The global stainless steel fasteners market is experiencing robust expansion, driven by increasing demand across industries such as automotive, construction, aerospace, and renewable energy. According to a report by Grand View Research, the global fasteners market was valued at USD 104.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030, with stainless steel variants gaining preference due to their corrosion resistance, durability, and performance in extreme environments. Similarly, Mordor Intelligence projects a CAGR of over 5.8% during the forecast period of 2023–2028, citing rising infrastructure investments and stringent regulatory standards for material quality as key growth catalysts. As demand surges, particularly in Asia-Pacific and North America, a select group of manufacturers have emerged as industry leaders, setting benchmarks in innovation, quality, and global supply capabilities.

Top 9 Stainless Fasteners Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Alloy Fasteners

Domain Est. 1997

Website: alloyfasteners.com

Key Highlights: A leading nationwide distributor, USA manufacturer, and direct importer specializing in stainless steel fasteners. With over 55 years of industry expertise, ……

#2 Chrome Bolts, Stainless Steel Bolts, Metric Bolts, Socket Head Cap …

Domain Est. 2002

Website: allensfasteners.com

Key Highlights: 30-day returnsFasteners & Industrial Supply ; Stainless Steel Bolts · Aluminum Bolts · Socket Head Bolts ; Chrome Bolts · Machine Screws · Metric Bolts ; Lock Washers · Flat ……

#3 FM Stainless Fasteners

Domain Est. 2005

Website: fmstainless.com

Key Highlights: FM Stainless Fasteners is a leading domestic manufacturer, fabricator & supplier of a variety of stainless steel fasteners and hardware including: Concrete ……

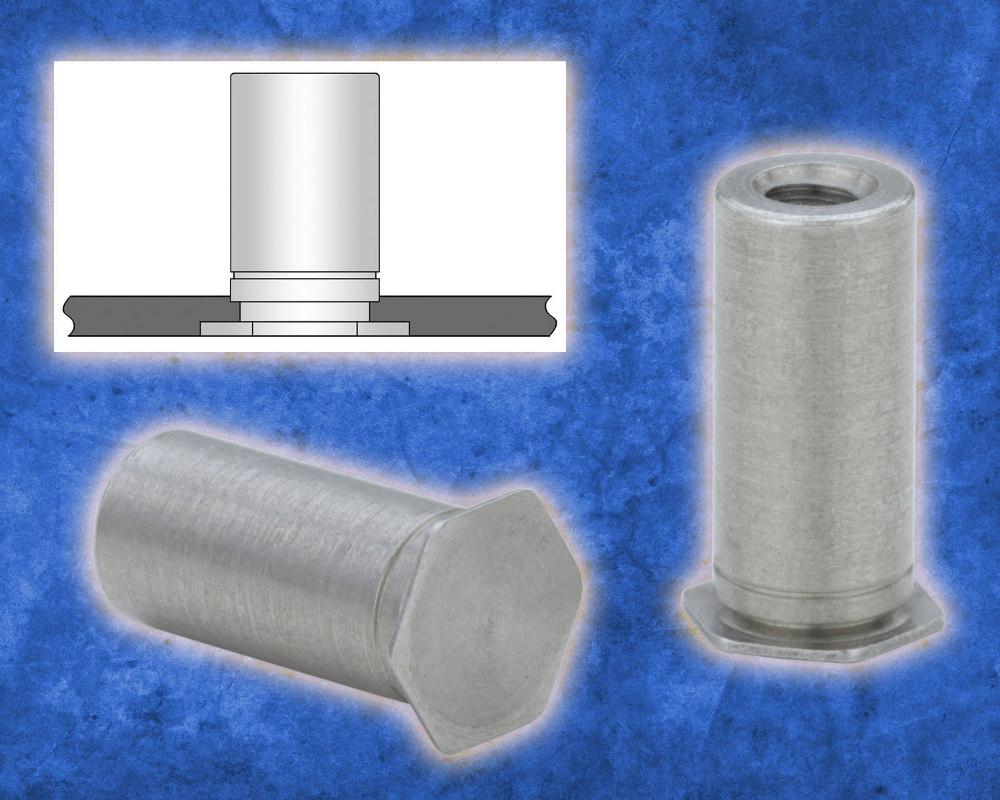

#4 PEM – PennEngineering

Domain Est. 1996

Website: pemnet.com

Key Highlights: PEM offers innovative fastening solutions for a variety of applications across industries like Automotive Electronics, Consumer Electronics, Datacom and more….

#5 Alloy & Stainless Fasteners

Domain Est. 1996

Website: goasf.com

Key Highlights: Bolts · Nuts · Studs · Sockets · Washers · Bent Bolts · Special Metals and Alloys · 10,000 Ton Inventory · Over 150 Material Grades · Over 300 Machines · Over 25 ……

#6 Wholesale Stainless Steel Products

Domain Est. 1998

Website: starstainless.com

Key Highlights: Star Stainless is a wholesale distributor specializing in Stainless Steel products. For over 70 years our STAR Service, Off-the-Shelf Inventory Programs and ……

#7 Marsh Fasteners

Domain Est. 2003

Website: marshfasteners.com

Key Highlights: As top fastener suppliers, our extensive inventory of quality fasteners includes stainless steel fasteners in 18-8, 304 & 316 Stainless Steel….

#8 Stainless Steel Fasteners

Domain Est. 2008

Website: aftfasteners.com

Key Highlights: Free delivery over $200 · 30-day returnsUpgrade your projects with our stainless steel fasteners. Durable, corrosion-resistant, and available in various styles. Order today for fa…

#9 Fastener Supplier

Domain Est. 2009

Website: k2fasteners.ca

Key Highlights: We offer a full line of stainless-steel fasteners, other corrosion resistant materials, and a range of steel and alloy steel fasteners from stock in Canada….

Expert Sourcing Insights for Stainless Fasteners

H2: Projected Market Trends for Stainless Steel Fasteners in 2026

The global stainless steel fasteners market is poised for steady growth by 2026, driven by rising industrialization, infrastructure development, and increasing demand from key end-use sectors. Several macroeconomic and sector-specific trends are expected to shape the market landscape.

-

Growing Demand from Construction and Infrastructure

By 2026, the global construction industry—especially in emerging economies across Asia-Pacific, the Middle East, and Africa—is expected to significantly boost demand for corrosion-resistant and durable fastening solutions. Stainless steel fasteners are increasingly preferred in high-exposure environments such as coastal buildings and chemical plants due to their longevity and low maintenance. Urbanization and government-led infrastructure projects will further amplify this demand. -

Expansion in Automotive and Transportation Sectors

The automotive industry’s shift toward lightweight, fuel-efficient, and electric vehicles (EVs) is creating new opportunities for high-performance fasteners. While weight reduction often favors aluminum or composites, stainless steel remains critical in high-temperature and high-stress areas (e.g., exhaust systems and undercarriage components). Regulatory standards emphasizing safety and durability will sustain demand for premium-grade stainless fasteners in both conventional and EV manufacturing. -

Renewable Energy and Industrial Applications

The renewable energy sector, particularly solar and wind power, relies heavily on stainless steel fasteners for their resistance to weathering and fatigue. With global investments in clean energy projected to rise through 2026, demand for stainless fasteners in turbine assembly, solar panel mounting, and grid infrastructure will grow. Additionally, oil & gas, chemical processing, and marine industries continue to require high-grade austenitic and duplex stainless steel fasteners for safety-critical applications. -

Technological Advancements and Material Innovation

Manufacturers are investing in advanced manufacturing techniques such as cold forging, precision threading, and surface treatments to improve strength, corrosion resistance, and dimensional accuracy. The development of super-austenitic and super-duplex grades is gaining traction, especially in demanding environments. Digital supply chain integration and Industry 4.0 technologies are also enabling faster customization and just-in-time delivery to meet complex industrial needs. -

Sustainability and Regulatory Pressures

Environmental regulations and sustainability goals are influencing material selection across industries. Stainless steel’s high recyclability and long lifecycle make it an environmentally favorable choice. By 2026, stricter emissions and safety standards, particularly in Europe and North America, will likely mandate the use of corrosion-resistant fasteners in critical applications, supporting market growth. -

Regional Market Dynamics

Asia-Pacific will remain the largest market for stainless steel fasteners, led by manufacturing hubs in China, India, and Southeast Asia. However, trade tensions, raw material price volatility, and supply chain diversification efforts may prompt regionalization of production. Meanwhile, North America and Europe are expected to see moderate growth, driven by infrastructure renewal programs and industrial automation. -

Challenges and Competitive Landscape

Despite favorable trends, the market faces challenges including fluctuating raw material (nickel, chromium) prices and intense competition from low-cost producers. Companies are responding by focusing on value-added products, certifications (e.g., ISO, ASTM), and strategic partnerships to differentiate in a crowded marketplace.

In conclusion, the stainless steel fasteners market in 2026 will be characterized by resilient demand across multiple industries, innovation in materials and manufacturing, and a growing emphasis on sustainability. Manufacturers who adapt to regional regulatory frameworks and invest in high-performance solutions are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Stainless Steel Fasteners (Quality & Intellectual Property)

Sourcing stainless steel fasteners involves more than just comparing prices and lead times. Overlooking critical quality and intellectual property (IP) aspects can lead to project delays, safety risks, financial losses, and legal complications. Below are key pitfalls to avoid:

Poor Material Quality and Non-Compliance

One of the most prevalent issues is receiving fasteners made from substandard or misrepresented stainless steel. Suppliers may claim compliance with standards like ASTM A193, A320, or ISO 3506 but deliver materials with incorrect alloy composition (e.g., substituting lower-grade 201 or 304 for 316), inadequate mechanical properties, or improper heat treatment. This can result in premature corrosion, fastener failure under load, or incompatibility with the operating environment—especially in critical sectors like oil & gas, marine, or medical devices.

Counterfeit or Non-Certified Products

The stainless fastener market is prone to counterfeit goods masquerading as genuine, certified components. Unscrupulous suppliers may falsify mill test certificates (MTCs), reuse certification documents, or provide products without any traceability. Purchasers relying on these may unknowingly install non-compliant fasteners, violating industry regulations and exposing their organization to liability. Always insist on original, batch-specific MTCs and consider third-party verification for high-risk applications.

Inadequate Manufacturing and Thread Quality

Even with correct material, poor manufacturing practices can compromise performance. Common defects include incorrect thread tolerances, improper head formation, burrs, or inconsistent surface finishes. These flaws can lead to galling during installation, reduced fatigue strength, or thread stripping. Visual inspection alone is often insufficient—dimensional checks and functional testing are essential, especially when sourcing from unfamiliar suppliers.

Lack of Traceability and Documentation

Reputable suppliers provide full traceability, including heat numbers, manufacturing locations, and quality control records. A lack of proper documentation not only raises red flags about authenticity but also undermines compliance with ISO, AS9100, or other quality management systems. Without traceability, recalls or failure analysis become nearly impossible, increasing risk and downtime.

Intellectual Property Infringement Risks

Sourcing fasteners, particularly proprietary or specialty designs (e.g., aerospace-grade, tamper-proof, or patented locking mechanisms), carries IP risks. Some suppliers may replicate protected designs without authorization. Purchasing such components—knowingly or not—can expose your company to legal action, product recalls, and reputational damage. Always verify that the supplier holds proper licensing or is authorized by the IP holder.

Insufficient Supplier Vetting and Due Diligence

Relying solely on online marketplaces or brokers without vetting the manufacturer increases exposure to quality and IP issues. Conduct thorough audits, request references, and, if possible, visit production facilities. A supplier’s certifications (e.g., ISO 9001, PED, or NORSOK) should be current and relevant to your application.

Overlooking Environmental and Application-Specific Needs

Not all stainless steels perform equally in all environments. Using standard 304 fasteners in chloride-rich environments, for example, invites pitting corrosion. Sourcing decisions must consider the specific operating conditions—temperature, chemical exposure, load requirements—to ensure the correct grade and finish (e.g., passivated, electropolished) are selected.

Avoiding these pitfalls requires diligence, technical knowledge, and strong supplier relationships. Prioritize quality assurance, enforce strict documentation requirements, and conduct due diligence to protect both product integrity and your organization’s legal standing.

Logistics & Compliance Guide for Stainless Steel Fasteners

Overview

This guide outlines the essential logistics and compliance considerations for the international shipment, storage, and regulatory adherence of stainless steel fasteners. Ensuring proper handling, documentation, and conformity with global standards is critical for uninterrupted supply chain operations and legal compliance.

Product Classification & HS Code

Stainless steel fasteners are typically classified under the Harmonized System (HS) Code 7318.15 (Stainless steel bolts, screws, and studs) or 7318.29 (Stainless steel nuts). Accurate classification is vital for customs clearance, tariff determination, and regulatory compliance. Always verify the specific HS code based on product type, dimensions, and country-specific tariff schedules.

Material & Quality Standards Compliance

Stainless steel fasteners must conform to recognized international standards, such as:

– ISO 3506: Specifies mechanical and physical properties of corrosion-resistant fasteners (covers property classes like A2-70, A4-80).

– ASTM A193/A194: For high-temperature or high-pressure service applications.

– DIN 933, DIN 931, DIN 976: Common German standards used globally.

– EN 14399: For preloaded high-strength structural connections.

Ensure mill test certificates (e.g., EN 10204 3.1 or 3.2) are provided to confirm material traceability and compliance.

Packaging & Labeling Requirements

- Packaging: Use moisture-resistant materials (e.g., VCI paper, sealed plastic wraps) to prevent corrosion during transit. Bulk shipments should be palletized and secured with strapping.

- Labeling: Each package must include: product description, material grade (e.g., AISI 304, 316), size, quantity, batch/lot number, manufacturer name, and compliance markings (e.g., ISO, ASTM).

- Hazard Communication: While stainless steel fasteners are generally non-hazardous, ensure labels comply with local regulations (e.g., OSHA, CLP).

Shipping & Transportation Logistics

- Mode of Transport: Choose air, sea, or land freight based on urgency, volume, and cost. Sea freight is most common for bulk shipments.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DAP) in all contracts to avoid disputes.

- Temperature & Humidity Control: Avoid condensation by using desiccants and climate-controlled containers when shipping across varying climates.

- Stacking & Handling: Follow load limits and stacking guidelines to prevent damage. Use protective corner boards on pallets.

Import & Export Documentation

Essential documentation includes:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (required for preferential tariffs under trade agreements)

– Material Test Reports (MTRs)

– Export Declaration (if applicable)

– Import License (for certain countries)

Ensure all documents are accurate, consistent, and submitted in the required language (often English).

Regulatory & Environmental Compliance

- REACH & RoHS (EU): Confirm that fasteners do not contain restricted substances (e.g., lead, cadmium) above permissible levels.

- CBAM (Carbon Border Adjustment Mechanism): Monitor potential carbon reporting requirements for shipments to the EU.

- Customs-Trade Partnership Against Terrorism (C-TPAT): For shipments to the U.S., compliance enhances security and may expedite customs clearance.

- Country of Origin Marking: Fasteners must be clearly marked with the country of manufacture per destination country rules (e.g., “Made in Germany”).

Storage & Inventory Management

- Store in dry, indoor environments with controlled humidity to prevent surface oxidation.

- Use first-in, first-out (FIFO) inventory practices to minimize long-term storage risks.

- Segregate different grades (e.g., 304 vs 316) to avoid mix-ups.

- Conduct periodic quality audits to ensure product integrity.

Traceability & Recall Preparedness

Maintain full traceability from raw material to finished product using batch/lot tracking systems. In case of non-conformance, a robust recall plan should include:

– Immediate customer notification

– Return or replacement procedures

– Root cause analysis and corrective actions

Conclusion

Adhering to logistics and compliance best practices ensures that stainless steel fasteners meet quality expectations, arrive on time, and satisfy all regulatory requirements. Regular training, documentation audits, and supplier collaboration are key to maintaining a compliant and efficient supply chain.

Conclusion for Sourcing Stainless Steel Fasteners:

Sourcing stainless steel fasteners requires a strategic approach that balances quality, cost, and reliability. Given their critical role in ensuring structural integrity and corrosion resistance across industries such as construction, automotive, marine, and manufacturing, it is essential to partner with reputable suppliers who adhere to international standards (e.g., ISO, ASTM, DIN). Prioritizing material grade (such as A2/A4 stainless steel), proper certification, and traceability ensures long-term performance and compliance.

Additionally, evaluating total cost—beyond just unit price—to include factors like lead times, minimum order quantities, logistics, and after-sales support contributes to supply chain efficiency. Building strong relationships with qualified suppliers, conducting regular quality audits, and maintaining inventory flexibility can mitigate risks associated with supply disruptions.

In conclusion, a well-structured sourcing strategy for stainless steel fasteners enhances product durability, reduces maintenance costs, and supports operational reliability—making it a vital component of effective procurement and project success.