The global small engine transmission market is experiencing steady growth, driven by increasing demand across residential, commercial, and industrial applications such as lawn and garden equipment, construction machinery, and agricultural tools. According to Grand View Research, the global off-highway transmissions market—which includes small engine applications—was valued at USD 38.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Similarly, Mordor Intelligence projects a robust CAGR of approximately 4.8% for the off-road and small vehicle transmission market over the same period, underpinned by advancements in fuel efficiency, rising automation in equipment, and growing urbanization spurring demand for landscaping and construction machinery. As this sector evolves, a select group of manufacturers have emerged as leaders, combining engineering precision, scalability, and innovation to dominate a competitive and rapidly expanding landscape. These top 10 small engine transmission manufacturers are shaping the future of power transmission in compact and specialized machinery worldwide.

Top 10 Small Engine Transmission Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

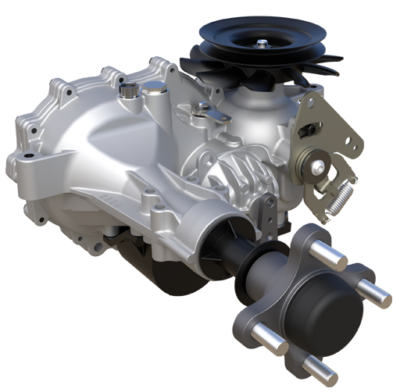

#1 Hydro

Domain Est. 1996

Website: hydro-gear.com

Key Highlights: Hydro-Gear is the world’s leading manufacturer of drivetrain solutions from industrial machines to residential mowers….

#2 STOBER

Domain Est. 1996

Website: stober.com

Key Highlights: Right Angle Geared Motors. From helical gearboxes to planetary gearboxes, STOBER has geared motor options that fit your requirements….

#3 Industrial belt manufacturer

Domain Est. 2001

Website: hutchinsontransmission.com

Key Highlights: Industrial belt manufacturer. Hutchinson, Belt drive manufacturer, develops and manufactures complete industrial power transmission systems incorporating ……

#4 Baldor.com

Domain Est. 1995

Website: baldor.com

Key Highlights: ABB is the world’s number-one manufacturer of NEMA motors, and we’re proud to support you locally with the Baldor-Reliance product brand….

#5 JASPER remanufactured engines, transmissions & differentials

Domain Est. 1996

Website: jasperengines.com

Key Highlights: We are the nation’s largest remanufacturer of gas and diesel engines, transmissions, differentials, air and fuel components, marine engines, sterndrives….

#6 Cross & Morse: Cross+Morse

Domain Est. 2002

Website: crossmorse.com

Key Highlights: Cross+Morse is the official distributor in the UK for all the American transmission products manufactured by Regal-Beloit. The ranges include Sealmaster ……

#7 Premium Transmission

Domain Est. 2014

Website: premium-transmission.com

Key Highlights: Explore Premium Transmission’s comprehensive range of high-quality gears, industrial gearboxes, and power transmission solutions….

#8 Remanufactured CASE IH, CE and New Holland Parts

Domain Est. 2020

Website: mycnhreman.com

Key Highlights: Protect your investment with genuine CNH Industrial Reman Remanufactured parts that are far superior to repairing or rebuilding. Skilled Technicians….

#9 Peerless Gear

Domain Est. 1996

Website: peerlessgear.com

Key Highlights: We proudly build differentials, gearboxes, transmissions, and transaxles. Our final drives also accept hydraulic or electric motors to meet your specific needs….

#10 GT

Domain Est. 2002

Website: generaltransmissions.com

Key Highlights: GT is a world leader in the outdoor power equipment market. We make single and variable-speed drives and transmission, motor, and control systems….

Expert Sourcing Insights for Small Engine Transmission

2026 Market Trends for Small Engine Transmission

The small engine transmission market is poised for significant transformation by 2026, driven by technological innovation, regulatory pressures, and shifting consumer preferences. As industries ranging from agriculture and construction to lawn and garden equipment evolve, demand for efficient, durable, and environmentally friendly transmission systems continues to grow. This analysis explores key trends expected to shape the small engine transmission landscape in 2026.

Electrification and Hybridization

One of the most prominent trends influencing the small engine transmission market is the rise of electrification. By 2026, electric and hybrid small engine systems are expected to gain substantial market share, particularly in consumer and light commercial applications. Urban emissions regulations, such as those in the European Union and parts of North America, are accelerating the shift away from traditional internal combustion engines (ICEs). In response, manufacturers are developing specialized transmissions designed for electric motors, which require different torque delivery characteristics and gear reduction mechanisms. These new transmission systems are lighter, more compact, and optimized for seamless integration with battery-powered drivetrains.

Demand for Efficiency and Performance Optimization

Efficiency remains a top priority for OEMs and end-users alike. In 2026, small engine transmissions will increasingly incorporate advanced materials and precision engineering to reduce energy loss and improve fuel or power efficiency. Continuously Variable Transmissions (CVTs) and automated manual transmissions (AMTs) are expected to see wider adoption, especially in lawn tractors, utility vehicles, and agricultural machinery. These systems enhance performance by maintaining optimal engine speed under varying loads, thereby improving both fuel economy and operator comfort.

Growth in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa are projected to drive demand for small engine-powered equipment due to rising agricultural mechanization and urban infrastructure development. As a result, the demand for cost-effective, reliable small engine transmissions will grow. Localized manufacturing and the development of simplified, rugged transmission designs tailored to regional operating conditions—such as high heat, dust, and variable terrain—are expected to be key strategies for market expansion.

Integration with Smart Technologies

By 2026, smart technology integration will become increasingly common in small engine transmissions. IoT-enabled sensors, predictive maintenance systems, and real-time performance monitoring will allow operators to optimize transmission usage and detect issues before failure. These features are particularly valuable in commercial and industrial applications where equipment downtime can be costly. Additionally, connectivity enables firmware updates and adaptive control algorithms that improve transmission responsiveness and longevity.

Sustainability and Regulatory Compliance

Environmental regulations will continue to shape transmission design and materials. By 2026, manufacturers will face stricter emissions and noise standards, pushing innovation toward quieter, cleaner transmission systems. The use of recyclable materials and sustainable manufacturing processes will become more prevalent as companies strive to meet ESG (Environmental, Social, and Governance) goals. Biodegradable transmission fluids and sealed systems that reduce leakage and contamination are likely to gain traction.

Consolidation and Strategic Partnerships

The competitive landscape of the small engine transmission market is expected to see increased consolidation. As development costs for advanced transmission technologies rise, smaller players may form strategic alliances or be acquired by larger industrial groups. Partnerships between transmission manufacturers and electric motor or battery suppliers will be critical to delivering integrated powertrain solutions, especially for electric outdoor power equipment.

In conclusion, the 2026 small engine transmission market will be defined by innovation in electrification, efficiency, and digital integration. Companies that adapt to these trends—by investing in R&D, embracing sustainable practices, and aligning with evolving regulatory frameworks—will be best positioned to capitalize on emerging opportunities across global markets.

Common Pitfalls Sourcing Small Engine Transmission (Quality, IP)

Sourcing small engine transmissions, commonly used in equipment like lawn mowers, generators, and agricultural machinery, involves navigating several critical challenges. Two of the most significant areas of risk are quality consistency and intellectual property (IP) protection. Overlooking these can lead to production delays, product failures, legal disputes, and reputational damage.

Quality Inconsistencies and Lack of Standardization

One of the foremost pitfalls in sourcing small engine transmissions—especially from low-cost regions—is inconsistent product quality. Many suppliers may offer attractive pricing but fail to maintain rigorous manufacturing standards. This can result in variations in gear tolerances, material strength, heat treatment, and overall durability. Without proper quality control processes (e.g., ISO certification, in-line inspections, and performance testing), buyers risk receiving transmissions that wear prematurely, overheat, or fail under load. Additionally, the absence of standardized specifications across suppliers can make part interchangeability difficult, complicating maintenance and after-sales support.

Intellectual Property (IP) Risks and Design Theft

Another critical concern is the potential for IP infringement or misappropriation during the sourcing process. When working with overseas manufacturers—particularly in regions with less stringent IP enforcement—there is a risk that proprietary transmission designs, gear profiles, or patented technologies could be copied or reverse-engineered without authorization. Suppliers might also reuse designs for competing customers, diluting competitive advantage. Furthermore, unclear contractual terms regarding ownership of molds, tooling, and engineering data can leave buyers vulnerable to legal disputes or unauthorized production. Failing to conduct due diligence on supplier IP practices or to secure robust legal agreements significantly increases exposure to these risks.

Logistics & Compliance Guide for Small Engine Transmissions

Overview

Small engine transmissions—commonly found in equipment such as lawn mowers, snow blowers, generators, and agricultural machinery—require careful logistics planning and strict adherence to compliance regulations. This guide outlines key considerations for the safe, efficient, and legal transportation, handling, and distribution of small engine transmissions.

Packaging & Handling

Proper packaging is essential to prevent damage during transit.

– Use moisture-resistant, corrugated cardboard or reusable plastic containers with internal cushioning (e.g., foam inserts or molded trays).

– Secure transmission shafts and moving parts with protective caps or tape to prevent contamination and mechanical damage.

– Clearly label packages with handling instructions: “Fragile,” “This Side Up,” and “Protect from Moisture.”

– Follow ESD (Electrostatic Discharge) protocols if the transmission includes electronic components.

Storage Conditions

Transmissions should be stored in a climate-controlled environment.

– Maintain temperatures between 40°F and 80°F (4°C to 27°C) and relative humidity below 60%.

– Avoid direct sunlight and exposure to corrosive chemicals or salt air.

– Store units on pallets off the floor to prevent moisture absorption and allow for air circulation.

– Implement First-In, First-Out (FIFO) inventory practices to minimize aging and obsolescence.

Transportation & Shipping

Choose reliable carriers experienced in handling mechanical components.

– Use enclosed trucks or containers to protect against weather, dust, and vibration.

– Secure loads with straps or dunnage to prevent shifting during transit.

– For international shipments, comply with Incoterms (e.g., FOB, EXW, DDP) and ensure accurate documentation (commercial invoice, packing list, bill of lading).

– Monitor shipment conditions with GPS and temperature/humidity sensors when necessary.

Regulatory Compliance

Ensure adherence to domestic and international regulations.

– Export Controls: Verify if transmissions contain controlled technologies under EAR (Export Administration Regulations) or ITAR. Obtain necessary licenses if exporting to restricted countries.

– Hazardous Materials: Confirm that lubricants or cleaning agents used in transmissions do not classify as hazardous under DOT, IATA, or IMDG regulations.

– Product Certification: Meet standards such as CE (Europe), UKCA (UK), or EPA/Carb (emissions in the U.S.) where applicable.

– RoHS & REACH: Comply with restrictions on hazardous substances in electrical and electronic components (EU directives).

Import & Customs Clearance

Prepare documentation accurately to avoid delays.

– Provide Harmonized System (HS) codes (e.g., 8483.40 for gearboxes).

– Submit certificates of origin, import licenses (if required), and test reports.

– Partner with a licensed customs broker to manage duties, tariffs, and VAT.

– Be aware of trade agreements (e.g., USMCA, CETA) that may reduce tariffs.

Quality & Traceability

Maintain full traceability throughout the supply chain.

– Implement serial or batch numbering for each transmission.

– Use barcode or RFID systems for inventory tracking.

– Keep records of inspection, testing, and calibration for at least five years.

– Follow ISO 9001 or IATF 16949 quality management standards if applicable.

Environmental & Sustainability Practices

Adopt eco-friendly logistics strategies.

– Use recyclable or reusable packaging materials.

– Optimize load planning to reduce fuel consumption and CO₂ emissions.

– Partner with carriers that have sustainability certifications (e.g., SmartWay).

– Establish take-back or recycling programs for end-of-life transmissions.

Incident Response & Recall Preparedness

Be prepared to respond to compliance violations or product issues.

– Develop a recall plan aligned with regulatory requirements (e.g., CPSC in the U.S.).

– Maintain contact lists for suppliers, distributors, and regulatory agencies.

– Conduct mock recalls annually to test response efficiency.

– Report safety incidents promptly to relevant authorities.

Conclusion

Effective logistics and compliance management for small engine transmissions ensures product integrity, regulatory adherence, and customer satisfaction. By integrating proper handling, documentation, and quality controls, businesses can minimize risks and enhance operational reliability in a global market.

Conclusion for Sourcing Small Engine Transmissions

In conclusion, sourcing small engine transmissions requires a strategic approach that balances cost, quality, reliability, and supply chain efficiency. After evaluating potential suppliers, technical specifications, and market availability, it is evident that establishing relationships with reputable manufacturers—whether domestic or international—can significantly impact the performance and longevity of equipment. Key factors such as durability, compatibility, customization options, and after-sales support must be prioritized to ensure optimal integration into end-use applications.

Additionally, considering total cost of ownership rather than initial purchase price helps avoid long-term maintenance issues and downtime. Exploring both OEM and aftermarket options provides flexibility, but rigorous quality control and testing are essential to maintain performance standards. Ultimately, a well-informed sourcing strategy that includes supplier vetting, long-term partnerships, and continuous performance monitoring will ensure a reliable supply of small engine transmissions that meet technical requirements and support overall operational success.