The global patient lift market is experiencing robust growth, driven by an aging population, rising prevalence of mobility impairments, and increased focus on caregiver safety in both clinical and home healthcare settings. According to a report by Mordor Intelligence, the patient lift market was valued at USD 1.8 billion in 2023 and is projected to grow at a CAGR of 7.2% through 2029. Sit-and-stand Hoyer lifts, a critical segment within this market, are increasingly favored for their role in promoting patient independence and reducing the physical strain on healthcare providers during transfers. These devices support partial weight-bearing ambulation, enabling rehabilitation and enhancing quality of life for individuals with limited mobility. As demand surges across hospitals, long-term care facilities, and home care environments, innovation in ergonomics, safety mechanisms, and electric actuation has become a key differentiator among manufacturers. In this landscape, nine leading companies have emerged at the forefront, combining technological advancement with clinical efficacy to meet evolving care delivery needs.

Top 9 Sit And Stand Hoyer Lift Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sit

Domain Est. 1996

Website: ezlifts.com

Key Highlights: Our sit-to-stand patient lifts offer more than just pivot transfers. With height adjustable and removable footplates and walker handles, our stands also help ……

#2 Wy’East Medical

Domain Est. 2011

Website: wyeastmedical.com

Key Highlights: Wy’East Medical is a US manufacturer of Safe Patient Handling & Mobilty (SPHM) Equipment with a wide range of products for healthcare facilities….

#3 Patient Lifts

Domain Est. 1997

Website: hillrom.com

Key Highlights: Utilize patient lifts such sit to stand and overhead lifts to safely transition your patients into their new position with ease….

#4 SMT Health Systems Store

Domain Est. 1998

Website: patientlift.com

Key Highlights: Home · Sit-to-Stand Lifts · Full Body Lifts · Slings · Rock-King Wheelchair; Parts. Parts. Parts – Full Body · Parts – Sit-to-Stand · Parts – Rock-King ……

#5 Hoyer Lifts

Domain Est. 2000

Website: hoyerlift.com

Key Highlights: Hoyer Elevate Stand-Up Lift. The Elevate is an active lift designed to improve the lifting experience for both the caregiver and the patient. Learn More!…

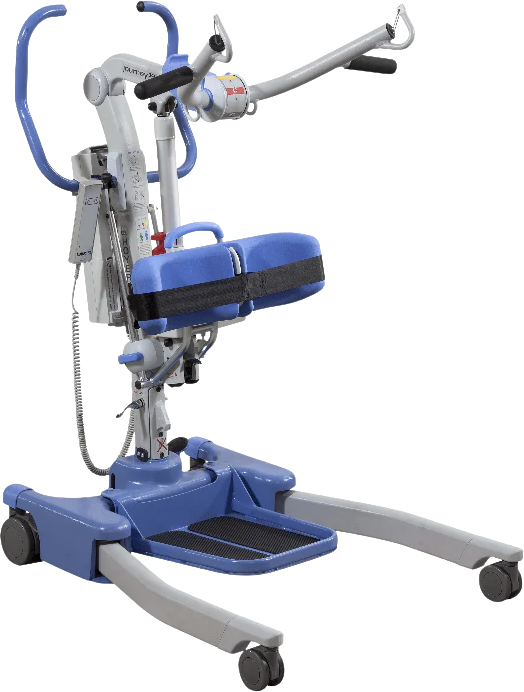

#6 Hoyer Journey Sit to Stand Lift

Domain Est. 2002

Website: performancehealth.com

Key Highlights: In stock Rating 4.8 4 Hoyer Journey Sit to Stand Lift is ideal for patients who have decreased weight-bearing abilities and require assistance while standing….

#7 Numotion

Domain Est. 2011

Website: numotion.com

Key Highlights: Explore Numotion’s full range of mobility solutions and services. Empowering independence through innovative wheelchair and assistive technologies….

#8 F500S Powered Sit to Stand Patient Lift

Domain Est. 2012

Website: pathomation.com

Key Highlights: Rating 4.0 (134) Dec 30, 2025 · Effortlessly transfer patients from sitting to standing positions with the F500S Powered Sit to Stand Patient Lift. With its powerful lift ……

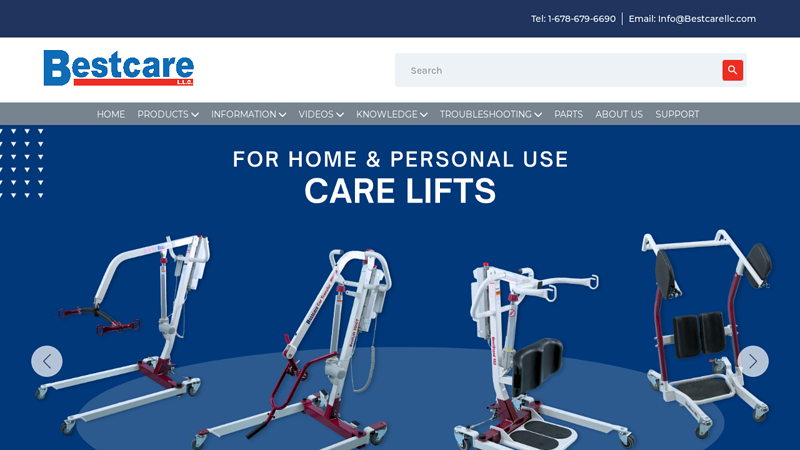

#9 BestCare

Domain Est. 2010 | Founded: 1993

Website: bestcarellc.com

Key Highlights: Bestcare has been designing and making quality patient lift and transfer products since 1993. Safety, comfort, and affordability are the cornerstones of our ……

Expert Sourcing Insights for Sit And Stand Hoyer Lift

H2: 2026 Market Trends for Sit-to-Stand Hoyer Lifts

The global market for sit-to-stand Hoyer lifts is projected to experience significant growth and transformation by 2026, driven by demographic shifts, technological advancements, and evolving healthcare needs. Key trends shaping the market include:

-

Aging Population and Rising Demand for Home Healthcare

The global elderly population (65+) is expanding rapidly, particularly in North America, Europe, and parts of Asia-Pacific. As older adults seek to age in place, demand for mobility-assist devices like sit-to-stand lifts is increasing. This shift is fueling adoption in home care settings, reducing reliance on institutional care and lowering healthcare costs. -

Technological Integration and Smart Features

By 2026, manufacturers are incorporating smart technologies into sit-to-stand Hoyer lifts, including remote controls, app-based monitoring, weight sensors, and IoT connectivity. These enhancements improve user safety, caregiver efficiency, and data tracking for rehabilitation progress, making devices more appealing to both medical professionals and consumers. -

Focus on Ergonomics and User Safety

Safety remains a top priority. Next-generation lifts are being designed with improved stability, anti-slip platforms, adjustable height settings, and smoother transition mechanisms. These ergonomic advancements reduce the risk of falls and injuries for both patients and caregivers, aligning with workplace safety regulations and insurance requirements. -

Expansion of Reimbursement and Insurance Coverage

In key markets like the U.S. and parts of Western Europe, improvements in Medicare, Medicaid, and private insurance coverage for mobility aids are increasing patient access. Greater reimbursement support is expected to lower out-of-pocket costs, encouraging wider adoption of sit-to-stand Hoyer lifts. -

Growth in Emerging Markets

While North America and Europe dominate the current market, regions such as India, Brazil, and Southeast Asia are emerging as high-growth areas. Increasing healthcare infrastructure, rising awareness of assistive technologies, and government initiatives for disability support are accelerating demand in these regions. -

Sustainability and Lightweight Design

Manufacturers are focusing on eco-friendly materials and energy-efficient production. Lightweight, portable models are gaining popularity among caregivers and family members who need easy storage and transport, especially in multi-user or mobile care environments. -

Competitive Landscape and Innovation

The market is seeing increased competition from both established players (e.g., Joerns Healthcare, Stryker, Mason Medical) and new entrants offering cost-effective alternatives. Innovation in battery life, motor efficiency, and customizable sling options is enhancing product differentiation and market penetration.

In conclusion, the 2026 sit-to-stand Hoyer lift market will be characterized by smarter, safer, and more accessible devices, supported by demographic demand and healthcare modernization. Stakeholders who prioritize innovation, user experience, and global scalability are poised to capture significant market share.

Common Pitfalls When Sourcing Sit and Stand Hoyer Lifts: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Sit-to-Stand Hoyer Lift

This guide outlines the essential logistics considerations and compliance requirements for the safe and effective use, transport, and maintenance of Sit-to-Stand Hoyer Lifts in healthcare and home care environments.

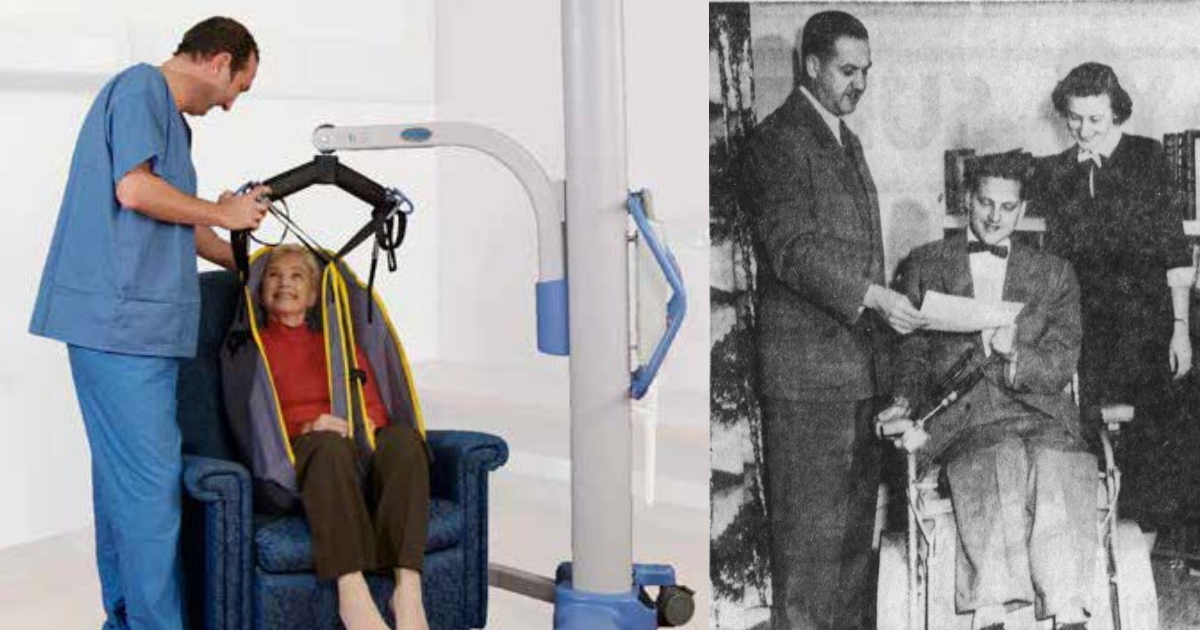

Product Overview and Intended Use

The Sit-to-Stand Hoyer Lift is a mechanical assistive device designed to support caregivers in transferring individuals with limited mobility from a seated to a standing position, and vice versa. It is not intended for full-body lifting or horizontal transfers. Proper use reduces caregiver strain and enhances patient dignity and safety during mobility assistance.

Regulatory Compliance

FDA Classification and Registration

Sit-to-Stand Hoyer Lifts are classified as Class I medical devices under the U.S. Food and Drug Administration (FDA) regulations. They are subject to general controls, including:

– Establishment registration

– Medical Device Listing

– Adherence to Quality System Regulation (QSR), specifically 21 CFR Part 820

– Labeling compliance per 21 CFR Part 801

Facilities and distributors must verify that the lift model is listed in the FDA’s database and that the manufacturer is registered.

ISO Standards

Manufacturers should comply with relevant international standards, including:

– ISO 13485:2016 (Quality Management Systems for Medical Devices)

– ISO 14971:2019 (Application of Risk Management to Medical Devices)

– ISO 15223-1:2021 (Medical devices – Symbols to be used with medical device labels)

Ensure product documentation includes conformity declarations to applicable standards.

CE Marking (EU Compliance)

For distribution within the European Union, the lift must meet the requirements of the Medical Device Regulation (MDR) (EU) 2017/745 and carry the CE mark. This includes:

– Technical documentation

– Risk assessment

– Clinical evaluation (as applicable)

– Notified Body involvement, if required

– Declaration of Conformity

Safety and Usage Compliance

Staff Training and Certification

Only trained and authorized personnel may operate the Sit-to-Stand Hoyer Lift. Training must include:

– Proper setup and inspection procedures

– Correct sling selection and attachment

– Safe transfer techniques

– Emergency procedures (e.g., power failure, instability)

Documentation of staff training must be maintained per OSHA and Joint Commission standards.

Patient Assessment and Weight Limits

Prior to each use:

– Assess patient’s ability to bear partial weight and follow directions

– Confirm patient’s weight is within the lift’s specified capacity (typically 300–450 lbs, model-dependent)

– Select an appropriate sling based on patient size, mobility, and clinical needs

Exceeding weight limits or improper sling use may result in device failure and patient injury.

Inspection and Maintenance

Routine Inspections

Conduct pre-use visual and functional checks, including:

– Frame integrity (cracks, bends, or corrosion)

– Hydraulic or electric lift mechanism operation

– Sling condition (tears, fraying, or damaged hooks)

– Battery charge level (for powered models)

Document inspections using a standardized checklist.

Preventive Maintenance Schedule

Follow the manufacturer’s maintenance guidelines, typically including:

– Monthly lubrication of moving parts

– Quarterly load testing

– Annual comprehensive safety and performance audit

Maintenance records must be retained for a minimum of five years.

Transport and Storage Logistics

In-Facility Transport

- Always collapse or fold the lift according to manufacturer instructions before moving

- Use hallways and doorways with sufficient clearance (verify dimensions)

- Secure loose components (e.g., sling, base legs) during transit

- Avoid ramps steeper than 6° unless the lift is designed for incline use

Long-Distance Shipping

When shipping lifts between facilities or for service:

– Use original packaging or a protective crate

– Secure hydraulic cylinders and mast to prevent movement

– Include all accessories and documentation

– Label with “Fragile” and “This Side Up” indicators

– Comply with IATA/IMDG regulations if shipping internationally with lithium batteries

Storage Requirements

Store lifts in a:

– Dry, climate-controlled environment

– Clean area away from moisture, chemicals, and extreme temperatures

– Upright position with base fully open to prevent frame stress

– Location where unauthorized access is restricted

Documentation and Recordkeeping

Maintain the following records for compliance and audit readiness:

– Device log (serial number, location, usage)

– Training records for all operators

– Inspection and maintenance logs

– Incident reports (malfunctions, near misses, injuries)

– Manufacturer service reports

Retention period should align with organizational policy and regulatory requirements (minimum 7 years recommended).

Disposal and End-of-Life

Dispose of non-functional lifts in accordance with:

– Environmental regulations (e.g., proper battery recycling under EPA or local laws)

– HIPAA guidelines if the device contains patient usage data

– Manufacturer take-back programs, if available

Do not discard in regular waste streams; coordinate with certified medical equipment recyclers.

Emergency Procedures

In the event of lift malfunction:

– Safely lower the patient using manual techniques or backup equipment

– Tag the device “Out of Service”

– Report the incident to supervisor and risk management

– Contact the manufacturer for evaluation and repair

All malfunctions must be documented and reported through appropriate safety reporting systems (e.g., FDA MedWatch for serious adverse events).

By following this guide, healthcare providers and facilities can ensure compliance with applicable regulations, promote user safety, and maintain optimal functionality of Sit-to-Stand Hoyer Lifts throughout their lifecycle.

Conclusion for Sourcing Sit-to-Stand Hoyer Lifts:

After thorough evaluation of available options, it is clear that sourcing sit-to-stand Hoyer lifts is a valuable investment in promoting patient safety, caregiver ergonomics, and overall efficiency in healthcare environments. These devices significantly reduce the risk of injury during patient transfers, support rehabilitation efforts, and enhance independence for individuals with mobility challenges.

When sourcing these lifts, it is essential to consider factors such as weight capacity, ease of use, portability, durability, and compatibility with existing care protocols. Engaging reputable suppliers with strong service and technical support ensures long-term reliability and proper training for staff.

In conclusion, procuring sit-to-stand Hoyer lifts aligns with best practices in patient-centered care and workplace safety. The benefits far outweigh the initial costs, leading to improved outcomes for both patients and healthcare providers. A strategic sourcing approach—focused on quality, support, and user needs—will maximize the return on investment and support a safer, more effective care environment.