The global sales of selective laser sintering (SLS) powder are experiencing robust growth, driven by increasing adoption in aerospace, automotive, and medical industries. According to Grand View Research, the global 3D printing materials market—of which SLS powders are a critical segment—was valued at USD 1.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 19.3% from 2023 to 2030. This surge is fueled by rising demand for high-performance polymers like PA12 (nylon 12) and advancements in industrial additive manufacturing. As companies seek reliable, high-quality powder suppliers to support production-grade 3D printing, identifying leading manufacturers becomes essential. Based on market presence, material innovation, and technical capabilities, the following eight companies have emerged as the top SLS powder manufacturers shaping the future of digital manufacturing.

Top 8 Sls Powder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sodium Lauryl Sulphate Powder

Domain Est. 2014

Website: sgchem.in

Key Highlights: Manufacturer of Sodium Lauryl Sulphate Powder – Godrej Sls Powder offered by Shree Ganesh Chemicals, Ahmedabad, Gujarat … Godrej Sls Powder. Rs 185 / Kg….

#2 Sodium Lauryl Sulfate (SLS)

Domain Est. 2015

Website: aksharinternational.in

Key Highlights: Manufacturers and Suppliers of sodium lauryl sulfate (sls). Akshar Chemical India Private Limited is one of the largest chemical supplier and manufacturer….

#3 SLS POWDER Manufacturer & Supplier in China

Domain Est. 2016

Website: hnlcaw.com

Key Highlights: Why choose Resun auway SLS POWDER? · Excellent location with three factories · Huge capacity for surfactants · Diversified surfactants products · Professional ……

#4 China Sodium Lauryl Sulfate (SLS) Manufacturers and Suppliers

Domain Est. 2020

Website: brillachem.com

Key Highlights: SLS Powder 93%; 95%, Sodium Lauryl Sulfate, 151-21-3, Toothpaste, Shampoo, oil well firefighting (seawater). Sodium Lauryl Sulfate (SLS) has good features ……

#5 SURFAC® SLS BP POWDER

Domain Est. 1998

Website: surfachem.com

Key Highlights: Product Features. Naturally derived; High foaming; Wetting; Anionic; Alkali stable. Chemical Description. Sodium Lauryl Sulfate. Resources….

#6 sls powder

Domain Est. 2012

Website: alphachemicals.in

Key Highlights: In stockWe manufacture Sodium Lauryl Sulphate powder using superior chemical processes, which imparts superior quality as per the prescribed quality norms. It is widely ……

#7 SLS POWDER

Domain Est. 2020

Website: atamanchemicals.com

Key Highlights: SLS Powder is a strong anionic surfactant derived from natural sources like coconut oil. SLS Powder is derived naturally from coconut oil or palm kernel oil….

#8 Sodium Lauryl Sulfate(SLS)

Domain Est. 2022

Website: yeserchem.com

Key Highlights: Rating 5.0 · Review by YeserChemExplore Yeser Chemicals for superior Sodium Lauryl Sulfate (SLS) surfactant. Find comprehensive information, product specifications, and answer…

Expert Sourcing Insights for Sls Powder

H2: 2026 Market Trends for SLS Powder – Strategic Growth, Demand Drivers, and Emerging Applications

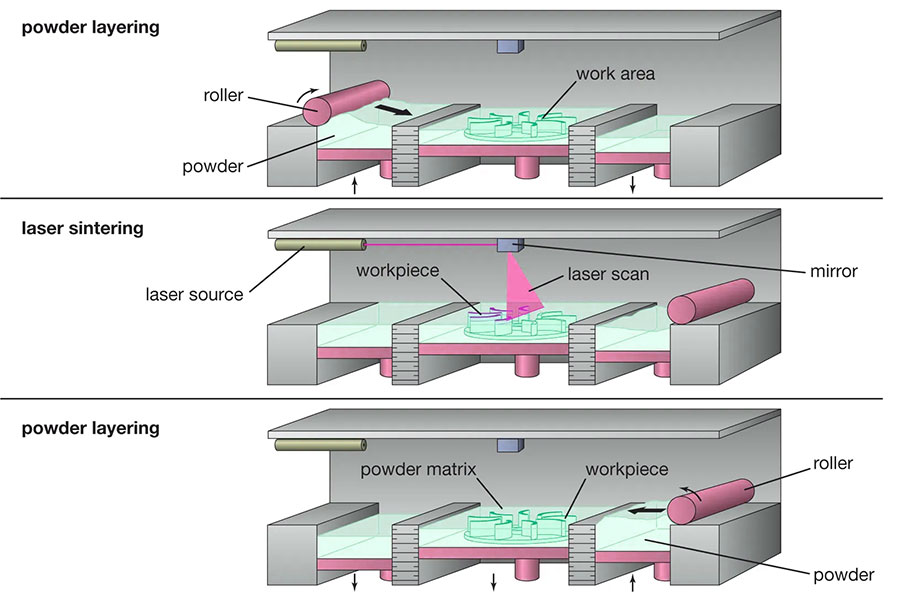

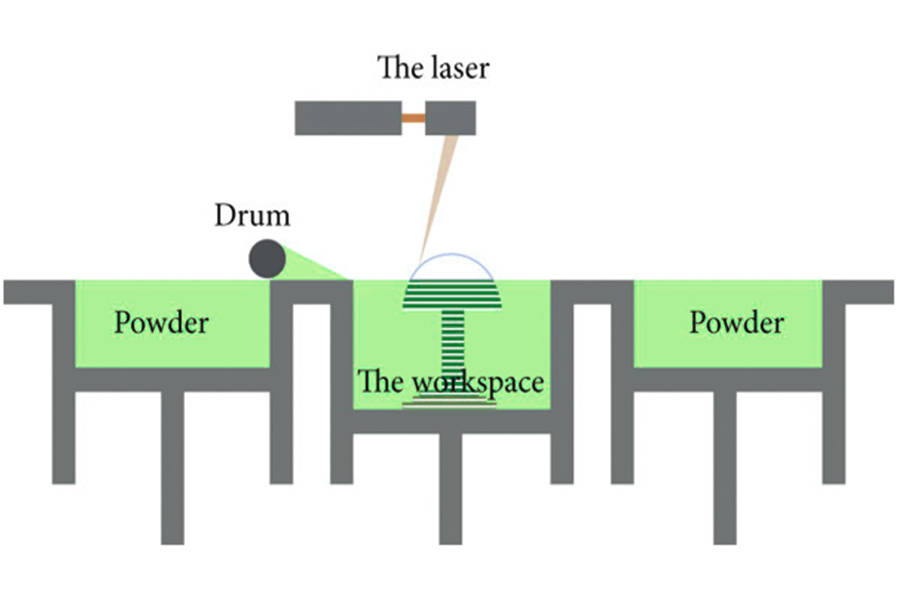

The market for Selective Laser Sintering (SLS) powder is projected to experience robust growth by 2026, fueled by advancements in additive manufacturing, rising industrial adoption, and increasing demand for high-performance materials across key sectors. As a cornerstone technology in industrial 3D printing, SLS (Selective Laser Sintering) relies heavily on specialized polymer powders—primarily polyamide (PA11, PA12), thermoplastic elastomers (TPUs), and emerging bio-based or recycled formulations. Below is an in-depth analysis of the key market trends shaping the SLS powder landscape in 2026:

-

Expansion in Industrial Manufacturing Adoption

By 2026, SLS powder is expected to see increased penetration in end-use part production, moving beyond prototyping into full-scale manufacturing. Industries such as automotive, aerospace, and medical devices are leveraging SLS for its design freedom, part consolidation, and on-demand production capabilities. The trend toward digital inventory and decentralized manufacturing further accelerates demand for reliable, high-quality SLS powders. -

Material Innovation and Sustainability Focus

Sustainability is a dominant trend influencing SLS powder development. Leading material suppliers are investing in bio-sourced, recyclable, and lower-carbon footprint powders. Polymers like PA11 (derived from castor oil) and recycled PA12 are gaining traction. In 2026, expect broader commercial availability of eco-certified SLS powders, driven by ESG mandates and circular economy goals. -

Rise of Multi-Material and Functional Powders

The demand for functional performance—such as flame retardancy, chemical resistance, and conductivity—is pushing innovation in composite and doped SLS powders. Fillers like glass beads, carbon fiber, and aluminum are being integrated to enhance mechanical properties. Additionally, research into multi-material compatibility is expanding the application scope in electronics and tooling. -

Cost Reduction and Powder Reusability Enhancements

Powder cost remains a barrier to wider SLS adoption. However, by 2026, improved powder recycling techniques and closed-loop systems are reducing material waste and operational costs. OEMs and material providers are standardizing aging models and rejuvenation protocols, enabling higher reuse ratios (up to 70–80%) without compromising part quality. -

Geographic Market Shifts

While North America and Europe remain strong markets due to advanced manufacturing ecosystems, Asia-Pacific—especially China, Japan, and South Korea—is emerging as a high-growth region. Localized production of SLS powders, government support for advanced manufacturing, and expanding industrial 3D printing hubs are driving regional demand. -

Consolidation and Vertical Integration Among Suppliers

The SLS powder market is witnessing increased vertical integration, with major players like BASF, Arkema, and Evonik acquiring or partnering with 3D printing firms. This trend ensures tighter control over material-performance alignment and fosters ecosystem development. In 2026, a few dominant material suppliers are expected to control a significant share of the high-performance SLS powder market. -

Standardization and Certification

As SLS moves into regulated industries (e.g., aerospace, medical), material traceability, batch consistency, and certification (e.g., ISO, ASTM) are becoming critical. By 2026, the market will see wider adoption of certified SLS powders with full documentation, enabling compliance and accelerating regulatory approvals. -

Growth in Service Bureaus and On-Demand Manufacturing

Third-party 3D printing service providers are expanding their SLS capabilities, offering access to advanced powders without upfront capital investment. This model supports SMEs and startups, broadening the user base and stimulating powder consumption.

Conclusion

By 2026, the SLS powder market is poised for transformation, driven by industrial digitization, material innovation, and sustainability imperatives. While challenges around cost and standardization persist, strategic advancements in powder formulation, recycling, and ecosystem collaboration will solidify SLS as a mainstream manufacturing technology. Companies that invest in high-performance, sustainable, and certified powders are likely to lead the next phase of growth in the additive manufacturing sector.

Common Pitfalls Sourcing SLS Powder (Quality, IP)

Sourcing Sodium Lauryl Sulfate (SLS) powder requires careful consideration to avoid significant quality and intellectual property (IP) risks. Overlooking these pitfalls can lead to product failures, regulatory non-compliance, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Purity and Impurity Profiles

SLS purity significantly impacts performance and safety. Low-quality or poorly controlled SLS may contain high levels of impurities like inorganic sulfates, residual alcohols (e.g., dodecanol), or unreacted starting materials. These impurities can affect foaming, viscosity, skin irritation potential, and stability in formulations. Suppliers without rigorous quality control may provide inconsistent batches, leading to variability in final product performance.

Moisture Content and Physical Stability

SLS powder is hygroscopic. Poor packaging or storage can result in high moisture content, causing clumping, caking, or degradation over time. This affects dosing accuracy and processability. Ensure suppliers provide moisture content specifications (typically <2–5%) and use moisture-resistant packaging (e.g., multi-layer poly-lined bags).

Incorrect Grade or Form

SLS is available in different grades (technical, industrial, pharmaceutical, cosmetic) and physical forms (powder, flakes, beads). Mistaking technical-grade for cosmetic-grade SLS can introduce contaminants unsuitable for consumer products. Always verify the intended application and confirm the grade meets relevant pharmacopoeial or cosmetic standards (e.g., USP, Ph. Eur., or ISO).

Lack of Certifications and Documentation

Reputable suppliers should provide Certificates of Analysis (CoA), Material Safety Data Sheets (MSDS/SDS), and evidence of regulatory compliance (e.g., REACH, FDA, ECOCERT for natural/cosmetic use). Absence of proper documentation increases the risk of non-compliant or adulterated material.

Intellectual Property (IP) and Legal Pitfalls

Unlicensed or Infringing Manufacturing Processes

While SLS as a chemical compound is generic, specific manufacturing processes (e.g., ethoxylation methods, purification techniques) may be protected by patents. Sourcing from producers using patented technology without licensing can expose buyers to IP infringement claims, especially in regulated markets like pharmaceuticals or high-end cosmetics.

Misrepresentation of Origin or Green Claims

Some suppliers may falsely claim SLS is “natural,” “plant-based,” or “sustainable” without certification. While SLS can be derived from coconut or palm oil, the sulfation process is chemical. Misleading claims can lead to greenwashing allegations and regulatory action. Verify sourcing claims with documentation (e.g., mass balance certifications, supplier declarations).

Supply Chain Transparency and Traceability Gaps

Lack of visibility into the supply chain increases risks of sourcing from unethical or non-compliant producers (e.g., deforestation-linked palm oil, poor labor practices). This is especially critical for brands committed to ESG (Environmental, Social, Governance) standards. Always demand traceability to the source and audit capabilities.

Counterfeit or Diverted Material

In regions with weak regulatory oversight, counterfeit or diverted SLS may enter the market. This material may not meet stated specifications and could be repackaged industrial-grade product sold as pharmaceutical or food-grade. Vet suppliers thoroughly and prefer those with direct manufacturing capabilities or strong supply chain controls.

Mitigation Strategies

- Conduct rigorous supplier qualification audits (on-site if possible).

- Require batch-specific CoAs and long-term stability data.

- Use independent third-party testing for critical quality attributes.

- Consult legal counsel to assess potential IP risks in target markets.

- Prioritize suppliers with transparent sourcing, certifications (ISO, GMP, eco-labels), and strong compliance records.

Avoiding these pitfalls ensures reliable, compliant, and legally sound sourcing of SLS powder for your application.

Logistics & Compliance Guide for SLS Powder

Overview of SLS Powder

Selective Laser Sintering (SLS) powder is a key material used in additive manufacturing (3D printing) processes. Common types include nylon-based powders such as PA11, PA12, and composites with fillers like glass or aluminum. Due to its fine particulate nature and potential combustion risk, proper handling, storage, transportation, and regulatory compliance are critical.

Classification & Regulatory Status

UN Classification and Hazard Identification

SLS powders are typically classified under the United Nations Globally Harmonized System (GHS) due to their physical hazards. Most dry, fine polymer powders may be categorized as:

– UN 3175, NITRATED FIBROUS MATERIAL, FLAMMABLE SOLID, 4.1

– Or as Not Regulated (for non-hazardous variants) depending on test results

However, classification must be confirmed through standardized testing (e.g., UN Manual of Tests and Criteria, Part III, 33.2.1) for combustibility and dust explosion risk (Kst, Pmax).

Safety Data Sheet (SDS) Requirements

An up-to-date SDS (per OSHA HazCom 2012 / GHS standards) is mandatory and must include:

– Hazard identification (dust explosion, respiratory irritation)

– Composition/information on ingredients

– First-aid and firefighting measures

– Accidental release measures

– Handling and storage guidance

– Exposure controls and PPE recommendations

– Physical and chemical properties

– Stability and reactivity

– Toxicological and ecological information

– Disposal, transport, and regulatory information

Packaging & Labeling

Packaging Standards

- Use sealed, moisture-resistant, static-dissipative containers to prevent clumping and electrostatic discharge.

- Inner liners (e.g., polyethylene bags) should be heat-sealed.

- Outer packaging must meet drop-test and stacking requirements (e.g., UN-certified packaging if classified as hazardous).

- Avoid overfilling to minimize powder suspension during transport.

Labeling Requirements

- Proper shipping name and UN number (if applicable)

- GHS pictograms: Flame (for flammable solids), Exclamation Mark (health hazard)

- Signal word: “Danger” or “Warning”

- Precautionary and hazard statements

- Transport hazard class (e.g., Class 4.1 Flammable Solid)

- Net weight and batch/lot number

- Manufacturer/importer contact information

Transport & Shipping

Ground, Air, and Sea Transport

- Air (IATA DGR): If the powder is classified as a flammable solid (Class 4.1), it may be forbidden or restricted on passenger aircraft. Shipments require proper classification, packaging, marking, labeling, and documentation.

- Sea (IMDG Code): Follow Class 4.1 regulations if applicable; otherwise, may be shipped as “Not Restricted” with proper documentation.

- Road (ADR/RID in Europe, 49 CFR in USA): Align packaging and documentation with local hazardous materials regulations.

Exemptions

Some SLS powders may qualify for limited or excepted quantities:

– Limited Quantity (LQ): Allows reduced labeling and packaging requirements for small amounts.

– Excepted Quantity (E0–E5): For very small packages under defined thresholds.

Note: Exemptions require confirmation through testing and regulatory review.

Storage & Handling

Storage Conditions

- Store in a cool, dry, well-ventilated area away from heat, sparks, and ignition sources.

- Relative humidity: 30–50% to prevent moisture absorption.

- Use grounded containers to prevent static buildup.

- Segregate from oxidizers and flammable liquids.

Handling Procedures

- Use local exhaust ventilation or fume hoods when transferring or dispensing powder.

- Prohibit open flames, smoking, and hot work in handling areas.

- Implement grounding and bonding practices for equipment.

- Use non-sparking tools and conductive flooring in production environments.

Health & Safety

Personal Protective Equipment (PPE)

- Respiratory protection: NIOSH-approved N95 respirator or higher (e.g., P100) for dusty environments.

- Eye protection: Safety goggles or face shield.

- Skin protection: Nitrile gloves and anti-static lab coat.

- Hearing protection if using high-pressure cleaning equipment.

Exposure Limits

- Follow manufacturer-recommended exposure limits (OELs).

- In absence of specific data, treat as a nuisance dust with an 8-hour TWA limit of 10 mg/m³ (total dust, ACGIH).

Environmental & Waste Disposal

Environmental Precautions

- Prevent release to sewers, soil, or waterways.

- Capture spilled powder with HEPA-filtered vacuum systems; do not use compressed air.

Waste Disposal

- Dispose of waste powder and contaminated packaging in accordance with local, state, and federal regulations (e.g., EPA, RCRA in the U.S.).

- Consider incineration in permitted facilities for energy recovery.

- Recycle unused powder when possible following manufacturer guidelines.

Compliance Documentation

Required Documents

- Safety Data Sheet (SDS)

- Certificate of Analysis (CoA)

- Transport Declaration (if hazardous)

- Regulatory Compliance Statement (e.g., REACH, RoHS, TSCA)

- Waste disposal manifest (if applicable)

Regulatory Frameworks

- OSHA (U.S.): Hazard Communication Standard (29 CFR 1910.1200), Process Safety Management

- REACH (EU): Registration, Evaluation, Authorization of Chemicals

- CLP Regulation (EU): Classification, Labeling and Packaging

- DOT (U.S.): 49 CFR for hazardous materials transportation

- EPA: Resource Conservation and Recovery Act (RCRA) for waste

Emergency Response

Spill Management

- Evacuate non-essential personnel.

- Eliminate ignition sources.

- Use explosion-proof vacuum (HEPA) to collect powder.

- Wipe surfaces with damp cloth to avoid dust dispersion.

- Dispose of as hazardous waste if classified.

Fire Response

- Small fires: Use CO₂, dry powder, or sand. Do not use water jets—may disperse dust and increase explosion risk.

- Large fires: Evacuate and let burn in controlled conditions; use unmanned monitors.

- Firefighters should wear full SCBA and protective gear.

Training & Audits

Personnel Training

- Conduct regular training on:

- Hazard communication

- Dust explosion risks

- PPE usage

- Emergency procedures

- Maintain records of training and certifications.

Compliance Audits

- Perform periodic internal audits of:

- Storage and handling practices

- SDS and labeling accuracy

- Waste management logs

- Transportation documentation

- Address non-conformities promptly.

Conclusion

Safe and compliant logistics for SLS powder requires a proactive approach to hazard classification, packaging, regulatory documentation, and personnel safety. Always verify the specific properties of your SLS powder through testing and consult with regulatory experts to ensure full compliance with national and international standards.

Conclusion for Sourcing SLS (Sodium Lauryl Sulfate) Powder:

In conclusion, sourcing high-quality SLS powder requires careful consideration of several critical factors, including purity, supplier reliability, compliance with regulatory standards (such as FDA, REACH, or ISO certifications), and cost-effectiveness. It is essential to conduct thorough due diligence on potential suppliers, including site audits, quality assurance documentation, and testing for contaminants to ensure the material meets the required specifications for its intended application—whether in personal care, pharmaceuticals, or industrial products.

Sustainability and ethical sourcing practices are increasingly important, with growing demand for environmentally responsible manufacturing processes. Establishing long-term partnerships with reputable suppliers can lead to consistent quality, better pricing, and improved supply chain resilience. Ultimately, a strategic approach to sourcing SLS powder not only ensures product safety and performance but also supports regulatory compliance and brand integrity in competitive markets.