Article Navigation

- Top 10 Single Stage Centrifugal Pump Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for single stage centrifugal pump

- Understanding single stage centrifugal pump Types and Variations

- Key Industrial Applications of single stage centrifugal pump

- 3 Common User Pain Points for ‘single stage centrifugal pump’ & Their Solutions

- Strategic Material Selection Guide for single stage centrifugal pump

- In-depth Look: Manufacturing Processes and Quality Assurance for single stage centrifugal pump

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘single stage centrifugal pump’

- Comprehensive Cost and Pricing Analysis for single stage centrifugal pump Sourcing

- Alternatives Analysis: Comparing single stage centrifugal pump With Other Solutions

- Essential Technical Properties and Trade Terminology for single stage centrifugal pump

- Navigating Market Dynamics and Sourcing Trends in the single stage centrifugal pump Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of single stage centrifugal pump

- Strategic Sourcing Conclusion and Outlook for single stage centrifugal pump

- Important Disclaimer & Terms of Use

Top 10 Single Stage Centrifugal Pump Manufacturers & Suppliers List

1. Single-stage Centrifugal Pumps Companies – Mordor Intelligence

Domain: mordorintelligence.com

Registered: 2013 (12 years)

Introduction: Single-stage Centrifugal Pumps Company List · Sulzer Ltd. · KSB Company · Grundfos · North Ridge Pumps · Xylem Inc. · Wilo Group · Flowserve Corporation · Baker Hughes.Missing: manufacturers suppliers…

2. Top 12 Centrifugal Pump Companies in the World – IMARC Group

Domain: imarcgroup.com

Registered: 2009 (16 years)

Introduction: List of Top Companies Operating in the Centrifugal Pump Industry: · 1. Baker Hughes (A GE Company) · 2. Circor International Inc. · 3. Ebara Corporation · 4….

3. Top 10 Centrifugal Pump Manufacturer in World 2025 – Liancheng

Domain: liancheng-pump.com

Registered: 2023 (2 years)

Introduction: Flowserve’s reputation as a leading centrifugal pump manufacturer and supplier is well-deserved, with an extensive product range catering to ……

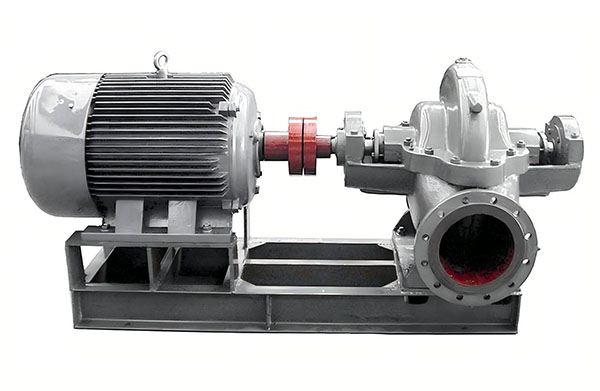

Illustrative Image (Source: Google Search)

4. ANSI & API Centrifugal Pump Manufacturers | PumpWorks | Houston …

Domain: pumpworks.com

Registered: 1998 (27 years)

Introduction: PumpWorks is a global manufacturer of ANSI and API Centrifugal Process Pumps headquartered in Houston, TX….

5. Pumps and pumping systems – Sulzer

Domain: sulzer.com

Registered: 1996 (29 years)

Introduction: As one of the world’s leading pump manufacturers, Sulzer provides a wide range of products for engineered, configured, and standard pumping solutions….

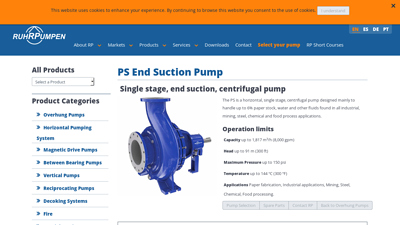

6. PS single stage, end suction, centrifugal pump – Ruhrpumpen

Domain: ruhrpumpen.com

Registered: 2000 (25 years)

Introduction: The PS is a horizontal, single stage, centrifugal pump designed mainly to handle up to 6% paper stock, water and other fluids found in all industrial, mining, ……

7. Single-Stage Centrifugal Pumps

Domain: northridgepumps.com

Registered: 2019 (6 years)

Introduction: Heavy Duty Single Stage Centrifugal Pumps for Industrial or Hygienic Applications. ATEX Rated. Plastic & Metallic Designs….

Illustrative Image (Source: Google Search)

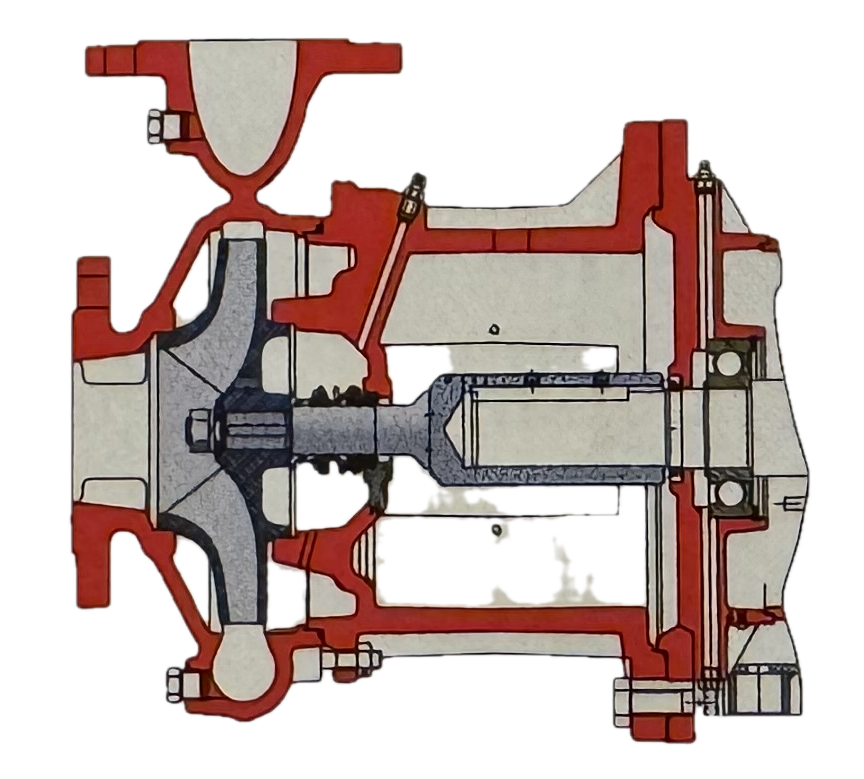

In-depth Look: Manufacturing Processes and Quality Assurance for single stage centrifugal pump

In-depth Look: Manufacturing Processes and Quality Assurance for Single Stage Centrifugal Pumps

Understanding how single stage centrifugal pumps are manufactured provides critical insight into their reliability, performance consistency, and long-term value. For procurement professionals and engineers evaluating suppliers, manufacturing quality directly impacts operational uptime, maintenance costs, and total cost of ownership.

Manufacturing Process Overview

The production of single stage centrifugal pumps follows a systematic sequence designed to ensure dimensional accuracy, material integrity, and hydraulic performance.

1. Material Preparation

| Stage | Process | Critical Factors |

|---|---|---|

| Raw Material Selection | Sourcing cast iron, stainless steel, bronze, or specialty alloys | Chemical composition verification, material certificates |

| Incoming Inspection | Spectroscopic analysis, hardness testing | Compliance with ASTM/EN material standards |

| Pattern/Mold Preparation | Creating casting patterns or CNC programming | Dimensional tolerances, shrinkage allowances |

Material selection varies by application—bronze components for seawater service, 316 stainless steel for chemical compatibility, or duplex alloys for corrosive environments.

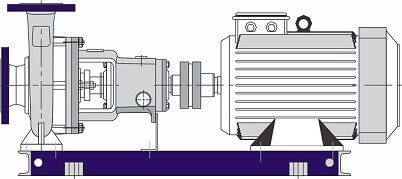

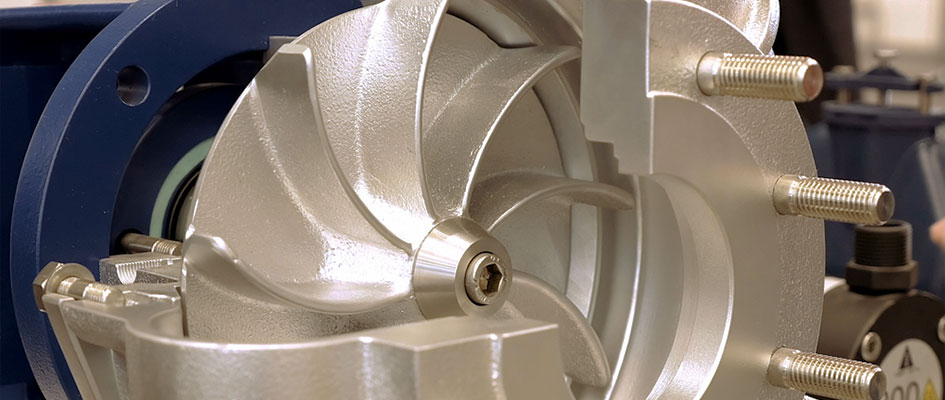

2. Component Forming

Casting Operations:

– Sand casting or investment casting for volute casings and impellers

– Heat treatment for stress relief and hardness optimization

– Shot blasting for surface preparation

Illustrative Image (Source: Google Search)

Machining Operations:

– CNC turning of shaft journals and bearing surfaces

– Multi-axis milling of volute chambers

– Precision boring of seal chambers to tight tolerances (typically ±0.025mm)

Impeller Manufacturing:

– Closed impellers: Cast as single piece or welded construction

– Open impellers: Machined from solid stock for abrasive applications

– Dynamic balancing to ISO 1940 G2.5 or G1.0 standards

3. Assembly Process

| Assembly Stage | Key Activities | Quality Checkpoints |

|---|---|---|

| Sub-assembly | Shaft fitting, bearing installation, seal mounting | Interference fits, seal face flatness |

| Main Assembly | Impeller mounting, casing closure, coupling alignment | Impeller clearances, gasket compression |

| Mechanical Seals | Installation per API 682 or manufacturer specifications | Face condition, spring tension |

| Final Assembly | Motor mounting, baseplate alignment | Shaft runout, coupling gap |

4. Quality Control and Testing

In-Process Inspections:

– Dimensional verification using CMM (Coordinate Measuring Machines)

– Non-destructive testing (dye penetrant, radiographic) for castings

– Surface finish measurement (Ra values per hydraulic requirements)

Performance Testing:

– Hydrostatic pressure testing at 1.5× design pressure

– Performance curve verification per ISO 9906 or HI 14.6

– NPSH testing for critical applications

– Vibration analysis per ISO 10816

Illustrative Image (Source: Google Search)

Quality Standards and Certifications

Reputable manufacturers maintain certifications that demonstrate systematic quality management:

| Standard | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Baseline manufacturing quality |

| ISO 14001 | Environmental Management | Sustainable production practices |

| ISO 5199 | Technical specifications for centrifugal pumps | Design and construction requirements |

| API 610 | Centrifugal pumps for petroleum/heavy-duty | Refinery and petrochemical applications |

| ATEX/IECEx | Explosive atmosphere certification | Hazardous location compliance |

| CE Marking | European conformity | EU market access |

Supplier Evaluation Criteria

When assessing pump manufacturers, consider:

- Traceability systems — Material certificates linked to specific components

- Test documentation — Factory acceptance test (FAT) reports with actual performance data

- Calibration records — Test equipment maintained to ISO 17025 standards

- Warranty terms — Coverage scope reflecting manufacturing confidence

- After-sales capability — Spare parts availability and technical support infrastructure

Key Takeaways

Manufacturing excellence in single stage centrifugal pumps combines precision machining, controlled assembly processes, and rigorous testing protocols. Buyers should request test certificates, verify ISO compliance, and evaluate manufacturing facilities when sourcing pumps for critical applications. The upfront diligence in supplier qualification translates directly to reduced lifecycle costs and improved operational reliability.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘single stage centrifugal pump’

Practical Sourcing Guide: A Step-by-Step Checklist for Single Stage Centrifugal Pumps

Sourcing the right single stage centrifugal pump requires systematic evaluation of technical requirements, supplier capabilities, and total cost of ownership. This checklist guides procurement professionals through each critical decision point.

Illustrative Image (Source: Google Search)

Step 1: Define Application Requirements

Before contacting suppliers, document your operational parameters:

| Parameter | Details to Specify |

|---|---|

| Flow Rate | Required GPM/m³/h (minimum, normal, maximum) |

| Head/Pressure | Total dynamic head in feet/meters or PSI/bar |

| Fluid Properties | Viscosity, specific gravity, temperature range |

| Solids Content | Particle size, concentration percentage |

| Chemical Compatibility | pH levels, corrosive compounds present |

| Operating Conditions | Continuous vs. intermittent duty, ambient temperature |

Critical Questions:

– [ ] Is the fluid abrasive, corrosive, or temperature-sensitive?

– [ ] Are there regulatory requirements (ATEX, FDA, API)?

– [ ] What is the available NPSH at your installation site?

Step 2: Establish Technical Specifications

Material Selection Checklist:

– [ ] Casing material (cast iron, stainless steel, bronze, duplex)

– [ ] Impeller material and design type (closed, semi-open, open)

– [ ] Shaft and sleeve materials

– [ ] Seal type requirements (mechanical seal, gland packing)

– [ ] Gasket and O-ring compatibility

Performance Specifications:

– [ ] Efficiency requirements at operating point

– [ ] Motor specifications (voltage, frequency, mounting position)

– [ ] Coupling type and alignment requirements

– [ ] Orientation (horizontal vs. vertical configuration)

Step 3: Evaluate Supplier Capabilities

Supplier Assessment Criteria:

| Category | Evaluation Points |

|---|---|

| Technical Expertise | Application engineering support, pump curve analysis |

| Manufacturing Standards | ISO certifications, quality control processes |

| Product Range | Availability of materials, sizes, configurations |

| Geographic Coverage | Local service centers in USA/Europe |

| Lead Times | Standard vs. expedited delivery options |

Due Diligence Questions:

– [ ] Does the supplier provide detailed pump curves for your specific gravity?

– [ ] What testing and documentation accompanies delivery?

– [ ] Are spare parts readily available?

– [ ] What warranty terms are offered?

Step 4: Request and Compare Quotations

Information to Request from Suppliers:

– [ ] Complete pump curve at specified conditions

– [ ] Bill of materials with material certifications

– [ ] Dimensional drawings and installation requirements

– [ ] Power consumption data

– [ ] MTBF (Mean Time Between Failures) data

– [ ] Maintenance schedule and requirements

Quotation Comparison Matrix:

| Criteria | Supplier A | Supplier B | Supplier C |

|---|---|---|---|

| Unit Price | |||

| Delivery Lead Time | |||

| Efficiency at Duty Point | |||

| Warranty Period | |||

| Spare Parts Availability | |||

| Technical Support |

Step 5: Calculate Total Cost of Ownership

TCO Components:

– [ ] Initial purchase price

– [ ] Installation and commissioning costs

– [ ] Energy consumption over expected lifespan

– [ ] Planned maintenance costs (seals, bearings, impellers)

– [ ] Spare parts inventory requirements

– [ ] Potential downtime costs

Energy Cost Formula:

Annual Energy Cost = (Power kW × Operating Hours × Electricity Rate) ÷ Pump Efficiency

Step 6: Verify Compliance and Documentation

Required Documentation:

– [ ] Material test certificates (MTCs)

– [ ] Performance test reports

– [ ] CE marking / UL certification (as applicable)

– [ ] ATEX certification (if hazardous environment)

– [ ] Installation, operation, and maintenance manuals

– [ ] Spare parts list with part numbers

Step 7: Finalize Purchase Terms

Commercial Checklist:

– [ ] Payment terms and conditions

– [ ] Incoterms for international shipments

– [ ] Insurance requirements during transit

– [ ] Installation supervision availability

– [ ] Commissioning support

– [ ] Training for operations and maintenance personnel

– [ ] Service agreement options

Quick Reference: Red Flags to Avoid

- Suppliers unable to provide application-specific pump curves

- Missing material certifications or test documentation

- No local service or spare parts support

- Unusually low prices without clear justification

- Vague or non-standard warranty terms

Post-Purchase Actions

- [ ] Verify equipment against purchase order upon delivery

- [ ] Document baseline performance during commissioning

- [ ] Register warranty with manufacturer

- [ ] Establish preventive maintenance schedule

- [ ] Stock critical spare parts (mechanical seals, bearings)

Comprehensive Cost and Pricing Analysis for single stage centrifugal pump Sourcing

Comprehensive Cost and Pricing Analysis for Single Stage Centrifugal Pump Sourcing

Understanding the full cost structure of single stage centrifugal pumps enables procurement professionals to make informed sourcing decisions and negotiate effectively with suppliers. This analysis breaks down the key cost components and provides actionable strategies for cost optimization.

Cost Component Breakdown

Materials (40-55% of Total Cost)

| Component | Material Options | Cost Impact |

|---|---|---|

| Casing | Cast iron, stainless steel (304/316), bronze | 15-25% of unit cost |

| Impeller | Cast iron, bronze, stainless steel, engineered polymers | 10-15% of unit cost |

| Shaft | Carbon steel, stainless steel, alloy steel | 5-8% of unit cost |

| Mechanical seals | Carbon/ceramic, silicon carbide, tungsten carbide | 8-12% of unit cost |

| Bearings | Standard, heavy-duty, or specialized | 3-5% of unit cost |

Key material cost drivers:

– Corrosion resistance requirements (stainless steel adds 30-50% over cast iron)

– Abrasion resistance for slurry applications

– Temperature and pressure ratings

– Chemical compatibility requirements

– Regulatory compliance (ATEX, food-grade certifications)

Labor (15-25% of Total Cost)

| Labor Category | Typical Allocation |

|---|---|

| Machining and fabrication | 8-12% |

| Assembly and testing | 4-7% |

| Quality control and inspection | 2-4% |

| Engineering and customization | 1-3% (standard) / 5-10% (custom) |

Labor costs vary significantly by manufacturing region:

– Western Europe/USA: Highest labor costs, premium quality standards

– Eastern Europe: Moderate costs, strong engineering capabilities

– Asia (China, India): Lower labor costs, variable quality levels

Logistics (8-15% of Total Cost)

| Logistics Factor | Cost Consideration |

|---|---|

| Shipping weight | Single stage pumps: 15-500+ kg depending on capacity |

| Freight mode | Sea (economical), air (urgent), road (regional) |

| Packaging | Standard palletizing vs. custom crating |

| Import duties | 0-6% depending on origin and trade agreements |

| Insurance | 0.5-2% of declared value |

Regional logistics benchmarks:

– Intra-Europe delivery: €150-€800 per unit

– Asia to Europe/USA: $500-$2,500 per unit (sea freight)

– Expedited air freight: 3-5x standard shipping costs

Illustrative Image (Source: Google Search)

Additional Cost Factors

Total Cost of Ownership (TCO) Considerations

Beyond purchase price, factor in:

| TCO Element | Typical Annual Impact |

|---|---|

| Energy consumption | 60-80% of lifetime operating costs |

| Maintenance and spare parts | 3-8% of purchase price annually |

| Downtime costs | Highly variable by application |

| Installation and commissioning | 5-15% of equipment cost |

Certification and Compliance Costs

| Certification | Typical Premium |

|---|---|

| ATEX (explosive atmospheres) | 15-30% |

| FDA/3-A sanitary | 20-40% |

| API 610 compliance | 25-50% |

| Marine classification (DNV, Lloyd’s) | 10-25% |

Cost-Saving Strategies

Specification Optimization

- Right-size the pump – Oversizing by one frame increases costs 20-35% without proportional benefit

- Challenge material specifications – Confirm whether 316SS is truly required vs. 304SS or coated alternatives

- Standardize across facilities – Reduces spare parts inventory and training costs

- Evaluate seal options – Mechanical seals vs. gland packing based on actual application requirements

Procurement Tactics

| Strategy | Potential Savings |

|---|---|

| Volume consolidation across sites | 8-15% |

| Long-term supply agreements (2-3 years) | 5-12% |

| Blanket orders with scheduled releases | 3-8% |

| Competitive bidding with qualified suppliers | 10-20% |

| Off-peak ordering (Q1, Q3) | 3-7% |

Supplier Selection Considerations

Evaluate total value, not just unit price:

– Lead time reliability (stock availability vs. made-to-order)

– Technical support and application engineering

– Warranty terms and local service capability

– Spare parts availability and pricing

– Training and documentation quality

Logistics Optimization

- Consolidate shipments – Combine orders to reach full container loads

- Regional sourcing – Reduce freight costs and lead times for standard specifications

- Forward stocking agreements – Negotiate supplier-held inventory for critical pumps

- Incoterms selection – Compare DDP vs. EXW pricing to identify true landed costs

Price Benchmarking Guidelines

| Pump Category | Flow Range | Typical Price Range (USD) |

|---|---|---|

| Standard duty, cast iron | 5-50 m³/h | $800-$3,500 |

| Process duty, stainless steel | 10-100 m³/h | $2,500-$12,000 |

| High-pressure, multistage equivalent | 20-200 m³/h | $5,000-$25,000 |

| Sanitary/hygienic | 5-50 m³/h | $4,000-$18,000 |

| ATEX-certified | Varies | Base price + 15-30% |

Note: Prices exclude motors, drives, and installation. Actual pricing depends on specifications, quantities, and supplier relationships.

Negotiation Leverage Points

- End-of-quarter timing – Suppliers often have flexibility to meet sales targets

- Multi-year commitments – Trade volume certainty for better pricing

- Spare parts bundling – Negotiate package pricing for recommended spares

- Payment terms – Offer faster payment in exchange for discounts (2-3% for net-15 vs. net-60)

- Reference site agreements – Some manufacturers offer discounts for case study participation

Summary: Cost Reduction Checklist

- [ ] Validate specifications against actual operating requirements

- [ ] Benchmark pricing across 3-5 qualified suppliers

- [ ] Calculate TCO including energy and maintenance costs

- [ ] Consolidate purchasing volume where possible

- [ ] Negotiate long-term agreements for recurring needs

- [ ] Optimize logistics through shipment consolidation

- [ ] Consider regional sourcing for standard specifications

- [ ] Review certification requirements for potential over-specification

Alternatives Analysis: Comparing single stage centrifugal pump With Other Solutions

Alternatives Analysis: Comparing Single Stage Centrifugal Pumps With Other Solutions

Selecting the right pump technology directly impacts operational efficiency, maintenance costs, and system reliability. Below is a detailed comparison of single stage centrifugal pumps against two primary alternatives commonly considered in industrial applications.

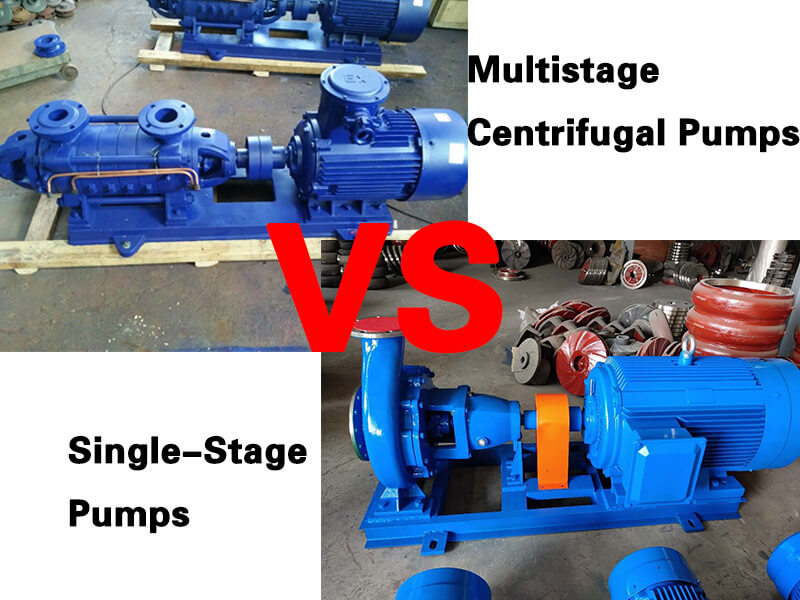

Illustrative Image (Source: Google Search)

Comparison Overview

| Factor | Single Stage Centrifugal Pump | Multi-Stage Centrifugal Pump | Positive Displacement Pump |

|---|---|---|---|

| Head Range | Low to moderate (up to ~150m) | High (150m–2,000m+) | Variable (pressure-dependent) |

| Flow Rate | High volume, continuous | Moderate to high | Lower, pulsating flow |

| Viscosity Handling | Best for low-viscosity fluids (<100 cP) | Low-viscosity fluids only | Excellent for high-viscosity fluids |

| Efficiency at BEP | 70–85% | 75–85% | 80–90% (at design conditions) |

| Initial Cost | Lower | Higher | Moderate to high |

| Maintenance Complexity | Low—fewer components | Moderate—multiple impeller stages | Higher—seals, gears, or rotors |

| Space Requirements | Compact | Larger footprint | Varies by type |

| Solids Handling | Limited (clean/slightly dirty fluids) | Poor | Good (depending on design) |

| Flow Control | Variable with speed/valve adjustment | Variable | Fixed displacement per revolution |

Analysis

Single Stage Centrifugal Pump vs. Multi-Stage Centrifugal Pump

Single stage centrifugal pumps are optimal when head requirements remain below approximately 150 metres. Their simpler construction—one impeller, one volute—translates to lower capital expenditure, reduced spare parts inventory, and faster maintenance turnaround. Multi-stage pumps become necessary only when system pressure demands exceed single stage capabilities, such as boiler feed applications or high-rise building services. For standard transfer, circulation, and moderate-pressure duties, the single stage design delivers equivalent reliability at lower total cost of ownership.

Single Stage Centrifugal Pump vs. Positive Displacement Pump

The decision between these technologies hinges on fluid characteristics and process requirements. Single stage centrifugal pumps excel at moving large volumes of low-viscosity liquids—water, light chemicals, fuels—at consistent flow rates. They handle variable demand efficiently through VFD integration or throttling without mechanical stress.

Illustrative Image (Source: Google Search)

Positive displacement pumps (progressive cavity, gear, lobe) are better suited for:

– High-viscosity fluids (oils, polymers, slurries)

– Applications requiring precise metering

– Processes demanding consistent flow regardless of discharge pressure

– Shear-sensitive products

However, positive displacement pumps carry higher maintenance burdens due to wear components (stators, rotors, gears) and typically require pulsation dampeners for smooth delivery.

Selection Recommendation

Choose single stage centrifugal pumps when:

– Handling clean or lightly contaminated fluids under 100 cP viscosity

– Head requirements stay below 150 metres

– High-volume, continuous flow is prioritised

– Minimising maintenance complexity and costs is critical

– Space constraints demand a compact solution

For applications outside these parameters, evaluate multi-stage or positive displacement alternatives based on specific pressure, viscosity, and process precision requirements.

Illustrative Image (Source: Google Search)

Essential Technical Properties and Trade Terminology for single stage centrifugal pump

Essential Technical Properties and Trade Terminology for Single Stage Centrifugal Pumps

Key Technical Properties

Single stage centrifugal pumps operate with one impeller mounted on a shaft, converting rotational energy into fluid velocity. Understanding these core specifications is critical for procurement and engineering decisions.

Performance Parameters

| Property | Definition | Typical Units |

|---|---|---|

| Flow Rate (Q) | Volume of fluid delivered per unit time | m³/h, GPM, L/min |

| Head (H) | Energy imparted to fluid, expressed as height | meters, feet |

| Efficiency (η) | Ratio of hydraulic power output to shaft power input | Percentage (%) |

| NPSH Required | Minimum suction head needed to prevent cavitation | meters, feet |

| NPSH Available | Suction head provided by the system | meters, feet |

| Specific Speed (Ns) | Dimensionless value characterizing impeller design | Unitless |

| BEP | Best Efficiency Point—optimal operating condition | Flow/Head intersection |

Mechanical Specifications

- Impeller Type: Open, semi-open, or closed designs affect solids handling and efficiency

- Shaft Seal: Mechanical seals, gland packing, or sealless (magnetic drive) configurations

- Casing Material: Cast iron, stainless steel (304/316), bronze, duplex, or engineered polymers

- Motor Mounting: Close-coupled, long-coupled, or bare shaft arrangements

- Flange Standards: ANSI, DIN, ISO, or JIS connections

Trade Terminology for B2B Procurement

Commercial Terms

| Term | Definition |

|---|---|

| MOQ | Minimum Order Quantity—lowest unit count per purchase order |

| OEM | Original Equipment Manufacturer—pumps supplied for integration into third-party systems |

| ODM | Original Design Manufacturer—custom-engineered solutions to buyer specifications |

| FOB | Free On Board—shipping terms defining cost/risk transfer point |

| CIF | Cost, Insurance, Freight—seller covers delivery to destination port |

| EXW | Ex Works—buyer assumes all shipping costs from seller’s facility |

| RFQ | Request for Quotation—formal inquiry for pricing and lead times |

Industry Standards and Certifications

- API 610: American Petroleum Institute standard for refinery/petrochemical applications

- ISO 5199: International standard for technical specifications

- ATEX: European directive for explosive atmosphere equipment

- CE Marking: European conformity for safety, health, and environmental requirements

- UL/CSA: North American electrical safety certifications

Lead Time and Supply Chain Terms

- ATP: Available to Promise—confirmed delivery commitment

- MTO: Made to Order—manufactured upon receipt of purchase order

- MTS: Made to Stock—standard configurations held in inventory

- Blanket Order: Pre-negotiated pricing for scheduled releases over defined period

Navigating Market Dynamics and Sourcing Trends in the single stage centrifugal pump Sector

Navigating Market Dynamics and Sourcing Trends in the Single Stage Centrifugal Pump Sector

Market Overview and Growth Drivers

The single stage centrifugal pump market continues to demonstrate steady expansion across North American and European regions, driven by infrastructure modernization, industrial process optimization, and tightening environmental regulations. Key sectors fueling demand include:

- Water and wastewater treatment – Municipal infrastructure upgrades and stricter discharge standards

- Chemical manufacturing – Process intensification requiring reliable fluid transfer

- Oil and gas – Downstream processing and fuel transfer applications

- Power generation – Cooling systems and boiler feed applications

- Mining operations – Dewatering and slurry handling requirements

Current Sourcing Trends

| Trend | Impact on Procurement | Regional Considerations |

|---|---|---|

| Localized supply chains | Reduced lead times, lower logistics costs | Strong preference in both USA and EU post-pandemic |

| Energy efficiency standards | Higher upfront costs offset by operational savings | EU ErP directives; US DOE pump standards |

| Material traceability | Increased documentation requirements | Critical for chemical and pharmaceutical applications |

| Digital integration | Pumps with IoT-ready monitoring capabilities | Growing demand for predictive maintenance data |

Sustainability Imperatives

Procurement decisions increasingly incorporate environmental criteria:

- Carbon footprint reduction – Manufacturers investing in energy-efficient motor designs and optimized hydraulics

- Material selection – Shift toward recyclable components and reduced hazardous material content

- Extended service life – Focus on maintainability, spare parts availability, and mechanical seal longevity

- Operational efficiency – Variable frequency drive (VFD) compatibility now standard expectation

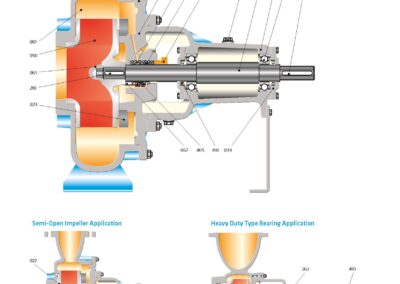

Historical Context and Evolution

Single stage centrifugal pumps have evolved from basic cast iron designs to sophisticated engineered solutions incorporating:

Illustrative Image (Source: Google Search)

- Advanced metallurgy for corrosive and abrasive applications

- Precision-machined impeller designs optimized through computational fluid dynamics

- Standardized mounting configurations (motor mounting codes) enabling interchangeability

- Enhanced sealing technologies reducing leakage and maintenance intervals

Strategic Sourcing Considerations

For USA-based buyers:

– Evaluate domestic manufacturing capabilities versus import options

– Consider total cost of ownership including energy consumption

– Verify compliance with EPA and state-level environmental requirements

For European buyers:

– Ensure CE marking and ATEX certification where applicable

– Assess alignment with EU Ecodesign requirements

– Factor in carbon border adjustment mechanisms for imported equipment

Key Takeaway

Successful sourcing in this sector requires balancing initial capital expenditure against lifecycle costs, regulatory compliance, and sustainability objectives—making supplier partnerships with strong technical support and spare parts networks increasingly valuable.

Frequently Asked Questions (FAQs) for B2B Buyers of single stage centrifugal pump

Frequently Asked Questions (FAQs) for B2B Buyers of Single Stage Centrifugal Pumps

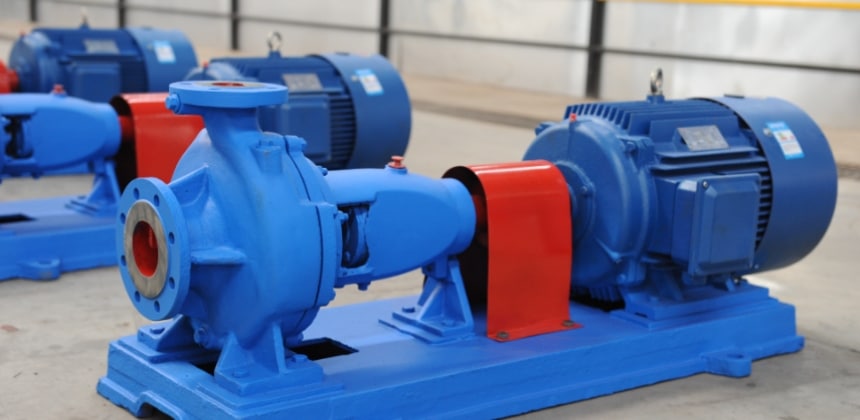

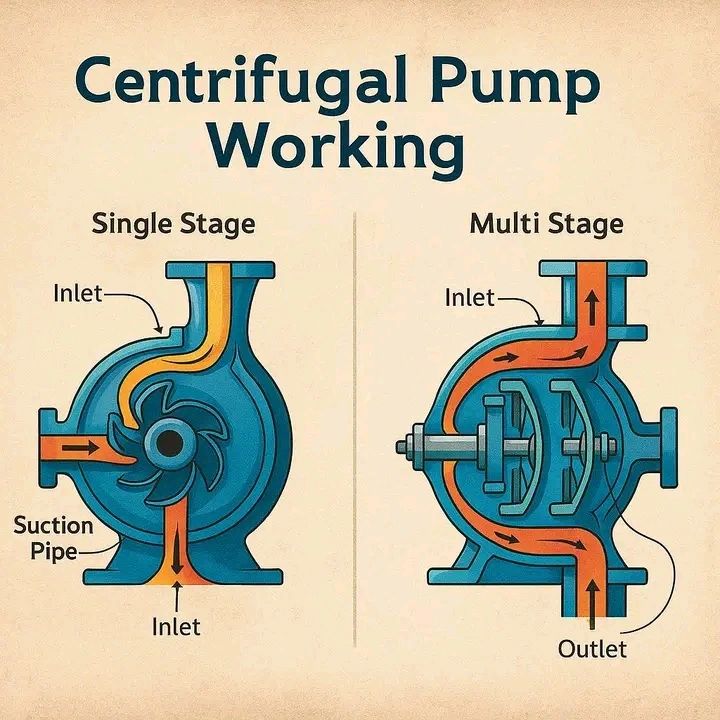

1. What is a single stage centrifugal pump, and how does it differ from multi-stage designs?

A single stage centrifugal pump contains one impeller that converts rotational energy into fluid velocity, then into pressure. Unlike multi-stage pumps with multiple impellers in series, single stage units are designed for applications requiring moderate head (pressure) at higher flow rates.

Illustrative Image (Source: Google Search)

| Feature | Single Stage | Multi-Stage |

|---|---|---|

| Number of Impellers | 1 | 2 or more |

| Head Capacity | Low to moderate | High |

| Complexity | Simpler | More complex |

| Maintenance | Easier | More involved |

| Cost | Lower | Higher |

2. What applications are single stage centrifugal pumps best suited for?

Single stage centrifugal pumps excel in:

- Water transfer and circulation — fresh water, cooling systems, building services

- Chemical transfer — compatible materials available for corrosive media

- Wastewater and effluent handling

- Fuel and oil transfer

- Agricultural irrigation

- Mining dewatering operations

- Marine applications

These pumps are optimal when your system requires high flow rates with head requirements typically below 100 meters.

3. What specifications should we provide when requesting a quote?

Prepare the following technical data for accurate pump selection:

- Flow rate (m³/h, GPM, or L/min)

- Total dynamic head (meters or feet)

- Fluid properties — viscosity, specific gravity, temperature, chemical composition

- Solids content — particle size and concentration if applicable

- Suction conditions — NPSH available, lift requirements

- Operating environment — indoor/outdoor, hazardous area classification (ATEX requirements)

- Material preferences — cast iron, stainless steel, bronze, or specialty alloys

- Drive requirements — motor voltage, frequency, mounting configuration

4. How do we determine the correct pump size for our application?

Pump sizing requires matching your system curve to the pump performance curve. Key steps include:

Illustrative Image (Source: Google Search)

- Calculate total dynamic head (static head + friction losses)

- Determine required flow rate at operating conditions

- Account for fluid properties — viscosity affects curve performance

- Verify NPSH available exceeds NPSH required

- Select a pump operating near its Best Efficiency Point (BEP)

Note: Operating significantly off-BEP increases energy consumption, accelerates wear, and shortens pump life. Request pump curves from suppliers and verify the duty point falls within 80-110% of BEP flow.

5. What are the primary seal options, and how do we choose?

| Seal Type | Best For | Considerations |

|---|---|---|

| Mechanical seals | Most industrial applications | Minimal leakage, requires proper alignment |

| Gland packing | Abrasive fluids, budget constraints | Allows controlled leakage, easier field adjustment |

| Magnetic drive | Hazardous/toxic fluids, zero-leakage requirements | Higher cost, temperature limitations |

| Double mechanical seals | Dangerous fluids, environmental compliance | Requires barrier fluid system |

Selection depends on fluid hazard level, environmental regulations, maintenance capabilities, and total cost of ownership.

6. What materials are available for corrosive or specialized applications?

Standard and specialty material options include:

- Cast iron — general water and non-corrosive fluids

- 316 Stainless steel — mild chemicals, food-grade applications

- Duplex/Super duplex stainless — chloride-rich environments, seawater

- Bronze — seawater applications (proven marine compatibility)

- Hastelloy, Titanium — aggressive chemical environments

- Lined pumps (PTFE, rubber) — highly corrosive chemicals

Always verify material compatibility with your specific fluid chemistry, temperature, and concentration levels.

7. What maintenance requirements should we anticipate?

Routine maintenance for single stage centrifugal pumps typically includes:

- Daily/Weekly: Monitor vibration, temperature, pressure, and flow

- Monthly: Check seal condition, bearing lubrication, alignment

- Annually: Inspect impeller wear, replace wear rings if needed, verify clearances

Common failure points to monitor:

– Mechanical seal degradation (8 primary causes include dry running, misalignment, contamination)

– Bearing wear

– Impeller erosion (especially with abrasive fluids)

– Coupling wear

Implementing predictive maintenance through vibration analysis and performance trending reduces unplanned downtime.

8. What certifications and compliance standards should we verify?

Depending on your industry and location, verify compliance with:

Illustrative Image (Source: Google Search)

| Requirement | Application |

|---|---|

| ATEX/IECEx | Explosive atmospheres (EU/International) |

| API 610 | Oil & gas, refinery service |

| ISO 5199/2858 | General industrial standards |

| FDA/3-A | Food and pharmaceutical |

| EHEDG | Hygienic design (EU) |

| CE Marking | European market compliance |

| UL/CSA | North American electrical safety |

Request certificates of conformity and material test reports for critical applications. For hazardous environments, ensure the complete pump assembly—including motor and instrumentation—meets zone classification requirements.

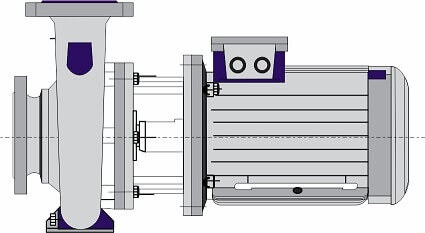

Strategic Sourcing Conclusion and Outlook for single stage centrifugal pump

Strategic Sourcing Conclusion: Single Stage Centrifugal Pumps

Single stage centrifugal pumps remain the backbone of industrial fluid handling across manufacturing, water treatment, chemical processing, and building services applications. Their straightforward design delivers measurable value through:

| Value Driver | Business Impact |

|---|---|

| Lower acquisition costs | 15-30% savings vs. multi-stage alternatives |

| Reduced maintenance complexity | Fewer wear components, shorter downtime |

| Energy efficiency | Optimized hydraulics for moderate-head applications |

| Broad material compatibility | Solutions for corrosive, abrasive, and hygienic applications |

Key Sourcing Priorities

- Application matching: Verify head/flow requirements fall within single-stage capabilities

- Material selection: Align wetted components with fluid chemistry and regulatory requirements

- Supplier capability: Prioritize vendors offering engineering support, spare parts availability, and documented lead times

- Total cost analysis: Factor installation, energy consumption, and maintenance into procurement decisions

Market Outlook

Demand for single stage centrifugal pumps continues growing, driven by water infrastructure investments, chemical sector expansion, and energy efficiency mandates in both North American and European markets. Manufacturers are responding with improved hydraulic designs, smart monitoring integration, and expanded material options.

Strategic procurement teams should establish qualified supplier relationships now to secure competitive pricing, reliable delivery, and technical support for ongoing operational requirements.

Illustrative Image (Source: Google Search)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.