The global drone components market is experiencing robust expansion, driven by rising demand across commercial, defense, and consumer applications. According to Grand View Research, the global drone market size was valued at USD 22.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.8% from 2024 to 2030. This surge is fueled by advancements in autonomous systems, increased adoption in precision agriculture, infrastructure inspection, and expanding regulatory support for beyond visual line of sight (BVLOS) operations. As drone fleets scale, so does the need for reliable spare parts—including motors, propellers, flight controllers, batteries, and cameras—creating a booming aftermarket segment. With Mordor Intelligence forecasting similar momentum, including a CAGR of over 12% through 2029, the demand for high-performance, durable, and easily replaceable components is reshaping supply chains and elevating the importance of specialized spare parts manufacturers. In this evolving landscape, identifying top-tier suppliers becomes critical for operators aiming to maximize uptime and operational efficiency.

Top 9 Spare Drone Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 UAV Components

Domain Est. 2011

Website: unmannedsystemstechnology.com

Key Highlights: Find UAV component manufacturers & suppliers of parts for drones, unmanned systems, vehicles & accessories; UAV engines, sensors, antennas, ground equipment ……

#2 UAV & Drone Parts, UAV Accessories Suppliers

Domain Est. 2002

Website: store.foxtech.com

Key Highlights: 7-day returnsExplore our extensive range of accessories for UAV equipment, including data links, frames, motors, batteries, and more….

#3 High

Domain Est. 2012

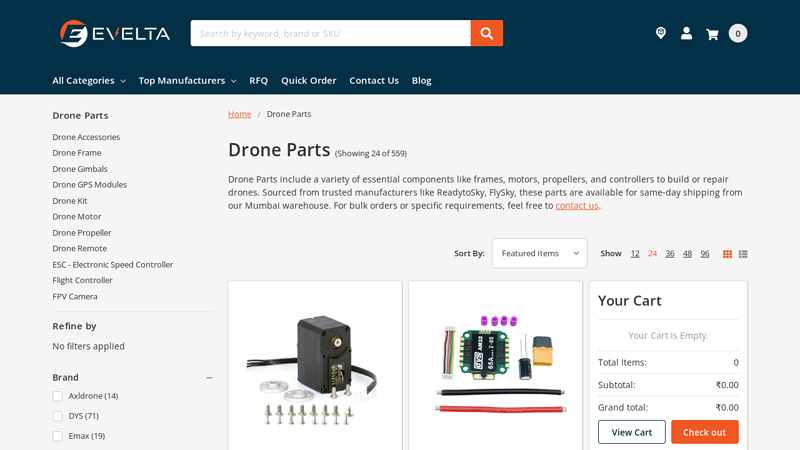

Website: evelta.com

Key Highlights: 14-day returnsDrone Parts include a variety of essential components like frames, motors, propellers, and controllers to build or repair drones….

#4 Drone Spare Parts

Domain Est. 2013

Website: hse-uav.com

Key Highlights: Drone Spare Parts. Shop Raptor’s Spare Parts for DJI & XAG Spraying Drones (& UGV)….

#5 Shop All Accessories

Domain Est. 2014

Website: dronenerds.com

Key Highlights: Free delivery over $599 · 10-day returnsQuadcopter & Drone Replacement Parts and Accessories. There are many reasons you may need to buy parts and accessories for your drone….

#6 Rotor Riot

Domain Est. 2015

Website: rotorriot.com

Key Highlights: Free delivery over $100 · 15-day returnsRotor Riot is the premier source for FPV Drones and Kwad Lifestyle. Our Top Pilots have chosen the BEST components so you can shop with con…

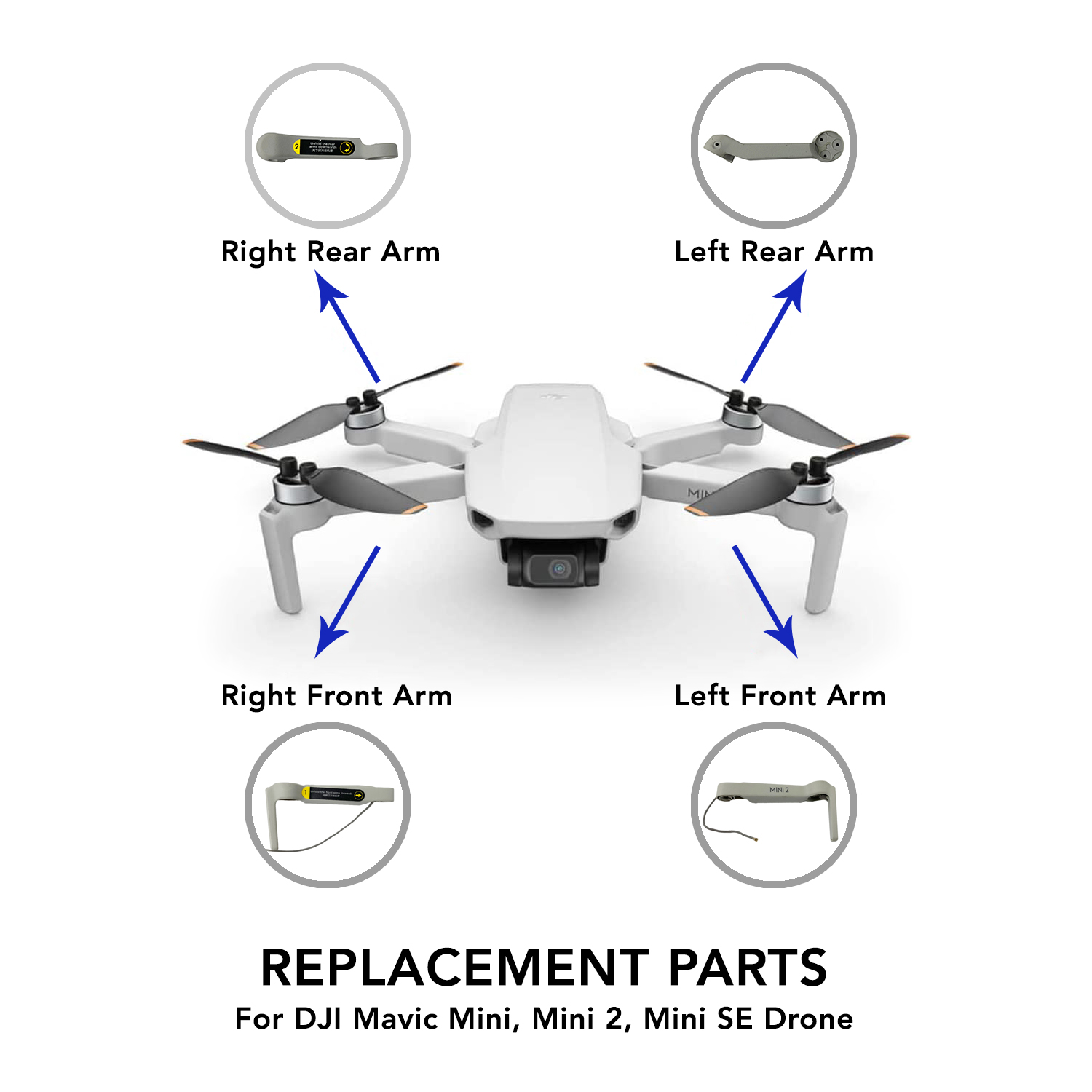

#7 DJI Drone Spare Replacement Parts

Domain Est. 2015

Website: cloudcitydrones.com

Key Highlights: Free delivery over $30 14-day returnsCloud City offers expert services and a vast inventory of DJI spare parts. Find high-quality DJI drone replacement parts for repairs and upgrad…

#8 Parts Center

Domain Est. 2016

Website: store.effort-tech.com

Key Highlights: WELCOME TO · ZP Series Parts · Z20 Parts · EP Series Parts · G410 G610 G616 Parts · G420 G620 G630 Parts · G06 G20 G20Q Parts · X6100/X6120 Parts….

#9 4DRC Drone Accessories

Domain Est. 2020

Expert Sourcing Insights for Spare Drone Parts

2026 Market Trends for Spare Drone Parts

The global spare drone parts market is poised for significant transformation by 2026, driven by technological advancements, expanding commercial applications, and evolving regulatory frameworks. Key trends shaping the industry include:

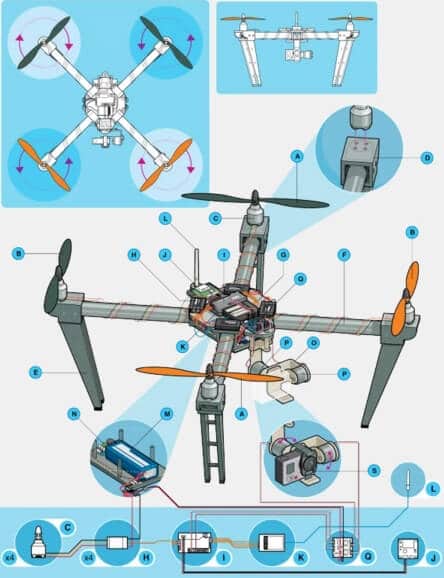

Accelerated Adoption of Modular and Swappable Components

By 2026, modular design principles will dominate drone manufacturing, especially in enterprise and industrial sectors. OEMs and third-party suppliers will increasingly offer standardized, plug-and-play spare parts—such as quick-release motors, swappable batteries, and tool-less propeller systems—to minimize downtime and simplify maintenance. This shift will be fueled by the growing demand for operational efficiency in logistics, agriculture, and infrastructure inspection, where rapid repairs are critical. As a result, the market for modular spare parts is expected to grow at a CAGR exceeding 18% through 2026.

Rise of AI-Driven Predictive Maintenance and On-Demand Supply Chains

Artificial intelligence and IoT integration will revolutionize spare parts logistics. Drone fleets equipped with embedded sensors will transmit real-time performance data, enabling AI algorithms to predict component failures before they occur. This predictive capability will drive a surge in demand for just-in-time spare parts delivery, particularly for high-wear items like propellers, motors, and landing gears. By 2026, leading drone service providers will partner with AI-powered inventory platforms to automate reordering and reduce overstocking, creating a more responsive and cost-effective spare parts ecosystem.

Expansion of Aftermarket and Third-Party Component Ecosystems

As drone fleets age and legacy models remain in service, the aftermarket for compatible, cost-effective spare parts will expand significantly. Independent manufacturers will gain market share by offering certified, lower-cost alternatives to OEM parts—especially in regions with high drone utilization such as North America, Europe, and parts of Asia-Pacific. Regulatory bodies may introduce clearer certification standards by 2026, legitimizing third-party components and increasing competition, which will ultimately drive innovation and reduce prices.

Increased Focus on Sustainability and Component Reconditioning

Environmental concerns and ESG (Environmental, Social, and Governance) mandates will push companies toward sustainable practices in drone operations. By 2026, reconditioned and refurbished spare parts—particularly batteries, gimbals, and flight controllers—will gain traction as a cost-efficient and eco-friendly alternative. OEMs and service centers will launch take-back and remanufacturing programs, reducing electronic waste and extending the lifecycle of drone components. This trend will be supported by evolving consumer preferences and potential regulatory incentives.

Geopolitical and Supply Chain Resilience Considerations

Global supply chain volatility will continue to influence the spare drone parts market. In response, manufacturers will localize production and establish regional distribution hubs to mitigate risks from geopolitical tensions and logistics disruptions. By 2026, regional hubs in Southeast Asia, Eastern Europe, and Latin America will emerge as key suppliers of spare parts, supporting local drone economies and reducing dependency on single-source components, particularly semiconductors and advanced sensors.

In summary, the 2026 spare drone parts market will be characterized by modularity, intelligence, sustainability, and regional diversification. Stakeholders who invest in agile supply chains, predictive technologies, and sustainable practices will be best positioned to capitalize on these evolving dynamics.

Common Pitfalls When Sourcing Spare Drone Parts (Quality, IP)

Poor Component Quality and Durability

One of the most frequent issues when sourcing spare drone parts—especially from third-party or non-OEM suppliers—is receiving substandard components. Low-quality motors, propellers, batteries, or camera modules may appear compatible but often fail prematurely under stress or in adverse conditions. These parts can compromise flight stability, reduce battery life, and increase the risk of in-flight failures. Buyers may also encounter inconsistent tolerances, which affect assembly and performance, leading to increased maintenance and operational costs over time.

Risk of Counterfeit or Non-Genuine Parts

The drone market, particularly for popular models, is rife with counterfeit spare parts that mimic authentic branding but lack the engineering and safety standards of original equipment. These fake parts often bypass rigorous testing and certification processes, posing safety hazards such as overheating batteries, motor failure, or signal interference. Identifying counterfeit components can be difficult without expert knowledge, and using them may void warranties or insurance coverage.

Intellectual Property (IP) and Legal Concerns

Sourcing spare parts from unauthorized manufacturers can lead to intellectual property violations. Many drone components—especially firmware, circuit boards, and proprietary sensors—are protected by patents, copyrights, or trade secrets. Using or distributing cloned or reverse-engineered parts may expose individuals or companies to legal action, especially in regulated industries or jurisdictions with strict IP enforcement. Additionally, unauthorized firmware modifications can breach end-user license agreements and expose operators to cybersecurity vulnerabilities.

Compatibility and Integration Issues

Even if spare parts appear identical, subtle differences in design, firmware, or communication protocols can prevent seamless integration with the original drone system. Third-party components may not fully support software updates, calibration features, or fail-safe mechanisms, leading to degraded performance or unexpected behavior during flight. This is particularly critical for commercial or industrial drones where reliability and precision are essential.

Lack of Technical Support and Documentation

Non-OEM suppliers often provide limited or no technical support, user manuals, or compatibility guidance. This absence of documentation makes troubleshooting difficult and increases downtime during repairs. Without proper calibration tools or firmware access, users may struggle to integrate new parts, ultimately reducing operational efficiency and increasing long-term costs.

Supply Chain Transparency and Traceability

Many spare parts, especially those sourced from overseas markets or unauthorized distributors, lack verifiable supply chain histories. This opacity raises concerns about ethical sourcing, component origin, and adherence to safety standards such as RoHS or CE certification. Without traceability, it becomes difficult to ensure parts meet regulatory requirements or to respond effectively in case of recalls or compliance audits.

Logistics & Compliance Guide for Spare Drone Parts

Understanding Product Classification

Spare drone parts are typically classified under specific Harmonized System (HS) codes depending on the component type (e.g., motors, propellers, batteries, flight controllers). Correct classification is essential for customs clearance, duty assessment, and regulatory compliance. Common codes include 8501 (electric motors), 8543 (electronic control units), and 8507 (lithium-ion batteries). Always verify with updated national tariff schedules.

Battery Regulations and Safety

Lithium-ion batteries, commonly found in spare drone parts, are classified as dangerous goods under IATA, IMDG, and ADR regulations. Shipments must comply with UN 38.3 testing, proper packaging (including rigid outer packaging and insulation of terminals), and hazard labeling (Class 9 label). Air transport requires UN3481 classification, and state-of-charge must not exceed 30% unless exempted.

Export Controls and ITAR/EAR Compliance

Certain drone components, especially advanced sensors or GPS modules, may be subject to export controls under the U.S. Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR). Verify whether parts require an export license, especially when shipping to embargoed or high-risk countries. Maintain accurate technical specifications and end-user documentation.

Customs Documentation Requirements

Ensure all shipments include a commercial invoice, packing list, and bill of lading/air waybill. The invoice must detail HS codes, country of origin, value in USD, and a clear description of parts (e.g., “spare brushless motor for unmanned aerial vehicle”). For regulated components, include export control classification numbers (ECCN) or license exceptions.

Country-Specific Import Restrictions

Many countries impose restrictions on drone-related imports due to security or aviation regulations. For example, India requires a license from the Directorate General of Civil Aviation (DGCA), while the EU enforces CE marking and Radio Equipment Directive (RED) compliance for wireless components. Research destination requirements before shipping.

Packaging and Handling Standards

Use anti-static packaging for electronic components and secure fragile parts (e.g., camera gimbals) with cushioning. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”). Battery-containing packages must display lithium battery handling labels per IATA guidelines.

Carrier Selection and Shipment Tracking

Work with carriers experienced in handling electronics and dangerous goods (e.g., DHL, FedEx, UPS). Ensure real-time tracking is enabled and communicate tracking details to recipients. Choose services with customs brokerage support to minimize delays.

Recordkeeping and Audit Preparedness

Maintain records of shipping documents, export licenses, compliance certifications, and customer due diligence for a minimum of five years. Regular internal audits help ensure adherence to evolving regulations and reduce the risk of penalties.

Environmental and RoHS Compliance

Drone parts must comply with environmental directives such as the EU’s Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives. Confirm that components are free from restricted substances (e.g., lead, cadmium) and provide compliance documentation upon request.

Returns and Reverse Logistics

Establish a clear returns process for defective or incorrect parts. Include pre-paid return labels where applicable, and ensure incoming shipments are inspected for safety (especially batteries). Comply with local disposal regulations for non-repairable components.

In conclusion, sourcing spare drone parts requires a strategic approach that balances cost, quality, authenticity, and reliability. It is essential to identify reputable suppliers—whether original manufacturers, authorized distributors, or trusted third-party vendors—to ensure compatibility and longevity of the components. Factors such as lead time, warranty, technical support, and customer reviews should be carefully evaluated. Additionally, maintaining an inventory of commonly needed spare parts can minimize operational downtime, especially in commercial or critical applications. By establishing a consistent and well-researched sourcing process, drone operators can enhance maintenance efficiency, extend the lifespan of their equipment, and ensure optimal performance across their fleet.