The global stainless steel drinkware market is experiencing robust growth, driven by rising consumer demand for sustainable, durable, and eco-friendly alternatives to single-use plastics. According to Grand View Research, the global reusable water bottle market was valued at USD 11.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. A key driver behind this expansion is the increasing adoption of stainless steel tumblers, particularly in the foodservice, corporate gifting, and retail sectors. This surge in demand has fueled the growth of bulk manufacturers capable of delivering high-quality, customizable, and cost-efficient stainless steel tumblers at scale. As businesses and organizations seek reliable supply chains, identifying top-tier bulk manufacturers has become critical. Based on production capacity, export volume, customer reviews, and compliance with international quality standards, the following list highlights the top 10 stainless steel tumbler bulk manufacturers shaping the industry.

Top 10 Stainless Steel Tumbler Bulk Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

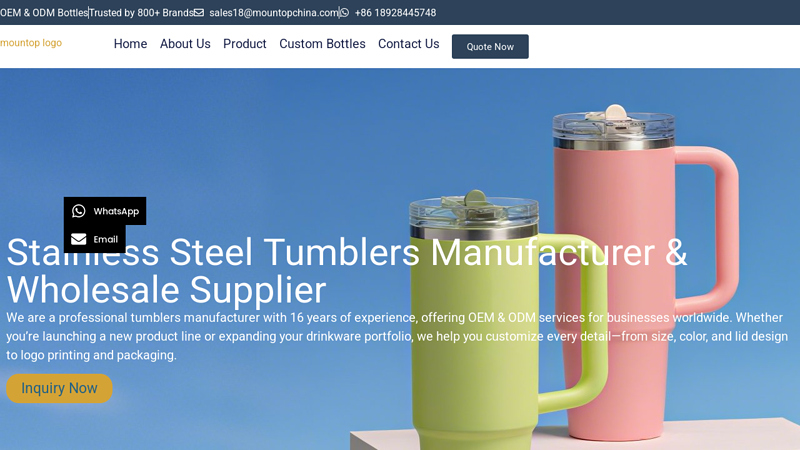

#1 Stainless Steel Tumblers Manufacturer & Wholesale Supplier

Domain Est. 2024

Website: mountopbottle.com

Key Highlights: Discover high-quality custom tumblers solutions for your brand. OEM/ODM factory with 16+ years of experience and fast global delivery….

#2 Stainless Steel Tumblers

Domain Est. 2024

Website: easteggbottle.com

Key Highlights: Browse our range of premium stainless steel tumblers, produced in our state-of-the-art factory. Perfect for custom orders and competitive wholesale pricing….

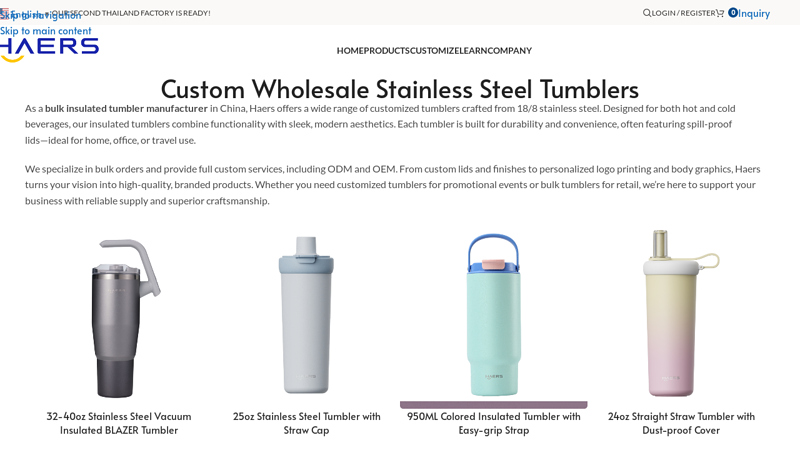

#3 Custom Stainless Steel Tumblers in Bulk

Domain Est. 2002

Website: haers.com

Key Highlights: As a bulk insulated tumbler manufacturer in China, Haers offers a wide range of customized tumblers crafted from 18/8 stainless steel….

#4 Wholesale Stainless Steel Tumblers & Mugs — OEM …

Domain Est. 2021

Website: novfeel.com

Key Highlights: Novfeel manufactures insulated stainless steel tumblers and mugs for wholesale, private label, and promotional markets. Our tumblers are available with ……

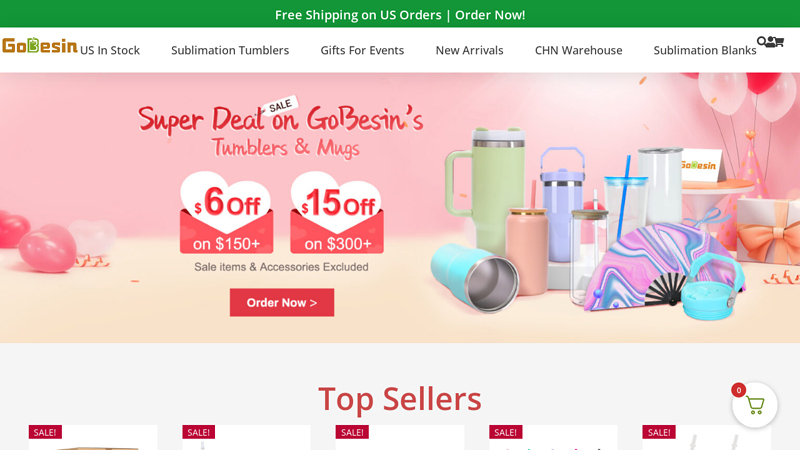

#5 GoBesin

Domain Est. 2022

Website: gobesin.com

Key Highlights: Free delivery30oz Skinny Straight Sublimation Tumbler Blank Bulk Stainless Steel Tumbler. $129.00 Original price was: $129.00. $115.00 Current price is: $115.00. Sale ……

#6 Tervis

Domain Est. 1996 | Founded: 1946

Website: b2b.tervis.com

Key Highlights: The official B2B site for Tervis, the original double-insulated drinkware that has been American owned since 1946….

#7 Buy Wholesale Custom Stainless Steel Tumblers in Bulk

Domain Est. 2009

Website: customearthpromos.com

Key Highlights: Customize our insulated wholesale stainless steel tumblers to reach your eco-friendly market! These tumblers are perfect for your hot and cold drinks!…

#8 Stainless Steel Insulated Tumbler Bottles & Cups

Domain Est. 2010

#9 Stainless Steel 40 oz Wholesale Tumblers

Domain Est. 2010

#10 Tumblerbulk.com Stainless Steel Tumbler Wholesale 20oz Tumbler …

Domain Est. 2019

Website: tumblerbulk.com

Key Highlights: Buwaters Stainless Steel Tumbler Wholesale ,12 oz,15 oz,20 oz,30 oz etc.,sublimation tumblers,sublimation blank,20oz skinny straight tumbler cups….

Expert Sourcing Insights for Stainless Steel Tumbler Bulk

H2: Projected Market Trends for Stainless Steel Tumbler Bulk in 2026

The global market for bulk stainless steel tumblers is poised for significant transformation by 2026, driven by evolving consumer behavior, sustainability mandates, and supply chain innovations. As businesses and consumers increasingly prioritize eco-conscious products, stainless steel tumblers have emerged as a preferred alternative to single-use plastics. This analysis outlines key trends expected to shape the bulk stainless steel tumbler market in 2026.

1. Surge in Corporate and Promotional Demand

By 2026, corporate gifting and promotional campaigns are expected to be a major growth driver for bulk tumbler purchases. Companies are adopting branded stainless steel tumblers as part of their sustainability initiatives and employee wellness programs. The emphasis on ESG (Environmental, Social, and Governance) goals will push enterprises to invest in reusable merchandise, boosting bulk orders from promotional product suppliers and B2B distributors.

2. Expansion of E-Commerce and Direct-to-Business Platforms

Online marketplaces and B2B e-commerce platforms will play a pivotal role in facilitating bulk purchases. By 2026, streamlined digital procurement processes, customizable ordering portals, and AI-driven inventory forecasting will enable businesses to source tumblers more efficiently. Platforms offering design personalization, volume discounts, and fast logistics will gain a competitive edge.

3. Emphasis on Sustainability and Circular Design

Sustainability will remain a core market differentiator. Buyers will increasingly favor suppliers using recycled stainless steel, low-impact manufacturing processes, and recyclable packaging. The rise of circular economy principles may lead to take-back programs and refurbishment services for bulk purchasers, especially in the corporate and retail sectors.

4. Innovation in Product Features and Customization

To meet diverse consumer preferences, manufacturers will offer enhanced functionalities such as double-wall vacuum insulation, smart temperature indicators, and modular lids. Custom branding options—ranging from laser engraving to full-color wraps—will be in high demand, particularly for event planners, educational institutions, and fitness brands sourcing in bulk.

5. Regional Market Diversification

While North America and Europe will continue to dominate demand, emerging markets in Southeast Asia, Latin America, and the Middle East are expected to see accelerated growth. Urbanization, rising disposable incomes, and government bans on single-use plastics will fuel regional adoption of reusable drinkware, creating new export opportunities for bulk suppliers.

6. Supply Chain Resilience and Localization

Post-pandemic supply chain lessons will lead to greater regionalization of production. By 2026, manufacturers may shift toward localized or nearshored facilities to reduce lead times, mitigate trade risks, and meet regional compliance standards. This trend will support faster turnaround for bulk orders and reduce carbon footprints.

7. Price Volatility and Material Optimization

Fluctuations in stainless steel prices and raw material availability will pressure suppliers to optimize material usage and explore alternative alloys. Advances in manufacturing efficiency, such as automated stamping and seamless welding, will help maintain margins while fulfilling large-volume contracts.

Conclusion

The 2026 market for bulk stainless steel tumblers will be defined by sustainability, digital integration, and customization. Businesses that invest in eco-friendly production, scalable e-commerce solutions, and responsive supply chains will be well-positioned to capture growing demand across corporate, retail, and institutional sectors.

Common Pitfalls When Sourcing Stainless Steel Tumblers in Bulk: Quality and Intellectual Property (IP) Concerns

Sourcing stainless steel tumblers in bulk can be a cost-effective way to meet market demand, but it comes with several risks—particularly related to product quality and intellectual property (IP) protection. Being aware of these pitfalls helps buyers make informed decisions and avoid costly mistakes.

Quality-Related Pitfalls

1. Substandard Material Composition

One of the most common issues is receiving tumblers made from inferior-grade stainless steel (e.g., non-food-grade 201 or poorly processed 304). Buyers may expect 18/8 (304) food-grade steel but receive 201 or even recycled blends that are more prone to rust, leaching, or metallic taste. Always request material certifications (e.g., Mill Test Certificate) and conduct third-party lab testing.

2. Inconsistent Insulation Performance

Double-wall vacuum insulation is a key selling point. However, inconsistent welding or poor vacuum sealing during manufacturing can lead to reduced thermal retention. Without proper quality control, bulk orders may include units that fail to keep beverages hot or cold for the advertised duration.

3. Poor Workmanship and Finishing

Bulk manufacturing often leads to variations in surface finish, lid fit, and seam alignment. Look out for rough edges, misaligned welding, peeling powder coating, or ill-fitting lids. These flaws not only affect user experience but also raise safety concerns.

4. Lack of Compliance with Safety Standards

Tumblers must comply with food safety regulations (e.g., FDA in the U.S., LFGB in Germany, or GB4806 in China). Suppliers may neglect testing for heavy metals (lead, cadmium) or fail to meet migration limits. Always verify compliance documentation before shipment.

5. Inadequate Packaging and Shipping Damage

Fragile finishes and lids can be damaged during transit if packaging is insufficient. Avoid suppliers who use minimal or non-protective packaging. Specify requirements for individual polybags, foam inserts, or master cartons with shock absorption.

Intellectual Property (IP) Risks

1. Inadvertent Design Infringement

Many popular tumbler designs are trademarked or patented (e.g., shape, lid mechanism, branding placement). Sourcing a look-alike product—even unintentionally—can lead to cease-and-desist letters, customs seizures, or legal action. Always conduct an IP clearance search before mass production.

2. Supplier Uses or Copies Your Custom Design

When providing custom designs or molds, there’s a risk that the manufacturer replicates and sells them to competitors. Without a strong legal agreement, especially in jurisdictions with weak IP enforcement, your unique product can quickly be duplicated.

3. Lack of IP Assignment or Protection in Contracts

Many sourcing agreements fail to clearly assign IP ownership of custom molds, logos, or designs to the buyer. Ensure contracts include clauses that transfer full IP rights and prohibit the supplier from using your designs for others.

4. Counterfeit or Branded Imitations

Some suppliers offer “branded-style” tumblers (e.g., “similar to Yeti” or “compatible with Stanley”). These may infringe on trademarks and cannot be legally sold in many markets. Avoid vendors promoting knock-offs, even if they claim they are “not branded.”

5. No Traceability or Brand Control

When IP isn’t protected, your supplier might sell identical products under different brand names, diluting your market position. Implement strict confidentiality agreements (NDAs), register designs where possible, and use unique identifiers (e.g., QR codes) to monitor distribution.

Conclusion

To mitigate these risks, conduct thorough due diligence on suppliers, request samples and certifications, use legal contracts with clear IP terms, and consider third-party inspections. Proactive management of quality and IP issues ensures a reliable, legally sound supply chain for stainless steel tumblers in bulk.

Logistics & Compliance Guide for Stainless Steel Tumbler Bulk Shipments

Product Overview and Specifications

Stainless steel tumblers are insulated drinkware items typically made from food-grade 18/8 (304) or 18/10 stainless steel. When shipped in bulk, they are often packaged in standardized cartons or pallets. Key specifications include capacity (e.g., 12 oz, 20 oz), insulation type (double-wall vacuum), lid material (plastic, silicone), and compliance with food contact safety standards.

Packaging and Unit Load Design

Bulk stainless steel tumblers should be packaged to prevent damage during transit. Standard practices include:

– Inner packaging: Each tumbler wrapped in protective film or placed in a molded tray.

– Master cartons: Corrugated boxes with dividers, typically holding 12–48 units depending on size.

– Palletization: Cartons stacked on standard 48″x40″ pallets, secured with stretch wrap and corner boards.

– Weight limits: Pallet loads should not exceed 1,500 lbs (680 kg) to ensure safe handling.

Domestic and International Shipping Requirements

For domestic U.S. shipments:

– Use common carriers (e.g., FedEx Freight, UPS Freight, LTL carriers).

– Provide accurate freight class (typically NMFC 85 or 92.5 based on density and packaging).

– Ensure proper labeling: shipper/consignee details, PO numbers, and handling instructions.

For international shipments:

– Utilize ocean freight (FCL or LCL) or air freight depending on volume and urgency.

– Prepare commercial invoice, packing list, and bill of lading/air waybill.

– Confirm Incoterms (e.g., FOB, CIF, DDP) with the buyer.

– Account for longer lead times and potential port delays.

Import/Export Compliance

Ensure compliance with customs regulations in both origin and destination countries:

– HS Code: Use 7323.93.00 (stainless steel tableware) for U.S. imports; verify local HTS codes for other countries.

– Country of Origin Labeling: Clearly mark “Made in [Country]” on packaging.

– FDA Compliance (U.S.): Confirm tumblers meet FDA 21 CFR §175.300 for food-contact materials (especially lids and interior coatings).

– Proposition 65 (California): If applicable, provide warnings if products contain listed chemicals (e.g., lead in decorative elements).

Safety and Quality Standards

Bulk stainless steel tumblers must meet relevant safety and quality standards:

– Food Safety: Use only lead-free, BPA-free materials for lids and seals. Verify supplier certifications (e.g., SGS, Intertek).

– CPSIA (U.S.): While primarily for children’s products, ensure compliance if tumblers are marketed for kids (lead content < 90 ppm, phthalates < 0.1%).

– REACH & RoHS (EU): Comply with restrictions on hazardous substances in the European market.

– LFGB (Germany): Required for food contact products sold in Germany; includes migration testing.

Documentation and Recordkeeping

Maintain accurate records for traceability and compliance:

– Product specifications and material safety data sheets (MSDS).

– Third-party test reports (e.g., for food safety, coating integrity).

– Certificates of Compliance (CoC) from manufacturers.

– Shipping documents (commercial invoice, packing list, bill of lading).

– Retain records for a minimum of 5 years, as required by many regulatory bodies.

Environmental and Sustainability Considerations

- Use recyclable packaging materials (corrugated cardboard, biodegradable void fill).

- Minimize over-packaging to reduce waste and shipping costs.

- Encourage suppliers to follow ISO 14001 environmental management practices.

- Consider carbon offset programs for large international shipments.

Risk Management and Insurance

- Obtain cargo insurance covering loss, damage, and delay during transit.

- Verify carrier liability limits and supplement if necessary.

- Include quality inspection clauses in supplier contracts.

- Conduct pre-shipment inspections (PSI) for large orders to verify quantity, packaging, and compliance.

Final Inspection and Quality Control

Before shipment:

– Perform a visual inspection for dents, scratches, or defective lids.

– Randomly test vacuum insulation performance (e.g., hot/cold retention).

– Verify correct labeling, barcodes, and safety markings.

– Confirm carton and pallet counts match purchase orders.

Adhering to this logistics and compliance guide ensures efficient, safe, and legally compliant bulk shipping of stainless steel tumblers across domestic and international markets.

In conclusion, sourcing stainless steel tumblers in bulk offers a cost-effective, sustainable, and high-quality solution for businesses looking to meet consumer demand for eco-friendly and durable drinkware. By carefully selecting reliable suppliers, evaluating material quality (preferably 18/8 or 18/10 food-grade stainless steel), ensuring compliance with safety and environmental standards, and considering customization options, companies can build a competitive edge in the market. Additionally, leveraging bulk purchasing enables better pricing, consistent branding opportunities, and reduced environmental impact by minimizing single-use plastic consumption. With growing consumer preference for reusable products, investing in bulk stainless steel tumblers is not only a smart business decision but also a step toward promoting sustainability and long-term brand loyalty.