The global sewing products market is experiencing steady growth, driven by rising demand in both industrial and consumer segments. According to Mordor Intelligence, the global sewing machine market was valued at USD 33.94 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. This expansion is supported by increasing interest in DIY fashion, the resurgence of home sewing, and advancements in smart and computerized sewing technology. Additionally, emerging economies are witnessing a boom in garment manufacturing, fueling demand for industrial-grade sewing equipment and accessories. As a result, there is growing interest in reliable wholesale manufacturers who can deliver high-volume, cost-effective, and quality-assured sewing products. In this competitive landscape, identifying top-tier manufacturers with strong production capabilities, global distribution networks, and innovation in product design is critical for retailers, distributors, and private-label brands aiming to capture market share. The following list highlights the top 10 wholesale manufacturers shaping the future of the sewing products industry.

Top 10 Sewing Products Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Frank A Edmunds: Needlework & Stitching Supplies

Domain Est. 1999

Website: faedmunds.com

Key Highlights: Frank A. Edmunds Co. is a manufacturer of needlework and stitching supplies, specializing in hoops, frames, stretcher bars, and other sewing accessories….

#2 Clover

Domain Est. 2002

Website: clover-usa.com

Key Highlights: Offering the highest quality sewing, quilting, knitting, crocheting, needleart, beading, and craft supplies….

#3 Prym Consumer USA Inc.

Domain Est. 2005

Website: prymconsumerusa.com

Key Highlights: We are a leading supplier of creative sewing, quilting, and needlework products to retailers in North America….

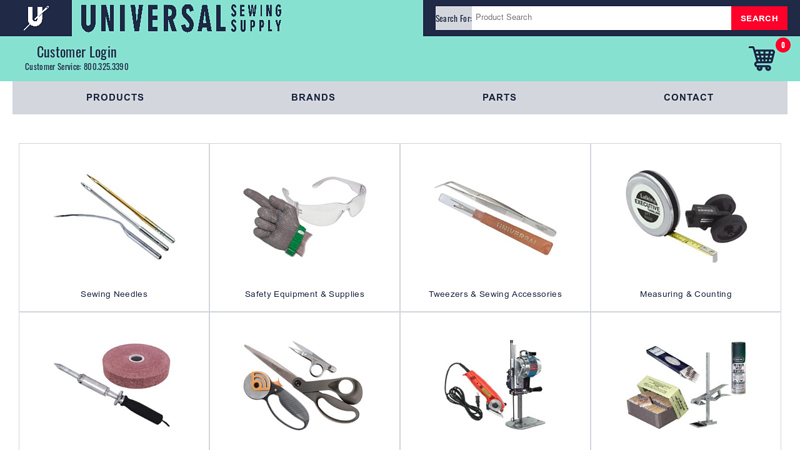

#4 Universal Sewing Supply

Domain Est. 1995

Website: universalsewing.com

Key Highlights: Sewing Needles · Safety Equipment & Supplies · Tweezers & Sewing Accessories · Measuring & Counting · Tools & Tool Accessories · Scissors, Snips & Rotary Cutting ……

#5 Brewer Sewing

Domain Est. 1997

Website: brewersewing.com

Key Highlights: Get 10% off of your first order when you open an account with Brewer! Use code NC10OFF at checkout. Excludes all sale items and fabric….

#6 JustWholesale

Domain Est. 1998

Website: justwholesale.com

Key Highlights: Top-quality bulk fabric, notions, leather, webbing, sewing machines, pillows, adhesive, and hardware at our wholesale company. Find everything you need for ……

#7 Rotary Cutters, Quilting Tables, Notions, and More

Domain Est. 2005

Website: martellinotions.com

Key Highlights: Free delivery over $300 30-day returnsWe make tools, equipment, workstations, and machines for sewing, quilting, and embroidery. Browse our selection to find everything needed for …

#8 American Sewing Supply, Pay Less, Buy More…

Domain Est. 2009

#9 Fabric Wholesale Direct

Domain Est. 2014

Website: fabricwholesaledirect.com

Key Highlights: Free delivery over $99 30-day returnsLarge online fabric store providing designers, sewers, and decorators with an extensive collection of premium fabrics by the yard at wholesale …

#10 Taylorseville.com

Domain Est. 2014

Website: taylorseville.com

Key Highlights: Providing innovative and high quality sewing, quilting Notions and Tools….

Expert Sourcing Insights for Sewing Products Wholesale

H2: 2026 Market Trends for Sewing Products Wholesale

The wholesale sewing products market is poised for notable transformation by 2026, driven by evolving consumer behavior, technological innovation, sustainability demands, and shifts in global supply chains. Below is a comprehensive analysis of key market trends expected to shape the industry in 2026.

1. Rising Demand for DIY and Home Sewing

The do-it-yourself (DIY) culture continues to gain momentum, especially among younger demographics embracing sustainable fashion and personalized apparel. Platforms like TikTok and Instagram have popularized sewing as a creative and eco-conscious hobby. This trend is expected to significantly boost demand for wholesale sewing supplies, including fabrics, threads, needles, and machines. Wholesalers who cater to crafters, independent designers, and small ateliers will benefit from this surge in grassroots creativity.

2. Growth in E-Commerce and Direct-to-Business (D2B) Models

By 2026, online B2B marketplaces will dominate the distribution of sewing products. Digital platforms such as Alibaba, Faire, and specialized sewing supply marketplaces enable wholesalers to reach a global network of retailers, sewing schools, and micro-businesses. Advanced logistics and fulfillment services will allow for faster delivery and scalable inventory management. Wholesalers investing in user-friendly digital storefronts and omnichannel strategies will gain a competitive edge.

3. Emphasis on Sustainable and Ethical Sourcing

Sustainability is no longer optional. Consumers and downstream businesses are demanding transparency in material sourcing and ethical labor practices. By 2026, wholesale suppliers offering eco-friendly threads (e.g., organic cotton, recycled polyester), biodegradable packaging, and certifications like GOTS (Global Organic Textile Standard) will attract environmentally conscious buyers. This shift is pushing manufacturers and distributors to reevaluate supply chains and adopt circular economy principles.

4. Technological Advancements in Sewing Equipment

Smart sewing machines, computerized embroidery systems, and AI-assisted design tools are becoming mainstream. Wholesalers will increasingly distribute high-tech sewing equipment that integrates with mobile apps, offers pattern automation, and supports IoT connectivity. These innovations appeal not only to professional tailors but also to tech-savvy hobbyists, expanding the potential customer base. As a result, training and after-sales support will become value-added services offered by leading wholesalers.

5. Regional Market Diversification and Nearshoring

Geopolitical tensions and supply chain disruptions have prompted a shift toward nearshoring and regional production. In North America and Europe, there is growing interest in locally sourced sewing supplies and domestic manufacturing. Wholesalers who partner with regional mills and manufacturers will reduce lead times and transportation costs while appealing to “buy local” sentiments. Meanwhile, Asia remains a dominant manufacturing hub, particularly in countries like Vietnam, India, and Bangladesh, which are modernizing their textile infrastructure.

6. Customization and Niche Product Lines

Wholesale success in 2026 will depend on product differentiation. Wholesalers offering specialized products—such as adaptive sewing kits for people with disabilities, eco-friendly quilting supplies, or culturally specific fabrics—will meet the needs of niche markets. Custom branding and private-label options for retailers will also be a growing service, allowing small businesses to differentiate themselves in a competitive landscape.

7. Impact of Education and Community Engagement

Sewing education—both in schools and community workshops—is on the rise. Governments and NGOs are promoting textile skills as part of vocational training and sustainability initiatives. Wholesalers that partner with educational institutions to supply bulk kits, curriculum-aligned materials, and teacher resources will tap into a stable, institutional demand stream. Additionally, sponsoring sewing challenges or online communities can enhance brand loyalty and drive long-term sales.

Conclusion

By 2026, the wholesale sewing products market will be shaped by digital transformation, sustainability imperatives, technological innovation, and a deeply engaged consumer base. Wholesalers who adapt to these trends—by embracing e-commerce, offering eco-conscious products, supporting education, and leveraging technology—will be best positioned for growth in an increasingly dynamic and competitive global market.

Common Pitfalls Sourcing Sewing Products Wholesale: Quality and Intellectual Property Risks

Sourcing sewing products—such as fabrics, threads, patterns, pre-cut kits, and accessories—wholesale can be highly profitable, but it comes with significant risks if not managed carefully. Two of the most critical pitfalls involve inconsistent quality and intellectual property (IP) violations. Understanding and avoiding these issues is essential for building a reliable and legally compliant supply chain.

Inconsistent Product Quality

One of the most frequent challenges in wholesale sourcing is maintaining consistent quality across batches. This is especially true when working with overseas manufacturers or new suppliers.

- Material Variability: Fabrics may differ in weight, texture, colorfastness, or durability between shipments. Thread strength and consistency can also vary, affecting end-product performance.

- Workmanship Issues: Sewn components or finished goods may exhibit poor stitching, misaligned patterns, or irregular cutting, particularly if quality control is lax.

- Lack of Standardization: Suppliers may not adhere to industry standards (e.g., GSM for fabric weight, color codes), leading to mismatches with customer expectations.

- Inadequate Quality Control Processes: Some wholesalers skip or minimize quality inspections, increasing the risk of defective goods reaching your inventory.

How to Mitigate: Request physical samples before bulk ordering, establish clear quality specifications in contracts, conduct third-party inspections, and build long-term relationships with vetted suppliers.

Intellectual Property (IP) Infringement

The sewing industry is rife with designs, patterns, and brand-specific materials, making it a hotspot for IP risks when sourcing wholesale.

- Copyrighted Patterns and Designs: Many sewing patterns and fabric prints are protected by copyright. Sourcing and reselling these without proper licensing can lead to legal action.

- Trademark Violations: Using branded threads, zippers, or labels (e.g., Coats & Clark, YKK) in unauthorized ways or on counterfeit goods can result in trademark infringement claims.

- Counterfeit or Knockoff Goods: Some wholesalers offer “inspired by” products that closely mimic popular designs, risking legal liability for distributors and retailers.

- Unclear Licensing Agreements: Suppliers may claim they have rights to distribute certain designs, but fail to provide proof, leaving buyers exposed.

How to Mitigate: Always verify IP rights, obtain written proof of licensing or permission from rights holders, avoid “too good to be true” deals on branded items, and consult legal counsel when in doubt.

By proactively addressing quality control and intellectual property concerns, businesses can safeguard their reputation, avoid legal disputes, and ensure customer satisfaction in the competitive sewing products market.

Logistics & Compliance Guide for Sewing Products Wholesale

Overview of Sewing Products Wholesale Logistics

Wholesale logistics for sewing products involves the efficient management of inventory, transportation, warehousing, and distribution of items such as thread, needles, fabrics, patterns, sewing machines, and accessories. Due to the variety in product types—ranging from bulk textiles to small hardware components—logistics must be tailored to handle different materials, packaging needs, and storage conditions. A streamlined logistics operation ensures timely fulfillment, cost control, and customer satisfaction.

Inventory Management Best Practices

Effective inventory management is critical in sewing product wholesale to balance stock availability with turnover. Utilize inventory management software to track stock levels, monitor reorder points, and forecast demand based on seasonal trends (e.g., increased craft demand during holidays). Categorize products by type (e.g., fasteners, fabrics, tools) and turnover rate to optimize warehouse layout. Implement barcode or RFID systems for accurate tracking and reduce overstocking or stockouts.

Warehousing and Storage Requirements

Sewing products require careful storage to maintain quality. Fabrics should be stored in a dry, climate-controlled environment away from direct sunlight to prevent fading or mildew. Thread and needles must be kept in sealed containers to avoid dust and moisture damage. Heavy items like sewing machines should be stored securely on pallets with proper support. Organize the warehouse using a logical bin system (e.g., alphabetical or category-based) to speed up picking and packing.

Transportation and Distribution Strategies

Partner with reliable freight carriers experienced in handling both lightweight (e.g., spools, patterns) and bulky items (e.g., fabric bolts, machines). Use consolidated shipping to reduce costs, especially when supplying retail chains or craft stores. For international shipments, ensure compliance with import/export regulations and use Incoterms (e.g., FOB, CIF) to define responsibility. Consider regional distribution centers to reduce delivery times and shipping expenses.

Packaging Standards and Sustainability

Adopt standardized packaging protocols to protect sewing products during transit. Use durable, right-sized boxes and protective materials (e.g., bubble wrap for glass bobbins, polybags for thread). Clearly label packages with product details, barcodes, and handling instructions. Embrace sustainable packaging by using recyclable or biodegradable materials—this aligns with growing consumer demand for eco-friendly practices and enhances brand reputation.

Regulatory Compliance and Safety Standards

Ensure all sewing products meet relevant safety and regulatory standards. In the U.S., fabric dyes and children’s sewing kits may fall under CPSC (Consumer Product Safety Commission) regulations. Electrical sewing machines must comply with UL (Underwriters Laboratories) or ETL safety certifications. Internationally, adhere to EU REACH regulations for chemical use in textiles and CE marking for machinery. Maintain documentation for audits and product traceability.

Import/Export Documentation and Tariff Considerations

For cross-border wholesale operations, accurate documentation is essential. Prepare commercial invoices, packing lists, certificates of origin, and bill of lading/airway bills. Be aware of HS codes for sewing products (e.g., 5208 for cotton fabric, 8452 for sewing machines) to determine applicable tariffs. Monitor trade agreements and tariff changes (e.g., Section 301 tariffs) that may affect pricing and sourcing strategies. Work with a customs broker if needed.

Product Labeling and Country-of-Origin Rules

Label all products clearly with required information, including fiber content (per FTC Textile Rules in the U.S.), country of origin, care instructions, and safety warnings (e.g., for sharp needles). Mislabeling can result in fines or shipment rejection. For imported goods, ensure country-of-origin marking is permanent and legible. Verify labeling compliance for each target market, as requirements vary (e.g., EU labeling directives).

Quality Control and Returns Management

Implement a quality control process at receiving and before shipping to catch defects (e.g., frayed fabric, broken needles). Establish a clear returns policy for damaged or incorrect shipments. Use a returns management system to inspect, restock, or dispose of returned items efficiently. Analyze return data to identify recurring issues and improve supplier quality.

Environmental and Ethical Compliance

Source materials from suppliers that follow ethical labor practices and environmental standards. Certifications such as GOTS (Global Organic Textile Standard) or OEKO-TEX can enhance product credibility. Comply with waste disposal regulations for packaging and damaged goods. Consider participating in take-back programs for electronic sewing machines to meet e-waste compliance in certain jurisdictions.

Technology Integration for Efficiency

Use integrated logistics platforms that connect inventory, order management, shipping, and compliance tracking. Tools like ERP (Enterprise Resource Planning) or WMS (Warehouse Management Systems) improve visibility and coordination. Automate compliance checks (e.g., export license requirements) and generate necessary documentation to reduce errors and delays.

Final Recommendations

To succeed in sewing products wholesale, prioritize logistics precision and regulatory compliance. Invest in scalable systems, train staff on safety and compliance protocols, and maintain strong relationships with carriers and suppliers. Regularly review logistics performance and adapt to market changes to remain competitive and compliant.

In conclusion, sourcing sewing products wholesale offers numerous advantages for retailers, craft businesses, and manufacturers seeking to maximize profitability and ensure product availability. By partnering with reliable wholesalers, businesses can benefit from cost savings through bulk purchasing, access a diverse range of materials and tools, and maintain consistent inventory levels. However, it’s essential to conduct thorough research when selecting suppliers, evaluating factors such as product quality, pricing, minimum order requirements, and shipping policies. Building strong relationships with reputable wholesalers—and considering both domestic and international options—can lead to long-term success and scalability. Ultimately, strategic wholesale sourcing empowers sewing-related businesses to meet customer demands efficiently while maintaining high standards and competitive pricing in a growing market.