The global outdoor cooking equipment market is experiencing steady expansion, driven by rising participation in recreational activities such as camping, hiking, and adventure tourism. According to a 2023 report by Mordor Intelligence, the global camping equipment market was valued at USD 6.8 billion in 2022 and is projected to grow at a CAGR of 5.2% through 2028. This growth is further supported by increasing consumer preference for durable, lightweight, and corrosion-resistant materials—making stainless steel a top choice for camp cookware. Grand View Research also notes a surge in demand for premium, long-lasting outdoor kitchen solutions, with stainless steel cookware gaining traction due to its thermal efficiency and low maintenance. As the market evolves, a select group of manufacturers have emerged as leaders in innovation, scalability, and product performance, setting the benchmark for quality in stainless camp cookware. Based on production capacity, global distribution, and product reviews, here are the top eight stainless camp cookware manufacturers shaping the industry today.

Top 8 Stainless Camp Cookware Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

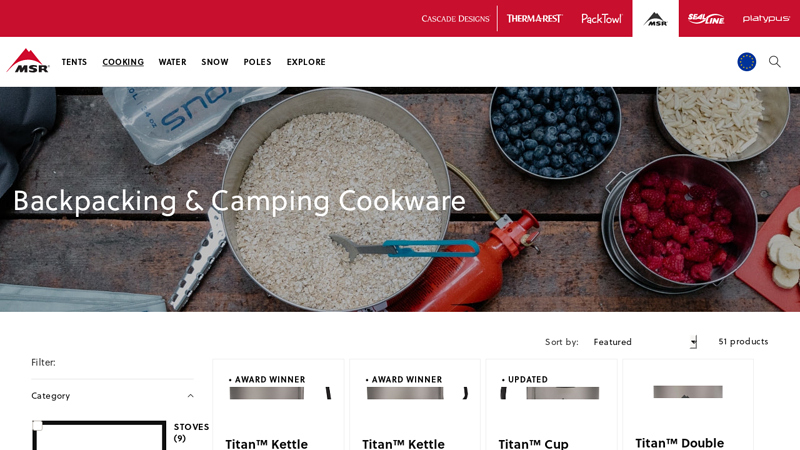

#1 Backpacking & Camping Cookware

Domain Est. 1995

Website: cascadedesigns.com

Key Highlights: Free delivery · Free 30-day returnsMSR offers a wide range of camping cookware. Shop ceramic, nonstick, titanium, and stainless steel camping pots, pans, kettles, dishes and utens…

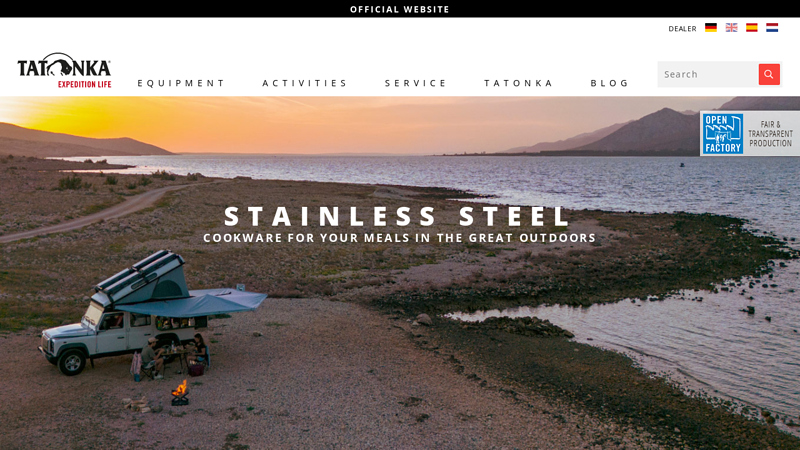

#2 Outdoor cookware by Tatonka

Domain Est. 1996

Website: tatonka.com

Key Highlights: Stainless steel cooking equipment that’s unbreakable, easy to clean and food-safe. With measurement markings in the pots and cups it’s easier than ever to ……

#3 Stainless Steel Camp Kitchen

Domain Est. 1996

#4 Cookware Sets

Domain Est. 1998

#5 Campfire Cookware and Cookware Sets

Domain Est. 1999

Website: gsioutdoors.com

Key Highlights: Free delivery over $45 30-day returnsShop GSI Outdoors Camping Cook Sets and cookware. From family camping to a solo backpacking trip, GSI Outdoors camp pots and pans are designed …

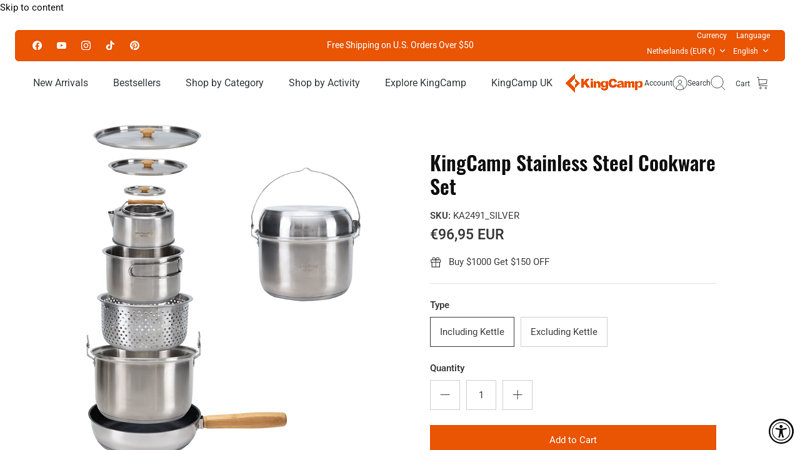

#6 KingCamp Stainless Steel Cookware Set

Domain Est. 1999

Website: kingcamp.com

Key Highlights: In stock Rating 5.0 2 Superior Quality: Crafted from high-quality 304 stainless steel, this cookware set promises durability and longevity. The handles are made of natural bamboo…

#7 Stainless Steel Camping Cookware

Domain Est. 2011

#8 Camp Cookware

Domain Est. 2019

Website: stanley1913.com

Key Highlights: Free delivery over $75Stanley’s camping cookware makes it easy to feed a hungry crowd on an epic road trip to just yourself while scaling the next mountain….

Expert Sourcing Insights for Stainless Camp Cookware

2026 Market Trends for Stainless Camp Cookware

As outdoor recreation continues to grow in popularity and consumers increasingly prioritize durability, sustainability, and multi-functional gear, the stainless camp cookware market is poised for significant evolution by 2026. Driven by shifting consumer preferences, technological advancements, and environmental awareness, several key trends are expected to shape the industry in the coming years.

Rising Demand for Durable and Sustainable Outdoor Gear

Consumers are becoming more conscious of the environmental impact of their outdoor equipment. Stainless steel, known for its longevity, recyclability, and non-toxic properties, aligns well with the growing demand for sustainable products. Unlike non-stick coatings that degrade over time and may release harmful chemicals, stainless steel is inert and does not require chemical treatments. This durability reduces the need for frequent replacements, appealing to eco-conscious campers and aligning with the “buy it for life” philosophy gaining traction in outdoor communities.

Growth in Backpacking and Ultralight Camping

While stainless steel is traditionally heavier than materials like titanium or aluminum, advancements in manufacturing—such as deep drawing and weight-optimized designs—are enabling lighter stainless cookware without compromising strength. By 2026, expect to see more hybrid products that combine stainless steel with lightweight materials or feature collapsible or nesting designs to appeal to ultralight backpackers. Brands may also emphasize the heat efficiency and even cooking performance of stainless steel, countering the weight trade-off with superior functionality.

Integration with Multi-Fuel and Off-Grid Cooking

As overlanding, van life, and dispersed camping grow in popularity, campers are investing in versatile cooking systems that work across various fuel sources—canister stoves, wood fires, and even vehicle-powered induction. Stainless steel performs reliably across these heat sources without warping or degrading, making it ideal for multi-fuel compatibility. By 2026, stainless camp cookware is likely to be marketed as part of modular, all-in-one cooking systems designed for off-grid living, including nesting pots with integrated strainers, fry pans, and lids that double as skillets.

Emphasis on Aesthetic and Premium Design

The outdoor market is witnessing a shift toward premiumization, with consumers willing to pay more for aesthetically pleasing, high-performance gear. Stainless camp cookware benefits from a sleek, modern appearance that appeals to this trend. In 2026, expect increased innovation in design elements such as brushed finishes, ergonomic handles with heat-resistant coatings, and modular sets packaged in sustainable materials. Limited edition collaborations with outdoor influencers or designers may further elevate brand perception.

Expansion of Direct-to-Consumer (DTC) and Niche Brands

The rise of e-commerce and social media has enabled niche outdoor brands to compete with established players by focusing on specific customer needs. Many of these emerging brands are targeting minimalist, sustainability-oriented, or tech-savvy outdoor enthusiasts with stainless cookware that emphasizes craftsmanship and transparency in sourcing. By 2026, DTC models will likely dominate, offering customization options, repair programs, and educational content to build brand loyalty.

Technological Enhancements and Smart Features

While still in early development, the integration of smart technology into outdoor gear could influence the cookware market. By 2026, some stainless camp cookware may feature embedded temperature indicators, induction compatibility, or RFID tags for tracking usage and maintenance. Though not widespread, these innovations could appeal to high-end consumers and tech-forward adventurers.

Conclusion

The 2026 market for stainless camp cookware is set to benefit from converging trends in sustainability, durability, and outdoor lifestyle growth. While challenges remain—particularly around weight perception—ongoing innovation in design and materials will help stainless steel maintain a competitive edge. As consumers seek reliable, long-lasting, and environmentally responsible gear, stainless camp cookware is well-positioned to capture a growing share of the outdoor cooking market.

Common Pitfalls When Sourcing Stainless Camp Cookware (Quality and Intellectual Property)

Sourcing stainless camp cookware, especially from international suppliers, can present several challenges related to product quality and intellectual property (IP) risks. Avoiding these pitfalls is crucial for maintaining brand reputation, ensuring customer satisfaction, and protecting legal rights. Below are the most common issues businesses encounter:

Inconsistent or Substandard Material Quality

One of the most frequent issues is receiving cookware made from inferior-grade stainless steel (e.g., non-18/10 or non-304 grade). Some suppliers may advertise “high-quality stainless steel” but deliver thin-gauge material prone to warping, scratching, or uneven heating. Buyers should verify material certifications and conduct third-party lab testing if necessary.

Poor Craftsmanship and Construction

Low-cost manufacturers may cut corners in welding, handle attachment, or polishing. Weak rivets, uneven seams, or poorly bonded bases (on encapsulated cookware) can compromise durability and safety. It’s essential to request pre-production samples and conduct factory audits to assess manufacturing standards.

Misrepresentation of Product Features

Suppliers may falsely claim features such as oven-safe temperatures, induction compatibility, or non-stick properties. These misrepresentations can lead to customer dissatisfaction and product liability issues. Always validate claims through performance testing and clear technical specifications in contracts.

Lack of Compliance with Safety and Environmental Regulations

Importing cookware without proper compliance (e.g., FDA, LFGB, CE, or Prop 65) can result in customs delays, recalls, or legal penalties. Stainless cookware that leaches harmful metals due to poor metallurgy may fail safety standards. Ensure suppliers provide compliance documentation for target markets.

Intellectual Property Infringement Risks

Sourcing from regions with lax IP enforcement increases the risk of unintentionally importing counterfeit or copycat designs. Using patented shapes, logos, or proprietary technologies without authorization can lead to legal action. Conduct due diligence on design ownership and sign IP protection clauses in supplier agreements.

Inadequate Packaging and Branding Protection

Poor packaging may result in product damage during shipping. Additionally, unbranded or generically packaged goods increase the risk of IP theft, as designs can be reverse-engineered. Use custom, branded packaging and consider using non-disclosure agreements (NDAs) with suppliers.

Failure to Secure IP Ownership in Manufacturing Agreements

Many buyers assume they own the tooling or design once paid for, but without explicit contract terms, the supplier may retain IP rights. This can prevent exclusivity or lead to the same product being sold to competitors. Always formalize IP ownership in writing before production begins.

By proactively addressing these pitfalls through rigorous supplier vetting, clear contracts, and quality control processes, businesses can mitigate risks and ensure a reliable supply of high-quality, legally protected stainless camp cookware.

Logistics & Compliance Guide for Stainless Camp Cookware

Product Classification and Regulations

Stainless Camp Cookware is categorized as consumer kitchenware intended for outdoor and recreational use. It must comply with relevant national and international safety, material, and labeling standards. Key regulatory bodies include the U.S. Food and Drug Administration (FDA) for food contact surfaces, the Consumer Product Safety Commission (CPSC), and international standards such as EU Regulation (EC) No 1935/2004 for materials intended to come into contact with food.

Material Safety and Food Contact Compliance

All stainless steel components must be made from food-grade materials, typically 18/8 or 18/10 stainless steel, which are non-reactive and safe for cooking. Suppliers must provide certification that materials meet FDA 21 CFR §178.3297 and EU Regulation (EC) No 10/2011 for food contact materials. No lead, cadmium, or other harmful substances should be present in coatings or finishes.

Labeling and Packaging Requirements

Each unit must include permanent labeling indicating:

– Material composition (e.g., “18/8 Stainless Steel”)

– Country of origin

– Care and usage instructions

– Warning labels if applicable (e.g., “Handle becomes hot during use”)

Packaging should be durable, environmentally responsible where possible, and include barcodes, SKU information, and compliance marks (e.g., FDA-compliant, BPA-free).

Import/Export Documentation

For international shipping, ensure all necessary documentation is prepared, including:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– FDA Prior Notice submission (for U.S. imports)

– CE Declaration of Conformity (for EU markets)

Verify compliance with destination country import regulations, including customs tariffs under HS Code 7323.93 (stainless steel tableware).

Transportation and Handling

Ship in sturdy, moisture-resistant packaging to prevent scratching or deformation. Use pallets and stretch wrap for bulk shipments. Avoid exposure to extreme temperatures or humidity during transit. Clearly label packages as “Fragile” and “This Side Up” where applicable. Coordinate with carriers experienced in consumer goods logistics.

Environmental and Sustainability Compliance

Ensure manufacturing and packaging processes adhere to environmental standards such as ISO 14001. Prioritize recyclable materials and minimize single-use plastics in packaging. Comply with extended producer responsibility (EPR) regulations in applicable regions, including WEEE or packaging waste directives in the EU.

Quality Assurance and Testing

Conduct routine third-party testing for:

– Food safety (migration tests for metals)

– Durability (thermal shock, corrosion resistance)

– Compliance with ASTM F963 (U.S. toy safety standard, if marketed for children)

Maintain a traceability system for batch tracking and recall readiness.

Recalls and Incident Response

Establish a product recall plan in accordance with CPSC and equivalent international bodies. Report any safety incidents promptly and maintain customer communication channels. Keep records of all compliance testing and corrective actions for a minimum of five years.

Storage and Inventory Management

Store in dry, clean facilities to prevent corrosion or contamination. Implement FIFO (First In, First Out) inventory rotation. Monitor shelf life of packaging materials and inspect for damage regularly. Ensure warehouse staff are trained in proper handling procedures.

Certification and Audit Readiness

Maintain up-to-date compliance documentation, including:

– Material test reports

– Factory audit results (e.g., BSCI, SMETA)

– Certificates of compliance (FDA, CE, etc.)

Be prepared for unannounced audits by regulatory or retail partners.

In conclusion, sourcing stainless steel camp cookware requires careful consideration of durability, weight, functionality, and value for outdoor use. Stainless steel offers excellent resistance to corrosion, longevity, and ease of cleaning—ideal qualities for backcountry and camping environments. When selecting suppliers, prioritize reputable manufacturers or brands known for high-quality materials and craftsmanship to ensure performance and safety. Comparing features such as weight, nesting design, compatibility with various heat sources, and included components (e.g., pots, pans, lids) will help identify the best option for different camping needs. Additionally, evaluating cost versus long-term use underscores the investment value of durable stainless steel over lighter but less resilient alternatives. By focusing on these factors, outdoor enthusiasts can source reliable, efficient, and sustainable cookware that enhances their camping experience for years to come.