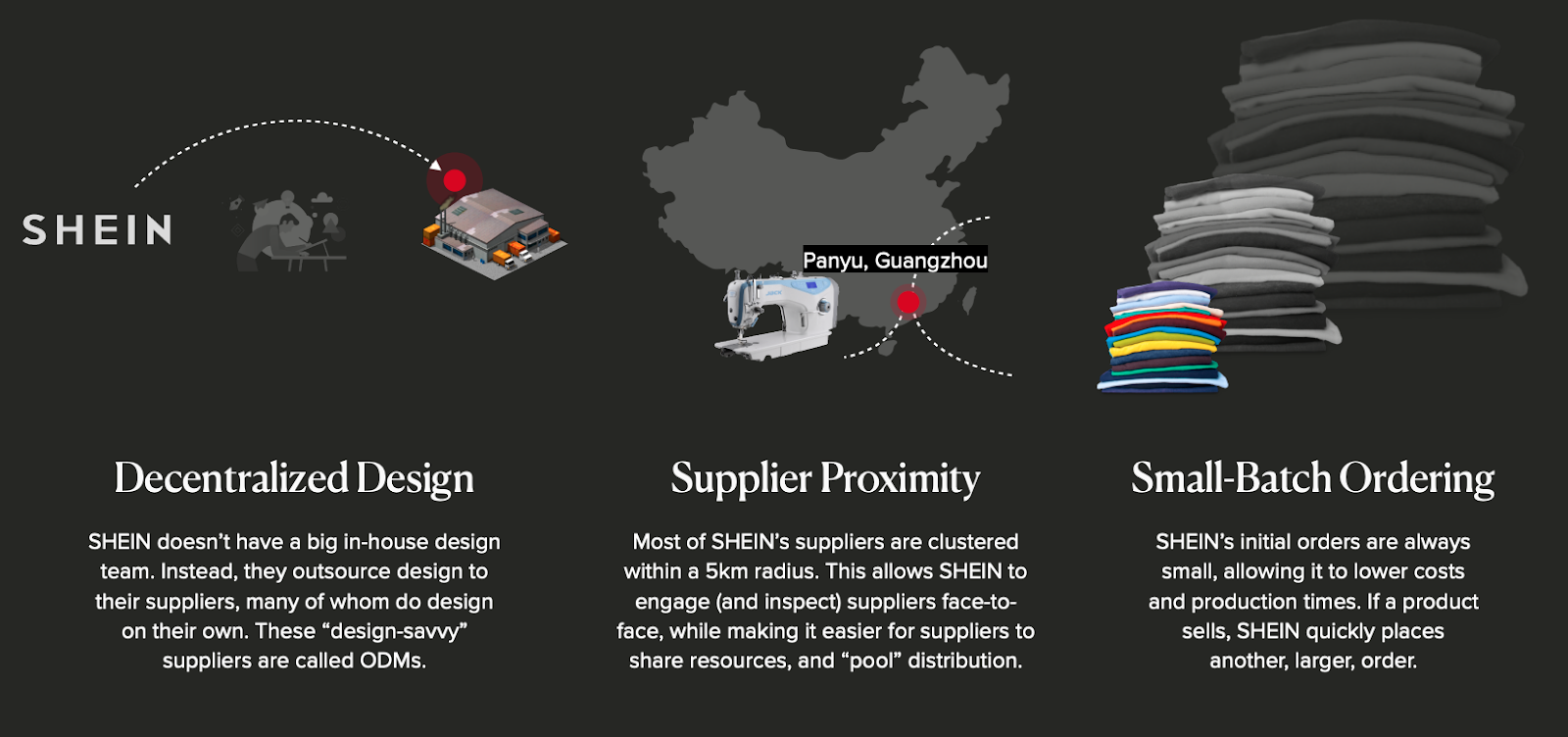

The global wholesale apparel market continues to expand at a robust pace, driven by increasing demand for fast fashion and cost-effective sourcing solutions. According to a 2023 report by Grand View Research, the global apparel market size was valued at USD 1.5 trillion and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This surge is fueled by shifting consumer behavior, e-commerce growth, and brands’ emphasis on scalable supply chains. Within this landscape, Shein has emerged as a dominant player, leveraging a tightly integrated network of wholesale clothing manufacturers to deliver trend-responsive products at scale. Behind Shein’s rapid production cycles and competitive pricing lies a select group of high-efficiency manufacturers—primarily concentrated in Guangdong, China—who combine advanced logistics, digital inventory systems, and rapid prototyping capabilities. These suppliers not only support Shein’s massive output but also set benchmarks for speed and cost-efficiency across the industry. Based on production volume, quality control, and integration with Shein’s supply chain, the following three manufacturers stand out as the top wholesale partners powering its global success.

Top 3 Shein Wholesale Clothing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wholesale shein for your store

Domain Est. 1998

Website: faire.com

Key Highlights: 2–5 day delivery · Free 60-day returnsExplore wholesale options for Shein clothing, women’s garments, and shoes. Discover a range of products designed for USA buyers….

#2 Shein Wholesale Suppliers & Distributors

Domain Est. 2012

Website: merkandi.com

Key Highlights: 30-day returnsThe Shein brand focuses on affordable fashion. The Chinese company offers a wide range of clothes for women, men and children, as well as shoes and stylish ……

#3 Shein Wholesale

Domain Est. 2019

Website: fashionatlasgroup.com

Key Highlights: Rating 4.8 (21) To buy Shein wholesale, contact us via our website or explore our product catalog. Our team will guide you through the selection and ordering process….

Expert Sourcing Insights for Shein Wholesale Clothing

H2: 2026 Market Trends for Shein Wholesale Clothing

As we approach 2026, Shein’s wholesale clothing segment is poised to experience significant transformation driven by shifting consumer behaviors, technological advancements, sustainability demands, and evolving global supply chain dynamics. Here’s an in-depth analysis of the key market trends shaping Shein’s wholesale business in 2026:

1. Accelerated Digital Integration and AI-Powered Demand Forecasting

By 2026, Shein is expected to deepen its reliance on artificial intelligence (AI) and big data analytics across its wholesale operations. The company’s vertically integrated supply chain will leverage real-time consumer data from its e-commerce platform to predict regional demand, enabling more efficient inventory allocation to wholesale partners. This hyper-responsive model will allow Shein to offer tailored wholesale bundles based on local market trends, reducing overstock and increasing turnover for retailers.

2. Expansion of B2B Digital Wholesale Platforms

Shein is anticipated to invest heavily in a dedicated B2B digital marketplace by 2026, allowing small and medium-sized retailers worldwide to access its vast catalog of fast-fashion items directly. This platform will feature AI-curated product recommendations, dynamic pricing, and fast fulfillment options—mirroring the agility of its B2C model. The expansion will lower entry barriers for independent retailers, boosting Shein’s wholesale distribution reach, particularly in emerging markets.

3. Growing Demand for Sustainable and Ethical Collections in Wholesale

With increasing regulatory pressure and consumer awareness, sustainable fashion is no longer optional. By 2026, Shein’s wholesale offerings are expected to include a clearly segmented line of eco-conscious apparel—made from recycled materials and produced under improved labor standards. These “Shein Eco” or “Responsible Edit” wholesale lines will cater to environmentally conscious retailers and meet compliance requirements in markets like the EU, where regulations such as the Ecodesign for Sustainable Products Regulation (ESPR) will be enforced.

4. Regionalization of Supply Chains and Nearshoring

Geopolitical tensions and supply chain disruptions have prompted Shein to diversify its manufacturing footprint. By 2026, the company is likely to expand production facilities in Southeast Asia, India, and Latin America to support regional wholesale distribution. This shift will reduce shipping times and tariffs, making wholesale orders more cost-effective and responsive—especially for North and South American markets.

5. Rise of Micro-Wholesale and Drop-Shipping Collaborations

Shein is expected to embrace more flexible wholesale models in 2026, including micro-wholesale (smaller order quantities) and drop-shipping partnerships. These models will cater to social media influencers, micro-retailers, and e-commerce entrepreneurs who want to resell Shein products without holding inventory. By integrating with platforms like Shopify and TikTok Shop, Shein can scale its wholesale reach through affiliate and reseller networks.

6. Increased Competition and Price Pressures

While Shein maintains a cost leadership position, rising competition from other ultra-fast-fashion players (like Romwe, Zaful, and emerging regional brands) will intensify price competition in the wholesale segment. To maintain margins, Shein may focus on value-added services—such as branding customization, private labeling, and marketing support—for wholesale clients, differentiating itself beyond just low price points.

7. Regulatory and Trade Challenges Impacting Global Wholesale

By 2026, Shein will face heightened scrutiny over import regulations, particularly in the U.S. and EU, related to forced labor concerns and environmental compliance. These challenges may lead to increased compliance costs and potential tariffs, which could affect wholesale pricing structures. Shein’s ability to demonstrate transparent sourcing and ethical practices will be critical to maintaining trust with wholesale partners and avoiding supply chain bottlenecks.

Conclusion

In 2026, Shein’s wholesale clothing segment will evolve into a more agile, tech-driven, and sustainable business arm. While maintaining its core advantage of low-cost, trend-responsive fashion, Shein will need to balance scalability with responsibility. Success in the wholesale market will depend on its ability to empower retailers with digital tools, respond to sustainability mandates, and adapt to a fragmented global trade environment.

Common Pitfalls When Sourcing Shein Wholesale Clothing: Quality and Intellectual Property Issues

Logistics & Compliance Guide for SHEIN Wholesale Clothing

Understanding SHEIN’s Wholesale Model

SHEIN primarily operates as a direct-to-consumer (DTC) fast-fashion retailer and does not offer a traditional wholesale program for third-party resellers. The company manages its entire supply chain in-house, from design and manufacturing to global distribution. As of now, SHEIN does not authorize external businesses to purchase bulk inventory directly from them for resale under standard wholesale agreements. Be cautious of third-party platforms claiming to offer “SHEIN wholesale” — these may not be officially affiliated and could pose compliance or authenticity risks.

Sourcing Alternatives and Authorized Channels

If you’re looking to resell SHEIN products, consider authorized avenues such as SHEIN’s affiliate program, influencer partnerships, or the SHEIN Marketplace (where applicable). These programs allow individuals and businesses to earn commissions or sell approved products while remaining compliant with SHEIN’s terms. Always verify the legitimacy of any reseller or distributor claiming to offer SHEIN wholesale clothing, as unauthorized sourcing can lead to legal, logistical, and reputational issues.

International Shipping and Import Logistics

SHEIN ships globally from its centralized distribution centers, primarily in China and regional hubs. For businesses attempting to import SHEIN products in bulk from third parties, standard international logistics apply:

– Use reliable freight forwarders experienced in garment shipments.

– Ensure accurate product classification (HS codes) for apparel (typically 61 or 62 for knitted/woven clothing).

– Prepare commercial invoices, packing lists, and bill of lading/airway bill.

– Account for shipping lead times (15–45 days for sea freight; 5–10 days for air).

Customs Compliance and Duties

Importing apparel into most countries requires compliance with customs regulations:

– Determine applicable import duties and taxes based on destination country (e.g., U.S. HTS codes, EU TARIC).

– Ensure products meet country-specific labeling requirements (e.g., fiber content, country of origin, care labels).

– Be aware of textile quotas or restrictions that may apply to certain countries or fabric types.

– Maintain documentation for audit purposes, including proof of origin and compliance with trade agreements.

Product Safety and Regulatory Standards

Wholesale apparel must meet safety and labeling standards in the destination market:

– United States: Comply with FTC Care Labeling Rule, CPSIA (for children’s clothing), and flammability standards (16 CFR 1610).

– European Union: Adhere to REACH (chemical restrictions), EN standards for textiles, and CE marking where applicable.

– United Kingdom: Follow UKCA marking requirements post-Brexit, along with similar safety standards as the EU.

– Avoid items containing restricted substances (e.g., azo dyes, formaldehyde) or non-compliant materials.

Intellectual Property and Brand Compliance

Reselling SHEIN-branded apparel requires caution:

– Do not alter or remove SHEIN labels without understanding trademark implications.

– Avoid unauthorized use of SHEIN’s logos, packaging, or marketing materials.

– Reselling genuine SHEIN products is generally allowed under the “first sale doctrine” (in the U.S.), but large-scale operations may attract scrutiny.

Returns, Inventory Management, and Reverse Logistics

Unlike traditional wholesalers, SHEIN does not support bulk returns or exchanges for resellers. If sourcing independently:

– Establish your own return policy and reverse logistics process.

– Use inventory management systems to track stock levels, turnover, and expiry of fashion items.

– Plan for seasonal demand and fast-changing trends typical of fast fashion.

Sustainability and Ethical Considerations

SHEIN faces scrutiny over environmental and labor practices. Resellers should:

– Be transparent about supply chain origins if marketing sustainability.

– Review SHEIN’s published sustainability reports or supplier code of conduct for insights.

– Consider the ethical implications of promoting fast-fashion models with high turnover and low pricing.

Final Recommendations

Given the lack of an official SHEIN wholesale program, businesses should:

– Focus on authorized partnership models (affiliate, marketplace).

– Conduct due diligence when sourcing from third-party suppliers claiming to offer SHEIN inventory.

– Prioritize compliance with import, safety, and labeling laws in your target market.

– Consult legal or logistics experts when importing apparel at scale.

Always verify the latest policies directly through SHEIN’s official website or business support channels to ensure up-to-date and accurate information.

In conclusion, sourcing wholesale clothing from Shein can offer numerous advantages for retailers and entrepreneurs looking to stay competitive in the fast-fashion market. With its vast product range, trend-driven designs, and highly competitive pricing, Shein provides a convenient and cost-effective solution for bulk purchasing. The streamlined online ordering process and global shipping capabilities further enhance its appeal for small to medium-sized businesses. However, potential challenges such as quality variability, longer lead times, and ethical considerations regarding manufacturing practices should be carefully weighed. Conducting due diligence—such as ordering samples, reviewing customer feedback, and assessing sustainability practices—can help mitigate risks. When approached strategically, sourcing wholesale clothing from Shein can be a viable option to boost inventory turnover, meet consumer demand for fashion-forward apparel, and improve profit margins—making it a compelling choice in today’s dynamic retail landscape.