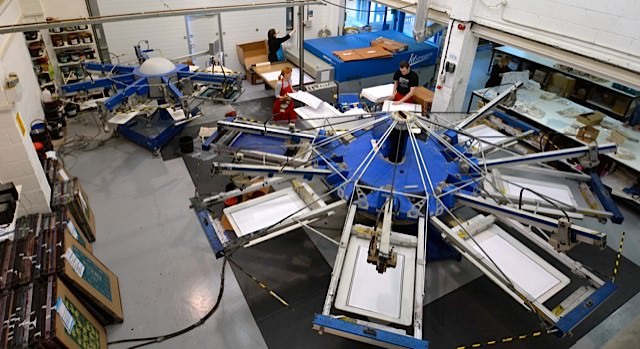

The global screen printing market is experiencing steady growth, driven by rising demand across industries such as textiles, electronics, and packaging. According to Grand View Research, the global screen printing market size was valued at USD 2.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. A critical component within this ecosystem is silk screen printing emulsion, which plays a pivotal role in stencil creation and print quality. As demand for high-resolution, durable prints increases—particularly in the fashion and technical textile sectors—manufacturers are innovating to deliver emulsions with faster exposure times, greater durability, and improved eco-compatibility. This growing market landscape has elevated the prominence of key emulsion producers who balance performance, reliability, and sustainability. Based on market presence, product innovation, and customer adoption, the following nine companies have emerged as leading silk screen printing emulsion manufacturers shaping the industry’s future.

Top 9 Silk Screen Printing Emulsion Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 KIWO Inc.

Domain Est. 1997

Website: kiwo.com

Key Highlights: KIWO is a leading manufacturer of chemical products for screen making and specialty adhesives. We offer a complete line of screen making products….

#2 Screen Printing

Domain Est. 1995

Website: fujifilm.com

Key Highlights: Fujifilm is the global leader in the formulation, manufacture and marketing of premium inks and consumables for the Graphics, Industrial and Textile Screen ……

#3 Emulsions & Hardeners for Industrial Printing

Domain Est. 1996

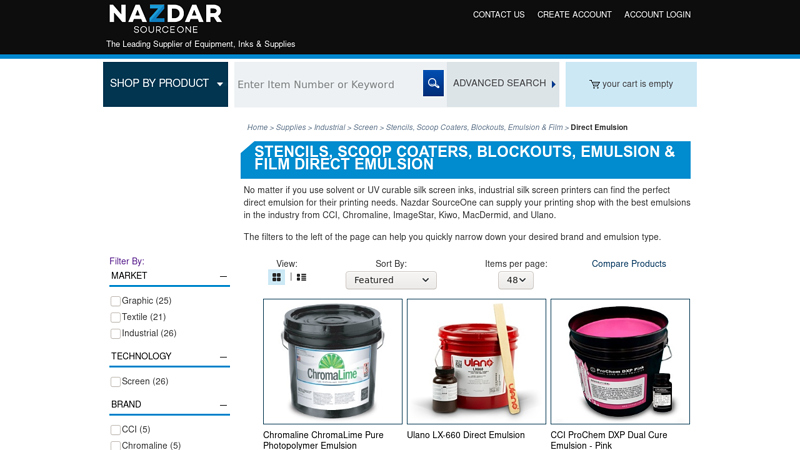

Website: sourceone.nazdar.com

Key Highlights: $45 deliveryNazdar SourceOne can supply your printing shop with the best emulsions in the industry from CCI, Chromaline, ImageStar, Kiwo, MacDermid, and Ulano….

#4 IKONICS

Domain Est. 2000

Website: ikonics.com

Key Highlights: Screen Printing Market. Chromaline Screen Print Products is a leading developer, manufacturer and worldwide marketer of photostencil emulsions, capillary films, ……

#5 Chromaline Screen Print Products

Domain Est. 1996

Website: chromaline.com

Key Highlights: Chromaline offers film and emulsion products, each having benefits for your printing application. We are here to help find the stencil system for you….

#6 Ulano

Domain Est. 1997

Website: ulano.com

Key Highlights: The Ulano Corporation is recognized as a world-class leader in the screen printing and graphics arts industry….

#7 Murakami Screen

Domain Est. 1997 | Founded: 1965

Website: murakamiscreen.com

Key Highlights: Murakami Screen was established in 1965 by Shizuo Murakami in Chiba, Japan. Shizuo started out in a different company distributing dyes for the textile / fabric ……

#8 Chemical Consultants Incorporated

Domain Est. 1997

#9 Screen Printing Materials

Domain Est. 2018

Website: macdermidalpha.com

Key Highlights: Our screen printing materials deliver high-quality stencil films, emulsions, and chemicals for precision. Our essential accessories optimize stencil life….

Expert Sourcing Insights for Silk Screen Printing Emulsion

2026 Market Trends for Silk Screen Printing Emulsion

The silk screen printing emulsion market is poised for notable evolution by 2026, driven by technological advancements, shifting consumer demands, and sustainability imperatives across the printing industry. As a critical component in screen printing processes—used to transfer designs onto textiles, signage, electronics, and packaging—emulsion formulations are adapting to meet the growing need for efficiency, durability, and environmental responsibility.

Rising Demand in Textile and Fashion Industries

The global textile and apparel sector remains a primary driver of silk screen printing emulsion consumption. With the resurgence of customized and limited-edition clothing, especially in North America and Europe, demand for high-quality, durable emulsions is increasing. By 2026, the market is expected to benefit from growth in fast fashion and personalized garments, particularly through e-commerce platforms. Emulsions that offer faster exposure times, higher resolution, and better stencil durability will be in high demand to support rapid production cycles.

Shift Toward Environmentally Friendly Formulations

Sustainability is a defining trend shaping the 2026 emulsion landscape. Regulatory pressures and consumer preference for eco-conscious production methods are pushing manufacturers to develop water-washable, solvent-free, and biodegradable emulsions. Traditional diazo and dual-cure emulsions are being reformulated to reduce volatile organic compound (VOC) emissions. By 2026, water-based and photopolymer emulsions with low environmental impact are projected to gain significant market share, especially in regions with stringent environmental regulations like the EU and California.

Technological Innovation and Product Performance

Advancements in emulsion chemistry are enhancing print precision and operational efficiency. High-solids-content emulsions, improved resistance to solvents and water, and faster reclaiming processes are becoming standard. Manufacturers are investing in R&D to create emulsions compatible with automated screen coating systems and high-tension mesh screens, supporting digital hybrid workflows. By 2026, smart emulsions with UV-curable indicators or built-in exposure gauges may begin to enter niche markets, improving consistency and reducing waste.

Growth in Industrial and Specialty Applications

Beyond textiles, the use of screen printing in electronics (e.g., printed circuit boards, sensors), automotive displays, and architectural glass is expanding. These applications require emulsions with exceptional fine-line resolution and thermal stability. The demand for high-performance emulsions in industrial printing is expected to grow steadily through 2026, particularly in Asia-Pacific, where electronics manufacturing is concentrated. Emulsions tailored for conductive inks and rigid substrates will see increased adoption.

Regional Market Dynamics

Asia-Pacific is forecasted to dominate the silk screen printing emulsion market by 2026, fueled by robust manufacturing in China, India, and Southeast Asia. Meanwhile, North America and Europe will lead in innovation and sustainable product development. Localized supply chains and shorter lead times are encouraging regional production of emulsions, reducing dependency on global logistics and enhancing responsiveness to market needs.

Competitive Landscape and Consolidation

The market is witnessing consolidation among chemical suppliers and printing material providers. Major players are acquiring niche emulsion developers to expand product portfolios and integrate sustainable solutions. By 2026, companies offering end-to-end screen printing solutions—including emulsions, inks, and equipment—are likely to gain competitive advantage. Smaller manufacturers focusing on specialty or custom emulsions will thrive by serving niche markets such as fine art and high-end packaging.

Conclusion

By 2026, the silk screen printing emulsion market will be characterized by innovation, sustainability, and diversification. Success will depend on the ability of manufacturers to balance performance with environmental responsibility, cater to evolving application needs, and respond to regional market dynamics. As digital and hybrid printing technologies continue to grow, emulsion producers must position themselves as essential enablers of high-quality, efficient, and eco-friendly screen printing processes.

Common Pitfalls When Sourcing Silk Screen Printing Emulsion

Sourcing the right silk screen printing emulsion is critical for achieving high-quality, durable prints. However, several common pitfalls can compromise results, particularly concerning emulsion quality and intellectual property (IP) considerations. Being aware of these issues helps ensure a reliable supply chain and protects your business.

Poor Emulsion Quality

One of the most frequent issues when sourcing emulsions—especially from unknown or low-cost suppliers—is receiving substandard products. Low-quality emulsions often exhibit inconsistent viscosity, poor adhesion to screens, inadequate sensitivity to UV light, or reduced durability during printing and washout. These flaws lead to stencil breakdown, pinholes, and inconsistent ink laydown. Emulsions stored or shipped improperly (e.g., exposed to heat or light) may degrade before use, further reducing performance. Always verify supplier credibility, request product specifications (such as spectral sensitivity and exposure times), and test small batches before full-scale adoption.

Intellectual Property (IP) Risks

Sourcing emulsions from unverified or offshore suppliers can expose businesses to intellectual property risks. Some generic or “compatible” emulsions may infringe on patented formulations or trademarks owned by major chemical manufacturers. Using such products could result in legal liability, especially in regions with strong IP enforcement. Additionally, replicating branded emulsion performance with counterfeit or knock-off products not only risks legal action but may also damage your brand’s reputation due to inconsistent print quality. To mitigate IP risks, source emulsions from authorized distributors or reputable manufacturers, and avoid suppliers offering suspiciously low prices or unbranded “equivalent” products without proper documentation.

Logistics & Compliance Guide for Silk Screen Printing Emulsion

Storage and Handling

Silk screen printing emulsion is a light-sensitive chemical compound that requires careful storage and handling to maintain its effectiveness and ensure workplace safety. Emulsions are typically water-based or solvent-based and contain photoreactive agents such as diazo or SBQ. To preserve shelf life and performance:

- Store emulsion in a cool, dark environment, ideally between 10°C and 25°C (50°F–77°F).

- Keep containers tightly sealed when not in use to prevent evaporation and contamination.

- Avoid direct sunlight or exposure to UV light, including fluorescent lighting, which can prematurely expose the emulsion.

- Store containers upright to prevent leaks and ensure stability.

- Use clean, non-metallic tools (e.g., plastic or stainless steel squeegees) for handling to prevent chemical reactions.

Transportation Requirements

When transporting silk screen printing emulsion, especially in bulk or across regulatory jurisdictions, compliance with transportation regulations is essential:

- Classify emulsion according to local and international shipping standards (e.g., UN/DOT, IATA, IMDG).

- Most water-based emulsions are non-hazardous and can be shipped as general freight, but solvent-based emulsions may be classified as flammable liquids (UN1993) and require appropriate labeling.

- Use secure, leak-proof packaging with secondary containment to prevent spills during transit.

- Include Safety Data Sheets (SDS) with shipments, especially for commercial or international transport.

- Label packages clearly with contents, handling instructions, and any relevant hazard symbols if applicable.

Regulatory Compliance

Compliance with health, safety, and environmental regulations is critical when using and disposing of screen printing emulsion:

- OSHA (U.S. Occupational Safety and Health Administration): Ensure employees have access to SDS and are trained in handling procedures. Use appropriate PPE such as gloves, goggles, and protective clothing.

- REACH & CLP (EU): Confirm that emulsion formulations comply with Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) and Classification, Labelling and Packaging (CLP) regulations. Suppliers must provide compliant SDS.

- EPA (U.S. Environmental Protection Agency): Follow guidelines for proper disposal of used emulsion and washout waste. Do not pour emulsion or reclaim water down standard drains without treatment; it may contain sensitizers or organic compounds that require filtration or chemical neutralization.

- Local Waste Disposal Codes: Adhere to municipal or regional hazardous waste regulations. Used emulsion and reclaim solutions may be classified as hazardous waste depending on formulation and local laws.

Workplace Safety and PPE

To protect personnel and meet safety standards:

- Provide adequate ventilation in coating and exposure areas.

- Use chemical-resistant gloves (e.g., nitrile) and safety goggles during emulsion application and screen reclaiming.

- Install emergency eyewash stations and safety showers where emulsions are handled in large quantities.

- Train staff on spill response procedures and first aid measures in case of skin or eye contact.

Environmental Impact and Disposal

Minimize environmental impact through responsible disposal practices:

- Separate emulsion waste from other screen cleaning chemicals (e.g., solvents, degreasers).

- Use emulsion removers designed to coagulate and filter out emulsion solids before water discharge.

- Consider closed-loop filtration systems to recover water and reduce waste volume.

- Dispose of solid emulsion sludge through licensed hazardous waste handlers if required by local regulations.

Following these logistics and compliance guidelines ensures safe, legal, and efficient use of silk screen printing emulsion across all stages—from storage and transport to application and disposal.

In conclusion, sourcing the right silk screen printing emulsion is crucial for achieving high-quality, durable, and precise prints. When selecting an emulsion, factors such as sensitivity to light, durability, ease of reclaiming, and compatibility with inks and substrates should be carefully considered. Water-resistant emulsions are ideal for longer print runs and plastisol inks, while diazo-based or dual-cure emulsions offer a good balance of performance and shelf life. It is also important to source emulsions from reputable suppliers to ensure consistency and quality. Proper storage and handling, along with correct exposure times, significantly impact the success of the screen printing process. Ultimately, investing time in choosing and testing the right emulsion leads to improved print results, reduced waste, and greater efficiency in screen printing operations.