The global gear manufacturing industry is experiencing robust growth, driven by increasing demand from automotive, industrial machinery, robotics, and renewable energy sectors. According to Grand View Research, the global gear market size was valued at USD 89.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Similarly, Mordor Intelligence forecasts steady growth, citing advancements in precision engineering and automation as key market accelerants. As industries prioritize efficiency, durability, and miniaturization, standard gear manufacturers are at the forefront of innovation and scalability. In this landscape, eight leading companies have distinguished themselves through technological excellence, global supply chain reach, and consistent quality—setting the benchmark for performance in an increasingly competitive market.

Top 8 Standard Gear Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OEM Gearboxes

Domain Est. 2001

Website: standardmachine.ca

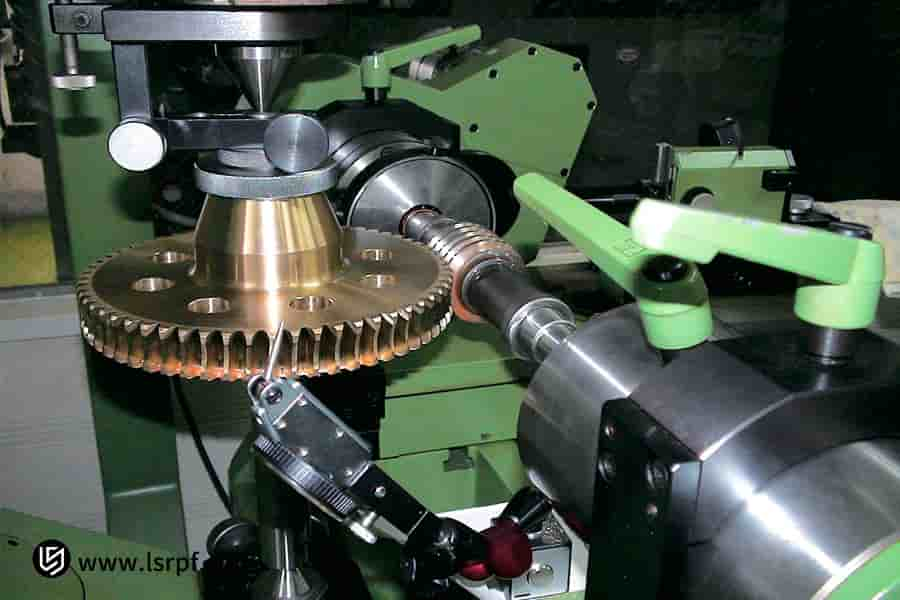

Key Highlights: As their official OEM gear manufacturer, Standard Machine’s state-of-the-art gear machine shop is the leader of industrial gear manufacturers in Canada for ……

#2 Standard Gear Manufacturing, Inc.

Domain Est. 1997

Website: sites.google.com

Key Highlights: We are a gear, spline and sprocket manufacturer. Quality gear manufacturing and dependable service; those are our priorities. Our reputation is built on fast ……

#3 Standard Gear Manufacturing, Inc.

Domain Est. 2002

Website: industrial-gears.com

Key Highlights: Standard Gear Manufacturing, Inc. is a leading provider of industrial gears, offering a wide range of products and services….

#4 General Motors

Domain Est. 1992

Website: gm.com

Key Highlights: General Motors (GM) is one of the world’s leading automotive manufacturers with iconic vehicle brands like Chevrolet, Buick, GMC, and Cadillac. We’ve been ……

#5 American Gear Manufacturers Association

Domain Est. 1997

Website: agma.org

Key Highlights: AGMA is the global network for technical standards, education, and business information for manufacturers, suppliers, and users of gears and mechanical power ……

#6 BJ-Gear A/S

Domain Est. 2005

Website: bj-gear.com

Key Highlights: Leading developer and manufacturer of standard & customized high-tech transmission solutions. Expertise in industry-specific transmission solutions….

#7 USA Standard Gear

Domain Est. 2008

Website: usastandardgear.com

Key Highlights: Shop USA Standard Gear for affordable, reliable, better-than-OEM drivetrain replacement parts. From differentials and axles to driveshafts and steering ……

#8 Rockland Standard Gear

Domain Est. 2003

Website: rsgear.com

Key Highlights: Rockland Standard Gear has a 30-year proven track record — building more than 100 manual transmissions, transfer cases and powertrain components each week ……

Expert Sourcing Insights for Standard Gear

H2: Market Trends Analysis for Standard Gear in 2026

As we look ahead to 2026, Standard Gear—assuming it is a manufacturer or supplier in the industrial components, automotive, or power transmission sector—is poised to navigate a dynamic and evolving market landscape shaped by technological innovation, sustainability demands, and shifting global supply chains. This H2 analysis outlines the key market trends expected to influence Standard Gear’s operations, competitiveness, and strategic positioning.

1. Accelerated Adoption of Electrification and E-Mobility

The automotive and industrial sectors are undergoing a structural shift toward electrification. By 2026, electric vehicle (EV) production is projected to account for over 30% of global vehicle sales. For Standard Gear, this trend implies reduced demand for traditional internal combustion engine (ICE) transmission systems. However, opportunities exist in developing specialized gearing solutions for EV drivetrains, including high-efficiency, low-noise gear systems for electric motors. Adapting product lines to support e-mobility applications will be critical for sustained market relevance.

2. Rise of Smart Manufacturing and Industry 4.0 Integration

The proliferation of smart factories and connected machinery is reshaping industrial gear demand. By 2026, predictive maintenance, real-time monitoring, and IoT-enabled gear systems will become standard in manufacturing. Standard Gear can capitalize on this by integrating sensors and digital twins into gear products, offering data-driven performance insights. Partnerships with automation and IIoT platforms will enhance product value and open new service-based revenue streams (e.g., predictive maintenance contracts).

3. Sustainability and Regulatory Pressure

Environmental regulations are tightening worldwide, with a focus on energy efficiency and carbon footprint reduction. The EU’s Green Deal, U.S. Inflation Reduction Act, and similar policies are driving demand for energy-efficient industrial components. Standard Gear must focus on lightweight materials, improved lubrication technologies, and recyclable designs to meet compliance standards and appeal to ESG-conscious clients. Certification to sustainability standards (e.g., ISO 14001) will increasingly influence procurement decisions.

4. Reshoring and Supply Chain Reconfiguration

Geopolitical tensions and pandemic-era disruptions have prompted companies to diversify and localize supply chains. In North America and Europe, reshoring initiatives are gaining momentum. Standard Gear can benefit by strengthening regional production capabilities, reducing reliance on offshore manufacturing, and offering shorter lead times. Localization will also support compliance with “Buy Local” policies in public infrastructure and defense sectors.

5. Growth in Renewable Energy Infrastructure

Wind and solar power installations are expanding rapidly, with wind turbines requiring robust and reliable gearboxes. The global wind energy market is expected to grow at a CAGR of 7–9% through 2026. Standard Gear can leverage its expertise in precision gearing to capture market share in wind turbine drivetrains, particularly in next-generation offshore wind projects that demand high durability and maintenance efficiency.

6. Consolidation and Competitive Pressures

The industrial components sector is experiencing consolidation, with larger players acquiring niche gear manufacturers to broaden portfolios. To remain competitive, Standard Gear may need to pursue strategic partnerships, invest in R&D, or explore niche markets (e.g., aerospace, robotics, or medical devices) where high-precision gearing is essential.

Conclusion

By H2 2026, Standard Gear must position itself as an agile, innovative, and sustainable solutions provider. Success will depend on embracing electrification, digital transformation, and green manufacturing while adapting to evolving global supply dynamics. Proactive investment in R&D, customer-centric product development, and strategic market diversification will be key to maintaining a strong competitive edge in the coming years.

Common Pitfalls Sourcing Standard Gear (Quality, IP)

Sourcing standard gears—such as spur, helical, bevel, or worm gears—may seem straightforward due to their off-the-shelf availability. However, overlooking critical quality and intellectual property (IP) aspects can lead to significant operational, legal, and financial risks. Below are key pitfalls to avoid:

Inadequate Quality Assurance and Material Specifications

Many suppliers offer “standard” gears, but material composition, heat treatment, surface finish, and dimensional tolerances can vary widely. Assuming all gears meeting basic dimensional standards are equivalent can result in premature wear, noise, or failure under load. Always verify certifications (e.g., ISO, AGMA), material test reports, and quality control processes. Lack of traceability or inconsistent batch quality can compromise system reliability.

Misunderstanding Application Requirements

Standard gears are designed for nominal operating conditions, but real-world applications often involve higher loads, speeds, or environmental challenges (e.g., temperature, contamination). Sourcing without validating the gear’s suitability for actual service conditions—such as torque, duty cycle, and alignment—can lead to performance issues. Always cross-reference catalog specs with application demands.

Overlooking Geometric and Manufacturing Tolerances

Even within standard gear designs, variations in tooth profile, lead accuracy, runout, and backlash can affect meshing efficiency and lifespan. Poorly controlled tolerances increase vibration, noise, and wear. Ensure supplier drawings or data sheets specify AGMA or DIN quality grades and confirm inspection reports are available.

Ignoring Intellectual Property and Counterfeit Risks

Some “standard” gears may be based on proprietary designs or patented geometries. Using such components without proper licensing—even if they appear generic—can expose buyers to IP infringement claims. Additionally, counterfeit or non-compliant gears from unverified suppliers may mimic reputable brands but fail to meet performance or safety standards, posing liability risks.

Supply Chain Transparency and Traceability Gaps

A lack of transparency in the supply chain can make it difficult to verify manufacturing origins, process controls, or material sources. This is especially critical in regulated industries (e.g., aerospace, medical). Always require traceable documentation and audit rights when sourcing critical components.

Failure to Secure Long-Term Availability

“Standard” does not guarantee long-term supply. Suppliers may discontinue lines or change manufacturers, leading to obsolescence or compatibility issues in future replacements. Confirm product lifecycle status and consider dual sourcing or stocking critical spares.

By proactively addressing these pitfalls—focusing on verified quality, precise specifications, and IP compliance—organizations can ensure reliable performance and mitigate risks when sourcing standard gears.

Logistics & Compliance Guide for Standard Gear

This guide outlines the essential logistics and compliance procedures for Standard Gear to ensure efficient operations, regulatory adherence, and customer satisfaction. All departments must follow these guidelines to maintain consistency, minimize risk, and uphold company standards.

Transportation & Shipping

All shipments must be scheduled and tracked using the company’s certified logistics management system. Standard Gear uses a mix of ground freight, air, and sea transportation depending on product type, destination, and urgency. Key requirements include:

- Carrier Selection: Use only pre-approved carriers that meet our safety, sustainability, and delivery performance criteria.

- Freight Classification: Accurately classify goods according to NMFC (National Motor Freight Classification) standards to avoid billing discrepancies.

- Documentation: Ensure all bills of lading, packing slips, and shipping labels are complete, accurate, and attached to each shipment.

- Delivery Windows: Coordinate with customers to confirm delivery appointments and access requirements, especially for large or time-sensitive orders.

Inventory Management

Maintain real-time inventory accuracy across all distribution centers using barcode scanning and warehouse management systems (WMS). Responsibilities include:

- Cycle Counts: Conduct weekly cycle counts per zone to verify inventory levels and promptly resolve discrepancies.

- Storage Standards: Store products according to weight, size, and environmental requirements (e.g., temperature-sensitive items).

- FIFO Protocol: Apply First-In, First-Out principles to manage stock rotation and reduce obsolescence.

- Safety Stock Levels: Monitor and adjust safety stock based on demand forecasting and lead times.

Regulatory Compliance

Standard Gear must comply with all local, national, and international regulations related to product safety, labeling, and trade. Key areas include:

- Product Labeling: Ensure all products meet FTC, OSHA, and relevant industry-specific labeling requirements (e.g., ANSI for safety gear).

- Import/Export Controls: Adhere to customs regulations, including proper use of HS codes, commercial invoices, and export declarations. Obtain necessary licenses for restricted items.

- REACH & RoHS Compliance: Confirm that all materials used in gear manufacturing meet EU chemical safety standards.

- Record Retention: Maintain all compliance documentation for a minimum of seven years in accordance with federal and industry standards.

Safety & Environmental Standards

Prioritize workplace safety and environmental responsibility in all logistics operations:

- OSHA Compliance: Follow OSHA guidelines for material handling, forklift operation, and warehouse safety signage.

- Hazardous Materials: Properly store, label, and transport any hazardous components in accordance with DOT and EPA regulations.

- Sustainability Initiatives: Optimize packaging to reduce waste, use recyclable materials, and participate in vendor take-back programs where applicable.

Audits & Continuous Improvement

Conduct quarterly internal audits of logistics and compliance processes. Audit findings must be documented and corrective actions implemented within 30 days. Encourage staff to submit process improvement suggestions through the company’s continuous improvement portal.

All employees are responsible for understanding and adhering to this guide. Updates will be communicated through official company channels and training sessions.

Conclusion for Sourcing Standard Gears:

Sourcing standard gears is a critical step in ensuring the efficiency, reliability, and cost-effectiveness of mechanical systems. By selecting gears that conform to established industry standards (such as AGMA, ISO, or DIN), manufacturers can benefit from proven performance, interchangeability, and reduced lead times. Careful evaluation of key parameters—including module or diametral pitch, pressure angle, material, tolerance class, and quality grade—enables optimal match between gear performance and application requirements. Additionally, partnering with reputable suppliers ensures consistent quality, technical support, and traceability. Ultimately, a strategic approach to sourcing standard gears supports streamlined design, simplified maintenance, and long-term operational success across diverse industrial applications.