The global spring hooks market is experiencing steady momentum, driven by rising demand across automotive, industrial machinery, and consumer goods sectors. According to Grand View Research, the global springs market—encompassing compression, extension, torsion, and specialty variants like spring hooks—was valued at USD 9.4 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing automotive production, particularly in electric vehicles requiring precision spring components, as well as expanding manufacturing activities in Asia-Pacific and Latin America. Mordor Intelligence further supports this trajectory, forecasting a CAGR of over 5% for the global springs market through 2028, citing automation and industrial equipment modernization as key drivers. Within this expanding landscape, spring hooks—essential for secure fastening and dynamic load applications—are gaining prominence, prompting both established players and niche manufacturers to innovate in materials, durability, and customization. As demand climbs, identifying the top manufacturers becomes critical for procurement teams, OEMs, and supply chain managers seeking reliable, high-performance components. Here, we evaluate the top nine spring hooks manufacturers shaping the industry through technological capability, global reach, and consistent quality.

Top 9 Spring Hooks Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Spring Snap Hooks

Domain Est. 1997

Website: elitesalesinc.com

Key Highlights: Elite Sales Inc. is a wholesaler and supplier of snip spring hook with a 1700 working load limit. It’s suitable for all industrial applications….

#2 Spring Hooks Made of Steel Metal and Stainles Steel

Domain Est. 2008

Website: usalanyards.com

Key Highlights: Free deliveryWe are a factory-direct wholesaler and manufacturer of heavy-duty, high quality spring hooks. Our spring hooks are available in 4 colors….

#3 Hooks and Paint Hooks Manufacturers

Domain Est. 2018

Website: chinaspringparts.com

Key Highlights: CSPI Spring, a leading custom hook and paint hook manufacturer. Efficient hook manufacturing, custom end options….

#4 Spring Snap Hooks

Domain Est. 1997

Website: ronstan.com

Key Highlights: Free delivery over $75 30-day returnsSpring Snap Hooks – Commodity Grade Stainless Steel Hardware – Industrial Products – Products | Ronstan Sailboat Hardware USA….

#5 EPSI Precision

Domain Est. 1997

Website: epsi.com

Key Highlights: EPSI hooks: Industrial finishing solutions for powder coating, e-coating, and painting. Improve efficiency with our precision-engineered hooks….

#6 YENCHANG HARDWARE HOOK & SPRING FACTORY

Domain Est. 2016

Website: yenchang.com.tw

Key Highlights: Established in Tainan, Taiwan in 1992, Yen Chang is a company specializing in manufacturing exporting, and servicing stamping products….

#7 Spring Snap Clip Supplies

Domain Est. 2021

Website: murphylift.com

Key Highlights: In stock Free deliveryMurphy Lift’s wide selection of spring snap hooks brings dependable function and outstanding strength for various industrial uses….

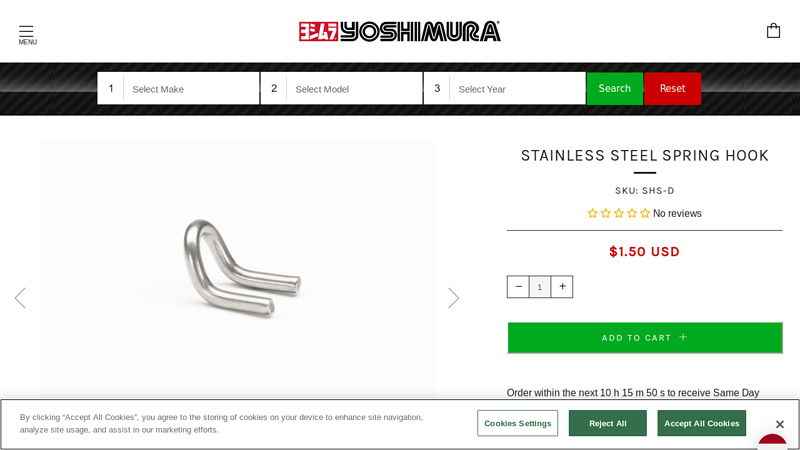

#8 Stainless Steel Spring Hook

Domain Est. 1996

Website: yoshimura-rd.com

Key Highlights: Our spring hooks are made in house from 304L steel rod (70 degree angle) and are essential for securing springs on your custom made system….

#9 Spring Hooks

Domain Est. 2018

Website: baronhardware.com

Key Highlights: Spring load interlocking snaps. Ideal for small boat, water skiing, mooring, motor safety line, etc. 700. 2450S-4, 3/8, 4 ……

Expert Sourcing Insights for Spring Hooks

2026 Market Trends for Spring Hooks

The global spring hooks market is poised for steady evolution by 2026, shaped by advancements in materials, growing automation, and increasing demand across key industries such as automotive, industrial manufacturing, and consumer goods. Below is an analysis of the anticipated market trends driving growth and innovation in spring hooks over the coming years.

Rising Demand in the Automotive Sector

The automotive industry remains a primary driver for spring hooks, particularly as vehicle production rebounds and electrification accelerates. Spring hooks are extensively used in suspension systems, engine components, and interior mechanisms. By 2026, the shift toward electric vehicles (EVs) is expected to create new opportunities for lightweight, corrosion-resistant spring hooks engineered for improved efficiency and durability. Increased use of high-strength alloys and composite materials will support this trend, meeting the need for compact and reliable fastening solutions in EV architectures.

Adoption of Advanced Materials and Coatings

Material innovation will be central to the competitiveness of spring hooks in 2026. Manufacturers are increasingly adopting stainless steel, alloy steels, and non-ferrous materials such as titanium and nickel alloys to enhance performance in extreme environments. Additionally, advanced surface treatments—including zinc-nickel plating, PTFE coatings, and black oxide finishes—will gain traction to improve corrosion resistance, reduce friction, and extend product lifespan. These enhancements are particularly critical in aerospace, medical devices, and outdoor applications.

Growth in Automation and Smart Manufacturing

The integration of automation in manufacturing processes will influence both the production and application of spring hooks. By 2026, demand is expected to rise for precision-engineered spring hooks compatible with robotic assembly lines. These components must offer consistent dimensional accuracy and reliable performance to support high-speed automated systems. Furthermore, Industry 4.0 initiatives will push manufacturers to develop smart spring hooks with embedded sensors for real-time monitoring of stress, load, and fatigue—enabling predictive maintenance in industrial machinery.

Expansion in Consumer and DIY Markets

The consumer goods and do-it-yourself (DIY) sectors will continue to contribute to market growth. Spring hooks are widely used in home organization, gardening tools, fitness equipment, and retail displays. As e-commerce and home improvement trends persist, demand for affordable, versatile, and easy-to-install spring hooks will increase. Manufacturers will respond with user-friendly designs, multi-pack configurations, and environmentally conscious packaging to appeal to eco-aware consumers.

Sustainability and Regulatory Compliance

Environmental regulations and sustainability goals will shape material selection and manufacturing practices. By 2026, there will be greater emphasis on recyclable materials, energy-efficient production, and reduced hazardous substance use (e.g., RoHS and REACH compliance). Companies investing in green manufacturing and circular economy principles—such as take-back programs or recyclable product lines—are likely to gain a competitive advantage, especially in Europe and North America.

Regional Market Dynamics

Asia-Pacific, led by China, India, and Southeast Asia, will remain the fastest-growing region due to expanding industrialization, infrastructure development, and rising automotive production. Meanwhile, North America and Europe will focus on high-performance and specialized spring hooks for advanced applications in aerospace, medical technology, and renewable energy systems. Localized supply chains and nearshoring trends may also influence production strategies, reducing lead times and enhancing supply chain resilience.

In conclusion, the spring hooks market in 2026 will be defined by innovation in materials, integration with automation, and responsiveness to sustainability imperatives. Companies that align with these trends through R&D investment, strategic partnerships, and agile manufacturing will be best positioned to capture emerging opportunities across diverse end-use sectors.

Common Pitfalls When Sourcing Spring Hooks: Quality and Intellectual Property (IP) Concerns

Sourcing spring hooks—mechanical components used in various applications such as automotive, industrial equipment, and consumer goods—can present significant challenges, particularly regarding quality consistency and intellectual property (IP) protection. Below are the most common pitfalls in these two critical areas.

1. Quality-Related Pitfalls

Inconsistent Material Specifications

One of the most frequent quality issues is the use of substandard or inconsistent materials. Suppliers may substitute lower-grade steel or alloys to reduce costs, leading to reduced fatigue life, corrosion resistance, or load-bearing capacity.

Poor Dimensional Accuracy and Tolerances

Spring hooks require precise geometry to function correctly within assemblies. Sourcing from manufacturers with inadequate quality control can result in non-compliance with specified tolerances, leading to fitment issues or premature failure.

Inadequate Testing and Certification

Many suppliers, especially low-cost offshore vendors, may lack proper testing protocols (e.g., load testing, cycle testing, salt spray corrosion tests). Without documented certification (e.g., ISO 9001, IATF 16949), there is increased risk of receiving non-conforming parts.

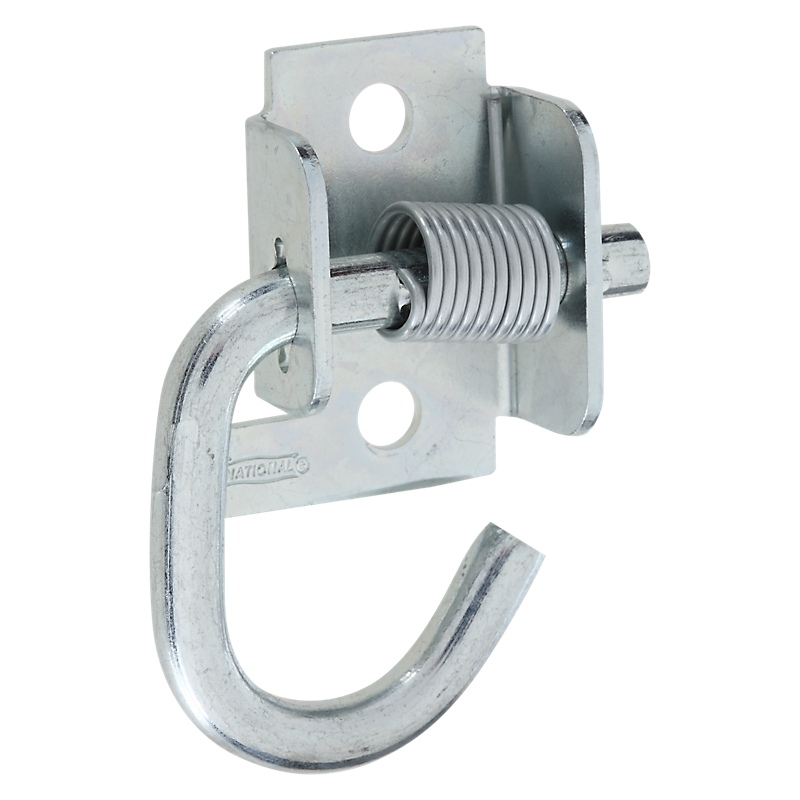

Process Variability in Manufacturing

Inconsistent heat treatment, coiling, or hook-forming processes can affect the mechanical properties of the spring. Automated vs. manual production methods can further exacerbate variability if not properly monitored.

2. Intellectual Property (IP) Risks

Design Replication and Reverse Engineering

Providing detailed CAD models or physical samples to potential suppliers exposes proprietary designs. Unscrupulous vendors may replicate and sell the design to competitors or use it in their own product lines without authorization.

Lack of IP Clauses in Contracts

Many sourcing agreements fail to include clear IP ownership language. Without a well-drafted contract, the supplier may claim partial rights to design modifications or tooling, creating legal disputes.

Unauthorized Subcontracting

Suppliers may outsource production to third-party workshops without disclosure. These subcontractors are often outside the control of IP protection agreements, increasing the risk of design leakage.

Weak Jurisdictional Enforcement

In regions with poor IP enforcement, legal recourse for design theft is limited. Even with contractual protections, enforcing IP rights across borders can be time-consuming and costly.

Mitigation Strategies

- Require material certifications and batch traceability.

- Conduct on-site audits and process validation.

- Use NDAs and robust contracts specifying IP ownership.

- Limit design disclosure—share only necessary information.

- Work with trusted suppliers in jurisdictions with strong IP laws.

- Implement stage-gated supplier qualification processes.

Addressing these pitfalls proactively ensures reliable supply, product performance, and protection of proprietary innovations.

Logistics & Compliance Guide for Spring Hooks

This guide outlines the key logistics and compliance considerations for the manufacturing, transportation, and sale of spring hooks. Adhering to these standards ensures product safety, regulatory compliance, and efficient supply chain operations.

Product Specifications and Material Compliance

Ensure all spring hooks meet defined technical specifications, including dimensions, load capacity, material composition, and corrosion resistance. Materials must comply with relevant international and regional standards such as ASTM A313 (for stainless steel springs) or ISO 4892 (for material durability). Restricted substances (e.g., lead, cadmium, or substances listed under REACH or RoHS) must be absent or within permissible limits.

Manufacturing and Quality Control

Implement a documented quality management system (e.g., ISO 9001). Conduct routine inspections during production, including tensile strength testing and dimensional accuracy checks. Maintain traceability of raw materials and finished goods through batch numbering and production logs. Third-party testing may be required for certification in certain markets.

Packaging and Labeling Requirements

Package spring hooks to prevent damage during transit, using anti-corrosion measures if necessary. Labels must include:

– Product identification (e.g., model number)

– Load rating and safety warnings

– Manufacturer name and contact information

– Country of origin

– Compliance marks (e.g., CE, UKCA, or other applicable certifications)

Ensure multilingual labeling if distributing across multiple regions.

Transportation and Shipping Logistics

Use appropriate shipping methods based on order volume and destination. Secure spring hooks to prevent shifting during transit. For international shipments:

– Prepare accurate commercial invoices and packing lists

– Classify goods using correct HS codes (e.g., 7326.90 for other articles of iron or steel)

– Comply with carrier-specific requirements (e.g., dimensional weight, hazardous materials restrictions)

Consider incoterms (e.g., FOB, DDP) to clarify responsibilities between buyer and seller.

Import/Export Regulations

Verify export controls and import requirements for target markets. Some regions may require:

– Certificates of Conformity (CoC)

– Customs documentation (e.g., import licenses, permits)

– Compliance with local safety or engineering standards (e.g., ANSI, BS)

Engage a licensed customs broker if necessary to ensure smooth clearance.

Environmental and Safety Compliance

Dispose of manufacturing waste in accordance with local environmental regulations. Provide Safety Data Sheets (SDS) if materials used are subject to OSHA’s Hazard Communication Standard. Ensure workplace safety during production per OSHA or equivalent standards.

Recordkeeping and Audit Preparedness

Retain documentation for a minimum of 5 years, including:

– Material test reports

– Certificates of compliance

– Shipping records

– Customer complaints and corrective actions

Regular internal audits help maintain compliance and identify areas for improvement.

Regulatory Updates and Market-Specific Requirements

Monitor changes in regulations across operating markets. For example:

– EU market: Ensure compliance with the Construction Products Regulation (CPR) if used in construction

– North America: Verify adherence to ANSI or ASME standards where applicable

Designate a compliance officer or team to stay current with regulatory developments.

By following this guide, businesses can ensure that their spring hooks meet all logistical and compliance obligations, minimizing risk and supporting sustainable market access.

Conclusion for Sourcing Spring Hooks

Sourcing spring hooks requires a strategic approach that balances quality, cost, supplier reliability, and specific application requirements. After evaluating various suppliers, materials, manufacturing processes, and pricing models, it is clear that selecting the right spring hook involves more than just the lowest price—it demands attention to durability, corrosion resistance, load capacity, and compliance with industry standards.

Key takeaways include the importance of partnering with suppliers who offer consistent quality control, certifications (such as ISO or industry-specific standards), and the capability to scale production as needed. Additionally, regional vs. overseas sourcing decisions must consider lead times, logistics, customs, and total landed costs.

Ultimately, an effective sourcing strategy for spring hooks combines thorough due diligence, supplier audits, material testing, and ongoing performance evaluation. By prioritizing long-term value over short-term savings, businesses can ensure reliable supply, improved product performance, and minimized risk across their operations.