The global soda caustica (caustic soda) market, valued at approximately USD 34.5 billion in 2023, is projected to grow at a CAGR of around 4.2% through 2030, according to Grand View Research. This steady expansion is driven by rising demand across key industries including chemicals, pulp and paper, textiles, alumina refining, and water treatment. Increasing global production of chlorine—a co-product in caustic soda manufacturing via the chlor-alkali process—further influences supply dynamics and market growth. Additionally, expanding industrial activities in Asia-Pacific, particularly in China and India, are propelling regional dominance in both production and consumption. As demand continues to climb, a select group of manufacturers has emerged as leaders in capacity, innovation, and global reach, shaping the competitive landscape of this essential industrial chemical.

Top 10 Soda Caustica Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Caustic Soda

Website: shinetsu.co.jp

Key Highlights: Caustic Soda ; Company: Shin-Etsu Chemical Co., Ltd. ; Department: Chlor, Alkali & Derivatives Department PVC Division ; Phone: +81-3-6812-2381.Missing: caustica manufacturer…

#2 Sodium Hydroxide – Caustic Soda Supplier & Distributor

Domain Est. 1997

Website: hawkinsinc.com

Key Highlights: Hawkins is a reliable Caustic Soda (Sodium Hydroxide) supplier, distributor & manufacturer. Shop now to buy various concentrations in bulk….

#3 Caustic Soda

Domain Est. 1998

Website: ineos.com

Key Highlights: Caustic soda is a widely used industrial chemical which is used in pulp and paper, detergents, packaging, agriculture, environmental protection, water treatment ……

#4 Caustic Soda

Domain Est. 2015

Website: vynova-group.com

Key Highlights: Vynova is a major European producer of sodium hydroxide (NaOH), also known as caustic soda. Caustic soda is a widely used chemical produced by electrolysis….

#5 Caustic Soda

Domain Est. 1994

Website: westlake.com

Key Highlights: Caustic soda is used in the manufacturing of pulp and paper, soap and detergent, textiles, aluminum and petrochemical refining….

#6 Soda Solvay®, A global leader in Soda Ash

Domain Est. 1995

Website: solvay.com

Key Highlights: Solvay is a global leader in Soda Solvay® sodium carbonate production, using two different processes: the traditional Solvay ammonia process and the refining ……

#7 Caustic Soda

Domain Est. 1995

Website: chemicals.basf.com

Key Highlights: Caustic soda is an important base chemical for numerous applications. BASF has now a certified LowPCF variety that helps customers to offer even more ……

#8 Sodium Hydroxide (Caustic Soda)

Domain Est. 1999

Website: rowellchemical.com

Key Highlights: Rowell is one of the industry leaders in distribution of Sodium Hydroxide (Membrane and Diaphragm Grades). Using multiple sources for Caustic Soda….

#9 Sodium Hydroxide (Caustic Soda, NaOH, Lye)

Domain Est. 2018

#10 Altair Chimica is authorized for the production of caustic food soda

Domain Est. 2023

Website: altairchemical.com

Key Highlights: Altair Chimica obtained the authorization to produce caustic soda food grade E524 from the Local Health Authority of Volterra….

Expert Sourcing Insights for Soda Caustica

H2: 2026 Market Trends for Soda Caustica (Caustic Soda)

The global caustic soda (sodium hydroxide, or Soda Caustica) market is poised for moderate but strategic growth by 2026, driven by evolving industrial demand, supply chain dynamics, and regional production shifts. As a critical chemical feedstock, caustic soda’s market trajectory in 2026 reflects broader trends in downstream industries and energy policies. Below is an analysis of key market trends expected to shape the Soda Caustica landscape in 2026.

1. Steady Demand Growth in Key End-Use Sectors

Caustic soda remains indispensable in several core industries, and demand in 2026 will be primarily sustained by:

- Chemicals & Organic Intermediates: Rising production of ethylene dichloride (EDC) and polyvinyl chloride (PVC) continues to consume substantial caustic soda, particularly in Asia and the Middle East.

- Pulp & Paper: Despite long-term decline in some regions, emerging markets in Southeast Asia and Africa are maintaining demand for caustic soda in pulp processing.

- Alumina & Aluminum Production: The growing demand for aluminum in electric vehicles and lightweight construction supports caustic soda use in bauxite refining, especially in China, India, and Brazil.

- Soaps, Detergents, and Textiles: Urbanization and rising hygiene standards in developing economies are boosting demand for consumer goods that rely on caustic soda in manufacturing.

2. Supply-Demand Imbalance and Chlor-Alkali Linkage

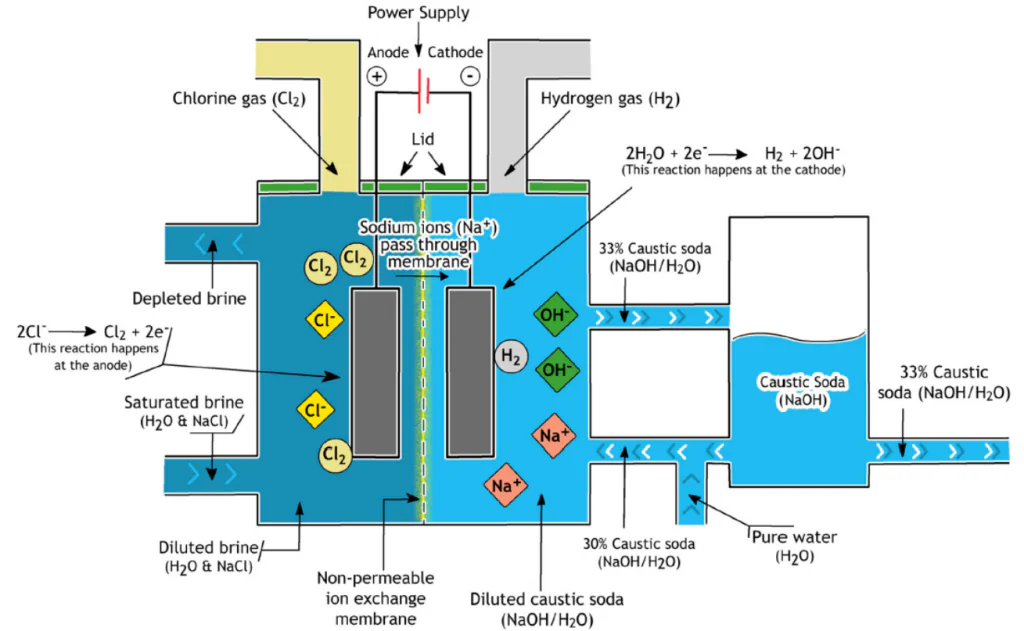

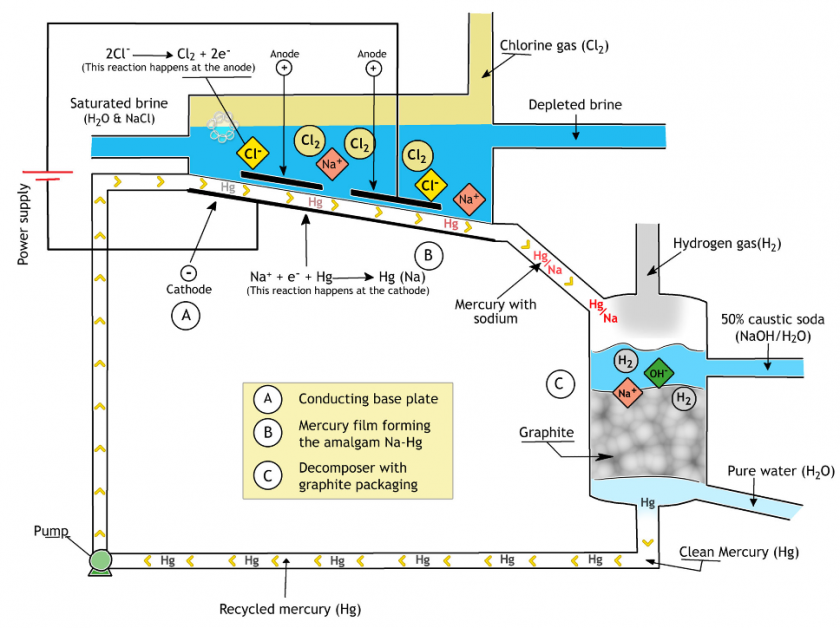

Caustic soda is a co-product of chlorine production via the chlor-alkali process. In 2026, market dynamics will continue to be influenced by this inherent linkage:

- Chlorine Demand as a Driver: Fluctuations in chlorine demand (e.g., for water treatment, PVC) directly impact caustic soda supply. If chlorine demand weakens, caustic soda production may be curtailed, tightening supply.

- Regional Divergence: In North America and Europe, balanced chlor-alkali operations and environmental regulations are limiting new capacity. Conversely, in the Middle East and Asia, new chlor-alkali plants are coming online, increasing caustic soda availability—potentially leading to export surpluses.

3. Asia-Pacific as the Growth Engine

By 2026, Asia-Pacific will remain the dominant region for both consumption and production:

- China: Despite environmental crackdowns and overcapacity concerns, China maintains strong domestic demand. However, export volumes may stabilize due to tighter energy efficiency standards.

- India: Increasing investments in infrastructure and manufacturing are fueling demand for alumina, textiles, and chemicals—key sectors for caustic soda.

- Southeast Asia: Countries like Indonesia and Vietnam are expanding chemical manufacturing, creating new demand centers.

4. Trade Flows and Geopolitical Influences

Global trade in caustic soda will be affected by:

- Export Dynamics: The U.S. Gulf Coast remains a major exporter, but increased domestic consumption and infrastructure investments may reduce surplus volumes by 2026.

- Logistics & Freight Costs: Geopolitical tensions (e.g., Red Sea disruptions, Panama Canal droughts) could impact shipping routes and delivery times, affecting regional pricing.

- Trade Policies: Tariffs and anti-dumping measures, especially in the EU and India, may continue to shape import patterns.

5. Environmental Regulations and Sustainability Pressures

Environmental considerations will increasingly influence the caustic soda market:

- Energy Consumption: The chlor-alkali process is energy-intensive. Rising electricity costs and carbon pricing (e.g., EU Emissions Trading System) may pressure producers to adopt membrane cell technologies or shift production to lower-carbon regions.

- Circular Economy: Efforts to recycle spent caustic and reduce waste in downstream industries may alter consumption patterns and create niche markets for regenerated sodium hydroxide.

6. Price Volatility and Market Consolidation

- Price Trends: Caustic soda prices in 2026 are expected to remain volatile, influenced by feedstock (salt, electricity), chlorine co-product credits, and logistics.

- Consolidation: Ongoing mergers and joint ventures among chlor-alkali producers (e.g., in Europe and North America) may lead to tighter supply control and more stable pricing.

7. Technological and Operational Efficiency

Producers are investing in:

- Membrane Cell Technology: More efficient and environmentally friendly than older mercury or diaphragm cells, membrane cells will dominate new capacity.

- Digitalization: Predictive maintenance and supply chain optimization tools are improving operational efficiency and reliability.

Conclusion

In 2026, the Soda Caustica market will reflect a complex interplay of industrial demand, environmental policy, and global supply chains. While growth will be moderate—estimated at a CAGR of 2.5–3.5% from 2022 to 2026—regional disparities and co-product dynamics will create both challenges and opportunities. Producers who can adapt to sustainability mandates, optimize trade logistics, and align with high-growth end-use sectors will be best positioned to thrive in the evolving landscape.

Common Pitfalls When Sourcing Soda Cáustica (NaOH) – Quality & IP Concerns

Sourcing high-quality soda cáustica (caustic soda, NaOH) is critical for industrial processes, as impurities and intellectual property (IP) issues can lead to production inefficiencies, safety hazards, and legal risks. Below are key pitfalls to avoid:

1. Inadequate Purity and Impurity Control

One of the most frequent issues is receiving soda cáustica that does not meet required purity standards. Common impurities include:

- Chloride (Cl⁻) content: Excess chlorides can cause corrosion in stainless steel equipment, especially at high temperatures. Always verify chloride levels—industrial-grade NaOH should typically have < 50 ppm.

- Sulfate (SO₄²⁻) content: High sulfate levels can interfere with chemical reactions, particularly in alumina production or organic synthesis.

- Metals (Fe, Ni, Cr, Ca, Mg): Trace metals can act as catalysts in unwanted side reactions or degrade product color in textile or pharmaceutical applications.

- Carbonate (CO₃²⁻) content: Forms due to NaOH exposure to CO₂ in air. High carbonate reduces effective alkalinity and can precipitate in process lines.

Pitfall: Accepting material without a full Certificate of Analysis (CoA) specifying impurity profiles for your application.

2. Incorrect Physical Form and Concentration

Soda cáustica is available in solid (flakes, pearls, granules) and liquid (typically 50% w/w) forms. Choosing the wrong form can lead to:

- Handling difficulties (e.g., moisture absorption in flakes leading to caking)

- Inaccurate dosing due to concentration variability in liquid NaOH

- Incompatibility with existing storage or feed systems

Pitfall: Not specifying the exact physical form, density, and concentration requirements in procurement contracts.

3. Inconsistent Quality from Batch to Batch

Variability between supplier batches affects process stability. This often stems from:

- Multiple production sources or inconsistent manufacturing processes

- Lack of supplier quality management systems (e.g., ISO 9001)

Pitfall: Relying on spot purchases without long-term supplier qualification and performance monitoring.

4. Intellectual Property (IP) and Formulation Risks

In specialty applications (e.g., electronics, pharmaceuticals), the NaOH may be part of a proprietary process or formulation.

- Reverse engineering risk: If a supplier gains insight into your process through NaOH usage patterns, they might develop competitive products.

- Unauthorized reselling: Suppliers may resell your specifications to competitors.

- Lack of confidentiality agreements: Failure to bind suppliers to NDAs can expose process-critical information.

Pitfall: Not securing IP protections before disclosing usage details or custom requirements.

5. Regulatory and Compliance Gaps

Soda cáustica is a hazardous chemical regulated globally (e.g., OSHA, REACH, GHS). Pitfalls include:

- Receiving non-compliant labeling or SDS (Safety Data Sheets)

- Import/export restrictions due to incorrect classification

- Environmental compliance risks from impurities (e.g., mercury-contaminated NaOH from outdated mercury-cell processes)

Pitfall: Not verifying supplier compliance with regional safety and environmental regulations.

6. Supply Chain and Logistics Failures

- Contamination during transport: Use of non-dedicated or improperly cleaned tankers for liquid NaOH.

- Temperature control: Solid NaOH can absorb moisture if stored in humid conditions; liquid NaOH can crystallize if exposed to cold.

- Packaging integrity: Leaking drums or compromised bags lead to safety risks and material loss.

Pitfall: Overlooking logistics specifications in sourcing agreements.

Best Practices to Mitigate Risks:

– Require full CoA with every shipment.

– Audit suppliers regularly for quality and compliance.

– Use long-term contracts with clear quality specs and IP clauses.

– Implement supplier qualification programs.

– Enforce NDAs and limit technical disclosure to only what is essential.

By addressing these pitfalls proactively, companies can ensure reliable supply, maintain process integrity, and protect valuable intellectual property.

H2: Logistics & Compliance Guide for Soda Caustica (Sodium Hydroxide)

Soda caustica, commonly known as sodium hydroxide (NaOH), is a highly corrosive and reactive chemical widely used in industrial processes such as chemical manufacturing, pulp and paper production, water treatment, and soap making. Due to its hazardous nature, strict logistics and compliance protocols must be followed to ensure safe handling, transportation, storage, and regulatory compliance.

1. Identification & Classification

- Chemical Name: Sodium Hydroxide (Soda Caustica)

- CAS Number: 1310-73-2

- UN Number: UN1823 (Solid), UN1824 (Solution)

- Class: 8 – Corrosive Substances (Dangerous Goods)

- Packing Group: II (for most solid and concentrated liquid forms)

2. Hazard Information

- Physical State: Available as solid (pellets, flakes, granules) or aqueous solution (typically 50% concentration).

- Hazards:

- Corrosive: Causes severe skin burns and eye damage (H314).

- Reactivity: Reacts exothermically with acids, metals (e.g., aluminum), and organic materials.

- Inhalation Risk: Dust or mist can cause respiratory irritation.

- Environmental Hazard: Harmful to aquatic life.

3. Packaging & Labeling Requirements

Packaging:

– Use corrosion-resistant containers (e.g., high-density polyethylene, polypropylene).

– Drums, intermediate bulk containers (IBCs), or tank containers for liquids.

– Ensure airtight seals to avoid moisture absorption (hygroscopic).

Labeling (GHS/CLP Regulation):

– Pictograms: Corrosion (GHS05), Health Hazard (GHS07).

– Signal Word: Danger

– Hazard Statements:

– H314: Causes severe skin burns and eye damage.

– H318: Causes serious eye damage.

– Precautionary Statements:

– P280: Wear protective gloves/protective clothing/eye protection/face protection.

– P305+P351+P338: IF IN EYES: Rinse cautiously with water for several minutes. Remove contact lenses, if present and easy to do. Continue rinsing.

Transport Labels:

– UN Marking: UN1823 or UN1824

– Class 8 Corrosive Label (black and white on red background)

– Proper shipping name: “Sodium hydroxide, solid” or “Sodium hydroxide solution”

4. Storage Guidelines

- Location: Dry, cool, well-ventilated area, away from direct sunlight and moisture.

- Segregation:

- Store separately from acids, oxidizers, flammable materials, and reactive metals (e.g., aluminum, zinc).

- Use dedicated, non-metallic shelving.

- Containers: Keep tightly closed. Use secondary containment (e.g., spill trays) to prevent leaks.

- Shelf Life: Indefinite if stored properly; however, solutions may absorb CO₂ over time, forming sodium carbonate.

5. Transportation Requirements

Road (ADR – Europe):

– Requires ADR-compliant packaging, labeling, and documentation.

– Vehicle must display Class 8 placards.

– Driver must have ADR training certification.

– Emergency response equipment (e.g., spill kit, neutralizing agent) must be available.

Maritime (IMDG Code):

– UN1823/1824 under Class 8.

– Proper stowage and segregation from incompatible goods (e.g., acids, cyanides).

– Container must be marked and documented accordingly.

Air (IATA DGR):

– Limited quantity allowances may apply.

– Must be packed in leak-proof, corrosion-resistant packaging.

– Maximum concentration allowed in solution: ≤ 50% for most air shipments.

Documentation:

– Safety Data Sheet (SDS) – must accompany every shipment.

– Dangerous Goods Declaration (DGD) as per transport mode.

– Transport Emergency Card (TREM card) in some regions.

6. Handling Procedures

- Personal Protective Equipment (PPE):

- Chemical-resistant gloves (e.g., nitrile or neoprene).

- Face shield and safety goggles.

- Acid/alkali-resistant apron and footwear.

- Respiratory protection if dust or mist is present (e.g., NIOSH-approved respirator).

- Safe Practices:

- Always add NaOH to water slowly (never water to solid NaOH) to control exothermic reaction.

- Use non-sparking tools.

- Work in well-ventilated areas or under fume hoods.

- Prohibit eating, drinking, or smoking in handling areas.

7. Spill & Emergency Response

- Spill Procedure:

- Evacuate non-essential personnel.

- Wear full PPE.

- Neutralize with weak acid (e.g., citric acid or vinegar for small spills).

- Absorb with inert material (e.g., sand, vermiculite).

- Collect and dispose of as hazardous waste.

- First Aid:

- Skin Contact: Rinse immediately with plenty of water for at least 15 minutes. Remove contaminated clothing.

- Eye Contact: Flush eyes continuously with water for at least 15–20 minutes. Seek medical attention immediately.

- Inhalation: Move to fresh air. Administer oxygen if breathing is difficult.

- Ingestion: Rinse mouth. Do NOT induce vomiting. Seek medical help.

8. Regulatory Compliance

- OSHA (USA): Complies with HCS 2012 (Hazard Communication Standard).

- REACH & CLP (EU): Registration, evaluation, and labeling under ECHA regulations.

- GHS: Globally Harmonized System for classification and labeling.

- EPA (USA): Regulated under CERCLA (reportable quantity: 1,000 lbs).

- Local Regulations: Verify country-specific requirements (e.g., NOM in Mexico, NIOSH/NIOSH in India).

9. Waste Disposal

- Dispose of as hazardous chemical waste.

- Neutralize before disposal where permitted.

- Use licensed waste management contractors.

- Follow RCRA (USA), Waste Framework Directive (EU), or equivalent.

10. Training & Documentation

- Employee Training: Required for all personnel involved in handling, storage, and transport.

- Topics: Hazards, PPE, emergency procedures, spill response.

- Record Keeping:

- Maintain SDS, training records, inspection logs, and shipping documents.

- Retain records per local regulatory requirements (typically 3–5 years).

Conclusion

Safe logistics and compliance for Soda Caustica require strict adherence to international and national regulations, proper packaging, labeling, and thorough training. Always consult the latest Safety Data Sheet (SDS) and regulatory guidance before handling or transporting sodium hydroxide.

Note: Regulations may vary by country. Always verify with local authorities prior to shipment or storage.

Conclusion on the Sourcing of Caustic Soda (Sodium Hydroxide)

Sourcing caustic soda requires a strategic approach that balances supply reliability, quality standards, cost-efficiency, and regulatory compliance. As a critical chemical used across industries such as chemical manufacturing, pulp and paper, textiles, water treatment, and food processing, ensuring a consistent and safe supply is essential.

Key considerations in sourcing caustic soda include selecting reputable suppliers with proven track records in quality and safety, evaluating logistical capabilities—especially due to its corrosive nature—and understanding global market dynamics, including price volatility influenced by chlorine production (as caustic soda is a co-product of chlor-alkali processes).

Additionally, compliance with health, safety, and environmental regulations—both local and international—is crucial when transporting and handling caustic soda. Long-term supply agreements, diversification of supply sources, and strong supply chain partnerships can help mitigate risks related to availability and pricing fluctuations.

In conclusion, successful sourcing of caustic soda involves a comprehensive strategy that emphasizes supplier reliability, logistical efficiency, regulatory adherence, and market awareness. By proactively managing these factors, organizations can ensure a secure, safe, and cost-effective supply of caustic soda to support their operational needs.