The global small water chiller market is experiencing robust growth, driven by rising demand for precision cooling solutions across industries such as pharmaceuticals, electronics, and food & beverage. According to Grand View Research, the global chiller market was valued at USD 30.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030, with compact and energy-efficient units gaining traction due to space constraints and sustainability initiatives. Similarly, Mordor Intelligence projects a CAGR of over 5.8% during the forecast period 2023–2028, citing increased industrial automation and HVAC efficiency standards as key drivers. Amid this growth, small water chillers—typically rated below 100 tons of refrigeration—are emerging as critical assets for applications requiring reliable, localized cooling. This demand surge has catalyzed innovation among manufacturers specializing in compact, high-performance systems. Below, we spotlight the top 10 small water chiller manufacturers shaping the future of efficient thermal management.

Top 10 Small Water Chiller Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thermal Care: Industrial Water Chiller Manufacturer

Domain Est. 1996

Website: thermalcare.com

Key Highlights: Thermal Care is a leading manufacturer of industrial water chillers & process cooling equipment and systems for applications worldwide. ISO 9001 certified….

#2 Cold Shot Chillers

Domain Est. 1999

Website: waterchillers.com

Key Highlights: 40+ Years Specializing in Chillers. Reliable Air-cooled & Water-cooled Solutions. Cold Shot Chillers® offers both air-cooled and water-cooled chiller variants ……

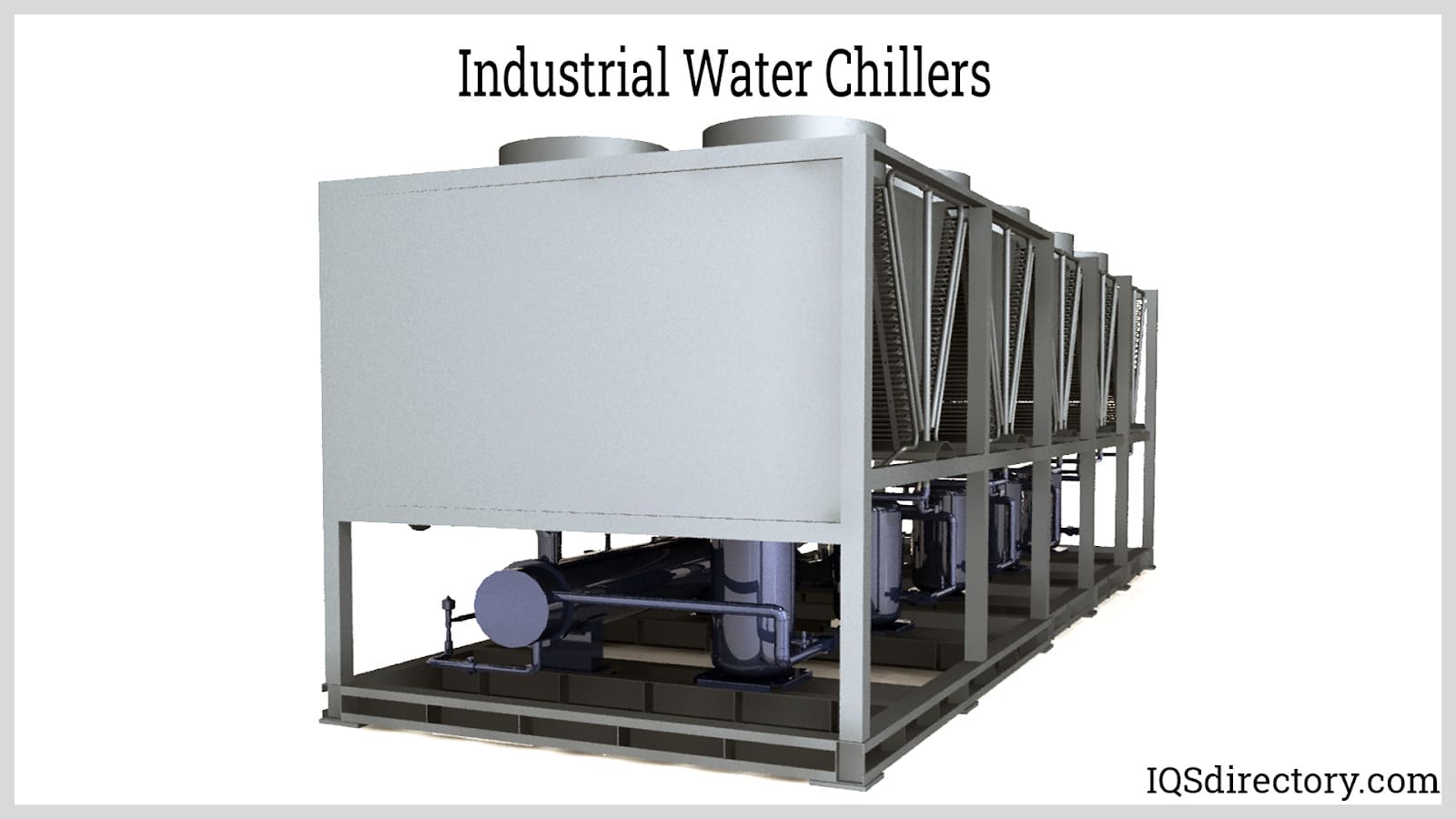

#3 Water-Cooled Chillers

Domain Est. 1995

Website: york.com

Key Highlights: YORK® Water-cooled Chillers meet your building efficiency needs with the widest variety of water-cooled industrial and commercial chillers on the market….

#4 Process Cooling & Industrial Water Chillers

Domain Est. 1995

Website: atlascopco.com

Key Highlights: The Atlas Copco TCX series is a compact all-in-one water chiller with an air-cooled condenser and integrated hydro module….

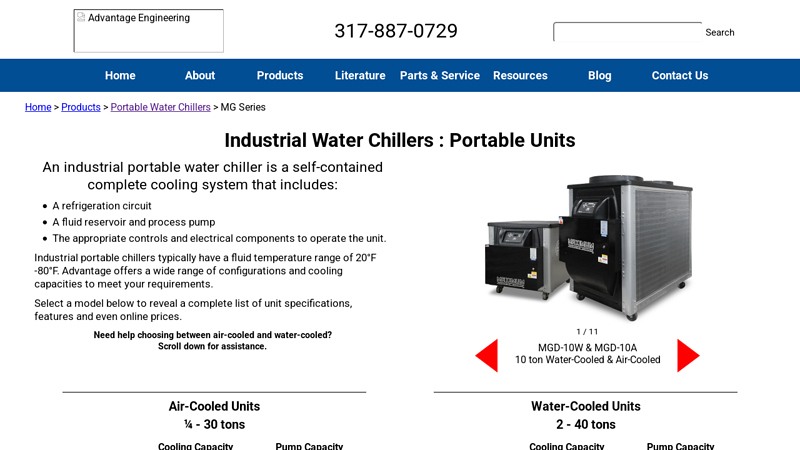

#5 Industrial Water Chillers : Portable Units

Domain Est. 1996

Website: advantageengineering.com

Key Highlights: An industrial portable water chiller is a self-contained complete cooling system that includes: A refrigeration circuit; A fluid reservoir and process pump ……

#6 Mini Water Chiller

Domain Est. 2016

Website: rigidhvac.com

Key Highlights: RIGID’s Mini Water Chiller is a breakthrough in compact liquid cooling technology, engineered for performance, precision, and portability….

#7 Water Cooled Chillers

Domain Est. 1996

Website: daikin.com

Key Highlights: Forged under harsh conditions around the world, Daikin water cooled chillers provide high quality, operation efficiency, and energy savings….

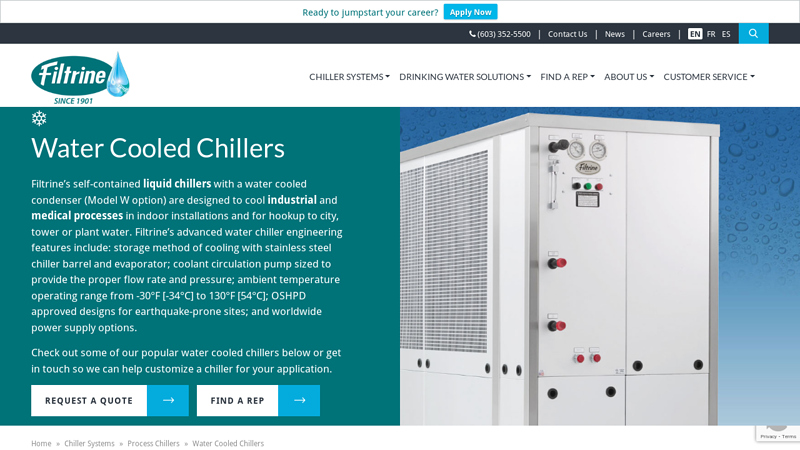

#8 Water Cooled Chillers

Domain Est. 1998

Website: filtrine.com

Key Highlights: Filtrine’s self-contained liquid chillers with a water cooled condenser are designed for indoor installation only and for hookup to city, tower or plant ……

#9 EVRCOOL Process Cooling Chiller System

Domain Est. 2023

Website: evrcool.com

Key Highlights: The EVRCOOL Process Cooling Chiller System solution is an ECO-friendly, low GWP chiller that has the smallest footprint on the market….

#10 Your Best Mini Chiller,Small Chiller Manufacturer and …

Domain Est. 2016

Website: topchillers.com

Key Highlights: TopChiller can design and manufacture all types of small chillers for you. Cooling capacity ranges from 1 Ton to 30 Ton; Temperature control ranges from 3°C ……

Expert Sourcing Insights for Small Water Chiller

2026 Market Trends for Small Water Chiller

The global market for small water chillers—typically defined as units with cooling capacities under 100 tons (350 kW)—is poised for significant transformation by 2026. Driven by technological innovation, regulatory shifts, and evolving end-user demands, this segment is expanding beyond traditional industrial applications into sectors such as healthcare, data centers, renewable energy, and smart buildings. Below is a detailed analysis of key market trends projected for 2026.

Rising Demand in Emerging Applications

One of the most notable trends shaping the small water chiller market is the diversification of application areas. While historically used in manufacturing and HVAC systems, small chillers are increasingly being integrated into advanced technology environments. Data centers, especially edge computing facilities, require compact, reliable cooling solutions to manage heat from high-density servers. By 2026, the demand from data centers is expected to grow at a CAGR of over 8%, driven by the proliferation of 5G networks and IoT devices.

Similarly, medical and laboratory equipment—such as MRI machines, laser systems, and analytical instruments—rely on precise temperature control. The expansion of telemedicine and diagnostic services in emerging economies is amplifying the need for compact, efficient chillers. These niche applications favor smaller footprint, low-noise, and energy-efficient designs, spurring product innovation.

Energy Efficiency and Regulatory Compliance

Environmental regulations are accelerating the shift toward energy-efficient and low-global warming potential (GWP) refrigerants. By 2026, compliance with the Kigali Amendment to the Montreal Protocol and regional standards such as the EU’s F-Gas Regulation will be mainstream. This is driving manufacturers to adopt next-generation refrigerants like R-32, R-1234ze, and CO₂ (R-744), particularly in small chillers where charge size limitations make new refrigerants more viable.

Additionally, governments are tightening energy performance standards. In markets like the U.S. and EU, mandatory Seasonal Energy Efficiency Ratio (SEER) and Integrated Part Load Value (IPLV) benchmarks are pushing OEMs to incorporate variable speed compressors, advanced heat exchangers, and smart controls. By 2026, over 60% of new small water chillers are expected to feature inverter-driven compressors for dynamic load matching.

Smart Integration and IoT Connectivity

Digitalization is transforming small water chillers into intelligent, connected devices. By 2026, a growing share of units will come equipped with IoT sensors, remote monitoring, and predictive maintenance capabilities. These features allow facility managers to optimize performance, reduce downtime, and lower operational costs. Cloud-based platforms will enable real-time diagnostics and energy usage analytics, particularly valuable in commercial and industrial settings.

Artificial intelligence (AI) and machine learning algorithms are being deployed to analyze chiller performance data, enabling automatic fault detection and optimization of setpoints based on ambient conditions and load profiles. This trend is especially prominent in smart buildings and industrial automation, where integration with Building Management Systems (BMS) is becoming standard.

Regional Market Dynamics

Asia-Pacific remains the fastest-growing region for small water chillers, driven by industrialization in India, Vietnam, and Indonesia, as well as investments in healthcare infrastructure and data centers. China continues to dominate manufacturing and domestic consumption, supported by government incentives for green technologies.

In North America and Europe, the market is maturing, with growth fueled by chiller replacements and retrofits aimed at improving energy efficiency. The push for net-zero buildings and corporate sustainability goals is boosting demand for high-efficiency small chillers in commercial real estate and light manufacturing.

Latin America and the Middle East are emerging as secondary growth markets, particularly in pharmaceuticals, food processing, and desalination plants—sectors that require reliable process cooling.

Competitive Landscape and Innovation

The small water chiller market is becoming increasingly competitive, with both established HVAC players and niche manufacturers vying for market share. Key companies such as Daikin, Mitsubishi Electric, Trane, and Johnson Controls are investing in modular, scalable chiller designs that offer plug-and-play installation and reduced maintenance.

There is also a rise in localized manufacturing and customization, as customers demand solutions tailored to specific environmental conditions and operational needs. 3D printing and advanced manufacturing techniques are enabling faster prototyping and lower production costs for small-batch, high-performance units.

Sustainability and Circular Economy

By 2026, sustainability will extend beyond energy efficiency to include end-of-life recyclability and reduced material footprint. Manufacturers are adopting design-for-disassembly principles and increasing the use of recyclable metals and plastics. Service models based on leasing and performance-based contracts are gaining traction, aligning vendor incentives with long-term equipment efficiency and lifecycle management.

Conclusion

By 2026, the small water chiller market will be defined by intelligence, efficiency, and adaptability. Driven by digitalization, regulatory pressures, and expanding applications, the sector is evolving from a commodity product to a value-added, integrated solution. Companies that prioritize innovation, sustainability, and customer-centric design will lead the market in this transformative period.

H2: Common Pitfalls When Sourcing Small Water Chillers (Quality and IP Considerations)

Sourcing small water chillers can be a complex process, especially when balancing cost, performance, and long-term reliability. Two critical areas where buyers often encounter challenges are product quality and intellectual property (IP) risks. Being aware of these pitfalls can help avoid operational failures, legal complications, and financial losses.

1. Compromised Quality Due to Cost-Cutting Manufacturers

Many suppliers, particularly in competitive or low-cost markets, reduce manufacturing expenses by using substandard materials or components. This can lead to:

– Shortened equipment lifespan

– Frequent maintenance and downtime

– Inefficient cooling performance

– Higher energy consumption

To mitigate this, verify the manufacturer’s certifications (e.g., ISO 9001), request third-party test reports, and conduct factory audits when possible.

2. Lack of Compliance with International Standards

Small chillers may not meet regional safety, electrical, or environmental standards (e.g., CE, UL, RoHS). Non-compliant units pose safety hazards and may be rejected at customs or during installation. Always confirm that the chiller meets the regulatory requirements of the target market.

3. Inadequate or Falsified Technical Documentation

Some suppliers provide incomplete, inaccurate, or misleading specifications. This includes overstated cooling capacity, underspecified power requirements, or missing dimensional drawings. Request detailed technical data sheets and validate performance claims through independent testing if necessary.

4. Intellectual Property (IP) Infringement Risks

Sourcing from regions with weak IP enforcement increases the risk of purchasing chillers that copy patented designs, control systems, or proprietary technologies. Consequences include:

– Legal liability if the product is imported or resold

– Brand damage due to association with counterfeit goods

– Inability to service or upgrade systems due to lack of support

Always work with reputable suppliers, conduct IP due diligence, and include IP indemnification clauses in procurement contracts.

5. Hidden Design Copying or Reverse Engineering

Some manufacturers reverse-engineer leading brands’ chillers and sell them under generic labels. While these may appear cost-effective, they often lack reliability and technical support. Look for unique design features, original firmware, and traceable component sourcing.

6. Poor After-Sales Support and Spare Parts Availability

Even if initial quality seems acceptable, long-term operation can be hampered by lack of technical support, manuals, or spare parts. Confirm the supplier’s service network and parts availability before procurement.

Conclusion

To avoid quality and IP pitfalls when sourcing small water chillers, prioritize transparency, due diligence, and supplier vetting. Invest time in verifying certifications, technical accuracy, and IP legitimacy to ensure reliable, compliant, and legally safe equipment procurement.

Logistics & Compliance Guide for Small Water Chiller

Product Classification and Regulatory Overview

Small water chillers are typically classified under industrial or commercial cooling equipment. Depending on the region, they may fall under energy efficiency regulations, environmental protection standards, and product safety directives. Understanding the correct classification (e.g., HS Code 8415 for air conditioning machinery) is essential for international shipping and customs clearance.

Shipping and Transportation Requirements

Ensure the chiller is securely packaged to prevent damage during transit. Use palletized crating with corner protectors and moisture barriers. For international shipments, provide a detailed commercial invoice, packing list, and bill of lading or air waybill. Confirm compliance with IATA/IMDG regulations if the chiller contains refrigerants classified as hazardous materials.

Import/Export Documentation

Prepare all necessary documentation prior to shipment, including:

– Commercial Invoice (with full product description, value, and country of origin)

– Packing List (detailing weight, dimensions, and quantity)

– Certificate of Origin (if required by trade agreements)

– Bill of Lading or Air Waybill

– Export Declaration (if applicable)

Verify destination country requirements for import permits or pre-shipment inspections.

Environmental and Safety Compliance

Ensure the chiller complies with environmental regulations such as:

– F-Gas Regulation (EU): For equipment containing fluorinated greenhouse gases

– EPA Section 608 (USA): Proper handling and certification for refrigerant servicing

– RoHS and REACH (EU): Restriction of hazardous substances in electrical equipment

– Energy Efficiency Standards: Such as DOE regulations in the U.S. or Ecodesign Directive in the EU

Provide technical documentation, including test reports and compliance declarations.

Electrical and Safety Certification

Verify that the chiller meets electrical safety standards in the destination market, such as:

– CE Marking (Europe): Compliance with Low Voltage Directive and EMC Directive

– UL/CSA (North America): Certification for safety and performance

– PSE (Japan) or CCC (China): Required certifications for local market access

Include user manuals with safety instructions and electrical specifications in the local language.

Installation and On-Site Compliance

Provide installation guidelines that align with local building codes, plumbing standards, and electrical regulations. Emphasize proper ventilation, drainage, and clearance requirements. Recommend installation by certified technicians to ensure compliance with operational safety standards.

Warranty and After-Sales Support Logistics

Outline warranty terms, service availability, and spare parts logistics. Maintain records of shipped units for compliance tracking and recall management if required. Ensure spare parts are shipped with the same regulatory documentation as the main unit.

Disposal and End-of-Life Compliance

Inform customers of proper end-of-life disposal procedures. Adhere to WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions. Encourage recycling of refrigerants and components through certified facilities to meet environmental obligations.

Conclusion for Sourcing a Small Water Chiller

After careful evaluation of technical requirements, operational needs, and market options, sourcing a small water chiller should be guided by reliability, energy efficiency, cooling capacity, and long-term cost of ownership. It is essential to select a chiller that aligns with the specific application—whether for laboratory equipment, laser systems, or industrial processes—ensuring precise temperature control and consistent performance.

Key factors in the sourcing decision include the chiller’s cooling capacity, temperature stability, size and portability, ease of maintenance, and compatibility with existing systems. Additionally, considering suppliers with strong reputation, responsive customer support, and warranty coverage will help mitigate risks and ensure ongoing operational efficiency.

Ultimately, investing in a high-quality, appropriately sized small water chiller from a reputable manufacturer not only enhances process reliability and equipment lifespan but also contributes to lower energy consumption and reduced downtime. A well-informed sourcing strategy will deliver optimal performance and a strong return on investment over the chiller’s service life.