The global market for sodium potassium alloy (NaK), a eutectic alloy widely used in heat transfer systems, chemical reduction processes, and nuclear reactor applications, is experiencing steady growth due to rising demand in specialty chemicals and advanced energy technologies. According to Mordor Intelligence, the sodium-potassium alloy market is projected to grow at a CAGR of approximately 4.2% during the forecast period of 2023–2028, driven by increased adoption in pharmaceutical manufacturing and liquid-metal cooling systems. With industrialization accelerating across Asia-Pacific and North America leading in nuclear and aerospace R&D, the demand for high-purity NaK alloys is intensifying. As supply chains adapt to stringent safety and quality standards, a select group of manufacturers has emerged as key players, balancing innovation, scale, and regulatory compliance. Below are the top seven sodium potassium alloy manufacturers positioned at the forefront of this niche but critical segment.

Top 7 Sodium Potassium Alloy Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Alkali Metal Chemicals

Domain Est. 2000

Website: creativeengineers.com

Key Highlights: Creative Engineers is supplying Sodium-Potassium alloy (NaK) for various industrial applications. NaK is a eutectic alloy of sodium and potassium that is ……

#2 Potassium Sodium Alloy

Domain Est. 2022

Website: attelements.com

Key Highlights: ATT is a specialized supplier of potassium-sodium alloys, and we also manufacture plates, balls, ingots, balls, flakes, powders, rods, wires, sputtering targets ……

#3 Potassium alloy, nonbase, K,Na

Domain Est. 1997

Website: pubchem.ncbi.nlm.nih.gov

Key Highlights: Potassium alloy, nonbase, K,Na | KNa | CID 16211683 – structure, chemical names, physical and chemical properties, classification, patents, literature, ……

#4 Potassium Sodium Alloy

Domain Est. 1998

Website: americanelements.com

Key Highlights: Potassium Sodium Alloy qualified commercial & research quantity preferred supplier. Buy at competitive price & lead time. In-stock for immediate delivery….

#5 usantimony

Domain Est. 1999 | Founded: 1969

Website: usantimony.com

Key Highlights: USAC has produced various antimony products since 1969 and is a fully integrated mining, transportation, milling, smelting, and selling company….

#6 Potassium Sodium Alloy

Domain Est. 2000

Website: espimetals.com

Key Highlights: ESPI Metals offers high-purity metals in many forms to the research community worldwide….

#7 CALLERY™ Sodium

Domain Est. 2001

Website: echochemical.com

Key Highlights: Item Number:. 19-1910 ; Product Name:. CALLERY™ Sodium-Potassium Alloy 22:78 (min. 99%) ; Specifications:. 25g ; CAS No.:. 11135-81-2 ; Catalog No.:. 19-1910….

Expert Sourcing Insights for Sodium Potassium Alloy

H2: 2026 Market Trends Analysis for Sodium Potassium Alloy (NaK)

As of 2026, the global sodium potassium alloy (NaK) market is experiencing steady but niche growth, driven primarily by high-performance industrial, aerospace, and nuclear applications. NaK, a eutectic alloy of sodium and potassium that remains liquid at room temperature, continues to serve specialized sectors due to its exceptional thermal conductivity and low melting point. Below is an analysis of key market trends shaping the NaK industry in 2026.

1. Growing Demand in Advanced Nuclear Reactor Development

One of the most significant drivers of NaK demand in 2026 is its use as a coolant in next-generation nuclear reactors, particularly small modular reactors (SMRs) and space nuclear power systems. With increased global investments in clean energy and decarbonization, governments and private entities are advancing reactor designs that leverage liquid metal coolants. NaK—though less common than pure sodium—is valued in prototype systems and compact reactors due to its lower melting point and improved pumpability at ambient temperatures. Notably, space exploration initiatives, such as NASA’s fission surface power projects and lunar/Mars base planning, are testing NaK-based thermal management systems, contributing to R&D-driven procurement.

2. Aerospace and Defense Applications on the Rise

The aerospace sector is emerging as a key growth area for NaK. In 2026, satellite thermal regulation systems increasingly incorporate NaK in loop heat pipes and thermal switches for orbital stability and temperature control. Its ability to transfer heat efficiently in microgravity environments makes it ideal for long-duration space missions. Defense contractors are also exploring NaK in high-performance cooling systems for directed-energy weapons and hypersonic vehicle thermal management, where extreme heat dissipation is critical.

3. Supply Chain Constraints and Geopolitical Factors

The NaK market remains highly sensitive to raw material availability and geopolitical dynamics. Both sodium and potassium are abundant globally, but high-purity grades required for alloy production are concentrated in a few chemical producers, primarily in China, the United States, and Germany. Export controls on strategic materials and environmental regulations on alkali metal processing have tightened in 2026, leading to supply volatility. Additionally, NaK’s pyrophoric nature complicates transportation and storage, increasing logistics costs and limiting market expansion.

4. Safety and Environmental Regulations Tightening

Regulatory scrutiny on NaK use has intensified due to its reactivity with air and water, which poses safety and environmental risks. In 2026, the U.S. Environmental Protection Agency (EPA), European Chemicals Agency (ECHA), and other regulatory bodies have updated handling, storage, and disposal guidelines for NaK under updated REACH and OSHA standards. These regulations are pushing end-users to adopt safer encapsulation methods and alternative coolants, slowing adoption in less critical applications. However, the niche nature of NaK use means compliance is manageable for specialized operators.

5. Technological Innovation and Material Substitution Pressures

While NaK maintains a unique position, it faces increasing competition from alternative liquid metal alloys (e.g., sodium-potassium-indium blends) and advanced heat transfer fluids such as molten salts and nanofluids. Research in 2026 shows progress in developing less reactive, non-pyrophoric coolants that mimic NaK’s thermal properties. However, NaK still outperforms many alternatives in thermal conductivity and phase stability, particularly in extreme environments. As a result, innovation is focused on improving NaK containment systems and hybrid cooling solutions rather than outright substitution.

6. Regional Market Dynamics

- North America leads in NaK consumption, driven by defense spending, space programs (e.g., Artemis and commercial LEO platforms), and nuclear innovation.

- Europe shows moderate growth, with research institutions and nuclear agencies exploring NaK in fusion and fission prototypes.

- Asia-Pacific, particularly China and India, is expanding NaK use in nuclear energy programs and satellite development, though domestic production capacity remains limited.

- Middle East and Africa are negligible markets, with minimal industrial or nuclear infrastructure supporting NaK demand.

7. Pricing and Market Size Outlook

The global NaK market is projected to reach approximately $45–55 million in 2026, growing at a CAGR of 4.2% since 2021. Prices remain high due to low production volumes, stringent handling requirements, and custom formulation needs. High-purity NaK (e.g., NaK-78) commands premium pricing, especially for aerospace and nuclear R&D contracts.

Conclusion

In 2026, the sodium potassium alloy market remains a high-value, low-volume segment shaped by technological innovation, strategic applications, and regulatory challenges. While not a mass-market material, NaK’s irreplaceable role in extreme-environment thermal management ensures sustained demand in aerospace, defense, and advanced nuclear sectors. Future growth will depend on breakthroughs in safe handling technologies, geopolitical stability in supply chains, and continued investment in space and clean energy infrastructure.

When sourcing Sodium-Potassium (NaK) alloy—particularly grades suitable for use as a reducing agent or heat transfer medium in specialized applications—there are several critical pitfalls related to quality and intellectual property (IP) that must be carefully managed. Using hydrogen (H₂) as a reference or reaction environment introduces additional complexity. Below is a breakdown of common pitfalls in these areas, with emphasis on quality control and IP considerations, and how H₂ usage interacts with these issues.

🔹 Common Quality-Related Pitfalls in Sourcing NaK Alloy

- Impurity Levels (Oxygen, Moisture, Oxides)

- Pitfall: NaK is extremely reactive with air and moisture. Even trace impurities (H₂O, O₂, CO₂) can lead to oxide/hydroxide formation, reducing reactivity and increasing safety risks.

- H₂ Relevance: If NaK is used under H₂ atmosphere (e.g., in catalytic reductions or hydrogenation reactions), residual moisture or oxides can react with H₂ to produce water, degrading the alloy or contaminating the reaction.

-

Mitigation:

- Source from suppliers with certified inert-atmosphere packaging (e.g., argon-filled ampoules).

- Require certificates of analysis (CoA) detailing O₂, H₂O, and C content.

- Perform Karl Fischer titration or GC residual gas analysis upon receipt.

-

Incorrect Na:K Ratio

- Pitfall: The eutectic composition (NaK-78: 78% K, 22% Na) remains liquid at room temperature. Deviations can lead to solidification, causing handling issues and inconsistent reactivity.

- H₂ Relevance: In H₂-based processes requiring fluid metal media (e.g., hydrogen storage or catalytic transfer), solidification disrupts heat/mass transfer.

-

Mitigation:

- Verify alloy composition via ICP-MS or XRF.

- Specify eutectic or required ratio explicitly in procurement contracts.

-

Contamination from Container Materials

- Pitfall: NaK reacts with glass, many metals, and plastics. Improper storage (e.g., in glass ampoules without proper passivation) leads to contamination or rupture.

- H₂ Relevance: In H₂ environments, contaminated NaK may catalyze unwanted side reactions or degrade seals/gaskets.

-

Mitigation:

- Use stainless steel or nickel-alloy containers with proper passivation.

- Confirm packaging compatibility with supplier.

-

Degradation During Transport and Storage

- Pitfall: Exposure to temperature fluctuations or mechanical shock can compromise sealed containers.

- H₂ Relevance: In lab/plant settings using H₂, degraded NaK may initiate exothermic reactions with leaked H₂ or moisture, posing explosion risks.

-

Mitigation:

- Use triple-containment packaging.

- Monitor during transit with temperature and shock loggers.

-

Inconsistent Reactivity Due to Surface Passivation

- Pitfall: A surface oxide layer can inhibit NaK’s reactivity, leading to failed reductions or inconsistent results in H₂-involving reactions.

- H₂ Relevance: In hydrogenation reactions where NaK activates H₂, surface passivation reduces catalytic efficiency.

- Mitigation:

- Use under strict inert atmosphere (glovebox/Schlenk line).

- Activate surface mechanically (stirring with inert metal scraper) or chemically (trace of alcohol, cautiously).

🔹 Intellectual Property (IP)-Related Pitfalls

- Use of Proprietary Processes or Formulations

- Pitfall: Some NaK applications (e.g., in organic synthesis like Birch reductions or advanced nuclear cooling) may rely on patented methods. Sourcing NaK for use in such processes without IP clearance can lead to infringement.

- H₂ Relevance: If your process involves H₂ activation using NaK in a novel catalytic system, ensure freedom-to-operate (FTO).

-

Mitigation:

- Conduct patent landscaping (e.g., using USPTO, Espacenet) around NaK + H₂ applications.

- Consult IP counsel before scaling up or commercializing.

-

Supplier Know-How and Trade Secrets

- Pitfall: Some suppliers may claim proprietary methods for purifying or stabilizing NaK. Relying on such suppliers without understanding fallback options creates IP and supply chain risk.

- H₂ Relevance: If the supplier’s stabilization method interferes with H₂ reactivity (e.g., additives that poison catalysts), performance suffers.

-

Mitigation:

- Require full material disclosure (SDS, technical specs).

- Qualify multiple suppliers or develop in-house handling protocols.

-

Reverse Engineering Risks

- Pitfall: Attempting to replicate a competitor’s NaK-based H₂ process without proper IP clearance may violate trade secrets or patents.

-

Mitigation:

- Document R&D efforts thoroughly to support independent invention (if applicable).

- Avoid disassembly or analysis of competitor systems without legal review.

-

Joint Development and Ownership Ambiguity

- Pitfall: Collaborating with a supplier to improve NaK for H₂ applications (e.g., nanostructuring, coating) without clear IP agreements can lead to disputes over ownership.

- Mitigation:

- Define IP ownership in collaboration contracts upfront.

- Specify background vs. foreground IP.

🔹 Best Practices Summary (NaK + H₂ Context)

| Area | Best Practice |

|——|—————|

| Quality | Source NaK-78 in argon-sealed stainless steel containers; verify composition and moisture content. |

| Handling | Use exclusively in inert atmosphere gloveboxes; avoid contact with H₂O, air, or incompatible materials. |

| H₂ Compatibility | Ensure no residual oxides that could react with H₂ to form water; pre-treat if needed. |

| IP Risk Mitigation | Conduct FTO analysis for NaK + H₂ processes; secure licenses if required. |

| Supplier Management | Audit suppliers for quality systems (ISO 9001) and request full transparency on alloy specs. |

✅ Conclusion

Sourcing high-quality Sodium-Potassium alloy for use in hydrogen-involving processes demands rigorous attention to purity, composition, and handling, as even minor deviations can compromise safety and performance. Concurrently, IP risks must be proactively managed—especially when integrating NaK into catalytic or proprietary H₂-based technologies. Always validate both technical specs and legal freedom-to-operate before deployment.

Logistics & Compliance Guide for Sodium Potassium Alloy (NaK) – Using H2 (GHS/CLP Harmonized System)

1. Product Identification

- Chemical Name: Sodium Potassium Alloy (NaK)

- Common Names: NaK, Sodium-Potassium Alloy

- CAS Number: 11135-91-8 (for NaK-77, eutectic alloy)

- UN Number: UN 1423

- Class: 4.3 – Substances which, in contact with water, emit flammable gases

- Packing Group: I (High danger)

- GHS Classification (H2 System – Globally Harmonized System):

- Hazard Class: Flammable Solid; Pyrophoric Liquid; Water-Reactive

- Hazard Statements (H-Statements):

- H228: Flammable solid.

- H250: Catches fire spontaneously if exposed to air.

- H260: In contact with water releases flammable gases which may ignite spontaneously.

- H314: Causes severe skin burns and eye damage.

- H331: Toxic if inhaled (due to potential reaction byproducts, e.g., potassium hydroxide fumes).

- Precautionary Statements (P-Statements):

- P222: Do not allow contact with air.

- P223: Keep away from any possible contact with water, because violent reaction may occur.

- P231+P232: Handle and store under inert gas. Protect from moisture.

- P280: Wear protective gloves/protective clothing/eye protection/face protection.

- P303+P361+P353: IF ON SKIN (or hair): Remove/Take off immediately all contaminated clothing. Rinse skin with water/shower.

- P305+P351+P338: IF IN EYES: Rinse cautiously with water for several minutes. Remove contact lenses, if present and easy to do. Continue rinsing.

- P370+P378: In case of fire: Use dry sand, dry powder, or Class D fire extinguisher. Do NOT use water or CO₂.

- P422: Store contents under inert gas.

2. Physical and Chemical Properties

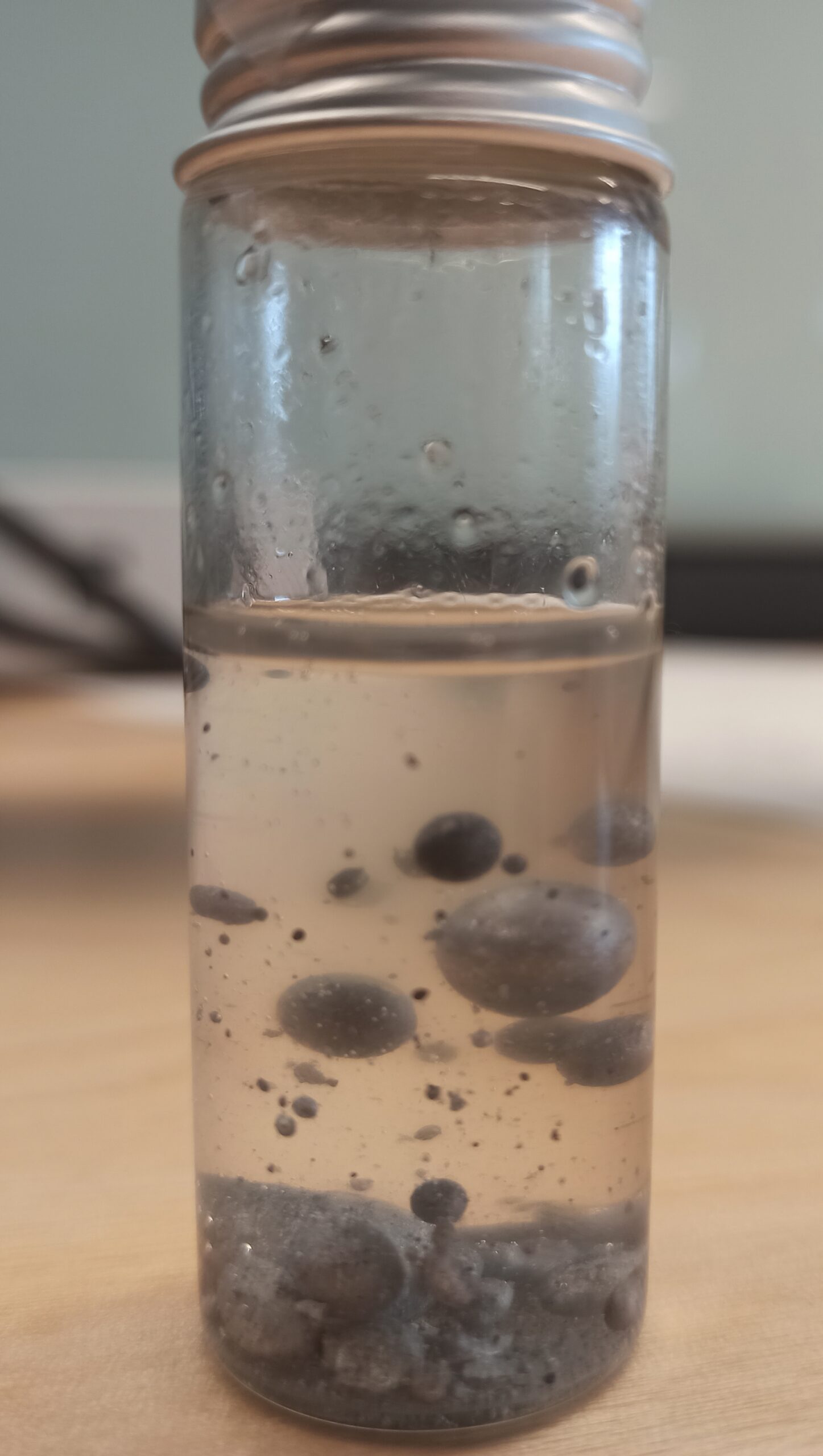

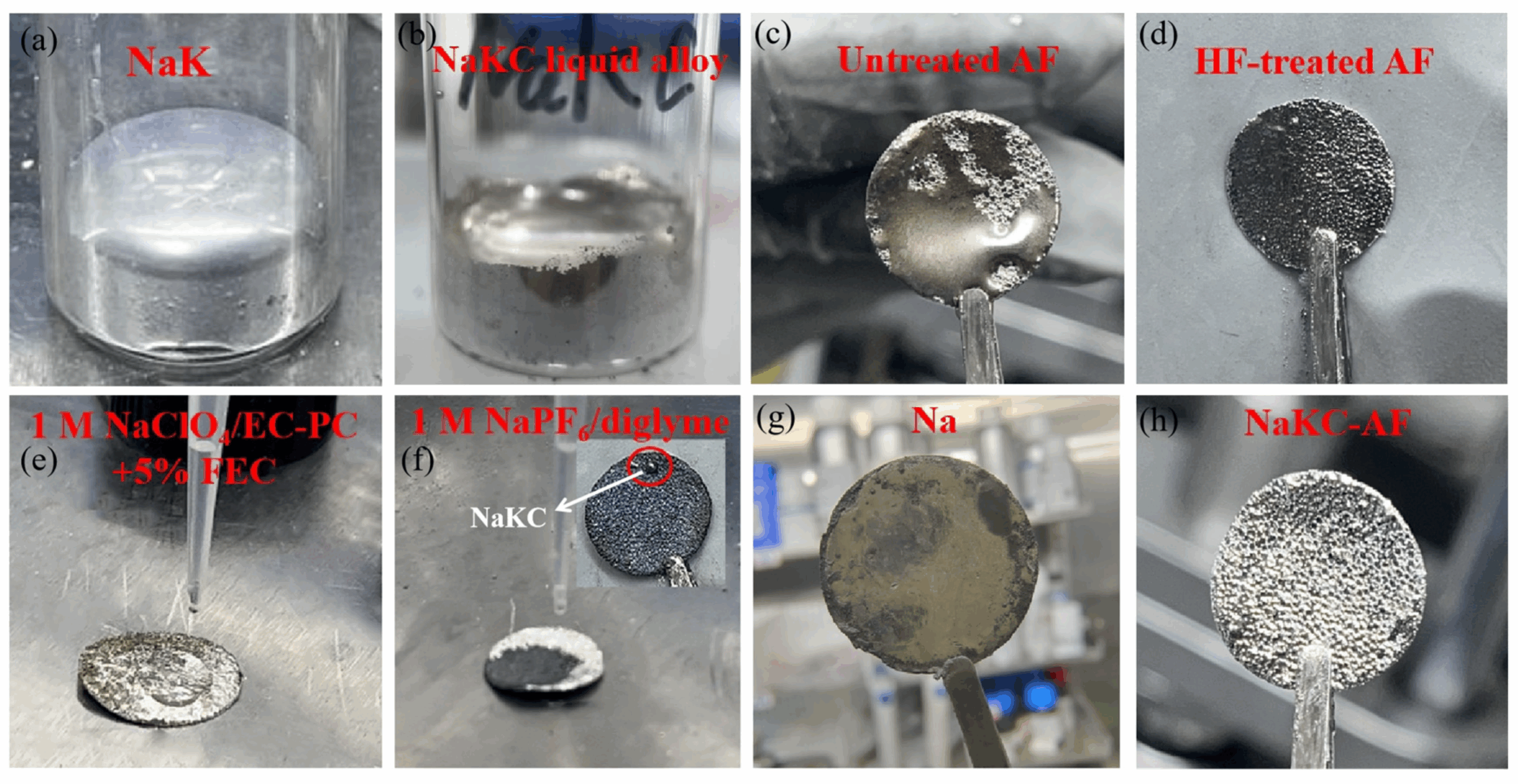

- Appearance: Silvery liquid (at room temperature for eutectic NaK-77)

- Melting Point: ~−12.6 °C (for NaK-77)

- Boiling Point: ~785 °C (sodium), ~774 °C (potassium) – alloy evaporates gradually

- Density: ~0.87 g/cm³

- Solubility in Water: Reacts violently (not soluble)

- Autoignition Temperature: <100 °C (pyrophoric in air)

- Vapor Pressure: Low, but reactive vapors may form

3. Hazards Identification (GHS H2 Criteria)

| Hazard Class | GHS Category | Signal Word | H-Phrases |

|————–|————–|————|———–|

| Flammable Liquids | Category 1 (Pyrophoric) | Danger | H250 |

| Self-Reactive Substances | Not applicable | — | — |

| Substances Emitting Flammable Gases on Contact with Water | Category 1 | Danger | H260 |

| Acute Toxicity (Inhalation) | Category 3 | Danger | H331 |

| Skin Corrosion/Irritation | Category 1B | Danger | H314 |

| Serious Eye Damage/Eye Irritation | Category 1 | Danger | H314 |

4. First Aid Measures

- Inhalation: Move to fresh air. If breathing is difficult, administer oxygen. Seek medical attention immediately. Symptoms may include coughing, shortness of breath, pulmonary edema.

- Skin Contact: Immediately flush with dry mineral oil or inert solvent (e.g., toluene), then cover with dry sand or talc. Do not use water. Remove contaminated clothing. Seek medical help.

- Eye Contact: Rinse cautiously with copious amounts of dry, inert oil (e.g., mineral oil), then flush with water only after all alloy is removed. Seek immediate medical attention.

- Ingestion: Do not induce vomiting. Rinse mouth with water (only if conscious). Never give anything by mouth to an unconscious person. Seek emergency medical care.

⚠️ Note: Water must NEVER be used during first aid due to violent reaction.

5. Fire-Fighting Measures

- Extinguishing Media: Use Class D fire extinguishers (e.g., Met-L-X, copper-based powders), dry sand, or dry sodium chloride-based agents.

- Special Hazards: Reacts violently with water, moisture, CO₂, halogens, acids. Releases hydrogen gas (flammable) and heat upon contact with water. May ignite spontaneously in air.

- Protective Equipment: Full fire-resistant suit, SCBA (self-contained breathing apparatus).

- Fire Procedures: Evacuate area. Approach from upwind. Do not use water, foam, or CO₂ extinguishers — these can worsen the fire.

6. Accidental Release Measures

- Personal Precautions:

- Evacuate non-essential personnel.

- Use explosion-proof equipment.

- Wear full chemical protective suit and SCBA.

- Work under inert atmosphere (e.g., argon glovebox).

- Containment and Cleanup:

- Do not use water.

- Cover spill with dry sand, vermiculite, or dry sodium chloride.

- Collect material using non-sparking tools under inert gas.

- Place in airtight, inert-atmosphere container for disposal.

- Decontaminate area with dry inert agents only.

7. Handling and Storage

- Handling:

- Handle only under inert atmosphere (argon or nitrogen).

- Use in well-ventilated, explosion-proof areas.

- Ground all equipment to prevent static discharge.

- Avoid contact with air, water, oxidizers, acids, halogens.

- Storage:

- Store sealed under inert gas (argon preferred).

- Keep in a cool, dry, fire-resistant cabinet away from incompatible materials.

- Storage containers must be leak-proof, non-reactive (e.g., stainless steel with inert seals).

- Clearly label with GHS pictograms: Flame (GHS02), Corrosion (GHS05), Exclamation Mark (GHS07).

8. Exposure Controls and Personal Protection

- Engineering Controls:

- Use closed systems and inert gas purging.

- Local exhaust ventilation with spark-proof ducts.

- Glove boxes or fume hoods rated for pyrophoric materials.

- Personal Protective Equipment (PPE):

- Eye/Face Protection: Chemical splash goggles + face shield.

- Skin Protection: Flame-resistant lab coat, neoprene or butyl rubber gloves (tested for metal reactivity), apron.

- Respiratory Protection: NIOSH-approved respirator with organic vapor and particulate cartridges, or SCBA in high-risk scenarios.

- Other: Static-dissipative footwear, no synthetic clothing.

9. Physical and Chemical Stability

- Stability: Unstable in air and moisture. Stable under inert atmosphere.

- Conditions to Avoid: Air, moisture, heat, water, oxidizing agents, acids.

- Incompatible Materials:

- Water, alcohols, acids, halogens, oxidizers, carbon dioxide, ammonia.

- Decomposition Products: Sodium/potassium hydroxides, hydrogen gas, heat.

10. Transport Information (Based on UN & IATA/IMDG/ADR Regulations)

- UN Number: 1423

- Proper Shipping Name: SODIUM POTASSIUM ALLOY

- Class: 4.3 (Substances which, in contact with water, emit flammable gases)

- Packing Group: I

- Labels Required:

- Class 4.3 (Flammable when wet)

- Class 4.2 (Pyrophoric, if applicable based on form)

- Packaging: Hermetically sealed, inert atmosphere, within robust outer packaging (e.g., steel drum with inert gas seal).

- Special Provisions: Must be transported under inert gas, protected from moisture and physical shock.

- Regulations:

- Air (IATA DGR): Forbidden or highly restricted; special approval required.

- Sea (IMDG Code): Limited quantities may be allowed with special arrangements.

- Road (ADR): Requires Class 4.3 labeling, tunnel code restrictions.

11. Regulatory Compliance (GHS H2 Implementation)

- GHS Implementation: Fully aligned with H2 (Sixth Revised Edition and later).

- SDS Requirements: Safety Data Sheet must include:

- Section 2: GHS classification, hazard pictograms, signal word, H/P statements.

- Section 7: Handling and storage under inert gas.

- Section 8: PPE recommendations specific to pyrophoric metals.

- Section 14: Transport classification (UN 1423, Class 4.3, PG I).

- Labeling: All containers must display:

- Product identifier

- Supplier information

- GHS pictograms (Flame, Corrosion)

- Signal word: Danger

- H- and P-statements as listed above

12. Disposal Considerations

- Disposal Code: Must comply with local hazardous waste regulations (e.g., EPA, ECHA).

- Method: Controlled hydrolysis under inert conditions (e.g., slow addition to dry isopropanol, then neutralization).

- Waste Classification: Reactive hazardous waste (UN 1423).

- Disposal Facilities: Licensed hazardous waste treatment center with pyrophoric handling capability.

- Documentation: Maintain waste manifests and disposal records.

13. Training and Emergency Planning

- Personnel Training:

- GHS hazard communication.

- Safe handling of pyrophoric and water-reactive materials.

- Emergency response (fire, spill, exposure).

- Emergency Plans:

- On-site spill response protocol.

- Coordination with local fire department (notify of NaK storage).

- Eyewash/shower stations with dry decontamination kits (no water contact).

Conclusion

Sodium Potassium Alloy (NaK) is a high-risk substance due to its pyrophoric nature and violent reaction with water. Strict adherence to GHS H2 hazard classification, inert handling, proper labeling, and emergency preparedness is essential for safe logistics, storage, and compliance.

Always consult the Safety Data Sheet (SDS) and follow national and international regulations (e.g., OSHA, REACH, CLP, DOT, IATA).

Disclaimer: This guide is for informational purposes only. Specific operational procedures must be developed in consultation with qualified safety professionals and regulatory authorities.

Conclusion for Sourcing Sodium-Potassium Alloy (NaK):

Sourcing sodium-potassium alloy (NaK) requires careful consideration due to its highly reactive and hazardous nature. Successful procurement depends on identifying reputable chemical suppliers specializing in specialty or reactive metals, such as Sigma-Aldrich, Alfa Aesar, or dedicated metal suppliers like American Elements or ABCR GmbH. Compliance with safety, handling, and transportation regulations—particularly those governing hazardous and pyrophoric materials—is essential to ensure legal and safe acquisition.

Given NaK’s reactivity with air and water, it must be stored and transported under inert atmospheres or in sealed containers, often requiring custom handling protocols. Buyers must also evaluate the required alloy composition (e.g., NaK-77, NaK-22) for specific applications such as heat transfer in nuclear reactors, chemical reducing agents, or experimental cooling systems.

Alternative options, such as on-site preparation (under strictly controlled conditions), may be viable for specialized research institutions, though this increases operational complexity and safety risks. Therefore, the decision to source NaK should balance application necessity, safety infrastructure, regulatory compliance, and supplier reliability.

In conclusion, while sodium-potassium alloy is a valuable material in niche industrial and scientific applications, its sourcing must be approached with rigorous attention to safety, regulatory standards, and supplier credibility to mitigate risks and ensure effective utilization.