The global carpet and rug market continues to demonstrate steady expansion, driven by rising residential and commercial construction, growing demand for aesthetically pleasing interior finishes, and increasing consumer preference for premium flooring solutions. According to a 2023 report by Grand View Research, the global carpet and rug market size was valued at USD 49.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of 5.8% over the same forecast period, citing urbanization and the expansion of the hospitality and retail sectors as key growth drivers. Amid this upward trajectory, a select group of staple carpet manufacturers have emerged as market leaders, combining innovation, scalability, and sustainability to capture significant global share. These companies not only dominate in production volume but also set benchmarks in quality, design, and eco-friendly manufacturing practices—shaping the future of the industry in a competitive and evolving landscape.

Top 5 Staple Carpet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Low Pile Carpet

Domain Est. 1995

Website: staples.com

Key Highlights: Free delivery over $35Discover our stylish low pile carpets at Staples, perfect for any space. Enhance your home or office with durable, easy-to-clean options that combine ……

#2 20 Gauge 3/16 Inch Crown 9/16 Inch Length Chisel Point Carpet …

Domain Est. 1996

#3 9/16″ Staples for Carpet Stapler (FC535)

Domain Est. 1998

Website: krafttool.com

Key Highlights: Divergent points create a secure hold. 9/16″ long, 3/16″ wide staples. Use with Electric Carpet Stapler. 5000 per box….

#4 Removing An Old Carpet And Staples

Domain Est. 2009

Website: younghouselove.com

Key Highlights: Here were our weapons of choice, basically all serving the purpose of prying things up (carpet, tack strips, staples) at varying levels of detail and care….

#5 GalleherDuffy Company Flooring & Installation Supplies

Website: galleherduffy.com

Key Highlights: Flooring installation supplies for carpet, tile, hardwood, laminate, vinyl, rubber, concrete and more. From slab to surface, from start to finish, GalleherDuffy ……

Expert Sourcing Insights for Staple Carpet

H2: 2026 Market Trends for Staple Carpet

As the global flooring market evolves, staple carpet—a cost-effective and widely used textile flooring solution—faces shifting dynamics shaped by consumer preferences, sustainability demands, and technological innovation. By 2026, several key trends are expected to influence the staple carpet sector:

1. Rising Demand for Sustainable and Recyclable Materials

Environmental consciousness is driving demand for eco-friendly flooring. By 2026, staple carpet manufacturers are increasingly incorporating recycled fibers—particularly post-consumer PET (polyethylene terephthalate)—into their products. Regulatory pressures and green building certifications (e.g., LEED, BREEAM) are pushing brands to improve recyclability and reduce carbon footprints. Biobased polymers and closed-loop production systems are anticipated to gain traction.

2. Shift Toward Residential and DIY Markets

While commercial applications have historically driven staple carpet sales, the residential segment is expected to grow significantly by 2026. Homeowners are favoring soft, warm flooring for bedrooms and living areas, especially in colder climates. The rise of e-commerce and DIY installation options—including modular carpet tiles and peel-and-stick formats—is making staple carpet more accessible to end consumers.

3. Competition from Hard Surface Flooring

Staple carpet continues to face stiff competition from luxury vinyl tile (LVT), engineered wood, and laminate flooring, which are perceived as more durable and easier to clean. However, improvements in stain resistance (e.g., enhanced fiber treatments like SmartStrand and EcoWorx) are helping staple carpet retain relevance, particularly in households with children and pets.

4. Regional Market Diversification

In North America and Europe, staple carpet demand is stabilizing with modest growth, driven by renovations and sustainability initiatives. Meanwhile, emerging markets in Asia-Pacific and Latin America are showing increased adoption due to urbanization and rising disposable incomes. Localized production and affordable pricing will be crucial for market penetration in these regions.

5. Innovation in Fiber Technology and Design

By 2026, advancements in fiber extrusion and texturing are expected to enhance the durability, softness, and aesthetic versatility of staple carpet. Digital printing and pattern customization are allowing for greater design flexibility, enabling staple carpet to mimic the look of high-end textiles or natural materials at a fraction of the cost.

6. Supply Chain Resilience and Cost Management

Ongoing volatility in raw material prices—especially polypropylene and nylon—will prompt manufacturers to adopt more resilient supply chains. Regional sourcing, long-term supplier contracts, and vertical integration are likely strategies to maintain profitability amid economic uncertainty.

Conclusion

By 2026, the staple carpet market will be defined by adaptation. Success will depend on innovation in sustainable materials, responsiveness to consumer demands for convenience and eco-friendliness, and strategic positioning against competing flooring types. Companies that invest in green technologies, digital engagement, and diversified market outreach will be best positioned to thrive in the evolving landscape.

Common Pitfalls When Sourcing Staple Carpet (Quality and Intellectual Property)

Sourcing staple carpet—particularly for commercial or large-scale applications—requires careful attention to both material quality and intellectual property (IP) compliance. Overlooking these aspects can lead to performance failures, legal risks, and reputational damage. Below are key pitfalls to avoid:

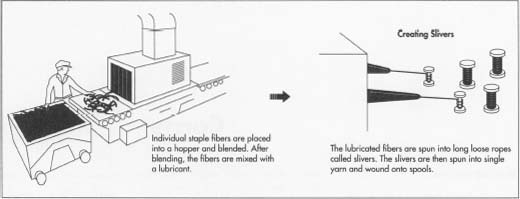

Overlooking Fiber Quality and Consistency

One of the most frequent issues in sourcing staple carpet is assuming all synthetic fibers are equal. Lower-cost suppliers may use recycled or substandard nylon or polyester that lacks the durability, colorfastness, or texture retention required for long-term use. Inconsistent fiber denier (thickness) or staple length leads to uneven pile, matting, and premature wear.

Ignoring Backing System Durability

The carpet backing is as critical as the face fiber. Poor-quality or incompatible backing systems—especially in modular tiles or broadloom—can result in delamination, curling, or dimensional instability. This is particularly problematic in high-traffic or moisture-prone environments, where subpar latex or polyurethane backings fail prematurely.

Failing to Verify Performance Testing

Many suppliers claim compliance with industry standards (e.g., CRI, ISO, ASTM), but not all provide verifiable test reports. Without third-party certification for abrasion resistance (e.g., ASTM D2493), static control, or stain resistance, buyers risk receiving products that underperform in real-world conditions.

Underestimating the Risk of IP Infringement

Staple carpet designs, textures, and manufacturing processes are often protected by patents, trademarks, or design rights. Sourcing from manufacturers who replicate proprietary patterns (e.g., branded textures like “Saxony” or “Frieze”) or patented technologies (e.g., specific fiber twisting methods) without licensing can expose the buyer to legal liability, shipment seizures, or forced product recalls.

Relying on Visual Samples Alone

Color and texture can vary significantly between sample swatches and bulk production, especially with staple dyed fibers. Without spectrophotometric color matching and pile height/density specifications, the final product may not meet aesthetic expectations or project requirements.

Selecting Suppliers Without IP Compliance Protocols

Some manufacturers—particularly in regions with weak IP enforcement—routinely produce “look-alike” products. Buyers must vet suppliers for documented IP clearance processes, request proof of design freedom-to-operate, and include IP indemnification clauses in contracts to mitigate legal exposure.

Neglecting Traceability and Chain of Custody

Without clear documentation of fiber origin, dye lots, and manufacturing batches, identifying the source of quality defects or IP issues becomes nearly impossible. Reliable suppliers should offer full traceability to ensure accountability and support compliance audits.

Avoiding these pitfalls requires due diligence: conducting factory audits, demanding test data, verifying IP rights, and building contracts with enforceable quality and legal safeguards. Proactive risk management ensures that staple carpet sourcing delivers both performance integrity and legal security.

Logistics & Compliance Guide for Staple Carpet

This guide outlines the essential logistics and compliance considerations for the manufacturing, transportation, storage, and sale of staple carpet products. Adhering to these standards ensures product quality, regulatory compliance, and customer satisfaction.

Product Specifications and Labeling Compliance

Staple carpet must meet regional and international labeling requirements. All products should include accurate fiber content (e.g., nylon, polypropylene, polyester), country of origin, flammability ratings (such as ASTM E648 or CAL 117), and any applicable care instructions. Labels must be durable and permanently affixed to meet FTC guidelines in the U.S. and equivalent regulations in the EU (REACH, CE marking) and other target markets.

Material Sourcing and Environmental Regulations

Ensure raw materials comply with environmental and safety standards. Fiber producers must provide documentation confirming adherence to REACH, RoHS, and Prop 65 (California) where applicable. Avoid restricted substances such as certain phthalates, heavy metals, and formaldehyde. Preference should be given to suppliers with ISO 14001 certification to promote sustainable sourcing practices.

Packaging and Palletization Standards

Use durable, moisture-resistant packaging to protect carpet rolls during transit. Rolls should be wrapped in polyethylene film and secured on sturdy cardboard cores. Pallets must be standardized (e.g., 48” x 40” in North America) and load-secure using stretch wrap or strapping. Clearly label each pallet with SKU, quantity, batch number, and handling instructions (e.g., “This Side Up,” “Protect from Moisture”).

Transportation and Freight Management

Coordinate with carriers experienced in handling bulky goods. Optimize load planning to maximize trailer or container space while preventing compression damage. For international shipments, ensure compliance with ISPM 15 for wooden pallets (heat-treated and stamped). Maintain proper documentation, including commercial invoices, packing lists, and bills of lading. Monitor transit times and conditions, especially for temperature-sensitive adhesives or backings.

Storage and Warehouse Handling

Store carpet rolls horizontally on racks to prevent deformation and edge damage. Maintain a clean, dry, and temperature-controlled warehouse (ideally 60–75°F and under 65% humidity) to avoid mold, mildew, or static buildup. Implement a first-in, first-out (FIFO) inventory system to minimize aging and ensure product freshness.

Safety and Flammability Compliance

All staple carpet products must pass mandatory fire safety tests. In the U.S., this includes compliance with the Federal Flammable Fabrics Act (FFA) and adherence to ASTM D2859 or NFPA 253. In commercial applications, carpets must meet Class I or Class II flooring criteria per ASTM E648 (Critical Radiance Index). Documentation of test reports should be maintained for audits and customer requests.

Import/Export Documentation and Duties

For cross-border shipments, ensure accurate HS codes (e.g., 5702.31 or 5702.42 for synthetic fiber carpets) are used to determine tariffs and assess duties. Prepare complete customs documentation, including certificates of origin, and confirm compliance with trade agreements (e.g., USMCA, CETA). Partner with licensed customs brokers to facilitate smooth clearance.

Sustainability and End-of-Life Compliance

Support environmental responsibility by offering recycling programs or take-back initiatives where feasible. Comply with extended producer responsibility (EPR) regulations in applicable regions, such as those in the EU under WEEE or national carpet stewardship schemes. Provide customers with disposal guidance and highlight eco-friendly attributes in marketing materials.

Quality Assurance and Audit Preparedness

Implement internal audits to verify compliance with all logistics and regulatory standards. Maintain traceability through batch tracking and retain records for a minimum of five years. Regularly review supplier certifications, test results, and shipping documentation to remain audit-ready for regulatory bodies or retail partners.

In conclusion, sourcing staple carpet requires a strategic approach that balances quality, cost, sustainability, and supplier reliability. By carefully evaluating material composition, manufacturing processes, and the reputation of suppliers, businesses can secure a durable and cost-effective flooring solution that meets both performance and aesthetic requirements. Additionally, considering factors such as environmental impact, certifications, and long-term maintenance can enhance the value and sustainability of the procurement decision. Establishing strong relationships with reputable suppliers and conducting ongoing assessments ensures a consistent supply of high-quality staple carpet, supporting project timelines and client satisfaction. Ultimately, effective sourcing contributes to greater efficiency, reduced lifecycle costs, and alignment with organizational and environmental goals.