The global fiber laser market is experiencing robust growth, driven by rising demand for high-precision laser solutions in manufacturing, automotive, and electronics industries. According to Grand View Research, the global fiber laser market size was valued at USD 2.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. This surge is fueled by the increasing adoption of laser-based cutting, welding, and marking technologies in industrial applications, where efficiency and accuracy are paramount. As a key player in this space, China has emerged as a dominant force in fiber laser production, with domestic manufacturers rapidly advancing in power output, reliability, and cost competitiveness. Against this backdrop, identifying the top-performing fiber laser manufacturers provides critical insights for sourcing managers and procurement leaders seeking reliable, high-performance solutions. Based on market presence, shipment volume, technological innovation, and customer reviews, the following ten companies represent the leading suppliers in the current landscape.

Top 10 Soldar Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laser Technology & Laser Machines from ALPHA LASER

Website: alphalaser.eu

Key Highlights: As a leading manufacturer of mobile, flexible, and high-performance laser systems for laser welding, laser hardening, powder deposit welding and additive metal ……

#2 LaserStar Technologies

Website: laserstar.net

Key Highlights: LaserStar Technologies is a US manufacturer of laser products and has engineered, designed, and built laser systems and solutions for use in high-precision ……

#3 Laserax

Website: laserax.com

Key Highlights: Laserax works with the world’s leading manufacturers to implement laser cleaning, welding, texturing, and marking solutions….

#4 Equipment & Systems

Website: amadaweldtech.com

Key Highlights: Manufacturer of equipment and systems for welding, cutting, marking, micromachining, sealing, and bonding. Resistance welding. Laser….

#5 Laser Machines

Website: lclasers.com

Key Highlights: Distribution and manufacture of laser machinery. Sales of laser marking, laser cleaning, laser engraving and welding machines….

#6 Denaliweld

Website: denaliweld.com

Key Highlights: We Specialize in Laser Welding & Cleaning. DenaliWeld INC, is a proud employee-owned fiber laser welding machine manufacturer based in Chicago, USA. Bolstered ……

#7 Reci Laser

Website: reci-laser.com

Key Highlights: A series high-power single-mode continuous-wave fiber laser is developed and produced by Reci Laser. The average power exceeds 1000W….

#8 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#9 Fanuci & Falcon

Website: fanuci-falcon.com

Key Highlights: FANUCI & FALCON is an innovative high-tech enterprise specializing in the manufacturing of advanced fiber laser machines for metal processing applications ……

#10 Laser Welding Machines

Website: coherent.com

Key Highlights: Get manual to fully automated laser welding machines that weld plastics and metals with speed and precision while improving throughput….

Expert Sourcing Insights for Soldar Laser

H2: Market Trends for Soldar Laser in 2026

As the global manufacturing and industrial technology sectors evolve, Soldar Laser, a prominent player in laser cutting and welding solutions, is poised to experience significant shifts in market dynamics by 2026. The following analysis outlines key trends expected to influence Soldar Laser’s market position, demand drivers, competitive landscape, and strategic opportunities during the second half (H2) of 2026.

1. Increased Demand in High-Growth Manufacturing Sectors

By H2 2026, industries such as electric vehicles (EVs), renewable energy, aerospace, and precision medical devices are projected to accelerate their adoption of advanced laser processing technologies. Soldar Laser stands to benefit from rising demand for high-precision, energy-efficient, and automated laser cutting and welding systems. The EV boom, particularly in Asia and Europe, will drive demand for lightweight materials like aluminum and high-strength steel, which require sophisticated laser solutions—areas where Soldar Laser has demonstrated technical strength.

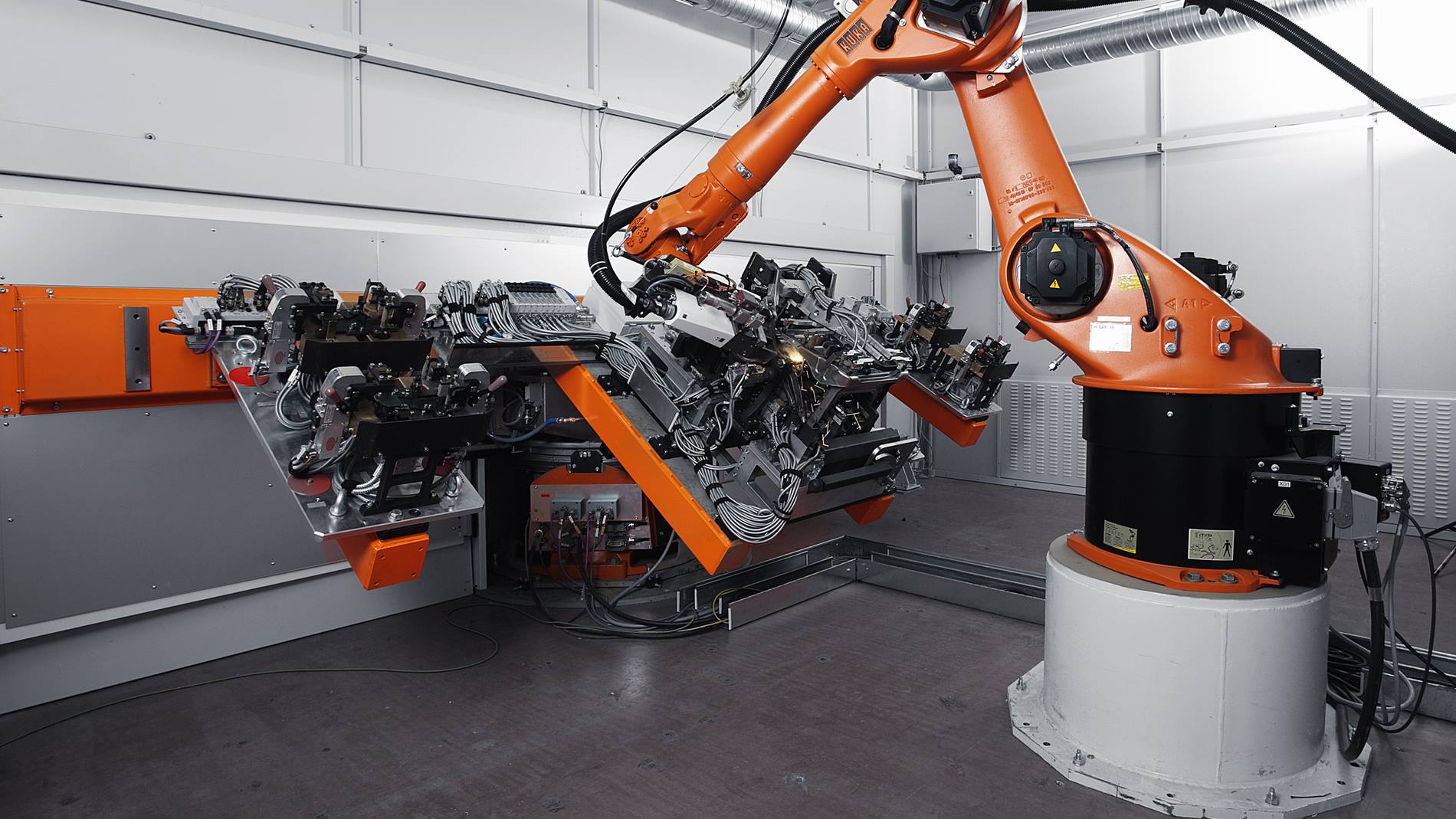

2. Expansion of Automation and Industry 4.0 Integration

Smart manufacturing and the integration of Industry 4.0 technologies will be mature by 2026. Soldar Laser is expected to see growing market preference for laser systems integrated with IoT connectivity, real-time monitoring, predictive maintenance, and AI-driven process optimization. In H2 2026, the company’s competitiveness will hinge on its ability to offer connected, data-enabled laser platforms that seamlessly integrate into automated production lines. Strategic partnerships with robotics and software firms will enhance Soldar’s value proposition.

3. Regional Market Diversification and Emerging Markets Growth

While traditional markets in Europe and North America remain stable, emerging manufacturing hubs in Southeast Asia (Vietnam, India, Indonesia), Latin America, and parts of Africa will contribute significantly to demand growth by H2 2026. Soldar Laser can capitalize on local industrialization efforts and government incentives for advanced manufacturing. Localization strategies—such as regional service centers, training programs, and tailored product variants—will be critical to gaining market share in these regions.

4. Sustainability and Energy Efficiency as Key Purchase Drivers

Environmental regulations and corporate ESG (Environmental, Social, and Governance) commitments will influence procurement decisions in H2 2026. Soldar Laser’s focus on energy-efficient fiber laser technology and reduced material waste will align with sustainability trends. Customers will prioritize vendors offering lower carbon footprints, recyclable components, and energy-saving operation modes—advantages Soldar can emphasize in its marketing and R&D roadmap.

5. Competition from Global and Local Players

The laser equipment market will remain highly competitive. By H2 2026, Soldar Laser will face intensified competition from global leaders like TRUMPF, Bystronic, and IPG Photonics, as well as from low-cost Chinese manufacturers offering commoditized laser systems. To differentiate, Soldar must focus on value-added services, superior after-sales support, and niche applications (e.g., ultra-thin metal cutting, hybrid welding). Innovation in software, beam delivery systems, and process reliability will be essential.

6. R&D and Product Innovation Momentum

In H2 2026, Soldar Laser is expected to launch next-generation hybrid laser systems combining cutting, welding, and surface treatment in a single platform. Advancements in ultrafast lasers and green laser technology for reflective materials (e.g., copper) will open new applications in battery manufacturing and electronics—key growth areas. Continued investment in R&D, supported by government grants and private funding, will be vital to maintaining technological leadership.

7. Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have led to a strategic shift toward regionalized production. By H2 2026, Soldar Laser may increasingly localize key component sourcing and assembly to mitigate risks and reduce lead times. Vertical integration of critical subsystems (e.g., laser sources, motion control) could enhance margins and responsiveness.

Conclusion: Strategic Outlook for H2 2026

In the second half of 2026, Soldar Laser is expected to operate in a dynamic and competitive environment characterized by technological convergence, sustainability imperatives, and shifting global manufacturing flows. To thrive, the company should prioritize innovation, digital integration, and geographic expansion, while reinforcing its brand as a provider of reliable, efficient, and future-ready laser solutions. With strong execution, Soldar Laser can solidify its position as a leading mid-tier global laser technology provider.

Common Pitfalls Sourcing Soldar Laser (Quality, IP)

Sourcing laser systems, particularly under a brand like Soldar Laser, involves navigating several critical challenges related to product quality and intellectual property (IP). Failing to address these pitfalls can lead to operational disruptions, legal liabilities, and financial losses.

Quality Inconsistencies and Lack of Standardization

One of the most frequent issues when sourcing Soldar Laser equipment is inconsistent product quality. Units may vary significantly in performance, durability, and precision due to substandard manufacturing processes or use of inferior components. Buyers often discover discrepancies only after deployment, such as misaligned optics, unstable beam output, or premature mechanical failure. Additionally, a lack of adherence to international quality standards (e.g., ISO 9001, CE, FDA) increases the risk of receiving non-compliant or unsafe systems.

Insufficient Technical Documentation and Support

Many Soldar Laser products come with incomplete or poorly translated technical documentation, making installation, calibration, and maintenance difficult. The absence of detailed specifications, maintenance manuals, or troubleshooting guides can hinder integration into existing production lines. Moreover, limited after-sales support—especially outside the manufacturer’s home region—can result in prolonged downtimes and increased total cost of ownership.

Intellectual Property (IP) Infringement Risks

A significant concern when sourcing Soldar Laser systems is the potential for IP violations. Some suppliers may use designs, software, or components that infringe on patents or copyrights held by other laser technology companies. Purchasing such equipment exposes the buyer to legal risks, including seizure of goods, fines, or litigation, particularly in markets with strict IP enforcement like the EU or North America. Due diligence on the supplier’s IP compliance is often overlooked but essential.

Misrepresentation of Origin and Authenticity

Soldar Laser branding may be used on systems that are not manufactured by the original company, especially when sourced through third-party distributors or online marketplaces. Counterfeit or rebranded units can mimic genuine products but lack the same engineering integrity and performance. Buyers may inadvertently purchase knock-offs that fail to meet claimed specifications, leading to reliability issues and voided warranties.

Inadequate Certification and Regulatory Compliance

Many Soldar Laser systems lack proper certification for key markets, such as FDA approval for medical lasers or IEC 60825 for laser safety. Importing non-compliant equipment can result in customs delays, rejection at borders, or operational shutdowns. Ensuring that the laser system meets regional regulatory requirements is a common oversight during the sourcing process.

Hidden Costs from Poor Integration and Training

Even when the laser unit functions correctly, poor integration with existing systems and insufficient operator training can undermine its value. Vendors may not provide adequate interface protocols, software SDKs, or training programs, leading to delays and additional engineering costs. These hidden expenses significantly impact the ROI of the procurement.

By proactively addressing these pitfalls—through rigorous supplier vetting, independent quality testing, and legal review of IP and compliance documentation—buyers can mitigate risks and ensure a reliable, lawful integration of Soldar Laser systems into their operations.

Logistics & Compliance Guide for Soldar Laser

This guide outlines the essential logistics and compliance procedures for handling the shipment, import/export, and regulatory requirements related to the Soldar Laser product. Adherence to these guidelines ensures safe, legal, and efficient movement of goods across international and domestic borders.

Shipping & Transportation

All shipments of the Soldar Laser must comply with international freight standards. Units must be securely packaged in ESD-safe, shock-absorbent materials and clearly labeled with handling instructions (e.g., “Fragile,” “This Side Up”). Shipments must be transported via carriers certified for handling precision industrial equipment. Use climate-controlled transport when moving through extreme temperature zones to protect sensitive components.

Export Controls & Licensing

The Soldar Laser may be subject to export control regulations due to its technical specifications, including laser power output and potential dual-use applications. Prior to export, verify classification under the Export Administration Regulations (EAR) or relevant national control lists (e.g., Wassenaar Arrangement). Obtain necessary export licenses or authorizations from the appropriate government agency (e.g., U.S. Department of Commerce, BIS) when required. Maintain a record of all export transactions for audit purposes.

Import Compliance

Ensure all import documentation is accurate and complete, including commercial invoices, packing lists, and certificates of origin. Classify the Soldar Laser correctly under the Harmonized System (HS) code to determine applicable tariffs and duties. Confirm compliance with destination country regulations, such as conformity assessment procedures (e.g., CE marking for EU, KC for South Korea, or INMETRO for Brazil). Assign a licensed customs broker to manage clearance and duty payments.

Product Safety & Regulatory Certifications

The Soldar Laser must meet all applicable safety standards in target markets. Key certifications include:

– Laser Safety (IEC 60825-1): Compliance with laser classification and labeling requirements.

– Electrical Safety (e.g., IEC 61010-1): For industrial equipment used in laboratory and manufacturing environments.

– EMC (IEC 61326-1): Electromagnetic compatibility for industrial settings.

Maintain up-to-date test reports and certification documents for each market. Affix required conformity marks visibly on the product and packaging.

Documentation & Recordkeeping

Maintain a digital and physical archive of all logistics and compliance documents for a minimum of five years. Required records include:

– Export licenses and authorizations

– Safety and compliance test reports

– Certificates of conformity

– Shipping manifests and customs declarations

– End-user verification forms (where applicable)

Ensure secure storage and access control to protect sensitive export-related data.

Restricted Parties Screening

Before initiating any transaction, screen all parties (end-users, intermediaries, consignees) against government restricted parties lists, including:

– U.S. Department of Commerce Denied Persons List

– U.S. Department of State Debarred Parties List

– EU Consolidated List

– UN Security Council Sanctions List

Conduct screening at the time of order placement and prior to shipment. Flag and escalate any matches for legal review.

Returns & Reverse Logistics

Establish a clear process for handling returns, repairs, or end-of-life disposal of Soldar Laser units. Returned units must be repackaged according to original shipping standards and accompanied by a Return Material Authorization (RMA) number. If returning across borders, comply with import regulations for returned goods and obtain necessary permits. For end-of-life units, follow WEEE (Waste Electrical and Electronic Equipment) directives or local e-waste disposal laws.

Training & Internal Compliance

All personnel involved in sales, logistics, or export operations must complete annual training on export controls, product compliance, and logistics procedures. Designate a Compliance Officer responsible for overseeing adherence to this guide, conducting internal audits, and updating policies in response to regulatory changes.

Conclusion for Sourcing Solder Laser Equipment:

Sourcing solder laser equipment requires a strategic approach that balances performance, reliability, cost-efficiency, and long-term support. As laser soldering technology continues to advance, it offers significant advantages in precision, repeatability, and thermal control—making it ideal for high-mix, high-density, and miniaturized electronic assemblies. When selecting a supplier, key factors such as technical capabilities, system accuracy, integration flexibility, after-sales service, and compliance with industry standards must be carefully evaluated.

Prioritizing suppliers with proven experience in laser soldering applications, strong customer references, and comprehensive training and maintenance programs can significantly reduce implementation risks and operational downtime. Additionally, considering total cost of ownership (TCO)—beyond just the initial purchase price—ensures sustainable value over time.

In conclusion, a well-informed sourcing decision, supported by thorough supplier due diligence and application-specific testing, will enable organizations to leverage the full benefits of laser soldering technology, enhancing manufacturing quality, productivity, and competitiveness in advanced electronics production.