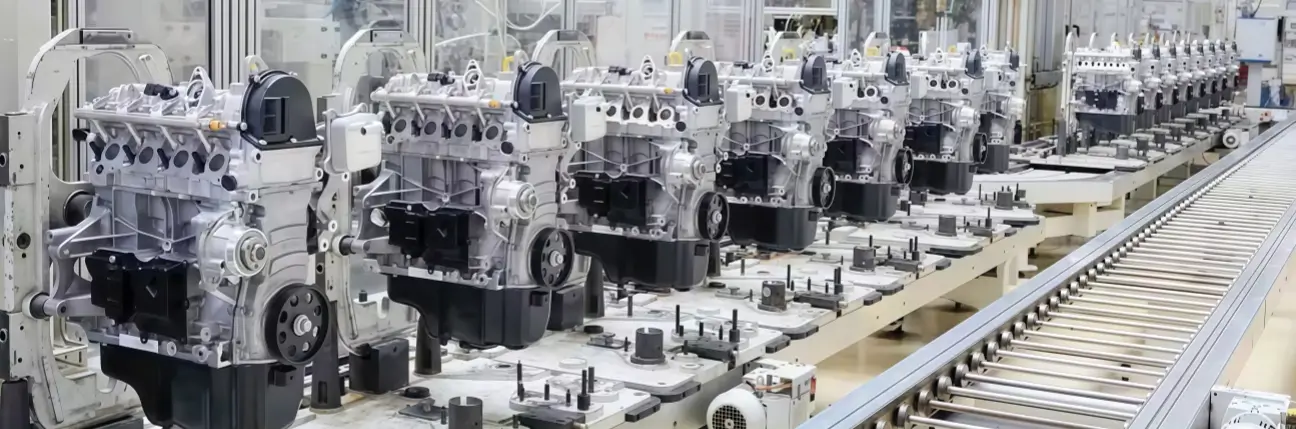

The global spare parts manufacturing industry is undergoing rapid expansion, driven by rising demand across automotive, industrial machinery, aerospace, and heavy equipment sectors. According to a 2023 report by Grand View Research, the global automotive spare parts market alone was valued at USD 339.8 billion and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Similarly, Mordor Intelligence projects that the broader industrial spare parts market will witness steady growth, fueled by increasing maintenance, repair, and operations (MRO) expenditures and the need for minimizing equipment downtime. With digitization, predictive maintenance, and supply chain resilience shaping procurement strategies, identifying the most reliable and innovative manufacturers has become critical for businesses aiming to optimize performance and reduce operational costs. In this data-driven landscape, the following ten companies stand out as leaders in quality, global reach, and technological advancement in spare parts manufacturing.

Top 10 Spare Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Genuine Parts Company

Domain Est. 1995 | Founded: 1928

Website: genpt.com

Key Highlights: Established in 1928, Genuine Parts Company is a leading global service provider of automotive and industrial replacement parts and value-added solutions….

#2 ACDelco: OEM & Aftermarket Auto Parts

Domain Est. 1996

Website: gmparts.com

Key Highlights: ACDelco offers the only aftermarket parts backed by GM. ACDelco’s Gold and Silver lines of premium aftermarket parts offer a precise fit for GM vehicles….

#3 OEM Parts Online

Domain Est. 2015

Website: oempartsonline.com

Key Highlights: At OEM Parts Online, we make it easier to shop for auto parts online. Find the right part at the right price by searching our collection of OEM catalogs….

#4 Shop GM Genuine Parts & ACDelco Parts for Chevrolet Vehicles

Domain Est. 1994

#5 Valeo Service

Domain Est. 2000

Website: valeoservice.com

Key Highlights: Valeo Service, the original equipment and car spare parts specialist, offers a complete range of parts and accessories for cars, trucks, and commercial ……

#6 Dorman Products

Domain Est. 2001

Website: dormanproducts.com

Key Highlights: Dorman gives auto repair professionals and vehicle owners greater freedom to fix cars and trucks by focusing on solutions first….

#7 Champion Auto Parts

Domain Est. 2002

Website: championautoparts.com

Key Highlights: The legend of Champion auto parts lives in through our innovative, time-tested, and quality replacement parts. No matter what you drive, make it a Champion….

#8 Bosch Auto Parts

Domain Est. 2004 | Founded: 1997

Website: boschautoparts.com

Key Highlights: World Leader and Supplier of Diesel Fuel Injection Systems. Since 1997, Bosch common rail injectors have been the industry standard for Diesel Fuel systems….

#9 DENSO Auto Parts

Domain Est. 2006

Website: densoautoparts.com

Key Highlights: DENSO is a global choice for top automakers, with multiple vehicle models rolling off the assembly line with DENSO auto parts under the hood….

#10 ERA

Domain Est. 2012

Website: eraspares.com

Key Highlights: ERA is a historic Italian company based in Moncalieri, Turin, and is specialized in the distribution of electric and electronic spare parts….

Expert Sourcing Insights for Spare Parts

H2 2026 Market Trends for Spare Parts

The global spare parts market in H2 2026 is expected to be shaped by a confluence of technological advancements, evolving customer demands, and strategic shifts driven by sustainability and supply chain resilience. Key trends include:

1. Accelerated Adoption of Digitalization and Predictive Maintenance:

* AI & Machine Learning Dominance: Predictive maintenance platforms using AI will become standard, analyzing real-time IoT sensor data to forecast part failures with high accuracy. This reduces unplanned downtime and optimizes spare parts inventory (moving towards “just-in-time” or even “just-in-case” models based on risk).

* Digital Twins Proliferation: Widespread use of digital twins for complex machinery (industrial equipment, aviation, automotive) will allow for virtual testing of part performance and failure scenarios, informing better spare parts forecasting and design.

* Enhanced E-Commerce & Marketplaces: B2B e-commerce platforms will mature significantly, offering seamless integration with ERP/MES systems, AI-powered part search (including image recognition), dynamic pricing, and transparent logistics tracking. Niche and aftermarket platforms will challenge OEM dominance.

2. Circular Economy & Sustainability Imperatives:

* Remanufacturing & Refurbishment Boom: Driven by cost pressures, ESG goals, and supply chain constraints, remanufactured and refurbished parts will gain significant market share, especially in automotive, industrial, and medical equipment. Quality standards and certifications will become crucial differentiators.

* Closed-Loop Systems: OEMs and large operators (e.g., airlines, mining) will increasingly implement closed-loop systems where used parts are systematically collected, remanufactured, and re-introduced, reducing waste and virgin material consumption.

* Regulatory Pressure: Stricter regulations (e.g., EU Ecodesign for Sustainable Products Regulation – ESPR) will mandate design for repairability, durability, and availability of spare parts, forcing manufacturers to adapt.

3. Supply Chain Resilience and Localization:

* Geographic Diversification: Companies will continue shifting from pure “just-in-time” to “just-in-case” or “just-in-resilience” models, diversifying suppliers and establishing regional/near-shore hubs to mitigate geopolitical and logistical risks.

* Additive Manufacturing (3D Printing) Maturation:

* On-Demand & Low-Volume Production: 3D printing will become a mainstream solution for producing obsolete parts, low-demand spare parts, and complex components on-demand, reducing inventory costs and lead times, particularly for legacy equipment.

* Spare Parts as a Service (SPaaS): OEMs and specialized providers will offer SPaaS models where they manage the digital inventory and print parts locally upon request, shifting from physical stock to intellectual property and service models.

* Blockchain for Traceability: Increased use of blockchain to ensure part authenticity, track provenance (especially critical for safety parts), prevent counterfeiting, and manage warranties.

4. Shifting Competitive Landscape & Business Models:

* OEM vs. Aftermarket Intensification: The battle between OEMs (leveraging data, connectivity, and brand) and the independent aftermarket (offering cost savings and innovation) will intensify. Data access (telematics, repair codes) will be a key battleground.

* Rise of Service-Led Models: The focus will shift from selling parts to selling uptime and performance. Outcome-based contracts (e.g., “power-by-the-hour” in aviation, “uptime guarantees”) will tie spare parts provision directly to service level agreements (SLAs).

* Consolidation: M&A activity is expected to continue as players seek scale, technology, geographic reach, and integrated service capabilities to compete effectively.

5. Evolving Customer Expectations:

* Demand for Speed & Transparency: Customers will expect faster delivery (leveraging local hubs, 3D printing), real-time tracking, and complete transparency on part origin, history, and pricing.

* Personalization & Customization: Demand for customized solutions and kits for specific maintenance procedures will grow, enabled by digital platforms and flexible manufacturing.

Conclusion for H2 2026:

The spare parts market in H2 2026 will be characterized by digitization, sustainability, and resilience. Success will depend on leveraging data and AI for predictive insights, embracing circular economy principles (remanufacturing, 3D printing), building agile and transparent supply chains, and evolving towards service-oriented business models. Companies that fail to adapt to these interconnected trends risk significant competitive disadvantage. The focus will be firmly on maximizing asset uptime while minimizing environmental impact and operational risk.

Common Pitfalls Sourcing Spare Parts (Quality, IP)

Sourcing spare parts, especially for legacy or specialized equipment, presents numerous challenges. Two of the most critical areas where organizations face risks are quality inconsistencies and intellectual property (IP) violations. Overlooking these pitfalls can lead to operational downtime, safety hazards, legal liabilities, and reputational damage.

Quality-Related Pitfalls

1. Inconsistent or Substandard Materials and Workmanship

One of the most frequent issues is receiving spare parts that do not meet original equipment manufacturer (OEM) specifications. Non-certified suppliers may use inferior materials or cutting corners in manufacturing, leading to premature part failure, reduced equipment performance, and increased maintenance costs.

2. Lack of Certifications and Traceability

Many third-party or gray-market suppliers fail to provide proper documentation such as material test reports, conformity certificates (e.g., ISO, AS9100), or traceability records. Without these, it becomes difficult to verify compliance with industry standards or regulatory requirements—especially in highly regulated sectors like aerospace, medical devices, or energy.

3. Counterfeit or Refurbished Parts Sold as New

Counterfeit parts are a major concern, particularly in industries with long equipment lifecycles. Fraudulent suppliers may recondition used parts and market them as new, or produce unauthorized copies. These parts often lack reliability and can pose serious safety risks.

4. Inadequate Testing and Quality Control Processes

Some suppliers implement minimal or no quality assurance protocols. Without rigorous testing—such as dimensional checks, stress tests, or performance validation—there’s no assurance that the part will function as intended under real-world conditions.

Intellectual Property (IP)-Related Pitfalls

1. Unauthorized Production and Trademark Infringement

Sourcing spare parts from unauthorized manufacturers may involve IP violations, such as copying patented designs, using protected trademarks, or replicating proprietary technology without licensing. Even if the part functions correctly, purchasing such components exposes the buyer to legal risk, especially if the OEM pursues litigation.

2. Risk of Legal Action from OEMs

Original Equipment Manufacturers often protect their designs through patents, copyrights, and trade secrets. Third-party production of identical parts—especially those with complex engineering—can infringe on these rights. Companies sourcing such parts may be named in lawsuits or forced to pay damages, even if they were unaware of the infringement.

3. Voided Warranties and Service Agreements

Using non-OEM or unlicensed spare parts can void equipment warranties or invalidate service contracts. OEMs frequently stipulate that only approved components be used during maintenance. Sourcing parts outside authorized channels may thus lead to unexpected costs and loss of support.

4. Lack of Licensing Agreements with Reverse-Engineered Parts

In some cases, suppliers reverse-engineer parts to bypass IP protections. While reverse engineering may be legal under certain jurisdictions and circumstances, selling or using such parts can still raise IP disputes, particularly if the design involves protected elements beyond functional aspects (e.g., embedded software, unique configurations).

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Prioritize suppliers with verifiable certifications and quality management systems.

– Conduct thorough due diligence, including audits and sample testing.

– Verify IP compliance by requesting documentation on design rights and licensing.

– Establish clear procurement policies that favor OEM or licensed aftermarket parts.

– Maintain traceability and documentation for all sourced components.

By proactively addressing quality and IP concerns, businesses can ensure operational reliability, regulatory compliance, and long-term cost efficiency in their spare parts sourcing strategy.

Logistics & Compliance Guide for Spare Parts

This guide outlines key logistics and compliance considerations for managing spare parts throughout their lifecycle—from procurement and transportation to storage, handling, and disposal. Adhering to these practices ensures operational efficiency, regulatory compliance, and supply chain resilience.

Procurement & Supplier Management

Establish clear specifications for spare parts, including OEM/aftermarket designations, material composition, and performance standards. Vet suppliers based on quality certifications (e.g., ISO 9001), delivery reliability, and compliance with relevant industry and environmental regulations. Ensure contracts include compliance clauses related to restricted substances (e.g., RoHS, REACH) and traceability requirements.

Classification & Documentation

Accurately classify spare parts using standardized systems such as HS (Harmonized System) codes for international trade. Maintain up-to-date documentation, including bills of lading, commercial invoices, certificates of origin, and material safety data sheets (MSDS/SDS) where applicable. Proper classification supports correct duty assessment and customs clearance.

Import & Export Compliance

Comply with export control regulations (e.g., EAR, ITAR) when shipping controlled spare parts across borders. Obtain required licenses or authorizations for dual-use or sensitive components. For imports, verify country-specific regulations, tariff rates, and any import restrictions or quotas. Utilize Authorized Economic Operator (AEO) programs where available to expedite customs processes.

Transportation & Handling

Select appropriate transportation modes (air, sea, ground) based on part criticality, shelf life, and delivery timelines. Use secure packaging that prevents damage and includes proper labeling (part number, handling instructions, hazardous indicators if applicable). For temperature-sensitive or fragile components, implement climate-controlled logistics and shock monitoring.

Inventory Management & Warehousing

Store spare parts in organized, labeled locations with environmental controls as needed (e.g., humidity, temperature). Implement inventory tracking systems (e.g., ERP, WMS) using barcoding or RFID to ensure traceability and prevent obsolescence. Conduct regular audits to reconcile physical stock with system records and support Just-in-Time (JIT) or vendor-managed inventory (VMI) models where applicable.

Regulatory Compliance & Certifications

Ensure spare parts meet industry-specific regulations (e.g., FAA for aviation, FDA for medical equipment, ATEX for explosive environments). Maintain certifications and test reports for quality and safety compliance. Track regulatory changes and update procedures accordingly to avoid non-compliance penalties.

Returns & Reverse Logistics

Establish a structured process for handling returned spare parts, including inspection, repair, recycling, or disposal. Comply with WEEE (Waste Electrical and Electronic Equipment) directives and other environmental regulations for end-of-life parts. Document returns for warranty, quality analysis, and regulatory reporting.

Risk Management & Business Continuity

Identify risks related to supply chain disruptions, counterfeit parts, and regulatory changes. Diversify suppliers, maintain safety stock for critical components, and conduct regular compliance training for logistics personnel. Develop contingency plans to ensure uninterrupted operations during disruptions.

Data Security & Traceability

Protect digital records related to spare parts logistics, including supplier data, shipment tracking, and compliance documentation. Ensure traceability from origin to end use, especially in regulated industries, using serialization and digital logs to support recalls or audits.

By following this guide, organizations can streamline spare parts logistics, reduce compliance risks, and enhance operational reliability across global supply chains.

In conclusion, effective sourcing of spare parts is critical to ensuring operational continuity, minimizing downtime, and optimizing maintenance costs across industries. A well-structured sourcing strategy should balance factors such as cost, quality, lead time, supplier reliability, and inventory management. Leveraging both local and global suppliers, embracing digital procurement tools, and maintaining strong supplier relationships contribute to a resilient supply chain. Additionally, adopting preventive measures like maintaining a critical parts inventory and utilizing data analytics for demand forecasting enhances responsiveness to unexpected failures. Ultimately, strategic spare part sourcing not only supports equipment reliability and longevity but also strengthens overall operational efficiency and competitiveness in an increasingly dynamic industrial environment.