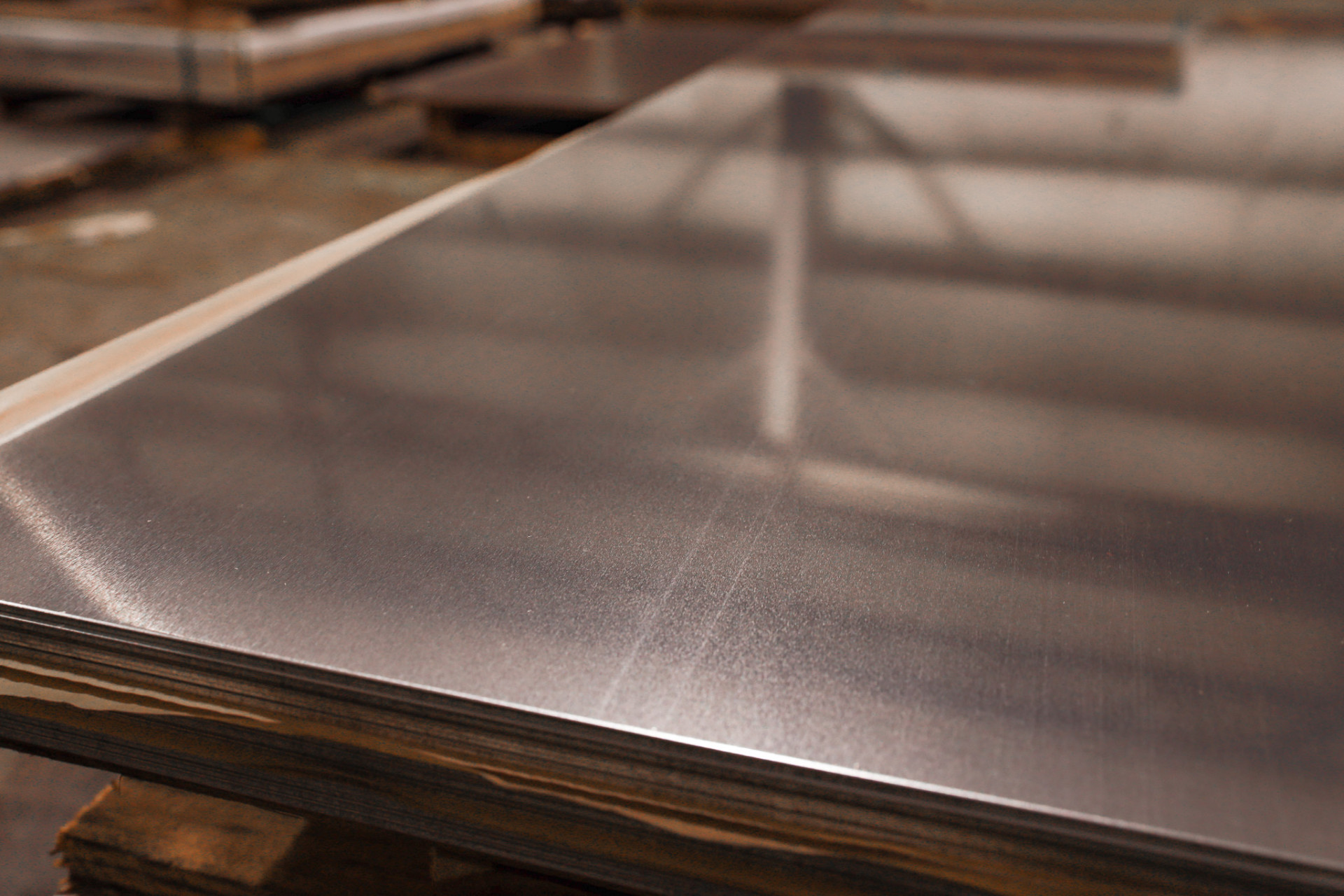

The global stainless steel sheet market is experiencing robust growth, driven by rising demand across construction, automotive, and consumer goods industries. According to a 2023 report by Mordor Intelligence, the market was valued at USD 85.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2028. This expansion is fueled by increasing infrastructure development, particularly in emerging economies, as well as the material’s corrosion resistance, durability, and aesthetic appeal. Stainless steel sheets are also gaining traction in renewable energy and industrial manufacturing applications, further accelerating demand. As competition intensifies, key players are investing in production capacity, advanced processing technologies, and sustainable practices to maintain market share. In this evolving landscape, a select group of manufacturers have emerged as leaders—combining scale, innovation, and global reach to lead the industry. Based on market presence, production volume, and technological capabilities, the following are the top 10 stainless steel sheet manufacturers shaping the future of the sector.

Top 10 Stainless Steel Sheet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SSAB high

Domain Est. 1996

Website: ssab.com

Key Highlights: SSAB is a specialized steel manufacturer. We only make steel grades with qualities that are fine-tuned to make applications stronger, lighter, safer, easier to ……

#2 North American Stainless

Domain Est. 1999 | Founded: 1990

Website: northamericanstainless.com

Key Highlights: Founded in 1990, North American Stainless (NAS) has undertaken several phases of expansion to become the largest, fully integrated stainless steel producer in ……

#3 304 Stainless Steel Sheet & Plate

Domain Est. 1999

#4 Outokumpu

Domain Est. 1996

Website: outokumpu.com

Key Highlights: Outokumpu is a global leader in sustainable stainless steel manufacturing. We manufacture a variety of stainless steel products. Discover our offering….

#5 Stainless Steel Plate and Sheet Supplier

Domain Est. 1996

Website: onealsteel.com

Key Highlights: We stock stainless sheet products in 304/304L and 316/316L. Some of the more popular gauges we carry are 14 GA, 16 GA, 18 GA, and 20 GA….

#6 Sandmeyer Steel Company

Domain Est. 1996

Website: sandmeyersteel.com

Key Highlights: Sandmeyer Steel stocks the largest and most extensive single-site stainless plate, nickel alloy, and titanium inventory in North America….

#7 Atlas Steel

Domain Est. 1997

Website: atlassteel.com

Key Highlights: Atlas provides stainless steel sheets and coil products that are available in a variety of finishes, cut-to-length and blanks, as well as tub products. Learn ……

#8 Stainless Steel Plate – SS Sheet Supplier

Domain Est. 1997

Website: twmetals.com

Key Highlights: TW Metals supplies stainless steel plates & sheets in 304/304L, 304 straight grade, 316/316L and 321 are available at TW Metals. Contact us today!…

#9 Stainless Steel Plate and Sheet

Domain Est. 1999

Website: stainlessandalloy.com

Key Highlights: We provide high-quality stainless steel plate & stainless steel sheet for many applications including custom fabrication and construction projects….

#10 Stainless International

Domain Est. 2007

Website: stainlessinternational.com

Key Highlights: Welcome to Stainless International, a leading independent Stainless Steel Supplier and Processor. Specialists in Stainless Steel Coil, Sheet, Tubular & Long ……

Expert Sourcing Insights for Stainless Steel Sheet

H2: 2026 Market Trends for Stainless Steel Sheet: Growth Drivers, Challenges, and Regional Dynamics

The global stainless steel sheet market is poised for steady growth in 2026, driven by resilient demand across key industries, technological advancements, and shifting economic and environmental priorities. However, this growth trajectory faces significant headwinds from raw material volatility, geopolitical tensions, and rising sustainability pressures. Here’s a breakdown of the key trends shaping the market:

1. Sustained Demand from Core End-Use Industries:

* Construction & Infrastructure (Resilient Growth): Demand remains strong, particularly in emerging economies (Asia-Pacific, Middle East) for architectural applications (cladding, roofing, facades), kitchen fixtures, and infrastructure projects prioritizing durability and low maintenance. Green building certifications (LEED, BREEAM) continue to favor stainless steel’s longevity and recyclability. However, high-grade (e.g., 316) demand may be more sensitive to project delays.

* Automotive & Transportation (EV-Driven Shift): While overall stainless steel usage per traditional ICE vehicle is modest, demand is growing in specific areas:

* Exhaust Systems: Still a major application, though evolving with stricter emissions standards.

* Electric Vehicles (EVs): Increasing use in battery trays, enclosures (requiring corrosion resistance and strength), and high-pressure hydrogen storage tanks for FCEVs (Fuel Cell EVs), particularly driving demand for specific grades.

* Rail & Shipbuilding: Steady demand for structural components, interiors, and piping.

* Industrial Equipment & Machinery (Rebound Expected): Post-pandemic and supply chain normalization should support increased investment in manufacturing, chemical processing, food & beverage plants, and energy infrastructure (especially renewables), boosting demand for process equipment, tanks, and ductwork.

* Consumer Goods & Appliances (Stable Demand): Consistent demand for kitchen appliances (sinks, refrigerators, cooktops), cookware, and furniture. Premiumization trends favor higher-quality finishes and grades.

2. Supply Chain & Raw Material Volatility:

* Nickel & Chromium Price Fluctuations: Nickel prices (the primary cost driver) remain highly sensitive to Indonesian export policies, global supply/demand imbalances, and speculative trading. Chromium supply chain stability is crucial. Producers will continue hedging strategies, but cost pass-through to consumers will remain a challenge, potentially dampening price-sensitive demand.

* Energy Costs: High and volatile energy prices (especially natural gas and electricity in Europe) significantly impact melting and processing costs. Regions with access to cheaper/renewable energy (e.g., parts of Asia, North America with specific incentives) may gain a competitive edge.

* Geopolitical Risks: Tensions (e.g., Ukraine conflict, US-China relations, Middle East instability) disrupt trade flows, impact raw material supply (e.g., Russian nickel/chromium), and influence trade policies (tariffs, sanctions, quotas like CBAM).

3. Technological Advancements & Product Innovation:

* New Grades & Properties: Development of leaner, higher-strength, and more corrosion-resistant grades (e.g., duplex, super-duplex, advanced austenitics) to meet specific application needs (lightweighting in transport, extreme environments in energy).

* Improved Surface Finishes: Growing demand for specialized finishes (e.g., ultra-smooth for hygiene, textured for aesthetics, colored PVD coatings) driven by architectural and consumer goods sectors.

* Digitalization & Process Optimization: Increased adoption of Industry 4.0 technologies (IoT, AI, data analytics) in production for enhanced quality control, yield improvement, predictive maintenance, and energy efficiency, helping to manage costs.

4. Sustainability & Environmental Pressures (Accelerating):

* Circular Economy & Recycling: Stainless steel’s high recyclability (>90% recovery rate) is a major selling point. Expect increased focus on using recycled content (scrap) to reduce embodied carbon and meet ESG goals. Producers investing in efficient scrap collection and processing will have an advantage.

* Carbon Footprint Reduction: The “Carbon Border Adjustment Mechanism” (CBAM) in the EU and similar initiatives globally are forcing producers to measure and report carbon intensity. Investment in low-carbon production methods (e.g., increased scrap use, hydrogen-based DRI, electrification of EAFs, carbon capture) will be critical, especially for exporters to Europe. “Green Stainless Steel” premiums may emerge.

* Regulatory Compliance: Stricter environmental regulations on emissions (SOx, NOx, particulates) and wastewater discharge will increase operational costs and necessitate investments in pollution control technologies.

5. Regional Market Dynamics:

* Asia-Pacific (Dominant Producer & Consumer): China remains the largest producer and consumer, but growth may moderate as its economy shifts. India, Southeast Asia (Vietnam, Indonesia), and Japan/South Korea will be key growth engines. Focus on infrastructure and manufacturing expansion.

* Europe (Mature Market, Sustainability Leader): Growth will be modest, driven by replacement, renewables, and EVs. Sustainability (CBAM, ESG) is the paramount concern, reshaping supply chains and production methods. High energy costs remain a challenge.

* North America (Stable Growth, Nearshoring): Steady demand supported by infrastructure spending (US IIJA, IRA) and industrial/manufacturing activity. Nearshoring and supply chain resilience trends may benefit regional producers. IRA incentives support clean energy manufacturing, boosting relevant stainless applications.

* Rest of World (Emerging Potential): Middle East (infrastructure, petrochemicals) and Africa (urbanization, infrastructure development) offer long-term growth potential but face economic and political challenges.

Conclusion for 2026:

The stainless steel sheet market in 2026 will be characterized by moderate but resilient growth, underpinned by fundamental demand drivers but heavily influenced by cost management and sustainability imperatives. Success will depend on:

- Navigating raw material and energy cost volatility.

- Investing in low-carbon production and circular economy practices to meet regulatory demands and customer ESG expectations.

- Developing innovative products for high-growth sectors like EVs and renewable energy.

- Adapting to regional shifts in trade, geopolitics, and economic development.

- Leveraging digitalization for operational efficiency and cost control.

Producers focusing on sustainability, technological innovation, and operational resilience are best positioned to capture growth opportunities in the 2026 landscape, while those unable to manage costs or adapt to environmental regulations may face significant challenges.

Common Pitfalls When Sourcing Stainless Steel Sheet (Quality & Origin Point)

Sourcing stainless steel sheet involves navigating complex quality standards and supply chain variables. Overlooking key factors can lead to performance failures, cost overruns, and project delays. Below are critical pitfalls to avoid:

1. Assuming All “Stainless Steel” Meets Required Specifications

A common mistake is treating stainless steel as a generic material. Different grades (e.g., 304 vs. 316) offer varying corrosion resistance, strength, and temperature tolerance. Sourcing without confirming the exact ASTM, AISI, or EN grade can result in premature failure in corrosive environments.

2. Inadequate Verification of Mill Test Certificates (MTCs)

Accepting material without valid, traceable Mill Test Certificates (e.g., EN 10204 3.1 or 3.2) is risky. Some suppliers provide falsified or generic certs. Always verify MTC authenticity and ensure chemical composition and mechanical properties match project requirements.

3. Ignoring Surface Finish Specifications

Stainless steel sheet surface finish (e.g., 2B, BA, No. 4) affects both aesthetics and functionality. Sourcing without specifying finish requirements can lead to unsatisfactory appearance or issues in fabrication, such as poor weldability or coating adhesion.

4. Overlooking Origin Point (IP) and Supply Chain Transparency

The origin of the material impacts quality consistency. Sourcing from regions with weak quality controls or unclear traceability increases the risk of substandard or misrepresented products. Always confirm the actual mill of origin, not just the exporting country.

5. Prioritizing Low Cost Over Proven Supplier Reliability

Choosing suppliers solely on price often leads to compromised quality. Unreliable mills may use inferior raw materials or inconsistent processing, leading to variability in gauge, flatness, or corrosion resistance. Invest in vetted suppliers with a track record of quality.

6. Failing to Inspect Material Upon Delivery

Even with proper documentation, physical inspection is crucial. Check for surface defects (scratches, pitting, roll marks), dimensional accuracy, and consistency in thickness. Hidden damage or deviations can disrupt fabrication timelines.

7. Not Confirming Heat Treatment and Passivation Processes

Improper heat treatment can reduce corrosion resistance and mechanical properties. Ensure the material has been properly annealed and passivated, especially for critical applications in food, pharmaceutical, or marine environments.

8. Underestimating Lead Times and Minimum Order Quantities (MOQs)

Some high-quality mills or specialized grades have long lead times or high MOQs. Failing to plan for this can delay projects. Clarify availability and delivery schedules early in the sourcing process.

Avoiding these pitfalls requires due diligence, clear specifications, and partnerships with trustworthy suppliers. Always prioritize quality assurance and traceability over short-term cost savings.

Logistics & Compliance Guide for Stainless Steel Sheet

Overview of Stainless Steel Sheet Transportation and Regulatory Requirements

Stainless steel sheets are widely used in construction, manufacturing, automotive, and food processing industries due to their durability, corrosion resistance, and aesthetic appeal. Proper logistics and compliance management are essential to ensure safe handling, cost-effective shipping, and adherence to international and local regulations.

Packaging and Handling Standards

Stainless steel sheets must be carefully packaged to prevent surface damage, corrosion, and deformation during transit. Common packaging methods include:

- Interleaving: Sheets are separated with paper or plastic film to prevent scratching.

- Edge Protection: Corrugated paperboard, plastic, or wooden strips are used to protect sheet edges.

- Banding and Strapping: Steel or plastic bands secure the stack to a wooden or metal pallet.

- Waterproof Wrapping: Plastic shrink wrap or kraft paper with moisture barrier prevents exposure to humidity.

Handling requires forklifts or cranes with padded clamps to avoid surface marring. Workers should wear gloves to prevent fingerprint corrosion.

Transportation Modes and Considerations

Stainless steel sheets can be transported via multiple modes, depending on volume, destination, and urgency:

- Maritime Shipping (FCL/LCL): Most cost-effective for international bulk shipments. Sheets are typically palletized and containerized. Compliance with IMDG Code is required if hazardous treatments (e.g., oils) are present.

- Rail Transport: Suitable for long-distance domestic or cross-border land transport in large quantities.

- Truck Freight: Ideal for regional distribution. Flatbeds or enclosed trailers are used, depending on environmental exposure risks.

Climate-controlled or dry containers are recommended for long sea voyages to prevent condensation and corrosion.

International Trade Compliance

Exporting or importing stainless steel sheets requires compliance with various trade regulations:

- HS Code Classification: Stainless steel sheets generally fall under HS Code 7219 or 7220, depending on composition and form (e.g., hot-rolled, cold-rolled, width, thickness). Accurate classification ensures correct tariffs and customs clearance.

- Country-Specific Tariffs and Quotas: Monitor anti-dumping duties (e.g., EU, USA, India) which may apply to imports from certain countries (e.g., China, South Korea).

- Certificates of Origin: Required for preferential tariff treatment under trade agreements (e.g., USMCA, RCEP, ASEAN).

Regulatory and Safety Standards

Stainless steel products must comply with material and quality standards in the destination market:

- ASTM Standards (USA): ASTM A240 for general chromium and chromium-nickel stainless steel plates, sheets, and strips.

- EN Standards (Europe): EN 10088-2 for technical delivery conditions of stainless steel sheet/plate.

- JIS Standards (Japan): JIS G 4304 for cold-rolled stainless steel plate, sheet, and strip.

Material Test Certificates (MTCs), such as EN 10204 3.1 or 3.2, must accompany shipments to verify chemical composition and mechanical properties.

Environmental and Chemical Compliance

Stainless steel itself is non-hazardous, but associated coatings, oils, or packaging materials may be subject to environmental regulations:

- REACH (EU): Ensure compliance for any chemical substances used in processing or protective coatings.

- RoHS (EU): Not typically applicable to raw stainless steel, but relevant if sheets are part of electronic assemblies.

- TSCA (USA): Confirm no restricted chemical treatments are used.

Dispose of packaging materials (e.g., plastic wraps, oils) in accordance with local environmental laws.

Documentation Requirements

Accurate documentation is critical for smooth customs clearance:

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- Material Test Certificate (MTC)

- Export/Import Licenses (if applicable)

Ensure all documents reflect consistent product descriptions, weights, and values to avoid delays.

Risk Management and Insurance

Insure shipments against common risks such as:

- Physical damage (bending, scratching)

- Corrosion due to moisture

- Theft or loss in transit

Choose all-risk marine cargo insurance for international shipments. Clearly define Incoterms® (e.g., FOB, CIF, DDP) to allocate responsibilities between buyer and seller.

Conclusion

Effective logistics and compliance management for stainless steel sheets ensures product integrity, regulatory adherence, and timely delivery. By following packaging best practices, understanding trade regulations, and maintaining accurate documentation, companies can minimize risks and optimize supply chain performance in global markets.

In conclusion, sourcing stainless steel sheets requires a strategic approach that balances quality, cost, supplier reliability, and compliance with technical specifications. It is essential to identify reputable suppliers—whether domestic or international—who adhere to industry standards such as ASTM, ISO, or JIS to ensure material consistency and performance. Evaluating factors like grade compatibility (e.g., 304, 316), surface finish, thickness tolerance, and minimum order quantities will help meet project or production requirements effectively. Additionally, considering logistics, lead times, and total landed costs contributes to a more efficient and economical procurement process. Building strong supplier relationships, conducting regular quality audits, and staying informed about market trends further enhance sourcing success. Ultimately, a well-planned sourcing strategy for stainless steel sheets supports operational efficiency, product durability, and long-term cost savings.