The global sight flow indicator market is experiencing steady expansion, driven by increasing demand for real-time visual monitoring solutions across process-intensive industries such as pharmaceuticals, food and beverage, oil and gas, and chemical processing. According to Grand View Research, the global flow meter market—of which sight flow indicators are a critical component—was valued at USD 10.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. This growth trajectory is supported by rising automation in industrial processes, stringent regulatory requirements for quality control, and the need for enhanced operational transparency. As industries prioritize system efficiency and preventive maintenance, sight flow indicators have become essential for monitoring fluid flow, detecting blockages, and ensuring process reliability. In this competitive landscape, several manufacturers have emerged as leaders through innovation, product durability, and global distribution networks, setting the benchmark for performance and compliance. The following list highlights the top nine sight flow indicator manufacturers shaping the industry.

Top 9 Sight Flow Indicators Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Sight Flow Indicators

Domain Est. 1996

Website: koboldusa.com

Key Highlights: Industrial Flow Indicators made from iron, steel, or SS for up to 580 PSI and 530 °F. Flap, rotor, or drip indication in NPT or ANSI….

#2 Sight Flow Indicators

Domain Est. 1997

Website: ljstar.com

Key Highlights: We offer sight flow indicators for industrial, sterile, and hygienic applications. Click here for more information….

#3 Sight Flow Indicators

Domain Est. 2023

Website: ernstinstruments.com

Key Highlights: Industrial Sight Flow Indicators and sight glass, designed for the monitoring of liquid flow in pipelines, ensuring optimal process control….

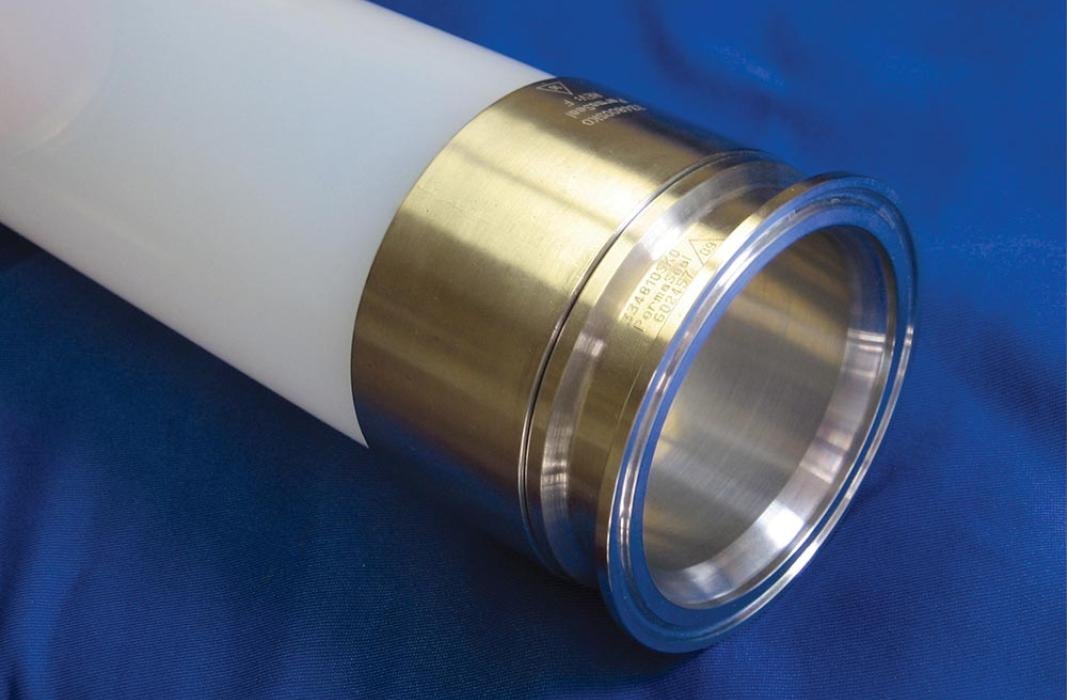

#4 Versilon® Sight Flow Indicators

Domain Est. 1995

Website: ics.saint-gobain.com

Key Highlights: Versilon Sight Flow Indicators from Saint-Gobain are constructed with a translucent heavy wall FEP tube that permits visual inspection of conveyed material….

#5 Sight Flow Indicators

Domain Est. 2000

Website: fluidhandling.kadant.com

Key Highlights: Sight flow indicators are engineered to provide maximum visual observation of liquid and gas flows through pipelines….

#6 Sight Flow Indicators

Domain Est. 2002

Website: andronaco.com

Key Highlights: Sight flow indicators provide users with the ability to view the flow and direction of liquids or gases. Additionally, they are relied upon to view the ……

#7 VISI

Domain Est. 2009

Website: opwglobal.com

Key Highlights: Sight-flow indicators are a cost-effective and efficient way to visually monitor the flow of fluids and to determine if any problems exist at certain points….

#8 Sight Flow Indicators

Domain Est. 2014

Website: sightglasswindows.com

Key Highlights: Sight flow indicators are inline piping-based units that allow direct observation of material flow through a line….

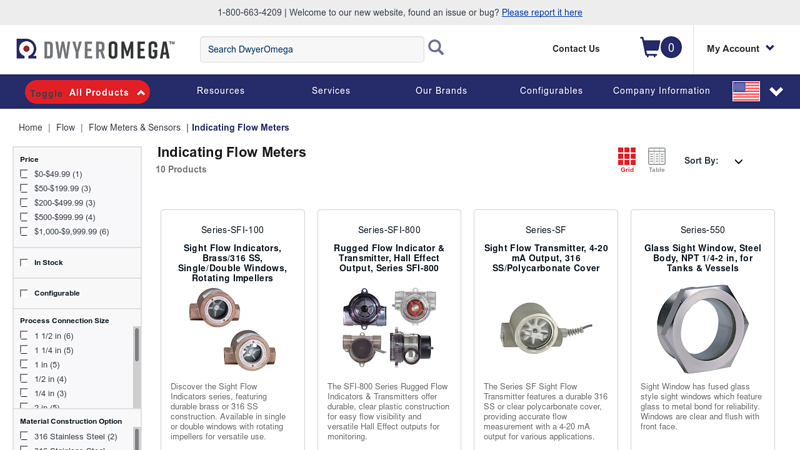

#9 Indicating Flow Meters

Domain Est. 2022

Website: dwyeromega.com

Key Highlights: The MIDWEST Sight Flow Indicator has a glass tube for clear flow visibility and is made from quality materials, ensuring reliable, long-lasting service at ……

Expert Sourcing Insights for Sight Flow Indicators

2026 Market Trends for Sight Flow Indicators

The global sight flow indicators market is poised for steady growth and significant transformation by 2026, driven by increasing demands for process transparency, safety compliance, and advanced monitoring across various industries. Key trends shaping the market include:

Growing Demand Across Critical Industries

Sight flow indicators are becoming essential components in industries such as pharmaceuticals, food and beverage, chemicals, and water treatment. By 2026, heightened regulatory scrutiny and the need for sterile, contamination-free processes will drive adoption, especially in hygienic applications where visual confirmation of fluid flow is critical for quality assurance and compliance with standards like FDA, EHEDG, and 3-A.

Shift Toward Smart and Digital Integration

A major trend by 2026 is the integration of digital technologies into traditional sight flow indicators. Smart sight glasses equipped with sensors, IoT connectivity, and remote monitoring capabilities are gaining traction. These advanced models allow real-time flow verification, predictive maintenance alerts, and data logging, supporting Industry 4.0 initiatives and enhancing operational efficiency in automated plants.

Emphasis on Material Innovation and Durability

Manufacturers are increasingly focusing on using corrosion-resistant materials such as borosilicate glass, sapphire windows, and high-performance polymers. These innovations improve longevity and reliability in harsh environments involving high pressure, temperature extremes, or aggressive chemicals—factors that will be crucial in expanding applications in oil & gas and chemical processing sectors.

Expansion in Emerging Markets

Asia-Pacific and Latin America are expected to see accelerated market growth by 2026 due to industrialization, rising investments in infrastructure, and expanding pharmaceutical and food production facilities. Local manufacturing and the push for process automation will create new opportunities for sight flow indicator suppliers.

Sustainability and Energy Efficiency Considerations

With growing emphasis on sustainable operations, sight flow indicators that minimize leakage, reduce maintenance needs, and support energy-efficient processes will be favored. Designs that enhance system integrity and reduce fluid waste will align with broader corporate sustainability goals.

In summary, the 2026 sight flow indicators market will be characterized by technological advancement, regulatory-driven demand, and geographic expansion, positioning smart, durable, and hygienic solutions at the forefront of industry adoption.

Common Pitfalls When Sourcing Sight Flow Indicators (Quality, IP)

Sourcing sight flow indicators may seem straightforward, but overlooking key quality and intellectual property (IP) considerations can lead to operational failures, safety hazards, and legal risks. Below are common pitfalls to avoid:

1. Prioritizing Low Cost Over Quality and Certification

One of the most frequent mistakes is selecting sight flow indicators based solely on price. Low-cost options often use inferior materials—such as substandard glass or non-compliant polymers—that can crack, leak, or fail under pressure, temperature, or chemical exposure. Additionally, uncertified products may not meet industry standards (e.g., ASME, ISO, or PED), posing safety risks and potentially voiding insurance or compliance.

Best Practice: Verify material certifications, pressure/temperature ratings, and compliance with relevant standards before purchase.

2. Ignoring Ingress Protection (IP) Ratings

The IP rating indicates the level of protection against solid particles and liquids. Using a sight flow indicator with an inadequate IP rating in harsh environments (e.g., washdown areas, outdoor installations, or dusty facilities) can result in internal contamination, electrical failure (in illuminated models), or premature degradation.

Best Practice: Match the IP rating to the operating environment—e.g., IP65 or higher for outdoor or high-moisture areas.

3. Overlooking Material Compatibility

Sight flow indicators are exposed to process media, and using incompatible materials (e.g., standard glass with caustic chemicals or elastomer seals with oils) leads to erosion, swelling, or failure. This can result in leaks, contamination, or unsafe conditions.

Best Practice: Confirm chemical compatibility of all wetted parts (glass, gaskets, body material) with the process fluid.

4. Assuming Universal Interchangeability

Sight flow indicators vary in connection types (threaded, flanged, tri-clamp), dimensions, and face-to-face lengths. Substituting one model for another without verifying dimensional and interface compatibility can lead to installation issues or system leaks.

Best Practice: Cross-check connection standards, size, and mounting dimensions with existing pipeline specifications.

5. Disregarding Intellectual Property (IP) Infringement Risks

Sourcing counterfeit or cloned products from unauthorized suppliers risks IP violations. These products often replicate patented designs, seals, or proprietary mounting systems without licensing, exposing the buyer to legal liability. Furthermore, knock-offs typically lack quality control and traceability.

Best Practice: Source from authorized distributors or directly from OEMs. Verify trademarks, part numbers, and supplier authenticity.

6. Failing to Validate Long-Term Supplier Reliability

Relying on suppliers without proven track records can lead to inconsistent quality, delayed deliveries, or lack of technical support. This is especially critical for industries requiring documentation, validation (e.g., pharmaceuticals), or spare parts availability.

Best Practice: Evaluate supplier certifications (ISO 9001), customer reviews, and support services before committing.

7. Neglecting Illumination and Visibility Requirements

For applications requiring visual monitoring in low-light conditions, illuminated sight flow indicators are essential. Choosing non-illuminated models or low-quality lighting systems can compromise operational safety and efficiency.

Best Practice: Ensure lighting meets environmental IP ratings and offers sufficient brightness and longevity (e.g., LED with proper sealing).

By addressing these pitfalls proactively, organizations can ensure reliable performance, regulatory compliance, and protection against operational and legal risks when sourcing sight flow indicators.

Logistics & Compliance Guide for Sight Flow Indicators

This guide outlines the key logistical considerations and compliance requirements for the procurement, transportation, storage, installation, and operation of sight flow indicators across various industries.

Product Classification and Regulatory Standards

Sight flow indicators are classified as process monitoring devices used in piping systems to visually confirm fluid flow. Their compliance is governed by multiple international and industry-specific standards depending on application and environment. Key standards include:

- ASME B31.3 – Process Piping: Governs design, materials, and fabrication for pressure-containing components.

- PED 2014/68/EU – Pressure Equipment Directive (Europe): Required for CE marking; applies to devices above certain pressure-volume thresholds.

- CRN (Canadian Registration Number) – Mandatory in Canada for pressure-retaining components; registration varies by province.

- ATEX/IECEx – Required for use in explosive atmospheres (hazardous locations); ensures equipment will not ignite flammable gases or dusts.

- FDA 21 CFR – Applies to sight flow indicators used in food, beverage, and pharmaceutical applications; requires materials to be non-toxic and cleanable.

- 3-A Sanitary Standards – Relevant for dairy and biopharma applications; mandates design for cleanability and hygiene.

Ensure all sight flow indicators are certified and labeled according to applicable regional and industry regulations prior to shipment.

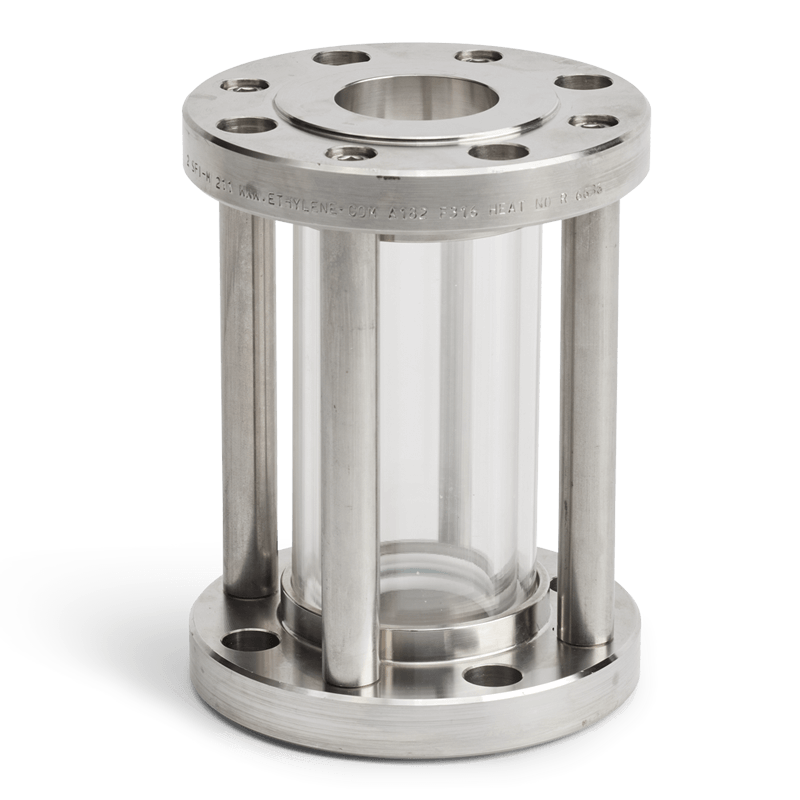

Material and Construction Compliance

Material selection must align with fluid compatibility, pressure, temperature, and cleanliness requirements. Common compliant materials include:

- 316L Stainless Steel – Standard for corrosive environments and sanitary applications.

- Borosilicate Glass or Sapphire – For viewing windows; must withstand thermal shock and pressure.

- EPDM, Viton®, or PTFE Seals – Selected based on fluid compatibility and temperature range.

Verify material certifications (e.g., Mill Test Reports, FDA compliance letters, 3-A documentation) are provided by the manufacturer and retained for audit purposes.

Packaging and Shipping Requirements

Proper packaging is essential to prevent damage during transit, especially to transparent viewing windows. Best practices include:

- Use of crush-resistant, waterproof packaging with internal cushioning to protect glass or sapphire viewports.

- Clearly labeled fragile and upright handling indicators on external packaging.

- Climate-controlled shipping for extreme environments (e.g., Arctic or tropical regions) to prevent condensation or material degradation.

- Documentation pack including compliance certificates, installation manuals, and material test reports.

For international shipments, ensure compliance with:

– Incoterms® 2020 – Define responsibilities for shipping, insurance, and customs (e.g., FOB, DDP).

– Customs Declarations – Accurate HS codes (typically 9026.20 or 8481.80) and value declarations.

– REACH & RoHS – Confirm no restricted substances in materials (EU compliance).

Storage and Handling Precautions

Before installation, store sight flow indicators in a controlled environment:

– Temperature: 5°C to 40°C (41°F to 104°F), dry, and free from contaminants.

– Position: Store upright to avoid stress on seals and viewports.

– Shelf Life: Inspect elastomeric seals periodically; replace if hardened or cracked (typical shelf life 5 years).

Avoid stacking heavy items on packaged units and protect from direct sunlight to prevent UV degradation of seals and viewports.

Installation and Operational Compliance

Installation must follow manufacturer guidelines and site-specific process safety requirements:

– Use proper torque specifications for flanged or threaded connections to prevent leaks or glass breakage.

– Align with piping stress-free; misalignment can cause premature failure.

– Perform hydrostatic testing per ASME B31.3 or site protocols after installation but before commissioning.

– Integrate into site safety management systems (e.g., permit-to-work, lockout/tagout).

For hazardous locations (classified areas), ensure:

– Proper ATEX/IECEx marking.

– Grounding and bonding to prevent static discharge.

– Use of explosion-proof lighting accessories if internal illumination is required.

Maintenance, Inspection, and Recordkeeping

Regular inspection is critical for continued compliance and safety:

– Inspect viewports monthly for clouding, scratching, or etching.

– Check seals and gaskets during scheduled maintenance (typically annually).

– Replace components per manufacturer’s recommended service life or after process upsets (e.g., overpressure, thermal cycling).

Maintain a compliance log including:

– Installation date and location.

– Inspection and maintenance records.

– Replacement part certifications.

– Calibration or testing reports (if applicable).

Disposal and Environmental Compliance

At end-of-life, dispose of components in accordance with local environmental regulations:

– Glass and metal components may be recyclable; separate from hazardous waste.

– Contaminated seals or housings exposed to hazardous fluids may require special handling under EPA or ECHA guidelines.

– Never incinerate fluoropolymer seals (e.g., PTFE) without proper emission controls.

Retain disposal records for audit and regulatory reporting.

Summary

Adhering to logistics and compliance protocols ensures the safe, reliable, and legally compliant use of sight flow indicators. Always verify certifications, follow handling and installation guidelines, and maintain thorough documentation throughout the product lifecycle.

Conclusion for Sourcing Sight Flow Indicators

Sourcing sight flow indicators requires a careful evaluation of application requirements, material compatibility, pressure and temperature ratings, connection types, and industry standards. Selecting the right sight flow indicator ensures reliable visual monitoring of fluid flow in piping systems, enhancing process efficiency, safety, and maintenance responsiveness. It is essential to work with reputable suppliers who provide certified, high-quality products and technical support. Additionally, considering factors such as regulatory compliance (e.g., FDA, 3A, ATEX), cleanability for hygienic applications, and long-term durability will contribute to optimal performance and reduced downtime. By systematically assessing supplier capabilities, product specifications, and total cost of ownership, organizations can make informed procurement decisions that support seamless operations across industries such as food & beverage, pharmaceuticals, chemical processing, and oil & gas.