The global demand for sheet laminate solutions in cabinetry has surged in recent years, driven by rising renovation activities, urbanization, and growing consumer preference for cost-effective, durable, and aesthetically versatile materials. According to Grand View Research, the global laminate market size was valued at USD 14.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030, fueled by increasing applications in residential and commercial interiors. Mordor Intelligence further highlights that the Asia-Pacific region is witnessing the fastest adoption due to expanding construction and furniture industries, particularly in India and China. As homeowners and designers prioritize long-lasting, low-maintenance surfaces, manufacturers are responding with innovations in high-pressure laminates (HPL), thermally fused laminates (TFL), and decorative veneers. In this competitive landscape, a select group of sheet laminate manufacturers has emerged as industry leaders, combining advanced production technologies, extensive design portfolios, and global distribution networks to meet evolving market demands. This list explores the top eight manufacturers shaping the future of cabinet laminate solutions through performance, sustainability, and design innovation.

Top 8 Sheet Laminate For Cabinets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wood Grain Laminate Sheets for Cabinets

Domain Est. 2010

Website: procabinetsupply.com

Key Highlights: 5–9 day deliveryWe carry a wide range of laminate from brand names such as Formica, Wilsonart, Nevamar, and Pionite. Order wood grain laminate sheets for your cabinets….

#2 Laminates

Domain Est. 1996

Website: egger.com

Key Highlights: Our decorative laminates produce an abrasion-, impact- and scratch-resistant product that is ideal for horizontal surfaces, as well as curved and rounded ……

#3 Formica Corporation

Domain Est. 1997

Website: formica.com

Key Highlights: Crafted for countertops, cabinets, worktops, wall panels and more. Discover Formica ® Laminate for interior spaces. Founded on quality, service and innovative ……

#4 Pionite

Domain Est. 1997

Website: panolam.com

Key Highlights: Our Pionite brand of high pressure laminates caters to traditional tastes with an eye towards versatility. With a broad range of tasteful and timeless designs….

#5

Domain Est. 1997

Website: arborite.com

Key Highlights: Arborite is synonymous with quality high-pressure laminate. Specializing in European-inspired designs, Arborite offers over 250 innovative patterns and ……

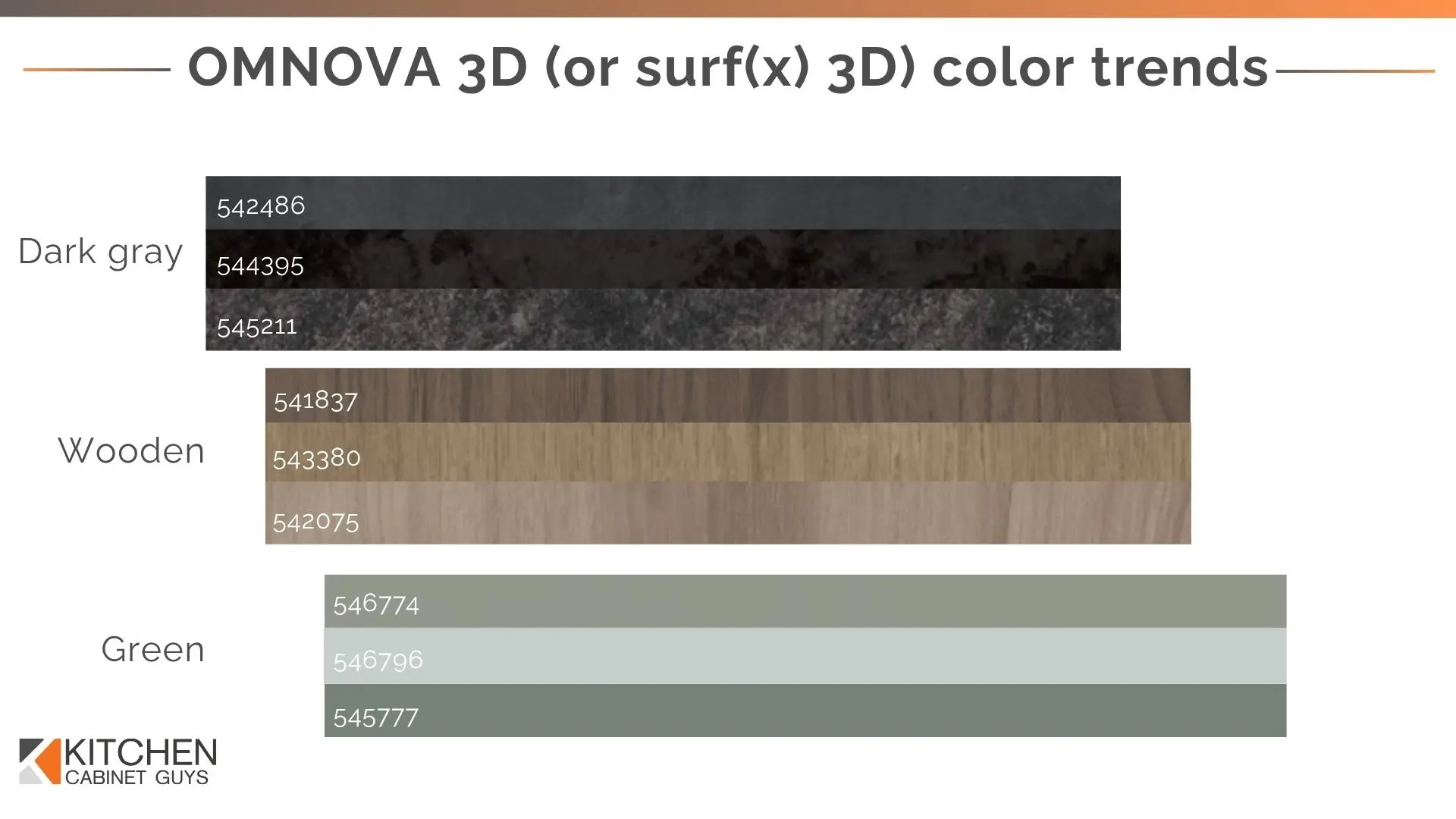

#6 OMNOVA

Domain Est. 1999

Website: omnova.com

Key Highlights: OMNOVA – A Division of SURTECO, is a global innovator of aesthetic and performance-enhancing surfaces for a variety of applications….

#7 American Laminates

Domain Est. 2006

Website: americanlaminates.com

Key Highlights: Available in various size panels, edge banded shelving, line-bored or grooved sides. Click on any color below to see a larger view or order individual samples….

#8 High

Domain Est. 2011

Website: merinolaminates.com

Key Highlights: Merino Laminates offers premium laminates/mica sheets at the best prices and unmatched quality, Browse various designs, textures, and finishes of mica to ……

Expert Sourcing Insights for Sheet Laminate For Cabinets

2026 Market Trends for Sheet Laminate For Cabinets

Rising Demand for Sustainable and Eco-Friendly Materials

In 2026, the sheet laminate for cabinets market is experiencing a significant shift toward sustainability. Consumers and manufacturers alike are prioritizing eco-friendly materials, leading to increased demand for low-VOC (volatile organic compounds) laminates, recycled content cores, and bio-based resins. Brands are investing in certifications such as FSC (Forest Stewardship Council) and GREENGUARD to meet regulatory standards and appeal to environmentally conscious buyers. This trend is being driven by stricter environmental regulations in North America and Europe, as well as growing consumer awareness about indoor air quality and carbon footprints.

Growth in Prefabricated and Modular Cabinetry

The popularity of prefabricated and modular kitchen and bathroom cabinetry continues to rise, particularly in urban housing and multifamily developments. Sheet laminates are ideal for these applications due to their consistency, durability, and ease of mass production. In 2026, manufacturers are leveraging automation and digital templating to produce high-volume, precision-cut laminated panels that reduce waste and installation time. This trend supports faster construction timelines and cost-effective solutions, especially in the affordable housing and remodeling sectors.

Advancements in Aesthetic and Textural Innovation

Aesthetic appeal remains a key driver in the cabinet laminate market. By 2026, manufacturers are introducing advanced printing and embossing technologies that replicate natural materials such as wood grain, stone, and concrete with remarkable realism. Textured finishes—ranging from matte and soft-touch to deep embossing—are gaining traction, allowing homeowners to achieve luxury looks at lower price points. Customization options, including bespoke colors and patterns through digital printing, are also expanding, catering to personalized design preferences in both residential and commercial spaces.

Expansion in Emerging Markets

While mature markets like the U.S. and Western Europe maintain steady demand, the fastest growth in the sheet laminate for cabinets sector is occurring in Asia-Pacific, Latin America, and parts of Africa. Rapid urbanization, rising middle-class populations, and increased investment in residential construction are fueling demand. Local production hubs are emerging to reduce import dependency and logistics costs, with countries like India, Vietnam, and Mexico becoming key manufacturing and consumption centers for decorative laminates.

Integration of Smart and Hygienic Surfaces

In response to evolving consumer lifestyles, some sheet laminate producers are incorporating antimicrobial additives and scratch-resistant nanocoatings into their products. These “smart” laminates are particularly appealing in healthcare facilities, senior living communities, and high-traffic residential kitchens. Additionally, integration with smart cabinetry systems—such as touch-activated lighting or sensor-based doors—is prompting laminate manufacturers to develop compatible surface finishes that support seamless technology integration without compromising durability.

Competitive Pricing and Supply Chain Optimization

With rising raw material and energy costs, suppliers are focusing on supply chain resilience and cost efficiency. In 2026, many companies are adopting regional sourcing strategies and investing in vertical integration to stabilize prices. Digital platforms for B2B sales and inventory management are streamlining distribution, reducing lead times, and improving responsiveness to market fluctuations. As a result, competitive pricing remains a key factor, especially in price-sensitive markets.

Conclusion

The 2026 market for sheet laminate for cabinets is defined by innovation, sustainability, and adaptability. As consumer preferences evolve and construction methods modernize, manufacturers who embrace eco-conscious production, design versatility, and global market opportunities are best positioned for growth. The convergence of technology, aesthetics, and environmental responsibility will continue to shape the future of decorative laminates in cabinetry applications.

Common Pitfalls When Sourcing Sheet Laminate for Cabinets (Quality & Intellectual Property)

Sourcing sheet laminate for cabinets involves more than just finding the lowest price. Overlooking key quality and intellectual property (IP) considerations can lead to costly mistakes, customer dissatisfaction, and legal risks. Here are the most common pitfalls to avoid:

Poor Material Quality and Durability

One of the biggest mistakes is selecting laminates that look good initially but fail under real-world use. Low-quality laminates may lack resistance to scratches, moisture, heat, or UV exposure, leading to premature wear, discoloration, or delamination. Always verify certifications (e.g., ANSI, HPDC) and request physical samples to test durability under expected conditions.

Inconsistent Color and Pattern Matching

Inconsistencies in color, grain, or texture between batches or sheets can ruin the aesthetic of cabinetry projects. This often occurs when suppliers source from multiple manufacturers or lack proper quality control. Specify batch consistency requirements upfront and inspect samples from the actual production run before full ordering.

Misrepresentation of Core and Backer Materials

Some suppliers may advertise high-end laminates while using inferior core materials (like low-density particleboard) or weak backing layers that compromise stability and longevity. Ensure specifications clearly define the core type, thickness, and compatibility with your manufacturing process (e.g., post-forming, edge banding).

Ignoring Intellectual Property (IP) Rights

Using laminates with protected designs—such as branded wood grains, patterns, or finishes—without proper licensing can expose your business to legal action. Some suppliers may illegally replicate proprietary designs. Always source from authorized distributors and request documentation proving IP compliance, especially for premium or designer looks.

Lack of Traceability and Certifications

Without proper traceability, it’s difficult to verify the origin, sustainability, or compliance of laminates. Failing to meet regulatory standards (e.g., CARB, TSCA Title VI, FSC) can result in rejected shipments or penalties. Demand full documentation, including material safety data sheets (MSDS), certification proofs, and chain-of-custody records.

Overlooking Minimum Order Quantities and Lead Times

Some high-quality or custom laminates come with high MOQs or long lead times. Failing to plan for this can disrupt production schedules. Clarify MOQs, production timelines, and reorder availability early in the sourcing process to avoid delays.

Choosing Solely Based on Price

Opting for the cheapest option often leads to hidden costs—waste from defects, rework due to warping or poor adhesion, or customer returns. Invest in higher-quality materials from reputable suppliers to ensure long-term performance and brand reputation.

By addressing these pitfalls proactively, cabinet manufacturers can ensure they source durable, compliant, and visually consistent laminates while protecting their business from legal and operational risks.

Logistics & Compliance Guide for Sheet Laminate For Cabinets

Product Overview and Classification

Sheet laminate for cabinets refers to thin layers of material—typically high-pressure laminate (HPL), low-pressure laminate (LPL), or decorative veneers—bonded to substrate materials like particleboard or MDF for use in furniture and cabinetry. Proper classification under international trade codes is essential for compliance. The Harmonized System (HS) code commonly used is 3920.62 for plastic-surfaced laminates, though variations may apply based on material composition (e.g., paper-based HPL may fall under 4811). Accurate classification ensures correct duty assessment and regulatory adherence.

Packaging and Handling Requirements

To prevent damage during transit, sheet laminates must be packaged securely. Best practices include:

– Stacking sheets between protective layers (kraft paper or plastic film).

– Securing stacks on wooden or composite pallets with edge protectors.

– Stretch-wrapping or banding to prevent shifting.

– Clearly labeling packages with product details, handling instructions (e.g., “Fragile,” “This Side Up”), and safety information.

– Protecting against moisture by using moisture-resistant wrapping or desiccants in humid environments.

Storage Conditions

Sheet laminates are sensitive to environmental conditions. Optimal storage includes:

– A dry, climate-controlled environment with temperatures between 15°C and 25°C (59°F–77°F).

– Relative humidity levels maintained at 40–60% to prevent warping or delamination.

– Flat storage on level surfaces to avoid bending or stress cracks.

– Avoiding direct sunlight or heat sources to prevent discoloration and material degradation.

Transportation and Freight Logistics

- Mode of Transport: Suitable for all modes (truck, rail, sea, air). Ocean freight is most common for bulk shipments due to cost efficiency.

- Pallet Configuration: Standard pallet sizes (e.g., 48”x40” in North America) should be used; overhang should not exceed 1.5 inches to ensure stability.

- Stacking Limits: Adhere to manufacturer-recommended stacking heights to prevent bottom-sheet compression.

- Documentation: Include commercial invoice, packing list, bill of lading, and HS code. For international shipments, ensure all documents are accurately completed to avoid customs delays.

Regulatory Compliance

- REACH & RoHS (EU): Confirm that laminates are free from restricted substances such as phthalates, heavy metals, and certain flame retardants. Suppliers must provide a Declaration of Conformity.

- TSCA Title VI (USA): For formaldehyde emissions, ensure compliance with EPA standards, particularly when laminates are applied to composite wood substrates.

- FSC or PEFC Certification: If using wood-based decor layers, chain-of-custody certification may be required for sustainable sourcing claims.

- Country-Specific Labeling: Some markets require bilingual labeling or safety data sheets (SDS) under local chemical regulations (e.g., CLP in EU).

Import/Export Documentation

Key documents for international trade include:

– Commercial Invoice with detailed product description, value, and Incoterms (e.g., FOB, CIF).

– Packing List specifying quantities, dimensions, weight per package, and total shipment weight.

– Certificate of Origin to determine tariff eligibility (e.g., under USMCA or other trade agreements).

– Bill of Lading or Air Waybill as a contract of carriage.

– Import Permits if required by destination country (rare for laminates but possible in regulated markets).

Incoterms and Liability

Clarify responsibility using standard Incoterms:

– FOB (Free On Board): Seller delivers to port; buyer assumes risk and cost thereafter.

– CIF (Cost, Insurance, Freight): Seller covers cost, insurance, and freight to destination port.

Choose terms that align with your logistics capabilities and customer expectations to minimize disputes.

Customs Clearance and Duties

- Validate HS code accuracy with customs authorities or a licensed broker.

- Be prepared to pay applicable import duties, which vary by country (e.g., 4.9% average in the U.S. for HPL under 3920.62).

- Use customs brokers in complex markets to ensure timely clearance and avoid penalties.

- Maintain records for at least 5 years for audit purposes.

Sustainability and Environmental Compliance

- Ensure compliance with local and international environmental standards.

- Provide take-back or recycling program details if required (e.g., under EU producer responsibility schemes).

- Minimize packaging waste using recyclable materials and optimize load efficiency to reduce carbon footprint.

Risk Management and Insurance

- Insure shipments against damage, loss, or delay, particularly for high-value or long-distance transport.

- Verify carrier liability limits and supplement with additional cargo insurance if needed.

- Conduct regular audits of logistics partners for compliance and performance.

Conclusion

Effective logistics and compliance for sheet laminate for cabinets require meticulous attention to packaging, regulatory standards, and documentation. By adhering to international trade requirements and implementing best practices in handling and transportation, businesses can ensure product integrity, avoid delays, and maintain market access worldwide.

Conclusion:

Sourcing sheet laminate for cabinets requires a balanced evaluation of quality, cost, durability, and aesthetic appeal. After assessing various suppliers, material options (such as high-pressure laminate (HPL) and low-pressure laminate), and finishes, it is evident that selecting the right laminate significantly impacts the longevity and visual success of cabinetry. Prioritizing reputable suppliers with consistent product quality, sustainable sourcing practices, and strong warranties ensures reliable performance. Additionally, considering lead times, customization options, and compatibility with fabrication processes streamlines production and installation. Ultimately, an informed sourcing decision—based on thorough comparison and sample testing—will result in a cost-effective, durable, and aesthetically pleasing cabinetry solution that meets both functional requirements and design intentions.