The global shipping container market continues to expand, driven by surging international trade and the need for standardized, durable freight solutions. According to Grand View Research, the market size was valued at USD 12.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Alternatively, Mordor Intelligence projects a CAGR of approximately 6.5% over the forecast period (2024–2029), underlining sustained demand across logistics, shipping, and modular construction sectors. With Asia-Pacific dominating manufacturing output—China alone accounts for over 80% of global container production—consolidation among key players has intensified. This growth trajectory reflects not only rising containerization rates but also innovations in materials, security, and sustainability. In this evolving landscape, identifying the top manufacturers becomes crucial for stakeholders seeking reliability, scale, and technological edge. Below is a data-informed overview of the leading shipping container manufacturers shaping the industry today.

Top 10 Shipping Conteiner Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MSC

Domain Est. 1993

Website: msc.com

Key Highlights: MSC is a world leader in global container shipping and a company that prides itself on offering digitized global services with local knowledge. Contact us!…

#2 Interport

Domain Est. 1994

Website: iport.com

Key Highlights: Interport offers a wide selection of new and used ISO containers, also known as a cargo containers, perfect for all your needs….

#3 Matson

Domain Est. 1995

Website: matson.com

Key Highlights: Matson offers ocean transportation to Hawaii, Alaska, Guam, Micronesia, the South Pacific, Japan and China, and international logistics expertise….

#4 Textainer

Domain Est. 1996

Website: textainer.com

Key Highlights: Textainer is a leading intermodal container lessor committed to providing high quality equipment and best-in-class service to customers worldwide….

#5 Florens

Domain Est. 1996

Website: florens.com

Key Highlights: As a leading container leasing company, we have built an extensive customer base with the world’s top 20 shipping companies being Florens’s major customers….

#6 Martin Container – Customized containers

Domain Est. 1997

Website: container.com

Key Highlights: All of our custom shipping containers are manufactured to rigorous standards. This ensures they can withstand even the harshest elements while keeping your ……

#7 USA

Domain Est. 2007

Website: usa-containers.com

Key Highlights: Whether looking for dry, refrigerated or custom containers, USA-Containers LLC has just what you need. Call 877-391-4064 today for a quote….

#8 Custom Shipping Containers

Domain Est. 2008

Website: is4s.com

Key Highlights: IS4S has unlimited solutions for custom shipping containers. Whether it’s a mobile machine shop or a portable shower system, we can do it all!…

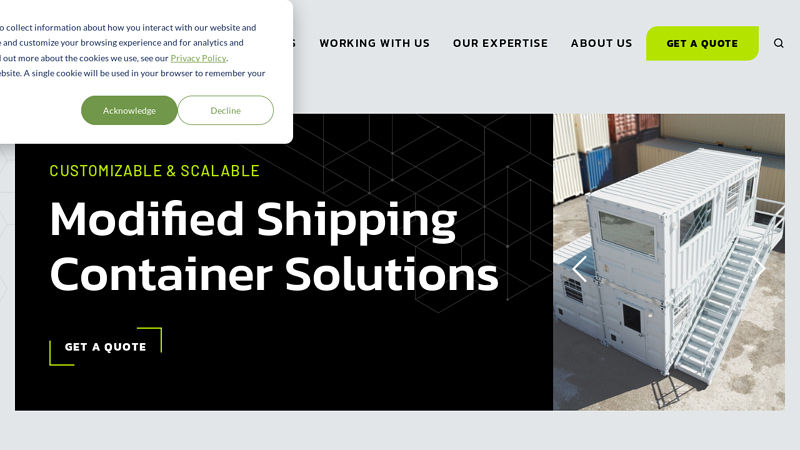

#9 Customizable & Scalable Modified Shipping Container Solutions

Domain Est. 2009

Website: falconstructures.com

Key Highlights: Falcon Structures is the leader in repurposing shipping containers that are fully customized or ordered at scale for a variety of organizations nationwide….

#10 Giant Containers

Domain Est. 2013

Website: giantcontainers.com

Key Highlights: Discover innovative custom modular shipping containers in North America. Transform your space with our unique designs. Get your free quote today!…

Expert Sourcing Insights for Shipping Conteiner

2026 Market Trends for Shipping Containers

The global shipping container market is poised for significant transformation by 2026, shaped by evolving trade dynamics, technological innovation, and growing environmental imperatives. Key trends indicate a shift toward sustainability, digitalization, and adaptive infrastructure.

Consolidation of Sustainable Practices and Demand for Eco-Friendly Containers

By 2026, environmental regulations and corporate sustainability goals will drive increased demand for green shipping solutions. The International Maritime Organization’s (IMO) 2030 and 2050 emissions targets are already influencing fleet upgrades and operational changes. As a result, carriers are investing in energy-efficient container designs, lightweight materials, and containers equipped with insulation or refrigeration systems that reduce energy consumption. The reuse and retrofitting of existing containers will grow in popularity, supported by circular economy initiatives. Additionally, demand for containers compatible with alternative fuels—such as LNG or hydrogen-powered vessels—may rise, especially on key trade lanes like Asia-Europe and trans-Pacific routes.

Expansion of Digitalization and Smart Container Adoption

The integration of IoT (Internet of Things) and real-time tracking technologies into shipping containers is expected to become mainstream by 2026. Smart containers equipped with GPS, temperature sensors, humidity monitors, and shock detectors will enhance supply chain visibility and reduce cargo loss. This digital transformation will enable predictive maintenance, improve security, and streamline customs clearance. Major logistics providers and container manufacturers are investing heavily in digital platforms, allowing shippers to monitor cargo conditions remotely. Blockchain-based documentation and container tracking systems will further increase transparency and trust in global trade.

Fluctuating Demand Amid Global Trade Realignment

Geopolitical shifts and supply chain diversification—such as nearshoring and friend-shoring—will influence container demand patterns in 2026. While overall containerized trade is projected to grow modestly (around 2–4% annually), regional variations will emerge. For instance, routes involving Southeast Asia, India, and Africa may see increased container traffic due to manufacturing relocation and rising consumer markets. Conversely, traditional high-volume lanes may stabilize or experience slower growth. The container leasing market is expected to remain strong, providing flexibility for shipping lines adjusting to volatile demand.

Rising Value of Intermodal and Last-Mile Container Solutions

By 2026, the integration of shipping containers into intermodal transport and urban logistics will expand. The use of smaller, modular containers for last-mile delivery—especially in e-commerce—will gain traction. Repurposed containers for mobile storage, pop-up retail, and emergency infrastructure will also contribute to secondary market growth. Investments in rail and inland waterway connectivity will support seamless container movement from ports to inland hubs, reducing road congestion and emissions.

Conclusion

The 2026 shipping container market will be defined by sustainability, digital intelligence, and adaptability. Companies that embrace smart technologies, prioritize eco-design, and respond flexibly to shifting trade flows will be best positioned to thrive. As global supply chains become more resilient and transparent, the humble shipping container will evolve from a passive vessel into an active node in a connected logistics ecosystem.

Common Pitfalls When Sourcing Shipping Containers (Quality and Intellectual Property)

Logistics & Compliance Guide for Shipping Containers

Shipping containers are the backbone of global trade, ensuring goods are transported safely and efficiently across oceans and continents. This guide outlines key logistics and compliance considerations when using shipping containers for international or domestic transport.

Container Types and Selection

Choosing the right container is crucial for protecting cargo and complying with transport regulations. Common types include:

- Dry Van Containers: Standard enclosed containers for general cargo.

- Refrigerated (Reefer) Containers: Temperature-controlled units for perishable goods.

- Open-Top Containers: Ideal for oversized cargo requiring top loading.

- Flat Rack Containers: Used for heavy or oversized items like machinery.

- Tank Containers: Designed for liquids, gases, or hazardous materials.

- High Cube Containers: Offer additional height compared to standard containers.

Ensure container selection aligns with cargo type, destination, and handling requirements.

Cargo Loading and Securing

Proper loading ensures cargo safety and compliance with international standards such as the IMO/ILO/UNECE Code of Practice for Packing of Cargo Transport Units (CTU Code).

- Weight Distribution: Distribute weight evenly to avoid container imbalance and structural stress.

- Cargo Securing: Use dunnage, braces, straps, or lashing to secure goods and prevent shifting during transit.

- Avoid Overloading: Respect maximum gross weight limits (including tare weight of the container).

- Documentation Accuracy: Ensure the packing list matches the actual load.

Improper loading can lead to accidents, cargo damage, and non-compliance penalties.

Documentation and Customs Compliance

Accurate documentation is essential for customs clearance and regulatory compliance.

- Bill of Lading (B/L): Contract between shipper and carrier; serves as title to goods.

- Commercial Invoice: Details transaction between buyer and seller for customs valuation.

- Packing List: Itemizes contents, weight, and dimensions of the shipment.

- Certificate of Origin: Confirms where goods were manufactured; may affect tariffs.

- Customs Declaration: Required for import/export; must be completed accurately.

- Dangerous Goods Declaration: Mandatory for hazardous materials (per IMDG Code).

Ensure all documents are complete, truthful, and submitted on time to avoid delays or fines.

Safety and Regulatory Standards

Compliance with international regulations ensures safe container operations.

- CSC (Container Safety Convention) Plate: Must be affixed to all containers used internationally; certifies structural integrity.

- IMDG Code: Applies to dangerous goods transported by sea; requires proper classification, packaging, labeling, and documentation.

- TAPA Standards: Relevant for high-value cargo; outlines security protocols for supply chain integrity.

- ISPM 15: Requires wood packaging material to be heat-treated and marked to prevent pest spread.

Always verify that containers and packaging meet applicable standards before shipment.

Customs Inspections and Security

Containers may be subject to inspection by customs or security agencies.

- Seals: Use tamper-evident seals to deter theft and ensure cargo integrity.

- Advance Filing Requirements: Submit data like the Importer Security Filing (ISF) for U.S.-bound shipments 24 hours before loading.

- Authorized Economic Operator (AEO): Certification can expedite customs processes in many countries.

- Non-Intrusive Inspection (NII): Use of X-ray or gamma-ray scanning by customs authorities.

Cooperate with authorities and maintain proper records to facilitate inspections.

Environmental and Sustainability Considerations

Growing regulatory focus on environmental impact affects container logistics.

- Emissions Regulations: Comply with IMO 2020 sulfur cap and upcoming carbon reduction initiatives.

- Container Repositioning and Recycling: Minimize empty container movements and recycle damaged units responsibly.

- Sustainable Practices: Optimize container utilization and support green shipping alliances.

Companies are increasingly expected to demonstrate environmental responsibility in their logistics operations.

Incident Reporting and Liability

Understand liability frameworks and reporting obligations.

- Hague-Visby Rules: Govern carrier liability for loss or damage to cargo.

- Incident Reporting: Report accidents, spills, or security breaches promptly to relevant authorities.

- Insurance Coverage: Ensure cargo and container insurance covers risks such as damage, theft, or delay.

Maintain detailed records to support claims or investigations.

Final Tips for Compliance and Efficiency

- Partner with experienced freight forwarders and customs brokers.

- Use digital tracking tools for real-time container monitoring.

- Stay updated on changing regulations in origin, transit, and destination countries.

- Conduct regular training for staff on safety, security, and compliance procedures.

By adhering to this guide, businesses can ensure smooth, compliant, and efficient containerized shipping operations across global supply chains.

Conclusion for Sourcing Shipping Containers

Sourcing shipping containers requires a strategic approach that balances cost, quality, availability, and logistics. Whether for storage, transportation, or repurposing into offices, homes, or retail spaces, selecting the right container involves evaluating key factors such as condition (new, used, or one-trip), size, certification standards (e.g., CSC certification), and location of suppliers.

It is essential to work with reputable suppliers or leasing companies and to inspect containers thoroughly—either in person or through detailed reports—to avoid structural, corrosion, or pest-related issues. Additionally, understanding shipping and delivery logistics, import regulations, and long-term maintenance needs ensures a smooth integration into your operational workflow.

Ultimately, effective sourcing not only reduces upfront costs but also enhances durability and functionality over time. By conducting proper due diligence and planning ahead, businesses and individuals can secure shipping containers that meet their specific requirements efficiently and sustainably.