The global shipbuilding market continues to gain momentum, driven by rising maritime trade, increasing demand for energy transportation, and growing investments in offshore infrastructure. According to a 2023 report by Mordor Intelligence, the shipbuilding market was valued at USD 172.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2028, reaching an estimated USD 258.6 billion by the end of the forecast period. Similarly, Grand View Research reports robust expansion, citing advancements in green shipping technologies, stricter environmental regulations, and growing fleet renewal initiatives as key growth catalysts. Amid this upward trajectory, a select group of shipyard manufacturers have emerged as industry leaders—combining scale, innovation, and technological expertise to secure dominant market positions. These top 10 shipyard manufacturers not only command significant global order books but also set benchmarks in efficiency, environmental compliance, and advanced vessel design, shaping the future of modern maritime infrastructure.

Top 10 Shipyard Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shipyard Supply

Domain Est. 2000

Website: shipyardsupplyinc.com

Key Highlights: Shipyard Supply delivers high-quality industrial and marine products designed to keep operations running smoothly. Specializing in industrial hose, ……

#2 Suppliers

Domain Est. 1992

Website: hii.com

Key Highlights: Businesses that supply HII can be found in nearly every state in America. More than 2,000 active suppliers support HII’s construction of the most complex, ……

#3 General Dynamics NASSCO

Domain Est. 1995 | Founded: 1960

Website: nassco.com

Key Highlights: General Dynamics NASSCO has been designing and building high-quality ships since 1960, specializing in auxiliary and support ships for the U.S. Navy and oil ……

#4 Damen Shipyards Group

Domain Est. 1996 | Founded: 1927

Website: damen.com

Key Highlights: We are family owned & client-driven company since 1927. Damen Group becomes the world’s most sustainable and connected shipbuilder….

#5 Bollinger Shipyards

Domain Est. 1996

Website: bollingershipyards.com

Key Highlights: Bollinger Shipyard exists to provide our clients with complete marine services to meet your needs from repair to vessel building….

#6 General Dynamics

Domain Est. 1998

Website: gdbiw.com

Key Highlights: Bath Iron Works is a leader in designing and building US Navy ships. We also provide maintenance, modernization and lifecycle support services for Navy ships….

#7

Domain Est. 1998

Website: cheoylee.com

Key Highlights: These cutting-edge technologies enable Cheoy Lee to manufacture vessels of up to 70 meters (230 feet) in length, showcasing their prowess in shipbuilding….

#8 Hawaii Ship Repair

Domain Est. 2000

Website: pacificshipyards.com

Key Highlights: PSI is a leader in maritime repair and conversion with a full-service shipyard headquartered in Honolulu. We strive to be at the forefront of the industry….

#9 Chesapeake Shipbuilding

Domain Est. 2002

Website: chesapeakeshipbuilding.com

Key Highlights: Chesapeake Shipbuilding is the most successful shipyard and naval architecture firm of its kind in the United States today. About Chesapeake Shipbuilding….

#10 Hanwha Philly Shipyard

Domain Est. 2024

Website: hanwhaphillyshipyard.com

Key Highlights: A leading US shipbuilder pursuing a mix of commercial and government work, ranging from shipbuilding to repair and maintenance….

Expert Sourcing Insights for Shipyard

H2 2026 Market Trends Analysis for the Global Shipbuilding Industry

The global shipyard industry in H2 2026 is navigating a complex landscape shaped by accelerating decarbonization mandates, technological transformation, shifting trade dynamics, and persistent supply chain and labor challenges. Here’s a breakdown of the key trends:

1. Dominance of Decarbonization & Green Shipbuilding:

* Regulatory Pressure Intensifies: The IMO’s revised greenhouse gas (GHG) strategy, particularly the Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) ratings, are now fully operational. Shipowners face significant penalties for poor CII ratings, driving massive retrofitting demand (e.g., hull cleaning, propeller upgrades, air lubrication systems) and accelerating newbuilding orders for inherently efficient vessels.

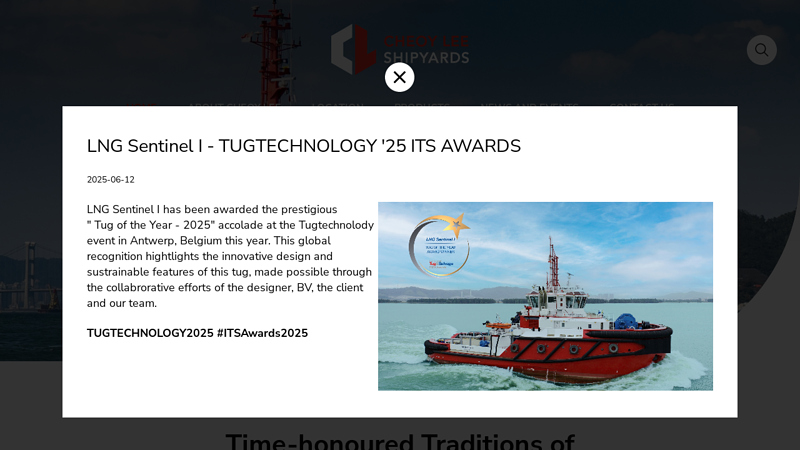

* Alternative Fuels Take Center Stage: Orderbooks are heavily skewed towards vessels capable of using low/zero-carbon fuels. LNG dual-fuel remains dominant, especially for large container ships and tankers. Methanol dual-fuel adoption is surging rapidly, driven by major liner companies’ commitments and perceived bunkering advantages. Ammonia and hydrogen are moving beyond concept to concrete pilot projects and first-mover orders, with specialized newbuilding capacity emerging. Shipyards are investing heavily in fuel storage, handling, and safety systems expertise.

* “Future-Proofing” as Standard: New designs prioritize flexibility, incorporating provisions for future conversion to zero-emission fuels (ammonia-ready, hydrogen-ready) and advanced energy-saving technologies (e.g., wind-assisted propulsion, advanced hull forms, waste heat recovery).

2. Technological Acceleration & Digitalization:

* Smart Ship Integration: Newbuilds increasingly feature integrated platforms for real-time monitoring, predictive maintenance, performance optimization, and remote support. Shipyards are becoming system integrators, partnering with tech providers.

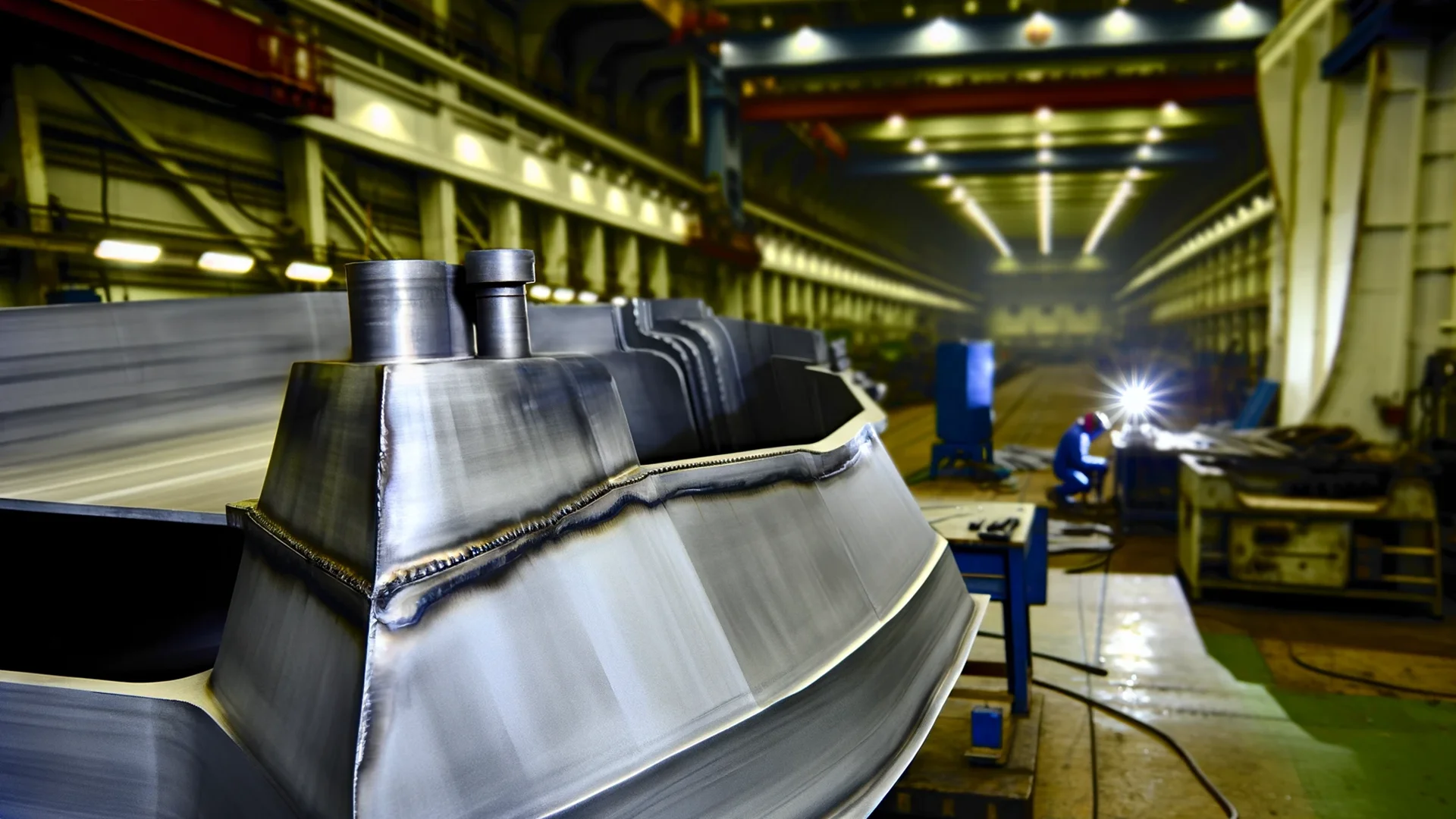

* Advanced Manufacturing Gains Traction: Wider adoption of modular construction (block outfitting), robotics (welding, painting), augmented reality (AR) for assembly guidance, and AI for design optimization and production scheduling is improving efficiency and quality, though full-scale automation remains limited.

* Digital Twins & Lifecycle Management: Shipyards are offering digital twin models of vessels to owners, providing value throughout the operational life (maintenance planning, performance analysis) and strengthening long-term relationships.

3. Shifting Orderbook Dynamics & Geopolitical Influences:

* Containerization & LNG Carriers Lead Newbuilding: Strong demand for larger, more efficient container ships (driven by trade recovery and fleet renewal) and the ongoing global LNG infrastructure build-out (requiring more carriers) dominate order intake. Cruise ship orders remain healthy but focus on smaller, more efficient, or expedition vessels.

* Geopolitical Fragmentation & Trade Route Shifts: Sanctions, “friend-shoring” trends, and the potential reconfiguration of global trade flows (e.g., nearshoring, regionalization) influence ship demand and route planning, impacting vessel size and type preferences. Shipyards in certain regions may face market access challenges.

* China’s Continued Dominance, Korea’s Premium Focus, Europe’s Niche Leadership: Chinese yards maintain the largest market share, leveraging scale and cost. Korean yards solidify their lead in high-value, complex vessels (LNG carriers, large containerships, green tech). European yards excel in high-end niche markets (cruise, offshore wind, specialized vessels) and advanced technology development.

4. Persistent Operational Challenges:

* Supply Chain Volatility: While improved from 2022-2023 peaks, supply chains for critical components (engines, electronics, specialized steel) remain fragile, susceptible to geopolitical events and raw material price fluctuations. Dual-sourcing and vertical integration are key strategies.

* Skilled Labor Shortage: The industry-wide shortage of skilled welders, engineers, and technicians persists, exacerbated by an aging workforce and competition from other sectors. Shipyards are investing heavily in training academies, automation to reduce manual labor, and improved working conditions.

* Financing & Cost Inflation: While credit is available, financing costs remain elevated. Inflation pressures on materials, labor, and energy continue to impact project costs and require sophisticated risk management in contracting.

5. Sustainability Beyond Emissions:

* Circular Economy Focus: Increased scrutiny on end-of-life ship recycling (driven by the Hong Kong Convention and EU regulations) pushes shipyards to design for easier disassembly and use more recyclable materials.

* On-Site Environmental Performance: Shipyards face stricter local regulations regarding emissions, waste management, and noise pollution. Investments in cleaner production processes, waste treatment, and renewable energy for yard operations are growing.

Conclusion for H2 2026:

The shipyard industry in H2 2026 is fundamentally reshaped by the energy transition. Success hinges on a yard’s ability to master green technologies (design, construction, safety), integrate digital solutions, manage complex supply chains and labor pools, and navigate a fragmented geopolitical landscape. While challenges remain, the drive for decarbonization and efficiency creates significant opportunities for innovative and adaptable shipyards, particularly those leading in LNG, methanol, and next-generation zero-carbon fuel vessels. The focus has irrevocably shifted from simply building ships to building the foundation of a sustainable maritime future.

Common Pitfalls Sourcing Shipyard (Quality, IP)

Sourcing shipyard services—whether for new builds, repairs, or conversions—presents unique challenges, particularly concerning quality assurance and intellectual property (IP) protection. Overlooking these aspects can result in costly delays, legal disputes, and compromised vessel performance. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Due Diligence on Shipyard Capabilities

Selecting a shipyard without thoroughly verifying its certifications (e.g., ISO, IACS classification society compliance), track record, and technical expertise can lead to substandard construction. Facilities may lack modern equipment or skilled labor, resulting in poor weld quality, misaligned hulls, or non-compliance with safety standards.

Lack of Clear Quality Control Specifications

Ambiguous or incomplete technical specifications and quality benchmarks in contracts allow for inconsistent workmanship. Without defined inspection milestones (e.g., steel cutting, keel laying, sea trials), deviations may go undetected until later stages, increasing rework costs.

Insufficient Onsite Oversight and Independent Surveys

Relying solely on the shipyard’s internal quality checks increases the risk of overlooked defects. Failing to engage independent surveyors or third-party inspectors during critical phases can compromise vessel integrity and regulatory compliance.

Overlooking Supply Chain Quality

Shipyards often subcontract critical components (e.g., propulsion systems, piping). If the shipyard does not enforce rigorous quality standards on its suppliers—or if the buyer fails to audit these—defective materials may be incorporated into the vessel.

Intellectual Property (IP) Pitfalls

Unclear Ownership of Design and Engineering IP

Many shipbuilding contracts fail to explicitly define who owns custom designs, blueprints, or software developed during the project. This can lead to disputes if the buyer intends to reuse the design or if the shipyard attempts to replicate the vessel for others.

Inadequate IP Protection in Contracts

Standard contracts may not include robust clauses on confidentiality, trade secret protection, or restrictions on reverse engineering. Without these, proprietary technology (e.g., energy-efficient hull designs, automation systems) may be exposed or misused.

Risk of IP Leakage Through Subcontractors

Shipyards often work with multiple subcontractors who may not be bound by the same IP safeguards. Sensitive information can be inadvertently shared or exploited if non-disclosure agreements (NDAs) are not consistently enforced across the supply chain.

Failure to Secure Export Control Compliance

Advanced maritime technologies may be subject to export control regulations (e.g., ITAR, EAR). Sourcing from international shipyards without ensuring compliance can result in legal penalties and project delays, especially if IP involves dual-use or military-grade systems.

Mitigation Strategies

- Conduct comprehensive audits of shipyard facilities, certifications, and past projects.

- Define detailed quality requirements and inspection protocols in the contract.

- Engage independent marine surveyors at key construction milestones.

- Clearly specify IP ownership, usage rights, and confidentiality obligations in legal agreements.

- Extend IP protections to subcontractors through binding NDAs and contractual clauses.

- Consult legal and technical experts to ensure compliance with international IP and export regulations.

Proactively addressing these pitfalls ensures better project outcomes, protects valuable intellectual assets, and maintains the long-term integrity of the vessel.

Logistics & Compliance Guide for Shipyard Operations

Overview

This guide outlines essential logistics and compliance considerations for efficient and lawful shipyard operations. It covers regulatory adherence, supply chain management, safety protocols, and environmental responsibilities to ensure smooth project execution and legal conformity.

Regulatory Compliance

International Maritime Organization (IMO) Standards

Shipyards must comply with relevant IMO conventions such as SOLAS (Safety of Life at Sea), MARPOL (Marine Pollution), and the Ballast Water Management Convention. Ensure all new builds and repairs meet current IMO requirements for safety, environmental protection, and operational performance.

Classification Society Requirements

Work in accordance with rules from recognized classification societies (e.g., ABS, DNV, Lloyd’s Register). These include structural design, material specifications, welding procedures, and inspection protocols. Maintain certification throughout construction and repair phases.

National and Local Regulations

Adhere to national labor, environmental, and industrial safety laws. This includes occupational health and safety standards (e.g., OSHA in the U.S.), environmental permits, and coastal zone management regulations. Obtain necessary local permits for construction, waste disposal, and waterfront operations.

Environmental Compliance

Waste Management

Implement a comprehensive waste management plan. Segregate and properly dispose of hazardous materials such as paints, solvents, oils, and asbestos. Maintain records of waste handling and ensure disposal through licensed facilities.

Air and Water Emissions

Control emissions from blasting, painting, and welding operations. Use low-VOC (volatile organic compound) paints and install filtration systems where necessary. Prevent runoff into waterways by using containment systems and oil-water separators.

Spill Prevention and Response

Develop and maintain a Spill Prevention, Control, and Countermeasure (SPCC) plan. Train staff in spill response and keep emergency kits (absorbents, booms, PPE) readily available. Report significant spills to regulatory authorities promptly.

Supply Chain & Material Logistics

Procurement & Vendor Management

Establish qualified vendor lists for critical components (e.g., propulsion systems, navigation equipment). Ensure all suppliers meet quality standards and deliver with proper documentation (mill test reports, certificates of conformity).

Inventory Control

Implement an inventory management system to track raw materials, consumables, and spare parts. Use barcode or RFID systems for high-value items. Conduct regular audits to prevent shortages or overstocking.

Just-in-Time (JIT) Delivery

Coordinate with suppliers to schedule JIT deliveries, reducing on-site storage needs and minimizing exposure to weather or theft. Align delivery timelines with construction milestones.

Material Handling & Storage

Store materials according to specifications (e.g., steel protected from moisture, electronics in climate-controlled areas). Use proper lifting equipment and follow load security guidelines during internal transport.

Safety & Workforce Compliance

Safety Training & Certification

Ensure all workers have up-to-date safety certifications (e.g., confined space entry, hot work, fall protection). Conduct regular safety drills and toolbox talks. Maintain training records for audits.

Personal Protective Equipment (PPE)

Mandate use of appropriate PPE across all work zones—hard hats, safety glasses, gloves, flame-resistant clothing, and respiratory protection where needed. Enforce compliance through supervision and inspections.

Incident Reporting & Investigation

Implement a system for reporting near-misses and accidents. Investigate root causes and take corrective actions to prevent recurrence. Report serious incidents to relevant authorities as required.

Documentation & Recordkeeping

Project Documentation

Maintain detailed logs of construction progress, inspections, test results (e.g., NDT reports), and corrective actions. Ensure digital and physical backups are securely stored.

Compliance Records

Keep records of permits, environmental monitoring data, training certifications, and audit reports. These must be available for regulatory inspections or client reviews.

As-Built Documentation

Deliver complete as-built drawings, equipment manuals, and compliance certificates to the client upon project completion. Archive a copy for future reference and warranty support.

Quality Assurance & Audits

Internal Audits

Conduct regular internal audits of logistics processes and compliance procedures. Identify gaps and implement corrective actions.

Third-Party Inspections

Facilitate access for classification society surveyors, client representatives, and regulatory inspectors. Address findings promptly and document resolutions.

Emergency Preparedness

Emergency Response Plan

Develop and communicate site-specific emergency plans covering fire, medical emergencies, chemical spills, and natural disasters. Conduct drills at least quarterly.

Communication Systems

Ensure reliable communication channels (radios, alarms, PA systems) are operational across the yard. Maintain updated contact lists for emergency services and key personnel.

Conclusion

Effective logistics and compliance are critical to the success and sustainability of shipyard operations. By integrating rigorous standards, proactive planning, and continuous improvement, shipyards can ensure safety, regulatory adherence, and customer satisfaction. Regular review and updates to this guide are recommended to reflect evolving regulations and industry best practices.

Conclusion: Sourcing Shipyard Suppliers

In conclusion, the process of sourcing shipyard suppliers requires a strategic and comprehensive approach that balances cost, quality, reliability, and compliance. Identifying and partnering with the right suppliers is critical to ensuring the successful execution of shipbuilding and repair projects, minimizing delays, and maintaining high safety and regulatory standards.

Key factors in effective supplier sourcing include thorough due diligence, evaluation of technical capabilities, financial stability, track record in delivering on time and within specification, adherence to international maritime regulations, and a demonstrated commitment to sustainability and innovation. Proximity, logistics, and long-term collaboration potential also play significant roles in reducing risks and enhancing project efficiency.

By establishing transparent communication, fostering strong relationships, and implementing continuous performance monitoring, shipyards can build resilient supply chains capable of adapting to industry challenges and market fluctuations. Ultimately, a well-structured supplier sourcing strategy not only supports operational excellence but also strengthens competitiveness in the global maritime sector.