The global sodium dithionite market is experiencing steady growth, driven by rising demand across key industries such as textiles, pulp and paper, water treatment, and food processing. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 770 million in 2022 and is projected to grow at a CAGR of 3.8% over the forecast period (2023–2028). This expansion is largely attributed to sodium dithionite’s role as a cost-effective reducing agent and bleaching agent, particularly in sustainable textile manufacturing and dechlorination processes. With Asia-Pacific dominating both production and consumption—China being the largest producer—the competitive landscape is shaped by manufacturers investing in process efficiency, product purity, and environmental compliance. As demand continues to rise, especially in emerging economies, the top six sodium dithionite manufacturers are scaling operations, enhancing R&D, and strengthening supply chains to maintain market leadership and meet evolving industrial needs.

Top 6 Sodium Dithionite Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Guangdi Chemical Company

Domain Est. 2016

Website: gdchemical.com

Key Highlights: Guangdi Chemical Co.,Ltd. is the largest sodium hydrosulfite(sodium dithionite) manufacturer in China, located in the Maoming National Hi-Tach Industrial ……

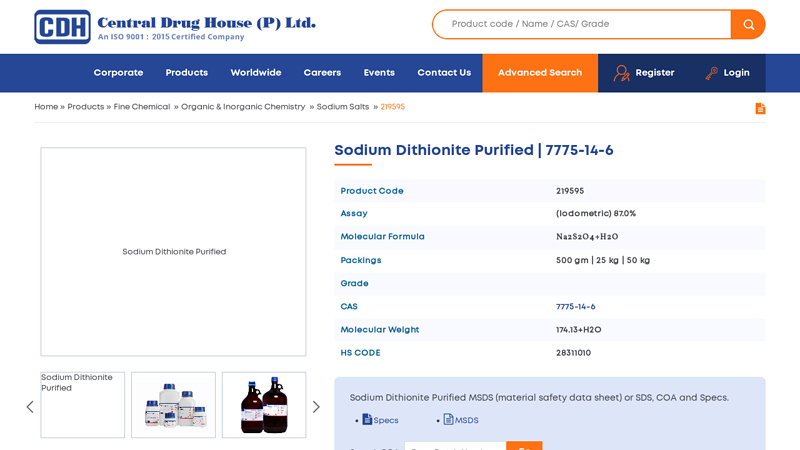

#2 Sodium Dithionite Purified

Domain Est. 2002

Website: cdhfinechemical.com

Key Highlights: CDH is an ISO certified Sodium Dithionite Purified manufacturer in India, Sodium Dithionite Purified (CAS-7775-14-6) supplier & exporter in India….

#3 Gulshan Chemicals Private Limited

Domain Est. 2006

Website: gulshanchemicals.com

Key Highlights: Gulshan Chemicals – A leading manufacturer of sodium hydrosulfite in india. we have established trust, reliability and sustainability….

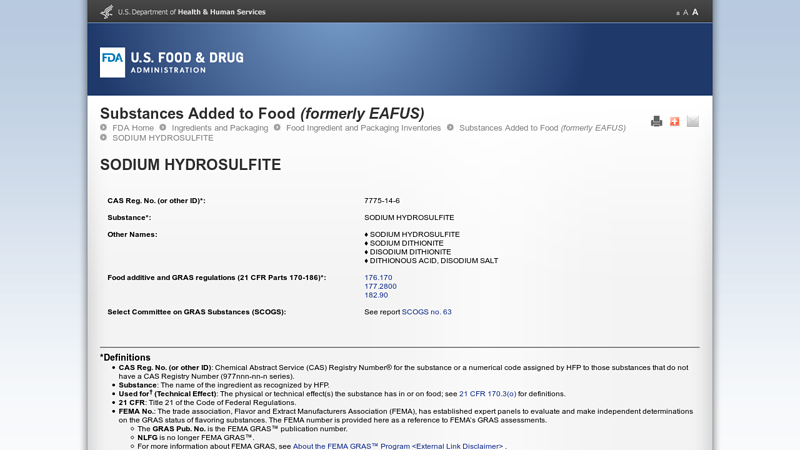

#4 sodium hydrosulfite

Domain Est. 2000

Website: hfpappexternal.fda.gov

Key Highlights: CAS Reg. No. (or other ID)*:, 7775-14-6. Substance*:, SODIUM HYDROSULFITE. Other Names: ♢ SODIUM HYDROSULFITE ♢ SODIUM DITHIONITE ♢ DISODIUM DITHIONITE…

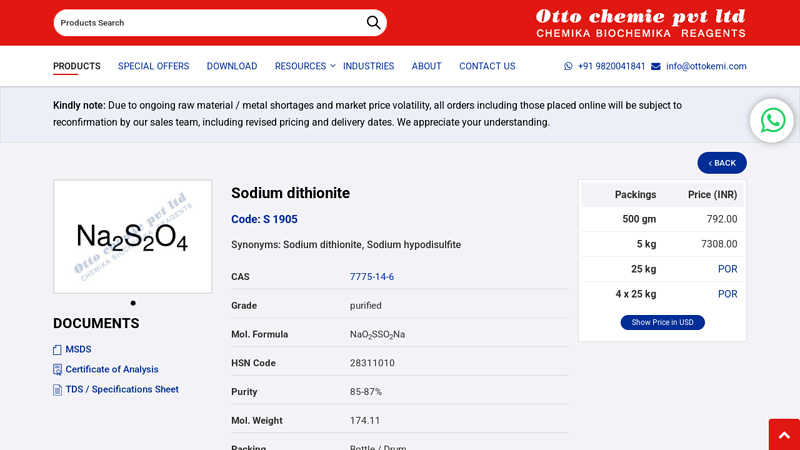

#5 Sodium dithionite 7775

Domain Est. 2000

Website: ottokemi.com

Key Highlights: Sodium dithionite (also known as sodium hydrosulfite) is a white crystalline powder with a weak sulfurous odor. It is the sodium salt of dithionous acid….

#6 Sodium Hydrosulfite

Domain Est. 2003

Website: bencochemical.com

Key Highlights: Experienced supplier of Sodium Hydrosulfite to the North American Market. Sodium hydrosulfite (sodium dithionite) is at the heart of our business….

Expert Sourcing Insights for Sodium Dithionite

As of now, detailed and verified market data for Sodium Dithionite in the year 2026 is not yet available, as that year has not occurred. However, using forward-looking analysis based on current industry dynamics, technological trends, and macroeconomic factors (as of H2 2024), we can project key market trends likely to shape the Sodium Dithionite (Na₂S₂O₄) industry through 2026.

Market Overview:

Sodium Dithionite, also known as sodium hydrosulfite, is a key reducing agent used primarily in the textile, paper, and chemical industries. Its main applications include vat dyeing, bleaching of wood pulp, and as a dechlorinating agent in water treatment.

Projected 2026 Market Trends for Sodium Dithionite (H2 2024–2026 Outlook):

- Growing Demand in the Textile Industry:

- The global textile sector, particularly in Asia-Pacific (China, India, Bangladesh), continues to recover post-pandemic, with increased production of cotton and synthetic fabrics.

- Vat dyeing remains a preferred method for colorfastness in cotton textiles, driving steady demand for Sodium Dithionite.

-

Projection: By 2026, Asia-Pacific will account for over 60% of global Sodium Dithionite consumption, supported by expanding textile manufacturing.

-

Environmental Regulations and Substitution Pressures:

- Sodium Dithionite decomposes into sulfur-containing byproducts, raising environmental concerns in wastewater discharge.

- Stricter environmental regulations in Europe and North America are pushing industries to explore alternatives such as glucose-based reducing agents or electrochemical reduction techniques.

-

Projection: Moderate decline in use in eco-sensitive regions, but continued dominance in cost-driven markets.

-

Price Volatility and Supply Chain Shifts:

- Sodium Dithionite production is energy-intensive and relies on raw materials like sulfur dioxide and zinc.

- Geopolitical tensions and fluctuating energy prices (especially in China, the largest producer) may lead to periodic supply disruptions.

-

Projection: Price volatility expected through 2026, with potential consolidation among manufacturers to ensure stable supply.

-

Innovation in Stabilized Forms and Packaging:

- To improve shelf life and safety (Na₂S₂O₄ is prone to oxidation), manufacturers are investing in microencapsulation and stabilized formulations.

- Adoption of double-layer packaging and oxygen scavengers is increasing.

-

Projection: By 2026, stabilized and solid-form products will gain market share, especially in export markets.

-

Expansion in Pulp & Paper Industry (Niche Growth):

- Although chlorine-free bleaching (e.g., ECF, TCF) reduces reliance on reducing agents, Sodium Dithionite is still used in high-brightness paper production.

- Demand remains stable in specialty paper and recycled fiber processing.

-

Projection: Low-to-moderate growth in this segment, with volume increases in emerging economies.

-

Rise of Green Chemistry Initiatives:

- Research into biobased and catalytic alternatives may challenge Sodium Dithionite’s dominance in the long term.

- However, due to its low cost and established infrastructure, full replacement is unlikely before 2030.

-

Projection: By 2026, Sodium Dithionite will still hold a dominant market share, but R&D investments in alternatives will accelerate.

-

Regional Market Dynamics:

- China: Remains the largest producer and consumer, with ongoing capacity expansions and consolidation among chemical firms.

- India: Emerging as a secondary hub due to textile growth and domestic chemical production push.

- Europe & North America: Mature markets with flat or slightly declining demand, offset by niche applications in water treatment and chemical synthesis.

Market Size & Forecast (Estimated):

– Global Sodium Dithionite market was valued at approximately USD 450–500 million in 2023.

– CAGR (2024–2026): ~3.5–4.5%, driven by Asia-Pacific demand.

– Projected market value by 2026: USD 550–600 million.

Key Players:

– Zouping Mingxing Chemical (China)

– Shandong Kerui Chemical

– Arkema (France)

– BASF (Germany)

– UBE Corporation (Japan)

These companies are investing in efficient production processes and export logistics to capture emerging market opportunities.

Conclusion (H2 2024–2026 Outlook):

The Sodium Dithionite market is expected to experience moderate global growth through 2026, fueled by demand in the textile sector—especially in Asia. While environmental pressures and innovation in green chemistry may limit expansion in developed markets, cost-effectiveness and established industrial use will sustain demand. Manufacturers that invest in stabilization technologies, supply chain resilience, and compliance with environmental standards will be best positioned for success.

Note: These projections are based on current trends and available data as of H2 2024 and are subject to change with macroeconomic conditions, regulatory developments, and technological advances.

H2: Common Pitfalls When Sourcing Sodium Dithionite – Quality and Intellectual Property (IP) Concerns

Sourcing sodium dithionite (also known as sodium hydrosulfite) presents several challenges, particularly in ensuring consistent quality and avoiding intellectual property (IP) risks. Below are key pitfalls under these two critical areas:

1. Quality-Related Pitfalls

a. Inconsistent Purity and Assay Levels

- Issue: Sodium dithionite is available in various grades (technical, reagent, industrial), with purity levels ranging from 85% to 90+% active content. Suppliers may not consistently meet specifications, especially from low-cost regions.

- Risk: Lower purity reduces reducing efficiency, increases waste, and may introduce impurities that affect downstream processes (e.g., dyeing, bleaching).

- Best Practice: Require COAs (Certificates of Analysis) with each batch and conduct third-party testing for active dithionite content, pH, and insoluble matter.

b. Poor Stability and Degradation During Storage/Transport

- Issue: Sodium dithionite is highly sensitive to moisture, heat, and oxygen, leading to rapid decomposition into sulfate and sulfite byproducts.

- Risk: Degraded material loses reducing power, resulting in inconsistent process performance.

- Best Practice: Source material packaged in nitrogen-flushed, moisture-proof, multi-layered bags or drums. Confirm supplier packaging protocols and ensure cold/dry storage and short transit times.

c. Variable Physical Form and Solubility

- Issue: Available as powder, granules, or crystals—each with different dissolution rates and handling characteristics.

- Risk: Poor solubility or clumping can cause dosing inaccuracies in continuous industrial processes.

- Best Practice: Match physical form to application needs (e.g., granules for automated feeding in textile mills) and test dissolution rate during supplier qualification.

d. Contamination with Heavy Metals or Impurities

- Issue: Some manufacturing processes (especially zinc-based production methods) may leave trace metals (e.g., Zn, Fe, Pb).

- Risk: Contaminants can catalyze decomposition or affect product quality (e.g., in food packaging bleaching or electronics).

- Best Practice: Specify strict limits on heavy metals in purchase agreements and verify via ICP-MS testing.

2. Intellectual Property (IP) Pitfalls

a. Use of Proprietary Manufacturing Processes

- Issue: Certain high-purity or stabilized forms of sodium dithionite are produced using patented methods (e.g., formaldehyde-free synthesis, encapsulation techniques).

- Risk: Sourcing from a supplier using a protected process without awareness could expose the buyer to indirect IP infringement, especially in regulated or competitive markets.

- Best Practice: Conduct due diligence on supplier’s manufacturing process. Request documentation confirming freedom-to-operate (FTO) or non-infringement, particularly for specialty grades.

b. Branded or Formulated Products with IP Protection

- Issue: Some suppliers market sodium dithionite under brand names (e.g., “Rongalite®”, although often confused with sodium hydroxymethanesulfinate) or stabilized formulations covered by trademarks or patents.

- Risk: Using a branded product without proper licensing—or replicating its performance without understanding IP boundaries—can lead to legal exposure.

- Best Practice: Ensure technical specifications are based on chemical composition, not brand names. Avoid reverse-engineering proprietary blends without legal review.

c. Lack of Transparency in Supply Chain

- Issue: Sodium dithionite may be sourced through intermediaries or toll manufacturers where the origin and process are obscured.

- Risk: Unknowingly sourcing a patented product or one produced via an IP-protected method.

- Best Practice: Audit key suppliers, request process descriptions, and include IP indemnification clauses in supply agreements.

Conclusion

To mitigate risks when sourcing sodium dithionite:

– Prioritize suppliers with consistent quality control, proper packaging, and transparent COAs.

– Conduct technical and legal due diligence to avoid IP conflicts, especially when sourcing specialty or high-performance grades.

– Establish long-term supplier agreements with quality and IP warranties.

Proactive management of both quality and IP issues ensures reliable supply and reduces operational and legal vulnerabilities.

Logistics & Compliance Guide for Sodium Dithionite (Using H2 Hazard Statement)

Prepared in accordance with GHS (Globally Harmonized System) and relevant regulatory standards

1. Chemical Identity

- Chemical Name: Sodium Dithionite (also known as Sodium Hydrosulfite)

- CAS Number: 7775-14-6

- Molecular Formula: Na₂S₂O₄

- UN Number: UN1384

- Proper Shipping Name: SODIUM DITHIONITE

- Hazard Class: 4.2 (Substances liable to spontaneous combustion)

- Packing Group: II (Medium danger)

- GHS Pictograms:

- GHS02 (Flame) – Flammable solid

- GHS07 (Exclamation mark) – Irritant

- GHS08 (Skull and crossbones) – Acute toxicity (if applicable, depending on formulation)

2. Hazard Classification & H2 Statement

-

Hazard Statement (H2):

H261: In contact with water releases flammable gases which may ignite spontaneously.

(Note: H261 is the primary H2 hazard statement relevant to Sodium Dithionite. This reflects its reactivity with moisture.) -

Other Relevant Hazard Statements:

- H315: Causes skin irritation

- H319: Causes serious eye irritation

- H335: May cause respiratory irritation

- H412: Harmful to aquatic life with long-lasting effects

3. Precautionary Measures (P Statements)

- P210: Keep away from heat, hot surfaces, sparks, open flames and other ignition sources. No smoking.

- P222: Do not allow contact with air.

- P223: Keep away from any possible contact with water, because of violent reaction and possible flash fire.

- P231+P232: Handle and store under inert gas. Protect from moisture.

- P261: Avoid breathing dust/fume.

- P271: Use only outdoors or in a well-ventilated area.

- P280: Wear protective gloves, eye protection, and face protection.

- P304+P340: IF INHALED: Remove victim to fresh air and keep at rest in a position comfortable for breathing.

- P370+P378: In case of fire: Use dry sand or dry powder to extinguish. Do NOT use water.

4. Physical & Chemical Properties

| Property | Value |

|——–|——-|

| Appearance | White to yellowish crystalline powder or granules |

| Odor | Sulfurous (due to decomposition) |

| Solubility | Soluble in water (decomposes) |

| Decomposition | Reacts with water and moisture to release sulfur dioxide and flammable gases (e.g., hydrogen sulfide) |

| Stability | Unstable in air and moisture; decomposes rapidly in water |

5. Storage Requirements

- Conditions:

- Store in a cool, dry, well-ventilated area.

- Keep containers tightly closed under inert atmosphere (e.g., nitrogen).

- Protect from moisture, heat, and direct sunlight.

-

Must be isolated from oxidizing agents, acids, and water sources.

-

Containers:

- Airtight, moisture-resistant containers (e.g., sealed drums with polymer liners).

-

Use of double containment recommended.

-

Shelf Life: Limited; monitor for caking or discoloration (signs of decomposition).

6. Handling Procedures

- Use only in controlled environments with inert gas purging if necessary.

- Avoid dust formation; use local exhaust ventilation.

- Prohibit eating, drinking, or smoking in handling areas.

- Ground and bond equipment to prevent static discharge.

- Use non-sparking tools.

7. Transportation (Land, Sea, Air)

- Regulations:

- IMDG Code (Sea): Class 4.2, UN1384, PG II

- IATA DGR (Air): Class 4.2, UN1384, PG II — Forbidden on passenger aircraft; permitted on cargo aircraft with restrictions

- ADR (Road – Europe): Class 4.2, UN1384, PG II

-

49 CFR (USA): Hazardous material, Class 4.2, UN1384, PG II

-

Packaging:

- Must meet UN performance standards (e.g., 4G, 1A2).

- Inner liners must be moisture-resistant (e.g., polyethylene).

-

Overpacks must prevent water ingress.

-

Labeling:

- Class 4.2 Flammable Solid label

- “Keep Dry” marking

-

“Forbidden for transport on passenger aircraft” (if applicable)

-

Documentation:

- Safety Data Sheet (SDS) required

- Shipper’s Declaration for Dangerous Goods (for air/sea)

- Emergency Response Information

8. Emergency Response

- Fire:

- Use dry chemical powder, sand, or graphite-based extinguishing agents.

- NEVER USE WATER — reaction may produce flammable and toxic gases (SO₂, H₂S).

-

Evacuate area and fight fire from a distance.

-

Spill/Leak:

- Eliminate ignition sources.

- Wear full PPE including SCBA if dust is airborne.

- Scoop into dry, inert container under inert atmosphere.

- Absorb residue with dry sand or vermiculite.

-

Dispose of as hazardous waste.

-

Exposure:

- Inhalation: Move to fresh air; seek medical attention if coughing or breathing difficulty occurs.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Rinse thoroughly with water for at least 15 minutes; seek medical help.

- Ingestion: Rinse mouth; do NOT induce vomiting; seek immediate medical attention.

9. Disposal

- Dispose in accordance with local, national, and international regulations (e.g., RCRA in USA).

- Treat as hazardous waste due to reactivity and environmental toxicity.

- Neutralization under controlled conditions may be required prior to disposal.

- Consult licensed waste disposal contractor.

10. Regulatory Compliance

- OSHA (USA): Regulated under 29 CFR 1910.1200 (Hazard Communication Standard)

- EPA: Listed under CERCLA (reportable quantity: 1000 lbs)

- REACH (EU): Registered substance; downstream user obligations apply

- GHS Implementation: Fully aligned with GHS Rev. 9 (or latest applicable)

11. Special Notes

- Sodium Dithionite is highly sensitive to moisture and air, leading to self-heating and potential spontaneous combustion.

- Do not mix with acids, oxidizers, or chlorinated compounds — risk of violent reaction.

- Regular inspection of storage containers is essential to detect early degradation.

Disclaimer: This guide is for informational purposes only. Always consult the latest Safety Data Sheet (SDS) and applicable regulations before handling, storing, or transporting Sodium Dithionite.

Version: 1.0 | Date: April 2025 | Prepared using H2 hazard statement H261 as per GHS.

Conclusion for Sourcing Sodium Dithionite:

Sourcing sodium dithionite requires a strategic approach that balances quality, cost, reliability, and regulatory compliance. As a sensitive reducing agent widely used in industries such as textiles, pulp and paper, and food processing, the selection of a dependable supplier is critical to ensure product stability, consistent performance, and safety. Key considerations include supplier资质, manufacturing standards (e.g., ISO certification), packaging and storage capabilities (due to the compound’s hygroscopic and oxidative nature), and logistical efficiency to minimize degradation during transit.

Additionally, engaging with suppliers who offer technical support and maintain transparency in raw material sourcing contributes to long-term supply chain resilience. It is also advisable to establish dual sourcing options to mitigate risks related to supply disruptions. Ultimately, a thorough evaluation of potential vendors—combined with rigorous quality testing and compliance with safety and environmental regulations—ensures the effective and sustainable procurement of sodium dithionite to meet operational demands.