The global sonitube manufacturing market is experiencing steady expansion, driven by increasing demand across industrial, environmental monitoring, and infrastructure testing applications. According to a 2023 report by Mordor Intelligence, the global ultrasonic testing equipment market—of which sonitubes are a critical component—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. This growth is fueled by stricter regulatory standards, rising investments in non-destructive testing (NDT) technologies, and growing emphasis on structural integrity in sectors such as oil & gas, power generation, and civil engineering. Additionally, Grand View Research valued the global ultrasonic testing market at USD 2.4 billion in 2022, citing automation advancements and increased adoption in emerging economies as key drivers. As demand for precision and reliability in acoustic-based measurement systems rises, a select group of manufacturers has emerged as industry leaders. Below are the top six sonitube manufacturers shaping the future of sonic instrumentation.

Top 6 Sonitube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sonotube Suppliers & Companies

Domain Est. 2012

Website: cardboardtubemanufacturers.com

Key Highlights: Connect with reliable sonotube manufacturers and suppliers and find a sonotube solution for your application requirements. Submit a request for quote today….

#2 Tubes and Cores

Domain Est. 1995

Website: sonoco.com

Key Highlights: Help projects run smoothly and stand strong with Sonotube® concrete forms. Sonoco manufactures and distributes Sonotube Rainguard®, Sonotube Commercial, ……

#3 Sonoco and Pacific Paper Tube Alliance

Domain Est. 2000

Website: pacificpapertube.com

Key Highlights: The Sonotube brand is recognized worldwide in the construction industry. The Sonotube family continues to expand with innovative products and features ……

#4 Sonotube Suppliers

Domain Est. 2002

Website: paper-tubes.net

Key Highlights: A list of sonotube suppliers who offer reliable service, durable solutions and fast delivery along with low prices for all of their sonotubes….

#5 Sonotube Brand

Domain Est. 2004

Website: whitecap.com

Key Highlights: Shop All Sonotube Products. Shop By Category. Hero Image · Concrete Forming and Accessories · Concrete Forming. White Cap….

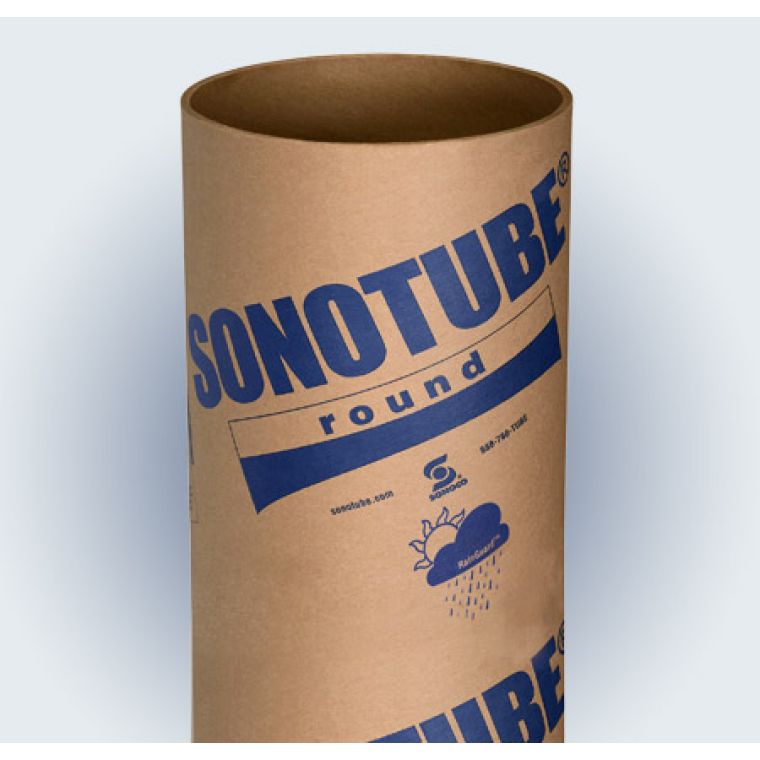

#6 Sonotube

Domain Est. 2004

Website: iqsdirectory.com

Key Highlights: IQS Directory provides an extensive list of sonotube manufacturers and suppliers. Utilize our website to review and source sonotube manufactures….

Expert Sourcing Insights for Sonitube

2026 Market Trends for Sonitube: Strategic Analysis and Forecast (H2 Focus)

Looking ahead to 2026, Sonitube, a leading manufacturer of advanced plastic pipe systems (particularly HDPE and PP-R), faces a dynamic market shaped by global megatrends, technological innovation, and evolving regulatory landscapes. This analysis, focusing on the second half of 2026 (H2 2026), examines key trends expected to impact Sonitube’s position, opportunities, and challenges.

1. Sustainability & Circular Economy Acceleration (H2 2026)

- Regulatory Pressure Intensifies: By H2 2026, the EU’s revised Packaging and Packaging Waste Regulation (PPWR) and similar global initiatives (e.g., expanded EPR schemes) will be in full implementation. Expect stricter mandates on recycled content (potentially 30-50% for certain plastic applications) and extended producer responsibility, directly impacting Sonitube’s raw material sourcing and end-of-life management strategies.

- Demand for Recycled & Bio-based Materials: Market demand for pipes incorporating high-quality post-consumer recycled (PCR) HDPE and PP-R will surge, driven by corporate ESG commitments and green building certifications (LEED, BREEAM). Sonitube’s investment in advanced recycling technologies (e.g., depolymerization for PP-R) and partnerships with waste management firms will be critical differentiators. Early movers in viable bio-based polymer blends will gain competitive advantage.

- Focus on Carbon Footprint: Lifecycle Assessment (LCA) data will be a key purchasing criterion. Sonitube’s ability to demonstrate significant reductions in embodied carbon through renewable energy use in manufacturing, optimized logistics, and lighter-weight, longer-life products will be paramount. H2 2026 will see increased customer requests for specific carbon footprint declarations.

2. Digitalization & Smart Infrastructure Integration (H2 2026)

- BIM & Digital Twins Dominance: By H2 2026, Building Information Modeling (BIM) will be standard in major construction projects globally. Sonitube must provide comprehensive digital product catalogs, detailed BIM objects, and compatibility with major platforms (Revit, ArchiCAD). Integration into project digital twins for asset management will become a value-added service.

- IoT-Enabled Pipes & Monitoring: Demand for “smart” infrastructure solutions will grow. Sonitube could leverage H2 2026 to pilot or scale solutions involving embedded sensors (for pressure, temperature, flow, corrosion detection) within pipe systems, enabling predictive maintenance for water utilities and industrial clients. Partnerships with sensor and data analytics companies will be key.

- Enhanced Supply Chain Visibility: Blockchain and advanced tracking technologies will be expected for supply chain transparency, especially concerning recycled content verification and ethical sourcing. Sonitube’s ability to provide real-time, verifiable data will build trust.

3. Resilience & Climate Adaptation (H2 2026)

- Water Infrastructure Modernization: Accelerated by climate change impacts (droughts, floods, aging infrastructure), global investment in water and wastewater networks will remain high. Sonitube’s trenchless installation technologies (e.g., pipe bursting, HDD with HDPE) will be in high demand for cost-effective, low-disruption rehabilitation, particularly in urban centers facing H2 peak construction seasons.

- Focus on Leak Reduction: With water scarcity increasing, pressure on utilities to reduce non-revenue water (NRW) will intensify. Sonitube’s leak-tight fusion joints and durable HDPE pipes will be a major selling point. Marketing will emphasize lifecycle cost savings and water conservation benefits.

- Energy Efficiency in Fluid Transport: Regulations and energy costs will drive demand for pipes with superior hydraulic performance (smooth bore, minimal friction loss). Sonitube’s high-quality HDPE and optimized PP-R systems will support energy savings in pumping applications.

4. Geopolitical & Supply Chain Reconfiguration (H2 2026)

- “Nearshoring” & Resilience: The trend towards regionalized supply chains, accelerated by recent disruptions, will solidify by H2 2026. Sonitube’s manufacturing footprint and ability to serve key markets (Europe, Americas, potentially strategic Asian hubs) with regional production will mitigate risks and appeal to customers prioritizing resilience.

- Raw Material Volatility: While stabilization might occur, geopolitical tensions and energy market fluctuations will keep polyolefin (HDPE, PP) prices susceptible. Sonitube’s long-term contracts, backward integration potential, and material efficiency innovations will be crucial for margin protection.

- Trade Dynamics: Tariffs and trade agreements (e.g., USMCA, EU trade pacts) will continue to influence competitiveness. Navigating these effectively will be essential, especially for cross-border projects.

5. Competitive Landscape & Market Consolidation (H2 2026)

- Increased Competition on Sustainability: Traditional rivals and new entrants will aggressively push recycled content and low-carbon claims. Sonitube must ensure its sustainability credentials are verifiable, leading, and communicated effectively.

- Consolidation Pressure: The need for scale to invest in R&D (sustainability, digitalization) and achieve cost efficiencies may drive further M&A activity in the pipe industry. Sonitube could be an acquirer or target.

- Value-Added Services: Competition will shift beyond just pipe specifications. Companies offering comprehensive solutions (design support, installation training, digital tools, lifecycle management) will capture more value. Sonitube’s service portfolio will be a key battleground.

H2 2026 Outlook & Sonitube’s Strategic Imperatives

- Opportunities: Lead the market in sustainable pipe solutions (high PCR content, verifiable low carbon), become the go-to provider for digital-ready and smart pipe systems, capitalize on massive water infrastructure investment, and leverage a resilient regional manufacturing network.

- Threats: Intensifying competition on sustainability and price, regulatory compliance costs, raw material cost volatility, potential for disruptive technologies, and customer demands for comprehensive digital integration.

- Recommendations for Sonitube (H2 Focus):

- Aggressively Scale Recycled Content: Ensure commercial availability of key products with high, certified PCR content well before H2 2026.

- Launch/Scale Digital Product Ecosystem: Fully deploy and market BIM tools, digital twins, and explore IoT pilot programs.

- Demonstrate Carbon Leadership: Publish comprehensive, verified LCAs for core products and set ambitious, science-based reduction targets.

- Strengthen Regional Resilience: Optimize manufacturing and supply chain for key markets to ensure reliability.

- Invest in Customer Solutions: Bundle pipes with advanced digital tools, training, and lifecycle support services.

Conclusion: H2 2026 will be a pivotal period where sustainability, digitalization, and resilience are not just differentiators but table stakes for Sonitube. Success will depend on executing a clear strategy focused on verifiable environmental leadership, seamless digital integration, and robust supply chain management, positioning Sonitube not just as a pipe supplier, but as a strategic partner in building future-proof infrastructure.

Common Pitfalls Sourcing Sonitube (Quality, IP)

When sourcing Sonitube—a brand name associated with high-performance acoustic ventilation systems—organizations often encounter significant challenges related to quality assurance and intellectual property (IP) risks. Being aware of these pitfalls is essential to avoid substandard products, legal complications, and reputational damage.

Quality Inconsistencies from Unauthorized Suppliers

One of the most common issues when sourcing Sonitube products is encountering inconsistent quality from third-party or unauthorized suppliers. Sonitube designs are precision-engineered for specific acoustic and airflow performance metrics. Unauthorized manufacturers or resellers may offer look-alike products that fail to meet the original technical specifications. These counterfeit or imitation units often use inferior materials, resulting in reduced noise attenuation, poor airflow efficiency, and premature failure. Sourcing from non-certified vendors increases the risk of receiving products that do not comply with building codes or acoustic performance standards, leading to costly retrofits or project delays.

Intellectual Property Infringement Risks

Sonitube is a registered brand, and its designs are protected under intellectual property laws, including patents and trademarks. Sourcing仿制品 (counterfeit or imitation) Sonitube units from unlicensed manufacturers constitutes IP infringement and can expose buyers and specifiers to legal liability. Even if a supplier claims the product is “Sonitube-compatible” or “inspired by,” using such products may still violate IP rights if they closely replicate patented features. Furthermore, building owners, contractors, or architects who specify or install infringing products may face cease-and-desist orders, fines, or project stoppages. Always verify that suppliers are authorized distributors or have proper licensing to ensure compliance with IP regulations.

Lack of Technical Support and Warranty Coverage

Non-genuine Sonitube products typically do not come with manufacturer-backed technical support, installation guidance, or warranty protection. In the event of performance issues or product failure, buyers may find themselves without recourse. Genuine Sonitube products are backed by comprehensive warranties and access to engineering support, which is critical for complex acoustic applications. Sourcing from unauthorized channels voids these benefits, increasing long-term operational risks and maintenance costs.

Misrepresentation and Opaque Supply Chains

Some suppliers may misrepresent generic acoustic ducts as authentic Sonitube products, either through misleading labeling or vague product descriptions. This is especially prevalent in online marketplaces or global procurement platforms where supply chain transparency is limited. Buyers may not receive proper documentation, test reports, or certification data, making it difficult to verify authenticity and compliance. Always request proof of authenticity, such as certification from the manufacturer or official distribution agreements.

Conclusion

To mitigate risks when sourcing Sonitube products, always work with authorized distributors, request full product documentation, and verify IP compliance. Prioritizing authenticity over short-term cost savings ensures long-term performance, legal safety, and project integrity.

Logistics & Compliance Guide for Sonitube

This guide outlines the key logistics and compliance procedures for Sonitube to ensure efficient operations, regulatory adherence, and supply chain reliability.

Supply Chain Management

Establish a structured supply chain network with qualified suppliers and verified logistics partners. Maintain up-to-date supplier documentation, including certifications and compliance records. Implement vendor risk assessments and conduct regular performance reviews to ensure consistency and quality.

Shipping and Distribution

Coordinate inbound and outbound shipments through approved freight carriers that meet safety, timing, and handling requirements. All shipments must be properly labeled, packaged, and tracked using a centralized logistics platform. Temperature-sensitive or fragile materials must be handled according to defined protocols.

Customs and International Trade Compliance

For cross-border shipments, ensure all export and import documentation is accurate and complete, including commercial invoices, packing lists, and certificates of origin. Classify products using correct HS codes and comply with local customs regulations. Adhere to export control laws such as EAR or ITAR, where applicable.

Regulatory Compliance

Sonitube must comply with all relevant industry and environmental regulations, including REACH, RoHS, and local health and safety standards. Maintain records of product conformity, safety data sheets (SDS), and compliance certifications. Regular internal audits should be conducted to verify adherence.

Documentation and Recordkeeping

Maintain a secure digital archive of all logistics and compliance-related documents. Required records include shipping logs, customs filings, compliance certificates, and audit reports. Retention periods must align with legal and regulatory requirements—typically a minimum of 5 years.

Incident Response and Non-Conformance Management

Implement a formal process for reporting and resolving logistics delays, damaged goods, or compliance violations. All incidents must be documented, investigated, and addressed with corrective and preventive actions (CAPA). Notify relevant authorities when required by law.

Training and Accountability

Provide regular training for logistics and operations staff on compliance requirements, handling procedures, and documentation protocols. Assign compliance officers to oversee regulatory adherence and serve as points of contact for audits or inspections.

By following this guide, Sonitube ensures reliable delivery, regulatory alignment, and continued trust with customers and authorities.

Conclusion on Sourcing Sonitube

In conclusion, sourcing Sonitube requires a strategic approach that balances product quality, compliance with acoustic and building standards, supplier reliability, and cost-efficiency. Sonitube, as a specialized acoustic ducting solution, plays a critical role in minimizing noise transmission in HVAC systems, particularly in sensitive environments such as hospitals, laboratories, and residential buildings. Therefore, it is essential to source the product from reputable manufacturers or authorized distributors who can guarantee certified performance data, technical support, and compliance with relevant acoustical and fire safety standards.

Key considerations when sourcing include verifying product authenticity, ensuring compatibility with project specifications, evaluating lead times and logistics, and assessing total lifecycle value rather than upfront cost alone. Additionally, engaging with suppliers who offer customization options and installation guidance can significantly enhance project outcomes.

Ultimately, successful sourcing of Sonitube contributes to the overall acoustic integrity and functionality of a building’s mechanical system, supporting occupant comfort and project sustainability goals. A well-informed procurement strategy ensures long-term performance and reliability of the acoustic solution.