The global solar photovoltaic (PV) market continues to experience robust expansion, driven by declining costs, supportive government policies, and increasing demand for clean energy. According to Mordor Intelligence, the solar PV market was valued at USD 189.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2029, reaching an estimated USD 285 billion by the end of the forecast period. This sustained growth reflects both technological advancements and a global shift toward decarbonization, creating strong demand for high-performance, reliable solar modules. As capacity additions accelerate worldwide, a handful of manufacturers have emerged as leaders, commanding significant market share through scale, innovation, and vertical integration. The following list highlights the top 10 solar photovoltaic manufacturers shaping the industry’s trajectory based on production volume, global reach, and technological leadership.

Top 10 Solar Photovoltaic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Boviet Solar

Domain Est. 2017

Website: bovietsolar.com

Key Highlights: Boviet Solar is a solar energy technology company specializing in manufacturing top-performing solar PV modules for solar projects….

#2 Trinasolar

Domain Est. 2004 | Founded: 1997

Website: trinasolar.com

Key Highlights: Founded in 1997, Trina Solar Co., Ltd. (stock symbol: Trinasolar; stock code: 688599) is mainly engaged in PV products, energy storage, system solutions and ……

#3 Suniva

Domain Est. 2005 | Founded: 2007

Website: suniva.com

Key Highlights: Suniva is America’s oldest and largest monocrystalline solar cell manufacturer in North America. Suniva was founded in 2007….

#4 SEG Solar

Domain Est. 2012

Website: segsolar.com

Key Highlights: We are a Leading US Solar Module Manufacturer with A Fully Integrated Supply Chain. About us. 1GW+. Global Cumulative Module Shipments. 1GW. Global PV Module ……

#5 Illuminate USA

Domain Est. 2019

Website: illuminateusa.com

Key Highlights: Illuminate USA is the largest single-site solar panel manufacturer in North America, using advanced manufacturing to supply the American solar market….

#6 First Solar

Domain Est. 1999

#7 Solar Manufacturing Map

Domain Est. 1999

Website: energy.gov

Key Highlights: The US Solar Photovoltaic Manufacturing Map shows only active manufacturing sites that contribute to the solar photovoltaic supply chain….

#8 Canadian Solar

Domain Est. 2001

Website: canadiansolar.com

Key Highlights: … one of the world’s largest solar photovoltaic products and energy solutions providers, as well as one of the largest solar power plant developers globally….

#9 Onyx Solar, Building Integrated Photovoltaics Solutions

Domain Est. 2005

Website: onyxsolar.com

Key Highlights: Onyx Solar is a global leader in manufacturing photovoltaic (PV) glass, turning buildings into energy-efficient structures….

#10 Heliene

Domain Est. 2009

Website: heliene.com

Key Highlights: We manufacture high quality solar photovoltaic modules in our American facilities. The supply chains are short, and our modules are never held up in port or ……

Expert Sourcing Insights for Solar Photovoltaic

H2: 2026 Market Trends for Solar Photovoltaic

The solar photovoltaic (PV) market is poised for transformative growth and technological evolution by 2026, driven by global decarbonization goals, policy support, falling costs, and advancements in energy infrastructure. This analysis outlines key trends expected to shape the solar PV industry in 2026.

1. Accelerated Global Capacity Expansion

By 2026, global solar PV installed capacity is projected to surpass 2,400 gigawatts (GW), up from approximately 1,400 GW in 2023. This growth will be fueled by aggressive renewable energy targets in major economies, including the United States, European Union, China, and India. China remains the dominant market, but the U.S. and India are expected to significantly increase deployment due to supportive policies such as the Inflation Reduction Act (IRA) and India’s National Green Hydrogen Mission.

2. Technological Advancements and Efficiency Gains

In 2026, solar cell efficiency will continue to improve, with mainstream PERC (Passivated Emitter and Rear Cell) technology being gradually overtaken by TOPCon (Tunnel Oxide Passivated Contact) and heterojunction (HJT) cells. These next-generation technologies offer higher efficiency (approaching 25% for commercial modules) and better performance under real-world conditions. Additionally, tandem solar cells—particularly perovskite-silicon combinations—are expected to begin limited commercial deployment, promising efficiencies over 30%.

3. Cost Reductions and Grid Parity Expansion

The levelized cost of electricity (LCOE) for solar PV is expected to decline further by 2026, reaching as low as $0.02–$0.03/kWh in optimal regions. This makes solar the cheapest source of electricity in most parts of the world. Continued reductions in manufacturing costs, supply chain optimization, and economies of scale—particularly in polysilicon production and module assembly—will sustain this downward trend.

4. Rise of Distributed and Rooftop Solar

Distributed solar, especially residential and commercial rooftop installations, will experience robust growth in 2026. Supportive net metering policies, falling battery storage costs, and increasing consumer demand for energy independence are key drivers. In markets like Germany, Australia, California, and Japan, over 40% of new solar capacity is expected to come from distributed systems.

5. Integration with Energy Storage and Smart Grids

The pairing of solar PV with battery energy storage systems (BESS) will become standard practice by 2026. Falling lithium-ion battery prices and advances in alternative chemistries (such as sodium-ion) will enable longer-duration storage and greater grid stability. Hybrid solar-plus-storage projects will dominate new utility-scale developments, particularly in regions with high solar penetration and variable demand.

6. Supply Chain Diversification and Geopolitical Shifts

Growing concerns over supply chain resilience—especially regarding polysilicon, wafers, and critical minerals—will lead to increased manufacturing diversification outside of China. The U.S., India, and the EU are investing heavily in domestic solar manufacturing capacity to reduce dependency and enhance energy security. Trade policies, tariffs, and local content requirements will shape global trade flows in solar components.

7. Focus on Sustainability and Circular Economy

As the volume of decommissioned solar panels rises, the industry will prioritize end-of-life management and recycling. By 2026, regulations in the EU and several U.S. states will mandate PV module recycling, spurring innovation in sustainable materials and circular design. Manufacturers will increasingly adopt eco-design principles and disclose carbon footprints of their products.

8. Digitalization and AI in Solar Operations

Artificial intelligence (AI) and digital twin technologies will be widely adopted for predictive maintenance, performance optimization, and grid integration. AI-driven forecasting tools will enhance the accuracy of solar generation predictions, improving grid reliability and market participation.

Conclusion

By 2026, the solar photovoltaic market will be characterized by rapid scalability, technological innovation, and deeper integration into the broader energy system. Solar PV will play a central role in the global energy transition, supported by favorable economics, policy frameworks, and increasing stakeholder commitment to climate action. However, challenges related to grid modernization, supply chain sustainability, and equitable access will require coordinated efforts across governments, industry, and civil society.

Common Pitfalls in Sourcing Solar Photovoltaic Systems: Quality and Intellectual Property Risks

Sourcing solar photovoltaic (PV) systems involves navigating complex supply chains, technological specifications, and legal considerations. Two critical areas prone to pitfalls are product quality and intellectual property (IP) protection. Overlooking these aspects can lead to performance shortfalls, financial losses, safety hazards, and legal exposure.

Quality-Related Pitfalls

1. Substandard Module Performance and Reliability

A primary risk when sourcing solar PV modules is receiving products that fail to meet promised efficiency, durability, or degradation standards. Low-cost suppliers may use inferior materials—such as subpar encapsulants, weaker frames, or lower-grade silicon cells—leading to early failure, reduced energy output, or safety issues like hotspots and delamination.

Best Practice: Require third-party certifications (e.g., IEC 61215, IEC 61730) and conduct independent lab testing. Review long-term performance warranties and manufacturer bankability.

2. Inadequate Due Diligence on Manufacturers

Many solar suppliers, particularly from emerging manufacturing regions, may lack proven track records or transparent production processes. Relying solely on datasheets without verifying manufacturing capabilities or quality control procedures increases the risk of counterfeit or misrepresented products.

Best Practice: Perform on-site audits or use third-party inspection services. Evaluate supplier history, market reputation, and financial stability.

3. Non-Compliance with Regional Standards

Solar PV systems must comply with local electrical, safety, and grid-interconnection standards (e.g., UL in the U.S., CE in Europe). Sourcing modules without verifying regional compliance can result in installation delays, failed inspections, or project rejection.

Best Practice: Confirm that modules and balance-of-system components are certified for the target market. Include compliance clauses in procurement contracts.

Intellectual Property-Related Pitfalls

1. Sourcing Counterfeit or IP-Infringing Components

The solar industry has seen cases where components, especially inverters and modules, incorporate patented technologies without authorization. Purchasing such products—even unknowingly—can expose buyers to legal liability, customs seizures, or forced system decommissioning.

Best Practice: Source from reputable, authorized distributors. Request IP compliance declarations and conduct background checks on key technologies used in components.

2. Lack of Transparency in Technology Licensing

Some manufacturers use proprietary cell technologies (e.g., PERC, TOPCon, HJT) protected by patents. When sourcing from lesser-known brands, there may be no assurance that these technologies are properly licensed, increasing the risk of downstream IP disputes.

Best Practice: Require suppliers to disclose technology origins and provide evidence of licensing agreements where applicable. Include indemnification clauses in contracts.

3. Weak Contractual Protections

Procurement agreements that fail to address IP ownership, warranty enforceability, or liability for infringement leave buyers vulnerable. Ambiguities in contracts can hinder recourse in case of disputes or performance failures tied to IP violations.

Best Practice: Engage legal counsel to draft or review contracts with clear terms on IP rights, warranty obligations, and dispute resolution mechanisms.

Conclusion

To mitigate risks in solar PV sourcing, organizations must adopt a proactive approach combining technical verification, supply chain diligence, and legal safeguards. Prioritizing quality certifications, conducting supplier audits, and securing robust IP protections are essential steps to ensure long-term project success and compliance.

Logistics & Compliance Guide for Solar Photovoltaic Projects

Project Planning and Site Assessment

Before initiating any solar photovoltaic (PV) project, thorough planning and site assessment are essential. Evaluate site accessibility, terrain, grid connection proximity, and environmental constraints. Conduct geotechnical surveys, shading analysis, and structural assessments to ensure the location is suitable for PV installation. Coordinate with local authorities to verify zoning regulations, land use permissions, and any restrictions affecting construction or operation.

Regulatory Compliance and Permits

Solar PV projects must comply with national, regional, and local regulatory frameworks. Key compliance areas include building codes, electrical safety standards (e.g., NEC in the U.S., IEC internationally), and environmental regulations. Obtain necessary permits such as building permits, electrical permits, grid interconnection agreements, and environmental clearances. Ensure adherence to fire safety codes, setback requirements, and historic preservation rules if applicable.

Equipment Sourcing and Procurement

Procure high-quality PV modules, inverters, mounting systems, and balance-of-system (BOS) components from certified suppliers. Verify product certifications (e.g., UL, IEC, CE) and ensure compatibility with project specifications. Establish reliable supply chains with contingency plans for delays. Maintain detailed records of equipment specifications, warranties, and conformity certificates for audit and compliance purposes.

Transportation and Logistics Management

Plan the transportation of PV components with attention to weight, dimensions, and fragility. Use specialized carriers for delicate items like solar panels to prevent damage. Optimize shipping routes and schedules to minimize transit time and costs. Coordinate customs clearance for international shipments, ensuring compliance with import regulations, duties, and documentation (e.g., commercial invoices, packing lists, certificates of origin).

Installation and Construction Compliance

Ensure all installation activities follow manufacturer guidelines and industry best practices. Use licensed and trained personnel for electrical and structural work. Implement quality control checks at each stage, including foundation work, racking installation, module mounting, and electrical wiring. Conduct on-site inspections to verify compliance with safety standards and project specifications before proceeding to commissioning.

Grid Interconnection and Utility Coordination

Submit interconnection applications to the local utility well in advance. Provide technical documentation, including single-line diagrams, equipment specifications, and protection settings. Comply with utility-specific requirements for metering, protection relays, and communication protocols. Schedule and pass all required utility inspections before energization.

Commissioning and Performance Testing

Conduct thorough commissioning procedures including insulation resistance tests, continuity checks, string verification, and inverter start-up. Perform performance ratio (PR) and yield assessments to validate energy production expectations. Document all test results and generate as-built drawings for handover. Obtain commissioning certificates and sign-off from relevant authorities or third-party inspectors.

Operations, Maintenance, and Ongoing Compliance

Implement a preventive maintenance schedule to ensure system longevity and optimal performance. Monitor system output using SCADA or remote monitoring platforms. Keep records of maintenance activities, repairs, and performance data for compliance reporting. Renew any required operational permits and ensure continued adherence to environmental, safety, and grid code requirements throughout the system’s lifecycle.

Decommissioning and End-of-Life Management

Plan for responsible decommissioning at the end of the system’s life. Follow local regulations for equipment removal, site restoration, and waste disposal. Recycle PV modules and electronics through certified e-waste handlers in compliance with environmental laws (e.g., WEEE Directive in the EU). Document decommissioning activities and obtain closure certifications where required.

Conclusion: Sourcing Solar Photovoltaic Manufacturers

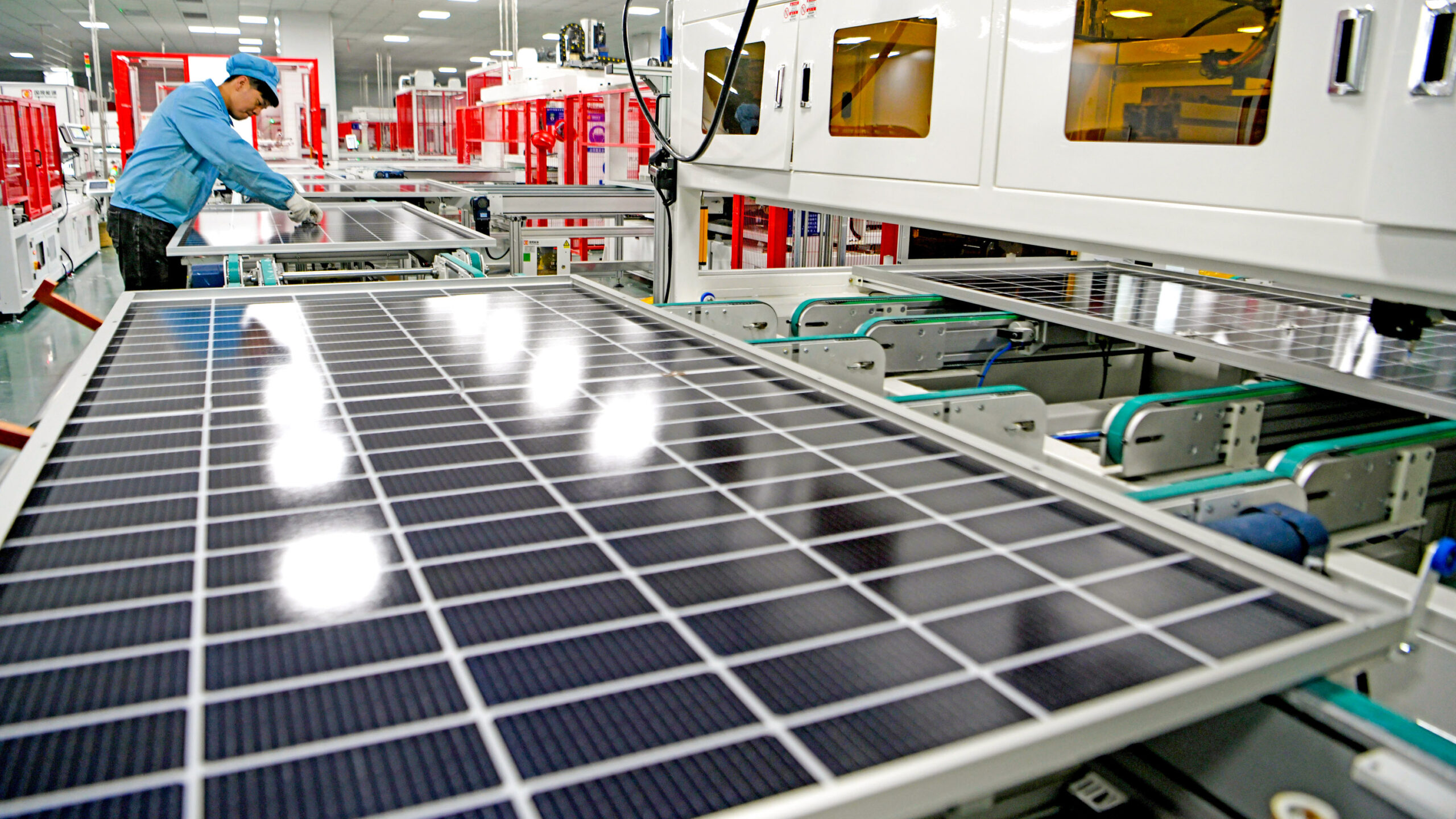

Sourcing solar photovoltaic (PV) manufacturers is a strategic decision that significantly impacts the quality, cost-efficiency, and long-term performance of solar energy projects. A thorough evaluation of manufacturers should consider key factors such as product quality, certifications (e.g., IEC, UL), production capacity, technological innovation, financial stability, and after-sales support. Regions like China, Southeast Asia, and increasingly India offer competitive manufacturing ecosystems, but due diligence is essential to ensure compliance with international standards and sustainability practices.

Establishing partnerships with reputable manufacturers enhances project reliability and supports scalability. Leveraging supplier audits, sample testing, and on-site inspections can mitigate risks related to supply chain disruptions, substandard materials, or shifting regulatory environments. Moreover, prioritizing manufacturers that invest in research and development ensures access to high-efficiency modules and emerging technologies such as bifacial panels and advanced cell architectures (e.g., TOPCon, HJT).

In conclusion, a well-informed sourcing strategy—balancing cost, quality, innovation, and sustainability—empowers stakeholders to build resilient solar supply chains and maximize return on investment in the rapidly growing global renewable energy market.