The global soda lime glassware market continues to expand, driven by rising demand across pharmaceutical, laboratory, and food & beverage industries. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 11.5 billion and is projected to grow at a CAGR of 4.8% from 2023 to 2028. This growth is underpinned by the material’s excellent chemical resistance, optical clarity, and cost-effectiveness, making it a preferred choice for packaging and precision glassware applications worldwide. Increasing healthcare expenditures, stringent regulations favoring inert packaging materials, and the expansion of research and development activities further bolster market dynamics. As demand intensifies, a select group of manufacturers have emerged as leaders in innovation, scale, and global reach. Based on production capacity, geographic footprint, product specialization, and market reputation, the following eight companies represent the top soda lime glassware manufacturers shaping the industry’s future.

Top 8 Soda Lime Glassware Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Soda

Domain Est. 1996

Website: elantechnology.com

Key Highlights: Soda-Lime Glasses, made up of Silica (SiO2), Calcium Oxide (CaO), Aluminum Oxide (Al2O3), and Sodium Oxide (Na2O) are the most common and least expensive ……

#2 Glass Materials

Domain Est. 1993

Website: goodfellow.com

Key Highlights: Free deliveryGoodfellow supplies a range of glass materials in various forms. These versatile materials are characterized by their optical clarity, thermal stability, and ……

#3 AR

Domain Est. 1995

Website: schott.com

Key Highlights: AR-GLAS is a robust soda-lime glass that suits demanding dimensional and cosmetic applications. It’s a reliable option for Type III pharmaceutical packaging….

#4 UFF® – Ultra-thin soda-lime glass

Domain Est. 1995

Website: hpm.nsg.com

Key Highlights: UFF is a high-quality, high-flatness, ultra-thin soda-lime glass with a track record of more than 40 years, mainly in the automotive and display industries….

#5 Swift Glass

Domain Est. 1998

Website: swiftglass.com

Key Highlights: Swift Glass is a worldwide leader in manufacturing quality fabricated glass parts, offering capabilities such as glass cutting, waterjet cutting and more….

#6 Soda lime glass

Domain Est. 1998

Website: continentaltrade.com.pl

Key Highlights: In summary, soda lime glass is a cornerstone of modern glassmaking. Its favorable chemical composition of glass, relatively low glass density, ease of glass ……

#7 Soda Lime / Low Iron Glass

Domain Est. 2002

Website: catiglass.com

Key Highlights: Soda Lime glass has been produced for centuries from sand, limestone and soda ash. This glass is inexpensive to make because of the abundant raw materials….

#8 Soda

Domain Est. 2010

Website: abrisatechnologies.com

Key Highlights: Soda-Lime sheet glass is made by a floating molten glass on a bed of molten tin; this method gives the sheet uniform thickness and very flat surfaces. Soda-lime ……

Expert Sourcing Insights for Soda Lime Glassware

H2: 2026 Market Trends for Soda Lime Glassware

The soda lime glassware market in 2026 is poised for moderate growth, driven by evolving consumer preferences, sustainability imperatives, and technological advancements, while facing challenges from material competition and economic headwinds. Key trends shaping the landscape include:

-

Heightened Focus on Sustainability & Circularity:

- Recycled Content: Regulatory pressure (e.g., EU Green Deal, extended producer responsibility schemes) and consumer demand will push manufacturers to significantly increase the use of cullet (recycled glass). Expect widespread adoption of bottles and containers containing 70-100% recycled content, particularly in food & beverage and cosmetics.

- Lightweighting: Continued innovation in forming technologies (e.g., advanced IS machines, improved molds) will enable further weight reduction without compromising strength, lowering material use, transportation emissions, and costs.

- Design for Recycling: Simplified designs (reduced colors, easier-to-remove labels, mono-material constructions) will become standard to improve sorting and recycling efficiency.

- Carbon Footprint Reduction: Investment in electric furnaces (using renewable energy) and alternative fuels (e.g., green hydrogen, biogas) will accelerate to meet corporate net-zero targets, though high capital costs remain a barrier.

-

Premiumization & Aesthetic Innovation:

- Luxury & Craft Markets: Growth in premium spirits, craft beverages, specialty foods, and high-end cosmetics will drive demand for sophisticated glassware. Expect intricate designs, unique shapes, custom embossing, and high-clarity glass to differentiate brands.

- “Clean Label” Appeal: Glass’s inherent association with purity, quality, and naturalness will be leveraged heavily, especially for organic, natural, and health-focused products.

- Enhanced Functionality: Integration of features like improved ergonomics, easy-pour spouts, resealable closures (e.g., twist-off), and barrier coatings (for oxygen sensitivity) will add value.

-

Resilience in Core Applications, Challenges in Others:

- Food & Beverage (F&B): Remains the dominant segment. Growth will be steady, fueled by demand for bottled water, beer, wine, spirits, and premium non-alcoholic beverages. Glass is favored for taste preservation and premium image.

- Pharmaceuticals: Critical reliance on glass for vials, ampoules, and syringes (especially Type I) ensures stable demand, driven by global healthcare needs and biologics. However, competition from advanced polymers for certain applications persists.

- Household & Tableware: Recovery post-pandemic slowdown, with growth in premium kitchenware and decorative items. Disposable glassware faces pressure from sustainability concerns.

- Lighting & Industrial: Steady but slower growth, potentially impacted by LED efficiency gains and material substitution.

-

Technological & Manufacturing Advancements:

- Automation & AI: Increased use of robotics for handling, inspection (machine vision), and logistics to improve efficiency, quality control, and address labor shortages.

- Process Optimization: AI-driven predictive maintenance for furnaces and forming machines, and advanced process control systems to minimize energy consumption and defects.

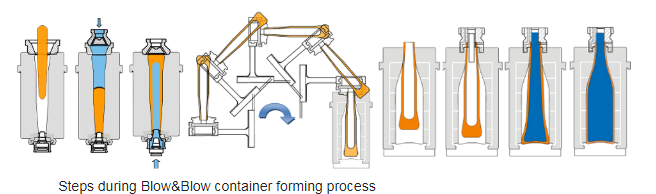

- Alternative Forming: While traditional IS (Individual Section) machines dominate, interest in technologies like press-and-blow for specific shapes and potential long-term development of float glass for containers may continue.

-

Persistent Challenges:

- Energy Costs & Volatility: Glass manufacturing is highly energy-intensive. Fluctuating energy prices (especially natural gas and electricity) remain a significant cost pressure and risk factor.

- Logistics & Weight: The inherent weight and fragility of glass increase transportation costs and carbon footprint compared to lighter alternatives, impacting supply chain efficiency.

- Competition from Alternatives: PET plastic (lighter, cheaper, shatter-resistant) dominates in mass-market water, soda, and some food applications. Aluminum is strong in beer and ready-to-drink beverages. Paperboard composites challenge glass in some food categories. Glass must continuously justify its premium cost through perceived quality and sustainability.

- Supply Chain Complexity: Ensuring a stable, high-quality supply of raw materials (sand, soda ash, limestone) and cullet is crucial. Geopolitical factors can disrupt supply.

Conclusion for 2026:

The soda lime glassware market in 2026 will be characterized by a strong push towards sustainability-driven innovation (recycling, lightweighting, decarbonization) and premiumization to maintain relevance and command value. While core markets like F&B and pharma provide stability, growth will depend on the industry’s ability to overcome cost and weight disadvantages through technological efficiency and compelling brand narratives centered on quality and environmental responsibility. Success will belong to players who can effectively balance cost management, sustainability mandates, and innovation to meet the demands of increasingly eco-conscious and quality-focused consumers.

Common Pitfalls When Sourcing Soda-Lime Glassware: Quality and Intellectual Property Concerns

Sourcing soda-lime glassware—commonly used for laboratory equipment, packaging, and consumer goods—presents specific challenges related to quality consistency and intellectual property (IP) protection. Avoiding these pitfalls is crucial for ensuring product performance, regulatory compliance, and safeguarding business interests.

Quality-Related Pitfalls

Inconsistent Material Composition and Purity

Soda-lime glass quality heavily depends on raw material consistency. Sourcing from suppliers with poor quality control can result in batch-to-batch variations in composition, affecting thermal shock resistance, chemical durability, and optical clarity. Impurities like iron oxide can discolor glass or reduce UV transmission, which is critical in scientific and pharmaceutical applications.

Poor Dimensional Accuracy and Tolerances

Many applications, especially in laboratories and medical devices, require precise dimensions (e.g., volumetric flasks, syringes). Suppliers lacking advanced molding or finishing processes may deliver items with inconsistent wall thickness, inaccurate graduations, or poor fit for closures and connectors. This can compromise functionality and safety.

Inadequate Surface Finish and Defects

Low-quality manufacturing often leads to surface flaws such as seeds (small bubbles), stones (unmelted material), or striations. These defects not only affect aesthetics but can also compromise structural integrity and increase the risk of breakage or contamination. Poor annealing practices can introduce internal stresses, making glassware prone to spontaneous cracking.

Lack of Compliance with Industry Standards

Reputable soda-lime glassware must meet standards such as ISO 9001 (quality management), USP <381> (pharmaceutical containers), or ASTM E438 (laboratory glassware). Sourcing without verifying certifications can result in non-compliant products unsuitable for regulated markets, leading to rejection, recalls, or legal liability.

Intellectual Property-Related Pitfalls

Unauthorized Replication of Design and Specifications

Soda-lime glassware often includes proprietary designs (e.g., specialized lab equipment shapes, ergonomic packaging). Suppliers in regions with weak IP enforcement may copy patented or trademarked designs without permission. Buyers risk receiving counterfeit or infringing products, exposing them to legal action from original equipment manufacturers (OEMs).

Lack of IP Clarity in Supplier Agreements

Many sourcing contracts fail to explicitly address IP ownership, especially for custom-designed molds or tooling. Without clear clauses, suppliers may claim rights to design improvements or reuse molds for competing clients, undermining competitive advantage and brand exclusivity.

Reverse Engineering and Technology Leakage

Sharing detailed specifications or prototypes with unvetted suppliers increases the risk of reverse engineering. Competitors may gain access to proprietary formulations or manufacturing techniques, potentially replicating high-performance glass with enhanced properties (e.g., improved durability or clarity).

Insufficient Due Diligence on Supplier IP Practices

Failing to audit a supplier’s IP compliance history—such as past infringement cases or lack of design registration—can lead to sourcing from vendors involved in IP violations. This not only risks supply chain disruption but also damages brand reputation and customer trust.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits, including facility inspections and quality certification verification.

– Require material test reports (MTRs) and batch traceability.

– Include robust IP clauses in contracts, specifying ownership and confidentiality.

– Work with legal counsel to register and protect unique designs in key markets.

– Consider sourcing from suppliers in jurisdictions with strong IP protection frameworks.

Proactive management of quality and IP risks ensures reliable, compliant, and legally secure soda-lime glassware procurement.

Logistics & Compliance Guide for Soda Lime Glassware

Overview of Soda Lime Glassware

Soda lime glass is the most common type of glass used in laboratory, pharmaceutical, food, and consumer applications due to its clarity, chemical resistance (for most substances), and cost-effectiveness. It is composed primarily of silica (SiO₂), sodium oxide (Na₂O), and calcium oxide (CaO). While durable under normal conditions, soda lime glass is fragile and susceptible to breakage, thermal shock, and chemical attack under extreme conditions. Proper logistics and compliance protocols are essential to ensure safety, regulatory adherence, and product integrity during handling, storage, and transport.

Regulatory Compliance Considerations

Soda lime glassware must comply with various international, national, and industry-specific regulations depending on its application. Key compliance areas include:

- REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. While glass is generally exempt from registration, components or coatings (e.g., labels, ink) may require assessment.

- FDA 21 CFR (USA): For food-contact and pharmaceutical applications, glassware must comply with food-safe material standards (e.g., 21 CFR 177.1520 for indirect food additives).

- USP <660> (United States Pharmacopeia): Specifies requirements for glass containers used in pharmaceutical packaging, including resistance to hydrolysis (Type I, II, III classification). Soda lime glass is typically Type III.

- ISO Standards: Relevant standards include ISO 12775 (classification of glass) and ISO 7459 (laboratory glassware specifications).

- GHS / CLP Regulations: If glassware is used to store or transport hazardous substances, labeling and safety data sheets (SDS) must comply with Globally Harmonized System (GHS) standards.

Ensure all glassware is clearly labeled with compliance marks (e.g., USP, ISO, food-safe symbols) and accompanied by Certificates of Conformance (CoC) when required.

Packaging & Handling Requirements

Proper packaging is critical to prevent breakage and contamination. Follow these guidelines:

- Inner Packaging: Use individual protective sleeves, foam inserts, or dividers to prevent glass-to-glass contact. Bubble wrap or molded pulp trays are recommended for fragile items.

- Outer Packaging: Use sturdy, corrugated cardboard boxes with sufficient crush resistance. Reinforce edges and corners. For large shipments, consider wooden crates.

- Cushioning: Fill void spaces with packing peanuts, air pillows, or recycled paper to minimize movement.

- Labeling: Clearly mark packages with “Fragile,” “This Side Up,” and “Handle with Care” labels. Include UN number if transporting hazardous contents.

- Stacking: Limit stack height to prevent crushing. Use pallets for bulk shipments and secure with stretch wrap. Avoid overhang.

Train personnel in safe handling techniques: use two hands, avoid sudden movements, and inspect packages for damage before and after transport.

Storage Conditions

Store soda lime glassware under controlled conditions to maintain quality:

- Environment: Keep in a dry, clean, temperature-stable area (15–25°C). Avoid extreme temperatures or rapid fluctuations to prevent thermal stress.

- Humidity: Relative humidity should be below 60% to prevent mold growth on packaging and corrosion of metal components (e.g., caps).

- Shelving: Use non-abrasive shelving with adequate support. Avoid overcrowding. Store vertically where possible (e.g., beakers, bottles).

- Separation: Isolate from chemicals, sharp objects, or heavy items that could cause breakage or contamination.

- Shelf Life: While glass itself does not expire, prolonged exposure to alkaline environments or high humidity may degrade surface quality. Inspect stored items periodically.

Transportation & Shipping

Adhere to transportation regulations to ensure safe delivery:

- Mode of Transport: Suitable for road, air, and sea freight. For air transport, comply with IATA regulations (e.g., proper packaging for pressurized environments).

- Vibration & Shock: Use shock-absorbing pallets or air-ride suspension trucks for long-distance road transport.

- Temperature Control: Avoid exposure to freezing temperatures (risk of liquid expansion) or excessive heat (thermal shock). Use insulated containers if necessary.

- Documentation: Include shipping manifests, packing lists, CoC, and SDS if applicable. Declare fragile cargo to carriers.

- UN Certification: Required only if glassware contains hazardous materials. Use UN-rated packaging (e.g., 4G, 4GV) when shipping dangerous goods.

Choose carriers with experience in handling fragile or scientific materials.

Quality Assurance & Inspection

Implement quality checks throughout the logistics chain:

- Incoming Inspection: Verify packaging integrity, product conformity, and compliance documentation upon receipt.

- In-Process Checks: Monitor storage conditions and conduct periodic visual inspections for chipping, cracking, or contamination.

- Outgoing Inspection: Before shipment, ensure proper packaging, labeling, and documentation accuracy.

- Non-Conformance Handling: Isolate and document damaged or non-compliant items. Initiate corrective actions and notify suppliers or customers as needed.

Maintain records of inspections, audits, and incident reports for traceability and regulatory compliance.

Environmental & Disposal Compliance

Soda lime glass is 100% recyclable and inert, making it environmentally favorable. However, proper disposal practices are essential:

- Waste Segregation: Separate uncontaminated glass from hazardous waste (e.g., chemical residues).

- Decontamination: Rinse glassware thoroughly before recycling if used with chemicals or biohazards. Follow local decontamination protocols.

- Recycling: Partner with certified glass recyclers. Crushed glass (cullet) can be reused in new glass production.

- Hazardous Waste: Glassware contaminated with regulated substances must be disposed of according to local hazardous waste regulations (e.g., RCRA in the US, Waste Framework Directive in EU).

Avoid landfill disposal whenever possible.

Emergency Response & Incident Management

Prepare for breakage or contamination incidents:

- Spill Kits: Keep glass-safe spill kits (with brooms, dustpans, puncture-resistant gloves, and containers) in storage and handling areas.

- First Aid: Train personnel in treating cuts and eye exposure. Ensure eyewash stations and first aid kits are accessible.

- Reporting: Document all incidents, including root cause analysis and corrective actions. Report significant spills or exposures per OSHA, EPA, or local regulations.

- Containment: Isolate broken glass immediately. Use sealed, labeled containers for disposal.

Review and update emergency procedures annually.

Conclusion for Sourcing Soda Lime Glassware:

In conclusion, sourcing soda lime glassware requires a balanced evaluation of quality, cost, supplier reliability, and specific application requirements. As a cost-effective and widely available material, soda lime glass is suitable for numerous applications in laboratory, pharmaceutical, food and beverage, and industrial settings. However, its limitations in thermal and chemical resistance must be carefully considered during selection. Establishing partnerships with reputable suppliers who adhere to international quality standards ensures consistency, compliance, and performance. By prioritizing material specifications, volume needs, lead times, and sustainability practices, organizations can optimize their sourcing strategy, achieving both operational efficiency and long-term value. Proper due diligence in sourcing not only mitigates risks but also supports the integrity and safety of end-use applications.