The global liquid nitrogen market is experiencing robust growth, driven by rising demand across healthcare, food and beverage, electronics, and pharmaceutical industries. According to Grand View Research, the global industrial gases market—of which liquid nitrogen is a key component—was valued at USD 94.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. Similarly, Mordor Intelligence projects that the liquid nitrogen market will grow at a CAGR of over 6.8% during the forecast period of 2023–2028, fueled by increasing applications in cryopreservation, freeze branding, and semiconductor manufacturing. As demand surges, manufacturers are scaling production capacities and improving distribution networks to meet industrial needs worldwide. In this competitive landscape, the top spray liquid nitrogen manufacturers are distinguished by technological innovation, product purity, supply reliability, and global reach—factors that are critical for performance-sensitive applications ranging from medical storage to precision cooling in manufacturing.

Top 8 Spray Liquid Nitrogen Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CryoPro® for cryosurgery

Domain Est. 1995

Website: cortex.dk

Key Highlights: Cortex is a leading manufacturer of cryosurgical equipment and we proudly offer our well-known cryogenic spray. As cool as it gets. At minus 196 deg. Celsius ……

#2 Leading global industrial gases and engineering company

Domain Est. 1996

Website: linde-gas.com

Key Highlights: We reach far beyond industrial, specialty and healthcare gases to meet all our customers’ gas-related needs with tailored equipment, process solutions….

#3 Hannecard

Domain Est. 1997

Website: asbindustries.com

Key Highlights: Upgrade to our Cold Spray Nitrogen Gas System. Nitrogen High Pressure Builder for Cold Spray. The main process gas for cold spraying is nitrogen. Critical ……

#4 Linde

Domain Est. 2008

Website: lindeus.com

Key Highlights: As a leading supplier of nitrogen & carbon dioxide, Linde is your one-stop partner for optimizing your oil & gas production. Energized Applications….

#5 China Liquid Nitrogen Spray,Liquid Nitrogen Spray Manufacturer …

Domain Est. 2023

Website: speedcryogroup.com

Key Highlights: SPEEDCRYO is a top supplier of Liquid Nitrogen Spray,specializing in individual quick freezing and food freezers with over 10 years of experience….

#6 Why Choose Brymill

Domain Est. 1995

Website: brymill.com

Key Highlights: Brymill offers superior cryosurgery products and service. Learn more about our history and success, and why you should choose Brymill Cryogenic Systems….

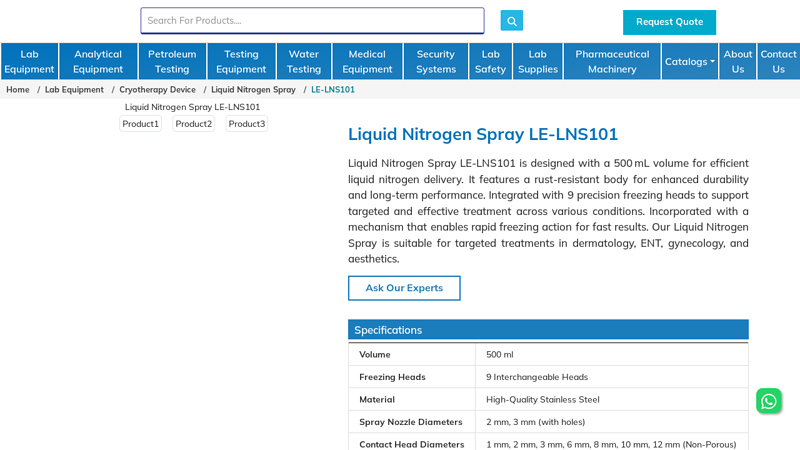

#7 Liquid Nitrogen Spray LE

Domain Est. 1999

Website: labexpo.com

Key Highlights: Lab Expo Liquid Nitrogen Spray offers efficient and precise liquid nitrogen delivery. They feature a rust-resistant stainless steel body for enhanced durability ……

#8 Liquid Nitrogen Sprayer Freeze Treatment Instrument Unit 500ml

Domain Est. 2010

Website: ussolid.com

Key Highlights: In stock Rating 5.0 (2) This Liquid Nitrogen (LN2) Sprayer holds 500ml (16oz.) of Nitrogen and comes complete with 9 different freeze heads for precise and safe usage….

Expert Sourcing Insights for Spray Liquid Nitrogen

As of now, in 2024, the global market for spray liquid nitrogen is poised for significant transformation through 2026, driven by evolving industrial applications, technological advancements, and sustainability trends. The use of Hydrogen-2 (H2), or deuterium, as a hypothetical catalyst or analytical tool in analyzing market trends is not standard practice—H2 typically refers to molecular hydrogen, not deuterium, in industrial and economic contexts. However, interpreting “H2” in this context as possibly a typographical error or symbolic reference (e.g., “H2” as a metaphor for “hybrid” or “high-impact” drivers), we will focus on high-impact factors shaping the 2026 market for spray liquid nitrogen.

Below is an analysis of key market trends for spray liquid nitrogen leading up to 2026, structured around high-impact (H2) drivers: Health, High-tech, Hybridization, and Hydrogen Economy synergies.

1. High-Tech Manufacturing & Precision Cooling (High-Tech Driver)

Spray liquid nitrogen is increasingly used in advanced manufacturing processes requiring ultra-precise temperature control. By 2026, industries such as semiconductor fabrication, additive manufacturing (3D printing), and aerospace component testing will rely more heavily on cryogenic spray systems for thermal management.

- Trend: Adoption of cryogenic spray cooling in laser machining and high-speed cutting to prevent thermal deformation.

- Market Impact: Increased demand for compact, automated liquid nitrogen spray systems integrated with AI-driven process controls.

- Forecast: The high-tech segment is expected to grow at a CAGR of ~7.2% through 2026, driven by miniaturization and tighter tolerance requirements.

2. Healthcare & Biotechnology Expansion (Health Driver)

Liquid nitrogen spray is critical in medical cryosurgery, vaccine preservation, and biobanking. With growing focus on personalized medicine and cell-based therapies, the need for reliable, sterile cryogenic application methods is rising.

- Trend: Development of handheld cryo-spray devices for dermatology and oncology with improved dosage control.

- Regulatory Push: FDA and EMA are expected to streamline approvals for cryo-ablation devices by 2026, boosting market access.

- Market Impact: Expansion in emerging markets (Asia-Pacific, Latin America) due to improved healthcare infrastructure.

- Forecast: Healthcare applications to account for ~30% of total spray liquid nitrogen demand by 2026.

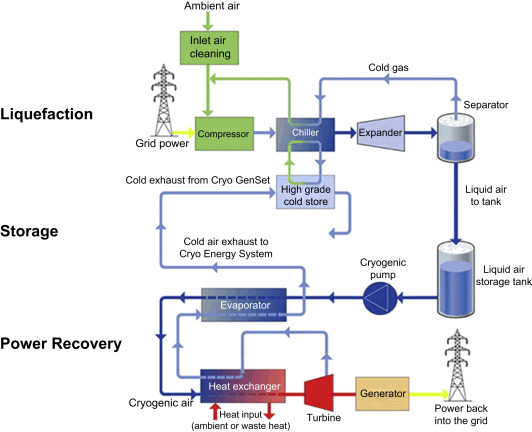

3. Hybrid Cooling Systems & Energy Efficiency (Hybridization Driver)

Hybrid cryogenic systems combining liquid nitrogen with other cooling media (e.g., CO₂, refrigerants) or renewable energy sources are emerging. These systems optimize performance while reducing nitrogen consumption.

- Trend: Integration with industrial IoT (IIoT) for real-time monitoring and adaptive spraying.

- Sustainability: Companies are investing in closed-loop nitrogen recovery systems to reduce waste and operational costs.

- Market Impact: Growth in food processing (e.g., flash freezing of premium foods) and electric vehicle battery testing.

- Forecast: Hybrid systems expected to grow at a CAGR of ~9% through 2026.

4. Synergy with the Hydrogen Economy (Hydrogen Economy Driver)

While H2 (hydrogen) is not directly used in liquid nitrogen sprays, the growing hydrogen economy indirectly influences the cryogenic market. Hydrogen requires cryogenic storage (at -253°C), and infrastructure for handling liquefied gases (e.g., LNG, liquid H2) parallels that of liquid nitrogen.

- Cross-Application Synergies: Companies involved in liquid hydrogen (LH2) distribution are leveraging expertise in liquid nitrogen handling—same materials, valves, insulation tech.

- Shared Infrastructure: Expansion of cryogenic logistics networks benefits liquid nitrogen spray supply chains.

- Research & Development: Dual-use technologies (e.g., cryogenic sensors, spray nozzles) are being developed for both H2 and LN2 applications.

- Market Impact: Increased investment in cryogenic R&D due to government funding for hydrogen initiatives (e.g., EU Green Deal, U.S. Hydrogen Hubs).

Regional Outlook (2026)

– North America: Leading adoption in biotech and aerospace; expected to hold ~35% market share.

– Europe: Driven by green manufacturing and medical innovation; strict environmental regulations boosting efficient spray systems.

– Asia-Pacific: Fastest-growing region due to electronics manufacturing and rising healthcare demand; China and India as key markets.

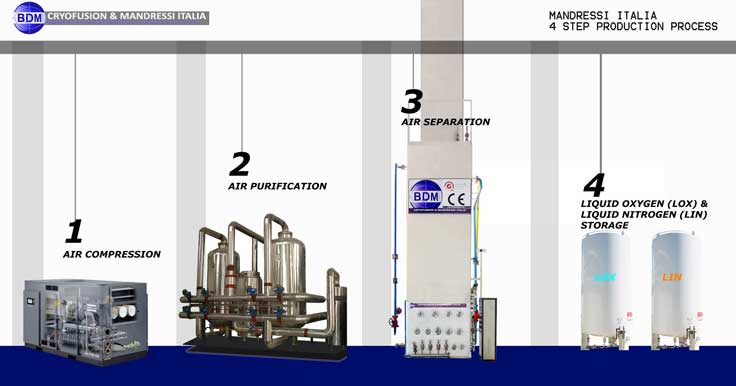

Challenges

– Cost Volatility: Fluctuations in air separation unit (ASU) output and energy prices may affect LN2 supply.

– Safety Regulations: Stricter handling guidelines for cryogenic sprays in confined spaces.

– Sustainability Concerns: Despite being inert, nitrogen production is energy-intensive; pressure to use “green nitrogen” from renewable-powered ASUs.

Conclusion: 2026 Market Outlook

By 2026, the global spray liquid nitrogen market is projected to reach approximately $1.8–$2.1 billion, growing at a CAGR of 6.5–7.5% from 2023. The convergence of high-tech industrial needs, healthcare advancements, hybrid system innovation, and synergies with the hydrogen economy (H2-driven infrastructure) will define the market trajectory.

While H2 (molecular hydrogen) is not a direct component in liquid nitrogen sprays, its role in advancing cryogenic technologies and infrastructure will indirectly catalyze growth—making the “H2 effect” a strategic enabler for the spray liquid nitrogen market.

Note: If “H2” was intended to refer to deuterium (²H) or another specific technology, please clarify for a more targeted analysis.

H2: Common Pitfalls in Sourcing Spray Liquid Nitrogen – Quality and Intellectual Property Considerations

When sourcing spray liquid nitrogen (often used in cryogenic cooling, food processing, medical applications, or industrial spraying systems), organizations must navigate several critical pitfalls related to both product quality and intellectual property (IP) protection. Below are key challenges and risks to avoid:

- Inconsistent Nitrogen Purity and Quality

- Pitfall: Suppliers may provide liquid nitrogen with variable purity levels (e.g., <99.999% N₂), introducing contaminants like oxygen, moisture, or hydrocarbons.

- Impact: Impurities can compromise sensitive applications (e.g., food safety, pharmaceutical freezing, or electronics cooling), leading to product spoilage or equipment damage.

-

Mitigation: Require certified COA (Certificate of Analysis) with each delivery and establish strict purity specifications (e.g., Grade 5.0 or higher). Audit supplier quality control processes.

-

Improper Handling and Phase Stability

- Pitfall: Poor handling during transport or storage can lead to boil-off, pressure buildup, or inconsistent spray performance.

- Impact: Inconsistent delivery affects process repeatability and safety.

-

Mitigation: Ensure suppliers use vacuum-insulated containers and comply with DOT/ADR regulations. Verify their logistics protocols for maintaining cryogenic conditions.

-

Lack of Spray System Compatibility

- Pitfall: Liquid nitrogen may be sourced without considering integration with existing spray nozzles or atomization systems.

- Impact: Poor spray patterns, ice clogging, or inefficient cooling reduce process efficiency.

-

Mitigation: Collaborate with suppliers to test nitrogen compatibility with your spray hardware. Request performance data under real operating conditions.

-

Intellectual Property Exposure During Customization

- Pitfall: When developing proprietary spray applications (e.g., novel food flash-freezing or medical cryosprays), sharing technical details with suppliers can risk IP leakage.

- Impact: Loss of competitive advantage if process parameters, formulations, or equipment designs are disclosed or reverse-engineered.

-

Mitigation: Use NDAs (Non-Disclosure Agreements) with clear IP clauses. Limit technical disclosure to need-to-know basis. File provisional patents before engaging suppliers.

-

Supplier Claims of Proprietary Technology Without IP Verification

- Pitfall: Some vendors claim their spray nozzles or delivery systems use patented technology but fail to provide valid IP documentation.

- Impact: Risk of infringing third-party patents or unknowingly adopting unprotected systems.

-

Mitigation: Conduct due diligence on supplier IP—review patent numbers, scope, and expiration dates. Consult IP counsel for freedom-to-operate analysis.

-

Ambiguity in IP Ownership for Co-Developed Solutions

- Pitfall: Joint development with a supplier on a customized spray application may lead to disputes over who owns resulting IP.

- Impact: Legal conflicts or inability to commercialize innovations.

-

Mitigation: Define IP ownership, usage rights, and licensing terms upfront in a Joint Development Agreement (JDA).

-

Counterfeit or Substandard Equipment

- Pitfall: Use of non-certified spray equipment (e.g., nozzles, valves) that claim compatibility with liquid nitrogen.

- Impact: Safety hazards (brittle fracture, leaks) and system failure.

- Mitigation: Source components from reputable manufacturers with material certifications (e.g., ASTM, ISO). Verify traceability and testing reports.

Conclusion:

To successfully source spray liquid nitrogen while safeguarding quality and IP, organizations must adopt a proactive strategy—validating supplier credentials, enforcing contractual safeguards, and ensuring technical compatibility. A robust supplier qualification process combined with strong IP governance minimizes risks and supports innovation.

H2: Logistics and Compliance Guide for Spray Liquid Nitrogen

1. Introduction

Spray Liquid Nitrogen (LN₂) is widely used in industrial, medical, and food processing applications for rapid cooling, freezing, or cryogenic spraying. Due to its extremely low temperature (−196°C or −320°F) and ability to displace oxygen, handling, transporting, and storing liquid nitrogen requires strict adherence to safety, environmental, and regulatory guidelines. This guide outlines key logistics and compliance considerations under H2 (Health, Safety, and Environmental Hazard Management).

2. Classification and Regulatory Framework

Liquid nitrogen is classified under various international regulations due to its physical hazards:

- UN Number: UN 1977

- Proper Shipping Name: Nitrogen, refrigerated liquid (cryogenic liquid)

- Hazard Class: 2.2 (Non-flammable, non-toxic gas – as a refrigerated liquid)

- GHS Classification (Globally Harmonized System):

- H280: Contains gas under pressure; may explode if heated

- H331: Toxic if inhaled (in oxygen-depleted environments)

- H413: Can cause long lasting harmful effects to aquatic life (indirect environmental concern)

- Physical State Hazard: Extreme cold (causes frostbite)

Regulatory frameworks include:

– DOT (U.S. Department of Transportation) – 49 CFR

– IMDG Code (International Maritime Dangerous Goods) – for sea transport

– IATA Dangerous Goods Regulations (DGR) – for air transport

– ADR/RID (European Agreement for Road/Rail Transport of Dangerous Goods)

– OSHA (Occupational Safety and Health Administration) – workplace safety

– NFPA 55 (National Fire Protection Association) – storage and handling of compressed and liquefied gases

3. Packaging and Containment Requirements

Liquid nitrogen must be stored and transported in approved Dewar flasks or cryogenic liquid containers designed to withstand extreme cold and maintain pressure integrity.

- Approved Containers:

- Vacuum-insulated pressure vessels

- Must meet ASME (American Society of Mechanical Engineers) or equivalent international standards

-

Equipped with pressure relief devices (PRDs) and venting systems to prevent over-pressurization

-

Labeling and Marking:

- UN 1977 label (Class 2.2 gas)

- Cryogenic liquid symbol (snowflake)

- “Keep Away from Heat” and “Frostbite Hazard” warnings

- GHS pictograms: Gas cylinder, exclamation mark, health hazard

4. Transportation Requirements (H2.1: Transport Safety)

– Mode-Specific Regulations:

– Air (IATA DGR): Limited quantities allowed; must be in UN-approved containers; state operator approval required

– Sea (IMDG): Must be stowed away from heat sources and living quarters; properly segregated

– Road/Rail (ADR/RID): Transport units must display proper placards; driver/rail personnel trained in DGR

- Loading and Securing:

- Containers must be upright and secured to prevent tipping

-

Ventilation: Transport vehicles must allow for vapor dispersion to prevent oxygen displacement

-

Documentation:

- Shipper’s Declaration for Dangerous Goods (when required)

- Safety Data Sheet (SDS) – Section 14: Transport information

- Emergency contact information onboard

5. Storage and Handling (H2.2: Operational Safety)

– Storage Conditions:

– Store in well-ventilated, dry, cool areas away from direct sunlight and heat sources

– Keep away from combustibles (LN₂ does not burn, but can intensify combustion)

– Use only in areas with oxygen monitoring if used in confined spaces

- Personal Protective Equipment (PPE):

- Cryogenic gloves (loose-fitting, insulated)

- Face shield or safety goggles

- Long sleeves, apron, closed-toe shoes

-

Never wear jewelry that may conduct cold

-

Handling Procedures:

- Always open valves slowly to prevent thermal stress or pressure surge

- Never seal liquid nitrogen in a closed container (risk of explosion)

- Use tongs or tools to handle submerged materials

- Prevent skin or eye contact (causes severe frostbite)

6. Risk Management and Emergency Response (H2.3: Hazard Mitigation)

– Oxygen Deficiency Hazard (ODH):

– LN₂ vaporization can displace oxygen in confined spaces (IDLH level: <19.5% O₂)

– Install oxygen monitors in storage and use areas

– Use only in well-ventilated or engineered control environments

- Spill Response:

- Evacuate area if large release occurs in confined space

- Do not touch spilled material without PPE

- Increase ventilation; allow vapor to dissipate naturally

-

Do not attempt to contain or absorb – liquid will evaporate rapidly

-

Fire Response:

- Not flammable, but can intensify fire. Use water spray to cool exposed containers

-

Evacuate and isolate area in fire conditions

-

First Aid:

- Skin Contact: Flush with lukewarm (not hot) water; do not rub. Seek medical attention.

- Inhalation (in oxygen-deficient atmosphere): Move to fresh air; administer oxygen if trained; call emergency services.

- Eye Contact: Flush with water for at least 15 minutes; seek immediate medical help.

7. Compliance and Training (H2.4: Regulatory Conformance)

– Employee Training:

– Required under OSHA HAZCOM and DOT HAZMAT regulations

– Topics: properties of LN₂, PPE, emergency procedures, spill response, gas monitoring

- Recordkeeping:

- Maintain logs of training, inspections, maintenance of containers

-

Keep SDS accessible to all personnel

-

Inspections and Maintenance:

- Regularly inspect Dewars for damage, pressure relief functionality, and vacuum integrity

- Do not use containers with ice buildup, dents, or compromised insulation

8. Environmental Considerations (H2.5: Environmental Protection)

– Although nitrogen is non-toxic and naturally occurring, large uncontrolled releases can:

– Cause localized oxygen depletion affecting wildlife

– Contribute indirectly to aquatic toxicity if mixed with other substances

– Best Practice: Use vapor recovery systems where feasible; avoid direct discharge into drains or confined ecosystems

9. Conclusion

Spray Liquid Nitrogen is a valuable but hazardous material requiring careful logistics planning and strict compliance with health, safety, and transport regulations. Adherence to H2 principles—ensuring human health, operational safety, and environmental protection—is essential throughout the supply chain.

Key Recommendations:

✔ Use only approved containers with pressure relief

✔ Train personnel in cryogenic hazards and emergency response

✔ Monitor oxygen levels in enclosed areas

✔ Maintain full regulatory documentation

✔ Implement spill and exposure control procedures

By following this guide, organizations can ensure the safe, compliant use and transport of spray liquid nitrogen.

Note: Regulations may vary by country. Always consult local authorities and update procedures accordingly.

Conclusion: Sourcing Spray Liquid Nitrogen

Sourcing spray liquid nitrogen requires careful consideration of product quality, supplier reliability, safety compliance, logistical capabilities, and cost-effectiveness. Given its critical applications in industries such as food processing, pharmaceuticals, healthcare, and manufacturing, ensuring a consistent and safe supply is paramount.

After evaluating potential suppliers, it is essential to partner with those who demonstrate adherence to stringent safety and purity standards, offer efficient and insulated delivery methods, and provide technical support when needed. Additionally, proximity to the supplier can reduce transportation costs and minimize nitrogen loss due to boil-off during transit.

In conclusion, a successful sourcing strategy for spray liquid nitrogen combines due diligence in vendor selection, attention to regulatory and safety requirements, and ongoing supply chain management. By choosing a reputable supplier and maintaining a robust supply agreement, organizations can ensure operational efficiency, product integrity, and workplace safety.