The global spark plug market is experiencing steady growth, driven by rising automotive production, increasing demand for fuel-efficient engines, and the continued dominance of internal combustion engines in emerging markets. According to a report by Mordor Intelligence, the spark plug market was valued at USD 7.32 billion in 2023 and is projected to reach USD 9.23 billion by 2029, growing at a CAGR of 3.92% during the forecast period. This expansion is fueled by technological advancements such as iridium and platinum-tipped spark plugs that offer enhanced durability and performance. Additionally, Grand View Research highlights the growing aftermarket demand and the integration of advanced materials in spark plug manufacturing as key industry trends. As competition intensifies, a select group of manufacturers are leading innovation, scalability, and global market penetration—shaping the future of ignition technology. Here are the top 9 spark plug manufacturers driving this evolution.

Top 9 Spark Plug Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Niterra

Domain Est. 2004

Website: ngkntk.com

Key Highlights: Niterra is one of the leading manufacturer of ignition parts (NGK) and vehicle electronics (NTK). Niterra ▷ Outstanding ignition and sensor technology….

#2 Spark Plugs

Domain Est. 2006

Website: densoautoparts.com

Key Highlights: DENSO brand Spark Plugs deliver more Quality, Reliability, and Value than any other manufacturer….

#3 Niterra Co., Ltd.

Domain Est. 2022

Website: niterragroup.com

Key Highlights: This is the official website of Niterra Co., Ltd. which manufactures and sells NGK spark plugs and NTK new ceramics. This website discloses Corporate ……

#4 Spark Plugs

Domain Est. 1996

Website: wwwqa.motorcraft.com

Key Highlights: Motorcraft spark plugs are available for a broad range of applications, including domestic and import cars and trucks of all makes and sizes….

#5 NGK Spark Plugs

Domain Est. 1997

Website: ngksparkplugs.com

Key Highlights: With a full line of spark plugs, coils, and wire sets, NGK covers 95% of import and domestic vehicles on the market….

#6 Autolite

Domain Est. 1997

Website: autolite.com

Key Highlights: With over 85 years in spark plug manufacturing, Autolite® is the most trusted name in the industry. We offer spark plugs for your vehicle, motorcycle, lawn…

#7 NGK.com

Domain Est. 1998

Website: ngk.com

Key Highlights: NGK.com specializes in hard to find NGK products. We are not NGK Spark Plugs USA. To contact them, click here. 888-800-9629; triangle with equal sides ……

#8 DENSO SPARK PLUG

Domain Est. 2000

Website: am.denso.com

Key Highlights: DENSO spark plugs use iridium alloy for their center electrode. Because of its extremely narrow diameter of just 0.4 mm, engine output and acceleration ……

#9 Online Spark Plug Catalog

Domain Est. 2002 | Founded: 1907

Website: championautoparts.com

Key Highlights: Our spark plugs have been improving engine performance since 1907. Choose your next Champion from the range of plugs that live up to the legacy of this iconic ……

Expert Sourcing Insights for Spark Plug

H2: 2026 Market Trends for Spark Plugs

The spark plug market in 2026 is poised for a period of significant transformation, driven by the accelerating shift towards electrification, stricter emissions regulations, and the emergence of new engine technologies. While the traditional internal combustion engine (ICE) market remains substantial, particularly in developing economies and specific vehicle segments, the long-term trajectory points towards consolidation and technological refinement rather than growth. Here’s a breakdown of the key trends shaping the market:

-

Accelerating Electrification Impact:

- Declining ICE Penetration: The most dominant trend is the continued and accelerating adoption of Battery Electric Vehicles (BEVs). Governments worldwide (especially in Europe, China, and increasingly North America) are implementing stricter ICE phase-out timelines and offering strong incentives for EVs. This directly reduces the total addressable market (TAM) for spark plugs in new vehicles.

- Focus Shift to Replacement Market: With fewer new ICE vehicles being sold, the primary revenue stream for spark plug manufacturers will increasingly come from the automotive aftermarket (replacement parts). The vast existing global fleet of ICE vehicles (cars, trucks, motorcycles, off-road equipment, marine engines, generators) will ensure demand for replacements for decades, but this market is more price-sensitive and competitive.

-

Rise of Hybrid Dominance:

- Plug-in Hybrids (PHEVs) & Mild Hybrids (MHEVs): As a bridge technology, hybrids (especially PHEVs) are experiencing significant growth. While they have electric motors, they still rely on efficient ICEs that require spark plugs. The trend towards smaller, turbocharged, highly efficient engines in hybrids demands higher-performance spark plugs (e.g., Iridium, Laser Iridium, double precious metal) capable of handling higher pressures, temperatures, and potential lean-burn conditions for improved fuel economy and lower emissions.

- Increased Complexity: Hybrid engines often operate under different load and temperature profiles (e.g., frequent start-stop, extended idle periods). This drives demand for spark plugs with enhanced durability, resistance to fouling, and optimized designs to ensure reliable ignition under these varied conditions.

-

Technological Refinement for ICE Efficiency:

- Advanced Materials & Designs: Even as the ICE market shrinks, the need for maximum efficiency and minimal emissions in remaining and hybrid applications drives innovation. Expect continued dominance and refinement of Iridium and Ruthenium center electrodes, finer wire designs, surface gap plugs for specific applications, and advanced insulator materials. Focus will be on extending service life (reducing replacement frequency) and improving ignition efficiency (especially for lean-burn and high-compression engines).

- Integration with Engine Management: Spark plugs may see slight integration with engine diagnostics, providing feedback on combustion quality, although this remains limited compared to sensors like oxygen or knock sensors.

-

Regional Market Divergence:

- Developed Markets (North America, Europe, Japan): Rapid decline in new ICE sales. Market focus shifts heavily towards premium replacement plugs for aging fleets and the growing hybrid segment. Demand for ultra-long-life, high-performance plugs will be strong.

- Developing Markets (India, Southeast Asia, Africa, LATAM): ICE vehicles (especially motorcycles, scooters, and commercial vehicles) will remain dominant for longer due to lower EV infrastructure and cost sensitivity. This region will be a crucial stronghold for spark plug volume, though often favoring more economical copper/nickel or standard platinum plugs. Growth here will be slower but more sustained.

- China: A critical and complex market. While EV adoption is fastest globally, China also has a massive existing ICE fleet and a huge domestic automotive industry. The market will see intense competition in both the premium replacement segment and for cost-effective plugs for new ICE and hybrid vehicles still being produced.

-

Consolidation and Competitive Pressure:

- Market Contraction: The overall market size for new vehicle spark plugs is expected to contract in many regions by 2026.

- Increased Competition: This contraction will intensify competition among major players (NGK, Denso, Bosch, Champion) and numerous regional/Asian manufacturers. Price pressure in the replacement market will be significant.

- Focus on Innovation & Cost: Survival and profitability will depend on continuous innovation (longer life, better performance for hybrids/efficient ICEs) and operational efficiency/cost management. Diversification into adjacent markets (e.g., industrial engines, marine, powersports) may become more important.

-

Sustainability and Manufacturing:

- Material Sourcing: Increased focus on the sustainable sourcing of precious metals (Iridium, Platinum, Ruthenium) due to supply chain concerns and ESG (Environmental, Social, Governance) pressures.

- Recycling: Enhanced recycling programs for spent spark plugs containing valuable precious metals will gain importance.

Conclusion for 2026:

The spark plug market in 2026 will be characterized by managed decline in new vehicle fitment, driven by electrification, but sustained by a massive replacement market and the specific demands of hybrid vehicles. Success will depend on:

- Dominance in the Aftermarket: Providing reliable, high-quality replacement plugs for a vast global ICE fleet.

- Leadership in Hybrid Technology: Supplying advanced, durable spark plugs optimized for the unique operating conditions of PHEVs and MHEVs.

- Technological Innovation: Continuously improving performance, longevity, and efficiency to meet stringent emissions and fuel economy standards in remaining ICE applications.

- Geographic Strategy: Balancing focus between declining developed markets and growth potential in developing regions.

- Cost Management & Consolidation: Navigating intense competition and margin pressure.

While the long-term future points towards obsolescence for new passenger vehicles, 2026 will still see the spark plug as a critical, high-tech component, particularly within the hybrid ecosystem and the enduring global replacement market. Adaptability and focus on value will be paramount.

Common Pitfalls When Sourcing Spark Plugs (Quality & Intellectual Property)

Sourcing spark plugs, especially for automotive or industrial applications, involves critical considerations around both product quality and intellectual property (IP) risks. Overlooking these factors can lead to performance failures, safety hazards, and legal liabilities. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Substandard Materials and Construction

Many low-cost spark plugs use inferior base metals (e.g., nickel alloys with poor heat resistance) or inadequate insulator ceramics. This leads to premature wear, misfiring, and engine damage. Always verify material specifications and insist on compliance with OEM standards (e.g., NGK, Denso, Bosch).

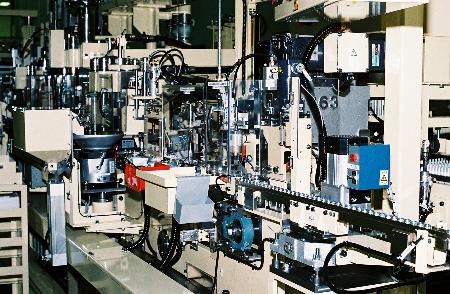

2. Inconsistent Manufacturing Tolerances

Poorly controlled production processes result in variations in electrode gap, thread pitch, and reach length. Even minor deviations can cause improper seating, poor combustion, or cylinder head damage. Require suppliers to provide certification (e.g., ISO 9001) and conduct dimensional audits.

3. Lack of Performance Validation

Some suppliers claim compatibility with multiple engine types without actual testing. Always request independent test data (e.g., thermal cycling, spark endurance) and validate plug performance under real operating conditions.

4. Counterfeit or Repackaged Products

The market is flooded with counterfeit spark plugs bearing fake branding of reputable manufacturers. These often fail quickly and can void engine warranties. Source only from authorized distributors and use verification tools (e.g., holograms, batch traceability).

Intellectual Property (IP) Pitfalls

1. Infringement of Patented Designs

Many spark plug features—such as fine-wire iridium tips, tapered ground electrodes, or specific insulator shapes—are protected by patents. Sourcing generic versions that replicate these designs can expose your company to IP litigation. Conduct freedom-to-operate (FTO) analyses before procurement.

2. Unauthorized Use of Trademarks

Using packaging or labeling that mimics established brands (e.g., color schemes, logos) may constitute trademark infringement, even if the product is technically different. Ensure that all branding and labeling are original and compliant with local IP laws.

3. Grey Market Imports

Purchasing spark plugs through unauthorized channels may result in IP violations, especially if the products were intended for a different region (parallel imports). Many OEMs enforce strict territorial IP rights, and resale can breach distribution agreements.

4. Lack of IP Documentation

Failing to obtain IP indemnification or documentation from suppliers leaves your business exposed. Always include IP warranties in contracts and confirm that the supplier owns or has licensed the right to manufacture and sell the product.

Best Practices to Mitigate Risks

- Partner with reputable, certified suppliers and verify their production facilities through audits.

- Require full traceability, including batch numbers and material certifications.

- Conduct pre-shipment inspections and performance testing.

- Consult IP counsel to review sourcing decisions, especially for high-volume or OEM-intent applications.

- Maintain clear documentation of compliance and due diligence.

By addressing both quality and IP concerns proactively, companies can ensure reliable performance, regulatory compliance, and legal protection in their spark plug sourcing strategy.

Logistics & Compliance Guide for Spark Plugs

Introduction

Spark plugs are essential components in internal combustion engines, and their global distribution requires adherence to specific logistics and compliance standards. This guide outlines key considerations for the safe, legal, and efficient transportation and handling of spark plugs across supply chains.

Classification and Packaging

Spark plugs are generally classified as non-hazardous automotive parts under international shipping regulations. However, proper packaging is critical to prevent damage during transit.

– Use durable, shock-resistant packaging such as corrugated cardboard with internal dividers or molded trays.

– Ensure packaging prevents movement and contact between individual spark plugs.

– Label packages with product identification, part numbers, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

Regulatory Compliance

Compliance with regional and international regulations is required to avoid customs delays and legal penalties.

– REACH (EU): Confirm that materials used (e.g., nickel, copper, ceramic insulators) comply with REACH regulations regarding restricted substances.

– RoHS (EU & others): Verify that spark plugs are free from restricted hazardous substances such as lead, cadmium, and mercury.

– Proposition 65 (California, USA): Provide clear warnings if spark plugs contain chemicals listed under Prop 65, such as lead or nickel.

– Customs Documentation: Include accurate Harmonized System (HS) codes (typically 8511.30 for spark plugs) on commercial invoices and packing lists.

Transportation and Shipping

Spark plugs are commonly shipped via air, sea, or ground freight. Key logistics considerations include:

– Air Freight (IATA): No special restrictions apply as spark plugs are non-hazardous. Ensure packaging meets IATA standards for general cargo.

– Sea Freight (IMDG): Classify as “Not Restricted” under IMDG Code. Standard containerized shipping is suitable.

– Ground Transport (DOT/ADR): No hazardous materials designation; standard automotive parts regulations apply.

Import/Export Requirements

- Obtain necessary export licenses if shipping to restricted countries or regions.

- Comply with import regulations in destination countries, including conformity assessments (e.g., CE marking in Europe, E-Mark for automotive components).

- Maintain records of compliance documentation (e.g., material declarations, test reports) for audit purposes.

Storage and Handling

- Store in a dry, temperature-controlled environment to prevent corrosion of metal components.

- Avoid exposure to moisture, oils, and contaminants.

- Use first-in, first-out (FIFO) inventory practices to ensure product freshness and traceability.

Environmental and Disposal Considerations

- End-of-life spark plugs may contain recyclable metals (e.g., copper, nickel, precious metals in electrodes).

- Encourage recycling through take-back programs or certified e-waste handlers.

- Follow local regulations for disposal of non-recyclable components (e.g., ceramic insulators).

Conclusion

Proper logistics and compliance management ensures the reliable delivery of spark plugs while meeting global regulatory standards. Regular audits, supplier certifications, and updated compliance documentation are essential for maintaining supply chain integrity.

In conclusion, sourcing spark plugs requires careful consideration of several key factors, including engine compatibility, material quality, brand reputation, and cost-effectiveness. Selecting the right spark plug ensures optimal engine performance, fuel efficiency, and longevity of the ignition system. Whether sourcing for original equipment manufacturing, replacement in automotive repair, or specialty applications, it is essential to procure from reliable suppliers who adhere to industry standards and provide consistent product quality. By evaluating technical specifications, conducting supplier assessments, and balancing cost with performance needs, organizations can make informed sourcing decisions that support reliable engine operation and long-term value.