric Hot Water Boiler ES – Electric Steam Boilers MBA – Electric Steam Boilers SSB – Stainless Steel ……

#10 Learn about steam

Domain Est. 2000

Website: spiraxsarco.com

Key Highlights: These tutorials explain the principles of steam engineering and heat transfer. They also provide a comprehensive engineering best practice guide….

Expert Sourcing Insights for Steam Heating Systems

2026 Market Trends for Steam Heating Systems

The global steam heating systems market is poised for measured transformation by 2026, driven by a complex interplay of energy efficiency demands, decarbonization policies, technological innovation, and regional infrastructure dynamics. While facing pressure from alternative heating technologies, steam systems retain critical niches where their unique advantages ensure continued relevance and targeted growth.

Accelerated Focus on Energy Efficiency and System Optimization:

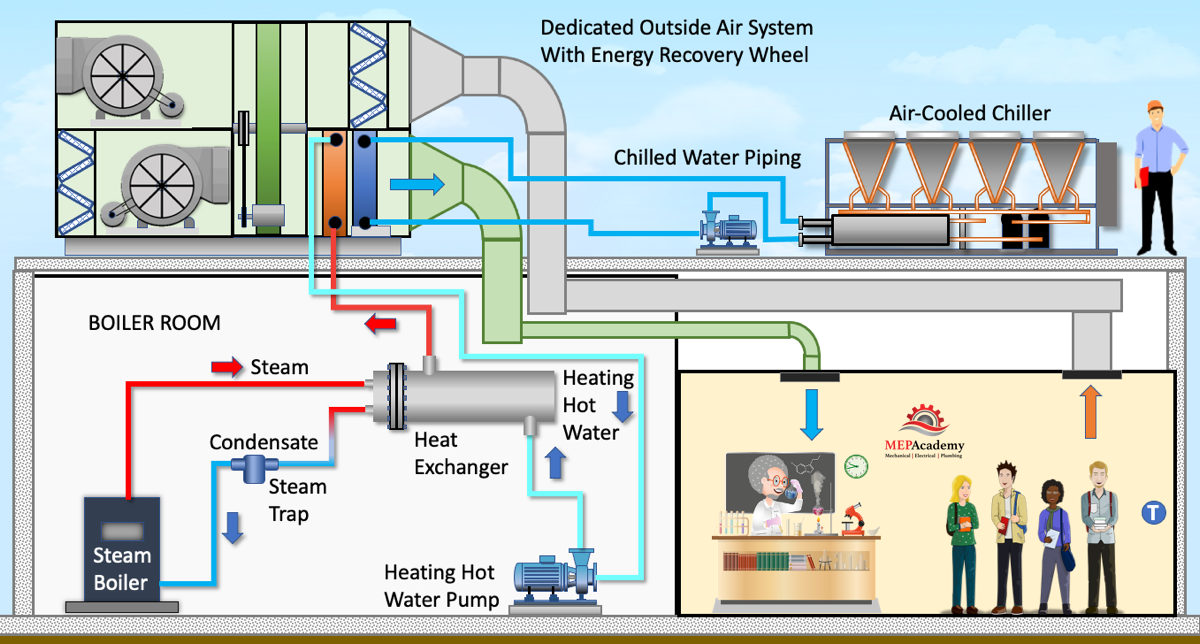

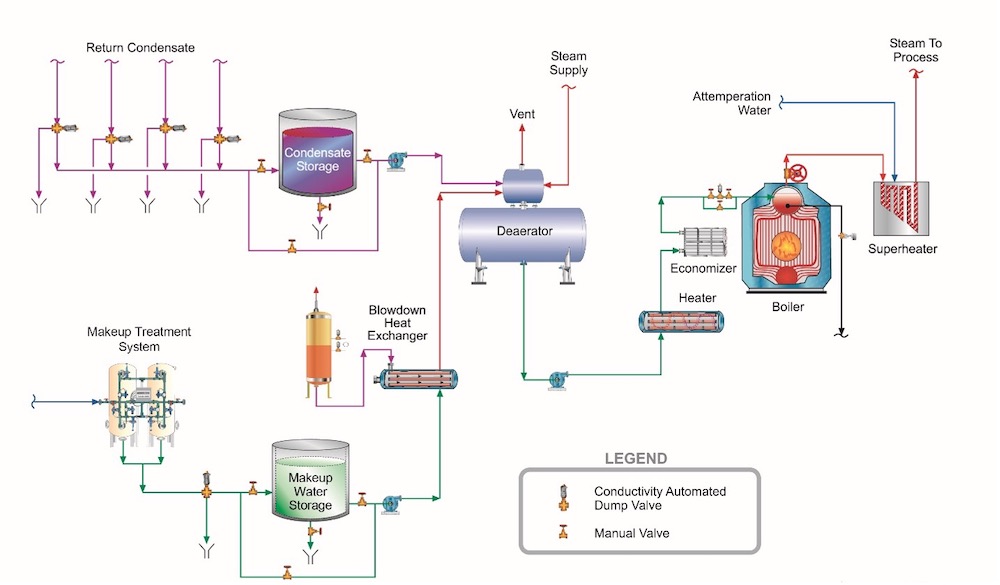

By 2026, maximizing the efficiency of existing steam systems will be paramount. The high energy intensity of steam generation makes it a prime target for cost reduction and emissions compliance. We will see widespread adoption of advanced monitoring and control systems (IIoT-enabled sensors, AI-driven analytics) for real-time optimization of boiler load, steam pressure, and condensate return. Predictive maintenance, leveraging data analytics to prevent leaks and failures in steam traps and distribution networks, will become standard practice, significantly reducing energy waste (a major source of inefficiency, with trap failures alone costing billions annually). Demand for high-efficiency condensing boilers and heat recovery systems (e.g., capturing waste heat from boiler blowdown or flue gases) will surge as facilities strive to meet stricter energy performance standards.

Growing Pressure from Decarbonization and Regulatory Shifts:

The transition to low-carbon energy is the most significant macro-trend shaping the 2026 landscape. Stringent government regulations (e.g., EU Green Deal, US clean energy standards) and corporate net-zero commitments will increasingly target the fossil fuel combustion inherent in most steam generation. This creates substantial pressure to decarbonize. The market will witness a strategic shift towards integrating steam systems with renewable energy sources, primarily through electrification using high-temperature heat pumps (though limited by temperature requirements) or direct use of renewable electricity for electric boilers (highly dependent on local grid decarbonization and electricity costs). Co-firing with biofuels or transitioning to hydrogen (especially green hydrogen) in existing or retrofitted boilers will be actively explored and piloted, particularly in heavy industry, though widespread commercial deployment by 2026 may still face cost and infrastructure hurdles.

Resilience in Critical Industrial and Institutional Sectors:

Despite challenges, steam heating will maintain strong demand in sectors where its high, consistent thermal energy delivery is irreplaceable. Heavy industries like chemical processing, food & beverage manufacturing, pharmaceuticals, and pulp & paper will continue to rely heavily on steam for process heating, sterilization, and humidification. Large institutional complexes (hospitals, universities, district heating networks in colder climates) with legacy infrastructure will prioritize retrofitting and optimizing existing steam systems rather than full replacement, driving demand for modernization services, advanced controls, and high-efficiency components. The reliability and established infrastructure of steam systems in these applications provide inertia against rapid displacement.

Technological Innovation and Hybrid System Integration:

Innovation will focus less on displacing steam entirely and more on enhancing its efficiency and integration. Key trends include the development of more durable and efficient steam traps, advanced insulation materials for distribution lines, and sophisticated control algorithms for dynamic load management. Hybrid systems, combining steam with lower-temperature heat sources (like hot water loops or heat pumps) for different parts of a facility, will gain traction as a pragmatic approach to reduce overall fossil fuel consumption while leveraging existing steam infrastructure for high-temperature needs. Digital twins of steam networks will emerge for simulation, optimization, and training.

Regional Divergence and Supply Chain Considerations:

Market dynamics will vary significantly by region. Mature markets (North America, Western Europe) will see slower growth, focused on retrofits, efficiency upgrades, and decarbonization pilots. Growth will be stronger in developing economies (parts of Asia, Middle East) undergoing industrialization and urbanization, where new industrial plants and district heating systems are being built, often initially reliant on fossil-fueled steam. Supply chain resilience for critical components (boilers, valves, specialty alloys) will remain a concern, potentially accelerating localization efforts and influencing procurement strategies.

Conclusion:

The 2026 steam heating systems market will not experience explosive growth but rather a period of strategic adaptation. Success will depend on embracing digitalization for efficiency, actively pursuing decarbonization pathways (electrification, hydrogen, biofuels), and leveraging steam’s inherent strengths in high-temperature industrial processes. While facing competition from alternative technologies, steam will remain a vital, albeit evolving, component of the global thermal energy landscape, particularly where high-grade heat is essential. The focus will shift decisively from simple heat generation to intelligent, efficient, and increasingly sustainable thermal energy delivery.

Common Pitfalls Sourcing Steam Heating Systems (Quality, IP)

Sourcing steam heating systems involves significant technical and commercial complexities. Overlooking key aspects can lead to poor performance, safety risks, increased costs, and intellectual property (IP) vulnerabilities. Here are critical pitfalls to avoid:

Poor Quality Components and Fabrication

-

Substandard Materials: Selecting components made from inferior-grade metals or materials not rated for high-pressure, high-temperature steam environments can result in premature failure, leaks, or catastrophic ruptures. Always verify material certifications (e.g., ASTM, ASME) and ensure compatibility with operating conditions.

-

Inadequate Manufacturing Standards: Suppliers may cut corners on welding, machining, or assembly. Lack of adherence to ASME BPVC (Boiler and Pressure Vessel Code) or other recognized standards compromises system integrity and safety. Require third-party inspections and pressure testing documentation.

-

Lack of Traceability and Documentation: Absence of proper documentation—such as material test reports (MTRs), weld maps, and inspection records—makes quality validation difficult and can hinder compliance during audits or regulatory reviews.

Intellectual Property (IP) Risks

-

Unlicensed or Counterfeit Designs: Sourcing from unauthorized manufacturers may result in systems that infringe on patented technologies (e.g., specialized heat exchanger designs, control algorithms). This exposes the buyer to legal liability and potential product seizure.

-

Proprietary Control Systems and Software: Many modern steam systems include proprietary control software. Purchasing without clear licensing terms may restrict modifications, integration, or future maintenance. Ensure software licenses are transferable and include source code access if needed.

-

Insufficient IP Clauses in Contracts: Failure to define IP ownership in procurement agreements—especially for custom-engineered components—can lead to disputes. Clarify who owns design modifications, performance data, and any innovations developed during the project.

Inadequate Supplier Qualification

-

Choosing Based on Price Alone: The lowest bid often correlates with compromised quality or hidden costs (e.g., higher maintenance, downtime). Conduct comprehensive supplier audits, including site visits and review of past project performance.

-

Lack of Industry-Specific Experience: Not all suppliers have proven expertise in steam systems. Inexperienced vendors may misunderstand system dynamics, leading to inefficient or unsafe installations. Verify references and request case studies in similar applications.

Non-Compliance with Codes and Standards

-

Ignoring Local and International Regulations: Steam systems must comply with jurisdictional requirements (e.g., OSHA, local boiler codes, PED in Europe). Sourcing equipment that doesn’t meet these standards delays commissioning and risks fines or shutdowns.

-

Missing Certifications: Ensure key components carry necessary certifications (e.g., ASME “U” or “S” stamps, CE marking). Lack of certification invalidates insurance and regulatory approval.

Poor Integration and Interoperability

-

Mismatched System Components: Components sourced from multiple vendors may not integrate seamlessly, leading to control conflicts, pressure imbalances, or efficiency losses. Use system integrators or require full system compatibility testing.

-

Obsolete or Proprietary Interfaces: Legacy or vendor-locked communication protocols hinder future upgrades and maintenance. Specify open standards (e.g., BACnet, Modbus) and ensure access to interface specifications.

By addressing these pitfalls proactively—through rigorous supplier vetting, clear contractual terms, and adherence to engineering standards—organizations can ensure reliable, safe, and legally compliant steam heating system deployments.

Logistics & Compliance Guide for Steam Heating Systems

System Design and Installation Requirements

Steam heating systems must be designed and installed according to applicable codes and standards, including ASME B31.1 (Power Piping), the International Mechanical Code (IMC), and local jurisdictional regulations. Key design considerations include proper pipe sizing, slope for condensate return, boiler capacity, and pressure rating compatibility. All components—boilers, piping, valves, traps, and expansion tanks—must be selected for the intended operating pressure and temperature. Installation should be performed by licensed professionals and documented for compliance audits.

Equipment Certification and Standards

All major components of a steam heating system must be certified to relevant safety and performance standards. Boilers should carry the ASME “S” or “HV” stamp, indicating compliance with the ASME Boiler and Pressure Vessel Code. Pressure relief valves must be certified by the National Board and sized according to ASME Section I requirements. Steam traps, control valves, and gauges should comply with ASTM, ANSI, or ISO standards. Maintain certification records for all equipment throughout the system’s lifecycle.

Safety and Operational Compliance

Steam systems operate under high pressure and temperature, making safety compliance critical. Required safety devices include pressure relief valves, low-water cutoffs, pressure gauges, and high-limit controls. These must be tested and calibrated annually. Operators must follow OSHA guidelines for confined space entry, lockout/tagout (LOTO) procedures, and personal protective equipment (PPE). A documented safety management plan, including emergency shutdown procedures, is mandatory.

Environmental and Emissions Regulations

Steam heating systems, especially those fueled by natural gas, oil, or biomass, are subject to environmental regulations from the EPA and local air quality management districts. Emissions of NOx, CO, SOx, and particulate matter must be monitored and reported as required. Systems may need continuous emissions monitoring systems (CEMS) or periodic stack testing. Compliance with the Clean Air Act and local air permits is mandatory, and records must be kept for inspection.

Inspection, Testing, and Maintenance

Regular inspection and maintenance are required to ensure safe and efficient operation. The National Board Inspection Code (NBIC) governs inspection intervals for boilers and pressure vessels. External inspections should occur annually; internal inspections every two to five years depending on system use and water quality. Steam traps should be tested quarterly for proper operation. Maintenance logs, repair records, and inspection reports must be retained for at least five years.

Documentation and Recordkeeping

Complete documentation is essential for regulatory compliance and system reliability. Required records include as-built drawings, equipment manuals, commissioning reports, pressure test results, water treatment logs, inspection certificates, and training records for personnel. Digital record management systems are recommended to ensure data accessibility during audits or incident investigations.

Training and Personnel Qualifications

Personnel operating and maintaining steam heating systems must be properly trained and, where required, licensed. Boiler operators may need state certification depending on the boiler’s horsepower or operating pressure. Training programs should cover system operation, emergency procedures, safety protocols, and compliance responsibilities. Refresher training should occur at least annually, with records maintained for all participants.

Transportation and Handling of Components

During logistics and installation, steam system components—particularly pressure vessels and large piping—must be handled according to manufacturer specifications and OSHA standards. Secure lifting, bracing, and transport procedures must be followed to prevent damage or injury. Proper storage in dry, protected areas is required to prevent corrosion prior to installation. Shipping documentation, including material safety data sheets (MSDS) for chemicals used in treatment, must accompany all deliveries.

Water Treatment and Chemical Compliance

Proper water treatment is critical to prevent scaling, corrosion, and microbiological growth in steam systems. Chemicals used—such as oxygen scavengers, pH adjusters, and antifoaming agents—must comply with EPA and OSHA regulations. Material Safety Data Sheets (MSDS/SDS) must be available on-site. Water quality should be tested regularly, and treatment programs must follow guidelines from the American Boiler Manufacturers Association (ABMA) or ASME guidelines.

Decommissioning and Disposal

When decommissioning a steam heating system, compliance with environmental and safety regulations is required. Residual pressure must be safely vented, and hazardous materials (e.g., asbestos insulation, chemical residues) must be removed and disposed of by licensed contractors. Piping and vessels should be cleaned and labeled per EPA and DOT regulations if being transported. A decommissioning report, including disposal certifications, must be filed and retained.

Conclusion for Sourcing Steam Heating Systems

In conclusion, sourcing steam heating systems requires a comprehensive evaluation of technical specifications, system efficiency, supplier reliability, and long-term operational costs. These systems remain a vital solution for industrial, commercial, and large-scale heating applications due to their high heat transfer efficiency and ability to deliver consistent thermal energy over long distances. When sourcing, it is essential to partner with reputable manufacturers and suppliers who offer robust system design support, compliance with safety and environmental standards, and reliable after-sales service.

Key considerations such as fuel type, boiler capacity, control systems, and integration with existing infrastructure must align with the specific heating demands and sustainability goals of the facility. Additionally, prioritizing energy-efficient and low-emission technologies can result in significant cost savings and reduced environmental impact over the system’s lifecycle.

Ultimately, a well-sourced steam heating system not only ensures operational reliability and safety but also supports long-term energy efficiency and scalability. Strategic planning and due diligence in the procurement process will maximize performance, minimize downtime, and provide a solid return on investment.