The global steal tubing market has seen steady expansion, driven by rising demand across oil & gas, automotive, and construction sectors. According to a 2023 report by Mordor Intelligence, the global seamless steel tubes and pipes market was valued at USD 66.5 billion and is projected to grow at a CAGR of 5.8% from 2023 to 2028. This growth is fueled by increasing infrastructure investments, particularly in emerging economies, and the need for durable, high-pressure resistant materials in energy transmission systems. In parallel, Grand View Research highlights that the global steel pipes and tubes market size reached USD 137.6 billion in 2022 and is expected to expand at a compound annual growth rate of 6.1% through 2030, underpinned by advancements in manufacturing technologies and tightening regulatory standards for pipeline safety. As competition intensifies and demand evolves, identifying reliable manufacturers with proven production capacity, material quality, and global reach becomes critical. Based on market presence, production volume, certifications, and performance metrics, the following nine manufacturers stand out as leaders in the steal tubing industry.

Top 9 Steal Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Atlas Tube

Domain Est. 1995

Website: atlastube.com

Key Highlights: As the leading manufacturer of structural steel tube, we’re here to help you. From conceptual design through project completion, our engineering team, design ……

#2 Stainless Steel Tubing Manufacturing

Domain Est. 1995

Website: plymouth.com

Key Highlights: Plymouth Tube Company is a global specialty manufacturer of carbon alloy, nickel alloy, and stainless precision steel tubing….

#3 Industrial Tube and Steel Corporation: Steel Tubing & Dura

Domain Est. 1997 | Founded: 1956

Website: industrialtube.com

Key Highlights: Since 1956, Industrial Tube and Steel has been servicing the steel tubing and continuous cast iron needs of businesses across the Midwest. Contact us!…

#4 T&B Tube: Precision Steel Tubing Manufacturer

Domain Est. 1998

Website: tbtube.com

Key Highlights: T&B Tube Company is a precision steel tubing manufacturer serving a variety of industries. We are precise, prepared, and prompt in fulfilling your needs….

#5 Zekelman Industries

Domain Est. 2002

Website: zekelman.com

Key Highlights: Zekelman Industries is the largest independent steel tube and pipe manufacturer in North America and an innovator in modular construction….

#6 Wheatland Tube

Domain Est. 1995

Website: wheatland.com

Key Highlights: American-made steel pipe and tube for electrical, process, fire suppression, fence framework, mechanical and energy systems….

#7 Small Diameter Tubes

Domain Est. 1996

Website: superiortube.com

Key Highlights: At Superior Tube, We are specialized in manufacturing small diameter thin wall tubes. High quality metal tubing in stainless steel, nickel, titanium and ……

#8 U.S. Steel

Domain Est. 1997

Website: ussteel.com

Key Highlights: Facts About Nippon Steel Corporation. U. S. Steel’s new partner is one of our industry’s largest, most technologically advanced steelmakers. Learn more about ……

#9 Chicago Tube & Iron

Domain Est. 1997 | Founded: 1914

Website: chicagotube.com

Key Highlights: Founded in 1914, CTI is one of the largest specialty steel service centers in the United States, with nine locations throughout the Midwest and in Monterrey, ……

Expert Sourcing Insights for Steal Tubing

H2: 2026 Market Trends for Steel Tubing

The global steel tubing market is poised for notable transformation by 2026, driven by evolving industrial demands, technological advancements, and shifting geopolitical and environmental landscapes. Several key trends are expected to shape the trajectory of the steel tubing sector in the coming years.

-

Increased Demand from Infrastructure and Construction Sectors

Governments worldwide are prioritizing infrastructure development as a means of economic recovery and long-term growth. Initiatives such as the U.S. Infrastructure Investment and Jobs Act, China’s continued urbanization, and the European Green Deal are projected to significantly boost demand for steel tubing in construction, bridges, and public utilities. By 2026, structural and mechanical steel tubing will see robust growth, particularly in emerging markets across Asia-Pacific, Africa, and Latin America. -

Growth in Oil & Gas and Energy Applications

Despite the global shift toward renewable energy, oil and gas exploration and production—especially in shale and offshore operations—are expected to maintain steady demand for high-strength, corrosion-resistant steel tubing. The resurgence of energy security concerns post-2022 geopolitical tensions has prompted renewed investment in energy infrastructure. Additionally, rising activity in LNG (liquefied natural gas) transportation and carbon capture and storage (CCS) projects will create new opportunities for specialized steel tubing by 2026. -

Automotive Lightweighting and Electrification

The automotive industry’s shift toward electric vehicles (EVs) and lightweight materials will impact steel tubing usage. While high-strength low-alloy (HSLA) steel tubing remains critical for chassis and safety components, competition from aluminum and composites is increasing. However, innovations in advanced high-strength steel (AHSS) tubing are enabling manufacturers to meet safety and efficiency standards without adding weight. By 2026, steel tubing will maintain a strong presence in EV battery enclosures, structural frames, and hydrogen fuel cell systems. -

Adoption of Green Steel and Sustainable Manufacturing

Environmental regulations and corporate sustainability goals are accelerating the adoption of low-carbon steel production methods. By 2026, steel tubing producers are expected to increasingly utilize electric arc furnaces (EAF), hydrogen-based direct reduced iron (DRI), and recycled scrap to reduce CO₂ emissions. Demand for “green steel tubing” from environmentally conscious industries—such as renewable energy and sustainable construction—is expected to rise, particularly in Europe and North America. -

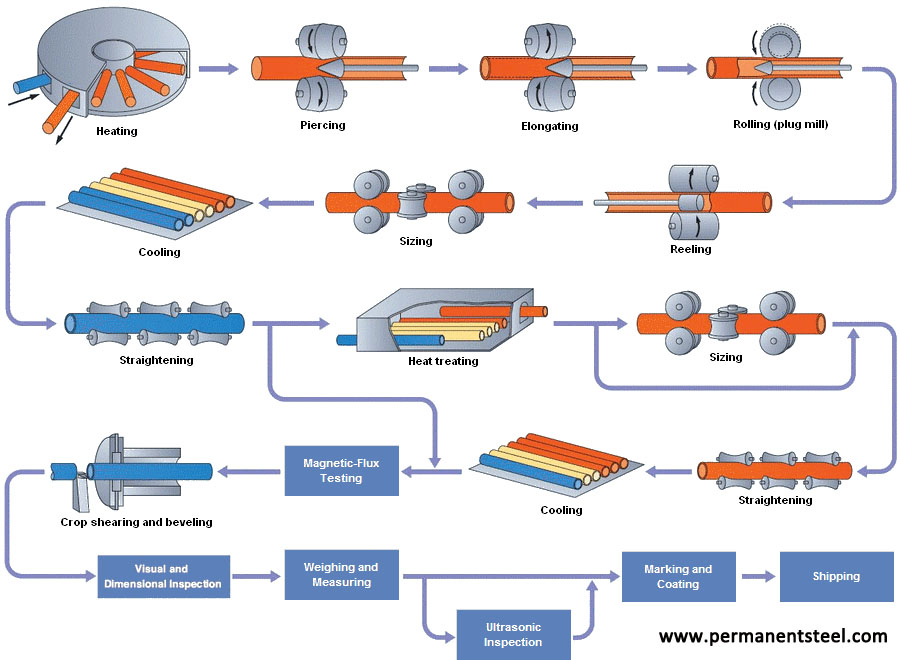

Technological Advancements in Production and Materials

Automation, digital twin technology, and AI-driven quality control systems are transforming steel tubing manufacturing. These innovations improve precision, reduce waste, and enhance supply chain resilience. Additionally, research into nanostructured and corrosion-resistant alloy tubing is expected to yield next-generation products with extended lifespans and performance in extreme environments. -

Geopolitical and Trade Dynamics

Trade policies, tariffs, and supply chain localization efforts will continue to influence the global steel tubing market. The U.S.-China trade tensions, coupled with regionalization trends, are pushing manufacturers to diversify sourcing and production. Nearshoring and friend-shoring strategies are expected to grow, benefiting domestic steel tubing industries in North America and Europe by 2026. -

Rising Competition from Alternative Materials

While steel tubing remains dominant in many applications, it faces increasing competition from composite materials, aluminum, and plastic piping—especially in sectors like automotive and water distribution. However, steel’s superior strength, recyclability, and cost-effectiveness in high-pressure and high-temperature environments will sustain its market share in critical industrial applications.

Conclusion:

By 2026, the steel tubing market will be shaped by a confluence of structural demand, sustainability imperatives, and technological innovation. Companies that invest in green production, product diversification, and digital transformation will be best positioned to capitalize on emerging opportunities. Despite challenges, the global steel tubing market is forecasted to grow steadily, underpinned by enduring demand across construction, energy, transportation, and industrial sectors.

Common Pitfalls When Sourcing Steel Tubing (Quality, IP)

Sourcing steel tubing involves navigating several critical challenges that can impact both product quality and intellectual property (IP) integrity. Overlooking these pitfalls can lead to supply chain disruptions, safety risks, legal disputes, and reputational damage. Below are key areas of concern:

Quality Inconsistencies

One of the most prevalent issues in sourcing steel tubing is inconsistent product quality. Suppliers, especially those in cost-driven markets, may cut corners by using substandard raw materials or outdated manufacturing processes. This can result in tubing with poor dimensional accuracy, inadequate mechanical properties (e.g., tensile strength, yield strength), or inconsistent wall thickness. Such inconsistencies compromise performance in critical applications like construction, automotive, or oil and gas systems. Buyers should insist on certified material test reports (MTRs), conduct third-party inspections, and perform batch testing to mitigate this risk.

Lack of Material Traceability

Traceability is essential for verifying the origin and composition of steel tubing. Without proper traceability—such as heat numbers or mill certifications—it becomes difficult to confirm compliance with required standards (e.g., ASTM, API, ISO). This lack of documentation increases the risk of receiving counterfeit or non-conforming materials. In regulated industries, this can lead to project delays or regulatory non-compliance. Ensure suppliers provide full documentation and maintain a transparent supply chain from raw material to finished product.

Non-Compliance with Industry Standards

Sourced steel tubing may appear to meet specifications but fail to adhere to relevant international or industry-specific standards. For example, tubing may be labeled as “API 5L” but lack proper certification or deviate from chemical composition requirements. Relying on visual inspection or supplier claims without independent verification exposes buyers to significant liability. Always require compliance documentation and consider pre-shipment inspections by accredited agencies.

Intellectual Property (IP) Infringement Risks

When sourcing proprietary or custom-designed steel tubing, there is a risk of IP theft or unauthorized replication. Some suppliers may reverse-engineer designs or share technical specifications with third parties, especially in regions with weak IP enforcement. This can lead to counterfeit products entering the market or loss of competitive advantage. To protect IP, use non-disclosure agreements (NDAs), limit the release of sensitive design data, and work with trusted partners in jurisdictions with strong IP protections.

Inadequate Supplier Vetting

Failing to properly vet suppliers can expose companies to both quality and IP risks. Red flags include lack of certifications (e.g., ISO 9001), limited production history, or refusal to allow facility audits. Engaging with unqualified suppliers may result in delivery delays, defective products, or legal complications. Conduct comprehensive due diligence, including on-site audits, reference checks, and review of past performance.

Supply Chain Transparency Gaps

Complex, multi-tiered supply chains can obscure the true origin of materials. Steel tubing may be sourced from unauthorized mills or involve subcontracting not disclosed to the buyer. This opacity increases exposure to sanctions, trade restrictions, or forced labor concerns. Demand full supply chain transparency and consider supplier mapping to identify and manage downstream risks.

Avoiding these pitfalls requires a proactive sourcing strategy that emphasizes due diligence, quality assurance, and IP protection throughout the procurement lifecycle.

Logistics & Compliance Guide for Steel Tubing

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, handling, storage, and regulatory adherence related to steel tubing products. Proper management ensures safety, regulatory compliance, and supply chain efficiency across domestic and international operations.

Product Classification & Specifications

Steel tubing is typically classified based on material type (carbon, stainless, alloy), dimensions (diameter, wall thickness, length), and manufacturing method (seamless, welded). Accurate product specifications must be documented and maintained for compliance with industry standards such as ASTM, API, and ISO.

Packaging & Handling Requirements

Steel tubing must be securely packaged to prevent damage during transit. Common methods include:

– Banded bundles on wooden skids

– Protective end caps to prevent thread or edge damage

– Waterproof wrapping for corrosion protection, especially for stainless or coated tubing

– Proper lifting using slings or forklifts to avoid deformation

Ensure handling equipment is rated for the weight and length of tubing loads.

Transportation & Shipping

Domestic Transport (e.g., North America, EU)

- Use flatbed trailers or enclosed trucks depending on tubing length and environmental exposure risks

- Secure loads with chains or straps meeting DOT or ADR regulations

- Comply with weight and dimension limits per road transport laws

- Maintain shipping documentation, including bill of lading and material test reports (MTRs)

International Shipping

- Prepare ISF (Importer Security Filing) for U.S.-bound shipments

- Use appropriate Incoterms (e.g., FOB, CIF) to define responsibility for freight and insurance

- Ensure compliance with customs regulations in destination countries

- Provide accurate HS codes (e.g., 7306.19, 7306.61 for specific steel tubes) for tariff classification

Storage & Inventory Management

- Store tubing in dry, well-ventilated areas to prevent rust and corrosion

- Elevate bundles off the ground using skids or racks

- Segregate by grade, size, and coating to avoid mix-ups

- Implement FIFO (First In, First Out) inventory practices

- Monitor storage conditions, especially in coastal or humid environments

Regulatory Compliance

Environmental & Safety Regulations

- Comply with OSHA (U.S.) or equivalent workplace safety standards for material handling

- Follow EPA or local environmental regulations for coating or galvanizing processes, if applicable

- Manage metal scrap and waste in accordance with environmental laws (e.g., RCRA in the U.S.)

Trade Compliance

- Adhere to anti-dumping and countervailing duties, particularly for steel imports from certain countries

- Monitor Section 232 tariffs (U.S.) or equivalent trade measures affecting steel products

- Maintain records for audit purposes (minimum 5 years recommended)

Product Standards & Certifications

- Ensure tubing meets required specifications (e.g., ASTM A53, A106, API 5L)

- Provide certified Material Test Reports (MTRs) with each shipment

- Obtain third-party inspections if required by customer or regulation

Documentation & Recordkeeping

Essential documents include:

– Purchase orders and sales contracts

– Packing lists and shipping manifests

– Certificates of Compliance and Conformance

– MTRs and quality inspection reports

– Customs documentation (commercial invoice, packing list, certificate of origin)

Maintain digital and physical records for traceability and audit readiness.

Risk Management

- Insure shipments against loss or damage

- Conduct supplier audits to ensure compliance and quality

- Develop contingency plans for supply chain disruptions (e.g., port delays, material shortages)

Conclusion

Effective logistics and compliance management for steel tubing reduces risk, ensures product integrity, and supports smooth operations across the supply chain. Regular training, process audits, and staying updated on regulatory changes are critical for ongoing compliance and operational excellence.

Conclusion for Sourcing Steel Tubing:

Sourcing steel tubing requires a careful evaluation of material specifications, supplier reliability, cost-efficiency, and logistical considerations. It is essential to partner with reputable suppliers who offer high-quality, certified steel tubing that meets industry standards such as ASTM, ASME, or ISO, depending on the application. Factors such as tubing dimensions, grade, finish, corrosion resistance, and mechanical properties must align with project requirements. Additionally, evaluating lead times, minimum order quantities, and geographic proximity of suppliers can significantly impact project timelines and overall costs. By conducting thorough market research, obtaining competitive quotations, and establishing long-term relationships with trusted vendors, organizations can ensure a consistent supply of reliable steel tubing, ultimately supporting operational efficiency, product integrity, and project success.