The global space technology market is undergoing rapid transformation, driven by increased private investment, advancements in satellite miniaturization, and growing demand for Earth observation, satellite broadband, and in-space services. According to a 2023 report by Mordor Intelligence, the space technology market was valued at USD 384.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% over the forecast period (2023–2028), reaching an estimated USD 598.7 billion by 2028. Similarly, Grand View Research projects even more robust expansion, forecasting a CAGR of 12.9% from 2023 to 2030, fueled by the proliferation of small satellites and the rise of new-space companies. This surge has paved the way for a new generation of agile, innovation-driven startups disrupting traditional aerospace models. From orbital launch providers to satellite constellations and in-space manufacturing ventures, these companies are not only lowering the cost of access to space but also enabling novel applications across telecommunications, climate monitoring, and national security. Here are the top 10 space startup companies and manufacturers leading this technological revolution.

Top 10 Space Startup Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thales Alenia Space

Domain Est. 2006

Website: thalesaleniaspace.com

Key Highlights: Thales Alenia Space is a global space manufacturer delivering, for more than 40 years, high-tech solutions for telecommunications, navigation, Earth ……

#2 Sidus Space

Domain Est. 2020

Website: sidusspace.com

Key Highlights: Sidus Space® (NASDAQ: SIDU) is a flight proven space and defense technology company providing the full tech-stack — hardware, software, and data. From our ……

#3 Vast – Building Next

Domain Est. 2005

Website: vastspace.com

Key Highlights: Vast is developing humanity’s most capable space stations, pioneering the next giant leap toward long-term living and thriving in space….

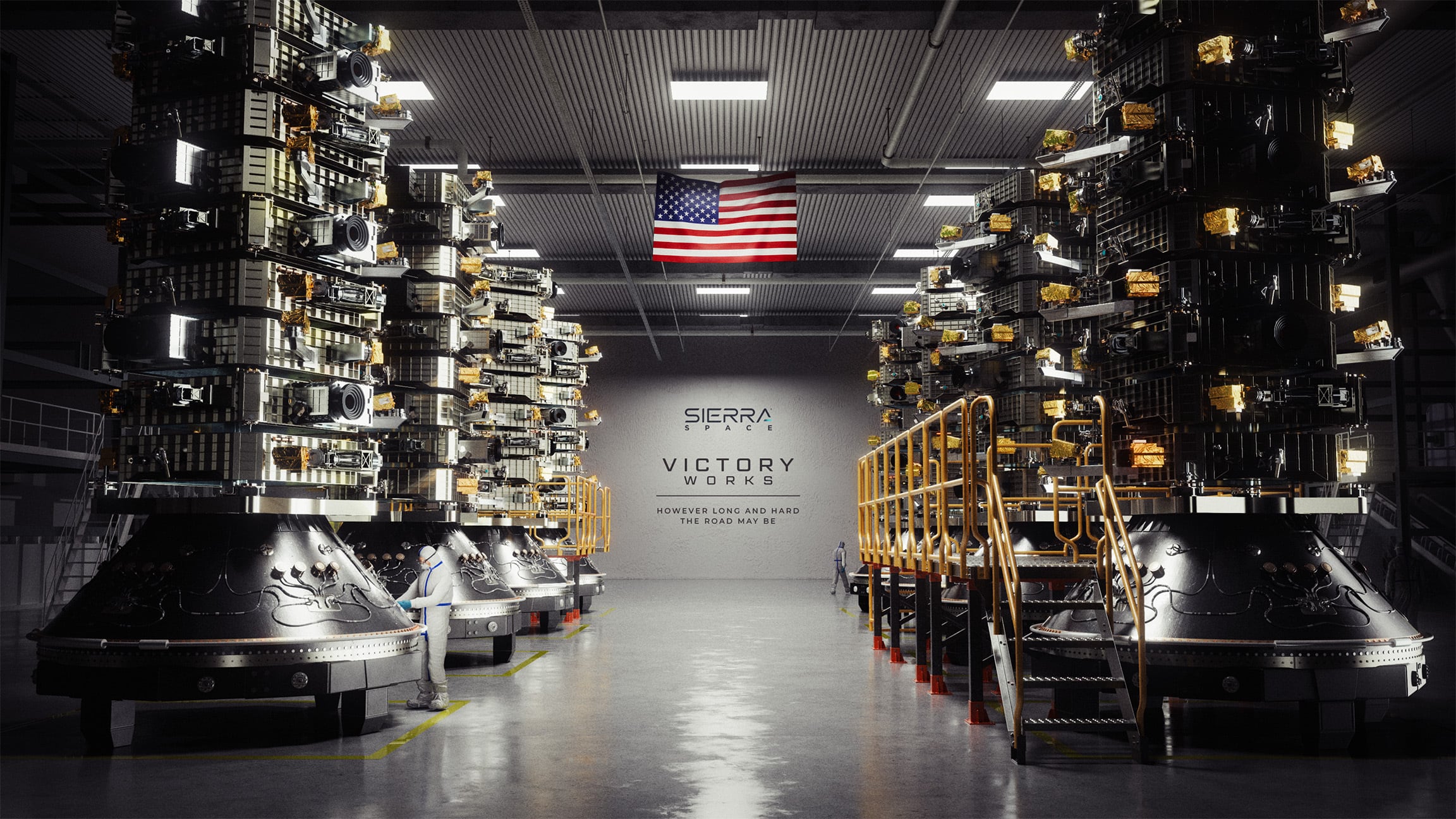

#4 Sierra Space

Domain Est. 2006

Website: sierraspace.com

Key Highlights: Sierra Space is a Defense Tech leader delivering satellites, subsystems, spaceplanes, hypersonics, and infrastructure trusted by U.S. National Security….

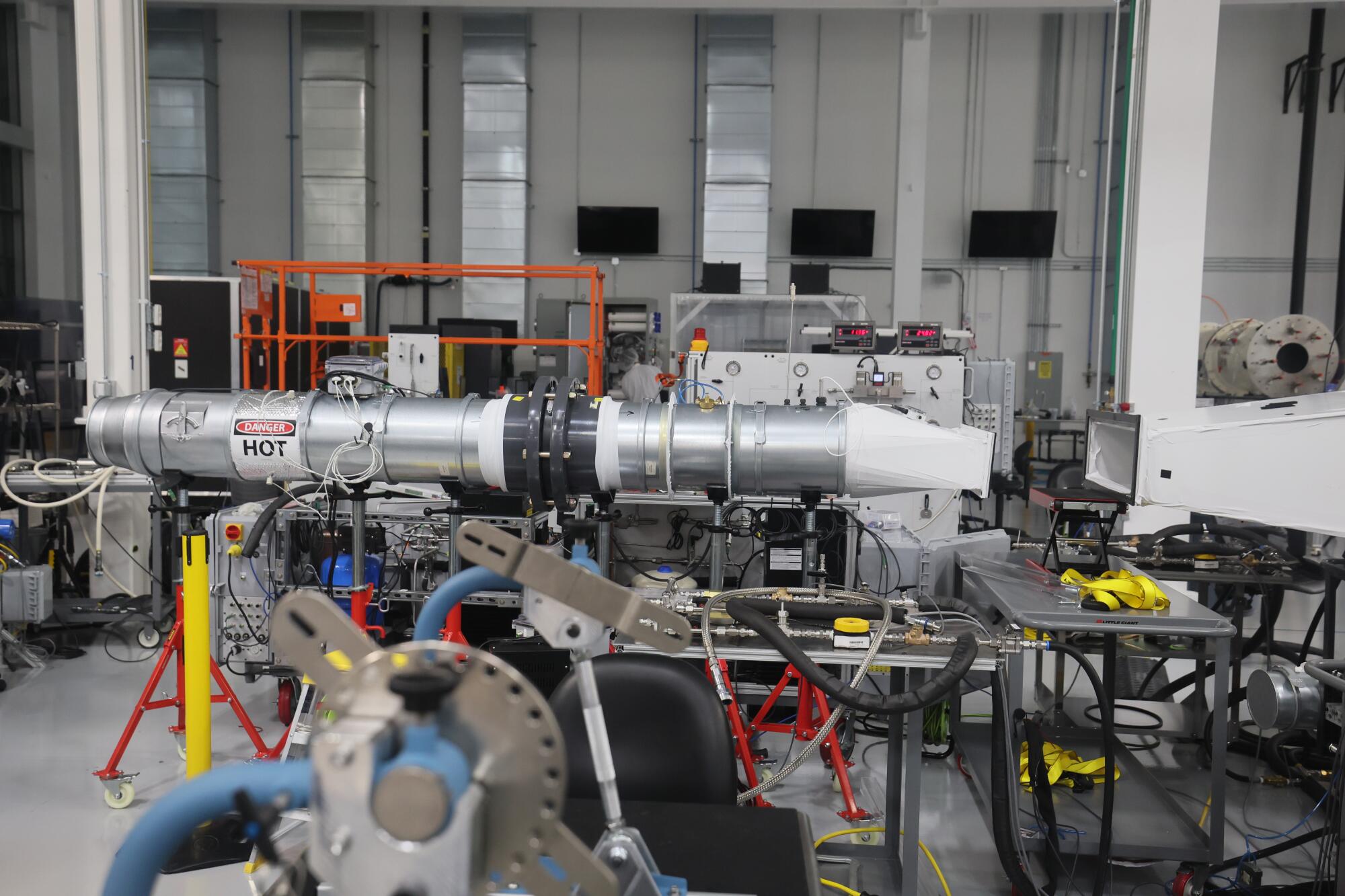

#5 Firefly Aerospace

Domain Est. 2013

Website: fireflyspace.com

Key Highlights: Firefly Aerospace is enabling our world to launch, land, and operate in space. Anytime. Anywhere….

#6 Axiom Space

Domain Est. 2014

Website: axiomspace.com

Key Highlights: Axiom Space is the leading provider of human spaceflight services and developer of human-rated space infrastructure. We operate end-to-end missions to the ISS ……

#7 Relativity Space

Domain Est. 2015

Website: relativityspace.com

Key Highlights: Relativity Space builds reusable rockets that make access to space more reliable and routine—empowering science, exploration, and innovation beyond our ……

#8 Turion Space

Domain Est. 2020

Website: turionspace.com

Key Highlights: Powering the future of space with scalable solutions that fuel real mission impact. Control our fleet through a single software layer….

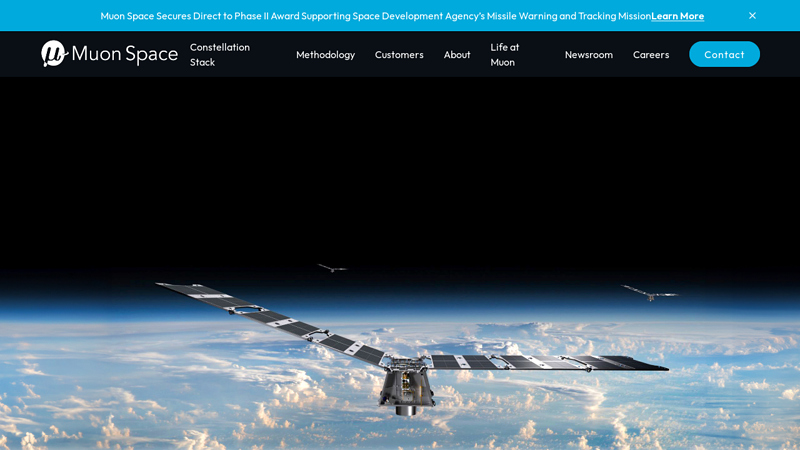

#9 Muon Space

Domain Est. 2020

Website: muonspace.com

Key Highlights: Constellations for a safe and resilient world. We design, build, and operate satellite constellations optimized for your mission….

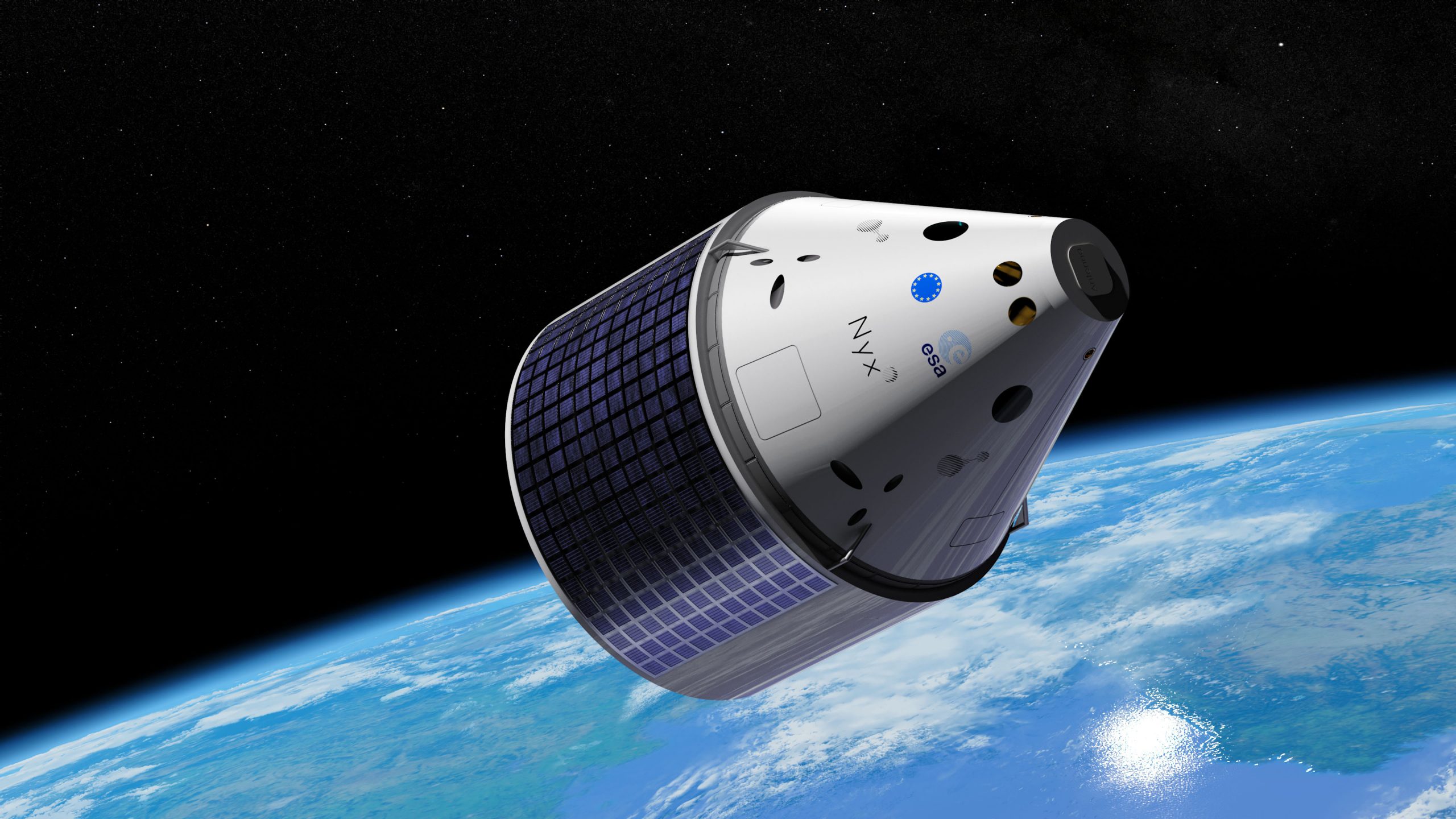

#10 The Exploration Company

Domain Est. 2021

Website: exploration.space

Key Highlights: We build space vehicles for a cooperative future. · A glimpse into our journey. · Nyx is a modular, reusable, and in-orbit refillable space vehicle. · Join us on ……

Expert Sourcing Insights for Space Startup Companies

2026 Market Trends for Space Startup Companies

The space industry is poised for transformative growth by 2026, driven by technological innovation, increasing private investment, and expanding commercial applications. Space startups are at the forefront of this evolution, shaping and being shaped by key market trends.

Accelerated Commercialization of Low Earth Orbit (LEO)

By 2026, Low Earth Orbit is expected to transition from government-dominated operations to a bustling commercial ecosystem. Startups are capitalizing on reduced launch costs and miniaturized satellite technology to deploy constellations for broadband internet, Earth observation, and in-orbit servicing. Companies like SpaceX, OneWeb, and newer entrants are driving demand for LEO-based services, while startups such as Momentus and Starfish Space are developing in-space transportation and satellite life-extension solutions, creating a new market for orbital logistics.

Rise of Space Sustainability and Debris Mitigation

With increasing satellite deployments, space debris has become a critical concern. Regulatory pressure and investor focus on ESG (Environmental, Social, and Governance) criteria are pushing startups to prioritize sustainability. By 2026, startups specializing in active debris removal (e.g., Astroscale, ClearSpace) and collision-avoidance technologies are gaining traction. Regulatory frameworks—such as those being developed by the FCC and ESA—are likely to mandate end-of-life disposal plans, creating a compliance-driven market for sustainable space operations.

Expansion of In-Space Manufacturing and Resources

The concept of utilizing space resources and manufacturing in microgravity is moving from theory to pilot projects. By 2026, startups like Varda Space Industries and Space Forge are expected to demonstrate commercial viability in producing high-value materials (e.g., pharmaceuticals, specialty alloys) in orbit. Additionally, interest in lunar and asteroid mining is growing, with companies such as ispace and AstroForge advancing technologies for prospecting and extraction, supported by public-private partnerships and venture capital.

Increased Investment and Market Maturation

The space startup ecosystem is maturing, with 2026 likely to see more Series B and later-stage funding rounds as early pioneers scale operations. While the pace of new venture capital inflows may moderate compared to the 2020–2022 peak, strategic investments from aerospace giants, defense contractors, and tech firms will remain strong. Startups offering dual-use technologies—applicable in both commercial and defense sectors—are particularly attractive, benefiting from government contracts and national security initiatives.

Democratization of Space Access

Advancements in small launch vehicles and rideshare programs are lowering the barrier to entry. Startups like Rocket Lab, Astra (pending recovery), and newer players such as SpinLaunch are enabling cost-effective, frequent access to space for small satellites. By 2026, this trend will empower startups in emerging markets and non-traditional sectors (e.g., agriculture, finance, climate monitoring) to leverage space-based data, fostering innovation across industries.

Integration with Terrestrial Technologies

Space startups are increasingly integrating with terrestrial digital infrastructure. The convergence of satellite data with AI, machine learning, and 5G/6G networks enables real-time analytics and global connectivity. In 2026, startups offering end-to-end solutions—such as satellite-to-cloud data pipelines or AI-driven Earth observation analytics—are capturing significant market share, serving sectors from logistics to environmental monitoring.

Geopolitical and Regulatory Evolution

As space becomes more contested, regulatory frameworks are evolving rapidly. By 2026, startups will need to navigate complex international regulations, spectrum allocation challenges, and national security concerns. Countries are establishing or updating space laws, creating both hurdles and opportunities. Startups with strong compliance strategies and partnerships with government agencies will have a competitive edge.

In summary, 2026 will mark a pivotal year for space startups, characterized by commercial scalability, sustainability imperatives, and deeper integration into the global digital economy. Those that innovate rapidly, adhere to emerging regulations, and forge strategic alliances will lead the next phase of the space revolution.

Common Pitfalls When Sourcing Space Startup Companies (Quality, IP)

Inadequate Technical Due Diligence Leading to Overestimated Capabilities

Many space startups present ambitious visions and prototypes that may not translate into scalable, flight-proven technology. A common pitfall is relying solely on marketing materials or early test results without conducting deep technical assessments. Investors or partners may overlook critical red flags such as unproven subsystems, lack of radiation hardening, thermal management issues, or insufficient testing under realistic space conditions. This can lead to sourcing companies whose technology is not space-qualified or fails during actual deployment.

Weak or Unclear Intellectual Property (IP) Position

Space startups often build on existing aerospace technologies or collaborate with research institutions, which can create complex IP ownership situations. A major risk is discovering that core innovations are co-owned, licensed restrictively, or based on publicly funded research with government usage rights. Additionally, some startups fail to file comprehensive patents or rely on trade secrets in an industry where reverse engineering is feasible. This exposes sourcing entities to potential litigation, licensing disputes, or inability to commercialize the technology freely.

Overreliance on Founder Expertise Without Scalable Teams

While charismatic founders with aerospace backgrounds can be compelling, sourcing decisions should not overlook the broader team’s depth and scalability. Many space startups lack experienced systems engineers, flight software developers, or regulatory compliance experts necessary to advance beyond prototype stages. A high-quality startup must demonstrate not just technical vision but also the organizational maturity to manage complex development cycles, rigorous testing, and mission assurance protocols.

Underestimating Regulatory and Export Control Risks

Space technologies often fall under strict international regulations such as ITAR (International Traffic in Arms Regulations) or national export controls. Startups may not have established compliance frameworks, risking delays in collaboration, hardware shipment, or international partnerships. Sourcing entities can inadvertently inherit these compliance burdens if IP or components are subject to restrictions, impacting development timelines and market access.

Misjudging Technology Readiness Level (TRL) and Development Timeline

Space hardware typically requires years of testing and validation to reach operational status. A frequent pitfall is interpreting a ground demonstration or suborbital test as evidence of high TRL, when in reality the jump to orbital reliability is substantial. Optimistic roadmaps may ignore system integration challenges, launch availability, or on-orbit failure modes. Sourcing decisions based on inflated TRL assessments can result in project delays and cost overruns.

Insufficient Focus on Supply Chain and Manufacturing Scalability

Many startups design cutting-edge systems using niche components or custom manufacturing processes that lack scalability. When sourcing, it’s critical to evaluate whether the startup can transition from a single prototype to serial production without compromising quality. Hidden weaknesses in the supply chain—such as reliance on single-source suppliers or non-qualified parts—can jeopardize mission success and long-term viability.

Conclusion

Sourcing space startups requires a disciplined approach that goes beyond impressive pitches. Thorough evaluation of technical maturity, robust IP strategy, regulatory compliance, team strength, and realistic development planning is essential to avoid costly missteps and ensure long-term success.

Logistics & Compliance Guide for Space Startup Companies

Launching a space venture involves navigating complex logistical operations and a stringent regulatory landscape. This guide outlines essential considerations to ensure your space startup remains compliant, efficient, and mission-ready.

Understanding International and National Regulatory Frameworks

Space startups must comply with both international treaties and national regulations. Key international agreements include the Outer Space Treaty, the Registration Convention, and the Liability Convention, which govern peaceful use, registration of space objects, and responsibility for damage. In the U.S., the Federal Aviation Administration (FAA) oversees commercial launch and reentry licensing, the Federal Communications Commission (FCC) manages spectrum allocation and satellite communications, and the Department of Commerce (via NOAA and the Office of Space Commerce) regulates remote sensing. Startups must determine which agencies apply based on mission type (e.g., launch, satellite operation, Earth imaging) and secure necessary authorizations before operations begin.

Licensing and Permits for Launch and Operations

Obtaining launch and operational licenses is critical. The FAA requires a Launch License or Experimental Permit for all commercial launches, involving detailed safety reviews, environmental assessments, and financial responsibility (third-party liability insurance). For satellite constellations, the FCC mandates a license for transmitting radio frequencies, including coordination of orbital slots and spectrum use to avoid interference. If your satellite captures Earth imagery, NOAA may require a remote sensing license under the Land Remote Sensing Policy Act. Early engagement with regulators, thorough documentation, and proactive compliance planning can streamline these processes and prevent costly delays.

Export Controls and Technology Transfer Compliance

Space-related technologies are often subject to strict export regulations. In the U.S., the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) control the export of defense-related and dual-use items, respectively. ITAR, administered by the Department of State, applies to launch vehicles, satellites, and related technical data, requiring registration and licenses for sharing controlled information—even with foreign nationals within your company. Startups must implement an internal compliance program, classify hardware and data correctly, and train employees to avoid violations that could result in fines, loss of license, or criminal liability.

Supply Chain and Component Sourcing

Global sourcing of components requires careful vetting for compliance and reliability. Startups should establish a qualified supplier list, perform due diligence for ITAR/EAR compliance, and ensure components meet space-grade standards (e.g., radiation tolerance, thermal stability). Maintaining traceability and documentation for all parts is essential for regulatory audits and mission assurance. Consider dual-sourcing critical components to mitigate supply chain disruptions, and evaluate logistics partners for secure handling and customs clearance of sensitive hardware.

Launch Site Coordination and Range Safety

Coordination with launch range operators (e.g., Cape Canaveral Space Force Station, Vandenberg Space Force Base, or commercial ranges like Spaceport America) is vital. Startups must comply with range safety requirements, including flight safety analysis, destruct systems, telemetry, and scheduling. Range fees, payload processing protocols, and integration timelines should be factored into mission planning. Early engagement with range authorities helps identify logistical constraints and ensures alignment with safety and environmental standards.

Satellite Registration and Orbital Debris Mitigation

Under the Registration Convention, all space objects must be registered with the United Nations, typically through the launching state (e.g., via the FAA in the U.S.). Startups must submit orbital parameters, mission details, and ownership information. Additionally, compliance with orbital debris mitigation guidelines from bodies like the Inter-Agency Space Debris Coordination Committee (IADC) and national regulators is mandatory. This includes designing for post-mission disposal (e.g., deorbit within 25 years), minimizing break-up risks, and avoiding collisions. Demonstrating debris mitigation plans strengthens licensing applications and supports sustainable space operations.

Insurance and Liability Management

Space operations carry significant financial risk. Launch and in-orbit insurance typically cover partial or total loss of payload and launch vehicle. Third-party liability insurance, required by the FAA (minimum $500M to $3B depending on risk), protects against damage to people or property on Earth or in flight. Startups should work with aerospace insurers early to assess risk profiles, structure coverage, and meet regulatory thresholds. As missions evolve, reassess insurance needs for constellations, in-space servicing, or lunar operations.

Data Handling, Ground Stations, and Cybersecurity

Satellite data transmission and ground station operations must comply with telecommunications regulations (FCC licensing for U.S. stations) and data protection laws (e.g., GDPR for European users). Establish secure data handling protocols, including encryption and access controls, to protect sensitive mission data and intellectual property. Cybersecurity is critical—implement frameworks like NIST or ISO 27001 to safeguard command and control systems from intrusion or spoofing, especially for autonomous or AI-driven operations.

Environmental and Sustainability Compliance

Environmental regulations apply to launch operations and manufacturing. The National Environmental Policy Act (NEPA) may require an Environmental Assessment (EA) or Environmental Impact Statement (EIS) for launch licenses. Startups should assess impacts such as acoustic pollution, fuel residuals, and land use. Embracing sustainable practices—such as reusable launch systems, green propellants, and end-of-life deorbiting—supports regulatory approval and enhances public and investor trust.

Continuous Monitoring and Regulatory Adaptation

The space regulatory environment is rapidly evolving. New policies on spectrum sharing, space traffic management, lunar activities, and environmental standards are emerging globally. Startups should establish a compliance function or designate a regulatory affairs lead to monitor changes, participate in industry forums (e.g., COMSTAC, SmallSat Alliance), and engage proactively with regulators. Staying ahead of policy trends ensures long-term operational flexibility and competitive advantage.

By integrating robust logistics planning with proactive compliance strategies, space startups can reduce risk, accelerate time-to-orbit, and build a foundation for sustainable growth in the new space economy.

In conclusion, sourcing space startup companies presents a unique and high-potential opportunity for investors, partners, and innovation-driven organizations. The commercial space industry is rapidly evolving, driven by technological advancements, declining launch costs, and growing public and private sector interest. Startups in this domain are pioneering innovations in satellite technology, space exploration, Earth observation, in-orbit servicing, and beyond.

Effective sourcing requires a strategic approach—leveraging industry networks, participating in space-focused events and accelerators, monitoring emerging technologies, and engaging with academic and government space programs. Key factors to consider include the technical feasibility of a startup’s mission, strength of the founding team, regulatory landscape, funding runway, and long-term scalability.

While the space sector carries higher risk due to capital intensity and long development cycles, the first-mover advantages and transformative impact offer substantial rewards. By carefully identifying and supporting promising space startups, stakeholders can play a pivotal role in shaping the future of the NewSpace economy and unlocking unprecedented value across industries on Earth and in orbit.