The global market for electrical plugs and sockets has experienced steady expansion, driven by rising infrastructure development, increasing urbanization, and the growing demand for reliable power connectivity solutions. According to a 2023 report by Mordor Intelligence, the global electrical plugs and sockets market was valued at USD 13.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 5.2% from 2024 to 2029. Asia-Pacific’s dominance in this growth is underscored by rapid industrialization and modernization across countries like Singapore, where high building standards and a strong focus on smart infrastructure have amplified demand for certified, high-quality power plug solutions. As a regional hub for precision manufacturing and innovation, Singapore has cultivated a robust ecosystem of manufacturers known for compliance with international safety standards such as SS 145 and IEC 60884. This convergence of market growth and technical excellence positions Singaporean plug manufacturers as key contributors in both residential and commercial power distribution sectors. The following list highlights the top 10 Singapore-based manufacturers, selected based on product innovation, export reach, certifications, and industry reputation.

Top 10 Singapore Power Plug Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Meltric

Domain Est. 1997

Website: meltric.com

Key Highlights: MELTRIC offers a full line of industrial plugs and receptacles, including our signature brand of UL-listed Switch-Rated devices with DECONTACTOR™ ……

#2 Manufacturer of industrial plugs and sockets

Domain Est. 1998

Website: proconect.fr

Key Highlights: Electrical connectors for ships at berth, dry docks and all types of vessels based in Singapore and internationally. Our Partners: Cluster Maritime Français, ……

#3 SUM Electrical

Domain Est. 2007

Website: sumelectrical.com

Key Highlights: SUM MFG(M) SDN BHD was established in August 2008. It specializes in producing of Plug Tops, Adaptors, Timer, Cable Reel, Switches & Wall Socket, Portable ……

#4 Legrand Singapore

Domain Est. 1996

Website: legrand.com.sg

Key Highlights: Welcome to Singapore’s Website, the world specialist in electrical infrastructures. This space dedicated to private customers will allow you to discover the ……

#5 Light Switches, Sockets and Accessories

Domain Est. 1997

Website: se.com

Key Highlights: Schneider Electric Singapore. A variety of electrical switches, electrical sockets and electrical accessories, the essential feature of every building to ……

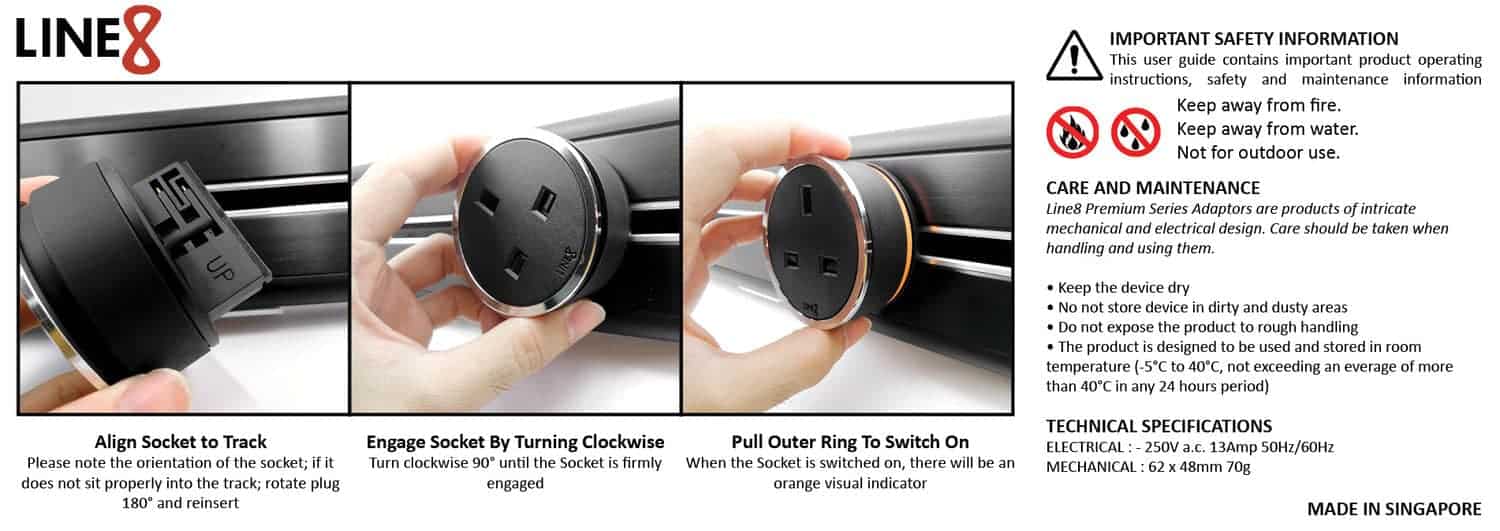

#6 Line8

Domain Est. 2015

Website: line8.com.sg

Key Highlights: Line8 offers premium power track solutions, meticulously crafted in Singapore. Benefit from our lifetime warranty and explore 11 exquisite finishes….

#7 SP Group

Domain Est. 2016

Website: spgroup.com.sg

Key Highlights: SP Group owns and operates transmission and distribution networks, delivering electricity and gas to households and businesses in Singapore….

#8 Choo Chiang

Domain Est. 2020

Website: choochiang.com

Key Highlights: Choo Chiang Holdings Ltd. is one of the leading and most established retailers and distributors of electrical products and accessories in Singapore….

#9 Type of Mains Plugs Suitable for use in Singapore

Domain Est. 2021

Website: consumerproductsafety.gov.sg

Key Highlights: 13-ampere (A) 3-pin fused mains plug (or Type G plug) – This is suitable for most electrical appliances in Singapore, but particularly important for those with ……

#10 World plugs

Website: iec.ch

Key Highlights: Select a location, electric potential or frequency to discover what plug type(s), voltage and frequency are used there….

Expert Sourcing Insights for Singapore Power Plug

H2: Market Trends for Singapore Power Plugs in 2026

As Singapore advances toward a smarter, more sustainable energy future, the market for power plugs and related electrical infrastructure is undergoing significant transformation by 2026. Driven by technological innovation, regulatory changes, and growing consumer demand for energy efficiency and safety, the Singapore power plug market is poised for notable developments. Below are the key market trends shaping the industry in 2026:

-

Adoption of Smart Power Plugs and IoT Integration

Smart power plugs are gaining traction in both residential and commercial sectors. With the proliferation of smart homes and the Internet of Things (IoT), consumers are increasingly adopting energy-monitoring plugs that allow remote control via mobile apps, voice assistants (e.g., Google Assistant, Amazon Alexa), and integration with home automation systems. By 2026, smart plugs are expected to capture over 35% of the residential power outlet market in Singapore, driven by energy-conscious households and government incentives for smart living. -

Enhanced Safety and Compliance Standards

The Energy Market Authority (EMA) and Singapore Standards Council continue to strengthen electrical safety regulations. By 2026, new mandatory requirements for child-proof shutters, overload protection, and fire-resistant materials are expected to be fully implemented. These standards favor high-quality, certified power plug designs—especially Type G (BS 1363), which remains the national standard—boosting demand for compliant, premium-grade products. -

Growth in Commercial and Industrial Demand

As Singapore expands its data centers, healthcare infrastructure, and green buildings, the demand for high-capacity, durable power plugs in commercial and industrial applications is rising. These sectors prioritize reliability, surge protection, and compatibility with uninterruptible power supply (UPS) systems. Modular and multi-standard power strips with USB-C and wireless charging capabilities are becoming standard in offices and co-working spaces. -

Sustainability and Eco-Friendly Materials

Environmental concerns are influencing product design. Leading manufacturers are introducing power plugs made from recycled plastics and biodegradable materials. By 2026, eco-labeling and energy efficiency ratings are expected to play a greater role in consumer purchasing decisions, aligning with Singapore’s Green Plan 2030. Brands emphasizing sustainability are gaining market share, particularly among younger, environmentally conscious consumers. -

Rise of Universal and Multi-Standard Adaptors

With Singapore’s status as a global business and tourism hub, demand for multi-standard power adaptors remains strong. However, by 2026, there is a shift toward sleek, all-in-one charging stations that support Type G, USB-A, USB-C, and wireless charging. These products cater to international travelers, expatriates, and multinational companies, creating a niche but growing segment within the power plug market. -

E-Commerce Dominance and Direct-to-Consumer Models

Online retail platforms such as Shopee, Lazada, and Amazon.sg dominate power plug sales. By 2026, over 70% of power plug purchases are expected to occur online. This trend enables rapid market entry for international brands and fosters competition based on innovation, pricing, and customer reviews. Subscription models for smart plug bundles and home electrification kits are emerging as novel sales strategies. -

Integration with Renewable Energy Systems

As solar panel installations grow across HDB flats and private properties, power plugs are being designed to interface with home energy management systems (HEMS). Plugs with real-time load monitoring help users optimize energy usage from solar sources, reducing grid dependency. This integration is supported by government grants and is expected to accelerate in the lead-up to 2030 sustainability targets.

In summary, the Singapore power plug market in 2026 is characterized by digitalization, safety, sustainability, and adaptability. Manufacturers and retailers who align with smart technology trends, regulatory standards, and environmental goals are best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing Singapore Power Plugs (Quality and Intellectual Property)

Sourcing Singapore power plugs—officially known as the BS 1363 plug—requires careful attention to quality standards and intellectual property (IP) considerations. While these plugs are widely manufactured and available globally, businesses often encounter pitfalls that can lead to safety issues, compliance failures, or legal risks. Below are key challenges to watch for:

Poor Manufacturing Quality

One of the most frequent issues when sourcing Singapore power plugs is substandard manufacturing. Many suppliers, particularly from low-cost regions, produce plugs that look identical to certified ones but fail to meet safety requirements. Common quality problems include:

- Use of inferior materials: Cheap plastics that are not flame-retardant or lack sufficient heat resistance.

- Insufficient insulation: Poorly insulated pins or internal wiring increase the risk of electric shock or short circuits.

- Weak fuse connections: The mandatory 3A or 13A fuse may be poorly seated or of incorrect rating, compromising overcurrent protection.

- Loose or improperly molded parts: Leads may detach easily, or plug casings may crack under stress.

These defects can lead to product recalls, liability claims, or even fires—highlighting the importance of rigorous quality audits and third-party testing.

Lack of Safety Certification

Singapore power plugs must comply with the Singapore Standard SS 145, which aligns closely with the British BS 1363 standard. A major pitfall is sourcing plugs that lack proper certification from recognized bodies such as:

- PSB (formerly Standards Mark Scheme by SPRING Singapore)

- Kitemark (BSI, UK)

- SIRIM (Malaysia)

Counterfeit certification marks are common. Buyers should verify certification through official databases and request test reports from accredited laboratories.

Intellectual Property (IP) Infringement

The BS 1363 plug design is protected under intellectual property laws in some jurisdictions. While the original patent has expired, certain design and trademark elements may still be protected.

- Trademark violations: Some manufacturers incorporate logos or branding that mimic those of reputable companies like MK, Brennen, or Panasonic without authorization.

- Design patent infringement: Although the basic plug shape is generic, specific safety shutter mechanisms or internal designs may be patented.

- Counterfeit products: Some suppliers sell “branded” plugs that are unauthorized replicas, exposing buyers to legal risk.

To avoid IP issues, ensure suppliers provide legal documentation and conduct due diligence on design origins.

Non-Compliance with Local Regulations

Singapore’s Energy Market Authority (EMA) and the Singapore Standards Council enforce strict electrical safety regulations. Importing non-compliant plugs can result in:

- Seizure of goods by customs

- Fines or penalties

- Ineligibility for sale in the Singapore market

Always confirm that sourced products meet SS 145 and are registered under the relevant approval schemes.

Inadequate Supplier Vetting

Many businesses source plugs via online marketplaces or intermediaries without verifying the manufacturer’s credentials. Pitfalls include:

- Dealing with brokers instead of actual factories

- Inability to conduct on-site audits

- Lack of traceability in the supply chain

Best practice includes visiting supplier facilities, reviewing production processes, and requiring sample testing before bulk orders.

Conclusion

Sourcing Singapore power plugs demands attention to both quality assurance and legal compliance. Cutting corners on supplier selection, certification verification, or IP due diligence can lead to serious safety hazards and legal consequences. Partnering with reputable, certified manufacturers and conducting thorough due diligence are essential steps to mitigate these risks.

Logistics & Compliance Guide for Singapore Power Plug

Overview of Singapore Power Plug Standards

Singapore uses the Type G power plug, which is identical to the British Standard BS 1363. This plug features three rectangular pins arranged in a triangular pattern and is designed for use with 230V AC at 50Hz. All plugs must incorporate a fuse, typically rated at 3A or 13A, for safety. Compliance with Singapore’s standards is monitored by the Energy Market Authority (EMA) under the Electricity (Safety) Regulations.

Mandatory Certification: PSB Safety Mark

All electrical appliances and power accessories, including power plugs and adaptors, sold or supplied in Singapore must comply with the Product Safety Scheme administered by Enterprise Singapore. The PSB Safety Mark (formerly known as the PSB Approval Mark) is mandatory. Manufacturers and importers must ensure their products are tested and certified by an accredited certification body to demonstrate compliance with relevant safety standards, primarily SS 145 (the Singaporean adoption of BS 1363).

Import Regulations and Documentation

Importers must register with Enterprise Singapore and ensure all shipments of power plugs are accompanied by proper documentation, including:

– Certificate of Conformity (CoC) or test reports from accredited labs

– PSB Safety Mark certification

– Commercial invoice, packing list, and bill of lading/airway bill

– Import permit (if required, based on shipment value and origin)

Customs clearance may be delayed if compliance documents are missing or incomplete.

Labeling and Packaging Requirements

Each power plug must be clearly labeled with the following:

– PSB Safety Mark

– Manufacturer or supplier name/trademark

– Model or type reference

– Rated voltage (230V) and current (e.g., 13A)

– Fuse rating

Packaging should include safety warnings, usage instructions, and compliance information in English, the official language of Singapore.

Testing and Quality Assurance

Power plugs must undergo rigorous testing per SS 145, including:

– Pin retention and insulation resistance

– Earth continuity and dielectric strength

– Mechanical strength (e.g., cord anchorage and impact resistance)

– Temperature rise under load

Regular factory audits and batch sampling are recommended to maintain consistent quality and compliance.

Logistics and Distribution

- Ensure warehouse storage conditions are dry and temperature-controlled to prevent damage to electrical components.

- Use tamper-evident packaging to maintain product integrity.

- Partner with logistics providers experienced in handling regulated electrical goods to avoid customs delays.

- Maintain traceability through batch numbering and digital inventory systems.

Post-Market Surveillance and Recalls

Enterprise Singapore conducts market surveillance to verify ongoing compliance. Non-compliant products may be recalled, and suppliers may face penalties. Establish a product recall plan and report any safety incidents promptly to the authority.

Key Regulatory Bodies

- Enterprise Singapore (ESG): Oversees product safety and certification.

- Energy Market Authority (EMA): Enforces electrical safety regulations.

- Singapore Customs: Manages import clearance and enforces trade regulations.

Summary

To successfully import and distribute power plugs in Singapore: obtain the PSB Safety Mark, comply with SS 145 standards, provide full documentation, ensure accurate labeling, and maintain quality control throughout the supply chain. Staying aligned with EMA and Enterprise Singapore requirements is essential for market access and consumer safety.

In conclusion, sourcing Singapore power plugs requires careful consideration of the country’s specific electrical standards, particularly the use of the Type G plug, which features three rectangular pins in a triangular pattern and operates on a 230V, 50Hz system. Compliance with Singapore’s safety regulations, such as SS 145 certification by SPRING (now Enterprise Singapore), is essential to ensure product safety and market acceptance. When sourcing, it is crucial to work with reputable manufacturers or suppliers who adhere to these standards and can provide necessary certifications. Additionally, factors such as product quality, pricing, lead times, and logistics should be evaluated to ensure a reliable and cost-effective supply chain. By prioritizing regulatory compliance and supplier reliability, businesses can successfully source Singapore power plugs that meet both performance and safety requirements.