The global stainless steel drums market is experiencing steady growth, driven by increasing demand across industries such as chemicals, pharmaceuticals, food and beverage, and oil & gas. According to Grand View Research, the global steel drums market size was valued at USD 15.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030, with stainless steel variants gaining preference due to their corrosion resistance, durability, and compliance with stringent regulatory standards. Similarly, Mordor Intelligence projects a CAGR of approximately 4.1% for the steel drums market from 2023 to 2028, highlighting a rising shift toward reusable and sustainable packaging solutions—particularly in emerging economies. As demand for high-integrity containment solutions grows, key players specializing in 55-gallon stainless steel drums are scaling production, innovating materials, and expanding global distribution. Based on market presence, production capability, quality certifications, and customer reviews, the following seven manufacturers have emerged as leaders in the stainless steel 55-gallon drum segment.

Top 7 Stainless Steel 55 Gallon Drums Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Stainless Steel Drums

Domain Est. 1996

Website: skolnik.com

Key Highlights: In addition to standard and customized stainless steel drums and barrels, Skolnik Industries manufacturers steel overpack drum, 55 gallon ……

#2 Steel Drums

Domain Est. 1999

Website: bronsteincontainer.com

Key Highlights: We offer a wide variety of Steel Drums including; Carbon Steel Drums, Stainless Steel Drums, Steel Salvage Drums, Composite Drums, and Agitator Drums….

#3 55 Gallon Drum Manufacturers

Website: 55gallondrumcompanies.com

Key Highlights: For over 60 years, Rahway Steel Drum Company has been a reliable supplier of 55 gallon drums and drum services. We supply containers from 1 quart to 330 gallons ……

#4 55 Gallon Steel Drums

Domain Est. 1997

Website: bascousa.com

Key Highlights: 5-day delivery 30-day returns55 Gallon Steel Drums Available Now with no Minimum Order Size. Order now on phone or online!…

#5 Heavy Duty Stainless Steel Drums

Domain Est. 1999

Website: thecarycompany.com

Key Highlights: 30-day returnsBrowse stainless steel drums in various sizes, from 5 to 85 gallons. We also carry top-selling stainless steel 55 gallon drums — Wholesale Pricing….

#6 55 Gallon Seamless Stainless Steel Barrel

Domain Est. 2012

#7 Safe Drum Handling Company

Domain Est. 2013

Website: safedrumhandling.com

Key Highlights: Stainless Steel Drum Handling Equipment for repositioning, lifting, moving, palletizing, mixing and pouring 55 gallon (208 liter) drums and barrels. Stainless ……

Expert Sourcing Insights for Stainless Steel 55 Gallon Drums

H2: Projected Market Trends for Stainless Steel 55-Gallon Drums in 2026

The global market for stainless steel 55-gallon drums is expected to experience steady growth by 2026, driven by increasing demand across key industrial sectors and evolving regulatory and sustainability trends. Several macroeconomic, technological, and industry-specific factors are shaping the trajectory of this niche but essential segment of industrial packaging.

-

Rising Demand in Chemical and Pharmaceutical Industries

The chemical, pharmaceutical, and biotechnology sectors are anticipated to remain primary consumers of stainless steel 55-gallon drums due to their superior corrosion resistance, hygiene, and durability. As global production of specialty chemicals, active pharmaceutical ingredients (APIs), and high-purity reagents increases, so does the need for reliable, reusable containment solutions. Stainless steel drums offer long-term cost efficiency and compliance with stringent safety standards, making them a preferred choice over plastic or carbon steel alternatives. -

Growth in Food and Beverage and Cosmetics Sectors

The food-grade stainless steel drum segment is expected to expand, particularly in the food processing, beverage, and cosmetics industries. With heightened consumer awareness regarding product safety and contamination risks, manufacturers are opting for sanitary, non-reactive storage and transport solutions. The use of 304 and 316L stainless steel drums—known for their resistance to oxidation and ease of cleaning—aligns with global food safety regulations such as FDA and EU standards. -

Sustainability and Circular Economy Drivers

Environmental regulations and corporate sustainability goals are pushing industries toward reusable and recyclable packaging. Stainless steel drums have a significantly longer lifespan than plastic or fiber drums—often exceeding 10–15 years with proper maintenance. By 2026, circular economy models that emphasize drum reconditioning, remanufacturing, and closed-loop logistics are expected to gain momentum, reducing waste and lifecycle costs. -

Regional Market Dynamics

North America and Europe will continue to dominate demand due to strict regulatory environments and mature industrial ecosystems. However, the Asia-Pacific region—especially China, India, and Southeast Asia—is projected to exhibit the highest growth rate. Rapid industrialization, expansion of pharmaceutical manufacturing, and infrastructure development in emerging economies will fuel demand for high-quality stainless steel packaging. -

Technological Advancements and Smart Drums

By 2026, integration of smart technologies into stainless steel drums—such as embedded sensors for monitoring temperature, pressure, and fill levels—is expected to emerge in high-value applications. These “smart drums” will enable real-time tracking, improve supply chain visibility, and enhance safety in handling hazardous materials, particularly in the chemical and life sciences sectors. -

Supply Chain and Raw Material Price Volatility

Fluctuations in the price of key raw materials like nickel, chromium, and molybdenum (critical components of stainless steel) may impact production costs. Manufacturers are likely to adopt hedging strategies, long-term supplier contracts, and alternative alloys to mitigate price volatility. Additionally, localization of production and nearshoring trends post-pandemic may reshape sourcing strategies, favoring regional manufacturing hubs. -

Competitive Landscape and Market Consolidation

The market is expected to see increased consolidation, with major players expanding capacity and acquiring smaller fabricators to enhance geographic reach and service offerings. Innovation in drum design—such as lightweight yet robust configurations and improved sealing mechanisms—will serve as key differentiators among suppliers.

Conclusion

By 2026, the stainless steel 55-gallon drum market will be shaped by a convergence of regulatory compliance, sustainability imperatives, and technological innovation. While challenges related to material costs and supply chain resilience persist, the long-term outlook remains positive, underpinned by the material’s unmatched performance in critical industrial applications. Companies that invest in reconditioning infrastructure, smart packaging solutions, and sustainable practices are likely to gain a competitive edge in this evolving market landscape.

Common Pitfalls When Sourcing Stainless Steel 55 Gallon Drums (Quality & IP)

Sourcing stainless steel 55-gallon drums, especially for critical applications in pharmaceuticals, food & beverage, or chemicals, requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking key factors can lead to significant operational, compliance, and legal risks. Below are the most common pitfalls to avoid:

1. Assuming All Stainless Steel is Equal

A frequent mistake is treating “stainless steel” as a single, uniform material. In reality, different grades (e.g., 304 vs. 316L) have vastly different properties. 316L stainless steel, with its molybdenum content, offers superior corrosion resistance—especially against chlorides and acids—making it essential for pharmaceutical and aggressive chemical environments. Sourcing drums made from lower-grade steels like 304 or non-certified material can result in premature corrosion, contamination, and product failure.

2. Overlooking Material Certification and Traceability

Failing to demand full material test reports (MTRs) and mill certifications is a major quality risk. Without proper documentation, you cannot verify the actual alloy composition, heat number, or compliance with standards like ASTM A240. Lack of traceability also complicates quality audits, regulatory submissions (e.g., FDA, EU GMP), and root cause analysis in case of contamination or failure.

3. Ignoring Surface Finish and Passivation Requirements

The interior surface finish (e.g., electropolished vs. mechanically polished) significantly impacts cleanability, corrosion resistance, and product compatibility. Electropolishing removes surface contaminants and enhances the passive chromium oxide layer. Sourcing drums without specified surface roughness (e.g., Ra < 0.8 µm) or proper passivation per ASTM A967 can lead to microbial growth, leaching, or cross-contamination—critical issues in sanitary applications.

4. Neglecting Weld Quality and Integrity

Poor welding practices introduce defects like porosity, cracks, or incomplete fusion, compromising structural integrity and creating crevices for contamination. Ensure welds are performed by certified welders using proper techniques (e.g., TIG welding), and insist on non-destructive testing (NDT) such as dye penetrant or X-ray inspection for critical drums.

5. Underestimating Intellectual Property (IP) Risks

Copying or reverse-engineering proprietary drum designs—especially those with specialized features like sanitary fittings, venting systems, or custom closures—can lead to IP infringement. Many established manufacturers hold patents or trade dress rights on unique geometries or connection systems. Sourcing generic or unlicensed replicas exposes your organization to legal action, product seizures, and reputational damage.

6. Failing to Verify Regulatory Compliance

Drums used in regulated industries must meet specific standards (e.g., 3A for dairy, FDA CFR 21 for food contact, ASME BPE for biopharma). Assuming compliance without documentation or third-party certification can result in rejected shipments, production delays, or regulatory citations during inspections.

7. Prioritizing Cost Over Long-Term Value

While low-cost suppliers may offer attractive upfront pricing, inferior materials, poor workmanship, or non-compliant designs often lead to higher total cost of ownership due to frequent replacements, downtime, or product contamination. Investing in high-quality, compliant drums from reputable suppliers reduces lifecycle risks and ensures reliability.

8. Inadequate Supplier Qualification

Partnering with suppliers without thorough vetting—such as on-site audits, quality management system reviews (e.g., ISO 9001), or references from similar industries—increases the risk of receiving substandard products. A reliable supplier should provide transparency into their manufacturing process, quality controls, and supply chain.

By proactively addressing these pitfalls, organizations can ensure they source stainless steel 55-gallon drums that meet stringent quality standards and avoid costly IP or compliance issues.

Logistics & Compliance Guide for Stainless Steel 55-Gallon Drums

Stainless steel 55-gallon drums are durable, corrosion-resistant containers widely used for storing and transporting a variety of chemicals, food-grade substances, pharmaceuticals, and hazardous materials. Proper logistics and compliance management are essential to ensure safety, regulatory adherence, and operational efficiency. This guide outlines key considerations using H2 headings for clarity.

H2: Regulatory Classification and Compliance

Stainless steel drums must comply with various national and international regulations depending on the contents and mode of transport. Key regulatory frameworks include:

- DOT (Department of Transportation) – 49 CFR: Regulates the transportation of hazardous materials in the U.S. Stainless steel drums used for hazardous materials must meet UN/DOT performance standards (e.g., UN 1A1 for non-removable head drums).

- UN Certification: Drums intended for hazardous materials must be UN-rated and marked accordingly (e.g., UN 1A1/Y1.8/150/22). The certification confirms the drum has passed drop, leakproofness, and stacking tests.

- FDA & USDA Compliance: For food, beverage, or pharmaceutical use, drums must be constructed from food-grade stainless steel (typically 304 or 316) and meet sanitary design standards (e.g., ASME BPE).

- EPA & RCRA: If used for hazardous waste, drums must comply with Resource Conservation and Recovery Act (RCRA) requirements, including proper labeling, storage conditions, and accumulation time limits.

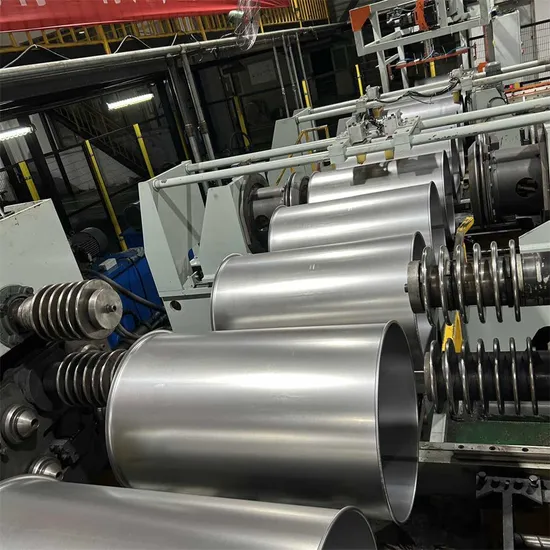

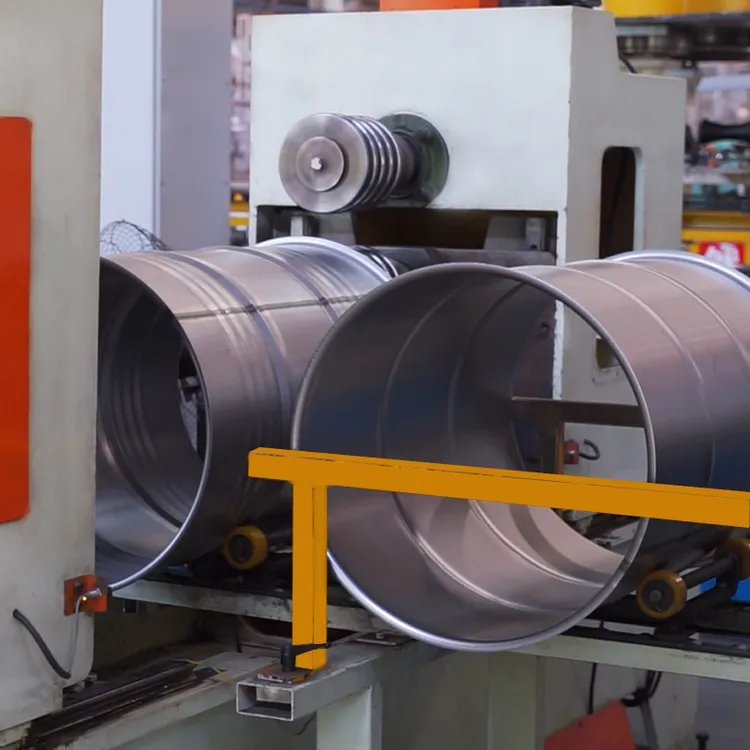

H2: Material and Construction Specifications

Stainless steel drums offer superior resistance to corrosion and contamination compared to steel or plastic alternatives. Key specifications include:

- Material Grade: Most commonly 304 or 316 stainless steel. 316 offers enhanced resistance to chlorides and acidic environments.

- Wall Thickness: Typically ranges from 14 to 16 gauge (1.5–2.0 mm), depending on pressure and stacking requirements.

- Design Types:

- Open Head (Removable Head): Features a bolt ring or triclamp closure; ideal for viscous materials or frequent access.

- Closed Head (Tight Head): Fixed top with 2” and 3/4” bung openings; suitable for liquids and pressurized contents.

- Finishes: Interior surfaces may be electropolished or passivated to enhance corrosion resistance and cleanability.

H2: Filling, Handling, and Storage

Proper handling ensures product integrity and worker safety.

- Filling Procedures:

- Ground drums during filling to prevent static discharge, especially with flammable materials.

- Use appropriate pumps or transfer systems to avoid contamination.

- Do not overfill; leave adequate headspace (typically 5–10%) for thermal expansion.

- Handling Equipment:

- Use drum dollies, forklifts with drum clamps, or cranes with lifting saddles.

- Never roll drums on their side unless designed for it.

- Storage Conditions:

- Store indoors or under cover to prevent exposure to weather and contaminants.

- Stack only as high as the drum rating allows, typically 3–4 high when full.

- Separate incompatible materials (e.g., acids from bases) per OSHA and NFPA guidelines.

H2: Labeling and Documentation

Accurate labeling is critical for safety and regulatory compliance.

- Required Labels:

- GHS-compliant hazard pictograms, signal words, and precautionary statements for hazardous materials.

- DOT hazard class labels (e.g., Flammable, Corrosive).

- Contents, concentration, date, and handling instructions.

- Accumulation start date for hazardous waste drums.

- Documentation:

- Safety Data Sheets (SDS) accessible to personnel.

- Shipping papers and manifests for hazardous materials.

- Inventory logs for traceability.

H2: Transportation Requirements

Transporting stainless steel drums involves strict adherence to modal regulations.

- Domestic (U.S.):

- Follow 49 CFR for hazardous materials: proper packaging, labeling, placarding, and shipping papers.

- Secure drums in vehicles to prevent movement (use straps or dunnage).

- International (IMDG, IATA, ADR):

- IMDG Code for maritime shipping.

- IATA Dangerous Goods Regulations for air transport.

- ADR for European road transport.

- All require UN-certified packaging and proper documentation.

- Inspection: Visually inspect drums before shipment for dents, leaks, or corrosion.

H2: Cleaning, Reuse, and Disposal

Proper end-of-life management is essential for environmental and legal compliance.

- Cleaning Procedures:

- Clean according to the substance contained (e.g., CIP systems for food-grade use).

- Use appropriate solvents and PPE; verify cleanliness via testing if needed.

- Maintain cleaning records for traceability.

- Reuse Considerations:

- Only reuse drums for compatible materials.

- Reconditioned drums must meet original UN certification standards.

- Disposal:

- Empty hazardous waste drums are regulated as hazardous waste until properly cleaned (triple-rinsed and rendered non-hazardous).

- Recycle stainless steel through certified metal recyclers.

- Maintain disposal manifests and records per RCRA.

H2: Safety and Training

Personnel must be trained on safe handling and emergency procedures.

- Training Topics:

- Hazard communication (HazCom).

- DOT/IATA/IMDG requirements for hazardous materials.

- Use of PPE (gloves, goggles, respirators as needed).

- Spill response and containment.

- Emergency Equipment:

- Spill kits, eyewash stations, and fire extinguishers must be readily available.

- Drums should be stored in secondary containment (e.g., spill pallets) when holding hazardous liquids.

By adhering to this guide, organizations can ensure safe, compliant, and efficient handling of stainless steel 55-gallon drums across the supply chain.

Conclusion: Sourcing Stainless Steel 55-Gallon Drums

In summary, sourcing stainless steel 55-gallon drums requires careful consideration of material quality, supplier reliability, compliance standards, and cost-efficiency. Stainless steel drums offer superior durability, corrosion resistance, and hygiene, making them ideal for industries such as food and beverage, pharmaceuticals, chemicals, and wastewater treatment. When selecting a supplier, it is essential to verify certifications (e.g., ASTM, FDA, 304 or 316 stainless steel grades), confirm manufacturing standards, and assess after-sales support.

Procurement decisions should balance upfront costs with long-term value, including lifecycle performance and safety. Domestic suppliers may offer faster lead times and easier communication, while international sources could provide cost savings if import logistics and quality control are properly managed. Building relationships with reputable vendors, conducting site audits when possible, and requesting material test reports ensure consistent product quality.

Ultimately, a strategic sourcing approach—emphasizing quality, compliance, and supply chain reliability—will ensure that stainless steel 55-gallon drums meet operational needs and contribute to safe, efficient, and sustainable business processes.