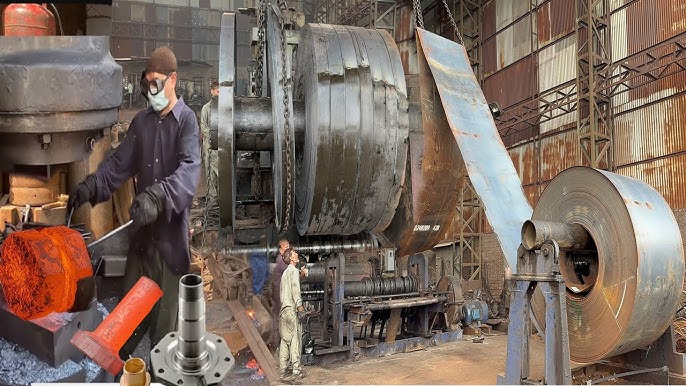

The global spindle truck market is experiencing steady growth, driven by increasing demand for heavy-duty transportation solutions in construction, mining, and logistics sectors. According to Grand View Research, the global heavy-duty truck market was valued at USD 185.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth trajectory is mirrored in the specialized segment of spindle trucks—vehicles engineered for extreme load capacity and rugged terrain performance. With infrastructure development accelerating across emerging economies and governments investing in large-scale transportation projects, the demand for high-performance spindle trucks continues to rise. As competition intensifies, innovation in axle technology, payload efficiency, and durability has become a key differentiator among manufacturers. Based on market presence, technological capabilities, and global reach, the following six companies stand out as leaders in the spindle truck manufacturing industry.

Top 6 Spindle Truck Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Belltech

Domain Est. 1995 | Founded: 1983

Website: belltech.com

Key Highlights: Established in 1983, Belltech is a manufacturer specializing in suspension for lowering, leveling and lift kits for over 40 years….

#2 Colonial Tool Group

Domain Est. 1996

Website: colonialtool.com

Key Highlights: Colonial Tool Group designs and manufactures precision spindles, broaching tools, machines, and indexable cutting tool systems for demanding industries….

#3 On-site Truck And Trailer Spindle Repair

Domain Est. 1999

Website: libertywelding.com

Key Highlights: Our family owned business owns patents on repairing and replacing truck and trailer axle housing spindles on-site. Axle repair is our main focus….

#4 Axle Spindle Repair

Domain Est. 2016

Website: trailerservicesofwesttexas.com

Key Highlights: The innovative proprietary United Axle process for spindle replacement is not only affordable but, also quickly completed on-site in under three hours….

#5 Axle & Spindle Repair

Domain Est. 2017

Website: unitedaxle.com

Key Highlights: Fast, fixed-price axle and spindle repairs for trucks and heavy-use vehicles. Trusted by transportation industry. Same-day turnarounds, no hidden costs….

#6 Top Axle Spindle Supplier of Trucks and Trailers in USA

Domain Est. 2019

Website: axlespindle.com

Key Highlights: Buy best Spindles for your trucks & trailers at Axle Spindle Inc☆ Order online – Get your spindle shipped next day! Call @716-336-4734☆USA☆Canada☆Mexico….

Expert Sourcing Insights for Spindle Truck

H2 2026 Market Trends for Spindle Trucks

As we look ahead to the second half of 2026, the market for spindle trucks—specialized heavy-duty vehicles designed for transporting extremely heavy and oversized loads, particularly in infrastructure, energy, and industrial sectors—is expected to be shaped by a confluence of economic, technological, and regulatory forces. Here’s a detailed analysis of the key trends:

1. Resurgence in Infrastructure & Energy Projects Drives Demand

- Government Investment Momentum: By H2 2026, major infrastructure initiatives launched under global stimulus packages (e.g., U.S. Infrastructure Law, EU Green Deal investments) will reach peak construction phases. Projects involving bridge replacements, rail expansions, and renewable energy installations (especially offshore wind turbines and large-scale solar farms) will heavily rely on spindle trucks for transporting pre-fabricated segments and heavy components.

- Energy Transition Acceleration: The global push for decarbonization will continue to boost demand for spindle trucks in the renewable sector. Transport of wind turbine blades, towers, and nacelles—particularly next-generation, larger units exceeding 10 MW—will require advanced multi-axle spindle configurations. Additionally, decommissioning of aging fossil fuel plants and construction of hydrogen production facilities will generate niche but consistent demand.

2. Technology Integration: Smart Spindles and Telematics

- Advanced Telematics & Monitoring: Spindle trucks will increasingly feature integrated IoT systems providing real-time load monitoring, axle weight distribution analytics, and route optimization. By H2 2026, fleet operators will demand spindle units with predictive maintenance alerts and remote diagnostics to reduce downtime and enhance safety.

- Automation & Remote Operation Trials: While full autonomy remains distant, pilot programs for semi-autonomous convoy systems (platooning) and remote-controlled spindle trailers in controlled environments (e.g., large industrial sites) may begin. This trend will be driven by labor shortages and the need for precision in hazardous or complex maneuvers.

3. Regulatory and Environmental Pressures

- Emission Standards Tighten: Stricter Euro 7 (EU) and EPA Tier 5 (U.S.) regulations will push prime movers (tractors) to be low-emission or zero-emission. While spindle trailers themselves are passive, the ecosystem will shift toward compatibility with electric or hydrogen-powered tractors. Hybrid or auxiliary power units for on-board systems (e.g., hydraulic leveling, lighting) may become standard.

- Permitting and Routing Optimization: Governments may streamline permitting for oversized loads using digital platforms and AI-driven route planning tools that consider real-time traffic, bridge load limits, and weather. This will improve efficiency and reduce delays for spindle truck operators.

4. Labor and Operational Challenges

- Driver & Technician Shortages: The specialized nature of spindle truck operation will continue to face a shortage of qualified drivers and technicians. This will drive investment in training programs and increased adoption of assistive technologies (e.g., automated ballast adjustment, stability control systems).

- Focus on Safety and Risk Management: With rising urban construction and complex transport corridors, safety will be paramount. Spindle trucks will feature enhanced visibility systems, collision avoidance sensors, and improved modular designs to reduce setup/teardown time and human error.

5. Market Consolidation and Customization

- OEM Specialization: Leading manufacturers (e.g., Scheuerle, Goldhofer, Cometto) will further differentiate through modular, customizable spindle solutions tailored to specific industries (e.g., oil & gas, aerospace, rail). Leasing and managed service models may grow as companies seek flexibility without heavy CAPEX.

- Regional Demand Variations:

- North America: Strong demand from shale energy logistics and interstate bridge projects.

- Europe: Focus on rail modernization and offshore wind.

- Asia-Pacific: Rapid infrastructure development in India and Southeast Asia will drive growth, with localized manufacturing partnerships emerging.

Conclusion

By H2 2026, the spindle truck market will be characterized by increased demand driven by infrastructure and energy transitions, deeper integration of smart technologies, and heightened regulatory scrutiny. Success will depend on manufacturers’ ability to deliver modular, connected, and compliant solutions while operators adapt to labor constraints and evolving environmental standards. Spindle trucks will remain indispensable for heavy haulage, but the ecosystem around them will be more digital, efficient, and sustainable than ever before.

Common Pitfalls Sourcing Spindle Trucks (Quality, IP)

Sourcing spindle trucks—whether for skateboards, longboards, or other applications—can present several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these pitfalls is crucial for businesses, retailers, or manufacturers to avoid costly mistakes and legal complications.

Quality Inconsistencies

One of the most prevalent issues when sourcing spindle trucks is inconsistent product quality. Many suppliers, especially those from regions with less stringent manufacturing oversight, may deliver products that vary significantly from batch to batch. Key quality concerns include:

- Material Integrity: Lower-cost spindle trucks may use substandard aluminum or steel, leading to premature wear, cracking, or failure under stress.

- Precision Tolerances: Poor machining can result in misaligned axles, uneven bushing seats, or inconsistent kingpin threading, affecting ride performance and safety.

- Finish and Corrosion Resistance: Inadequate anodizing or coating processes may lead to rust or cosmetic deterioration, reducing product lifespan.

- Lack of Testing: Reputable brands test trucks for load capacity and durability, but many generic suppliers skip these steps, increasing the risk of field failures.

To mitigate these risks, buyers should request samples, conduct third-party inspections, and verify supplier certifications (e.g., ISO standards).

Intellectual Property (IP) Infringement

Another major pitfall is the risk of sourcing spindle trucks that infringe on existing patents, trademarks, or design rights. Many established brands (e.g., Paris, Independent, Thunder) hold IP protections on specific truck geometries, hanger designs, and branding elements.

Common IP-related risks include:

- Patent Violations: Copying patented truck designs (such as kingpin angles or hanger profiles) can result in cease-and-desist letters, import seizures, or litigation.

- Trademark Infringement: Using logos, brand names, or packaging that mimics well-known brands—even unintentionally—can lead to legal action.

- Design Copying: While functional aspects may be patentable, aesthetic elements (e.g., distinctive hanger shapes) can be protected under design patents or trade dress laws.

To avoid IP issues, conduct thorough due diligence:

– Perform patent and trademark searches before finalizing designs.

– Work with suppliers who provide IP indemnification.

– Consider original design development to ensure uniqueness and compliance.

Ignoring these pitfalls can result in product recalls, damaged brand reputation, or costly legal disputes—making proactive risk management essential in the sourcing process.

Logistics & Compliance Guide for Spindle Truck

This guide outlines essential logistics procedures and compliance requirements for Spindle Truck operations. Adherence ensures safety, regulatory compliance, and efficient transportation services.

Vehicle Maintenance & Inspection

All Spindle Truck vehicles must undergo routine maintenance and pre-trip inspections in accordance with FMCSA regulations. Drivers are required to complete a DVIR (Driver Vehicle Inspection Report) after each shift. Any defects must be reported immediately and repaired before the vehicle is returned to service. Scheduled maintenance logs must be kept up to date and available for audit.

Hours of Service (HOS) Compliance

Drivers must strictly follow FMCSA Hours of Service regulations. Use of an approved Electronic Logging Device (ELD) is mandatory for recording driving time. Daily logs must accurately reflect on-duty, off-duty, driving, and sleeper berth time. Supervisors will conduct weekly audits to ensure compliance. Violations may result in fines and suspension of driving privileges.

Cargo Securement Standards

All freight transported by Spindle Truck must be secured in compliance with FMCSA cargo securement rules (49 CFR Part 393, Subpart I). Proper load distribution, tie-downs, and protective measures must be used based on cargo type. Drivers are responsible for inspecting and rechecking cargo securement at each stop and after every 50 miles during initial travel.

Driver Qualifications & Documentation

Only qualified drivers with a valid commercial driver’s license (CDL), medical examiner’s certificate, and up-to-date driving record are permitted to operate Spindle Truck vehicles. All driver files must include completed pre-employment screening, drug and alcohol testing records, and annual review documentation. Original documents must be stored securely and updated as required.

Hazardous Materials Handling (if applicable)

If Spindle Truck transports hazardous materials, drivers must possess a valid HAZMAT endorsement and current safety training certification (in compliance with 49 CFR Part 172). Proper placarding, shipping papers, and emergency response information must accompany each load. Drivers must complete HAZMAT refresher training every three years.

Insurance & Liability Coverage

Spindle Truck maintains minimum liability insurance as required by the FMCSA: $750,000 for general freight, or $5,000,000 if hauling oil or hazardous materials. Proof of insurance (Form MCS-90) must be carried in each vehicle and available upon request. Any accidents or claims must be reported to the compliance department within 24 hours.

Record Retention & Audits

All operational records—including logs, maintenance reports, inspection forms, and driver files—must be retained for a minimum of six months (logs) to three years (driver qualification files), as required by federal regulations. Spindle Truck is subject to DOT audits; all documentation must be readily accessible for inspection.

Safety & Incident Reporting

All accidents, near-misses, or safety violations must be reported immediately to the fleet manager and compliance officer. An incident report must be completed within 24 hours, including photos, witness statements, and police reports if applicable. Root cause analysis will be conducted to prevent recurrence.

State & Local Regulations

Drivers must comply with state-specific regulations, including weight limits, route restrictions, and toll requirements. IFTA fuel tax reporting and IRP registration must be maintained up to date. Oversize/overweight permits must be obtained in advance when required.

Environmental & Idling Policies

Spindle Truck enforces strict anti-idling policies to reduce emissions and fuel consumption. Drivers must limit engine idling to no more than five minutes in any 60-minute period unless for safety or operational necessity. Use of auxiliary power units (APUs) is encouraged during rest periods.

Conclusion for Sourcing a Spindle Truck

In conclusion, sourcing a spindle truck requires a comprehensive evaluation of operational needs, technical specifications, budget constraints, and long-term maintenance considerations. Selecting the right spindle truck involves not only choosing a model that aligns with current logistical and hauling demands—such as load capacity, terrain suitability, and axle configuration—but also partnering with reliable manufacturers or suppliers known for quality, durability, and after-sales support.

Conducting thorough market research, comparing new versus used options, and factoring in total cost of ownership—including fuel efficiency, maintenance, and compliance with emissions standards—will ensure a sound investment. Additionally, verifying certifications, warranty terms, and availability of spare parts contributes to minimizing downtime and maximizing operational efficiency.

Ultimately, a well-sourced spindle truck enhances productivity in heavy-haul and specialized transport applications, supporting business growth and reliability in demanding environments. By prioritizing performance, safety, and cost-effectiveness, organizations can secure a valuable asset that delivers strong returns over its service life.