The global sponge metal market is experiencing robust growth, driven by rising demand in aerospace, automotive, and industrial manufacturing sectors. According to Grand View Research, the global titanium sponge market size was valued at USD 3.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence projects steady expansion in sponge metal production, citing increasing investments in metal recycling and the shift toward lightweight, high-strength materials in defense and aviation applications. With key players concentrated in Asia-Pacific, North America, and Europe, advancements in reduction processes—particularly the Kroll process—are enhancing yield and purity. This growing market momentum underscores the importance of identifying leading manufacturers that combine scale, innovation, and supply chain reliability. Below are the top 8 sponge metal manufacturers shaping the industry’s future.

Top 8 Sponge Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 2017

Website: advancemnm.com

Key Highlights: AMM is the sole manufacturer and supplier of Composite Metal Foam (CMF) and is bringing this revolutionary metallic material to global markets….

#2 Zirconium Sponge (Industrial Grade) Supplier

Domain Est. 2013

Website: samaterials.com

Key Highlights: Zirconium Sponge (Industrial Grade) is mainly used in the production of chemical corrosion-resistant equipment, and electron industry….

#3 Hafnium Sponge (Hf Sponge) Manufacturer US

Domain Est. 2022

Website: attelements.com

Key Highlights: Hafnium sponge is a high purity, coarse powdered, or granular form of iridium metal with high porosity. Hafnium metal sponge is typically 3~25mm….

#4 Titanium Sponge

Website: toho-titanium.co.jp

Key Highlights: Our titanium sponge is produced through the Kroll Process, in which titanium tetrachloride is reduced with magnesium metal. Its quality is highly evaluated ……

#5 Sponge Metal Catalysts

Domain Est. 1995

Website: matthey.com

Key Highlights: Johnson Matthey’s SPONGE METAL™ catalysts are an affordable, effective and reliable solution for slurry phase hydrogenation processes….

#6 ERG Aerospace

Domain Est. 1997

Website: ergaerospace.com

Key Highlights: ERG Specializes in metal aerospace foam air oil separators, heat exchangers, energy absorbers, flame arrestors, bird strike protection, and more!…

#7 ATI

Domain Est. 2013

Website: atimaterials.com

Key Highlights: Our capabilities range from alloy development and vacuum melting to rolling, forging, powder and additive manufacturing, with high-value fabrication services ……

#8 Titanium Sponge Powder Supplier

Domain Est. 2018

Website: aemmetal.com

Key Highlights: At AEM METAL, we deliver high-quality titanium sponge with exceptional purity, strength, and lightweight properties….

Expert Sourcing Insights for Sponge Metal

H2: 2026 Market Trends for Sponge Metal

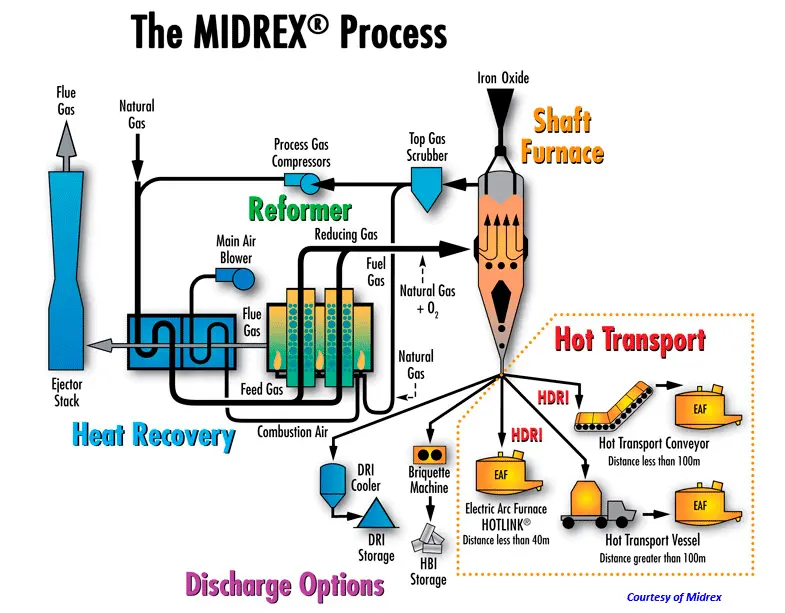

The global sponge metal market is poised for significant transformation by 2026, driven by rising demand in high-tech industries, evolving supply chain dynamics, and advancements in metallurgical processes. Sponge metal—primarily referring to porous, high-purity metals such as titanium, zirconium, and tantalum produced through reduction processes like the Kroll method—plays a critical role in aerospace, defense, medical devices, and clean energy applications.

1. Growth in Aerospace and Defense Sectors

The aerospace industry remains the largest consumer of titanium sponge, a key type of sponge metal. By 2026, increasing global aircraft production—especially from Boeing, Airbus, and emerging Chinese manufacturers like COMAC—is expected to drive sustained demand. Defense modernization programs in the U.S., China, India, and Europe will further bolster procurement of high-strength, lightweight titanium alloys, directly impacting sponge metal consumption.

2. Expansion in Medical and Biotechnology Applications

The biocompatibility of titanium and tantalum sponge metals continues to fuel demand in orthopedic implants, dental prosthetics, and surgical instruments. With aging populations in North America, Europe, and parts of Asia, the medical device sector is projected to grow, thereby increasing reliance on high-purity sponge metals. Innovations in 3D printing (additive manufacturing) of medical implants are expected to enhance material efficiency and further integrate sponge metal powders into production workflows.

3. Clean Energy and Hydrogen Economy Influence

Zirconium and titanium sponge metals are gaining importance in next-generation nuclear reactors and hydrogen production technologies. As countries invest in small modular reactors (SMRs) and green hydrogen infrastructure, demand for corrosion-resistant zirconium alloys and titanium-based components in electrolyzers is expected to rise. By 2026, government incentives and decarbonization targets will likely accelerate adoption, increasing sponge metal demand in the clean energy sector.

4. Supply Chain Resilience and Geopolitical Shifts

Geopolitical tensions and supply chain vulnerabilities—particularly around titanium sponge, currently dominated by China, Japan, and Russia—are prompting strategic re-evaluations. The U.S. and EU are investing in domestic sponge metal production to reduce dependency on foreign sources. By 2026, new production facilities in North America and Europe, supported by government funding and private investment, are expected to come online, reshaping the global supply landscape.

5. Technological Advancements and Cost Reduction

Traditional sponge metal production methods, such as the Kroll process, are energy-intensive and costly. However, by 2026, emerging technologies like the FFC Cambridge process and hybrid electrochemical methods are anticipated to gain commercial traction, offering lower costs, reduced environmental impact, and higher throughput. These innovations could disrupt the market by increasing accessibility and lowering entry barriers for new producers.

6. Price Volatility and Raw Material Constraints

Despite positive demand drivers, the sponge metal market faces risks from fluctuating raw material prices (e.g., titanium ore, magnesium, and sodium) and energy costs. Regulatory scrutiny on mining and environmental compliance may constrain feedstock availability. Producers who vertically integrate or secure long-term supply contracts are likely to maintain competitive advantages.

Conclusion

By 2026, the sponge metal market is expected to experience steady growth, underpinned by technological innovation, strategic supply chain developments, and expanding applications in high-growth sectors. While challenges related to cost, supply security, and environmental impact persist, ongoing advancements and policy support will likely position sponge metals as critical enablers of advanced manufacturing and sustainable technologies.

Common Pitfalls in Sourcing Sponge Metal: Quality and Intellectual Property Concerns

Sourcing sponge metal—such as titanium, zirconium, or tantalum sponge—poses unique challenges due to its complex production process and high-value applications in aerospace, medical, and defense industries. Buyers must be vigilant about both quality inconsistencies and intellectual property (IP) risks to avoid supply chain disruptions, regulatory non-compliance, and reputational damage.

Quality-Related Pitfalls

1. Inconsistent Chemical Composition and Purity

Sponge metal quality hinges on strict control of impurities such as oxygen, nitrogen, iron, and carbon. Poor batch-to-batch consistency often results from inadequate refining processes or substandard feedstock (e.g., low-grade ores or recycled materials). Even slight deviations can compromise mechanical properties and render the material unsuitable for critical applications like aerospace components.

2. Variable Physical Characteristics

Sponge morphology—including particle size, porosity, and surface area—affects downstream processing like melting and consolidation. Suppliers may deliver inconsistent flake sizes or excessive fines, leading to inefficient melting, increased scrap rates, and process instability in vacuum arc remelting (VAR) or electron beam melting (EBM).

3. Contamination During Handling and Packaging

Exposure to moisture, dust, or metallic contaminants during storage and transportation can degrade sponge quality. Improper packaging (e.g., non-vacuum or non-inert packaging) may lead to oxidation or hydrogen pickup, affecting final alloy performance and increasing rejection rates.

4. Lack of Traceability and Certification

Reputable suppliers provide full material test reports (MTRs) and adhere to standards such as ASTM B298 (titanium sponge) or AMS specifications. Sourcing from suppliers without traceable quality documentation increases the risk of receiving non-conforming or counterfeit material, especially in gray-market channels.

Intellectual Property-Related Pitfalls

1. Unauthorized Production Using Proprietary Processes

The Kroll or Hunter processes used to produce titanium and zirconium sponge are protected by patents and trade secrets. Sourcing from manufacturers in jurisdictions with weak IP enforcement may involve sponge produced using illegally acquired or reverse-engineered technology, exposing buyers to legal liability and reputational harm.

2. Supply Chain Opacity and “Black Box” Sourcing

Intermediaries or offshore distributors may obscure the origin of sponge metal, making it difficult to verify whether production adhered to licensed processes. This lack of transparency increases the risk of inadvertently supporting IP infringement, particularly when sourcing from low-cost regions with questionable compliance records.

3. Risk of Technology Leakage

Engaging with suppliers that lack robust IP protection measures may inadvertently expose a buyer’s own proprietary alloy formulations or processing requirements. This is especially critical when custom specifications or co-developed materials are involved.

4. Regulatory and Compliance Exposure

Using sponge metal derived from IP-infringing processes may result in import restrictions, customs seizures, or exclusion from government contracts (e.g., U.S. Defense Priorities and Allocations System). Compliance frameworks such as ITAR or EAR may be violated if materials originate from unauthorized or sanctioned sources.

Mitigation Strategies

- Conduct rigorous supplier audits focusing on process validation, quality control systems, and chain-of-custody documentation.

- Require full material traceability and compliance with international standards (e.g., ISO 9001, AS9100).

- Perform independent third-party testing of incoming sponge batches for chemistry, purity, and morphology.

- Verify IP compliance through supplier declarations, licensing disclosures, and legal due diligence, especially for high-risk regions.

- Establish long-term contracts with reputable, transparent suppliers who protect both quality and intellectual property rights.

By proactively addressing these quality and IP pitfalls, organizations can secure reliable, compliant sponge metal supplies essential for high-performance applications.

Logistics & Compliance Guide for Sponge Metal

Overview of Sponge Metal

Sponge metal, primarily referring to sponge iron (also known as direct reduced iron or DRI) or sponge titanium, is a porous form of metallic material produced through chemical reduction processes. Due to its high reactivity, pyrophoric nature (especially fine particles), and susceptibility to oxidation, sponge metal requires specialized handling, packaging, transportation, and regulatory compliance measures.

Classification and Regulatory Framework

Hazard Classification

Sponge metal is generally classified under hazardous materials due to its flammability and reactivity:

– UN Number: Varies by metal type

– UN 1394: Iron, powder, pyrophoric (for fine sponge iron)

– UN 1555: Titanium, powder, unalloyed, pyrophoric (for sponge titanium)

– Hazard Class: Class 4.2 – Substances liable to spontaneous combustion

– Packing Group: I (high danger) for pyrophoric forms

Applicable Regulations

- IMDG Code: For maritime transport (amendment 41-22, etc.)

- IATA DGR: For air transport (current edition)

- 49 CFR: For ground transport in the U.S. (DOT regulations)

- ADR/RID: For road and rail transport in Europe

- GHS (Globally Harmonized System): For classification, labeling, and SDS

Packaging Requirements

General Guidelines

- Inert Atmosphere Packaging: Sponge metal must be packaged under inert gas (e.g., argon or nitrogen) to prevent oxidation and spontaneous combustion.

- Sealed Containers: Use airtight, leak-proof steel drums or specialized ISO containers with internal liners.

- Moisture Control: Desiccants must be included to prevent moisture-induced reactions.

- Size Limitations: Avoid fine powders; granular or lump forms are preferred to reduce pyrophoric risk.

Approved Packaging Types

- UN-certified steel drums (e.g., 1A2)

- Intermediate Bulk Containers (IBCs) with protective liners

- Vacuum-sealed or nitrogen-flushed containers

- Double-walled containers for added protection

Handling and Storage

During Handling

- Personal Protective Equipment (PPE): Flame-resistant clothing, gloves, face shields, and respiratory protection.

- No Open Flames: Prohibit smoking, sparks, or welding near storage/handling areas.

- Static Control: Use grounding straps and anti-static equipment.

- Avoid Water Contact: Water can generate hydrogen gas, leading to fire or explosion.

Storage Conditions

- Environment: Cool, dry, and well-ventilated area; away from combustibles and oxidizers.

- Segregation: Store separately from acids, halogens, and oxidizing agents.

- Fire Protection: Class D fire extinguishers (for metal fires) must be available.

- Monitoring: Regular inspection for signs of heating, off-gassing, or container damage.

Transportation Requirements

Mode-Specific Guidelines

Maritime (IMDG Code)

– Properly labeled packages with Class 4.2 labels and “SPONTANEOUSLY COMBUSTIBLE” markings.

– Stowage away from heat sources and living quarters.

– Ventilation required in cargo holds.

Air (IATA DGR)

– Often prohibited or restricted due to high risk; exceptions require special approvals.

– If permitted, must be packed in Type Y containers with reduced quantities.

– Shipper must submit a Dangerous Goods Declaration and obtain airline approval.

Road/Rail (ADR/RID, 49 CFR)

– Vehicles must display Class 4.2 placards.

– Transport documents must include emergency response info.

– Drivers require hazardous materials training (e.g., DOT HAZMAT certification).

Documentation and Compliance

Required Documentation

- Safety Data Sheet (SDS): Must comply with GHS and include fire, reactivity, and first aid measures.

- Dangerous Goods Declaration: For all shipments involving regulated forms.

- Packing Certificates: Proof of UN-certified packaging.

- Export/Import Permits: Required for certain metals (e.g., titanium sponge under ITAR or dual-use controls).

Regulatory Compliance

- ITAR/EAR (U.S.): Titanium sponge may be controlled under ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations).

- REACH/CLP (EU): Registration, evaluation, and labeling under EU chemical regulations.

- Customs Declarations: Accurate HS codes (e.g., 7206.90 for sponge iron, 8108.20 for titanium sponge).

Emergency Response Procedures

Spill or Leak

- Do not touch spilled material.

- Evacuate area and eliminate ignition sources.

- Cover with dry sand or Class D extinguishing agent; do not use water.

- Contact hazardous materials response team.

Fire

- Use Class D fire extinguishers (e.g., powdered graphite, sodium chloride).

- Never use water, CO₂, or foam—may intensify fire.

- Evacuate and allow fire to burn in controlled conditions if safe.

First Aid

- Inhalation: Move to fresh air; seek medical attention.

- Skin Contact: Remove contaminated clothing; wash with dry cloth, then water.

- Eye Contact: Flush with water for at least 15 minutes; consult physician.

Best Practices Summary

- Confirm hazard class and regulatory status before shipment.

- Use inert packaging and UN-certified containers.

- Train personnel in hazardous materials handling.

- Maintain complete and accurate documentation.

- Coordinate with carriers experienced in Class 4.2 materials.

By adhering to this guide, companies can ensure the safe, compliant, and efficient logistics of sponge metal across global supply chains.

In conclusion, sourcing sponge metal requires a strategic approach that balances quality, cost, reliability, and sustainability. Key factors to consider include the purity and specifications of the metal to meet application requirements, the reputation and certifications of suppliers, and compliance with environmental and ethical mining practices. Establishing strong relationships with reputable suppliers, particularly in major producing regions such as China, Russia, or Kazakhstan, can ensure consistent supply and quality. Additionally, monitoring market trends, geopolitical risks, and fluctuations in raw material prices is essential for effective procurement planning. By conducting thorough due diligence and adopting a diversified sourcing strategy, businesses can secure reliable supplies of high-quality sponge metal while mitigating risks and supporting long-term operational success.